Global Textile Colors Market Size, Share, And Enhanced Productivity By Fibers (Natural Fibers, Synthetic Fibers), By Form (Powder, Granules, Liquid, Paste), By Dye Type (Disperse, Reactive, Direct, Acid, Vat, Basic), By Technology (Digital Textile Printing, Water-Less/Low-Water Solutions, Closed-Loop/Wastewater Recovery and Chemical Recycling, Others)By Fiber Type (Cotton, Viscose, Wool, Nylon, Polyester, Acrylic), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177610

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

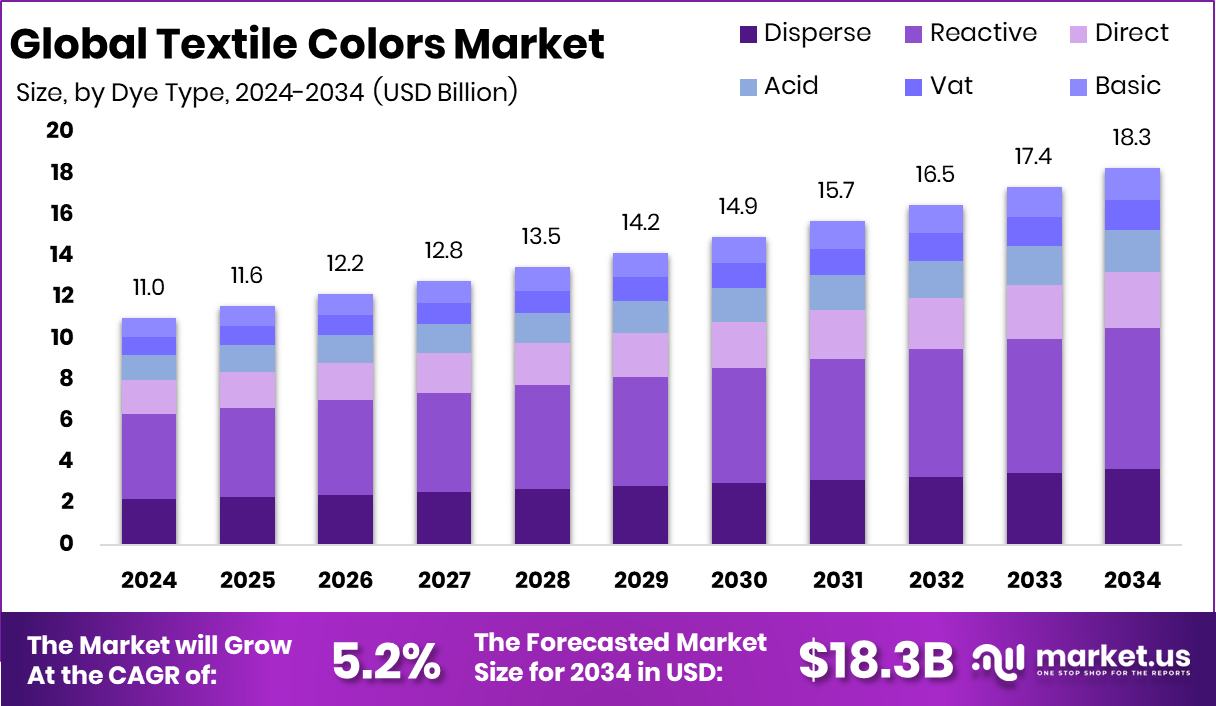

The Global Textile Colors Market is expected to be worth around USD 18.3 billion by 2034, up from USD 11.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. A strong textile manufacturing base drives Asia Pacific’s 46.9% leadership.

Textile colors are chemical substances used to add shade, brightness, and design to fabrics and garments. They help fibers absorb and retain color during dyeing or printing processes. These colors are applied across natural fibers such as cotton, wool, and viscose, as well as synthetic fibers like polyester, nylon, and acrylic. Textile Colors Market refers to the commercial ecosystem that includes production, distribution, and application of dyes and pigments in powder, liquid, paste, and granular forms across apparel, home textiles, and industrial fabrics.

The market is shaped by steady growth in fiber production and textile processing. For instance, the Agricultural Bank allocating 105 billion pounds to finance wheat and cotton for the upcoming season signals continued agricultural support for cotton cultivation, which directly influences dye consumption. Infrastructure improvements, such as the $4,208,000 grant and the separate $4M grant for development along Cotton Street, also reflect ongoing textile-linked industrial activity in cotton-centric regions.

Demand is driven by expanding garment manufacturing, rising synthetic fiber usage, and growing interest in digital textile printing and low-water dyeing technologies. At the same time, investments such as Recover, raising $100M to scale recycled cotton, highlight the increasing focus on sustainable fiber cycles, which supports demand for compatible dye solutions.

Opportunities are emerging in waterless dyeing, chemical recycling, and closed-loop systems as producers seek efficiency and environmental compliance. While financial instability headlines, including cases involving $53M or even $80m in investor cash losses, remind markets of capital risks, the textile coloration segment continues to align itself with long-term production and infrastructure trends.

Key Takeaways

- The Global Textile Colors Market is expected to be worth around USD 18.3 billion by 2034, up from USD 11.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Synthetic fibers dominate the Textile Colors Market with a significant 69.2% share globally.

- Powder form leads the Textile Colors Market, accounting for 43.7% consumption share.

- Reactive dyes capture 37.5% share in the global Textile Colors Market.

- Digital textile printing technology holds 29.3% share within the Textile Colors Market.

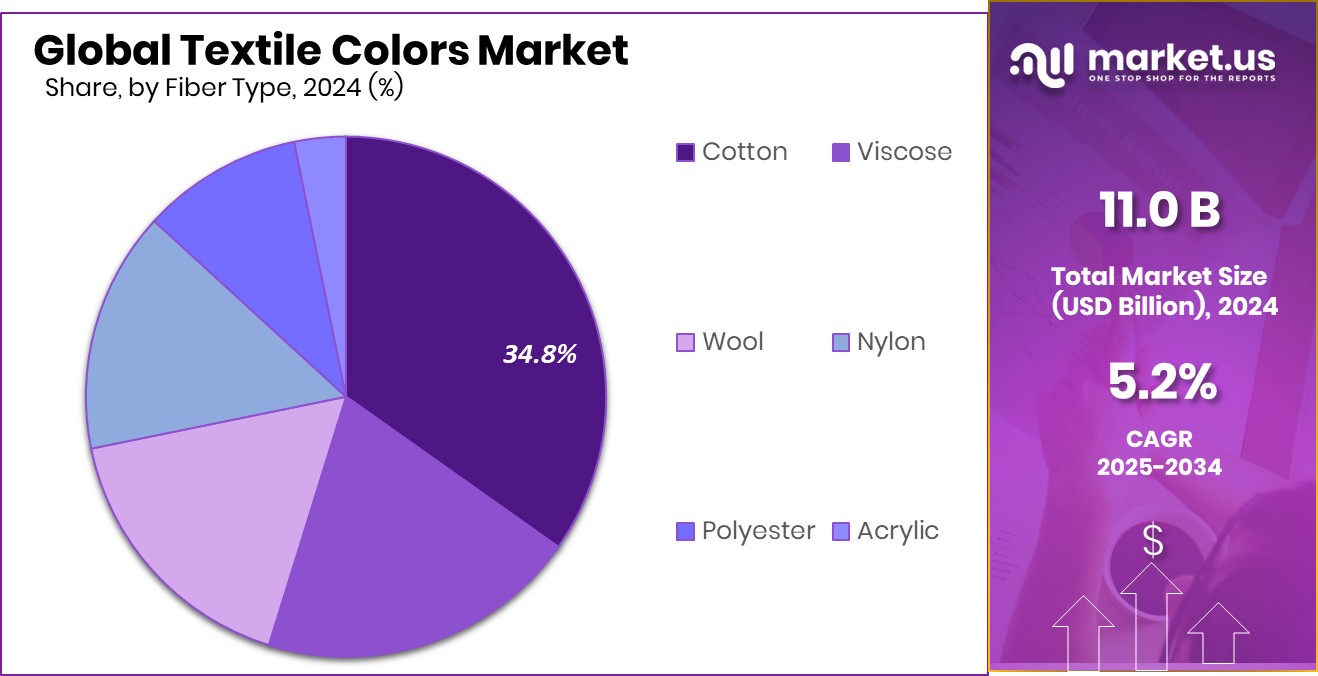

- Cotton fiber accounts for 34.8% demand in the Textile Colors Market.

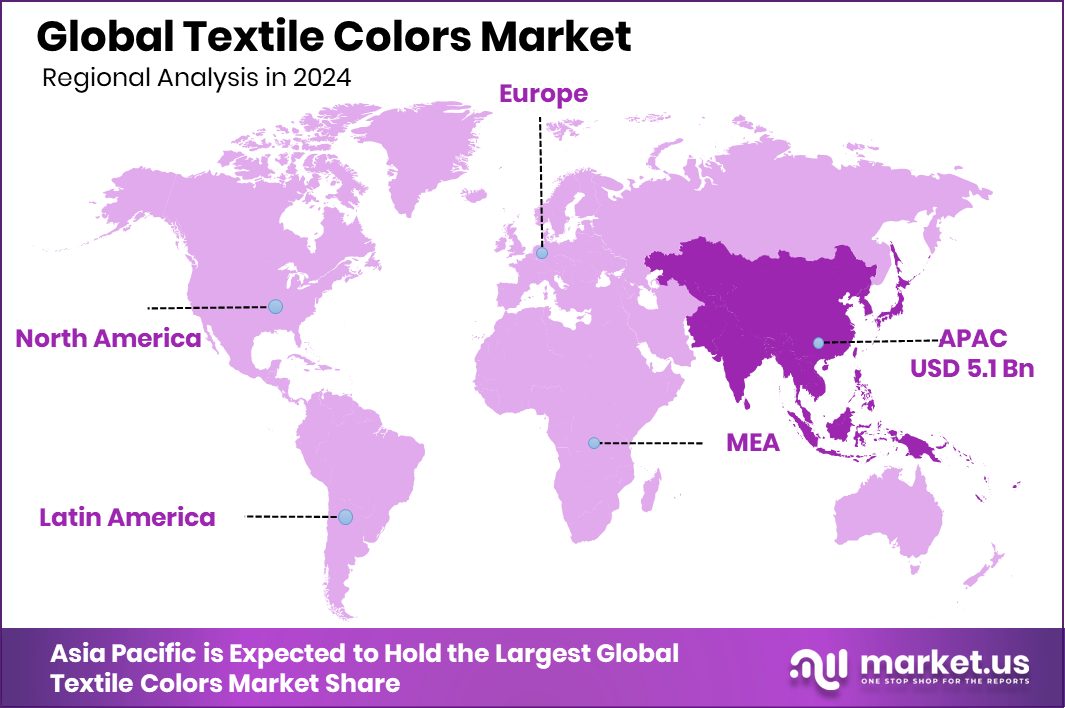

- The Asia Pacific generated USD 5.1 Bn in market revenue.

By Fibers Analysis

Synthetic fibers dominate the Textile Colors Market with a strong 69.2% share.

In 2024, the Textile Colors Market continued to be heavily dependent on synthetic fibers, which accounted for 69.2% of total demand. The dominance of polyester, nylon, and other man-made fibers in apparel, sportswear, and home textiles has directly influenced color consumption patterns. Synthetic fabrics offer durability, wrinkle resistance, and cost efficiency, making them highly preferred in mass production.

As global fast-fashion cycles accelerate, manufacturers increasingly rely on colorants compatible with synthetic materials to ensure colorfastness and vibrancy. In the Asia-Pacific region, where large-scale textile production is concentrated, dye houses are scaling up capacity specifically for polyester-based processing. This shift clearly positions synthetic-fiber-compatible textile colors as the backbone of volume-driven growth, particularly in performance wear and blended fabric applications.

By Form Analysis

Powder form leads the Textile Colors Market, capturing 43.7% segment.

In 2024, powder form textile colors held 43.7% share, reflecting their practicality in large-scale dyeing operations. Powder dyes are easier to store, transport, and measure in industrial settings, which reduces handling losses and supports bulk procurement strategies. Textile processing units prefer powder formulations due to longer shelf life and stable concentration levels compared to liquid alternatives.

Moreover, powder dyes allow flexible dilution, giving manufacturers better control over shade consistency during batch production. In cost-sensitive markets such as India, Bangladesh, and Vietnam, the economic advantage of powder dyes continues to support their leadership position. The segment also benefits from established distribution networks that cater specifically to small and mid-sized dyeing facilities operating across export-oriented textile clusters.

By Dye Type Analysis

Reactive dyes account for 37.5% Textile Colors Market demand.

In 2024, reactive dyes accounted for 37.5% of the Textile Colors Market by dye type, largely driven by their superior bonding performance with cellulosic fibers. Reactive dyes are known for delivering bright shades, strong wash fastness, and excellent light stability, making them ideal for fashion garments and casual wear. Their chemical structure enables covalent bonding with fibers, ensuring long-lasting color retention even after repeated washing.

With growing demand for high-quality cotton apparel, especially in premium and mid-range segments, reactive dyes remain a preferred choice among textile processors. Environmental compliance improvements and low-salt dyeing innovations are further enhancing the appeal of reactive formulations, supporting steady adoption across both developed and emerging textile manufacturing regions.

By Technology Analysis

Digital textile printing holds 29.3% in the Textile Colors Market.

In 2024, digital textile printing captured 29.3% share by technology, reflecting the industry’s gradual shift toward flexible and customized production. Brands are increasingly demanding shorter production runs, complex designs, and quick turnaround times, all of which favor digital systems over conventional rotary printing. Digital textile printing reduces water usage, minimizes waste, and allows on-demand production, aligning well with sustainability goals.

Fashion retailers leveraging e-commerce platforms are particularly driving this demand, as they require rapid design adaptation and inventory optimization. Although initial investment costs remain relatively high, medium and large textile exporters are expanding digital printing units to remain competitive. This technological shift is steadily transforming how textile colors are applied across apparel and home furnishing segments.

By Fiber Type Analysis

Cotton fiber contributes 34.8% within Textile Colors Market.

In 2024, cotton remained the leading fiber type with 34.8% share in the Textile Colors Market, highlighting its continued global relevance. Cotton’s comfort, breathability, and natural origin make it highly attractive across apparel categories, from everyday wear to premium fashion. The steady demand for cotton-based garments in North America and Europe, combined with strong production in India and China, sustains color consumption for this fiber segment.

Cotton fabrics respond well to reactive and direct dyes, enabling a wide spectrum of shades and finishes. As sustainability conversations gain momentum, cotton—especially organic variants—continues to influence dye innovation strategies, pushing manufacturers to develop formulations that balance performance, compliance, and reduced environmental impact.

Key Market Segments

By Fibers

- Natural Fibers

- Synthetic Fibers

By Form

- Powder

- Granules

- Liquid

- Paste

By Dye Type

- Disperse

- Reactive

- Direct

- Acid

- Vat

- Basic

By Technology

- Digital Textile Printing

- Water-Less/Low-Water Solutions

- Closed-Loop/Wastewater Recovery and Chemical Recycling

- Others

By Fiber Type

- Cotton

- Viscose

- Wool

- Nylon

- Polyester

- Acrylic

Driving Factors

Rising global textile production demand

Rising global textile production demand continues to strengthen the Textile Colors Market as garment output expands across cotton, polyester, and blended fabrics. Higher manufacturing volumes naturally translate into increased dye and pigment consumption across mills and processing units. At the same time, innovation around material performance is accelerating.

Plastic Degradation Company, breaking and emerging from stealth with a naturally derived solution to degrade multiple plastics and securing $10.5M in seed funding, reflects broader momentum toward material science advancements. Such developments indirectly influence textile coloration, especially where synthetic fibers dominate production. As polyester and other man-made fibers remain widely used, improvements in polymer sustainability and processing compatibility are supporting long-term colorant demand tied directly to expanding textile output.

Restraining Factors

Stringent environmental regulations on dyes

Stringent environmental regulations on dyes remain a major restraint in the Textile Colors Market, particularly as governments tighten discharge norms and chemical usage standards. Compliance requires higher investment in effluent treatment and reformulation, increasing operational costs for dye manufacturers. Simultaneously, the industry is witnessing strong recycling-focused innovation.

Samsara Eco is commercializing Nylon 6,6 recycling, while biotech company Digestiva closed an $18m funding round and Syntetica secured $4.5m for nylon recycling initiatives. These developments reflect a shift toward circular fiber systems, which may reduce reliance on virgin synthetic fiber dyeing over time. As recycling technologies mature, dye producers must adapt formulations for regenerated materials, creating transitional pressure on conventional product lines and compliance structures.

Growth Opportunity

Expansion of sustainable dye technologies

Expansion of sustainable dye technologies presents a strong opportunity for the Textile Colors Market as manufacturers prioritize lower-impact solutions. Developments in enzyme science and polymer breakdown are reshaping textile processing methods. For example, a project evolving from a high school science concept into an $18.3M funded venture focused on AI-accelerated enzymes targeting plastic waste highlights growing capital support for innovation linked to fast fashion’s environmental footprint.

These advancements create opportunities for dyes compatible with recycled and bio-treated fibers. As brands demand traceable and environmentally responsible production, color suppliers investing in cleaner chemistries, reduced salt processes, and compatibility with next-generation materials are positioned to benefit from this transformation.

Latest Trends

Shift toward waterless dyeing solutions

A clear trend in the Textile Colors Market is the shift toward waterless dyeing solutions, driven by sustainability and cost-efficiency goals. Companies are actively developing alternatives to traditional water-intensive processes. Bioweg landing $19m in Series A funding to replace microplastics with bio-based alternatives reflects increasing interest in environmentally safer material inputs that can influence textile coloration systems.

Additionally, nearly €630,000 granted for six marine infrastructure projects in Kerry underscores broader regulatory and environmental commitments tied to water ecosystems. Such initiatives reinforce pressure on textile processors to adopt low-water or closed-loop dyeing methods. This trend is steadily pushing the market toward cleaner technologies and advanced application systems.

Regional Analysis

Asia Pacific dominates the Textile Colors Market with 46.9% share globally.

In 2024, the Textile Colors Market demonstrates varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific clearly leads the global landscape, accounting for 46.9% of the total market and generating USD 5.1 Bn in revenue, positioning it as the dominant region. The region’s leadership reflects its strong textile manufacturing base and large-scale dyeing and processing capacity.

North America and Europe maintain stable demand patterns, supported by established apparel consumption and advanced textile processing infrastructure. Meanwhile, the Middle East & Africa and Latin America represent developing regional markets, contributing comparatively smaller shares but offering steady participation within the global structure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Huntsman Corporation continues to demonstrate strength through its diversified specialty chemical portfolio and established presence across major textile-producing regions. Its focus on high-performance dye solutions and process optimization supports long-term partnerships with large textile processors.

Kiri Industries Ltd. maintains a strong foothold in dyestuff manufacturing, particularly in reactive dyes, supported by vertically integrated operations and export-oriented production capabilities. The company’s operational scale and emphasis on cost competitiveness allow it to serve both domestic and international textile clusters effectively.

Atul Ltd. reinforces its market relevance through integrated chemical manufacturing and consistent product quality in color intermediates and dyes. Its structured production ecosystem and steady supply capabilities provide reliability to textile manufacturers seeking stable sourcing partners. Collectively, these three companies shape the competitive environment through manufacturing strength, product consistency, and strategic alignment with evolving textile processing requirements.

Top Key Players in the Market

- Huntsman Corporation

- Kiri Industries Ltd.

- Atul Ltd.

- LANXESS AG

- DyStar Singapore Pte Ltd

- Zhejiang Runtu Co. Ltd.

- Colorant Limited

- JAY Chemicals Industries Limited

- Shanghai Anoky Group Co. Ltd.

Recent Developments

- In June 2025, Kiri Industries Ltd. shared its investor presentation outlining operations in textile dyes, dye intermediates, and basic chemicals. It highlighted its manufacturing strength and global export reach as one of India’s largest dyes producers. This presentation confirmed the ongoing business focus on textile dye products.

- In March 2025, Huntsman Textile Effects released the third-generation AVITERA® ROSE SE poly-reactive dye range designed to deliver brilliant bluish-red shades with better performance. This new dye helps mills reduce water and energy usage in the dyeing process and improves overall fastness and shade quality for cotton and blended fabrics.

Report Scope

Report Features Description Market Value (2024) USD 11.0 Billion Forecast Revenue (2034) USD 18.3 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fibers (Natural Fibers, Synthetic Fibers), By Form (Powder, Granules, Liquid, Paste), By Dye Type (Disperse, Reactive, Direct, Acid, Vat, Basic), By Technology (Digital Textile Printing, Water-Less/Low-Water Solutions, Closed-Loop/Wastewater Recovery and Chemical Recycling, Others), By Fiber Type (Cotton, Viscose, Wool, Nylon, Polyester, Acrylic) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Huntsman Corporation, Kiri Industries Ltd., Atul Ltd., LANXESS AG, DyStar Singapore Pte Ltd, Zhejiang Runtu Co. Ltd., Colorant Limited, JAY Chemicals Industries Limited, Shanghai Anoky Group Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Huntsman Corporation

- Kiri Industries Ltd.

- Atul Ltd.

- LANXESS AG

- DyStar Singapore Pte Ltd

- Zhejiang Runtu Co. Ltd.

- Colorant Limited

- JAY Chemicals Industries Limited

- Shanghai Anoky Group Co. Ltd.