Global Synthetic Spider Silk Market By Production Process (Microbial Fermentation, Transgenic Production, Chemical Synthesis, and Others), By Product Type (Fibers And Threads, Films And Coatings, Gels And Foams, Nanocomposites And Hydrogels, and Others), By Application (Textiles, Medical Equipment, Packaging, Aerospace, Cosmetics And Personal Care, Military Gears, Packaging, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174849

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

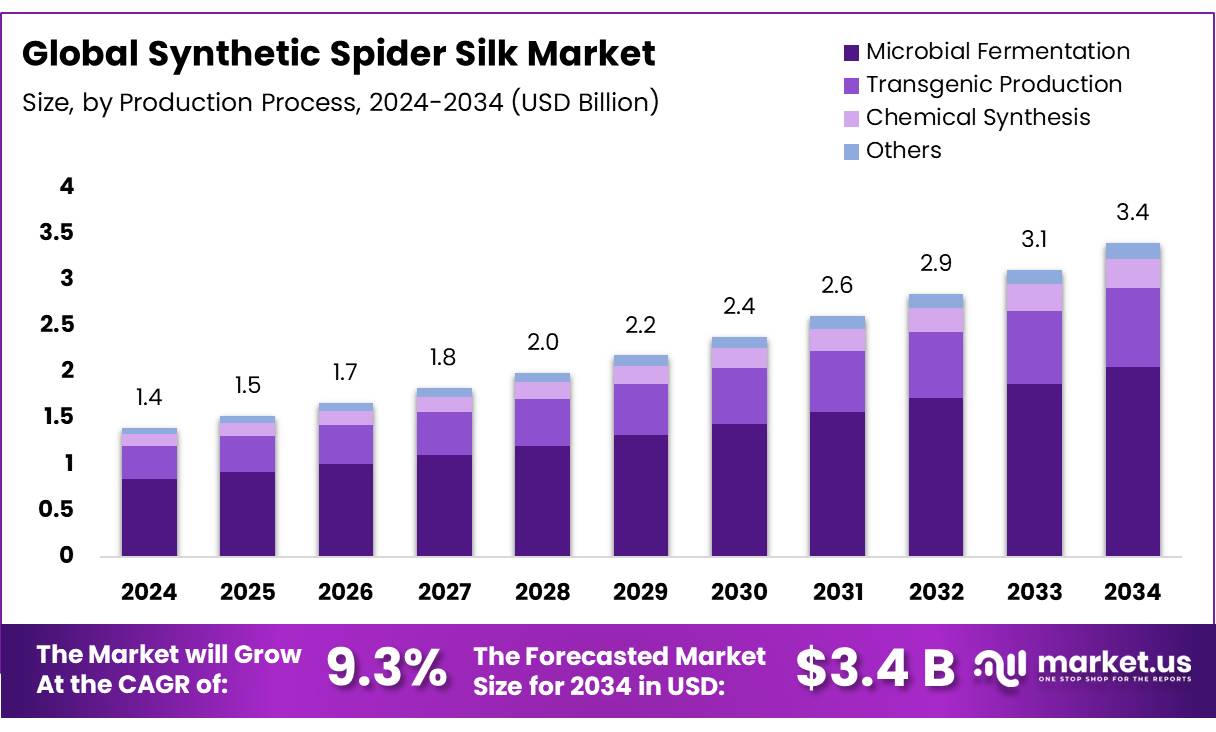

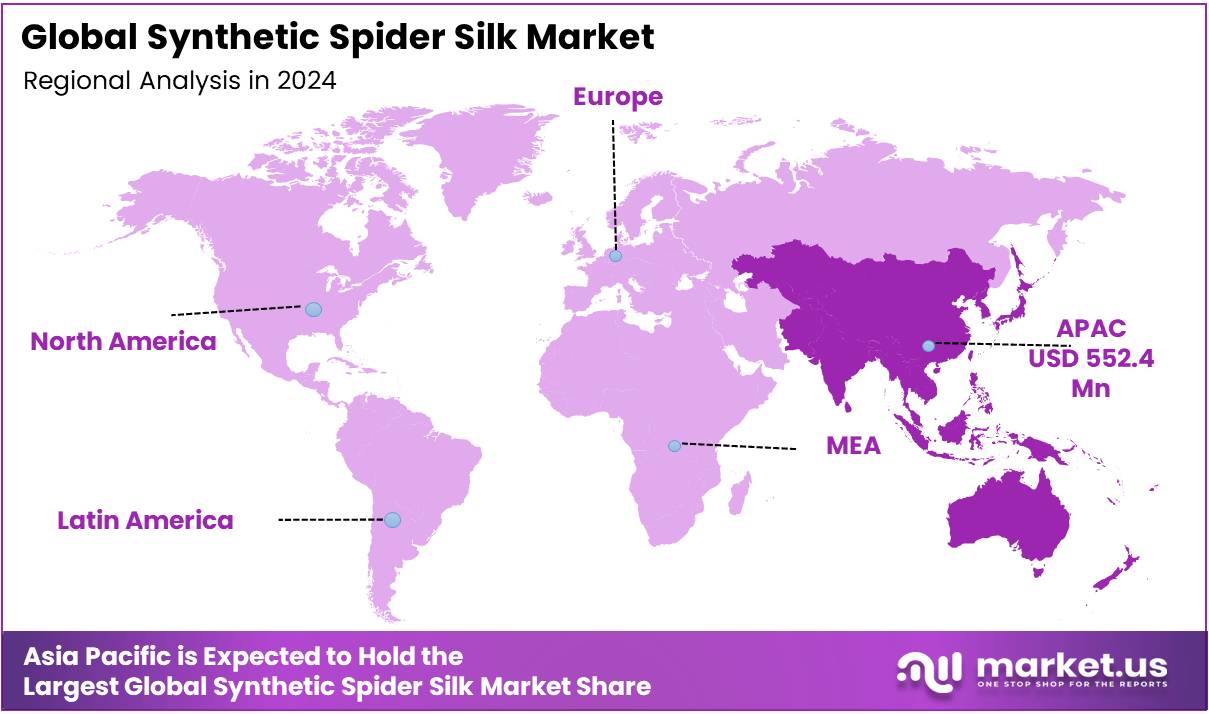

Global Synthetic Spider Silk Market size is expected to be worth around USD 1.4 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.9% share, holding USD 0.5 Billion in revenue.

Synthetic spider silk is a man-made material that mimics the strength, elasticity, and toughness of natural spider silk, created by either genetically engineering microbes, such as bacteria or yeast, to produce spider silk proteins, spidroins, or by developing water-based hydrogels that self-assemble into strong fibers, offering sustainable, biodegradable, and strong alternatives for traditional silk. This market is a rapidly evolving field driven by the unique properties of spider silk, such as its exceptional strength, flexibility, and biodegradability.

- As of October 2024, there were about 2,400 patents related to spider silk manufacturing, emphasizing growing commercial interest in the industry.

The primary production method, microbial fermentation, allows for scalable and cost-effective production of fibers and threads, which are most commonly used in textiles due to their versatility and high performance. Industries such as fashion, medical equipment, and protective gear have created demand for these fibers for their potential in creating durable, lightweight, and eco-friendly products.

While other applications, such as packaging, aerospace, and cosmetics, are gaining traction, they face challenges in scaling production and replicating the complex properties of natural spider silk. Despite the challenges, innovations in production methods and strategic partnerships continue to expand the scope of synthetic spider silk, positioning it as a promising material across various industries.

Key Takeaways

- The global synthetic spider silk market was valued at USD 1.4 billion in 2024.

- The global synthetic spider silk market is projected to grow at a CAGR of 9.3% and is estimated to reach USD 3.4 billion by 2034.

- On the basis of production processes, synthetic spider silk manufactured by microbial fermentation dominated the market, constituting 60.3% of the total market share.

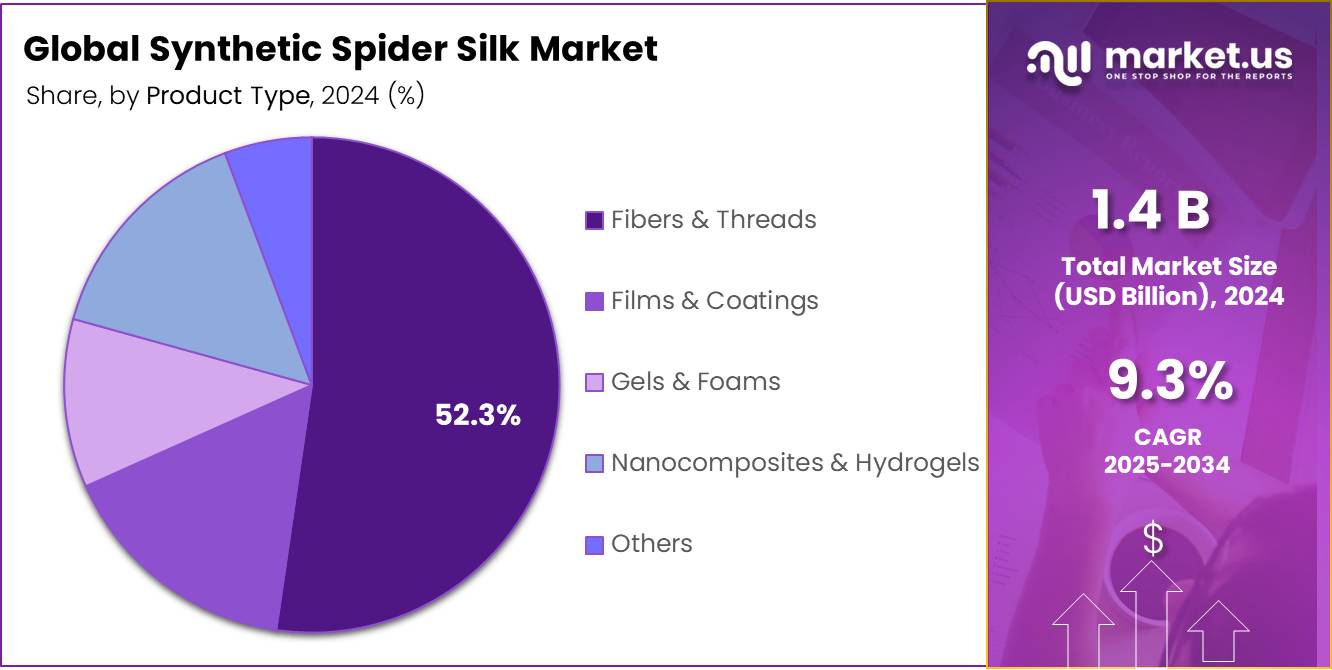

- Based on the product type, synthetic spider silk fibers & threads dominated the market, with a substantial market share of around 52.3%.

- Among the applications, textiles held a major share in the synthetic spider silk market, 40.8% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the synthetic spider silk market, accounting for 38.9% of the total global consumption.

Production Process Analysis

The Microbial Fermentation Process is a Prominent Segment in the Synthetic Spider Silk Market.

The synthetic spider silk market is segmented based on production process into microbial fermentation, transgenic production, chemical synthesis, and others. The microbial fermentation processes led the market, comprising 60.3% of the market share, due to their efficiency, scalability, and cost-effectiveness. This method involves genetically engineered microorganisms, such as bacteria or yeast, to produce spider silk proteins through fermentation processes.

It offers a more sustainable alternative to transgenic production, which can be complex, expensive, and time-consuming, involving the creation of genetically modified organisms to express silk proteins. In contrast, chemical synthesis is limited by the difficulty of replicating the natural protein’s intricate structure, which is essential for achieving the desired strength and elasticity. Microbial fermentation can be more easily controlled and scaled up for large-scale production, making it a preferred method for industrial applications while reducing the environmental footprint.

Product Type Analysis

Fibers & Threads Dominated the Synthetic Spider Silk Market.

Based on product type, the synthetic spider silk market is segmented into fibers & threads, films & coatings, gels & foams, nanocomposites & hydrogels, and others. The fibers & threads dominated the synthetic spider silk market, comprising 52.3% of the market share, due to their versatility and wide range of applications. The unique properties of synthetic spider silk, such as its lightweight yet extremely strong nature, make it an ideal material for textile production, medical sutures, and protective gear. The demand for fibers and threads is particularly high in industries focused on high-performance materials, where strength and flexibility are paramount.

In contrast, films, coatings, gels, foams, and hydrogels, while valuable in specific niches, such as biomedical applications or packaging, require more complex processing and are less versatile across various industrial sectors. Furthermore, fibers and threads offer easier scalability, allowing for mass production with existing manufacturing infrastructure, further driving their dominance in the synthetic spider silk market.

Application Analysis

Synthetic Spider Silk Products Are Mostly Utilized for the Manufacturing of Textiles.

Based on the applications, the synthetic spider silk market is segmented into textiles, medical equipment, packaging, aerospace, cosmetics & personal care, military gears, packaging, and others. Among the applications of the synthetic spider silk, 40.8% of the products consumed globally are for the manufacturing of textiles. Textiles are one of the most accessible and scalable applications for spider silk, as the material can be easily woven or knitted into fabrics for various uses, such as clothing and sportswear, where durability and comfort are essential.

While synthetic spider silk has potential in medical equipment, packaging, aerospace, cosmetics, and military gear, these industries require more specialized properties, often demanding further technological advancements and higher production costs. Additionally, the textile industry benefits from existing infrastructure that can be quickly adapted for large-scale production of silk fibers, making textiles the dominant application for this material in its current stage of development.

Key Market Segments

By Production Process

- Microbial Fermentation

- Transgenic Production

- Chemical Synthesis

- Others

By Product Type

- Fibers & Threads

- Films & Coatings

- Gels & Foams

- Nanocomposites & Hydrogels

- Others

By Application

- Textiles

- Medical Equipment

- Packaging

- Aerospace

- Cosmetics & Personal Care

- Military Gears

- Packaging

- Others

Drivers

High Demand for Silk Textiles Drives the Synthetic Spider Silk Market.

The increasing demand for silk clothes has significantly influenced the growth of the synthetic spider silk market, as manufacturers seek alternatives to traditional silks due to scaling challenges faced by these manufacturers. Spider silk, which is known for its strength and lightweight properties, is highly in demand for its potential in textile production.

However, the limited availability of natural spider silk has driven the research and development for synthetic counterparts. Consequently, companies have developed various methods to produce synthetic spider silk through bioengineering, such as using yeast, bacteria, and plants to create fibers that closely mimic the properties of natural silk. These synthetic fibers are gaining attention for their potential to revolutionize the fashion industry, offering a sustainable alternative to traditional silks.

For example, in July 2025, Japanese biotech venture Spiber, a pioneer in artificial protein fiber, and acclaimed Dutch haute couture designer Iris van Herpen collaborated to design and launch one of the designer’s two bridal looks during Paris Haute Couture Fashion Week Autumn/Winter 2025, which is made from Spiber’s Brewed Protein. This trend reflects a broader shift towards sustainable and high-performance materials in clothing production.

Restraints

Manufacturing Challenges Might Dampen the Growth of the Synthetic Spider Silk Market.

Despite significant advancements in the production of synthetic spider silk, the industry faces considerable challenges, particularly in replicating the high-performance mechanical properties of natural silk fibers. One major hurdle lies in the use of synthetic spinning dopes, which often differ in protein structure and function from their natural counterparts.

For instance, reconstituted silk proteins derived from silkworms exhibit lower molecular weight and distinct mechanical properties compared to spider silk proteins. Moreover, current fiber-forming processes, such as wet spinning and dry spinning, fail to replicate the natural, stress-induced phase transition that occurs in spider silk production. These differences result in artificial fibers with less ordered molecular structures, leading to lower strength and stiffness.

As shown in the research studies, linked fiber strength to reduced diameter, the thinner fibers tend to demonstrate improved mechanical performance. However, artificial fibers often deviate from this trend, indicating that the internal hierarchical structures, including micro/nanofibrils and the skin/core structure, are crucial for optimizing fiber strength. These complexities highlight the need for further innovation in synthetic silk production to address the limitations of current manufacturing methods.

Opportunity

Military and Protective Gear Manufacturing Creates Opportunities in the Synthetic Spider Silk Market.

The synthetic spider silk market is poised for significant opportunities, particularly in military and protective gear manufacturing, as well as in the packaging industry. The tensile strength of most spider silks can reach 0.9-1.4 GPa, and its high elasticity allows it to stretch 15% to 35% before breaking and recover its shape. This exceptional strength-to-weight ratio and durability of synthetic spider silk make it an ideal material for high-performance protective gear, such as bulletproof vests, helmets, and other armor. The following are some of the properties that make synthetic spider silk a preferred choice for protective gear.

Property Synthetic Spider Silk Strength Excellent (High) Elasticity (% stretch) 15%–35% Moisture Absorption Excellent Temperature Regulation Excellent Hypoallergenic Properties Yes Breathability Excellent Wrinkle Resistance Good Depending on the type, the spider silk fibers can be up to five times stronger than steel, while remaining lightweight, offering improved mobility without compromising safety. Similarly, in packaging, synthetic spider silk presents a sustainable alternative to conventional materials, offering superior tear resistance and elasticity, ideal for protective packaging of sensitive goods. The biodegradable nature of synthetic spider silk can lead to reduced environmental impact, making it increasingly attractive for eco-conscious industries.

Trends

Adoption of Synthetic Silk in Products due to its Biocompatibility.

The medical and personal care sectors are increasingly adopting synthetic spider silk due to its biocompatibility, strength, and eco-friendly properties. In the medical field, synthetic spider silk’s biocompatibility makes it a preferred material for sutures, implants, and tissue engineering. Its tensile strength and elasticity make it ideal for use in surgical sutures, which can dissolve over time without causing inflammation.

In addition, its non-toxic, biodegradable nature ensures that it poses no long-term environmental hazards, making it an attractive alternative for biodegradable medical devices. For instance, Latvian company PrintyMed develops biocompatible artificial spider silk for various medical applications, including tissue engineering, 3D heart valves, and skin reconstruction.

Similarly, in personal care, spider silk proteins are being incorporated into products such as shampoos, conditioners, and home care products due to their film-forming and strengthening properties. These proteins can enhance the smoothness, shine, and breakage resistance of hair, while providing natural, biodegradable coatings for laundry pods and dishwashing tablets. This shift towards natural, sustainable ingredients reflects the growing demand for cleaner and more eco-friendly formulations in the medical and cosmetic industries.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Disruption in the Production of Synthetic Spider Silk.

The geopolitical tensions have had a significant impact on the synthetic spider silk market, influencing both production and supply chains. Trade disruptions, particularly between major manufacturing hubs such as the United States, China, and the European Union, have caused delays in the sourcing of raw materials and biotechnological equipment necessary for synthetic silk production. For instance, the ongoing trade restrictions and supply chain bottlenecks have made it more challenging to access high-quality biomaterials and advanced fermentation technologies required for efficient silk protein production. Moreover, these tensions have led to increased manufacturing costs, as companies face rising energy prices and transportation costs.

Furthermore, the uncertainty in international relations has prompted some countries to seek greater self-sufficiency in biotechnology. Consequently, countries such as Japan and South Korea have accelerated their investments in domestic research and development to reduce reliance on foreign suppliers. Similarly, geopolitical instability has prompted companies to adopt more diversified sourcing strategies, exploring new markets and forming regional partnerships to mitigate risks.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Synthetic Spider Silk Market.

In 2024, the Asia Pacific dominated the global synthetic spider silk market, holding about 38.9% of the total global consumption, due to its strong industrial base, research initiatives, and increasing demand for innovative textiles and biotechnologies. Countries such as China, Japan, and India are at the forefront of developing synthetic spider silk for various applications, such as medical devices, textiles, and environmental solutions.

The well-established biotechnology and textile industries in the region have facilitated advancements in the production of spider silk proteins through bioengineering, such as microbial fermentation. For instance, in January 2024, in Japan, researchers at the RIKEN Center for Sustainable Resource Science (CSRS) have developed a device mimicking the chemical and physical changes in a spider’s silk gland, allowing them to spin artificial spider silk with natural properties. The technological expertise and large-scale manufacturing capabilities, along with a growing interest in sustainable solutions, have contributed to the leading position of the Asia Pacific in this emerging market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the synthetic spider silk market employ various strategies to gain a competitive edge, including focused product development, strategic partnerships, and investment in research. Several companies invest heavily in R&D to create advanced spider silk fibers with enhanced strength, durability, and versatility for diverse applications, such as textiles, medical devices, and packaging.

In addition, major players emphasize collaborations with academic institutions and biotechnological firms to leverage cutting-edge research and accelerate innovation. Similarly, they focus on partnerships with manufacturers in different industries to expand market reach and improve production capabilities.

Furthermore, companies focus on mergers and acquisitions as they seek to acquire intellectual property, new technologies, or established market players, allowing for faster scaling and diversification of their product portfolios. These strategies allow companies to remain competitive and capitalize on emerging opportunities in the rapidly evolving synthetic spider silk market.

The Major Players in The Industry

- AMSilk GmbH

- Bolt Projects (Bolt Threads)

- Kraig Biocraft Laboratories, Inc.

- Spiber, Inc.

- Inspidere BV

- Seevix

- Spintex Engineering Ltd.

- Other Key Players

Key Development

- In January 2024, AMSilk, a global leader in advanced materials made from spider silk-based proteins, and 21st.BIO, a leader in bioproduction, announced the collaboration to accelerate the upscaling of AMSilk’s silk protein production. 21st.BIO developed a new protein production strain created from highly specialized precision fermented microorganisms to help AMSilk scale production from the laboratory to industrial scale.

- In May 2025, Kraig Biocraft Laboratories, a world leader in spider silk technology, announced the successful development of a new recombinant spider silk parental line, purpose-built for large-scale commercial production.

Report Scope

Report Features Description Market Value (2024) US$1.4 Bn Forecast Revenue (2034) US$3.4 Bn CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Process (Microbial Fermentation, Transgenic Production, Chemical Synthesis, and Others), By Product Type (Fibres & Threads, Films & Coatings, Gels & Foams, Nanocomposites & Hydrogels, and Others), By Application (Textiles, Medical Equipment, Packaging, Aerospace, Cosmetics & Personal Care, Military Gears, Packaging, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape AMSilk GmbH, Bolt Projects (Bolt Threads), Kraig Biocraft Laboratories, Inc., Spiber, Inc., Inspidere BV, Seevix, Spintex Engineering Ltd., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Synthetic Spider Silk MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Synthetic Spider Silk MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AMSilk GmbH

- Bolt Projects (Bolt Threads)

- Kraig Biocraft Laboratories, Inc.

- Spiber, Inc.

- Inspidere BV

- Seevix

- Spintex Engineering Ltd.

- Other Key Players