Global Sulfamic Acid Market By Form (Powder, Liquid, Others), By Application (Metal Finishing, Dyes and Pigments, Paper and Pulp, Plastic, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149943

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

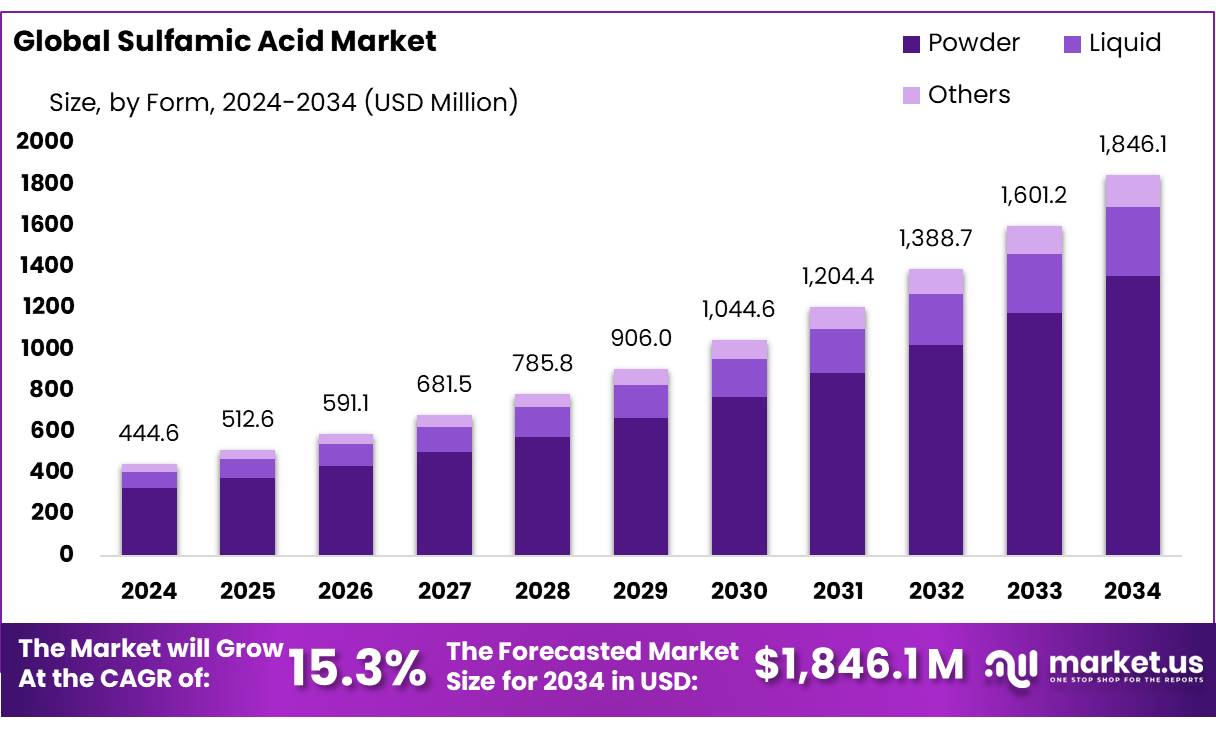

The Global Sulfamic Acid Market size is expected to be worth around USD 1846.1 Million by 2034, from USD 444.6 Million in 2024, growing at a CAGR of 15.3% during the forecast period from 2025 to 2034.

Sulfamic acid, a versatile compound with the chemical formula H₃NSO₃, plays a pivotal role across various industries due to its strong acidic properties and stability. It is extensively utilized as a descaling agent in industrial equipment, a cleaning agent in household products, and a catalyst in dye and pigment manufacturing. Additionally, its applications extend to the paper and pulp industry, water treatment processes, and the pharmaceutical sector, where it serves as a precursor in the synthesis of certain therapeutic agents.

Several factors are propelling the growth of the sulfamic acid market. The increasing demand for effective cleaning agents in industrial settings, coupled with the compound’s relatively low toxicity and environmental impact compared to alternatives like hydrochloric acid, enhances its appeal. Moreover, the rising awareness of hygiene and sanitation, especially in the wake of global health concerns, has led to a surge in demand for cleaning and disinfecting agents, further boosting the market.

Government initiatives and regulatory frameworks are also influencing the market dynamics. For instance, the European Chemicals Agency (ECHA) has classified sulfamic acid as hazardous under the REACH regulation, leading to stricter controls on its use and promoting the development of environmentally friendly alternatives. In the United States, the Environmental Protection Agency (EPA) has included the sulfuric and nitric acid manufacturing industry in its National Compliance Initiative to reduce harmful emissions, indirectly impacting the production and handling of related compounds like sulfamic acid.

Key Takeaways

- Sulfamic Acid Market size is expected to be worth around USD 1846.1 Million by 2034, from USD 444.6 Million in 2024, growing at a CAGR of 15.3%.

- Powder held a dominant market position, capturing more than a 56.4% share of the global sulfamic acid market.

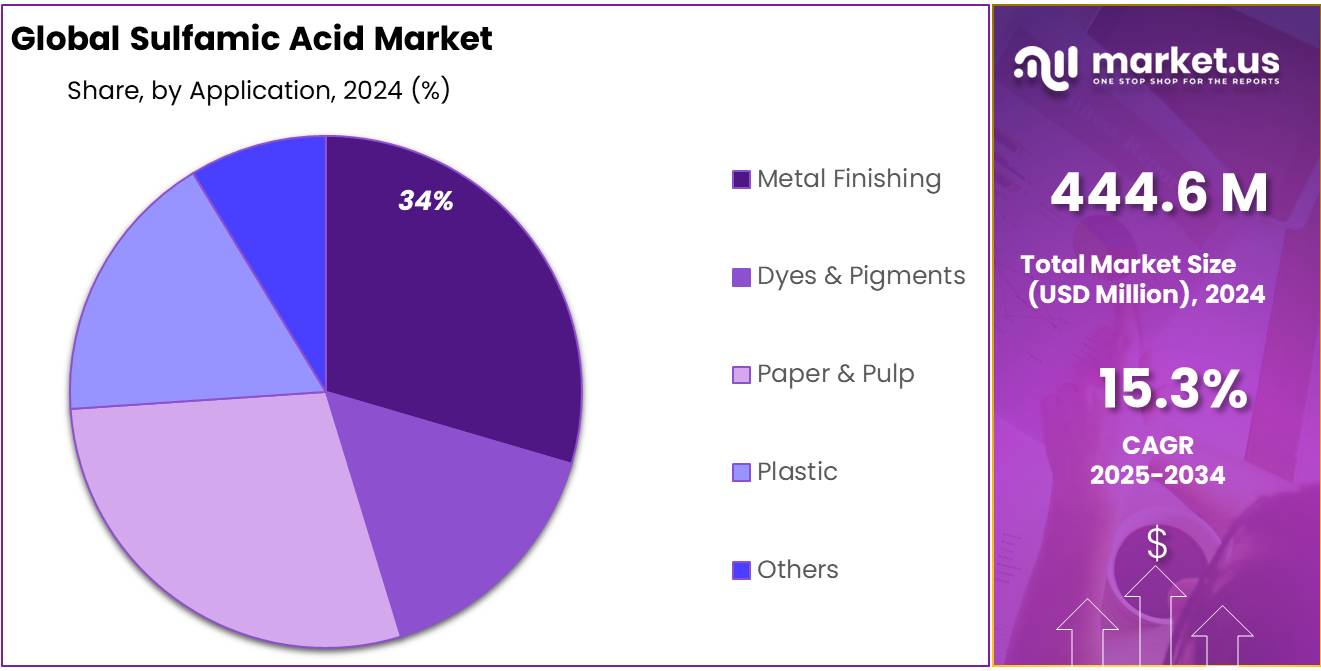

- Metal Finishing held a dominant market position, capturing more than a 34.5% share of the total sulfamic acid market.

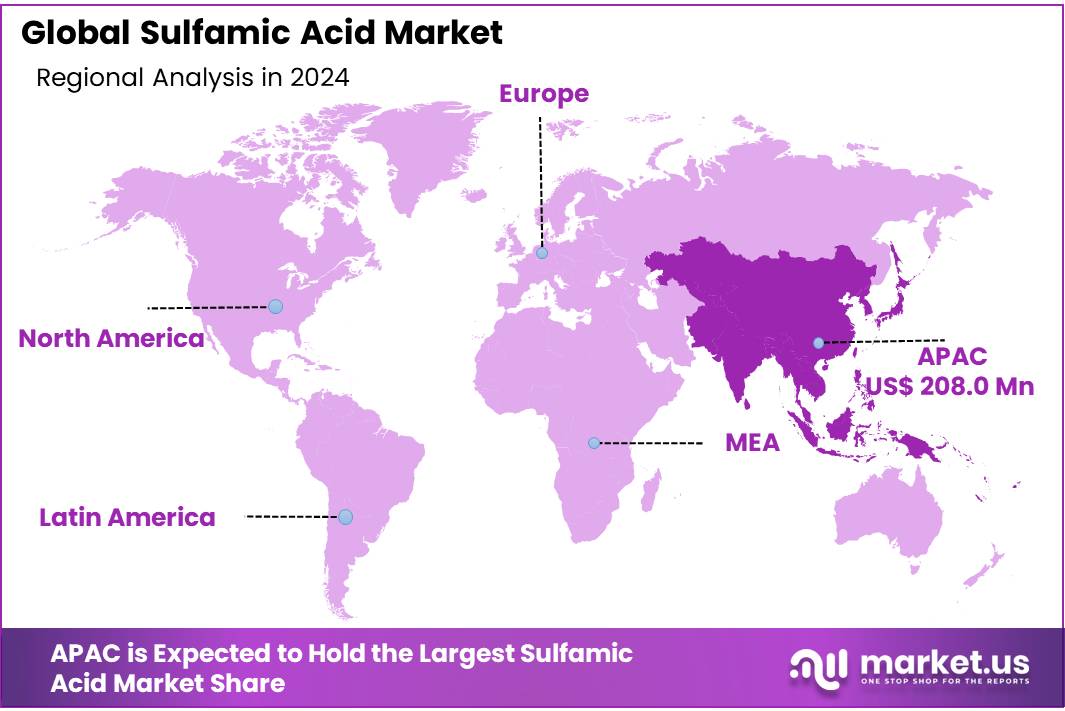

- Asia-Pacific (APAC) region solidified its leadership in the global sulfamic acid market, capturing an impressive 46.8% share, equivalent to USD 208.0 million.

By Form

Powder Form Leads Sulfamic Acid Market with 56.4% Share in 2024 Due to Its Stability and Ease of Use

In 2024, Powder held a dominant market position, capturing more than a 56.4% share of the global sulfamic acid market. This strong preference for the powder form is primarily due to its long shelf life, convenient packaging, and safer handling compared to liquid alternatives. Powdered sulfamic acid is widely used across multiple industries such as cleaning, pharmaceuticals, water treatment, and pulp and paper, where precise dosing and ease of storage are critical.

Its non-hygroscopic nature ensures minimal moisture absorption, making it particularly suitable in humid regions or for long-distance export. In both industrial and household cleaning formulations, powdered sulfamic acid maintains its effectiveness and stability, which contributes to its continued dominance through 2025 as demand for efficient, reliable, and eco-safe cleaning chemicals continues to grow.

By Application

Metal Finishing Leads Sulfamic Acid Demand with 34.5% Share in 2024, Driven by Its Precision Cleaning Role

In 2024, Metal Finishing held a dominant market position, capturing more than a 34.5% share of the total sulfamic acid market. This dominance is mainly due to the compound’s strong descaling and rust-removal capabilities, which are vital for cleaning and preparing metal surfaces in sectors like automotive, aerospace, and industrial machinery.

Sulfamic acid is widely valued for its non-corrosive action on most metals, making it a preferred choice over harsher acids. The consistency it offers in removing oxides and scale without pitting the metal helps manufacturers maintain quality standards in surface treatment processes. As industries continue modernizing their production lines through 2025, the reliability and efficiency of sulfamic acid in metal finishing applications are expected to support its continued leading role in this segment.

Key Market Segments

By Form

- Powder

- Liquid

- Others

By Application

- Metal Finishing

- Dyes & Pigments

- Paper & Pulp

- Plastic

- Others

Drivers

Rising Demand for Sulfamic Acid in the Food and Beverage Industry

A significant driving factor for the sulfamic acid market is its expanding application within the food and beverage sector. Sulfamic acid serves as an effective descaling agent and pH regulator, making it invaluable for cleaning and maintaining food processing equipment. Its ability to ensure hygiene and prevent contamination aligns with the industry’s stringent cleanliness standards.

The global food processing industry, valued at over USD 8 trillion, is experiencing steady growth, particularly in developing nations where urbanization and changing dietary habits are increasing the demand for processed foods. This surge necessitates efficient cleaning agents like sulfamic acid to maintain equipment and ensure product safety. Additionally, sulfamic acid’s role in the production of artificial sweeteners and its use as a flavor enhancer further embed it into food manufacturing processes.

Government regulations emphasizing food safety and hygiene have also contributed to the increased use of sulfamic acid. For instance, the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) have established guidelines that encourage the use of effective cleaning agents in food production, indirectly supporting the demand for sulfamic acid.

Restraints

Stringent Food Safety Regulations Limiting Sulfamic Acid Use

One significant factor restraining the growth of the sulfamic acid market is the stringent regulatory framework governing its use in the food industry. Sulfamic acid, while effective as a cleaning and descaling agent, is subject to strict regulations due to potential health concerns. For instance, the Food Safety and Standards Authority of India (FSSAI) mandates that food additives, including acidity regulators like sulfamic acid, must comply with specific safety standards and usage limits to ensure consumer safety.

In Canada, the use of sulfamic acid derivatives such as sodium cyclamate is regulated under the Food and Drug Regulations. These regulations stipulate that such compounds may only be sold as sweeteners for personal use, provided they are labeled accordingly and used under medical advice. This cautious approach reflects broader concerns about the long-term health effects of certain chemical additives in food products.

Moreover, in the European Union, sulfamic acid is classified under specific hazard statements due to its potential health risks, including skin and eye irritation. Such classifications necessitate careful handling and limit its application in food-related processes.

Opportunity

Expanding Applications in Food Contact Materials Drive Sulfamic Acid Market Growth

Sulfamic acid is gaining traction in the food industry, particularly in applications involving food contact materials. The U.S. Food and Drug Administration (FDA) has affirmed sulfamic acid as Generally Recognized As Safe (GRAS) for use as an indirect food additive, specifically in the manufacture of paper and paperboard that come into contact with food. This designation, outlined in 21 CFR §186.1093, permits its use under current good manufacturing practices without specific limitations, thereby broadening its applicability in food packaging and processing equipment.

Government regulations emphasizing food safety and hygiene have also contributed to the increased use of sulfamic acid. For instance, the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) have established guidelines that encourage the use of effective cleaning agents in food production, indirectly supporting the demand for sulfamic acid.

Trends

Eco-Friendly Cleaning Solutions Drive Sulfamic Acid Market Growth

A notable trend in the sulfamic acid market is the increasing demand for eco-friendly cleaning solutions. Industries are shifting towards sustainable practices, and sulfamic acid is gaining attention for its environmentally friendly properties. Its ability to effectively remove rust and scale without releasing harmful byproducts makes it a preferred choice over traditional, more hazardous chemicals.

In the food industry, sulfamic acid is used as a cleaning and descaling agent to maintain hygiene standards. Its effectiveness in removing mineral deposits and ensuring equipment cleanliness aligns with stringent food safety regulations. Similarly, in water treatment, sulfamic acid is utilized to prevent scale formation, contributing to efficient and sustainable operations.

The push for greener alternatives is also evident in the cosmetics sector, where sulfamic acid’s exfoliating and anti-aging properties are valued. Its inclusion in personal care products caters to consumer preferences for natural and environmentally responsible ingredients.

Regional Analysis

Asia-Pacific Commands Sulfamic Acid Market with 46.8% Share, Valued at USD 208.0 Million in 2024

In 2024, the Asia-Pacific (APAC) region solidified its leadership in the global sulfamic acid market, capturing an impressive 46.8% share, equivalent to USD 208.0 million. This dominance is primarily attributed to the region’s rapid industrialization, urbanization, and the expansion of key sectors such as water treatment, agriculture, and manufacturing. Countries like China and India are at the forefront, leveraging sulfamic acid’s efficacy in descaling and cleaning applications across various industries.

The APAC region’s growth is further fueled by the increasing demand for eco-friendly and efficient cleaning agents in industries like pharmaceuticals, food processing, and textiles. Sulfamic acid’s role in maintaining hygiene standards and equipment longevity aligns with the region’s emphasis on sustainable industrial practices. Moreover, the availability of raw materials and cost-effective labor in APAC countries enhances production capabilities, making the region a hub for sulfamic acid manufacturing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE plays a critical role in the global sulfamic acid market, leveraging its strong R&D capabilities and global distribution network. The company integrates sulfamic acid production into its broader chemicals portfolio, ensuring consistent supply and quality for industrial cleaning, water treatment, and pharmaceutical sectors. BASF’s focus on eco-efficient formulations supports sustainable demand. In 2024, BASF maintained a steady output across Europe and Asia, aligning with regional regulatory standards and advancing its position in industrial and specialty chemical applications.

DuPont contributes to the sulfamic acid market primarily through its focus on high-performance materials and chemical safety. The company’s advanced chemical processing expertise allows for the production of sulfamic acid with consistent purity, vital for food contact materials, metal finishing, and water treatment. In 2024, DuPont emphasized sustainability, incorporating sulfamic acid into its portfolio of environmentally responsible solutions. Its strong U.S. presence and expansion across Asia strengthened its market competitiveness in the specialty chemicals segment.

Based in China, Laizhou Jinxing Chemical Co. Ltd. is a leading sulfamic acid manufacturer with strong regional dominance in the Asia-Pacific market. The company’s operations benefit from cost-effective raw material access and proximity to key industrial zones. In 2024, it focused on increasing production capacity to meet rising domestic and international demand, particularly in cleaning and descaling applications. Its commitment to product quality and supply chain reliability has reinforced its standing among global buyers and industrial clients.

Top Key Players in the Market

- BASF SE

- DuPont

- Laizhou Jinxing Chemical Co. Ltd.

- Shandong Xingda Chemical Co. Ltd.

- Laizhou Guangcheng Chemical Co. Ltd.

- Shandong Mingda Chemical Technology Co., Ltd.

- Yantai Sanding Chemical Co. Ltd.

- Nissan Chemical Corporation

- Raviraj Group

- Palm Commodities International, LLC

Recent Developments

In 2024, BASF SE, a leading global chemical company, reported total sales of approximately €65.3 billion, reflecting its expansive operations across various chemical sectors.

In 2024, DuPont de Nemours, Inc. reported total net sales of approximately $12.4 billion, with its Electronics & Industrial segment contributing $5.93 billion, accounting for 52.23% of the company’s total revenue. While DuPont does not publicly disclose specific figures for sulfamic acid, the compound plays a vital role in the company’s portfolio, particularly within its Water & Protection segment, which generated $5.42 billion in revenue, representing 47.77% of total sales.

Report Scope

Report Features Description Market Value (2024) USD 444.6 Mn Forecast Revenue (2034) USD 1846.1 Mn CAGR (2025-2034) 15.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid, Others), By Application (Metal Finishing, Dyes and Pigments, Paper and Pulp, Plastic, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, DuPont, Laizhou Jinxing Chemical Co. Ltd., Shandong Xingda Chemical Co. Ltd., Laizhou Guangcheng Chemical Co. Ltd., Shandong Mingda Chemical Technology Co., Ltd., Yantai Sanding Chemical Co. Ltd., Nissan Chemical Corporation, Raviraj Group, Palm Commodities International, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- DuPont

- Laizhou Jinxing Chemical Co. Ltd.

- Shandong Xingda Chemical Co. Ltd.

- Laizhou Guangcheng Chemical Co. Ltd.

- Shandong Mingda Chemical Technology Co., Ltd.

- Yantai Sanding Chemical Co. Ltd.

- Nissan Chemical Corporation

- Raviraj Group

- Palm Commodities International, LLC