Global Strontium Carbonate Market Size, Share and Report Analysis By Form (Powder and Granules), By Purity (Up to 98% and Above 98%), By Production Method (Black Ash Method and Soda Ash Method), By Application (Glass And Ceramic, Electronics And Permanent Magnets, Pyrotechnics & Flares, Medical, Pigments And Paints, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178478

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

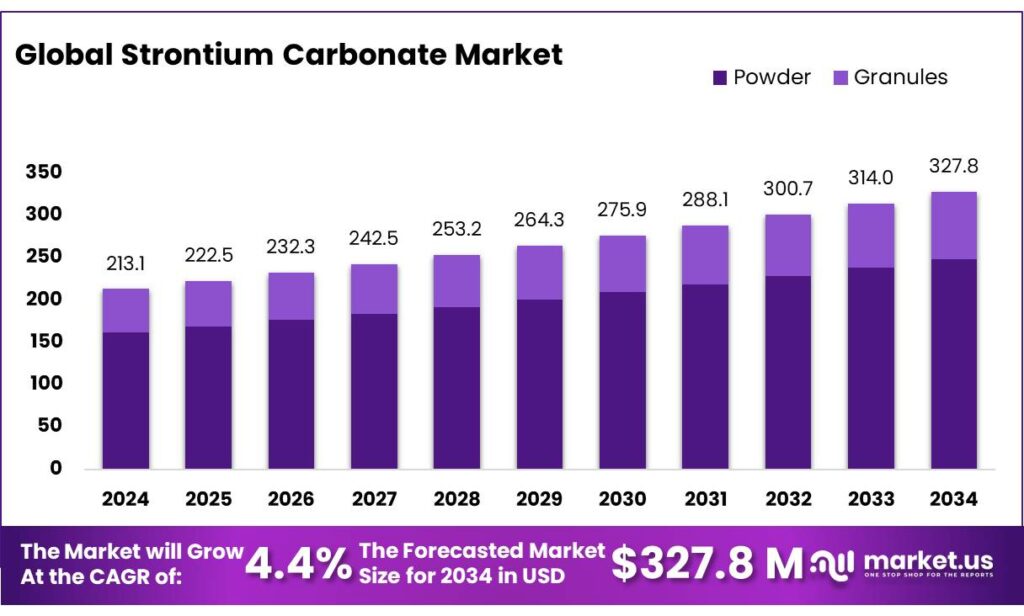

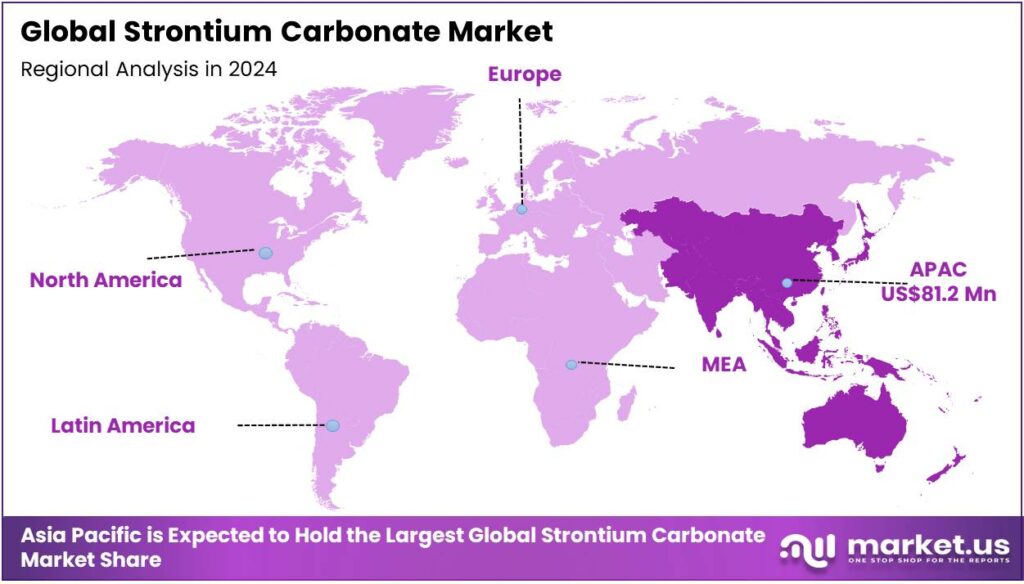

The Global Strontium Carbonate Market is expected to be worth around USD 327.8 Million by 2034, up from USD 213.1 Million in 2024, and is projected to grow at a CAGR of 4.4%, from 2025 to 2034. Asia Pacific accounted for 38.1%, reaching USD 81.2 Mn.

Strontium carbonate is an odorless, tasteless white or greyish compound primarily known for its role in ceramics and its ability to produce brilliant red flames in pyrotechnics. It occurs naturally as the mineral strontianite. It is stable under normal conditions but decomposes into strontium oxide and carbon dioxide when heated to approximately 1100°C–1494°C. While stable strontium is generally considered non-toxic, the powder can be a respiratory irritant.

- According to the United States Geological Survey, in 2024, the total global production of strontium reached approximately 520,000 metric tons, with Iran and Spain dominating the supply, each with 200,000 metric tons of strontium.

The market is primarily driven by its applications in electronics, permanent magnets, and other industrial sectors. The compound is most widely used in the production of ferrite magnets, which are essential components in electronic devices, motors, and renewable energy technologies. Additionally, the Asia Pacific region dominates the market, with China being a key producer and consumer, largely due to the high demand from its ceramics, glass, and pyrotechnics industries.

- According to the International Journal of Research and Analytical Reviews (IJRAR), India alone produces nearly 50,000 tons of firecrackers annually.

Strontium carbonate’s use in pyrotechnics, particularly in producing red flames for fireworks, remains significant, though its share is smaller compared to electronics and magnets. Furthermore, geopolitical tensions and environmental regulations present challenges, as they affect production costs and supply chain stability.

Additionally, strontium carbonate with greater than 98% purity is preferred for its superior performance in sensitive applications. Despite the competition from other materials, strontium carbonate continues to be vital for high-performance, precision applications in several industries, especially electronics.

Key Takeaways

- The global strontium carbonate market was valued at USD 213.1 million in 2024.

- The global strontium carbonate market is projected to grow at a CAGR of 4.4% and is estimated to reach USD 327.8 Million by 2034.

- On the basis of forms, powdered strontium carbonate dominated the market, constituting 75.9% of the total market share.

- Based on the purity, strontium carbonate that is more than 98% pure dominated the market, with a substantial market share of around 64.5%.

- Based on the production method, the black ash method led the strontium carbonate market, comprising 66.3% of the total market.

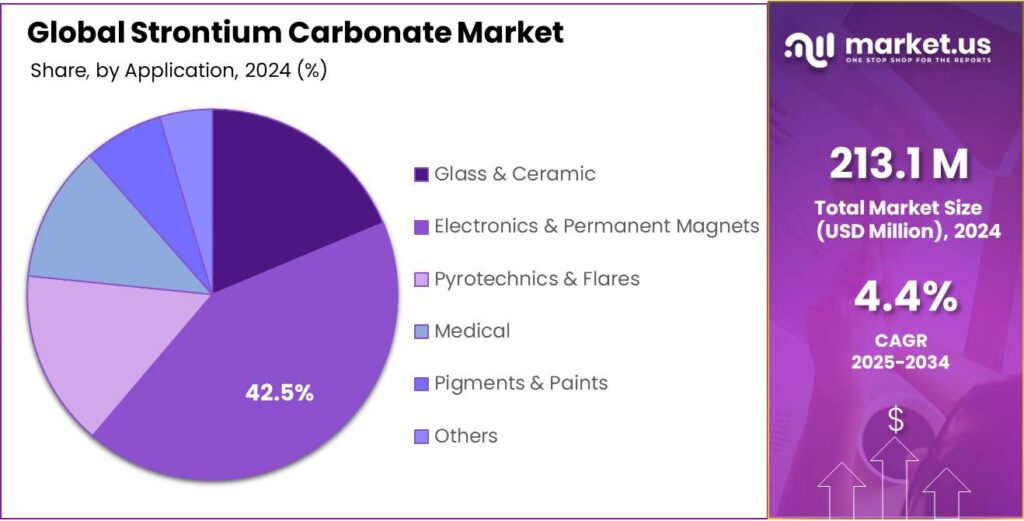

- Among the applications of strontium carbonate, electronics & permanent magnets held a major share in the market, 42.5% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the strontium carbonate market, accounting for 38.1% of the total global consumption.

Form Analysis

Powdered Strontium Carbonate is a Prominent Segment in the Market.

The market is segmented based on forms of strontium carbonate into powder and granules. The powdered strontium carbonate led the market, comprising 75.9% of the market share, due to its superior versatility and ease of application in various industrial processes. The fine powder form provides a larger surface area, facilitating faster dissolution and more efficient integration into chemical mixtures, which is especially important in applications such as ceramics, glass manufacturing, and pyrotechnics.

Additionally, powdered strontium carbonate can be more easily blended with other raw materials, ensuring uniform distribution in products. For instance, in pyrotechnics, powdered strontium carbonate enhances color consistency and flame characteristics. In contrast, granules tend to dissolve more slowly and may be less suitable for these precise applications. Consequently, the powdered form’s quick reactivity and ease of handling make it the preferred choice across industries.

Purity Analysis

Strontium Carbonate that is More Than 98% Pure Dominated the Market.

On the basis of the purity, the strontium carbonate market is segmented into up to 98% and above 98%. The strontium carbonate that is more than 98% pure dominated the market, comprising 64.5% of the market share, due to its higher performance and reliability in sensitive applications. In industries such as electronics, ceramics, and glass manufacturing, high purity ensures that the material does not introduce impurities that could affect product quality, color consistency, or performance.

For instance, in pyrotechnics, the precise formulation of color and stability requires high-purity strontium carbonate to avoid unintended reactions. Similarly, in high-end glass production, even trace impurities can compromise clarity or strength. Additionally, purity greater than 98% enhances the material’s reactivity, making it easier to integrate into chemical processes and ensuring a more consistent and efficient production process. The increased purity results in higher overall product quality and performance, and is preferred in critical applications.

Production Method Analysis

Most Strontium Carbonate is Produced by the Black Ash Method.

Based on the production method, the strontium carbonate market is divided into the black ash method and the soda ash method. Most strontium carbonate is produced by the black ash method, with a notable market share of 66.3%, due to its greater cost-efficiency and suitability for large-scale production. The black ash method involves reacting strontium-containing minerals, such as celestite, with a carbon-rich reducing agent, typically coal, producing strontium carbonate along with impurities that can be easily separated.

The method is simpler, requires fewer steps, and typically consumes less energy compared to the soda ash method, which involves using sodium carbonate to react with strontium ores at higher temperatures. The soda ash method is more complex and expensive, requiring additional chemical processes to purify the resulting strontium carbonate. Subsequently, the black ash method is favored for its economic advantage, especially when large volumes of strontium carbonate are required for industrial applications.

Application Analysis

Electronics & Permanent Magnets Held a Major Share of the Strontium Carbonate Market.

Among the applications, 42.5% of the total global consumption of strontium carbonate is for electronics & permanent magnets. Most strontium carbonate is used in electronics and permanent magnets due to the growing demand for high-performance materials in these sectors. Strontium carbonate is essential in the production of ferrite magnets, which are widely used in motors, speakers, and other electronic components due to their strong magnetic properties and temperature stability. The expansion of the electronics industry, driven by consumer electronics, automotive, and renewable energy technologies, has significantly increased the need for strontium ferrites.

While strontium carbonate is used in glass, ceramics, pyrotechnics, and pigments, the scale and technological advancements in electronics and magnets make these sectors the dominant consumers. These industries require large quantities of strontium carbonate to meet the demand for more efficient and miniaturized electronic devices, further driving its use in magnets and related technologies.

Key Market Segments:

By Form

- Powder

- Granules

By Purity

- Up to 98%

- Above 98%

By Production Method

- Black Ash Method

- Soda Ash Method

By Application

- Glass & Ceramic

- Electronics & Permanent Magnets

- Pyrotechnics & Flares

- Medical

- Pigments & Paints

- Others

Drivers

Manufacturing of Glass and Ceramics Drives the Strontium Carbonate Market.

The strontium carbonate market is sustained by its chemical role as a stabilizer and fluxing agent in the manufacturing of glass, ceramics, and ferrite magnets. In the glass industry, strontium carbonate is used to produce specialty glass, including colorless and optical glass, due to its ability to improve glass brilliance and scratch resistance. It replaces toxic barium in specific formulations to meet environmental standards. It enhances the durability of glass in high-performance applications, such as cathode ray tubes and television screens.

Similarly, in ceramics, strontium carbonate is utilized as a non-toxic flux to create vibrant glazes and pigments, particularly in the production of high-quality porcelain. It is the primary substitute for lead and barium in glazes. Strontium compounds are critical in enhancing the heat resistance and structural integrity of ceramic materials by reducing the melting point of silica.

- Annually, approximately 50% of global strontium output is sourced from celestite, with China and Spain acting as primary producers.

Apart from this, the most significant driver is the production of strontium hexaferrite magnets. As documented by the European Commission’s Raw Materials Information System (RMIS), strontium carbonate is calcined with iron oxide to produce magnets with high coercivity and resistance to demagnetization.

Restraints

High Production Costs Might Hinder the Growth of the Strontium Carbonate Market.

High production costs and stringent environmental regulations are significant challenges for the strontium carbonate market. Strontium carbonate is primarily produced from natural minerals, such as celestite, which requires energy-intensive processes involving high-temperature furnaces. The mining and refining of strontium ore consume considerable energy, raising production costs. The primary industrial method for producing strontium carbonate involves converting the mineral celestite to strontium carbonate through chemical or thermal processes.

Traditional calcining technology requires substantial thermal energy, as strontium carbonate decomposition occurs between 1000°C and 1300°C. The apparent activation energy for hydrothermal conversion ranges from 21.6 kJ/mol to 86.6 kJ/mol, depending on the chemical pathway used. These high energy requirements contribute to high operational costs. Additionally, complex chemical processes are required to purify strontium, which further adds to the cost burden.

Similarly, environmental regulations, particularly those governing mining and chemical manufacturing, are critical challenges. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes strict standards on the chemical substances used in the manufacturing of materials such as strontium carbonate. These regulations require companies to adhere to specific environmental safety protocols, increasing compliance costs and operational complexity.

Opportunity

Rising Demand for Renewable Energy Storage Creates Opportunities in the Strontium Carbonate Market.

Strontium carbonate is emerging as a high-potential material for thermochemical energy storage (TCES) within concentrating solar power (CSP) and long-duration storage systems. This application leverages the reversible carbonation-calcination cycle to store thermal energy chemically. Strontium compounds are utilized in TCES systems, where they play a key role in heat retention and transfer, enhancing energy storage efficiency. The strontium carbonate system offers a theoretical volumetric energy density of approximately 4GJ/m³, which is nearly 10 times higher than conventional sensible heat storage, such as molten salts.

Moreover, strontium-enhanced thermal storage can reduce the need for electricity grid backup by storing excess energy generated during peak renewable production hours. The National Renewable Energy Laboratory (NREL) indicates that TCES technologies are gaining traction in regions with high solar penetration, such as the southwestern United States. The integration of strontium-based materials in these systems aligns with global energy transitions, marking a growing opportunity for strontium carbonate.

- The U.S. Department of Energy (DOE) has funded projects aimed at reducing TCES costs to US$15/kWh_th to make renewable energy more competitive.

Trends

High Demand for Strontium Carbonate in Pyrotechnics & Flares.

Strontium carbonate is increasingly in demand for use in pyrotechnics and flares due to its ability to produce vibrant red colors and stable chemical properties. The strontium-based compounds, particularly strontium carbonate, are essential in fireworks manufacturing, where they are used to create the characteristic red flame effect. In pyrotechnic compositions, strontium compounds typically represent between 20% and 50% of the formulation, resulting in a strontium mass fraction of approximately 8% to 30%.

The U.S. Consumer Product Safety Commission (CPSC) noted that strontium salts are integral in enhancing pyrotechnic displays for commercial and public safety applications. It is preferred in chlorate-based compositions as it acts as an acid neutralizer, reducing the risk of spontaneous ignition caused by trace acids.

Similarly, in flares, strontium carbonate’s role in enhancing visibility during emergencies is highlighted. Military-grade flares often use strontium compounds for signaling and illumination, owing to their high luminosity and long-lasting effects under varying atmospheric conditions. The growing interest in high-quality, colorful pyrotechnic displays and the need for efficient emergency signaling continue to drive demand for strontium carbonate in these applications.

Geopolitical Impact Analysis

Geopolitical Uncertainties Have Affected the Global Supply of Strontium Carbonate.

The geopolitical tensions have affected the strontium carbonate market, particularly through disruptions in supply chains and shifts in trade policies. The strontium carbonate production is concentrated in a few countries, including China, Iran, Spain, Mexico, and Argentina. Geopolitical tensions, such as trade disputes and sanctions, have the potential to interrupt supply flows from these regions, leading to volatility in availability.

For instance, ongoing tensions between the U.S. and other countries over trade policies have led to heightened scrutiny of raw materials and increased tariffs on some imports. However, the U.S. Geological Survey (USGS) reports that the U.S. remains 100% net import reliant for strontium as of 2025-2026. This has prompted many U.S. manufacturers to seek alternative suppliers or adjust their sourcing strategies, often at higher costs.

Furthermore, in June 2025, a severe explosion at Iran’s Bandar Abbas port disrupted its strontium carbonate logistics, impacting the global supply as Iran is the biggest supplier of high-purity strontium carbonate. Similarly, strontium is designated as a critical raw material (CRM) by the European Commission, reflecting its high economic importance and supply risk. Additionally, geopolitical instability in mineral-rich regions further complicates the global mining of strontium ores. These geopolitical dynamics contribute to greater uncertainty and supply risks for the strontium carbonate market.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Strontium Carbonate Market.

In 2024, the Asia Pacific dominated the global strontium carbonate market, holding about 38.1% of the total global consumption, driven by substantial demand from industries such as ceramics, glass, and pyrotechnics. China is the leading producer and consumer of strontium compounds, accounting for a significant portion of global strontium production and consumption. The country’s growing ceramic and glass industries, which are central to its manufacturing sector, heavily utilize strontium carbonate for producing high-quality glazes and specialty glass products.

- According to the United States Geological Survey (USGS), in 2024, the total production of strontium in China reached approximately 80,000 metric tons.

In addition, the region’s increasing involvement in the production of pyrotechnics, particularly in countries such as India and China, contributes to the rising demand. Furthermore, the Asia Pacific region’s expanding renewable energy sector, with countries such as Japan and South Korea exploring thermal energy storage technologies, adds another layer to the growing demand for strontium carbonate.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of strontium carbonate focus on improving production efficiency by adopting advanced technologies to reduce energy consumption and enhance yield, which lowers production costs and minimizes environmental impact, aligning with regulatory standards. Similarly, companies emphasize geographic diversification of their supply chains to mitigate risks associated with geopolitical instability and sourcing bottlenecks. Additionally, some manufacturers focus on expanding their product portfolios by offering high-purity strontium carbonate for specialized applications, such as in renewable energy storage and high-end pyrotechnics.

The Major Players in The Industry

- Fertiberia

- Hoyonn Chemical

- JAM GROUP CO.

- Hengyang Jinnuo Chemical Co., Ltd

- Solvay

- Kandelium

- Unibrom Corp.

- Ereztech LLC

- Muscat Chemical

- ABASSCO

- BassTech International

- Joyieng Chemical LTD.

- Sakai Chemical Co., LTD.

- American Elements

- Vishnu Priya Chemicals Pvt Ltd

- Other Key Players

Key Development

- In August 2025, Vishnu Chemicals Limited unveiled a major expansion of its product range with the initiation of strontium carbonate production at its Atchutapuram facility in Visakhapatnam, India.

- In September 2025, Dateline Resources further asserted its position in the competitive field of critical minerals in the United States by acquiring the promising Argos strontium project, located approximately 100 kilometers from the company’s pioneering Colosseum gold and rare earths project in California.

Report Scope:

Report Features Description Market Value (2024) US$213.1 Mn Forecast Revenue (2034) US$327.8 Mn CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder and Granules), By Purity (Up to 98% and Above 98%), By Production Method (Black Ash Method and Soda Ash Method), By Application (Glass & Ceramic, Electronics & Permanent Magnets, Pyrotechnics & Flares, Medical, Pigments & Paints, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Fertiberia, Hoyonn Chemical, JAM GROUP CO., Hengyang Jinnuo Chemical Co., Ltd., Solvay, Kandelium, Unibrom Corp., Ereztech LLC, Muscat Chemical, ABASSCO, BassTech International, Joyieng Chemical LTD., Sakai Chemical Co., LTD., American Elements, Vishnu Priya Chemicals Pvt Ltd, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Fertiberia

- Hoyonn Chemical

- JAM GROUP CO.

- Hengyang Jinnuo Chemical Co., Ltd

- Solvay

- Kandelium

- Unibrom Corp.

- Ereztech LLC

- Muscat Chemical

- ABASSCO

- BassTech International

- Joyieng Chemical LTD.

- Sakai Chemical Co., LTD.

- American Elements

- Vishnu Priya Chemicals Pvt Ltd

- Other Key Players