Global Sprinkler Irrigation Market Size, Share, And Enhanced Productivity By Type (Center Pivot, Lateral Move, Solid Sets, Others), By Mobility (Stationary, Towable), By Component (Sprinklers, Pipes, Pumps, Control Units, Valves, Fittings and Accessories, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Sugar Crops, Others), By Field Size (Small Fields (Below 5 Hectares), Medium Fields (5-25 Hectares), Large Fields (Above 25 Hectares)), By Application (Field Crops, Orchard Crops, Landscape and Turf, Others), By End Use (Individual Farmers, Agricultural Cooperatives, Commercial Farms, Government Institutions, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178209

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Mobility Analysis

- By Component Analysis

- By Crop Type Analysis

- By Field Size Analysis

- By Application Analysis

- By End Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

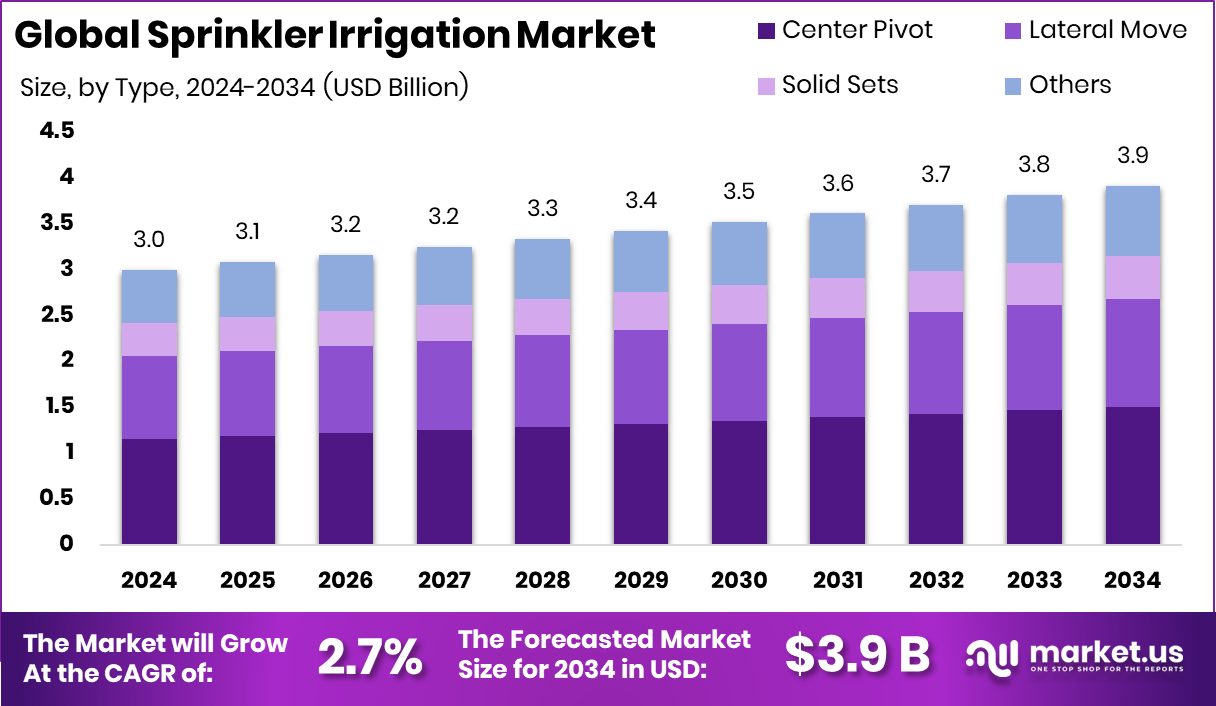

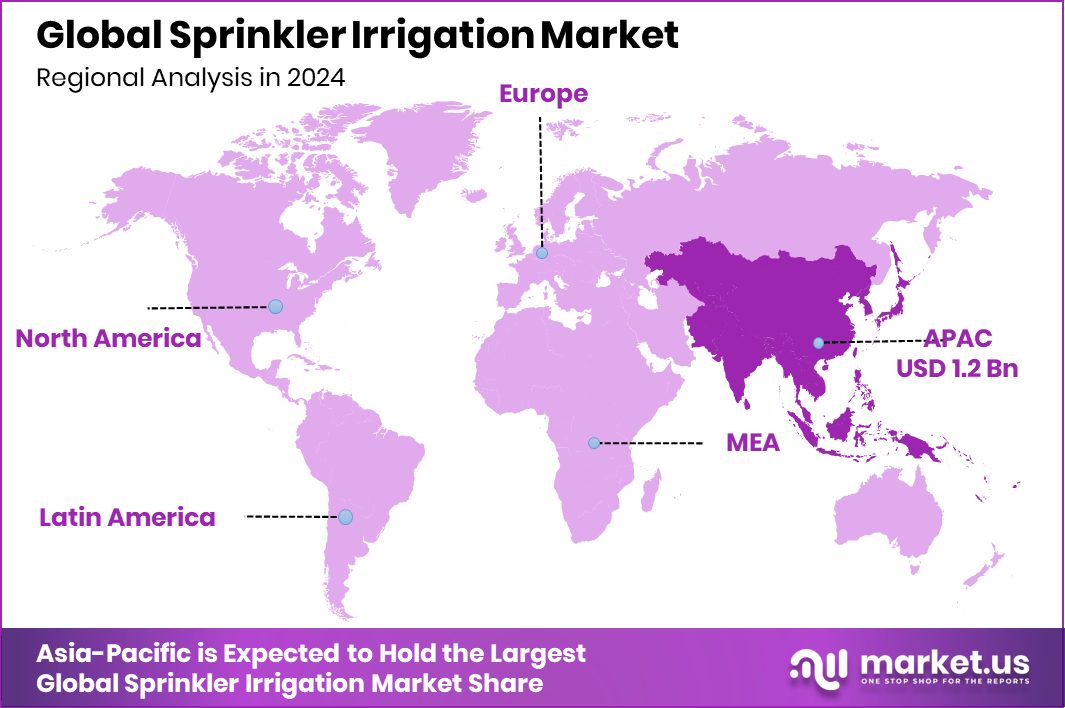

The Global Sprinkler Irrigation Market is expected to be worth around USD 3.9 billion by 2034, up from USD 3.0 billion in 2024, and is projected to grow at a CAGR of 2.7% from 2025 to 2034. Strong agricultural expansion supported Asia Pacific 42.6% share of USD 1.2 Bn.

Sprinkler irrigation is a method of applying water to crops in a controlled manner, similar to natural rainfall. Water is pumped through pipes and sprayed through sprinkler heads to distribute moisture evenly across the field. This system helps farmers manage water efficiently, reduce wastage, and maintain consistent soil moisture levels. It is widely used across cereals, oilseeds, fruits, vegetables, orchards, and landscape applications. The sprinkler irrigation market refers to the overall industry involved in manufacturing, supplying, and installing systems such as center pivots, lateral moves, pipes, pumps, valves, and control units used to irrigate agricultural land of different sizes.

The growth of the sprinkler irrigation market is strongly supported by rising investments in agriculture and grain infrastructure. For instance, the Manitoba Government made a $13-million investment in the Downtown Agriculture Exchange, while Manitoba also boosted its stake in the cereals centre to $23.5 million. In addition, discussions around a proposed $100M grain facility in Winnipeg reflect continued capital flow into cereal production. Such investments increase the need for reliable irrigation systems to support higher crop output and improved farm efficiency.

Demand for sprinkler irrigation continues to rise alongside expanding cereal and grain consumption. Clean-label cereal companies raising $6 million and Magic Spoon securing $85M for retail expansion demonstrate growing activity in grain-based food markets. As cereal production scales to meet food demand, farmers require dependable irrigation systems to protect yields and manage water effectively. This sustained agricultural demand strengthens the long-term outlook for sprinkler irrigation adoption.

Significant opportunities exist in modernizing medium and large farms with efficient irrigation technologies. As agricultural funding flows into infrastructure and grain development, farmers are encouraged to adopt systems that improve productivity per hectare. Sprinkler irrigation offers flexibility across field sizes and crop types, making it suitable for evolving farm structures. Continued investment in cereal ecosystems and processing facilities creates downstream pressure for a stable raw material supply, opening long-term opportunities for advanced irrigation deployment.

Key Takeaways

- The Global Sprinkler Irrigation Market is expected to be worth around USD 3.9 billion by 2034, up from USD 3.0 billion in 2024, and is projected to grow at a CAGR of 2.7% from 2025 to 2034.

- Center Pivot dominated the Sprinkler Irrigation Market by type with 38.5% share globally.

- Stationary systems dominated the Sprinkler Irrigation Market mobility segment, holding a 59.1% share.

- Sprinklers dominated the Sprinkler Irrigation Market component segment with 34.8% share.

- Cereals and Grains dominated the Sprinkler Irrigation Market crop type segment at 37.4% share.

- Medium Fields (5-25 Hectares) dominated the Sprinkler Irrigation Market with 42.7% share.

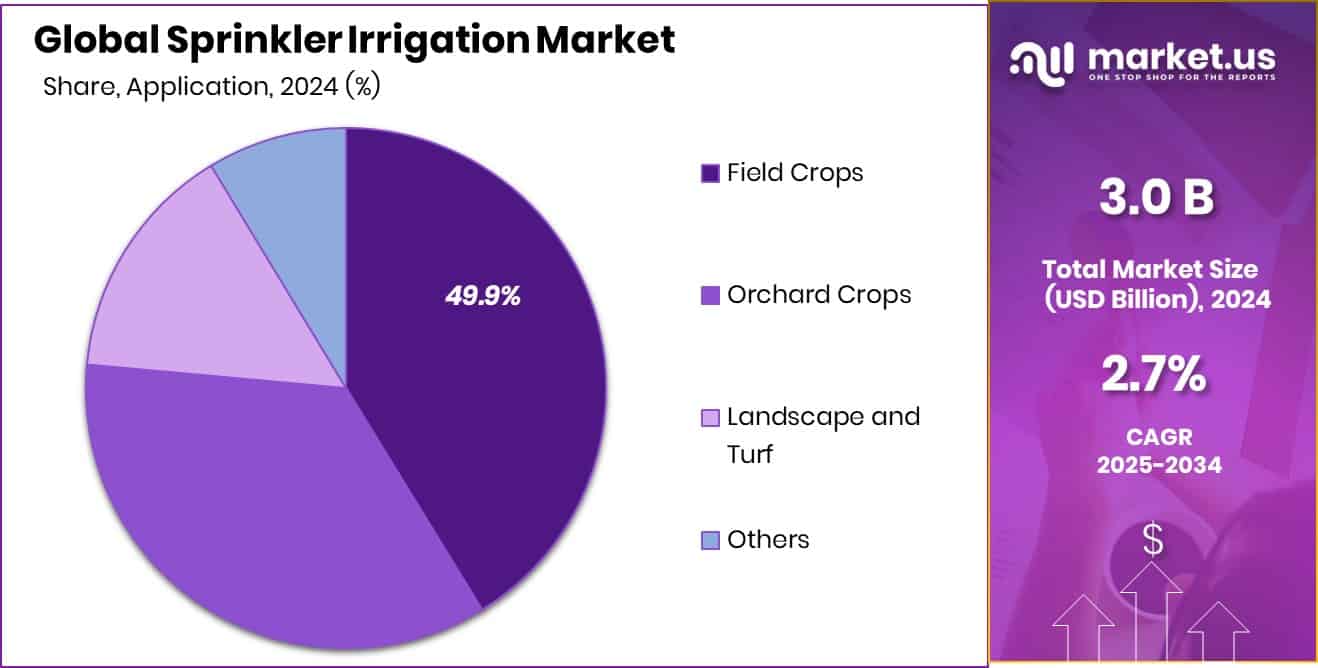

- Field Crops dominated the Sprinkler Irrigation Market application segment, accounting for 49.9% share.

- Individual Farmers dominated the Sprinkler Irrigation Market end use segment with 39.8% share.

- Asia Pacific recordeda market value reaching USD 1.2 Bn.

By Type Analysis

Center Pivot dominated the Sprinkler Irrigation Market with 38.5% share globally.

In 2024, the Center Pivot segment dominated the Sprinkler Irrigation Market by type, accounting for 38.5% share. This strong position reflects the widespread preference for center pivot systems across large agricultural regions where uniform water distribution and labor efficiency are critical. Farmers increasingly favor this system due to its ability to irrigate extensive circular fields with minimal manual intervention.

The dominance of this segment is further supported by rising investments in mechanized farming practices and improved irrigation infrastructure. Center pivot systems are also compatible with fertigation and chemigation applications, which enhance crop productivity. Their durability, long operational life, and ability to function in varying soil conditions continue to strengthen their leadership position in the overall sprinkler irrigation industry landscape.

By Mobility Analysis

Stationary systems dominated the sprinkler irrigation market, holding 59.1% share.

In 2024, the Stationary segment dominated the Sprinkler Irrigation Market by mobility, holding a 59.1% share. This significant share highlights the continued reliance on fixed irrigation setups among farmers who prioritize cost efficiency and long-term field planning. Stationary systems are widely adopted in regions where crop patterns remain consistent throughout the year, making permanent installation economically viable. Their dominance is driven by lower operational complexity and reduced movement-related maintenance compared to mobile systems.

Additionally, stationary sprinklers offer consistent water pressure and controlled coverage, supporting stable crop growth. The segment’s strong position is also reinforced by government initiatives promoting water conservation practices, encouraging farmers to invest in reliable, fixed irrigation systems for sustainable agricultural productivity.

By Component Analysis

Sprinklers component dominated the Sprinkler Irrigation Market, capturing 34.8% share.

In 2024, the Sprinklers component segment dominated the Sprinkler Irrigation Market with a 34.8% share. This leadership reflects the essential role sprinklers play as the core water distribution mechanism within irrigation systems. Farmers and agricultural enterprises prioritize high-performance sprinkler heads that ensure uniform spray patterns and optimized water usage. The segment’s dominance is supported by continuous product innovations focused on improving spray efficiency, clog resistance, and durability under different climatic conditions.

Replacement demand also contributes significantly to this share, as sprinklers require periodic maintenance and upgrades. With increasing focus on precision irrigation and minimizing water wastage, advanced sprinkler technologies are gaining rapid acceptance, reinforcing the segment’s strong market position and sustained growth trajectory.

By Crop Type Analysis

Cereals and Grains dominated the sprinkler irrigation market with 37.4% share.

In 2024, Cereals and Grains dominated the Sprinkler Irrigation Market by crop type, capturing a 37.4% share. This dominance is largely attributed to the vast global acreage dedicated to staple crops such as wheat, rice, maize, and barley. Reliable irrigation is essential for achieving stable yields in cereal cultivation, particularly in regions facing irregular rainfall patterns.

Farmers depend heavily on sprinkler systems to ensure even moisture distribution across large fields, which directly impacts crop quality and output. The segment’s leading position is also supported by rising food security concerns and expanding population demands. As governments encourage higher productivity in staple crops, sprinkler irrigation continues to play a crucial role in sustaining cereals and grains production worldwide.

By Field Size Analysis

Medium Fields 5-25 hectares dominated the Sprinkler Irrigation Market at 42.7%.

In 2024, Medium Fields ranging from 5 to 25 hectares dominated the Sprinkler Irrigation Market by field size, holding a 42.7% share. This segment’s dominance reflects the significant presence of mid-sized farms across developing and developed agricultural economies. Farmers operating medium-sized landholdings increasingly adopt sprinkler systems to balance productivity with water efficiency. These fields are large enough to justify mechanized irrigation investment yet manageable for structured irrigation planning.

The segment benefits from financial assistance programs and subsidies aimed at modernizing mid-scale agriculture. Additionally, sprinkler systems provide flexibility and scalability suited to medium plots, making them an attractive choice for farmers seeking improved crop yields without transitioning to large-scale industrial farming operations.

By Application Analysis

Field Crops application dominated the Sprinkler Irrigation Market, securing 49.9% share.

In 2024, the Field Crops segment dominated the Sprinkler Irrigation Market by application, accounting for a 49.9% share. Field crops such as maize, soybeans, cotton, and pulses require consistent and controlled irrigation to maintain yield quality. The dominance of this segment is driven by large-scale cultivation practices and the need to optimize water usage in open-field farming.

Sprinkler systems offer uniform coverage across expansive farmland, supporting healthy plant development and reducing dependency on unpredictable rainfall. Increased awareness about efficient irrigation management has further strengthened adoption within this category. As agricultural producers focus on maximizing output per hectare, sprinkler irrigation remains a preferred solution for sustaining productivity in field crop cultivation globally.

By End Use Analysis

Individual Farmers dominated the Sprinkler Irrigation Market with 39.8% share.

In 2024, Individual Farmers dominated the Sprinkler Irrigation Market by end use, securing a 39.8% share. This leadership highlights the strong participation of small and mid-scale farmers in adopting sprinkler irrigation technologies. Individual farmers increasingly recognize the benefits of water conservation, labor reduction, and improved crop uniformity provided by these systems.

Government-backed subsidy programs and rural financing initiatives have made sprinkler systems more accessible to independent agricultural operators. The segment’s dominance also reflects the global structure of agriculture, where individual landholders represent a substantial portion of farming activity. As awareness of sustainable irrigation practices expands, individual farmers continue to drive consistent demand within the sprinkler irrigation market landscape.

Key Market Segments

By Type

- Center Pivot

- Lateral Move

- Solid Sets

- Others

By Mobility

- Stationary

- Towable

By Component

- Sprinklers

- Pipes

- Pumps

- Control Units

- Valves

- Fittings and Accessories

- Others

By Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Sugar Crops

- Others

By Field Size

- Small Fields (Below 5 Hectares)

- Medium Fields (5-25 Hectares)

- Large Fields (Above 25 Hectares)

By Application

- Field Crops

- Orchard Crops

- Landscape and Turf

- Others

By End Use

- Individual Farmers

- Agricultural Cooperatives

- Commercial Farms

- Government Institutions

- Others

Driving Factors

Rising global agricultural water demand

Rising global agricultural water demand continues to be a major driving force in the Sprinkler Irrigation Market, as farmers increasingly look for efficient systems that ensure consistent crop hydration while conserving limited water resources. Expanding specialty crop exports, valued at $143B, are also influencing irrigation investments, particularly after the USDA funded packaging innovations to strengthen this export segment.

As agricultural trade grows, maintaining crop quality and yield becomes essential, encouraging growers to adopt reliable sprinkler systems. Water-efficient irrigation is becoming central to sustaining production levels, especially for high-value fruits, vegetables, and grains that support both domestic consumption and export markets. These structural developments collectively strengthen the long-term growth foundation of sprinkler irrigation technologies.

Restraining Factors

High initial installation equipment costs

High initial installation equipment costs remain a significant restraint for the Sprinkler Irrigation Market, particularly for small and medium-sized farmers operating with tight capital budgets. Although sprinkler systems improve long-term efficiency, upfront spending on pumps, pipes, control units, and system design can slow adoption.

At the same time, agricultural funding priorities such as Idaho elementary schools becoming eligible for $3 million in fruit and vegetable grants highlight how financial resources are often directed toward food access and nutrition programs rather than farm infrastructure upgrades. This allocation pattern can limit immediate irrigation modernization in certain regions. Cost sensitivity, combined with fluctuating farm incomes, continues to create hesitation among growers considering full-scale sprinkler system investments.

Growth Opportunity

Expansion across emerging agricultural economies

Expansion across emerging agricultural economies presents strong growth opportunities for the Sprinkler Irrigation Market, particularly where farming modernization is accelerating. As food supply chains evolve, investments in post-harvest and food preservation technologies are increasing, such as Lund-based foodtech Saveggy, raising €1.76 million to extend the shelf life of fresh fruits and vegetables. Such developments signal broader momentum in strengthening agricultural ecosystems from production to distribution.

For growers in developing markets, improving irrigation efficiency becomes critical to support higher yields and better-quality produce that aligns with expanding foodtech and export initiatives. As agricultural value chains modernize, sprinkler irrigation systems stand to benefit from rising awareness of water management, productivity improvement, and sustainable farming practices.

Latest Trends

Growing demand for precision irrigation

Growing demand for precision irrigation is shaping current trends in the Sprinkler Irrigation Market, as farmers aim to optimize water application according to crop needs and climate variability. Policy-driven food security measures are also influencing agricultural planning. For example, Nevada may spend $7.3M to keep women and infant food assistance programs functioning during a shutdown, while the USDA withdrew $11.3M previously allocated to purchase Iowa meat, dairy, fruits, and vegetables for schools and care centers. These shifts highlight how agricultural funding and food distribution priorities can directly impact crop planning decisions. In response, farmers increasingly turn to precise sprinkler technologies to protect yields, manage input costs carefully, and ensure stable production in uncertain policy environments.

Regional Analysis

Asia Pacific dominated the Sprinkler Irrigation Market with 42.6% share globally.

The Sprinkler Irrigation Market demonstrates varied growth patterns across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, reflecting differences in agricultural intensity, water availability, and infrastructure development.

Asia Pacific emerged as the dominating region, accounting for 42.6% of the global market and reaching a value of USD 1.2 Bn. The region’s leadership is supported by its vast agricultural base and increasing adoption of efficient irrigation systems to improve crop productivity. North America represents a mature market, driven by advanced farming practices and established irrigation infrastructure.

Europe shows steady demand supported by water conservation initiatives and precision agriculture adoption. The Middle East & Africa region reflects gradual expansion due to rising focus on optimizing limited water resources in arid climates.

Latin America continues to witness progressive adoption of sprinkler systems across commercial farming operations, contributing to overall market development while remaining behind the dominant Asia Pacific region in total share and value contribution.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Lindsay Corporation continues to hold a strong strategic position in the global Sprinkler Irrigation Market, supported by its established expertise in mechanized irrigation solutions. The company remains focused on enhancing operational efficiency for farmers through advanced center pivot and lateral move systems. Its consistent emphasis on engineering innovation and integrated control technologies strengthens its competitive edge. Lindsay’s approach centers on improving water-use efficiency while supporting large-scale agricultural productivity. By aligning its irrigation solutions with evolving farm management practices, the company sustains long-term relationships with commercial growers and agricultural enterprises across key farming regions.

Jain Irrigation Systems Ltd. plays a significant role in expanding sprinkler irrigation adoption, particularly among small and medium-scale farmers. The company’s diversified irrigation portfolio and strong distribution network enable it to address varying crop and field requirements. Jain’s emphasis on micro-irrigation expertise, combined with sprinkler offerings, positions it as a comprehensive irrigation solutions provider. Its focus on affordability, localized manufacturing, and farmer outreach programs strengthens its presence in developing agricultural economies and supports broader water conservation goals.

Valmont Industries maintains a leadership presence through its globally recognized irrigation brands and advanced mechanized systems. The company leverages strong manufacturing capabilities and technological development to enhance durability, automation, and system performance. Valmont’s commitment to precision irrigation and digital farm connectivity aligns well with modern agricultural demands. Its global footprint and consistent product enhancement strategies reinforce its competitive standing within the sprinkler irrigation landscape.

Top Key Players in the Market

- Lindsay Corporation

- Jain Irrigation Systems Ltd.

- Valmont Industries

- Rain Bird Corporation

- Reinke Manufacturing Co. Inc.

- Netafim Limited

- The Toro Company

- Hunter Industries

- Nelson Irrigation Corporation

- Rivulis Irrigation Ltd.

Recent Developments

- In August 2025, Jain Irrigation Systems Ltd. secured a large order to design, supply, and install 5,438 solar water pumps under the “Magel Tyala Saur Krushi Pump Yojana” (Phase II). Although this project focuses on solar pumping systems, it supports irrigation infrastructure that can integrate with sprinkler setups for agricultural water delivery. Jain will deliver pumps across Maharashtra worth ₹135 crore + GST.

- In March 2024, Lindsay Corporation announced it would invest over USD 50 million to expand and modernize its irrigation manufacturing facility. The investment aims to increase production capacity and improve product quality for its sprinkler and pivot irrigation systems. The expansion is expected to be completed by the end of 2025, strengthening the company’s ability to meet growing demand.

Report Scope

Report Features Description Market Value (2024) USD 3.0 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 2.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Center Pivot, Lateral Move, Solid Sets, Others), By Mobility (Stationary, Towable), By Component (Sprinklers, Pipes, Pumps, Control Units, Valves, Fittings and Accessories, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Sugar Crops, Others), By Field Size (Small Fields (Below 5 Hectares), Medium Fields (5-25 Hectares), Large Fields (Above 25 Hectares)), By Application (Field Crops, Orchard Crops, Landscape and Turf, Others), By End Use (Individual Farmers, Agricultural Cooperatives, Commercial Farms, Government Institutions, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lindsay Corporation, Jain Irrigation Systems Ltd., Valmont Industries, Rain Bird Corporation, Reinke Manufacturing Co. Inc., Netafim Limited, The Toro Company, Hunter Industries, Nelson Irrigation Corporation, Rivulis Irrigation Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sprinkler Irrigation MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Sprinkler Irrigation MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Lindsay Corporation

- Jain Irrigation Systems Ltd.

- Valmont Industries

- Rain Bird Corporation

- Reinke Manufacturing Co. Inc.

- Netafim Limited

- The Toro Company

- Hunter Industries

- Nelson Irrigation Corporation

- Rivulis Irrigation Ltd.