Global Spray Dried Food Market Size, Share Analysis Report By Product Type (Fruits and Vegetables, Beverages, Dairy Products, Fish, Others), By Application ( Desserts, Confectionary, Baked Goods, Flavoured Beverages, Baby Food, Others), By Distribution Channel ( Supermarkets and Hypermarkets, Food Service, Independent Retailers, Specialist Retailers, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162393

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

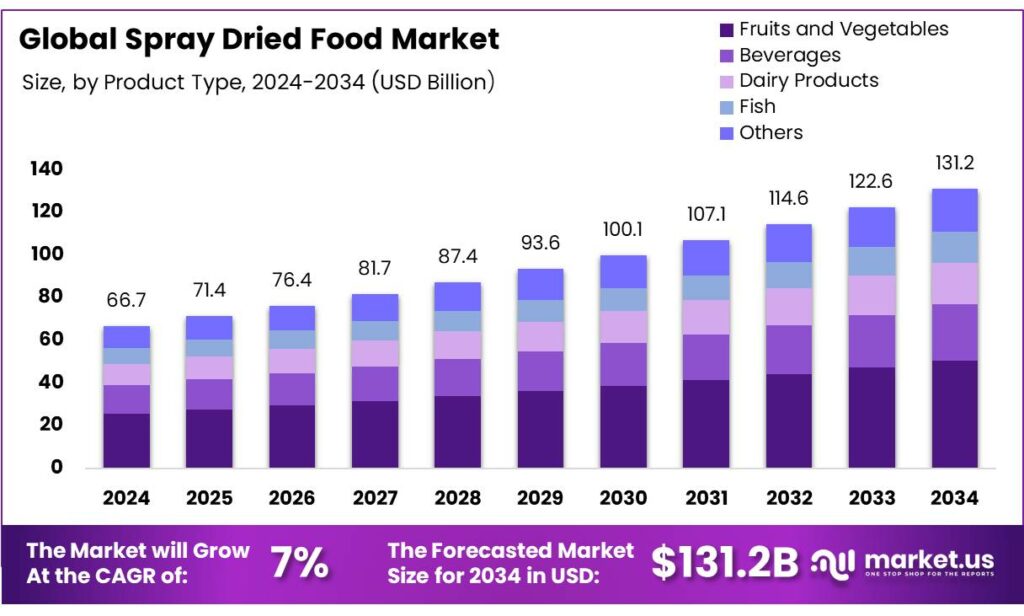

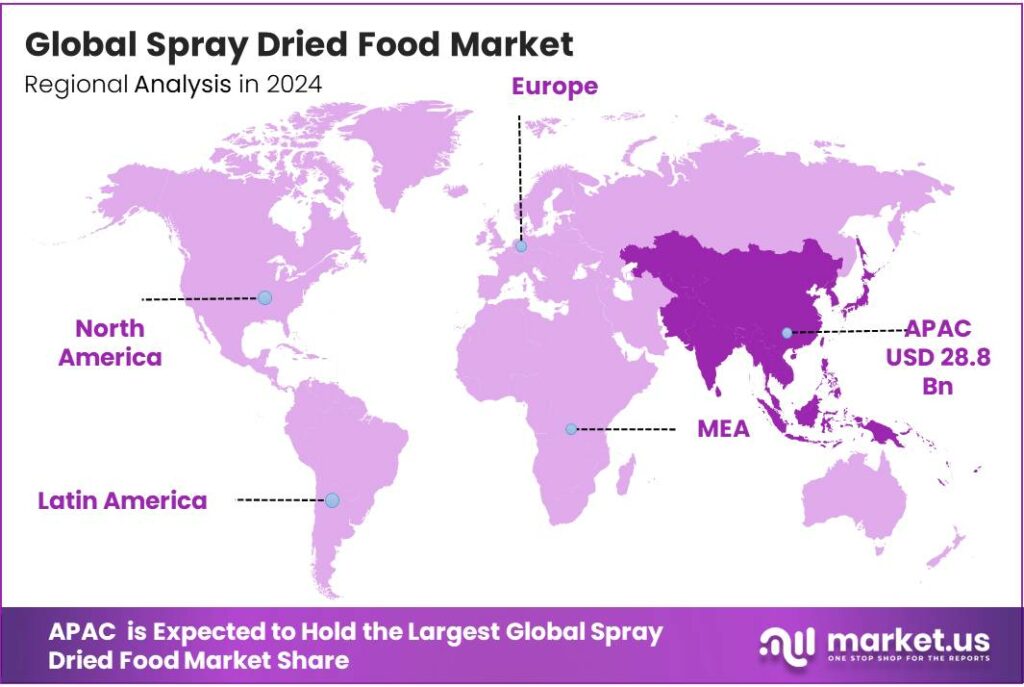

The Global Spray Dried Food Market size is expected to be worth around USD 131.2 Billion by 2034, from USD 66.7 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024 Asia Pacific (APAC) held a dominant market position, capturing more than a 43.2% share, holding USD 28.8 Billion in revenue.

Spray-dried foods are powders produced by atomizing liquid feeds (e.g., dairy, coffee, fruit, flavors) into a hot airflow to rapidly remove moisture and stabilize sensitive nutrients and aromas. Standards underscore quality targets: U.S. dry whole milk must contain 26–40% milkfat with ≤5.0% moisture; aligned Codex texts guide global trade in milk powders and related products.

Industrial dynamics are tightly linked to energy. Industry used 37% (166 EJ) of global energy in 2022, making efficiency central to powder manufacturing economics. Depending on country/region, industry accounts for 30–53% of total final energy consumption, underlining exposure to fuel and electricity costs across dryers, evaporators, and utilities. Process analyses show spray drying is typically the plant’s most energy-intensive stage; one assessment reported 5,208.7 MJ energy use and 300.3 kg CO₂ for the spray-dry step in a whole-milk-powder system, far exceeding pasteurization and evaporation contributions.

Driving factors include shelf-life extension, logistics savings, and clean-label fortification, but energy performance is now a competitive lever. Engineering studies indicate that integrating air dehumidification and heat recovery can cut milk concentration and spray-drying needs from 8.4 to 4.9 MJ heat/kg powder. Newer concepts report specific energy near 2,604 kJ/kg water evaporated, versus 4,500–11,500 kJ/kg in traditional spray dryers—material reductions that translate directly into lower operating costs and emissions.

Public programs reinforce adoption: the USDA Rural Energy for America Program (REAP) provides >$2 billion through 2031 for energy-efficiency and renewable upgrades at rural processors; in the EU, the EIB and Horizon Europe channel funding toward energy-saving measures and bioeconomy projects that can include drying modernization.

Future opportunities center on electrification, heat-pump integration, closed-loop air systems, and digital control of particle morphology to meet clean-label and performance demands. Policy tailwinds also matter: India’s Production Linked Incentive for Food Processing carries an outlay of ₹10,900 crore and has already catalyzed ₹8,910 crore in investments across 213 sites and created >289,000 jobs—supportive for domestic powdering of dairy, fruits, spices, and nutraceuticals.

Key Takeaways

- Spray Dried Food Market size is expected to be worth around USD 131.2 Billion by 2034, from USD 66.7 Billion in 2024, growing at a CAGR of 7.0%.

- Fruits and vegetables held a dominant position in the spray-dried food market, capturing more than a 38.6% share.

- Flavoured beverages held a dominant position in the spray-dried food market, capturing more than a 43.9% share.

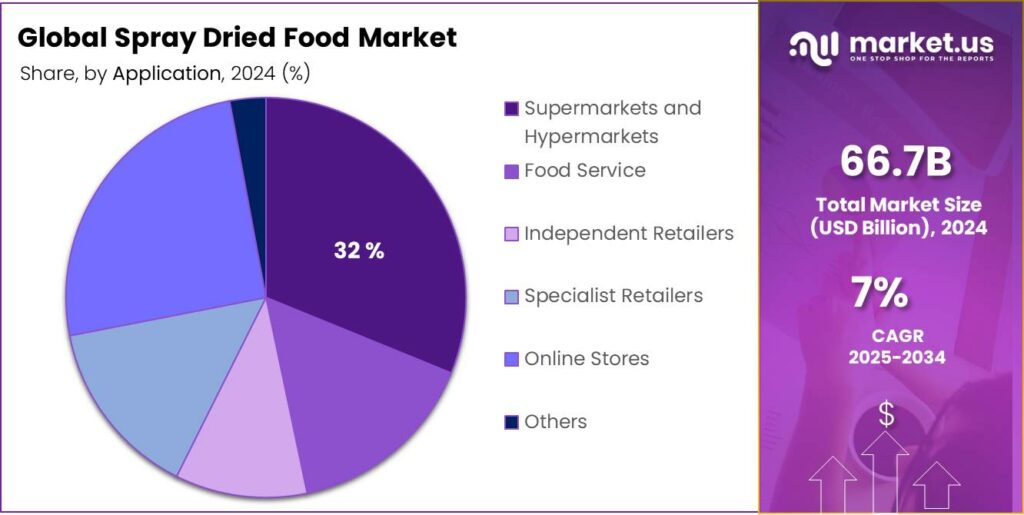

- Supermarkets and hypermarkets held a dominant position in the spray-dried food market, capturing more than a 32.1% share.

- Asia-Pacific (APAC) region held a dominant position in the global spray-dried food market, accounting for 43.2% of total revenue, valued at approximately USD 28.8 billion.

By Product Type Analysis

Fruits and Vegetables lead the segment with 38.6% market share in 2024

In 2024, fruits and vegetables held a dominant position in the spray-dried food market, capturing more than a 38.6% share. The strong performance of this segment was primarily driven by the growing consumer demand for natural ingredients and convenient, ready-to-use food products. Spray-dried fruits such as mango, banana, strawberry, and pineapple powders are increasingly used in beverages, confectionery, and bakery applications, while spray-dried vegetables like tomato, carrot, spinach, and beetroot powders are widely adopted in soups, sauces, and instant meal formulations.

The fruits and vegetables segment is expected to maintain its leadership due to continuous product innovation and the expansion of processing facilities in emerging economies. The ability of spray drying to retain flavour, colour, and nutrients while reducing waste from perishable produce has further enhanced its industrial relevance.

By Application Analysis

Flavoured Beverages dominate with 43.9% share in 2024 driven by rising demand for instant drink mixes

In 2024, flavoured beverages held a dominant position in the spray-dried food market, capturing more than a 43.9% share. This leadership is attributed to the increasing consumption of instant drink powders, coffee mixes, and fruit-flavoured beverages across both developed and emerging markets. The segment has benefited from changing lifestyles, where consumers prefer easy-to-prepare and long-shelf-life beverage options.

The flavoured beverage segment is expected to maintain strong momentum, supported by innovation in natural flavours and sugar-reduced formulations. Growing awareness of clean-label and fortified drinks is encouraging beverage manufacturers to invest in advanced spray-drying techniques for flavour encapsulation and stability enhancement.

By Distribution Channel Analysis

Supermarkets and Hypermarkets lead with 32.1% share in 2024 supported by strong retail visibility and consumer accessibility

In 2024, supermarkets and hypermarkets held a dominant position in the spray-dried food market, capturing more than a 32.1% share. This dominance is driven by their wide product assortments, established supply networks, and consumer preference for one-stop shopping experiences. These large retail formats have become primary distribution points for spray-dried products such as instant coffee, powdered milk, fruit powders, and seasoning mixes.

By 2025, the supermarkets and hypermarkets segment is expected to maintain its leading role, supported by the continued expansion of modern retail infrastructure and urbanisation trends in developing economies. The growing popularity of private-label spray-dried products and health-focused food powders is also enhancing shelf visibility within these stores.

Key Market Segments

By Product Type

- Fruits and Vegetables

- Beverages

- Dairy Products

- Fish

- Others

By Application

- Desserts

- Confectionary

- Baked Goods

- Flavoured Beverages

- Baby Food

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Food Service

- Independent Retailers

- Specialist Retailers

- Online Stores

- Others

Emerging Trends

Electrified, Low-Carbon Spray Drying Gains Speed

A clear trend in spray-dried foods is the push to cut energy use and carbon by shifting from fossil-fired air heating to electrified, high-efficiency systems. This is not a niche move; industry is the world’s biggest energy user, taking 37% (166 EJ) of final energy in 2022, so every incremental gain inside dryers matters for cost and climate. Food plants feel that pressure directly on utilities, especially where energy prices are volatile.

Technically, the case is compelling. Traditional spray dryers typically consume 4,500–11,500 kJ per kg of water evaporated, far above the theoretical minimum, because much of the latent heat leaves with exhaust air. Newer designs aim to close that gap with better heat recovery, higher inlet solids, and optimized airflows. Superheated-steam spray drying and advanced air dehumidification can cut energy needs materially; studies report 20–30% savings when switching the drying medium to steam and recovering heat. Heat-pump integration is the next step, with modern industrial configurations showing up to 22.3% efficiency improvement versus conventional cascade setups—useful where a moderate temperature lift is enough to preheat or post-dry.

Policy support is helping this trend scale. In the United States, the Rural Energy for America Program (REAP), expanded by the Inflation Reduction Act, makes >$2 billion available through 2031 for energy-efficiency and renewable projects at rural processors. For a dairy or fruit-powder line, that can mean funded upgrades to fans, heat-recovery coils, variable-speed drives, or even high-temperature heat pumps feeding the dryer’s air heater. USDA guidance also allows grants and loan guarantees for new efficient equipment in processing, which lowers payback times and de-risks first upgrades.

Drivers

Increased Shelf Life and Reduced Food Waste

One of the major driving factors behind the growth of spray-dried foods is the extended shelf life these products offer, which in turn helps reduce food waste and improves supply-chain flexibility. In simple terms, when foods such as milk, fruits, vegetables or flavourings are converted into powder form via spray drying, they becomes much more stable. That stability means fewer losses due to spoilage, less dependency on cold storage, and greater reach into distant or under-served markets.

Globally, milk production continues to rise steadily, which supports the need for effective preservation and processing; for example, the Food and Agriculture Organization (FAO) reports that worldwide milk production reached 965.7 million tonnes in 2023, up around 1.5 % from the previous year. With such immense volume of raw dairy, converting a significant—and growing—part into shelf-stable powders via spray drying becomes a practical solution, rather than simply relying on fresh/liquid forms.

In addition, the nutritional importance of milk and its derivatives is clear: one published analysis found that milk contributes 49% of the global availability of calcium, 24% of vitamin B2, and 18 % of lysine in the human diet. Turning these nutrients into a stable powder ensures that even in regions with less reliable refrigeration or distribution infrastructures, food processors can deliver nutrient-rich inputs with longer usable life.

Restraints

High Energy Consumption and Operational Cost

One of the major restraining factors in the growth of spray-dried food powders is the significant energy consumption and related operational cost incurred during production. For food processors, especially in developing markets or smaller scale operations, this challenge can limit adoption or expansion of spray-drying technologies.

To illustrate the magnitude: industry sources indicate that typical spray drying operations may consume between 4,500 kJ to 11,500 kJ per kilogram of water evaporated. In another case study, a spray drying facility using a standard setup reported an energy-efficiency of just 50-60%, meaning almost half of the input energy was effectively lost. Concretely, for one factory the annual savings possible by optimization equated to 90,000 m³ of natural gas plus 100 MWh of electricity. In practical terms, that adds substantial cost burden and carbon footprint.

For food manufacturers, this translates to higher input expenses and pressure on margins, especially when selling commodity powders into price-sensitive markets. Since drying is a thermally-intensive unit operation (latent heat of evaporation is ~2,250 kJ/kg water at 100 °C) the energy cost cannot easily be ignored. Each kilo of powder may require multiple kilos of water evaporation plus hot air and exhaust runs, meaning the drying chapter of the process becomes a major cost centre.

Opportunity

Nutrition-Focused, Shelf-Stable Powders for Public Programs

Spray-dried foods have a clear growth lane in nutrition fortification for children, women, and low-access communities. The need is large and well-documented. The World Health Organization estimates 30.7% of women aged 15–49 and 35.5% of pregnant women had anaemia in 2023, while 39.8% of children 6–59 months were affected in 2019—populations that benefit from iron, vitamins, and protein delivered in safe, shelf-stable formats. Spray-dried milk, fruit, and legume powders can carry iron, folate, vitamin A, and high-quality protein, with lower spoilage risk and easier logistics than liquid equivalents—vital where cold chains are thin.

Public nutrition platforms create predictable, scaling demand. UNICEF and partners reached 9.3 million children with treatment for severe wasting in 2023, the highest ever, underscoring the scale of programmatic pipelines that require stable, nutrient-dense inputs. On the supply side, dairy and crop volumes are large enough to support powder scale-up; FAO projected global bovine milk output near 950 million tonnes in 2023, sustaining feedstocks for fortified powders and value-addition close to farms.

Policy and finance now lower execution risk. India’s Production Linked Incentive (PLI) for Food Processing earmarks ₹10,900 crore to expand processing and brand building—supportive for domestic production of fortified milk, fruit, millet, and pulse powders with long shelf life. In the United States, the Rural Energy for America Program (REAP), bolstered by the Inflation Reduction Act, provides $2.03 billion in 2022–2027 authority for energy-efficiency and renewable upgrades—funds that can modernize dryers, cut costs, and make fortified powder lines viable for rural processors.

Regional Insights

Asia-Pacific dominates the global spray-dried food market with 43.2% share valued at USD 28.8 billion in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global spray-dried food market, accounting for 43.2% of total revenue, valued at approximately USD 28.8 billion. The regional dominance is primarily driven by high consumption of processed and convenient foods across countries such as China, India, Japan, and Indonesia.

Rapid urbanisation, changing dietary preferences, and rising disposable incomes have significantly increased the demand for spray-dried ingredients used in instant beverages, dairy products, nutritional supplements, and bakery applications. China remains the leading producer and consumer of spray-dried milk powders and fruit powders, supported by a strong domestic food manufacturing base and expanding export activities.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Fonterra Co-operative, a New Zealand-based dairy giant, maintained a dominant position in 2024, driven by high-volume production of spray-dried milk powders, proteins, and infant nutrition products. The cooperative’s focus on quality and large-scale processing enables exports to more than 100 countries. Investments in energy recovery and sustainable drying operations have improved operational efficiency. By 2025, Fonterra is expected to enhance its spray-drying capacity further to meet growing demand for dairy-based functional ingredients worldwide.

DSM-Firmenich showcased strong performance in 2024 through its innovative spray-dried micronutrients, flavour encapsulations, and nutritional solutions. The company’s focus on health, wellness, and sustainable food systems drives product innovation across the beverage, bakery, and dietary supplement sectors. Its global facilities incorporate advanced drying technologies to preserve bioactive ingredients. By 2025, DSM-Firmenich aims to strengthen its market position through R&D investment and partnerships supporting clean-label and functional ingredient trends.

Sensient Technologies Corporation maintained a robust position in 2024, specialising in spray-dried flavours, colours, and natural extracts. The company’s proprietary encapsulation methods enhance flavour stability and performance in powdered foods and beverages. With growing adoption in bakery, dairy, and nutraceutical applications, Sensient continues to focus on natural and cost-effective ingredient systems. By 2025, the company aims to expand its spray-dried product line through technological innovation and strategic regional partnerships across North America and Europe.

Top Key Players Outlook

- Bluegrass Ingredients, Inc.

- Kerry Group plc

- Fonterra Co-operative

- DSM-Firmenich

- Döhler GmbH

- Sensient Technologies

- McCormick & Co.

- Kanegrade Ltd.

- Mevive International

- Ingredion Inc.

Recent Industry Developments

In 2024, Döhler GmbH strengthened its role in the spray‐dried food sector by supplying natural ingredient systems, fruit and vegetable powders, and flavour bases tailored for beverages and bakery applications. The company operates globally with over 50 production sites and more than 7,000 employees.

In 2024, Kerry Group plc reported a Group revenue of €8.0 billion and continuing operations revenue of €6.9 billion, while its EBITDA reached €1.25 billion with a margin of 15.7%.

Report Scope

Report Features Description Market Value (2024) USD 66.7 Bn Forecast Revenue (2034) USD 131.2 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fruits and Vegetables, Beverages, Dairy Products, Fish, Others), By Application ( Desserts, Confectionary, Baked Goods, Flavoured Beverages, Baby Food, Others), By Distribution Channel ( Supermarkets and Hypermarkets, Food Service, Independent Retailers, Specialist Retailers, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bluegrass Ingredients, Inc., Kerry Group plc, Fonterra Co-operative, DSM-Firmenich, Döhler GmbH, Sensient Technologies, McCormick & Co., Kanegrade Ltd., Mevive International, Ingredion Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bluegrass Ingredients, Inc.

- Kerry Group plc

- Fonterra Co-operative

- DSM-Firmenich

- Döhler GmbH

- Sensient Technologies

- McCormick & Co.

- Kanegrade Ltd.

- Mevive International

- Ingredion Inc.