Global Sorbitan Monostearate Market Size, Share, And Business Benefit By Product Form (Liquid, Powder), By Application (Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161567

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

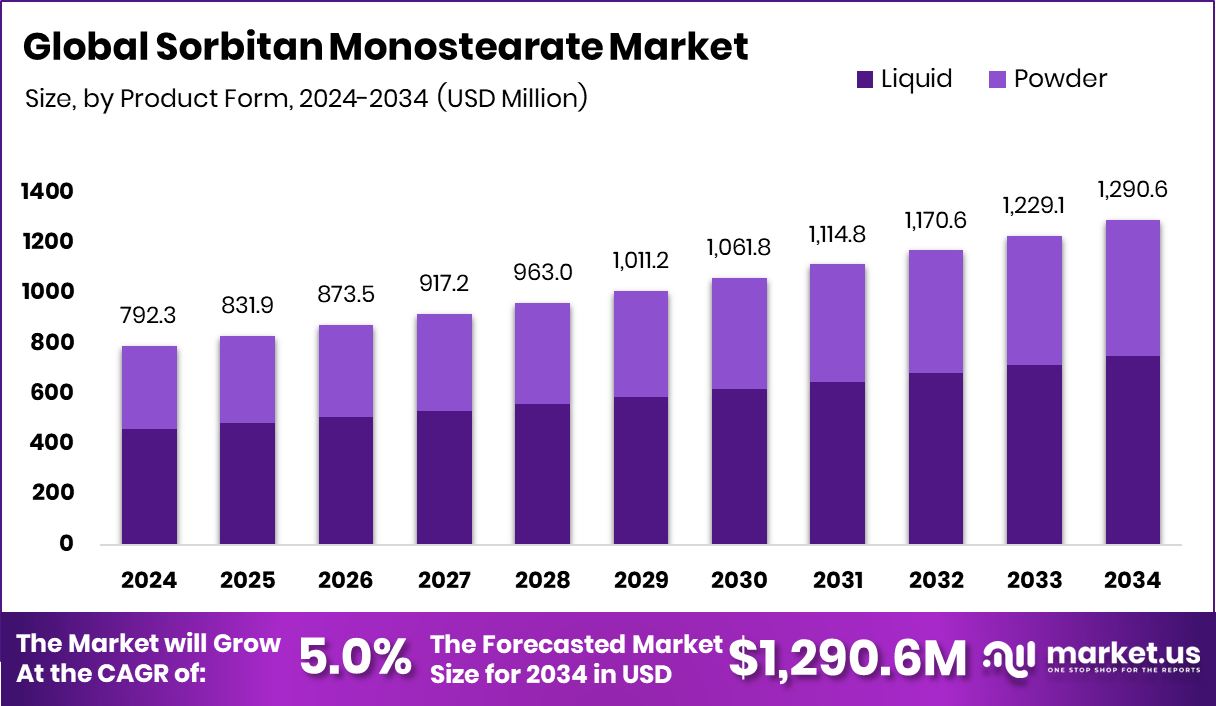

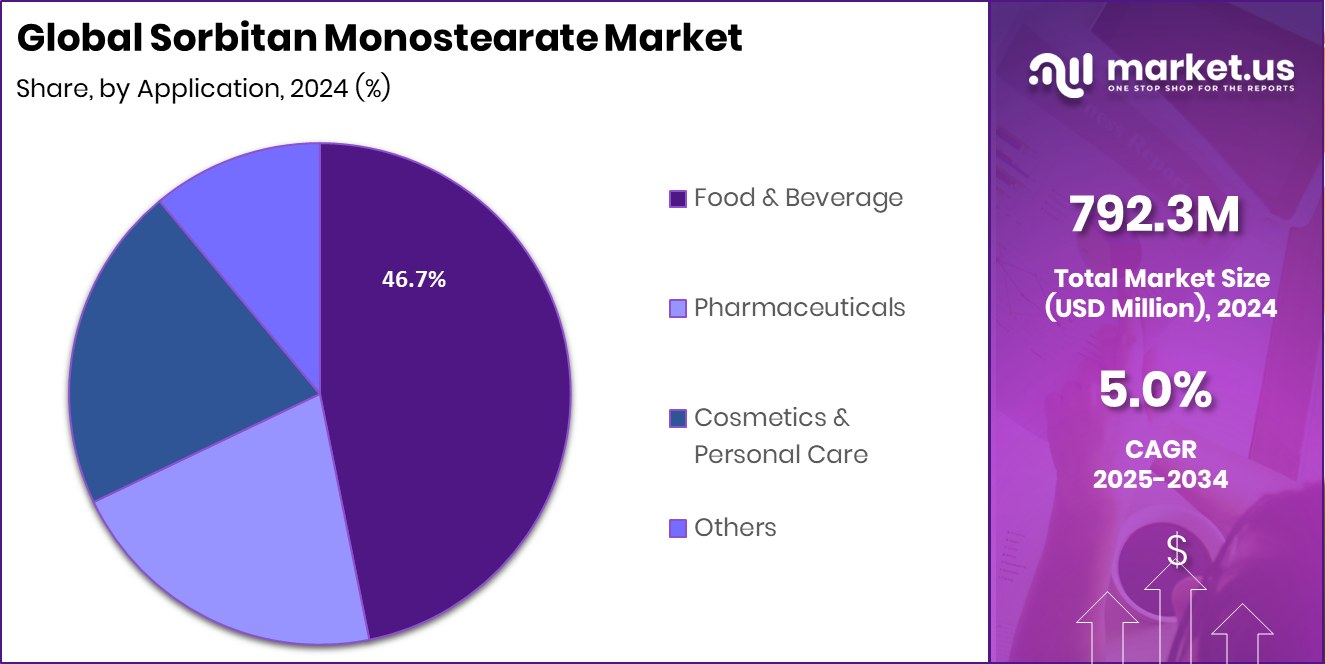

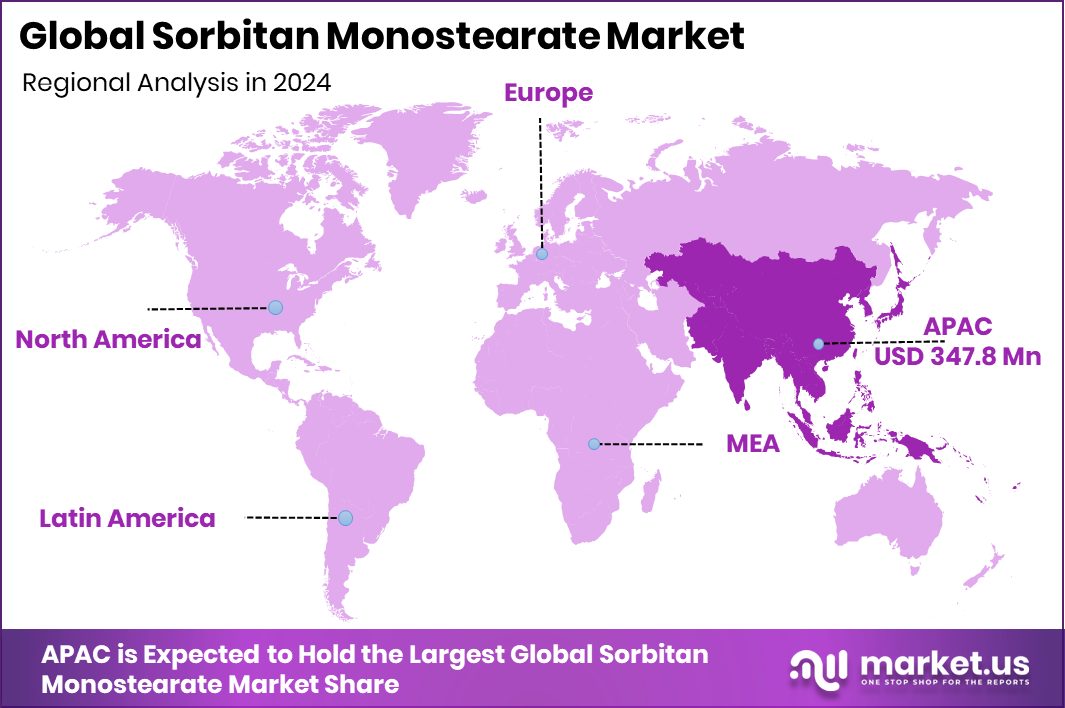

The Global Sorbitan Monostearate Market is expected to be worth around USD 1,290.6 million by 2034, up from USD 792.3 million in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. Asia Pacific’s expanding food and cosmetics industries largely supported its USD 347.8 Mn share.

Sorbitan monostearate is a non-ionic surfactant and emulsifier derived from sorbitol and stearic acid. In formulations, it helps reduce surface tension and stabilize emulsions, especially oil-in-water systems. It finds wide usage in food, cosmetics, pharmaceuticals, and personal care products because it is relatively mild, non-ionic (so less sensitive to pH or electrolytes), and offers good emulsification performance in low to moderate HLB ranges.

The market for sorbitan monostearate is underpinned by growth in cosmetics, food, and drug delivery sectors. As demand for stable emulsions in skin care, makeup, lotions, creams, and pharmaceutical suspensions rises, manufacturers increasingly turn to versatile emulsifiers like sorbitan monostearate. Additionally, consumer trends toward “clean label” and safer ingredient profiles push formulators to prefer well-known, regulatory-friendly emulsifiers over novel synthetic ones.

Demand for sorbitan monostearate is also driven by expanding urbanization, rising disposable incomes, and growing interest in personal care and wellness products in emerging markets. In food and confectionery, its role in controlling crystallization or improving texture adds incremental demand. However, pressures such as cost volatility of raw materials (fatty acids or sorbitol), regulatory scrutiny, and competition from alternative emulsifiers (like polysorbates, glyceryl esters, or natural emulsifiers) may impose constraints on demand growth.

One key opportunity lies in next-generation formulations—for instance, in nanoemulsions, encapsulation technologies, or novel delivery systems for actives (vitamins, botanicals) where stable emulsification is critical. Also, as more cosmetic and pharmaceutical brands scale globally, demand for standardized, regulatory-certified emulsifiers will increase. Partnerships between ingredient suppliers and end-product brands could drive the co-development of optimized blends.

Meanwhile, the cosmetic-tech sector is attracting more capital: for example, Renee Cosmetics raises $30 million, targeting offline growth and tech investment. In parallel, SUGAR Cosmetics mops up $5 Mn from Anicut Capital and others, and earlier secured US$4.5 M in a funding round—these illustrate how beauty brands are scaling, which in turn fuels demand for ingredients like sorbitan monostearate in formulation pipelines.

Key Takeaways

- The Global Sorbitan Monostearate Market is expected to be worth around USD 1,290.6 million by 2034, up from USD 792.3 million in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- In 2024, the Sorbitan Monostearate Market saw liquid form dominate with 58.2% market share.

- In 2024, the food and beverage sector led the sorbitan monostearate market with a 46.7% share.

- The Asia Pacific recorded a strong market valuation reaching USD 347.8 million overall.

By Product Form Analysis

In 2024, the Sorbitan Monostearate Market saw liquid dominate with 58.2%.

In 2024, Liquid held a dominant market position in the By-Product Form segment of the Sorbitan Monostearate Market, with a 58.2% share. The dominance of the liquid form is largely due to its excellent solubility, ease of blending, and superior dispersion properties in emulsified systems. It is widely used across food, cosmetics, and pharmaceutical applications, where uniform texture and stability are crucial.

The liquid form also offers enhanced handling efficiency and better compatibility with other surfactants, which increases its adoption in large-scale formulations. Its ability to create smooth and consistent emulsions has positioned it as the preferred form among formulators, sustaining its strong market share in 2024.

By Application Analysis

The food and beverage sector led the sorbitan monostearate market with 46.7%.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Sorbitan Monostearate Market, with a 46.7% share. The strong demand in this segment is driven by the ingredient’s extensive use as an emulsifier, stabilizer, and texturizing agent in bakery, confectionery, dairy, and processed food applications. Sorbitan monostearate enhances product consistency, improves mouthfeel, and extends shelf life, which makes it essential for large-scale food manufacturing.

Its ability to maintain uniform emulsions under varying temperatures further supports its popularity among food processors. With the continued rise in processed and convenience food consumption, the food and beverage segment maintained its clear dominance in 2024.

Key Market Segments

By Product Form

- Liquid

- Powder

By Application

- Food and Beverage

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

Driving Factors

Rapid Growth in Personal Care & Cosmetics Demand

One of the top driving factors in the Sorbitan Monostearate market is the escalating demand from the personal care and cosmetics industry. As more consumers seek skin care, makeup, moisturizers, and sunscreens, formulators increasingly rely on effective, stable emulsifiers like sorbitan monostearate to keep their products smooth, uniform, and safe. This ingredient helps mix oil and water phases, which is essential in creams and lotions. Because of that, growth in beauty and self-care directly boosts its usage.

Further fueling the ecosystem, new ventures are raising capital to scale tech, branding, and distribution. For instance, DOBRA raised Rs 1.5 crore in seed funding led by the D2C Insider Super Angels Fund. On the beverage side, Indian beverage startup Malaki raises $686k seed funding to expand. These funding moves, though in adjacent sectors, reflect rising investor confidence in consumer goods—and indirectly support the ingredient suppliers that service growing formulation demand.

Restraining Factors

Volatile Raw Material Costs Limit Profit Margins

A major restraining factor in the Sorbitan Monostearate market is the fluctuation in raw material prices, particularly for sorbitol and stearic acid. When the costs of these base chemicals rise due to supply constraints, agricultural variability, or energy prices, manufacturers face squeezed margins and often pass on costs to formulators. This volatility makes budgeting and long-term planning difficult, especially for smaller producers who lack the scale to absorb spikes. It can also slow down R&D investment or deter entry into new markets when input risks are high.

Meanwhile, investment activity in related consumer sectors underscores the contrast. For instance, H2Ok raised a $12.4 million Series A funding round, signaling strong investor appetite in adjacent industries. However, that enthusiasm does not always translate into raw ingredient stability—in fact, more demand downstream can exacerbate input cost pressures upstream.

Growth Opportunity

Rising Use in Food Emulsions Creates Opportunities

A key growth opportunity in the Sorbitan Monostearate market lies in its expanding use within the food and beverage sector, especially in emulsified products such as chocolates, baked goods, and dairy desserts. As consumers demand smoother textures, longer shelf life, and better-quality processed foods, manufacturers are turning to safe and multifunctional emulsifiers like sorbitan monostearate. Its ability to stabilize oil-in-water emulsions without altering taste or nutrition makes it an attractive ingredient for both established and emerging brands.

This opportunity is strengthened by fresh investments in the food and beverage ecosystem. Recently, Bengaluru-based F&B startup Nuvie raised $450,000 in a pre-seed funding round, aiming to scale its product innovation and market presence. Such funding momentum indicates growing confidence in food innovation, indirectly boosting demand for functional ingredients that improve product consistency and consumer appeal.

Latest Trends

Surge in “Clean Label” Demand Shapes Trends

One of the leading trends in the Sorbitan Monostearate market is the shift toward “clean label” formulations — meaning consumers and formulators prefer ingredients that appear simple, safe, and well understood. This trend pushes manufacturers to justify each additive, favoring emulsifiers with established safety profiles and regulatory acceptance. Sorbitan monostearate, being well known and non-ionic, is often presented as a more transparent option in emulsification systems.

Support from innovative consumer product funding emphasizes how important perception has become. For example, Olipop is valued at $1.85 billion following its latest funding round, highlighting investor confidence in beverage brands that champion cleaner, health-forward messaging. As clean label offerings grow, the pressure increases on ingredient suppliers to adapt — whether by improving sourcing, refining purity, or communicating clarity to end consumers.

Regional Analysis

In 2024, the Asia Pacific dominated the Sorbitan Monostearate Market with 43.90%.

In 2024, the Asia Pacific region held a dominant position in the Sorbitan Monostearate Market, capturing 43.90% of the total share, valued at USD 347.8 million. The region’s strong presence is attributed to its rapidly expanding food processing, cosmetics, and pharmaceutical industries across countries like China, India, Japan, and South Korea. Increasing consumer awareness of product quality and texture has encouraged greater use of emulsifiers in personal care and packaged foods, supporting steady market expansion.

North America continues to show stable growth, driven by high adoption in bakery, confectionery, and cosmetic formulations, while Europe maintains consistent demand supported by strict product quality standards and sustainability-focused manufacturers.

The Middle East & Africa region is experiencing gradual growth due to rising investments in the food and personal care manufacturing sectors. Latin America, meanwhile, is showing emerging opportunities as local industries modernize production capabilities and adopt multifunctional emulsifiers.

Overall, Asia Pacific remains the clear market leader, driven by large-scale industrial manufacturing, expanding consumer markets, and greater ingredient adoption across multiple end-use sectors, setting the regional benchmark for global demand and production of sorbitan monostearate.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Estelle Chemicals Pvt. Ltd has established itself as a reliable manufacturer and exporter of specialty surfactants and emulsifiers. The company’s focus on consistent product quality and tailored customer solutions positions it as a preferred supplier in both domestic and international markets. Its manufacturing competence supports the increasing demand for non-ionic surfactants like sorbitan monostearate in clean-label product lines.

Plus Chem contributes to the market through a diversified chemical portfolio catering to industrial and formulation-based needs. Its emphasis on sustainable sourcing and product reliability aligns with growing regulatory and environmental expectations, especially from cosmetics and food manufacturers seeking trusted ingredient partners.

Akhil Healthcare focuses on pharmaceutical-grade emulsifiers and specialty intermediates, helping the medical and nutraceutical segments maintain product stability and formulation efficiency. Its adherence to strict quality standards enhances its relevance in regulated industries. Collectively, these players reinforce the market’s competitive foundation, ensuring steady innovation and a dependable global supply of sorbitan monostearate.

Top Key Players in the Market

- Estelle Chemicals Pvt.Ltd

- Plus Chem

- Akhil Healthcare

- Jeevika Yugchem Private Limited

- Mohini Organics Pvt Ltd

- Fine Organics

- Shree Chemicals Industries Pvt. Ltd,

- Savannah Surfactants Ltd.

- Others

Recent Developments

- In April 2025, Godrej Industries’ Chemicals division acquired the food additives business of Savannah Surfactants, which includes emulsifier and ester operations.

- In February 2025, Mohini Organics expanded its manufacturing capacity to meet increasing demand in cosmetic-grade sorbitan monostearate use.

Report Scope

Report Features Description Market Value (2024) USD 792.3 Million Forecast Revenue (2034) USD 1,290.6 Million CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Liquid, Powder), By Application (Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Estelle Chemicals Pvt.Ltd, Plus Chem, Akhil Healthcare, Jeevika Yugchem Private Limited, Mohini Organics Pvt Ltd, Fine Organics, Shree Chemicals Industries Pvt. Ltd, Savannah Surfactants Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sorbitan Monostearate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Sorbitan Monostearate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Estelle Chemicals Pvt.Ltd

- Plus Chem

- Akhil Healthcare

- Jeevika Yugchem Private Limited

- Mohini Organics Pvt Ltd

- Fine Organics

- Shree Chemicals Industries Pvt. Ltd,

- Savannah Surfactants Ltd.

- Others