Global Solar Module Market Size, Share Analysis Report By Technology (Thin Film, Crystalline Silicon), By Product (Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, Copper Indium Gallium Diselenide), By Connectivity (On Grid, Off Grid), By Mounting (Ground Mounted, Roof Top), By End Use (Residential, Commercial And Industrial, Utility) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171574

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

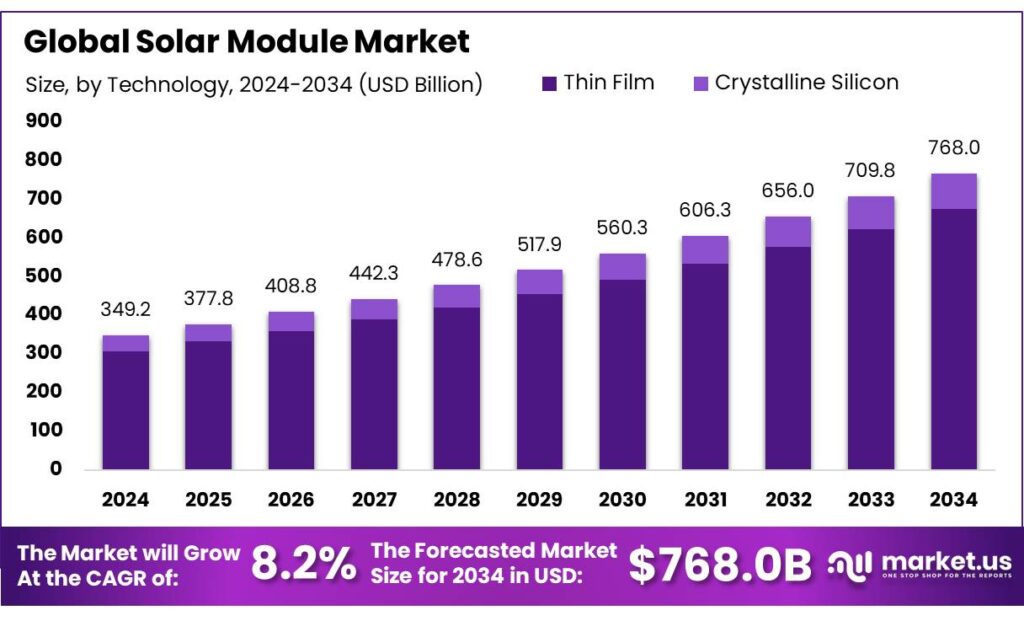

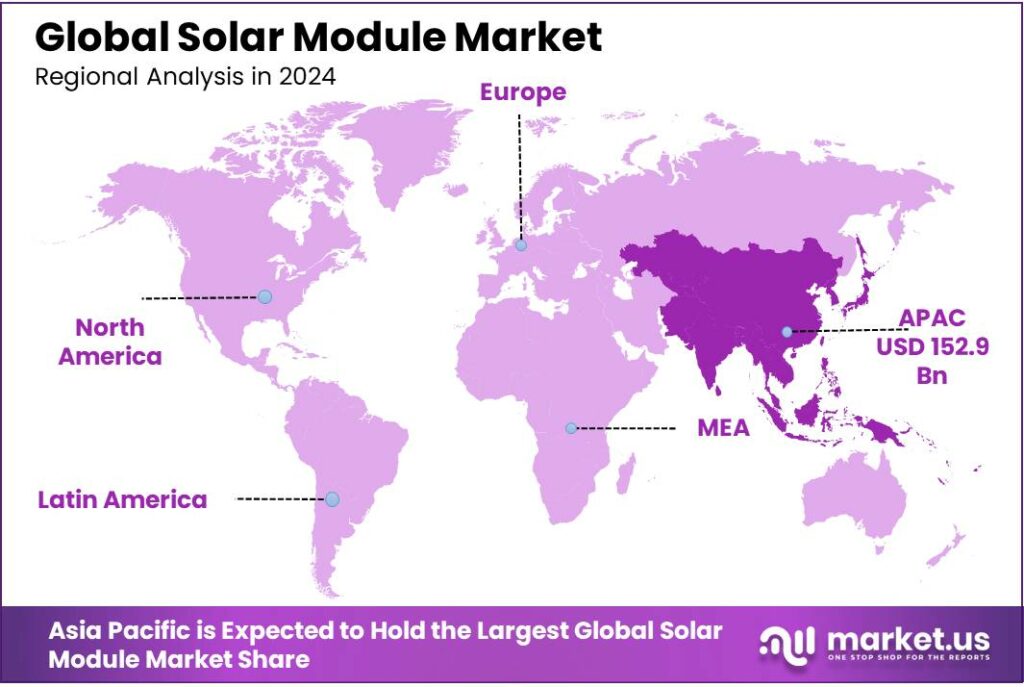

The Global Solar Module Market size is expected to be worth around USD 768.0 Billion by 2034, from USD 349.2 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.8% share, holding USD 152.9 Billion in revenue.

Solar modules (photovoltaic panels) sit at the center of today’s power-sector transition because they turn sunlight directly into electricity with a product that is modular, scalable, and increasingly standardized. The industry spans upstream materials, module assembly, and downstream distribution into utility, commercial/industrial, and residential projects. In deployment terms, solar is now the volume leader: global installed solar PV capacity reached 1,865 GW by end-2024, and the world added more than 451 GW of new solar PV capacity in 2024 alone.

- Industrial momentum is also reflected in total installed base. The IEA PVPS “Snapshot 2024” estimates global cumulative PV capacity reached about 1.6 TW in 2023 (up from 1.2 TW in 2022), with 407.3–446 GW of new PV systems commissioned. This scale-up has reshaped the industrial scenario: factories, logistics networks, quality certification, and after-sales performance guarantees increasingly resemble other high-volume manufacturing industries.

Key growth drivers remain tightly linked to economics and policy. First, module pricing has generally trended downward; the IEA highlights that PV module prices continued to decline in 2024, supporting further acceleration in capacity growth. Second, governments are actively trying to localize parts of the supply chain for resilience and jobs. The IEA’s World Energy Outlook 2024 executive summary flags a major imbalance: annual solar additions rose to about 425 GW, while manufacturing capacity is set to rise to more than 1,100 GW—creating both opportunity and pressure on margins, trade, and inventory cycles. In parallel, the EU’s Net-Zero Industry Act sets a benchmark to meet at least 40% of the EU’s annual deployment needs via domestic net-zero manufacturing capacity by 2030.

- Government initiatives are now a major “market shaper,” influencing where modules are made and which technologies scale. In Europe, the European Commission’s Net-Zero Industry Act sets an aim for the EU’s strategic net-zero technology manufacturing capacity to reach at least 40% of annual deployment needs by 2030, a signal designed to pull more PV manufacturing and investment into the region.

- In India, national programs combine deployment targets with manufacturing support: the Government of India reiterates a 500 GW non-fossil installed electricity capacity goal by 2030, and MNRE’s PLI scheme issued awards for 8,737 MW of fully integrated solar PV manufacturing under an outlay of ₹4,500 crore (INR).

Key Takeaways

- Solar Module Market size is expected to be worth around USD 768.0 Billion by 2034, from USD 349.2 Billion in 2024, growing at a CAGR of 8.2%.

- Crystalline Silicon held a dominant market position, capturing more than a 87.9% share in the global solar module market.

- Monocrystalline held a dominant market position, capturing more than a 69.2% share in the global solar module market.

- On Grid held a dominant market position, capturing more than a 82.4% share in the global solar module market.

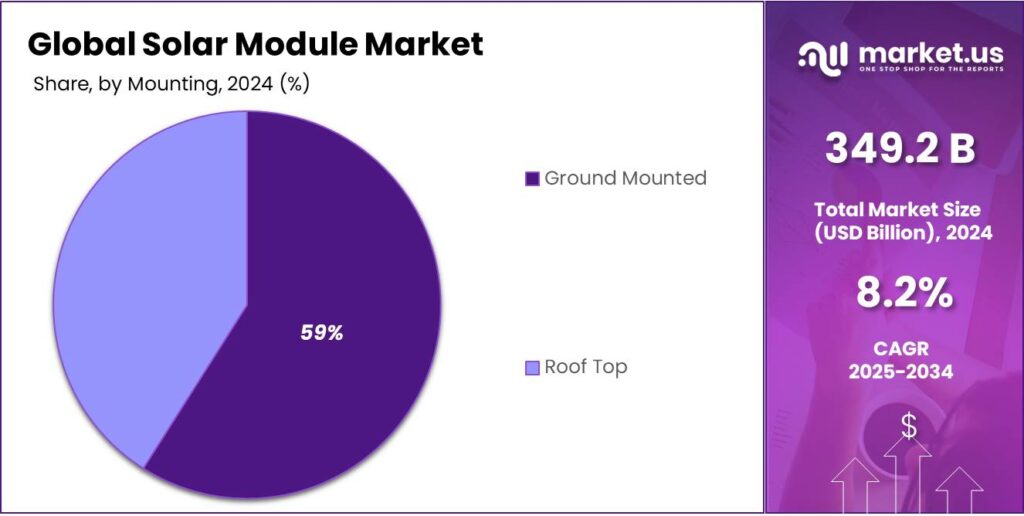

- Ground Mounted held a dominant market position, capturing more than a 59.6% share in the global solar module market.

- Utility held a dominant market position, capturing more than a 51.5% share in the global solar module market.

- Asia Pacific (APAC) region, which accounted for approximately 43.80% of the global market, representing a value of USD 152.9 billion.

By Technology Analysis

Crystalline Silicon dominates with 87.9% due to its proven efficiency, long lifespan, and strong global manufacturing base.

In 2024, Crystalline Silicon held a dominant market position, capturing more than a 87.9% share in the global solar module market. This leadership was primarily driven by its high energy conversion efficiency, stable performance across varied climates, and long operational life, which made it the preferred technology for both utility-scale and rooftop installations. The segment continued to benefit from large-scale manufacturing capacity, especially in Asia, which supported steady supply and cost optimization across global markets. In 2025, demand for crystalline silicon modules remained strong as governments and utilities focused on reliable and bankable solar technologies to meet renewable energy targets.

By Product Analysis

Monocrystalline dominates with 69.2% due to its higher efficiency and better space utilization in modern solar projects.

In 2024, Monocrystalline held a dominant market position, capturing more than a 69.2% share in the global solar module market by product. This strong position was supported by its superior power output per square meter, which made it highly suitable for space-constrained rooftop systems as well as large utility-scale solar plants. The technology was increasingly preferred for new installations as project developers focused on maximizing energy yield and reducing balance-of-system costs. In 2025, adoption remained steady as falling production costs and continuous improvements in cell design improved overall module efficiency and reliability.

By Connectivity Analysis

On Grid dominates with 82.4% due to its direct grid access and lower overall system cost.

In 2024, On Grid held a dominant market position, capturing more than a 82.4% share in the global solar module market by connectivity. This dominance was mainly supported by the wide deployment of grid-connected solar projects for utility-scale power generation and urban rooftop installations. On-grid systems allowed excess electricity to be fed directly into the power network, improving project economics and supporting faster return on investment. In 2025, growth remained strong as governments continued to expand grid infrastructure and promote large solar parks to meet rising electricity demand.

By Mounting Analysis

Ground Mounted dominates with 59.6% due to its suitability for large-scale solar power generation.

In 2024, Ground Mounted held a dominant market position, capturing more than a 59.6% share in the global solar module market by mounting type. This leadership was largely driven by the rapid development of utility-scale solar parks, where ground-mounted systems allowed optimal panel orientation and easier maintenance. These installations supported higher energy output and operational efficiency compared to rooftop alternatives, especially in regions with abundant land availability. In 2025, demand for ground-mounted solar modules remained strong as national renewable energy programs continued to prioritize large capacity additions to the power grid.

By End Use Analysis

Utility dominates with 51.5% due to large-scale capacity additions and long-term power purchase agreements.

In 2024, Utility held a dominant market position, capturing more than a 51.5% share in the global solar module market by end user. This dominance was supported by continuous investments in large solar power plants aimed at strengthening national power grids and reducing dependence on fossil fuels. Utility-scale projects benefited from economies of scale, which lowered the cost per unit of electricity generated and improved project viability. In 2025, the segment continued to expand as governments and power producers focused on long-term power purchase agreements to ensure stable revenue and energy security. The ability of utility projects to deliver high-volume, consistent power output reinforced their leading role in overall solar module demand.

Key Market Segments

By Technology

- Thin Film

- Crystalline Silicon

By Product

- Monocrystalline

- Polycrystalline

- Cadmium Telluride

- Amorphous Silicon

- Copper Indium Gallium Diselenide

By Connectivity

- On Grid

- Off Grid

By Mounting

- Ground Mounted

- Roof Top

By End Use

- Residential

- Commercial & Industrial

- Utility

Emerging Trends

High-Efficiency TOPCon Modules Paired with Storage for Reliable Power

On the technology side, the shift is happening fast. A U.S. National Renewable Energy Laboratory (NREL) industry update reports that 2024 global PV shipments were ~770 GW, and 98% of shipments were mono-crystalline silicon; within that, TOPCon accounted for 58% of PV shipments. This matters because TOPCon and other n-type products generally deliver better performance in real conditions (like heat and low light) and help projects produce more electricity over their lifetime.

At the same time, module prices have kept sliding, which is pushing buyers to upgrade to better tech instead of simply buying more panels. The International Energy Agency (IEA) notes that PV module prices continued to decline in 2024, helping accelerate capacity growth. Lower module prices, combined with higher efficiency, is one reason solar remains attractive even as project developers become more cautious about grid connection delays and curtailment risks.

- FAO’s work on sustainable food cold chains highlights that lack of effective refrigeration contributes to the loss of 526 million tonnes of food, around 12% of global food production. The refrigeration sector itself is a huge electricity user: the International Institute of Refrigeration (IIR) reports it accounts for about 20% of global electricity consumption and about 7.5% of global CO₂ emissions. When cold rooms and food processors install higher-efficiency modules and add storage, they aren’t just “going green”—they’re protecting product quality and reducing operating risk.

Governments are reinforcing this direction by scaling distributed solar programs that naturally favor high-efficiency modules and better system design. In India, MNRE reports cumulative solar capacity of 132.85 GW as of 30 November 2025, including 23.16 GW of grid-connected rooftop solar. India’s rooftop push is also visible in PM Surya Ghar updates: as of December 2025, 23.9 lakh households had installed rooftop solar totaling 7 GW, with ₹13,464.6 crore of subsidy released.

Drivers

Rapid Cost Decline and Economic Competitiveness

One of the most powerful forces driving the global adoption of solar modules today is the rapid decline in the cost of solar photovoltaic (PV) technology, especially the modules themselves. This cost shift has fundamentally changed how businesses, communities, and governments think about solar energy — from a nice-to-have renewable choice to a financially smart decision that competes directly with traditional power sources.

To put this in simple terms: a decade ago, solar modules were expensive enough that only a few early adopters could afford them. But since then, the price has dropped dramatically — by around 90% since the end of 2009 — making solar one of the cheapest options for new electricity generation in many parts of the world. This data comes from trusted research on global energy costs, monitored by renewable energy authorities such as the International Renewable Energy Agency (IRENA).

- Governments also take note of this cost trend and often build policies around it. For example, countries such as India have cut taxes and introduced incentives specifically to leverage the falling costs of solar. Notably, India reduced the Goods and Services Tax (GST) on solar photovoltaic modules from 12% to 5%, which is expected to reduce the overall capital cost of solar projects by about 5%. This kind of policy action makes solar even more financially appealing in fast-growing markets.

In a broader global context, international energy agencies now expect solar PV to account for a very large share of new renewable capacity in the coming years. For instance, one major outlook project from the International Energy Agency (IEA) suggests that solar PV will make up around 80% of the increase in renewable power capacity through 2030, largely because solar is now one of the most affordable ways to generate electricity.

Another dimension of this cost advantage is the job creation it enables. In India alone, government-backed incentive schemes aimed at solar manufacturing have already driven the creation of roughly 43,000 jobs in solar module production — with about 11,220 direct positions reported — across several states. This demonstrates how cost competitiveness not only helps adoption but also stimulates local economic activity and employment.

Restraints

Supply Chain and Integration Challenges

The solar industry’s supply chain — from the sourcing of raw materials to module manufacturing — remains fragile in many respects. Solar modules rely on a complex chain of inputs such as polysilicon, wafers, cells, and finished modules. Although global manufacturing capacity is increasing rapidly, a large share of this capacity (up to 80–90%) is still concentrated in a few countries, particularly China, according to projections by the International Energy Agency. This concentration means that any disruption — such as trade policy shifts, logistics delays, or geopolitical tensions — can ripple through the market and increase costs or delay deliveries.

- For example, even in India — which has aggressively pushed solar manufacturing through its Production Linked Incentive (PLI) scheme — not all targets have been met. As of mid-2025, only 31 GW of the planned 65 GW of solar module capacity was operational under the program, and investment levels reached ₹48,120 crore against a target of ₹94,000 crore. Job creation also lagged significantly, with about 38,500 jobs created versus a projected 1,95,000. These gaps signal that scaling manufacturing capacity is more difficult than expected, especially for upstream components like polysilicon and wafers, which still rely heavily on imports and foreign expertise.

Beyond manufacturing, another layer of challenge is grid integration. Solar power is inherently variable: it produces electricity only when the sun shines. This intermittency can strain electricity grids that were originally designed for conventional power plants that provide steady output. In many countries, grid infrastructure upgrades — such as smarter distribution networks or energy storage systems — are needed to absorb large amounts of solar energy. Without these upgrades, solar generators may face curtailment (where some of their potential power is wasted) or face limits on how much they can feed into the grid.

In practical terms, these supply chain strains mean solar developers — including large industrial users such as food processing companies or cold storage chains — may face uncertainty about module delivery timelines or price fluctuations. In an industry where planning often spans multiple years and financing depends on predictable costs, this uncertainty can slow investment decisions or increase project risk.

Opportunity

Solar-Powered Cold Chains and Food Processing Create a Big New Demand Pool

A major growth opportunity for solar modules is the fast-rising need for reliable, affordable electricity in food systems, especially cold storage, packhouses, dairies, meat and seafood processing, and temperature-controlled transport hubs. These sites run long hours, face high electricity bills, and cannot tolerate outages. Solar modules fit well here because they can supply daytime power at the point of use, cut peak demand charges, and pair smoothly with batteries or thermal storage for stability.

The scale of the food cold-chain gap is not small. FAO highlights that lack of effective refrigeration contributes to the loss of 526 million tonnes of food, or 12% of global food production. That number matters for solar module demand because fixing refrigeration is mostly an energy problem: you need dependable power to chill, freeze, and store food safely. When cold rooms are planned in markets with weak grids or high tariffs, decision-makers increasingly look at solar as a practical backbone, not a “green add-on.”

- Policy is now pushing in the same direction, which reduces risk for investors. The IEA says utility-scale solar is already the least-cost option for new electricity generation in a majority of countries, and that distributed solar (like rooftops) is set to grow faster where retail prices are high and policy support is improving. At the system level, the IEA projects global renewable capacity to rise by almost 4,600 GW from 2025–2030, with solar PV representing nearly 80% of the expansion—driven by low module costs and broad acceptance.

India shows how targeted schemes can quickly widen the addressable market for modules, including for small businesses that serve the food economy (bakeries, dairies, rice mills, cold rooms, and kirana distribution). Government reporting states that as of December 2025, 23.9 lakh households had installed rooftop solar totaling 7 GW, with ₹13,464.6 crore in subsidies released under PM Surya Ghar.

Regional Insights

APAC leads strongly with 43.80% share and a valuation of USD 152.9 Bn, reflecting deep market penetration and robust solar growth across the region.

In 2024, the Solar Module Market by region was prominently led by the Asia Pacific (APAC) region, which accounted for approximately 43.80% of the global market, representing a value of USD 152.9 billion. This commanding position was supported by rapid deployment of solar infrastructure and substantial manufacturing output, particularly from China, India, and other major economies within the region.

APAC’s dominance was underpinned by strong policy frameworks and ambitious renewable energy targets, which stimulated both domestic installations and export-oriented production. China continued to serve as a central hub for solar module manufacturing, contributing a significant proportion of the world’s supply and driving down production costs through scale. India, Japan, and Southeast Asian markets also registered notable increases in solar capacity additions, encouraged by supportive incentives and growing industrial demand.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Indosolar Limited is an Indian photovoltaic manufacturer producing solar cells and modules for residential, commercial, and utility grid applications. With an installed module capacity of around 1.3 GW, the company leverages premium raw materials and automated fabrication processes to deliver durable PV modules and is planning expansion aligned with government-supported capacity targets.

GCL System Integration (GCL-SI) is a major Chinese PV module producer with vertically integrated operations covering polysilicon, wafer, cell, and module production. Its manufacturing capacity reached around 30 GW in 2023, supporting a portfolio of high-efficiency TOPCon and bifacial panels for global markets, although profitability has faced pressure from oversupply conditions.

EMMVEE SOLAR is an Indian renewable energy manufacturer headquartered in Bengaluru, with an installed photovoltaic module capacity of approximately 6.6 GW and solar cell capacity of around 2.5 GW as of 2025. The company serves both utility and rooftop markets, adding reliability and quality validated by international product testing achievements.

Top Key Players Outlook

- CsunSolarTech

- Canadian Solar

- EMMVEE SOLAR

- GCL-SI

- Hanwha Group

- Indosolar

- Jinko Solar

- JA SOLAR Technology

- LONGI

- RENESOLA

Recent Industry Developments

By 2025, first‑quarter data Canadian Solar indicated module shipments of approximately 6.9 GW, reflecting continued market traction and broad geographic distribution across China, the United States, Pakistan, Spain, and Brazil.

By 2025, EMMVEE SOLAR expanded its PV module manufacturing capacity to around 6.6 GWp and solar cell capacity to about 2.5 GWp through the commissioning of new lines, enabling it to support a broader range of high‑efficiency bifacial and TOPCon modules and meet rising domestic and export demand.

Report Scope

Report Features Description Market Value (2024) USD 349.2 Bn Forecast Revenue (2034) USD 768.0 Bn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Thin Film, Crystalline Silicon), By Product (Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, Copper Indium Gallium Diselenide), By Connectivity (On Grid, Off Grid), By Mounting (Ground Mounted, Roof Top), By End Use (Residential, Commercial & Industrial, Utility) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CsunSolarTech, Canadian Solar, EMMVEE SOLAR, GCL-SI, Hanwha Group, Indosolar, Jinko Solar, JA SOLAR Technology, LONGI, RENESOLA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CsunSolarTech

- Canadian Solar

- EMMVEE SOLAR

- GCL-SI

- Hanwha Group

- Indosolar

- Jinko Solar

- JA SOLAR Technology

- LONGI

- RENESOLA