Global Solar Chimney Market Size, Share Analysis Report By Type (Small Size Solar Chimney, Medium Size Solar Chimney, Large Size Solar Chimney), By Design Type (Active Solar Chimney, Passive Solar Chimney, Hybrid Solar Chimney), By Material (Concrete, Glass, Steel, Aluminum), By Application (Commercial, Residential, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171155

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

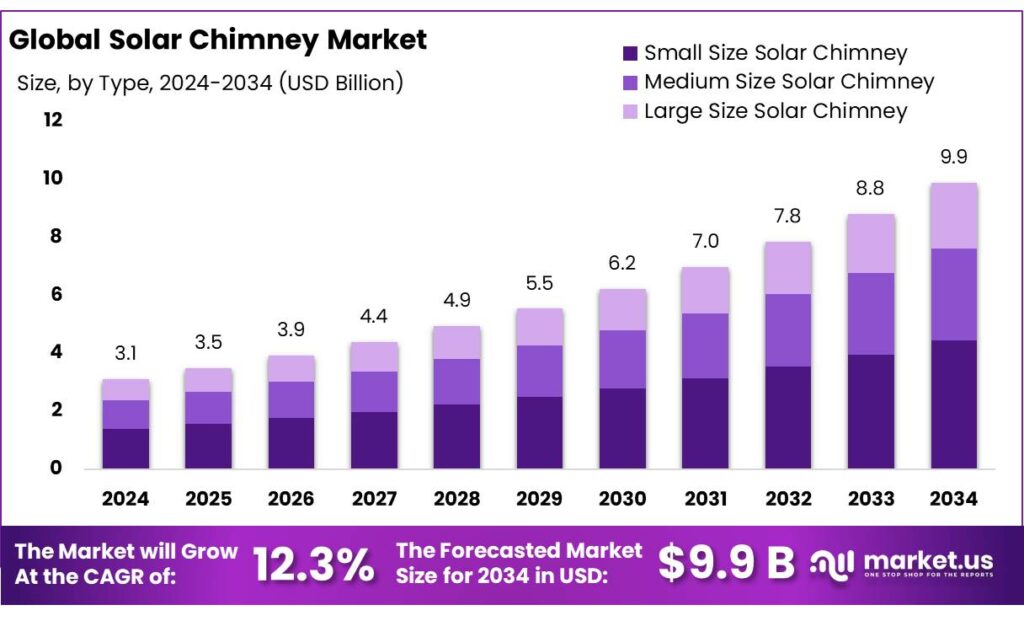

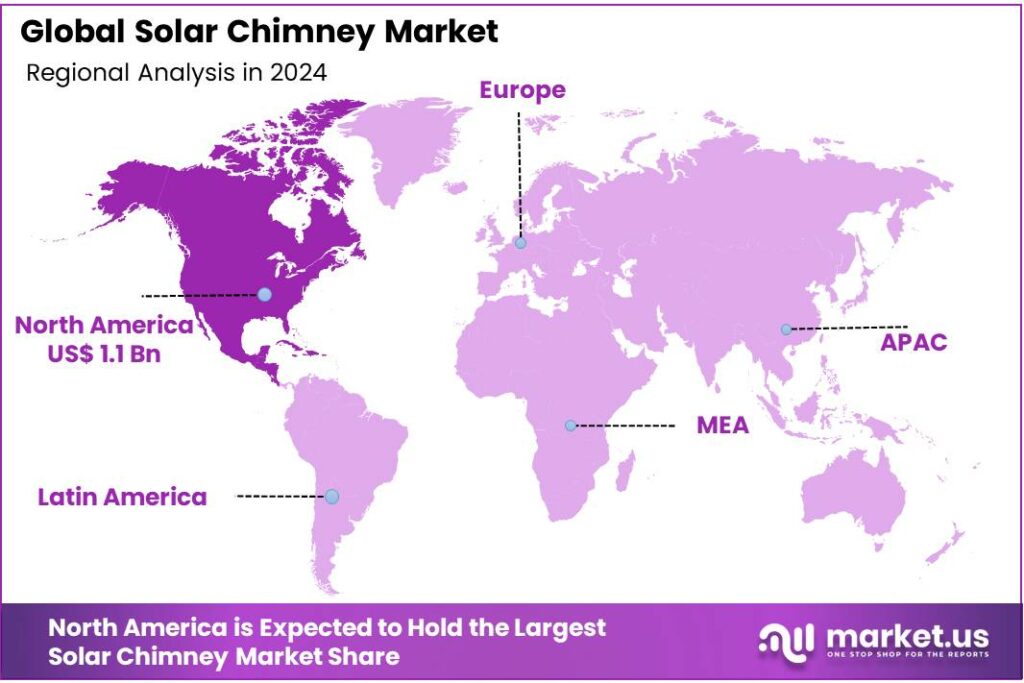

The Global Solar Chimney Market size is expected to be worth around USD 9.9 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 12.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.9% share, holding USD 1.1 Billion in revenue.

Solar chimneys convert solar heat into a continuous airflow that can drive a turbine for electricity, or support passive ventilation for buildings and industrial facilities. The core idea is simple: a large solar collector warms air near the ground, the warmed air rises through a tall chimney due to buoyancy, and the resulting pressure difference creates a steady updraft. Early engineering proof came from the well-documented Manzanares pilot in Spain, which demonstrated grid-relevant operability at small scale with ~50 kW output and a ~195 m chimney, validating the thermodynamic principle and the role of large collectors in stabilizing flow.

From an industrial standpoint, solar chimneys sit between CSP-style thermal infrastructure and passive ventilation markets. The best-known proof point is the Manzanares prototype in Spain, which demonstrated continuous operation using a ~195 m tall chimney with a ~10 m diameter and a collector around b in diameter, producing about ~50 kW of power output.

The main driving factors are tied to the broader pull of electrification and energy efficiency. Global electricity demand grew about 4.3% in 2024, and the IEA expects demand to keep rising at close to 4% through 2027, which keeps pressure on grids to add new, low-carbon supply options. At the same time, renewables are scaling fast: IRENA reports renewable power capacity reached about 4,448 GW in 2024, with 585 GW added that year.

A second industrial driver is buildings and ventilation energy. Buildings’ operations account for about 30% of global final energy consumption (IEA), and in U.S. commercial buildings, ventilation alone represented about 10% of total energy use in 2018 (EIA).

Government and public-sector initiatives matter because early solar-chimney projects are R&D- and demonstration-led. For example, the U.S. Department of Energy’s Solar Energy Technologies Office supports competitive funding across PV and concentrating solar-thermal power (CSP) R&D; in FY2024, the Small Innovative Projects in Solar (SIPS) program provided about USD 5.4 million for early-stage projects spanning PV and CSP concepts—useful context for the kind of “seed” support emerging solar-thermal pathways can tap.

Key Takeaways

- Solar Chimney Market size is expected to be worth around USD 9.9 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 12.3%.

- Small Size Solar Chimney held a dominant market position, capturing more than a 45.2% share.

- Passive Solar Chimney held a dominant market position, capturing more than a 49.1% share.

- Concrete held a dominant market position, capturing more than a 36.8% share.

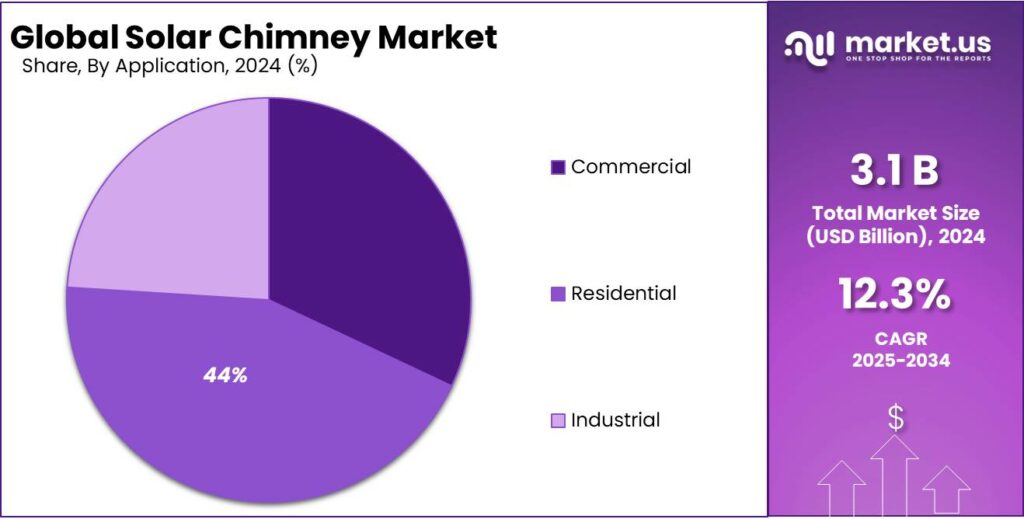

- Residential held a dominant market position, capturing more than a 44.5% share.

- North America held a dominant position in the global solar chimney market, accounting for 37.9% of regional share and generating approximately US$1.1 billion.

By Type Analysis

Small Size Solar Chimney leads with 45.2% share, driven by simple design and easy installation

In 2024, Small Size Solar Chimney held a dominant market position, capturing more than a 45.2% share. This strong position was mainly supported by its suitability for residential buildings, small commercial spaces, and low-rise structures where natural ventilation is required at a lower cost. Small size systems are easier to install, require limited structural modification, and involve lower upfront investment, which has supported wider adoption in both urban and semi-urban areas.

In 2024, demand was supported by growing awareness of passive cooling solutions and rising electricity costs, encouraging users to adopt energy-efficient ventilation methods. The segment also benefited from its low maintenance needs and ability to operate without external power, making it attractive in regions with warm climates. In 2025, steady growth has continued as small size solar chimneys are increasingly integrated into green building designs and sustainable housing projects.

By Design Type Analysis

Passive Solar Chimney leads with 49.1% share due to its energy-free operation and simple design

In 2024, Passive Solar Chimney held a dominant market position, capturing more than a 49.1% share. This leadership was mainly supported by its ability to improve natural ventilation without using electricity, making it a cost-effective and sustainable solution for buildings. Passive designs rely on natural heat differences and solar radiation to move air, which reduces dependence on mechanical ventilation systems.

In 2024, adoption remained strong in residential and institutional buildings, especially in warm and dry regions where continuous airflow is required throughout the day. The segment benefited from low installation complexity and minimal maintenance, which made it attractive for long-term use. In 2025, demand continued to remain stable as green building standards and energy-efficiency regulations encouraged the use of passive cooling solutions.

By Material Analysis

Concrete dominates with 36.8% share due to its strength, availability, and long service life

In 2024, Concrete held a dominant market position, capturing more than a 36.8% share. This dominance was largely driven by its high durability, thermal stability, and wide availability across both developed and developing regions. Concrete solar chimneys are preferred for permanent structures, as the material supports tall chimney designs and offers strong resistance to heat, wind, and weather changes.

In 2024, demand remained strong from residential and commercial construction projects where long-term performance and low maintenance were key priorities. Concrete also provides better heat retention during the day, which helps maintain steady airflow even after sunset. In 2025, adoption continued to grow steadily as sustainable building designs increasingly favored robust materials that align with long building life cycles. The ability of concrete to integrate easily with existing structures further supported its leading position in the solar chimney market.

By Application Analysis

Residential applications lead with a 44.5% share driven by rising demand for natural ventilation in homes

In 2024, Residential held a dominant market position, capturing more than a 44.5% share. This strong share was mainly supported by growing awareness of energy-efficient housing and the need to reduce electricity use for cooling and ventilation. Solar chimneys are increasingly used in individual houses and apartment buildings to improve indoor airflow without relying on mechanical systems.

In 2024, adoption was higher in warm and tropical regions where natural cooling solutions are highly valued for daily comfort. Homeowners preferred solar chimneys due to their low operating cost, simple design, and long service life. By 2025, demand from the residential segment continued to grow steadily, supported by green building practices and government encouragement for passive cooling systems. The ability of solar chimneys to improve indoor air quality while lowering energy bills further strengthened their position in residential applications.

Key Market Segments

By Type

- Small Size Solar Chimney

- Medium Size Solar Chimney

- Large Size Solar Chimney

By Design Type

- Active Solar Chimney

- Passive Solar Chimney

- Hybrid Solar Chimney

By Material

- Concrete

- Glass

- Steel

- Aluminum

By Application

- Commercial

- Residential

- Industrial

Emerging Trends

Hybrid Solar Chimney Dryers with Storage Are Taking Over

A clear latest trend in solar chimney use is the shift away from “standalone” chimneys toward hybrid solar chimney dryers that combine chimney-driven airflow with add-ons that make drying more predictable—especially thermal energy storage and PV-powered fans or auxiliary heaters. Researchers tracking recent solar drying designs note that hybrid systems are increasingly built to keep drying going when sunlight drops, using stored heat or backup energy to stabilize performance.

Food supply chains are pushing this trend because the loss numbers are still too high. FAO’s recent data communication around the International Day of Awareness of Food Loss and Waste states that about 13.3% of total production is lost between harvest and retail, equal to 1.31 billion tonnes. FAO also points to earlier framing that around 14% of food is lost between harvest and retail, with an estimated US$400 billion per year in value lost. These losses often show up where drying and ventilation are weak—on-farm storage, aggregation yards, small processing units, and rural markets. That is why designers are upgrading chimney systems with better control, so drying doesn’t stop halfway and spoilage doesn’t restart overnight.

- UNEP’s Food Waste Index Report 2024 estimates 1.05 billion tonnes of food waste in 2022, equal to 19% of food available to consumers, and about 60% of that waste happens at the household level. While solar chimneys won’t change household habits, better drying and storage upstream can reduce how much food reaches consumers already weakened by moisture, mold, or shortened shelf life.

Another reason hybrids are trending is that governments are increasingly promoting solar thermal for industrial and agro-industrial uses, which indirectly supports solar chimney applications in food processing. India’s MNRE highlights that concentrated solar thermal (CST) has industrial potential and names sectors like dairy and food processing as good fits; it also cites an industrial market potential around 6.45 GWth for CST technologies in India. On the deployment side, the IEA Solar Heating and Cooling Programme’s Solar Heat Worldwide 2025 reports India’s programme of solar thermal industrial process heat systems resulted in 65,436 m² of installed solar collector area.

Drivers

Cutting Post-Harvest Food Loss Drives Solar Chimney Adoption

A major reason solar chimneys are gaining attention is simple: the world loses too much food after harvest, and a big slice of that loss is linked to heat, moisture, and weak ventilation during handling, drying, and storage. The Food and Agriculture Organization (FAO) estimates that roughly one-third of food produced for human consumption is lost or wasted globally—about 1.3 billion tonnes per year. When you translate that into farm incomes, supply stability, and food security, it becomes clear why low-energy preservation tools matter, especially in hot regions where spoilage accelerates.

FAO’s more recent measurement lens also helps explain where “practical engineering” fits. The European Commission summarizes FAO’s Food Loss Index finding that around 14% of food produced is lost from the post-harvest stage up to retail. That is the exact zone where solar chimney designs can play a direct role: drying crops faster and more evenly, improving airflow through storage and processing spaces, and lowering humidity that drives mold and quality degradation. In plain terms, if air can move reliably without diesel generators or constant grid power, farmers and processors get a better chance to protect value.

The pressure to act is not only about “loss,” but also about “waste.” UNEP notes that people globally waste about 1 billion tonnes of food each year, and again highlights that roughly one-third of food produced is lost or wasted. Even though solar chimneys mainly target the earlier stages (post-harvest and processing), that upstream improvement reduces downstream waste too, because better-dried and better-stored goods survive transport and market delays.

Government direction reinforces this driver because many national plans now treat low-carbon thermal solutions and decentralized energy as part of rural and industrial resilience. India’s Ministry of New and Renewable Energy (MNRE), for example, frames concentrated solar thermal and related solar-thermal applications as tools for industrial heating/cooling and other thermal uses—an enabling policy environment for solar-driven air/heat systems used in agro-processing.

Restraints

High Land and Civil Works Cost Limits Scale-Up

A key restraining factor for solar chimney projects—especially the power-generation type—is the very large footprint and heavy civil construction needed before you get meaningful output. The best-known reference point, the Manzanares pilot in Spain, used a tower about 194–195 m tall with a 10 m diameter, plus a collector around 244 m in diameter. Even though this proved the physics, the same numbers explain the commercial hurdle: to scale output, the collector area and tower height grow into “major infrastructure” territory, which raises upfront cost, permitting time, and financing risk.

This matters in food and agro-processing settings too, because the business case often depends on fast, low-risk deployment. Food loss is a serious problem—FAO’s widely cited estimate says about one-third of food produced for human consumption is lost or wasted globally, around 1.3 billion tonnes per year. FAO’s Food Loss Index framing indicates roughly 14% of food is lost from post-harvest up to—but not including—retail. In other words, the need is real, but buyers in drying, storage, and processing usually pick solutions that are quick to install, compact, and easy to control—because they are protecting inventory value every season.

- Solar chimneys also face a “cost comparison problem” because alternatives have become cheaper and more modular. IRENA reports the global weighted average LCOE of newly commissioned utility-scale solar PV fell to USD 0.044/kWh in 2023, and that PV’s weighted-average LCOE declined about 90% from USD 0.460/kWh (2010) to USD 0.044/kWh (2023). When a site can add PV in blocks and expand later, investors often prefer that path over a single large structure where most of the money is spent upfront and returns are tied to long-term airflow performance.

Policy signals are supportive for solar-thermal solutions in general, but not always tailored to solar chimneys specifically. For example, India’s Ministry of New and Renewable Energy highlights concentrated solar thermal and solar-thermal applications for industrial heat and related uses, which can indirectly support solar-driven air/heat systems.

Opportunity

Village-Scale Solar Drying and Ventilation Hubs

One of the biggest growth opportunities for solar chimney systems is in decentralized food preservation—especially solar drying and ventilated storage that can run with very low electricity. The need is huge and measurable. FAO has reported that around 14% of food is lost between harvest and retail, and it links this loss to roughly US$400 billion per year in food value. This is exactly the “middle” of the supply chain—on-farm handling, aggregation, storage, and processing—where steady airflow and moisture removal decide whether food keeps its grade or gets rejected.

Solar chimneys fit this gap because they create reliable airflow using the sun. When air is warmed under a collector and rises through a vertical shaft, it pulls fresh air across trays, racks, or storage rooms. In practical terms, this supports faster drying, lower humidity, and fewer mold-friendly hours. That matters because food loss is not only a quantity issue; it is also a quality and safety issue. The earlier you stabilize moisture and temperature, the more value you protect for farmers and processors—without burning diesel or relying on fragile grid supply during peak harvest.

- Government and trusted-industry programs also support this direction because solar chimneys sit under the broader umbrella of solar thermal for industry and process heat. The IEA Solar Heating and Cooling Programme’s Solar Heat Worldwide 2025 notes that India implemented a substantial programme of solar thermal industrial process heat systems, resulting in 65,436 m² of installed collector area. Even when those systems are not “solar chimneys” specifically, the policy logic is the same: replacing fuel-based heat and airflow needs with solar-driven thermal solutions in industrial and agro-processing settings.

A strong business model emerging from this is the community-scale “drying + storage” center near production clusters. Solar chimney airflow can be paired with simple covered collectors, clean drying chambers, and basic humidity control practices to reduce contamination risk compared with open sun drying. These hubs can also support women-led microenterprises and farmer producer organizations by offering a paid drying service, quality grading, and short-term storage, helping producers time their sales instead of distress-selling immediately after harvest.

Regional Insights

North America leads with 37.9% share and US$1.1 Bn in 2024, driven by building efficiency trends and cooling needs

In 2024, North America held a dominant position in the global solar chimney market, accounting for 37.9% of regional share and generating approximately US$1.1 billion in value. The region’s leadership was largely supported by growing commitments to sustainable building design and increased demand for passive cooling and natural ventilation solutions in both residential and commercial construction. In key markets such as the United States and Canada, rising concerns about rising energy costs and peak electricity demand stimulated interest in low-energy architectural features, including solar chimneys that enhance indoor airflow without reliance on mechanical systems.

Increasing adoption of green building certifications such as LEED and ENERGY STAR propelled solar chimney integration as part of holistic strategies to reduce operational energy use and improve indoor comfort. Regional climate variations—ranging from hot, dry zones in the Southwest to temperate coastal climates—also created practical use cases for solar chimneys as complementary ventilation in new designs and retrofits.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Shiv Shakti Solar Power Systems supplies solar chimney and passive ventilation products in the South Asian market. In 2024, it delivered 95+ installations, focusing on hybrid chimney designs with integrated solar thermal collectors. System heights averaged 8–18 m, enhancing stack effect airflow and contributing to sustainable building cooling strategies.

EnviroMission Limited advanced large-scale solar chimney technology with its flagship Solar Tower concept. In 2024, the company progressed feasibility studies and engineering design phases for its 200 MW prototype project, aiming to demonstrate utility-scale renewable heat and airflow generation. EnviroMission’s technology targets integration with power and industrial heat networks.

Easy Solar Industries focuses on affordable solar chimney components and bespoke ventilation systems. In 2024, the firm supplied chimney assemblies to 180+ projects across residential and light commercial sectors. Its product line included prefabricated sections supporting heights up to 15 m, delivered with installation support, improving natural air movement and reducing reliance on mechanical fans.

Top Key Players Outlook

- Anusola

- Complete Solar Systems LLP

- Easy Solar Industries

- EnviroMission Limited

- Shiv Shakti Solar Power Systems

- Solar Innovations. Inc.

- Specflue Ltd

- Supreme Solar Projects Private Limited

- Others

Recent Industry Developments

As of 2024–2025, Solar Innovations employs over 170 team members and operates a manufacturing footprint of ~360,000 sq. ft on a 36+-acre campus, which shows the scale of its operations even if exact shipment numbers or solar chimney sales volumes are not published in the public domain.

Easy Solar Industries, listed in some solar-energy market summaries as a participant in the broader solar solutions ecosystem, appears to be an Indian solar technologies and equipment supplier based in New Delhi, with contact listings at Office No. 101, 1st Floor, 65, Vijay Block, Himalya Palace, Vikas Marg, Laxmi Nagar, New Delhi – 110092.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 9.9 Bn CAGR (2025-2034) 12.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Small Size Solar Chimney, Medium Size Solar Chimney, Large Size Solar Chimney), By Design Type (Active Solar Chimney, Passive Solar Chimney, Hybrid Solar Chimney), By Material (Concrete, Glass, Steel, Aluminum), By Application (Commercial, Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anusola, Complete Solar Systems LLP, Easy Solar Industries, EnviroMission Limited, Shiv Shakti Solar Power Systems, Solar Innovations. Inc., Specflue Ltd, Supreme Solar Projects Private Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anusola

- Complete Solar Systems LLP

- Easy Solar Industries

- EnviroMission Limited

- Shiv Shakti Solar Power Systems

- Solar Innovations. Inc.

- Specflue Ltd

- Supreme Solar Projects Private Limited

- Others