Global Slimming Tea Market Size, Share, And Enhanced Productivity By Form (Loose, Tea Bags), By Nature (Organic, Conventional), By End Use (Green Tea, White Tea, Oolong Tea, Others), By Distribution Channel (Supermarket/Hypermarket, Online Retailers, Specialty Stores, Mass Grocery Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172434

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

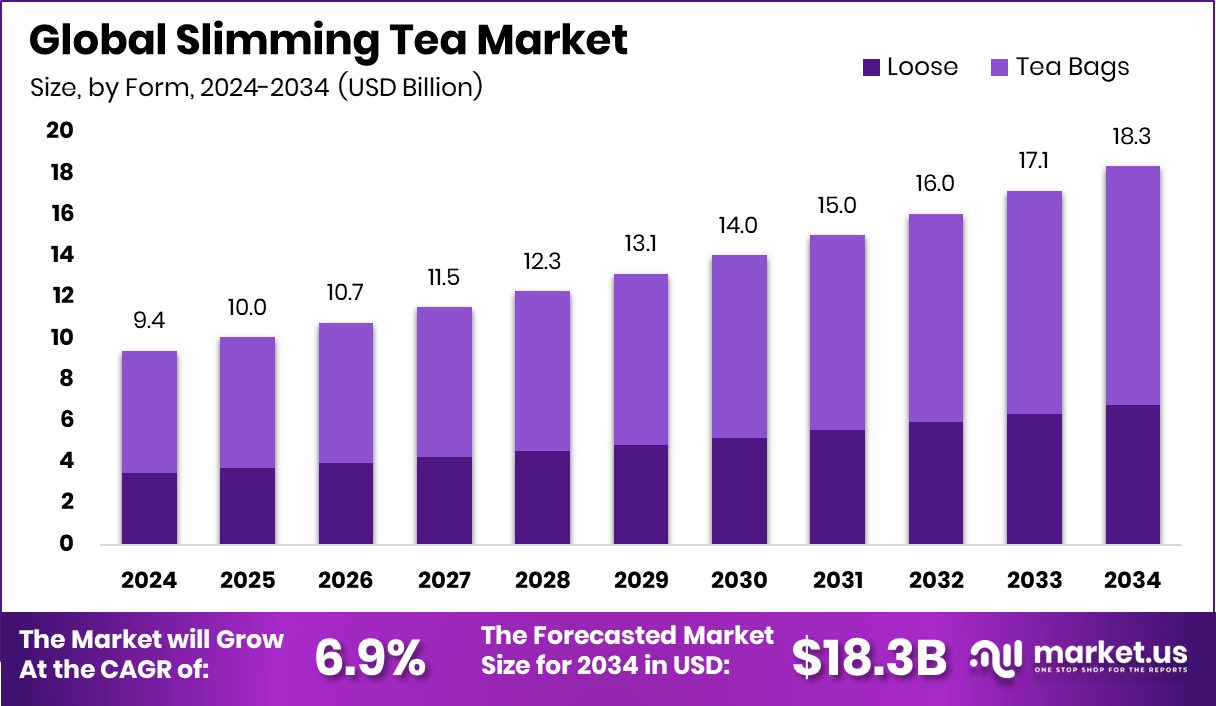

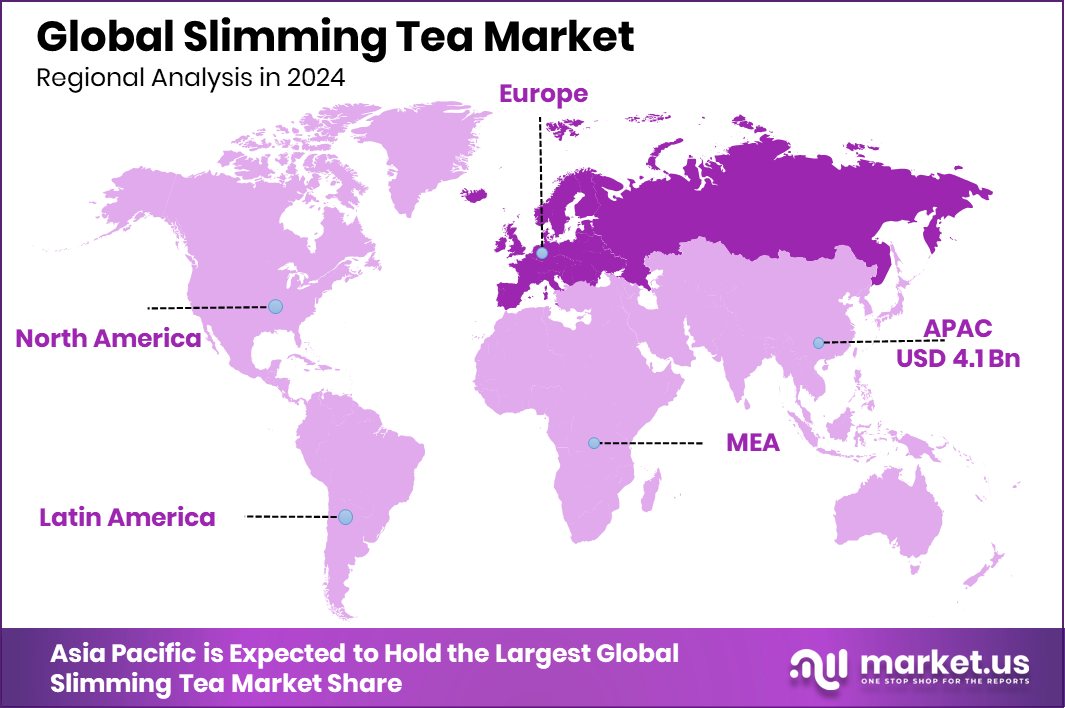

The Global Slimming Tea Market is expected to be worth around USD 18.3 billion by 2034, up from USD 9.4 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia Pacific leads the slimming tea market regionally at 43.80%, totaling USD 4.1 Bn.

Slimming tea is a beverage made from tea leaves, herbs, and plant extracts that support digestion, metabolism, and natural weight management. It is commonly prepared using green tea, oolong tea, or herbal blends that help reduce bloating and support daily wellness routines. Many consumers use slimming tea as part of a balanced lifestyle rather than as a medical solution.

The Slimming Tea Market refers to the global business ecosystem covering the production, branding, distribution, and retail sale of these functional teas. It includes products sold through supermarkets, specialty stores, and online platforms. The market is shaped by changing lifestyles, rising health awareness, and growing acceptance of tea as a functional wellness drink rather than a regular refreshment.

Growth factors in this market are closely linked to rising investments across the broader tea and wellness space. An alcoholic tea brand gaining £1.4m investment, a China-based bubble tea chain rising 43% during its Hong Kong debut, and East Forged completing a $1.5m capital raise all signal strong investor confidence in tea-led beverage innovation, indirectly supporting category expansion.

Demand for slimming tea is increasing as consumers shift away from sugar-heavy drinks toward natural alternatives. This trend is reinforced by VAHDAM India securing $3 million in funding to strengthen global tea distribution, improving product reach and consumer access across regions.

Opportunities are expanding with digital-first and direct-to-consumer models. An Assam-based D2C tea brand raising ₹3 crore in Pre-Series A funding from NEDFi Ventures highlights how regional sourcing, online sales, and wellness positioning are creating new growth pathways for slimming tea products globally.

Key Takeaways

- The Global Slimming Tea Market is expected to be worth around USD 18.3 billion by 2034, up from USD 9.4 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In the Slimming Tea Market, tea bags dominate by form with a 63.2% share.

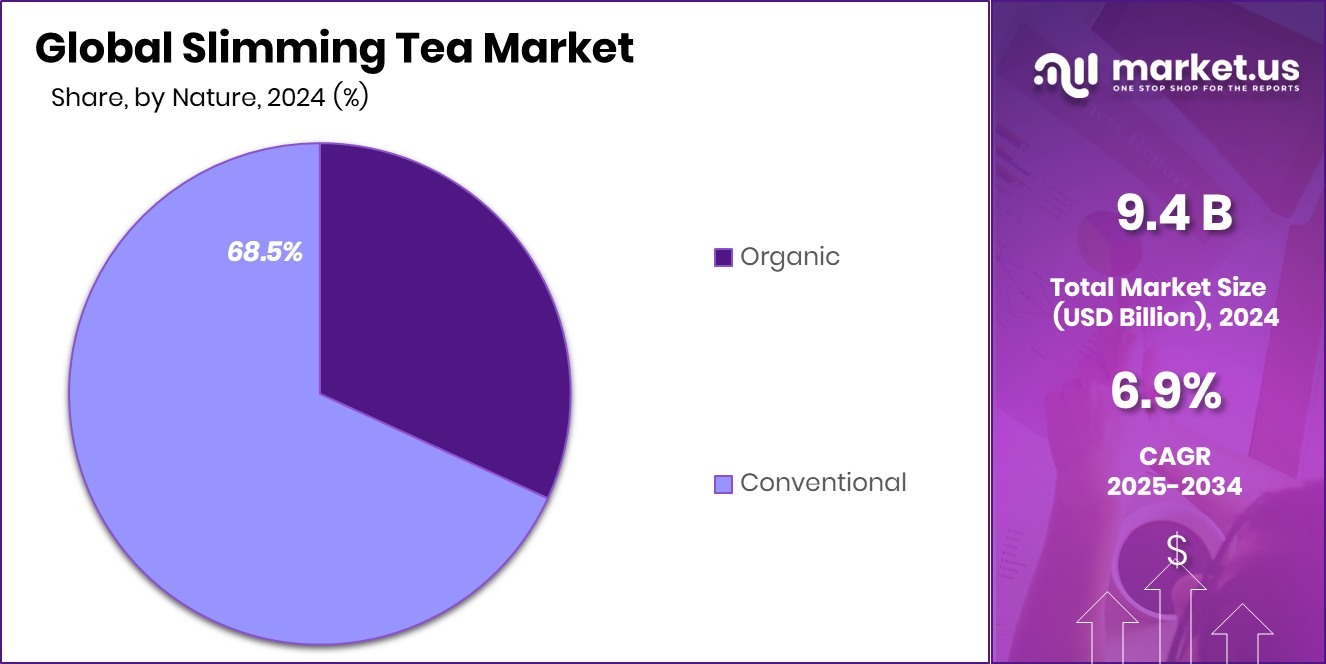

- Conventional products lead the slimming tea market by nature, accounting for 68.5% share.

- Green tea drives the Slimming Tea Market end-use, holding a 49.7% consumption share.

- Supermarkets and hypermarkets lead the slimming tea market distribution channels with 39.4% share.

- Asia Pacific growth reflects strong demand, holding 43.80% and reaching USD 4.1 Bn.

By Form Analysis

Tea bags dominate the Slimming Tea Market, holding 63.2% share due to convenience and portability.

In 2024, the Slimming Tea Market saw tea bags emerge as the most preferred form, holding a 63.2% share. Tea bags are widely favored because they are easy to use, mess-free, and fit well into daily routines. Consumers looking for weight management solutions often prefer simple preparation without special tools or long brewing times. Tea bags also help maintain portion control, which is important for calorie-conscious buyers.

Brands benefit from this format because it supports consistent dosing of herbal blends and active ingredients. In addition, tea bags are travel-friendly and widely available across retail formats. This strong demand reflects a shift toward convenience-driven wellness products, where ease of use plays a key role in repeat purchases and long-term consumer loyalty.

By Nature Analysis

Conventional products lead the Slimming Tea Market with 68.5% share, supported by affordability and availability.

In 2024, the Slimming Tea Market remained largely driven by conventional products, which accounted for a 68.5% share. Conventional slimming teas continue to dominate due to their lower price points and wider availability compared to organic alternatives. Many consumers, especially in price-sensitive regions, prioritize affordability over organic certification when purchasing daily wellness beverages.

Conventional farming also supports higher production volumes, helping brands maintain a steady supply and stable pricing. Retailers prefer these products because they offer faster inventory turnover. While awareness of natural and organic products is growing, conventional slimming teas still meet consumer expectations for effectiveness and taste. This segment’s dominance highlights how cost, accessibility, and established consumer trust continue to shape purchasing decisions in the global slimming tea landscape.

By End Use Analysis

Green tea dominates end use in the Slimming Tea Market, capturing 49.7% share globally.

In 2024, green tea led the Slimming Tea Market by end use, capturing a 49.7% share. Green tea is strongly associated with metabolism support, fat oxidation, and antioxidant benefits, making it a popular choice for weight-conscious consumers. Its natural image and long-standing use in traditional wellness practices add to its credibility.

Many buyers also prefer green tea because it offers both weight management and overall health benefits, such as improved digestion and heart health. Brands continue to innovate with flavored and blended green tea variants to attract new users while retaining loyal customers. This strong position reflects rising consumer preference for functional beverages that deliver multiple health benefits in a single, familiar product.

By Distribution Channel Analysis

Supermarkets and hypermarkets lead distribution in the Slimming Tea Market with 39.4% share nationwide.

In 2024, supermarkets and hypermarkets dominated the Slimming Tea Market distribution channels, holding a 39.4% share. These stores attract high foot traffic and allow consumers to compare brands, prices, and ingredients in one place. Shoppers often trust large retail chains for product authenticity and quality, especially for health-related items.

Promotional offers, in-store visibility, and bundled discounts further support strong sales through this channel. Supermarkets also play a key role in introducing new slimming tea products to mass consumers. Despite growing online sales, physical retail remains important for first-time buyers who prefer to read labels and make informed choices. This dominance highlights the continued importance of traditional retail in health beverage purchasing behavior.

Key Market Segments

By Form

- Loose

- Tea Bags

By Nature

- Organic

- Conventional

By End Use

- Green Tea

- White Tea

- Oolong Tea

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Online Retailers

- Specialty Stores

- Mass Grocery Stores

- Others

Driving Factors

Rising Investment Interest Fuels Slimming Tea Growth

In the Slimming Tea Market, strong investor interest is becoming a key driving factor for growth. Funding activity across the broader tea and wellness beverage space shows rising confidence in functional, health-focused drinks. For example, Blue Tea Bags secured $7.5 million on Shark Tank India, even after facing tough feedback from investors, highlighting the belief in long-term demand for specialty and wellness teas.

Similarly, Three Best Friends raised $100K in seed funding for their non-alcoholic beverage brand, reflecting growing support for low-calorie, health-oriented drink alternatives. These investments help brands improve sourcing, packaging, and distribution, making slimming teas more accessible and visible to consumers.

As capital flows into innovative tea-based beverages, product awareness increases, retail reach expands, and consumer trust strengthens. This funding-led momentum directly supports market growth by accelerating product development and encouraging wider adoption of slimming tea as a daily wellness choice.

Restraining Factors

High Brand Visibility Raises Consumer Expectation Pressures

In the Slimming Tea Market, rising brand visibility is becoming a restraining factor due to growing consumer expectations. When brands gain strong public attention, buyers often expect fast and visible results, which slimming tea alone cannot always deliver. This pressure increased after Teamonk Global raised US$ 1 million in pre-Series A funding, bringing more focus to premium wellness teas.

Similarly, Blue Tea, achieving INR 5 crore in monthly revenue after appearing on Shark Tank India, raised awareness but also scrutiny around product performance. As consumers become more informed, they question health claims and compare outcomes closely. If results feel slow or unclear, repeat purchases may decline. This challenge forces brands to invest more in education and trust-building, slowing growth for smaller players and making market entry harder despite strong demand.

Growth Opportunity

Expanding Tea Retail Networks Create New Demand

The Slimming Tea Market has a strong growth opportunity through the expansion of modern tea retail and lifestyle beverage brands. Physical tea cafés and retail chains help introduce slimming teas to consumers in an approachable way, encouraging trial and repeat use. This opportunity is supported by Chai Kings, raising $1 million from The Chennai Angels and other investors, allowing wider store expansion and stronger consumer reach.

At the same time, MISSION, raising £2 million with backing from Formula 1 driver Pierre Gasly, highlights rising interest in performance-linked, low-calorie beverages that align well with slimming tea positioning. These investments support new product formats, better branding, and stronger customer engagement. As tea moves from home kitchens into lifestyle spaces, slimming tea benefits from higher visibility and acceptance as a daily wellness drink.

Latest Trends

Tea Brands Shift Toward Lifestyle Wellness Positioning

A major latest trend in the Slimming Tea Market is the shift toward lifestyle-driven wellness brands supported by strong funding activity. Tea brands are no longer selling only weight support; they are building daily wellness habits through branding, cafés, and digital channels. This trend is reflected as Chai Kings bags $3 Mn in a Series A round, helping expand tea-led lifestyle consumption. At the same time, D2C tea brand Vahdam bags INR 25 Cr, strengthening online reach and global visibility for functional teas, including slimming variants.

New beverage startups are also shaping consumer choices, as Xiaojiwan secures $5 million in seed funding to target young consumers with alternative beverages, influencing cross-category competition. Meanwhile, sustainability-focused innovation gains attention with Nitricity bagging $50m for upcycled organic solutions, reinforcing clean-label expectations. Together, these developments show slimming tea evolving into a broader, modern wellness lifestyle choice.

Regional Analysis

Asia Pacific dominates the slimming tea market with a 43.80% share at USD 4.1 Bn.

Asia Pacific emerged as the dominating region in the Slimming Tea Market, accounting for 43.80% of global demand and valued at USD 4.1 Bn. This leadership is supported by a deep-rooted tea consumption culture, strong consumer acceptance of herbal weight-management solutions, and high awareness of metabolism-boosting beverages across several Asia Pacific economies. Daily tea-drinking habits naturally support higher adoption of slimming tea products, while urban lifestyles and rising wellness focus further strengthen regional demand.

In contrast, North America shows steady interest driven by lifestyle-related weight management needs and a growing preference for functional beverages positioned as natural alternatives.

Europe reflects moderate but stable demand, supported by increasing health consciousness and traditional herbal tea consumption patterns. The Middle East & Africa market remains niche, with gradual adoption linked to expanding retail availability and rising awareness of wellness teas.

Latin America represents an emerging regional market, where slimming tea consumption is developing alongside broader interest in herbal and plant-based beverages. Overall, regional demand patterns indicate Asia Pacific’s clear leadership, while other regions continue to evolve steadily without surpassing the established dominance of Asia Pacific in value and share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sira Impex Pvt. Ltd. plays a focused role in the global Slimming Tea Market through its strong export-oriented operations and diversified tea portfolio. The company benefits from India’s established tea supply base and leverages private-label manufacturing to serve international wellness brands. Its ability to customize blends and packaging supports flexible entry into weight-management tea categories. Operational consistency, sourcing control, and long-term buyer relationships position Sira Impex as a dependable supplier rather than a mass consumer brand, strengthening its relevance within global slimming tea supply chains.

Tea Treasure stands out for its premium positioning and emphasis on curated tea experiences. In the slimming tea space, the brand aligns wellness with indulgence, offering blends that appeal to health-conscious yet quality-driven consumers. Its focus on presentation, gifting formats, and specialty blends enhances brand recall in urban and online channels. Tea Treasure’s strategy reflects growing demand for lifestyle-oriented wellness products, where slimming teas are positioned as part of daily self-care rather than short-term weight solutions.

Hyleys brings strong international brand recognition to the Slimming Tea Market through its Sri Lankan tea heritage. The company emphasizes clean labeling and functional tea formulations that resonate with global consumers seeking trusted origins. Hyleys benefits from vertically integrated sourcing and consistent quality standards, supporting scalability across regions. Its established distribution networks allow slimming tea products to reach mainstream retail efficiently, reinforcing brand credibility and long-term market presence.

Top Key Players in the Market

- Sira Impex Pvt. Ltd.

- Tea Treasure

- Hyleys

- 21stCentury Healthcare, Inc

- Okuma Nutritionals

- Kudos Ayurveda

- Triple Leaf Tea Inc.

- Others

Recent Developments

- In December 2025, Hyleys expanded its slimming tea lineup by introducing a Raspberry Flavor Slim Tea variant. This product is positioned as a weight-loss supporting herbal tea that can be consumed easily before bedtime, adding variety to its existing fruit-flavored slimming tea range and appealing to consumers who prefer flavored functional beverages.

- In October 2025, the Kudos Active Slim Tea (2 gm) was listed on major online health and pharmacy platforms like Tata 1mg, showing that the company continues to promote and sell this herbal slimming tea designed to help boost metabolism and support weight management through natural ingredients like green tea extract and ayurvedic herbs. This listing with updated details reflects the continued market presence of the slimming tea product in 2025.

Report Scope

Report Features Description Market Value (2024) USD 9.4 Billion Forecast Revenue (2034) USD 18.3 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Loose, Tea Bags), By Nature (Organic, Conventional), By End Use (Green Tea, White Tea, Oolong Tea, Others), By Distribution Channel (Supermarket/Hypermarket, Online Retailers, Specialty Stores, Mass Grocery Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sira Impex Pvt. Ltd., Tea Treasure, Hyleys, 21stCentury Healthcare, Inc, Okuma Nutritionals, Kudos Ayurveda, Triple Leaf Tea Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sira Impex Pvt. Ltd.

- Tea Treasure

- Hyleys

- 21stCentury Healthcare, Inc

- Okuma Nutritionals

- Kudos Ayurveda

- Triple Leaf Tea Inc.

- Others