Global Silica Sand Market Size, Share Analysis Report By Purity (Up to 98% And Above 98%), By Application (Glass Manufacturing, Foundry, Chemical Production, Construction, Paints And Coatings, Ceramics And Refractories, Filtration, Oil And Gas, And Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162003

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

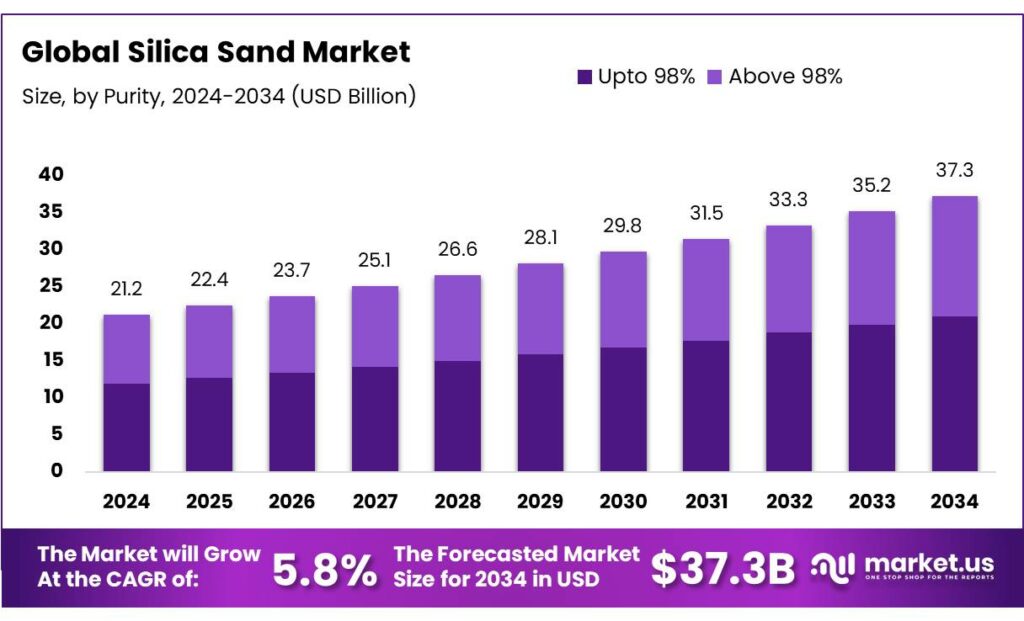

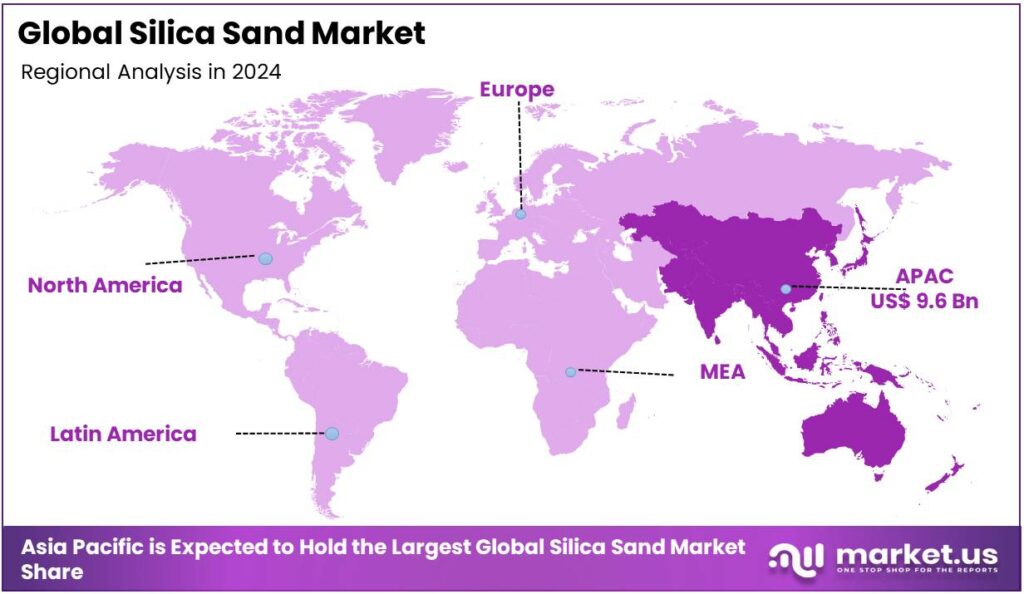

The Global Silica Sand Market size is expected to be worth around USD 37.3 Billion by 2034, from USD 21.2 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 45.3% share, holding USD 9.6 Billion in revenue.

Silica sand, which is known as industrial sand, contains a high proportion of silica that is made from two of the most abundant elements in the Earth’s crust, silicon and oxygen. In India, silica sand is recognized by the government as an essential raw material of national importance, and as such, there is a requirement to provide an adequate and steady supply through maintaining stocks of permitted reserves and safeguarding silica sand resources.

Due to its unique properties and chemical stability, silica sand is extensively used in the manufacturing of glass for various applications such as automotive, building, and electronics. Additionally, there is an exponentially growing demand for consumer electronics, and semiconductor chips are an integral part of this. Most chips are made from silicon, which is derived from silica sand. However, silica sand can be very hazardous to human health if inhaled, which has led the market to come under heavy scrutiny.

- According to the United States Geological Survey, global mine production of silica sand was estimated at 440 million metric tons in 2024.

Key Takeaways

- The global silica sand market was valued at USD 21.2 billion in 2024.

- The global silica sand market is projected to grow at a CAGR of 5.8% and is estimated to reach USD 37.3 billion by 2034.

- Based on the purity, silica sand that is pure up to 98% dominated the market, with around 56.4% of the total global market.

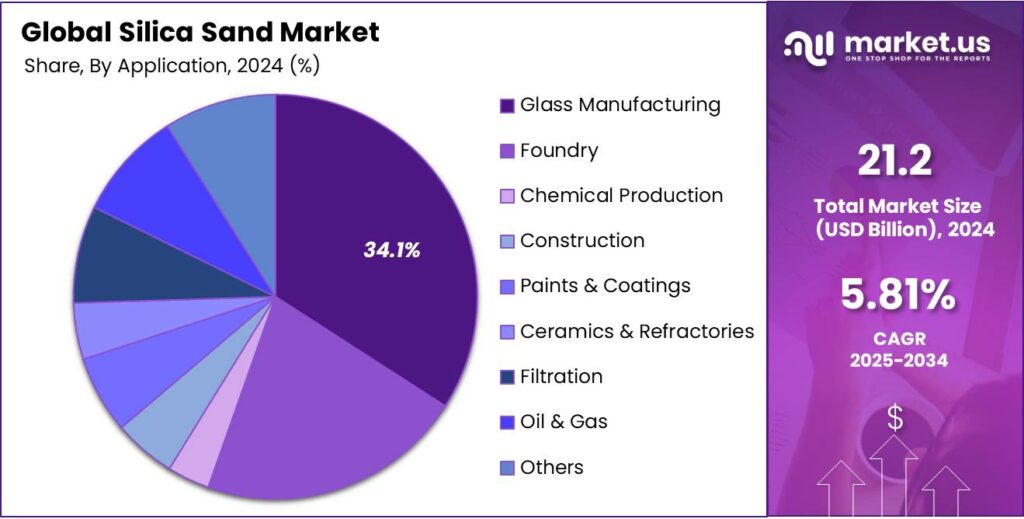

- Among the applications of silica sand, glass manufacturing emerged as a major segment in the market, with 34.1% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the silica sand market, accounting for around 45.3% of the total global consumption.

Purity Analysis

Silica Sand That is Pure Up to 98% Dominated the Market in 2024.

The silica sand market is segmented based on purity into up to 98% pure and above 98% pure. The silica sand that is pure up to 98% dominates the market, comprising around 56.4% of the market share. Silica sand with up to 98% purity is more widely utilized than higher-purity grades primarily due to its suitability for a broad range of industrial applications and its greater availability at lower cost. Various industries, such as construction, glass manufacturing, and metal foundry work, do not require ultra-high purity levels; 95-98% purity is sufficient to meet performance standards in these sectors.

In contrast, silica sand above 98% purity is typically reserved for specialized uses such as electronics or photovoltaic cells, where impurities can affect product quality or efficiency. As producing and processing ultra-pure silica is more expensive and technically demanding, it is used selectively, while 98% pure sand remains the more practical and economical choice for mass-market applications.

Application Analysis

Glass Manufacturing Emerged as a Leading Segment in the Silica Sand Market.

Based on applications of silica sand, the market is segmented into glass manufacturing, foundry, chemical production, construction, paints & coatings, ceramics & refractories, filtration, oil & gas, and others. Approximately 34.1% of the revenue in the silica sand market is generated by the glass manufacturing industry. Silica sand is most commonly used for glass manufacturing as its chemical composition and physical properties are ideal for producing clear, strong, and durable glass.

High-purity silica sand melts at high temperatures to form a uniform, transparent material essential for windows, containers, and specialty glass products. While other industries, such as foundry, chemical production, construction, paints, ceramics, filtration, and oil & gas, use silica sand, their requirements vary and often tolerate lower purity or different grain sizes. Glass manufacturing demands consistent purity and grain quality to avoid defects and ensure clarity, making silica sand indispensable in this sector. Its ability to withstand intense heat and form stable structures further solidifies its dominance in glass production over other applications.

Key Market Segments

By Purity

- Up to 98%

- Above 98%

By Application

- Glass Manufacturing

- Foundry

- Chemical Production

- Construction

- Paints & Coatings

- Ceramics & Refractories

- Filtration

- Oil & Gas

- Others

Drivers

Glass Production Drives the Silica Sand Market.

Glass production is one of the primary drivers of the silica sand market due to the high purity and specific grain size requirements of the industry. Silica sand, composed mainly of silicon dioxide (SiO₂), is a critical raw material in the manufacture of glass products, including flat glass for windows, container glass for bottles and jars, and specialty glass for electronics and solar panels. Silica is needed for solar panels, in the form of crystalline silicon and highly transparent tempered glass, which combined account for up to 80% of a solar panel’s weight.

The glass manufacturing requires silica sand with a purity of over 95%, and in many cases, over 98%, to ensure clarity and structural integrity. For instance, in the production of solar panels and high-performance optical glass, impurities in the sand can significantly affect efficiency and strength. Globally, it’s estimated that more than 33% of all industrial silica sand is consumed by the glass industry. Countries such as China, the United States, and Germany, major centers for automotive, construction, and technology, have consistently high demand for silica sand, driven by strong glass manufacturing sectors.

Restraints

Increased Competition and Environmental Regulations Might Pose a Challenge for the Silica Sand Market.

Increased competition and tightening environmental regulations are emerging as significant challenges for the silica sand market. As demand grows from industries such as glass, electronics, and construction, more players are entering the market, leading to supply saturation in some regions and putting pressure on pricing and profit margins. This heightened competition can be particularly challenging for smaller producers who may lack the infrastructure to meet strict quality or environmental standards.

Additionally, silica can be hazardous to human health. Based on significant information from the International Agency for Research on Evaluation of Cancer, the Occupational Safety and Health Administration (OSHA) has declared that any material containing more than 0.1% crystalline silica should indicate its carcinogenic hazard. Similarly, in April 2024, the Mine Safety and Health Administration published a final regulation that amended its existing standards to protect miners against exposure to respirable crystalline silica.

Furthermore, silica sand mining is increasingly scrutinized for its environmental impact, including habitat destruction, water consumption, and airborne particulate emissions. For instance, in parts of India and the United States, local communities and environmental groups have raised concerns about groundwater depletion and air quality near mining sites. Regulatory authorities in several countries have responded by imposing restrictions on mining operations, including mandatory environmental impact assessments, land rehabilitation requirements, and limits on extraction volumes. These challenges can delay projects, increase operational costs, and require producers to invest in more sustainable practices to remain compliant and competitive.

Opportunity

The Increased Demand for Silica Sand from the Electronics Industry Creates Opportunities in the Market.

The electronics industry has become a significant source of growing demand for high-purity silica sand, creating new opportunities within the silica sand market. Silica, in its ultra-pure form, is essential for producing silicon wafers, the foundation of semiconductors used in virtually all electronic devices, from smartphones and computers to advanced medical equipment and automotive electronics. Most sands retail for less than US$50/t, and even high-purity silica sands of more than 99% silica sell for around US$20/t. Meanwhile, silicon retails at US$3,700/t, and electronic chips are more than US$200,000/t. Processing this extremely low-revenue material, therefore, creates tremendous added value, in some instances, more than 10,000 times the initial price.

To manufacture these wafers, silica sand must be refined to a purity of 99.9999% (commonly known as 6N or six nines purity). This stringent requirement has increased the need for high-quality silica sand as a starting material. For instance, in semiconductor manufacturing hubs such as Taiwan, South Korea, and the United States, the demand for raw materials like high-purity silica continues to rise in tandem with technological advancements. Additionally, the growing use of electronics in renewable energy systems, smart devices, and electric vehicles further boosts the need for specialized silica, opening up niche supply chain opportunities for producers that can meet strict purity standards.

Trends

The Increased Demand for Silica Sand from the Construction Industry.

The rising demand for silica sand from the construction industry represents an ongoing trend in the silica sand market. Sand is the second-most used resource on Earth, after water. It is often dredged from rivers, dug up along coastlines, and mined. According to a study, 50 billion tons of sand are anticipated to be extracted for construction every year. Flooring, mortars, cement, roofing shingles, asphalt, and other industrial materials all use silica to improve durability and structural integrity.

It is the most crucial ingredient in concrete and mortar that acts as a filler that enhancing durability and compressive strength. Additionally, it is used in asphalt mixtures, stucco, and roofing shingles because of its fine texture and chemical stability. As urbanization increases, the demand for housing facilities increases, driving the need for high-quality silica sand for the construction industry.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Silica Sand market by disrupting the Essential Supply Chains in the Market.

The geopolitical tensions are significantly impacting the silica sand market by disrupting supply chains, increasing production costs, and altering trade dynamics. Conflicts and diplomatic strains between major global powers have led to export restrictions, higher tariffs, and stricter trade policies, which affect the movement of raw materials such as silica sand. For instance, ongoing tensions in the South China Sea, a region critical for global maritime trade, pose risks to the shipment of silica sand from Southeast Asian countries such as Vietnam and Malaysia, which are key exporters of high-quality sand.

In addition, sanctions and trade barriers between Western nations and countries such as Russia or China have led to reduced access to essential equipment, technology, and even specialty grades of silica sand needed for high-end applications such as semiconductors or solar panels. The United States is a major producer of silica sand, and China is a major consumer. These issues often force countries to look for alternative sources, sometimes at a higher cost or lower quality. Furthermore, rising fuel prices due to geopolitical instability in oil-producing regions directly affect transportation and mining operations, further inflating overall production costs. The geopolitical tensions are reshaping sourcing strategies and encouraging nations to prioritize domestic production or diversify their import partners.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Silica Sand Market.

In 2024, the Asia Pacific dominated the global silica sand market, holding about 45.3% of the total global consumption. The region held the largest share of the global silica sand market due to its strong industrial base and rapidly expanding end-use sectors such as construction, glass manufacturing, and electronics. Countries such as China, India, Japan, and South Korea are among the top consumers of silica sand, driven by high infrastructure development and robust production of glass and semiconductor components. For instance, China is one of the world’s largest producers of glass and flat glass used in construction and automotive industries, which rely heavily on high-quality silica sand.

Similarly, South Korea and Japan are major players in semiconductor manufacturing, where ultra-pure silica is essential for producing silicon wafers. Additionally, India contributes significantly to growing construction and solar panel production that demand silica-based materials. Similarly, the availability of natural silica sand reserves across the region, along with low-cost labor and favorable climatic conditions for mining, has further cemented the Asia Pacific’s dominant position in the global market.

- According to the United States Geological Survey, China produced around 89 million metric tons of silica sand in 2024.

According to the United States Geological Survey, global production of silicon ferroalloys and silicon metal is estimated at 9 Mt per year, equating to about 5% of global silica sand production. China accounts for about 70% of global silicon metal manufacturing annually.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the silica sand market are Sibelco, U.S. Silica (Apollo Global Management), Covia Holdings, Mitsubishi Corporation, Tochu Corporation, Badger Mining Corporation, Atlas Energy Solutions (Hi-Crush), JFE Mineral & Alloy, Euroquarz, Sil Industrial Minerals, Source Energy Services, Gulf Coast Sand, Chongqing Changjiang River Molding Material Group, Pum Group, Quarzwerke Group, Fineton Industrial Minerals, VRX Silica, and Australian Silica Quartz Group.

In 2024, multiple companies that were top producers of industrial sand and gravel were acquired by or merged with other companies. Several players in the silica sand market maintain a competitive edge through strategic activities, such as mergers and partnerships. Many companies focus on the expansion of their mining facilities, through government works of approval processes, to cater to the increasing demand for silica sand.

The major players in the industry

- Sibelco

- S. Silica (Apollo Global Management)

- COVIA Holdings LLC

- Mitsubishi Corporation

- TOCHU Corporation

- Badger Mining Corporation

- Atlas Energy Solutions Inc. (Hi-Crush Inc.)

- JFE Mineral & Alloy Company Ltd

- Euroquarz GmbH

- Sil Industrial Minerals

- Source Energy Services

- Gulf Coast Sand

- Chongqing Changjiang River Molding Material Group Co., Ltd.

- PUM Group

- Quarzwerke Group

- Fineton Industrial Minerals Ltd.

- VRX Silica Ltd.

- Australian Silica Quartz Group Ltd.

- Other Key Players

Key Development

- In May 2024, Covia, a leading provider of mineral-based and material solutions for a range of industrial markets, announced that it had completed the acquisition of R.W. Sidley’s Industrial Minerals Division, which provides high-quality, silica-based products for use in filtration, industrial, and sports applications.

- In September 2025, VRX Silica announced that it had received works approval from the Department of Water and Environmental Regulation (DWER) for the development of its 100%-owned Arrowsmith North Silica Sand Project (Arrowsmith North). Arrowsmith North, 270km north of Perth, contains a globally significant deposit of high-quality silica sand underpinning a mining project that will enable long-term production for the foundry, container glass, and flat-glass markets in Asia.

Report Scope

Report Features Description Market Value (2024) USD 21.2 Bn Forecast Revenue (2034) USD 37.3 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 98%, Above 98%), By Application (Glass Manufacturing, Foundry, Chemical Production, Construction, Paints & Coatings, Ceramics & Refractories, Filtration, Oil & Gas, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Sibelco, U.S. Silica (Apollo Global Management), Covia Holdings, Mitsubishi Corporation, Tochu Corporation, Badger Mining Corporation, Atlas Energy Solutions (Hi-Crush), JFE Mineral & Alloy, Euroquarz, Sil Industrial Minerals, Source Energy Services, Gulf Coast Sand, Chongqing Changjiang River Molding Material Group, Pum Group, Quarzwerke Group, Fineton Industrial Minerals, VRX Silica, Australian Silica Quartz Group, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Sibelco

- S. Silica (Apollo Global Management)

- COVIA Holdings LLC

- Mitsubishi Corporation

- TOCHU Corporation

- Badger Mining Corporation

- Atlas Energy Solutions Inc. (Hi-Crush Inc.)

- JFE Mineral & Alloy Company Ltd

- Euroquarz GmbH

- Sil Industrial Minerals

- Source Energy Services

- Gulf Coast Sand

- Chongqing Changjiang River Molding Material Group Co., Ltd.

- PUM Group

- Quarzwerke Group

- Fineton Industrial Minerals Ltd.

- VRX Silica Ltd.

- Australian Silica Quartz Group Ltd.

- Other Key Players