Global Signal Jammer Market Size, Share, Growth Analysis By Type (Military Jammers, Drone Signal Jammers, WiFi Jammers, Cell Phone Jammers, GPS Jammers, Bluetooth Jammers, Desktop Jammers, Walkie Talkie Jammers, LoJack Jammers, Others), By Frequency Band (VHF/UHF Band, L-Band, S-Band, C-Band, X-Band, Others), By Application (Military and Defense, Home Security, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178799

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

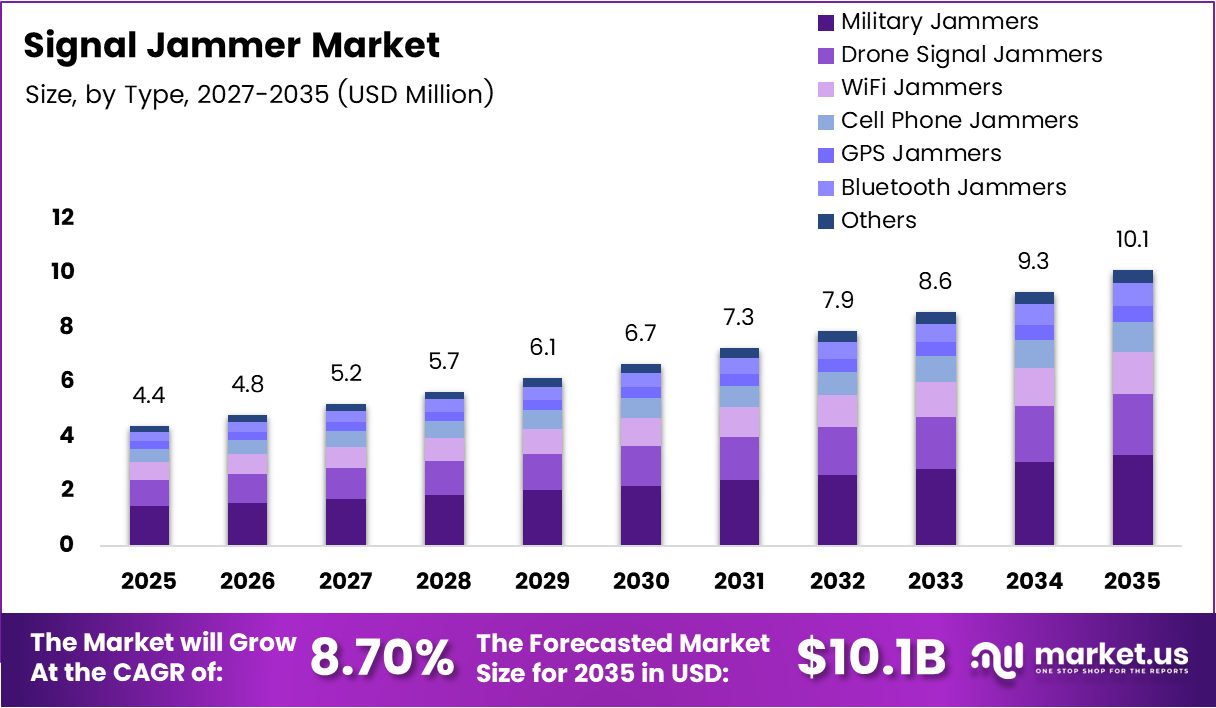

Global Signal Jammer Market size is expected to be worth around USD 8.70 Billion by 2035 from USD 4.04 Billion in 2025, growing at a CAGR of 8.70% during the forecast period 2026 to 2035.

The signal jammer market covers RF disruption devices that block, intercept, or deny wireless communications across military, security, and commercial applications. These systems span cell phone jammers, GPS jammers, drone signal jammers, and multi-band military platforms. Procurement is no longer limited to defense agencies — correctional facilities, airports, and critical infrastructure operators now drive a meaningful share of total demand.

Military and defense procurement anchors market revenue, but the fastest structural shift is happening at the intersection of counter-drone operations and urban security. Border agencies, airport authorities, and VIP protection units now treat RF disruption as a standard component of their threat response toolkit. This shift expands the total addressable market beyond traditional defense budgets into law enforcement and homeland security allocations.

Government investment in counter-IED and counter-UAV programs continues to pull forward procurement cycles. In May 2024, Anduril Industries unveiled its AI-powered Pulsar electronic warfare system, specifically designed to identify and neutralize evolving electromagnetic threats including drones. This signals a vendor-level shift from static jamming platforms toward adaptive, software-defined architectures that defense buyers increasingly specify in new contracts.

Correctional facility deployments represent a structurally underserved segment. Unauthorized inmate communications via smuggled mobile devices create security and legal risks that institutions cannot ignore. Signal jamming offers a cost-effective, passive enforcement layer — and as prison populations and regulatory scrutiny both rise, procurement in this category will accelerate independent of defense budget cycles.

According to data from the Ukrainian theater, approximately 73% of FPV drones operating in conflict zones were rendered inoperable or hijacked due to electronic warfare systems using signal jamming and spectrum denial techniques in 2024. This figure tells buyers and investors something critical: jamming has moved from a supplementary tactic to a primary neutralization method at scale.

Further corroborating this shift, Russian forces reportedly knocked out or shot down around 90% of Ukrainian drones early in the 2022 invasion using electronic warfare jamming. Together, these two data points confirm that signal denial is now a decisive variable in modern conflict — and defense procurement strategies globally are recalibrating to reflect this operational reality.

Key Takeaways

- The global Signal Jammer Market was valued at USD 4.04 Billion in 2025 and is forecast to reach USD 8.70 Billion by 2035, at a CAGR of 8.70%.

- By Type, Military Jammers held the dominant position with a 32.60% share in 2025.

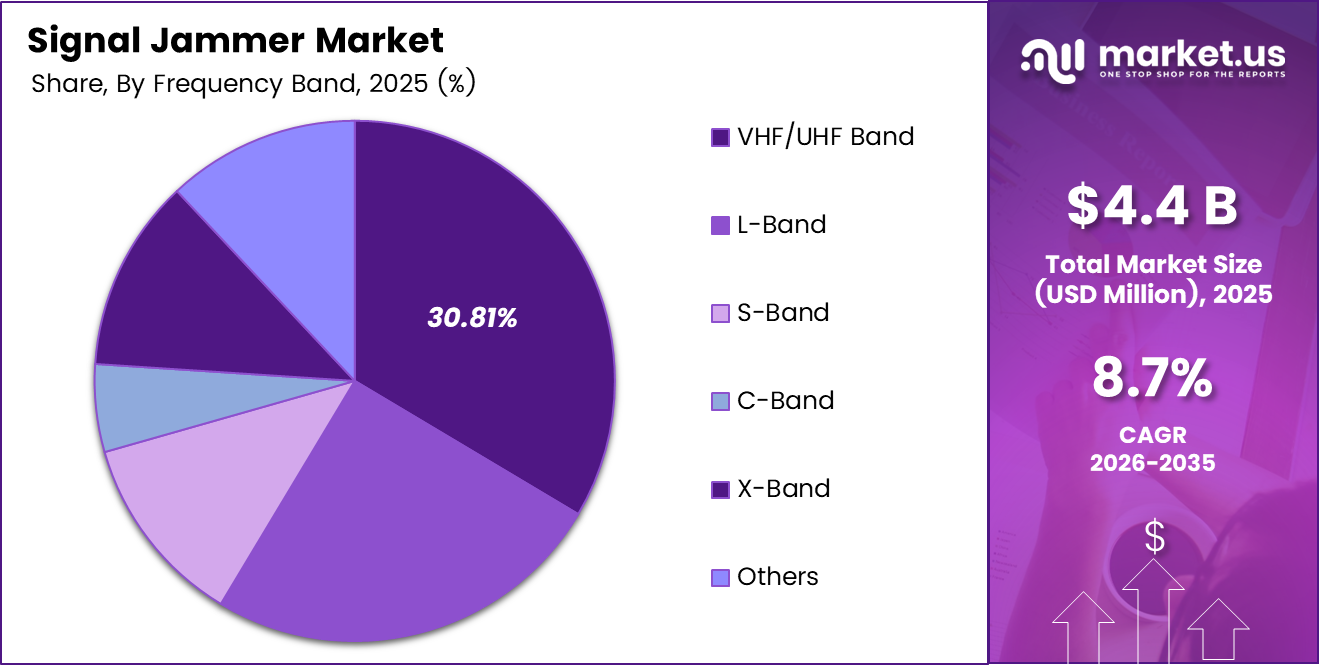

- By Frequency Band, VHF/UHF Band led with a 30.81% share in 2025.

- By Application, Military and Defense accounted for 41.26% of total market share in 2025.

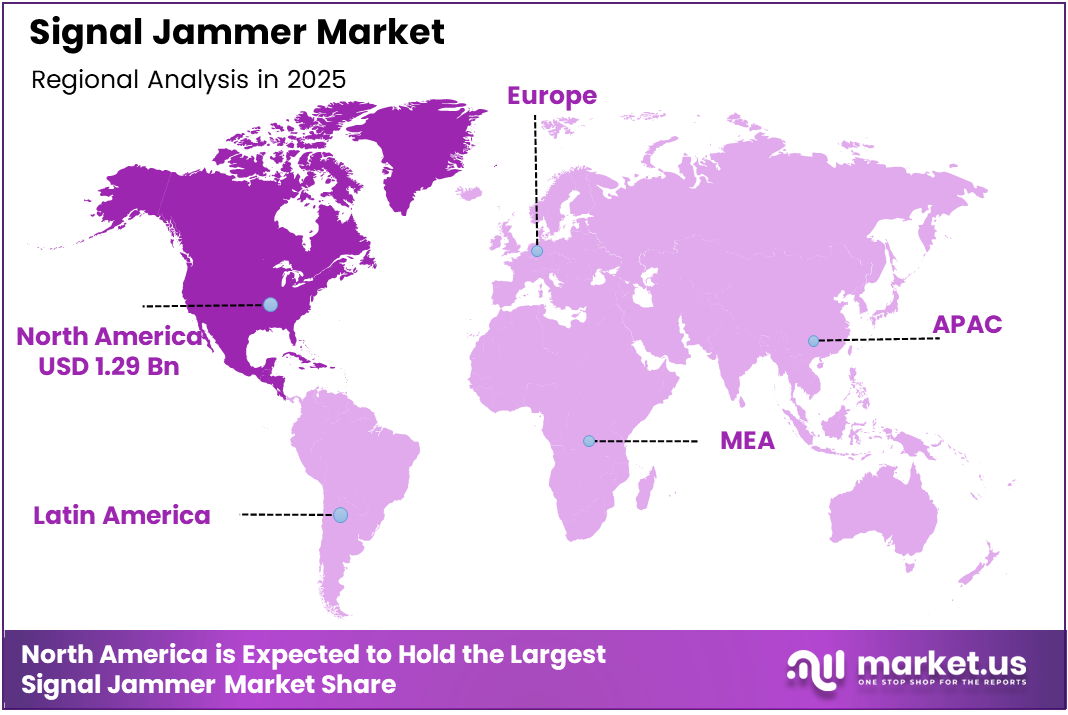

- North America dominated regional markets with a 31.82% share, valued at USD 1.29 Billion in 2025.

Type Analysis

Military Jammers dominate with 32.60% due to large-scale defense procurement budgets.

In 2025, Military Jammers held a dominant market position in the By Type segment of the Signal Jammer Market, with a 32.60% share. Defense agencies prioritize these systems because they cover multi-band disruption across wide operational ranges — capabilities that civilian-grade jammers cannot replicate. As counter-UAV and counter-IED missions intensify globally, military-spec procurement contracts continue to anchor this segment’s leadership position.

Drone Signal Jammers represent the fastest-expanding type within the RF disruption category. Airports, border agencies, and public event security teams now procure drone jammers as standard equipment — not as specialized additions. This broadening buyer base shifts procurement from purely defense channels into law enforcement and infrastructure security budgets, structurally widening the addressable market for this sub-type.

WiFi Jammers serve a narrower but high-compliance commercial niche, primarily in secure conference facilities, government buildings, and examination centers. Buyer sensitivity to unauthorized data transmission drives this adoption. However, their limited operational range and stricter civilian licensing requirements cap volume growth relative to military and drone-focused variants.

Cell Phone Jammers carry the largest non-military commercial use case, concentrated in correctional facilities and secure government installations. Their value proposition is straightforward: eliminate the primary channel for unauthorized inmate communications. Demand from prison administrations is driven by policy mandates rather than discretionary procurement, creating a relatively stable and recurring revenue stream for vendors serving this segment.

GPS Jammers address a critical vulnerability in both military and logistics operations — the disruption of position-navigation-timing (PNT) signals. Military applications dominate procurement, but infrastructure protection use cases, particularly around ports and energy installations, are beginning to expand the buyer profile for this type.

Bluetooth Jammers occupy a highly specialized role, typically deployed within high-security physical spaces where short-range wireless threats must be neutralized. Their lower price point and simple deployment profile make them accessible to corporate security teams, but the narrow threat scenario limits volume demand relative to broader-spectrum jamming systems.

Desktop Jammers serve fixed-location security applications — including examination halls, judicial chambers, and boardrooms — where continuous, stationary RF suppression is required. Their plug-and-operate design reduces the deployment complexity that often delays adoption in institutional buyers with limited technical staff.

Walkie Talkie Jammers target specific tactical scenarios where short-range radio coordination between unauthorized parties poses a security risk. Their use is predominantly confined to controlled-perimeter environments. Demand is modest but consistent, driven by venue security operators and industrial facility managers.

LoJack Jammers address vehicle tracking and asset recovery scenarios, with use cases that span both legitimate security testing and illicit interference. Regulatory controls on this type are strict in most jurisdictions, which limits commercial market development. However, legitimate procurement by forensic and law enforcement testing units represents a narrow, stable revenue base.

Others in the type segment capture emerging and hybrid jamming configurations not yet classified under standard categories, including multi-protocol and software-defined platforms. As the technology architecture of jamming systems shifts toward modularity, this segment will likely absorb newer product variants before they achieve sufficient volume to merit standalone classification.

Frequency Band Analysis

VHF/UHF Band dominates with 30.81% due to wide military and public safety coverage.

In 2025, VHF/UHF Band held a dominant market position in the By Frequency Band segment of the Signal Jammer Market, with a 30.81% share. These frequencies underpin the broadest range of military radio, emergency services, and commercial communications infrastructure globally. Jamming systems targeting VHF/UHF bands therefore deliver the widest operational impact per deployment — a decisive factor for defense and homeland security procurement teams.

L-Band systems address GPS and satellite navigation frequencies, making them critical for counter-UAV and anti-navigation operations. Military customers account for the majority of L-Band jamming procurement, particularly as drone-based surveillance and precision strike threats intensify across conflict zones and border security environments.

S-Band jamming platforms target weather radar, certain surveillance systems, and air traffic communications. Their procurement is concentrated among specialized military electronic warfare units. The S-Band’s operational specificity means demand is driven by high-value mission requirements rather than broad-volume commercial adoption.

C-Band systems cover satellite communications and long-range radar frequencies, with primary buyers in strategic military commands and space-adjacent security operations. As satellite constellations multiply — particularly low-earth-orbit systems — C-Band jamming capability becomes increasingly relevant to adversarial and defensive electronic warfare planners.

X-Band frequencies serve precision radar and missile guidance systems, making X-Band jammers a high-specification, low-volume segment with direct ties to advanced weapons program procurement. Buyers are almost exclusively national defense agencies and prime defense contractors integrating jamming into larger weapons system architectures.

Others in the frequency band segment include emerging multi-band and software-configurable platforms capable of spanning several frequency ranges within a single hardware unit. This flexibility is what defense buyers increasingly require — and it signals a structural transition away from single-band, fixed-frequency systems toward reconfigurable RF disruption platforms.

Application Analysis

Military and Defense dominates with 41.26% due to large-scale active conflict procurement cycles.

In 2025, Military and Defense held a dominant market position in the By Application segment of the Signal Jammer Market, with a 41.26% share. Active conflict zones, counter-terrorism missions, and base protection requirements create non-discretionary procurement demand that civilian applications cannot match in scale or urgency. As drone-based threats normalize across modern warfare, defense agencies treat signal jamming capability as core operational infrastructure rather than supplementary hardware.

Home Security applications represent a commercially underdeveloped segment constrained by legal restrictions in most jurisdictions. Consumer interest in RF-based perimeter protection exists, but enforcement barriers limit legal product availability. Consequently, revenue in this segment flows primarily through regulatory compliant devices — such as specific short-range privacy tools — rather than through broad-market signal jamming adoption.

Commercial applications span correctional facilities, examination centers, secure conference venues, and critical infrastructure operators. This segment offers the clearest near-term expansion path outside of defense — particularly as correctional facility mandates and anti-cheating regulations translate into institutional procurement programs with recurring budget lines and multi-year contracts.

Key Market Segments

By Type

- Military Jammers

- Drone Signal Jammers

- WiFi Jammers

- Cell Phone Jammers

- GPS Jammers

- Bluetooth Jammers

- Desktop Jammers

- Walkie Talkie Jammers

- LoJack Jammers

- Others

By Frequency Band

- VHF/UHF Band

- L-Band

- S-Band

- C-Band

- X-Band

- Others

By Application

- Military and Defense

- Home Security

- Commercial

Drivers

Counter-Drone and Counter-IED Demand Forces Signal Jamming Into Core Defense Procurement

Military and border security agencies no longer treat signal jamming as optional electronic warfare support. Counter-IED protection and anti-drone operations have made RF disruption a primary mission-critical capability. In NATO trials of integrated counter-UAS systems, according to dewinjammer.com, 95% of commercial drones below 500 meters were detected within 8 seconds — a performance benchmark that drives procurement specifications globally.

Correctional facility administrators face mounting legal and security liability from unauthorized inmate mobile communications. Signal jamming offers a passive, continuous enforcement solution that replaces costly manual monitoring. Moreover, legislative pressure from prison oversight bodies in multiple jurisdictions now pushes institutions toward RF-based communication controls as a compliance requirement rather than an operational choice.

Anduril Industries won a USD 642 million contract from the U.S. Marine Corps in March 2025 for mobile counter-small UAS systems integrating advanced jammer and EW elements for base protection. Contracts of this scale confirm that defense buyers have moved beyond pilot procurement — they now fund full-scale deployment of jamming capability as foundational force protection infrastructure.

Restraints

Regulatory Barriers and Friendly-Force Interference Risk Cap Signal Jammer Market Expansion

Federal law across major developed economies strictly prohibits the operation and sale of jammers that interfere with authorized radio communications — including cellular, emergency, and GPS signals. According to the referenced regulatory analysis, this legal framework directly eliminates civilian end markets in the U.S. and equivalent economies, structurally capping the addressable market to licensed institutional and defense buyers only.

The interference risk extends beyond regulatory paper. Certain field jamming systems have unintentionally jammed up to 82,000 frequencies during active operations, causing disruption to friendly military communications, according to RAND Corporation research. This operational hazard forces procurement agencies to impose strict deployment protocols — increasing operational complexity and slowing rollout timelines even within approved military programs.

Additionally, the public safety dimension of signal jamming restrains adoption in densely populated areas. A jammer that disrupts emergency 911 calls or first-responder radio networks creates liability exposure that most commercial operators will not accept. Consequently, even where demand exists — in venues, campuses, and transit systems — legal and operational risk keeps procurement confined to controlled-environment applications with explicit regulatory carve-outs.

Growth Factors

AI-Enabled Adaptive Jamming and Multi-Band 5G Disruption Unlock Next-Generation Market Segments

AI integration is redefining performance expectations for RF disruption systems. Field tests show that AI-enabled adaptive RF jamming systems achieved 92% threat neutralization effectiveness, compared to just 68% for conventional jammers, according to Semiconductor Insight. This 24-percentage-point gap is not incremental — it signals that defense and security buyers will face pressure to retire legacy systems faster than standard replacement cycles would suggest.

The expansion of 5G and IoT networks creates a structural need for advanced multi-band signal control that older single-frequency jamming platforms cannot address. Every new wireless protocol added to the operational environment expands the potential attack surface — and simultaneously expands the technical specification that procurement officers must include in new jamming contracts. Vendors with multi-band software-defined architectures are best positioned to capture this requirement shift.

In May 2025, CX2, a U.S. electronic warfare startup, secured USD 31 million in Series A funding to accelerate development of EW tools including autonomous systems and signals intelligence payloads. Venture capital entry into this space confirms that the commercial EW sector is no longer exclusively a prime defense contractor domain — smaller, faster-moving technology companies are competing for a share of the next generation of jamming capability.

Emerging Trends

Software-Defined and Directional Jamming Architectures Reshape Procurement and Deployment Models

Defense and security buyers are moving away from fixed-frequency jamming hardware toward modular, software-defined RF disruption platforms. This architectural shift allows operators to update jamming parameters in the field without hardware replacement — a capability that directly reduces lifecycle cost and extends equipment relevance across rapidly changing threat environments. Vendors who cannot offer software-defined configurations risk losing competitive positioning in next-cycle procurement.

Miniaturization of tactical jamming equipment enables field-level deployment by small unit operators, not just specialized electronic warfare teams. This changes the force multiplier equation: jamming capability distributes further down the command chain. According to a Global Spectrum Audit in 2023, 14% of unauthorized signal interference incidents in civilian airspace were attributed to anti-drone RF jamming operations — evidence that deployment of jamming has already expanded well beyond traditional military perimeters.

Directional and selective frequency jamming technologies reduce collateral interference risk — a key technical barrier that has historically slowed adoption in urban and mixed-use environments. By targeting specific frequencies or directional vectors, these systems allow operators to suppress threats without blanketing adjacent communications infrastructure. This precision capability directly addresses the regulatory and liability concerns that restrain signal jammer deployment in commercial and public-space applications.

Regional Analysis

North America Dominates the Signal Jammer Market with a Market Share of 31.82%, Valued at USD 1.29 Billion

North America holds 31.82% of the global Signal Jammer Market, valued at USD 1.29 Billion in 2025. The region’s leadership reflects sustained U.S. Department of Defense investment in counter-UAV and electronic warfare programs, combined with mature federal procurement infrastructure. Additionally, regulatory frameworks that clearly define licensed military and law enforcement use create a predictable demand environment that sustains long-cycle procurement programs.

Europe Signal Jammer Market Trends

Europe accelerates signal jammer investment driven by NATO interoperability requirements and active conflicts on its eastern border. Member states are fast-tracking electronic warfare procurement to align with collective defense postures. Moreover, the region’s strict civilian RF regulations concentrate commercial demand within well-defined institutional channels — correctional facilities, critical infrastructure operators, and national defense agencies.

Asia Pacific Signal Jammer Market Trends

Asia Pacific presents the broadest procurement expansion outside of North America, driven by territorial disputes, cross-border drone threats, and rising domestic defense budgets in China, India, and South Korea. Governments across the region are investing in indigenous electronic warfare development programs, which simultaneously drives demand for imported systems and builds local manufacturing capacity for future market self-sufficiency.

Middle East and Africa Signal Jammer Market Trends

Middle East and Africa procurement concentrates around active conflict environments, VIP protection mandates, and oil and gas critical infrastructure security. Gulf Cooperation Council member states in particular allocate significant security budgets toward RF disruption systems for convoy protection and facility perimeter defense. However, fragmented procurement infrastructure and inconsistent regulatory frameworks across the African continent limit broader market development.

Latin America Signal Jammer Market Trends

Latin America’s signal jammer demand is primarily institutional, concentrated in correctional facility upgrades and anti-narcotics operations where unauthorized communications pose operational security risks. Brazil and Mexico lead procurement volumes, but budget constraints and import dependency slow adoption relative to more mature regional markets. Regulatory clarity remains inconsistent across the region, which creates additional procurement friction for institutional buyers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

BAE Systems operates as one of the most vertically integrated electronic warfare suppliers in the global defense market. Their signal jamming platforms benefit from deep integration with broader weapons system architectures, giving them a structural advantage in winning platform-level contracts where jamming is one component of a larger electronic warfare suite rather than a standalone procurement item.

Northrop Grumman Corporation positions its jamming and EW capabilities within large-scale integrated defense systems, particularly airborne electronic attack platforms. This integration-first strategy makes Northrop Grumman difficult to displace once embedded in a program — a competitive moat that smaller, specialized jamming vendors cannot easily replicate despite potential technology advantages in specific sub-segments.

Raytheon Technologies Corporation leverages its radar and sensor integration expertise to deliver jamming systems with superior target discrimination — a capability that directly addresses the friendly-force interference risks that restrain broader deployment. Their systems’ ability to selectively suppress threats while protecting adjacent communications gives procurement officers a technically defensible justification for higher-priced platforms.

L3Harris Technologies differentiates through its focus on tactical and expeditionary jamming platforms designed for rapid field deployment. Their product architecture targets the growing demand for portable and vehicle-mounted jamming systems — an area where established prime contractors with large fixed-platform legacies are structurally slower to respond. This positions L3Harris favorably as defense buyers specify more mobile and adaptable EW requirements in new contracts. In October 2024, Anduril secured a contract worth approximately USD 249.98 million to deliver Pulsar EW capabilities and Roadrunner-M unmanned electronic warfare systems, signaling intensifying competition from well-funded new entrants targeting segments that traditional primes have historically owned.

Key Players

- BAE Systems

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- L3Harris Technologies

- Israel Aerospace Industries (IAI)

- Lockheed Martin

- MCTECH TECHNOLOGY

- Stratign

- WolvesFleet Technology Co. Ltd.

- Thales

- Leonardo S.p.A.

- Elbit Systems

- HENSOLDT

- DroneShield

- Other Key Players

Recent Developments

- October 2024 – Anduril secured a contract worth approximately USD 249.98 million to deliver Pulsar EW capabilities and Roadrunner-M unmanned electronic warfare systems, committing delivery of more than 500 units by end of 2025. This contract scale confirms Anduril’s transition from EW startup to a prime contract-level competitor in the U.S. defense electronic warfare market.

- March 2025 – Anduril won a USD 642 million contract from the U.S. Marine Corps for mobile counter-small UAS systems, integrating advanced jammer and electronic warfare elements for base protection. The contract value signals that the Marine Corps is treating mobile RF disruption as force-protection infrastructure rather than specialized equipment.

Report Scope

Report Features Description Market Value (2025) USD 4.04 Billion Forecast Revenue (2035) USD 8.70 Billion CAGR (2026-2035) 8.70% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Military Jammers, Drone Signal Jammers, WiFi Jammers, Cell Phone Jammers, GPS Jammers, Bluetooth Jammers, Desktop Jammers, Walkie Talkie Jammers, LoJack Jammers, Others), By Frequency Band (VHF/UHF Band, L-Band, S-Band, C-Band, X-Band, Others), By Application (Military and Defense, Home Security, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BAE Systems, Northrop Grumman Corporation, Raytheon Technologies Corporation, L3Harris Technologies, Israel Aerospace Industries (IAI), Lockheed Martin, MCTECH TECHNOLOGY, Stratign, WolvesFleet Technology Co. Ltd., Thales, Leonardo S.p.A., Elbit Systems, HENSOLDT, DroneShield, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BAE Systems

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- L3Harris Technologies

- Israel Aerospace Industries (IAI)

- Lockheed Martin

- MCTECH TECHNOLOGY

- Stratign

- WolvesFleet Technology Co. Ltd.

- Thales

- Leonardo S.p.A.

- Elbit Systems

- HENSOLDT

- DroneShield

- Other Key Players