Global Shunt Capacitor Market Size, Share and Report Analysis By Material Type (Aluminum, Polypropylene, Paper, Ceramic), By Capacitance Type (Low Voltage, Medium Voltage, High Voltage), By Application (Power Factor Correction, Voltage Regulation, Harmonic Filtering, Energy Storage, Reactive Power Compensation), By End Use (Utilities, Industrial, Commercial, Renewable Energy, Transportation), By Installation Type ( Indoor, Outdoor, Pole Mounted, Pad Mounted) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176124

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

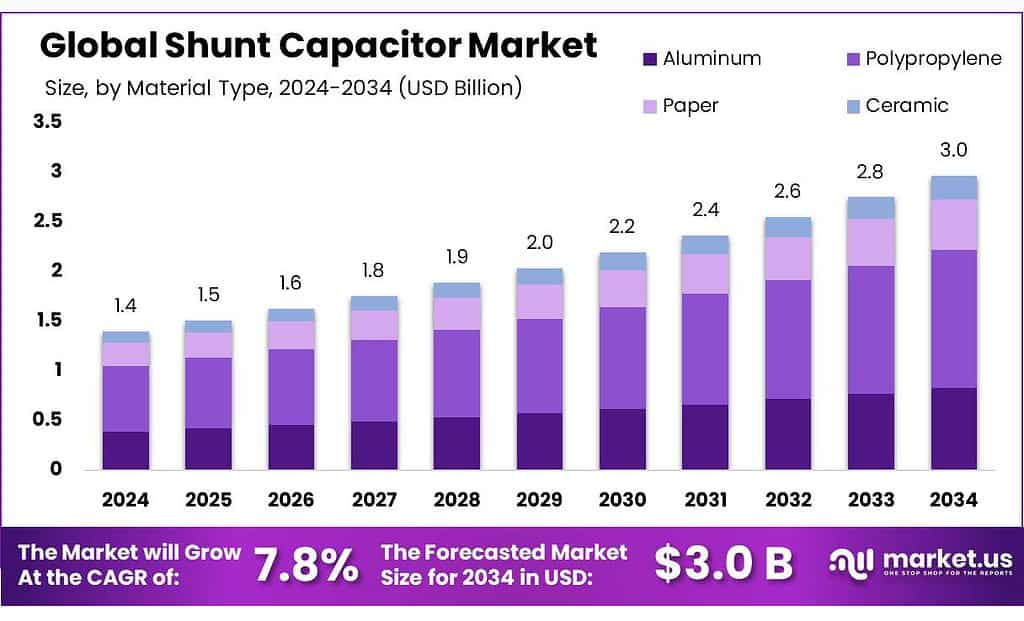

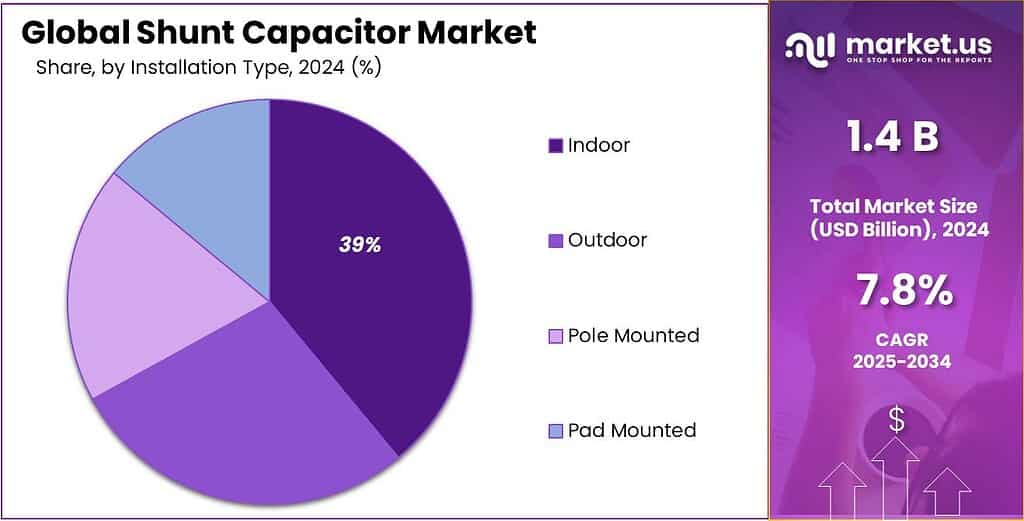

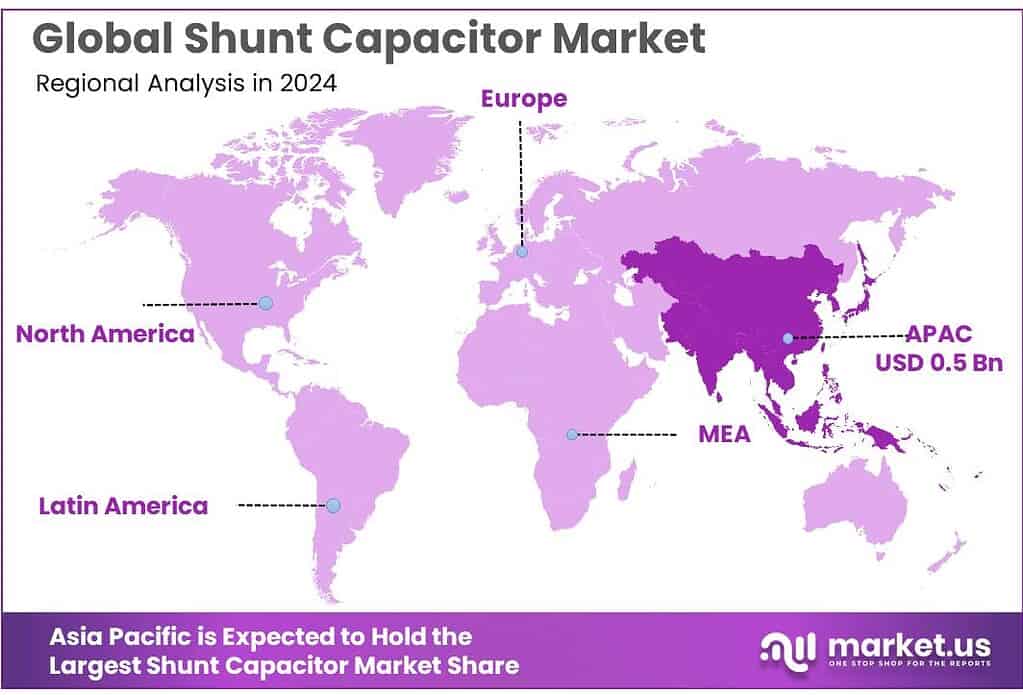

Global Shunt Capacitor Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 39.7% share, holding USD 0.5 Billion in revenue.

Shunt capacitors are widely used across transmission, distribution, and industrial facilities to inject reactive power locally, improve power factor, support voltage stability, and reduce I²R losses. In practice, utilities deploy shunt capacitor banks at substations and along feeders to keep voltage within operating bands, while factories and large commercial sites use them to offset inductive loads from motors, compressors, and drives.

- The International Energy Agency (IEA) reported global electricity demand growth of 4.3% in 2024, reflecting an accelerated “Age of Electricity” driven by electrification, cooling demand, and expanding digital infrastructure. Looking ahead, the IEA expects demand to keep growing strongly—around 3.3% in 2025 and 3.7% in 2026—which increases the value of low-cost grid efficiency tools such as reactive power compensation at the edge.

Key driving factors for shunt capacitor adoption are therefore structural. First, electrification and fast load growth from data centers increase reactive power variability and voltage sensitivity, especially in distribution networks. Second, renewable integration and inverter-based resources can shift reactive power requirements by location and time of day, raising the value of switched capacitor steps and coordinated volt/VAR control.

- Utilities and regulators are funding grid modernization at scale: the IEA notes India’s INR 3.03 trillion distribution-modernization scheme launched in 2022, including mandatory smart-meter rollout expected to cover 250 million devices by 2025—a digital layer that improves visibility and control for capacitor switching strategies.

Government initiatives further reinforce market momentum. In the United States, the Department of Energy’s Grid Deployment Office notes it has announced $7.6 billion in GRIP funding across 105 selected projects nationwide, reflecting sustained public investment into grid resilience and modernization where reactive power management is a frequent component of distribution upgrades. Regulatory and grid-code requirements also directly trigger capacitor procurement: an Indian CERC order notes a renewable plant’s compliance limits “beyond 340 MW without additional reactive power compensation,” with developers undertaking to install 100 MVAr capacitors to meet connectivity standards.

Key Takeaways

- Shunt Capacitor Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.8%.

- Polypropylene held a dominant market position, capturing more than a 47.8% share within the Shunt Capacitor Market.

- Medium Voltage held a dominant market position, capturing more than a 56.1% share in the Shunt Capacitor Market.

- Power Factor Correction held a dominant market position, capturing more than a 47.2% share within the Shunt Capacitor Market.

- Utilities held a dominant market position, capturing more than a 39.4% share in the Shunt Capacitor Market.

- Indoor held a dominant market position, capturing more than a 39.5% share in the Shunt Capacitor Market.

- Asia Pacific held the dominant position at 39.7% with a market value of USD 0.5 Bn.

By Material Type Analysis

Polypropylene Leads the Shunt Capacitor Market with a Strong 47.8% Share in 2024

In 2024, Polypropylene held a dominant market position, capturing more than a 47.8% share within the Shunt Capacitor Market, reflecting its reliability, stable electrical behavior, and long operational life. Industries continued to prefer polypropylene film because it offers low dielectric losses and strong insulation strength, which are essential for handling reactive power compensation in both transmission and distribution systems. As utilities increased their focus on reducing line losses and improving voltage stability, the use of polypropylene-based capacitors became more widespread across substations and industrial facilities.

By Capacitance Type Analysis

Medium Voltage Leads the Shunt Capacitor Market with a Strong 56.1% Share in 2024

In 2024, Medium Voltage held a dominant market position, capturing more than a 56.1% share in the Shunt Capacitor Market, driven by the rising demand for stable power distribution across utilities, commercial zones, and industrial clusters. Medium-voltage capacitor banks continued to be widely adopted because they offer an effective balance between cost, reactive power compensation, and voltage stabilization for feeders and substations. As distribution networks expanded to support higher electricity consumption, utilities increasingly relied on medium-voltage capacitor installations to reduce line losses and maintain healthy power factor levels.

By Application Analysis

Power Factor Correction Leads the Shunt Capacitor Market with a Strong 47.2% Share in 2024

In 2024, Power Factor Correction held a dominant market position, capturing more than a 47.2% share within the Shunt Capacitor Market, largely driven by industries and utilities aiming to reduce energy losses and avoid penalties linked to poor power factor performance. As more manufacturing facilities operated with inductive loads such as motors, pumps, and compressors, the need for reliable compensation grew. Shunt capacitors used for power factor correction offered a simple, durable, and cost-efficient solution, making them the preferred choice for improving electrical efficiency across medium- and large-scale operations.

By End Use Analysis

Utilities Lead the Shunt Capacitor Market with a Strong 39.4% Share in 2024

In 2024, Utilities held a dominant market position, capturing more than a 39.4% share in the Shunt Capacitor Market, supported by rising electricity demand and the continuous need to maintain grid stability. Utilities increasingly deployed shunt capacitor banks across substations and distribution feeders to manage reactive power effectively, improve voltage profiles, and reduce overall transmission losses. As networks grew more complex, utilities relied on these capacitors to enhance operational efficiency without major infrastructure overhauls.

By Installation Type Analysis

Indoor Installations Lead the Shunt Capacitor Market with a Strong 39.5% Share in 2024

In 2024, Indoor held a dominant market position, capturing more than a 39.5% share in the Shunt Capacitor Market, driven by the growing need for compact, protected, and easily maintainable capacitor setups within industrial plants and commercial facilities. Indoor installations gained preference because they ensure better environmental protection, reduced exposure to dust and moisture, and longer equipment life. This made them an ideal choice for manufacturing units, data centers, and commercial buildings seeking consistent reactive power support and improved power quality.

Key Market Segments

By Material Type

- Aluminum

- Polypropylene

- Paper

- Ceramic

By Capacitance Type

- Low Voltage

- Medium Voltage

- High Voltage

By Application

- Power Factor Correction

- Voltage Regulation

- Harmonic Filtering

- Energy Storage

- Reactive Power Compensation

By End Use

- Utilities

- Industrial

- Commercial

- Renewable Energy

- Transportation

By Installation Type

- Indoor

- Outdoor

- Pole Mounted

- Pad Mounted

Emerging Trends

Smart, switched shunt capacitor banks are becoming the “default” power-quality upgrade for food cold-chain and processing sites with fast-rising electricity loads.

A major latest trend in shunt capacitors is the shift from basic, fixed banks toward smart, automatically switched capacitor systems that can respond to changing loads in real time. This trend is showing up strongly in food-related infrastructure—cold storage, refrigerated transport hubs, dairy and beverage plants, grain milling, and packaged-food lines—because these facilities run a mix of compressors, motors, and drives that do not stay steady all day. When load swings are frequent, fixed capacitor banks can over-correct during light-load hours.

Food cold chains make the trend even clearer. SEforALL estimates that a lack of sustainable cold chains leads to 526 million tons of food production loss every year. That number has pushed governments and businesses to build more cold stores and refrigerated handling capacity—exactly the kind of sites that add large motor and compressor loads. At the same time, FAO notes the food cold chain is responsible for around 4% of total global greenhouse-gas emissions when emissions from cold chain technologies and food loss from lack of refrigeration are included.

Government programs are also reinforcing this direction, especially where food infrastructure is being scaled quickly. In India, the Union Cabinet approved a total outlay of ₹6,520 crore, including an additional outlay of ₹1,920 crore, for the PMKSY scheme during the 2021–22 to 2025–26 cycle. A PIB note further highlights ₹1,000 crore aimed at setting up 50 Multi-Product Food Irradiation Units and 100 NABL-accredited Food Testing Labs.

Drivers

Rising electrification in food processing and cold chains is pushing stronger power-quality needs, making shunt capacitors a practical efficiency tool.

One major driver for shunt capacitors is the fast rise in electricity use across “everyday essential” industries—especially food processing, refrigeration, and cold-chain logistics. These operations run on heavy electric loads such as motors, compressors, pumps, and variable-speed drives. When those inductive loads increase, power factor typically drops and reactive power demand rises.

The demand backdrop is clear: the IEA reports global electricity demand grew by 4.3% in 2024, and it expects growth to stay close to 4% through 2027. When electricity demand rises at that speed, distribution networks get tighter operating margins. That is exactly where shunt capacitor banks matter most—at substations, along distribution feeders, and inside industrial facilities—because they help release capacity and keep voltages within acceptable limits during peak operation.

Food-linked infrastructure adds a second layer of pressure. Cooling and refrigeration are not “optional” in modern food value chains; they are mission-critical loads that must run continuously. SEforALL highlights that the lack of sustainable cold chains directly results in 526 million tons of food production loss every year.

This figure is often used by policymakers to justify upgrades in storage, packhouses, and temperature-controlled transport—all of which add new electrical loads. At the same time, FAO points out that the food cold chain is responsible for 4% of global greenhouse-gas emissions, linking cold-chain expansion with a parallel push for higher energy efficiency.

Restraints

Rising electrical stress from expanding food-cold-chain loads is exposing grid fragility, making utilities cautious about uncontrolled shunt capacitor deployment.

One of the major restraining factors for shunt capacitor adoption is the growing electrical stress created by rapid cold-chain expansion and food-processing activities, which often operate on highly fluctuating loads. While the segment continues to grow, many utilities remain cautious in deploying fixed or improperly sized capacitor banks because they can cause voltage rise, ferroresonance, switching surges, and harmonics—especially when paired with heavy refrigeration compressors and induction-motor clusters.

This challenge becomes more visible when considering how fast electricity consumption tied to essential food infrastructure is increasing. The International Energy Agency (IEA) notes that global electricity demand rose 4.3% in 2024, significantly higher than the average growth of the previous decade.

The food sector’s rapid infrastructure expansion adds another layer of challenge. Sustainable Energy for All (SEforALL) highlights that the absence of efficient cold chains contributes to 526 million tons of food lost annually, prompting governments and private players to invest aggressively in new refrigeration and storage facilities.

Opportunity

Smarter, switched shunt capacitors for food cold-chain and processing hubs where electricity demand is rising fast

One of the clearest growth opportunities for shunt capacitors is the move toward controlled, “switchable” reactive power support in places where food-related electricity loads are expanding quickly—especially cold storage, refrigeration-heavy logistics, and large food-processing plants. These sites rely on compressors, motors, pumps, and variable-speed drives that change load throughout the day. That variation makes simple, fixed capacitor banks less attractive, but it makes automatically switched banks a strong fit.

The wider power system is already under pressure, and that is a tailwind for solutions that reduce losses and free up capacity on feeders. The IEA reports that global electricity demand increased by 4.3% in 2024, and it forecasts demand growth to remain close to 4% through 2027. When demand grows that quickly, utilities have fewer “easy” options to keep voltage stable and reduce distribution losses.

Food cold chains make this opportunity more specific and more urgent. SEforALL estimates that the lack of sustainable cold chains leads to 526 million tons of food production loss every year, a number that has become a common reference point in public policy discussions around storage and refrigeration expansion. At the same time, FAO notes that the food cold chain accounts for about 4% of global greenhouse-gas emissions when cold-chain technologies and food loss due to lack of refrigeration are considered together.

Government-led food infrastructure programs reinforce the demand pipeline for electrically intensive sites where power-factor correction is often required. In India, a PIB release states that the Union Cabinet approved a total outlay of ₹6,520 crore, including an additional outlay of ₹1,920 crore, for PMKSY. A separate PIB note adds that proposed 50 multi-product food irradiation units are expected to add preservation capacity of 20–30 lakh metric tonnes per year.

Regional Insights

Asia Pacific dominates the Shunt Capacitor Market with a 39.7% share, valued at USD 0.5 Bn

Asia Pacific leads demand for shunt capacitors because its grids are expanding quickly and carrying heavier, more variable loads. In many countries, utilities are adding capacitor banks at substations and along distribution feeders to support voltage stability and reduce reactive power flow as networks become denser and more complex. In 2024, Asia Pacific held the dominant position at 39.7% with a market value of USD 0.5 Bn, supported by strong industrial growth, large-scale electrification, and continuous buildout of transmission and distribution infrastructure.

Power consumption levels in the region show why reactive power management is a priority. China’s electricity consumption rose 6.8% year-on-year in 2024 to 9.85 trillion kWh, highlighting the scale of system loading where voltage support and loss reduction solutions are routinely needed. In Southeast Asia, electricity demand has risen by more than 60% over the last decade, reflecting rising industrial activity, urbanisation, and cooling needs—conditions that typically increase inductive loading and strengthen the case for power-factor improvement measures such as shunt capacitors.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Siemens Energy remains a major supplier of shunt capacitors for high-voltage and medium-voltage grids. With revenues of EUR 31 billion and operations in 90+ countries, the firm supports grid-stability programs and renewable integration. Siemens Energy’s capacitor solutions are widely installed across substations handling increasing load pressures, helping utilities reduce losses and improve power-factor performance in expanding electricity markets.

Schneider Electric, with revenues above EUR 36 billion, remains active in delivering shunt capacitors for manufacturing plants, commercial facilities, and utilities. Its presence spans 100+ countries, enabling strong regional distribution of low- and medium-voltage capacitor banks. Schneider’s emphasis on digital power-quality monitoring and energy-efficiency programs increases the adoption of capacitor solutions across modernising electrical networks.

ABB continues to strengthen its shunt capacitor portfolio through grid-modernisation projects and digital monitoring solutions. The company operates in 100+ countries and generates annual revenues above USD 29 billion. Its power-quality products support utilities facing rising reactive-power demand, especially in Asia and Europe, where ABB’s installed capacitor banks exceed tens of thousands of units across transmission and distribution networks.

Top Key Players Outlook

- ABB Ltd.

- Siemens Energy AG

- Eaton Corporation

- Schneider Electric SE

- General Electric Company

- Hitachi Energy Ltd.

- TDK Electronics AG

- Vishay Intertechnology Inc.

- CIRCUTOR SA

- Electronicon Kondensatoren GmbH

Recent Industry Developments

In 2024–2025, Siemens Energy AG strengthened its presence in the shunt capacitor and reactive-power compensation space by supplying advanced grid solutions that help utilities and large networks manage voltage quality and power flows. Siemens Energy reported €39.1 billion in revenue for 2025, up 15.2% year-on-year, and employed about 102,000 people, reflecting its broad scale in energy infrastructure.

In 2024, Schneider Electric supported the shunt capacitor space mainly through its power factor correction portfolio used in factories, commercial buildings, and utility distribution panels—where capacitor banks are installed to cut reactive power draw and keep voltage steadier. The company reported €38.2 billion in revenue in 2024 and a total average workforce of about 168,000 people, showing the scale behind its electrical distribution and power-quality business.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 3.0 Bn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Aluminum, Polypropylene, Paper, Ceramic), By Capacitance Type (Low Voltage, Medium Voltage, High Voltage), By Application (Power Factor Correction, Voltage Regulation, Harmonic Filtering, Energy Storage, Reactive Power Compensation), By End Use (Utilities, Industrial, Commercial, Renewable Energy, Transportation), By Installation Type ( Indoor, Outdoor, Pole Mounted, Pad Mounted) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Siemens Energy AG, Eaton Corporation, Schneider Electric SE, General Electric Company, Hitachi Energy Ltd., TDK Electronics AG, Vishay Intertechnology Inc., CIRCUTOR SA, Electronicon Kondensatoren GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Siemens Energy AG

- Eaton Corporation

- Schneider Electric SE

- General Electric Company

- Hitachi Energy Ltd.

- TDK Electronics AG

- Vishay Intertechnology Inc.

- CIRCUTOR SA

- Electronicon Kondensatoren GmbH