Global Sesame Oil Market Size, Share, And Business Benefits By Processing Type (Refined, Unrefined), By Product (Processed, Virgin), By Type (Cold-Pressed Sesame Oil, Refined Sesame Oil, Blended Sesame Oil), By Application (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153132

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

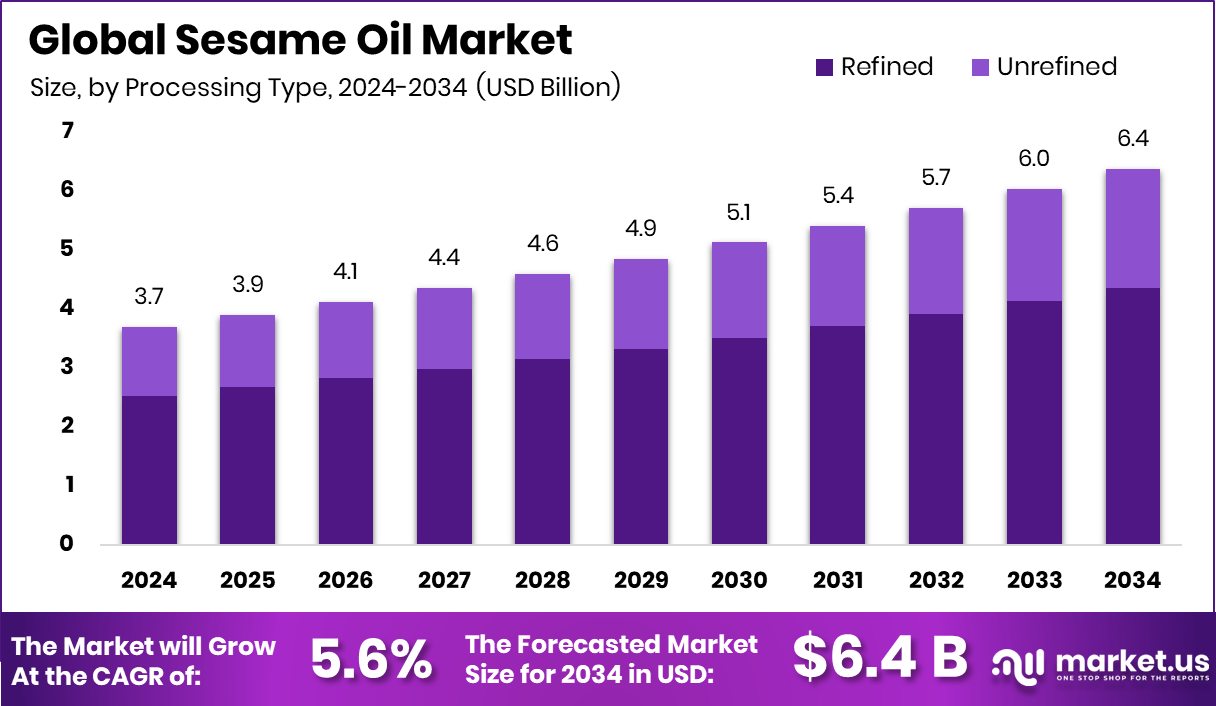

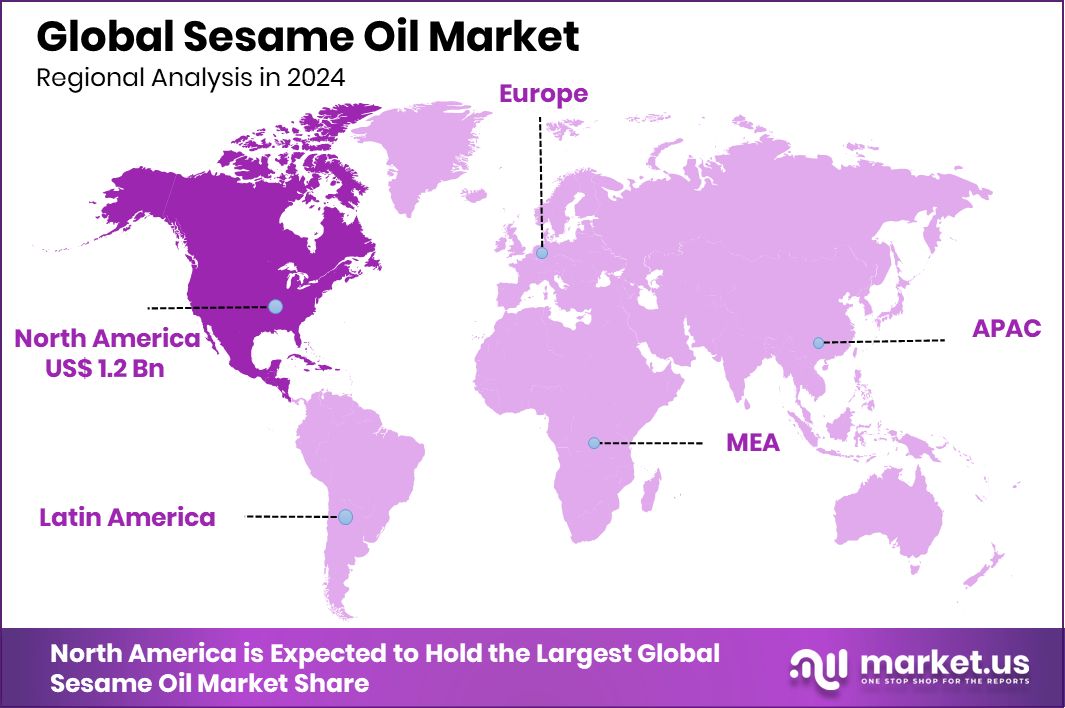

Global Sesame Oil Market is expected to be worth around USD 6.4 billion by 2034, up from USD 3.7 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034. With a 33.9% share, North America’s sesame oil market stood at USD 1.2 billion.

Sesame oil is a vegetable oil derived from sesame seeds, commonly used in cooking, cosmetics, pharmaceuticals, and traditional medicine. It is rich in antioxidants, healthy fats, and essential nutrients, making it valued not only for its distinct nutty flavor but also for its health benefits. Depending on the processing method, sesame oil may be light (refined) or dark (toasted), each offering different applications in food and non-food industries.

The sesame oil market refers to the global trade and consumption of sesame seed oil across various sectors, including food and beverage, personal care, and industrial use. Growing consumer interest in plant-based and natural oils is expanding their demand worldwide. The market is influenced by factors such as sesame seed availability, regional dietary preferences, and increasing awareness of the oil’s nutritional and therapeutic value.

Market growth is driven by increasing health awareness and the shift towards clean-label and functional food products. Consumers are increasingly drawn to oils with antioxidant and anti-inflammatory properties, boosting sesame oil consumption, particularly in urban health-conscious populations. Additionally, the rising popularity of Asian cuisine in Western countries has contributed to greater household and restaurant usage of sesame oil in flavor-intensive preparations.

Demand is also supported by growing applications in cosmetics and pharmaceutical formulations, where sesame oil is used for its moisturizing, healing, and carrier oil properties. As consumers move away from synthetic ingredients in skincare, natural oils like sesame oil are gaining prominence. Its role in Ayurvedic and traditional medicine systems further boosts its relevance in wellness-oriented product development.

Key Takeaways

- Global Sesame Oil Market is expected to be worth around USD 6.4 billion by 2034, up from USD 3.7 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034.

- In the Sesame Oil Market, refined processing accounts for a dominant 68.4% share globally.

- Processed products lead the Sesame Oil Market, representing 73.9% of the total product category.

- Refined sesame oil holds a 49.5% share in the global Sesame Oil Market by type.

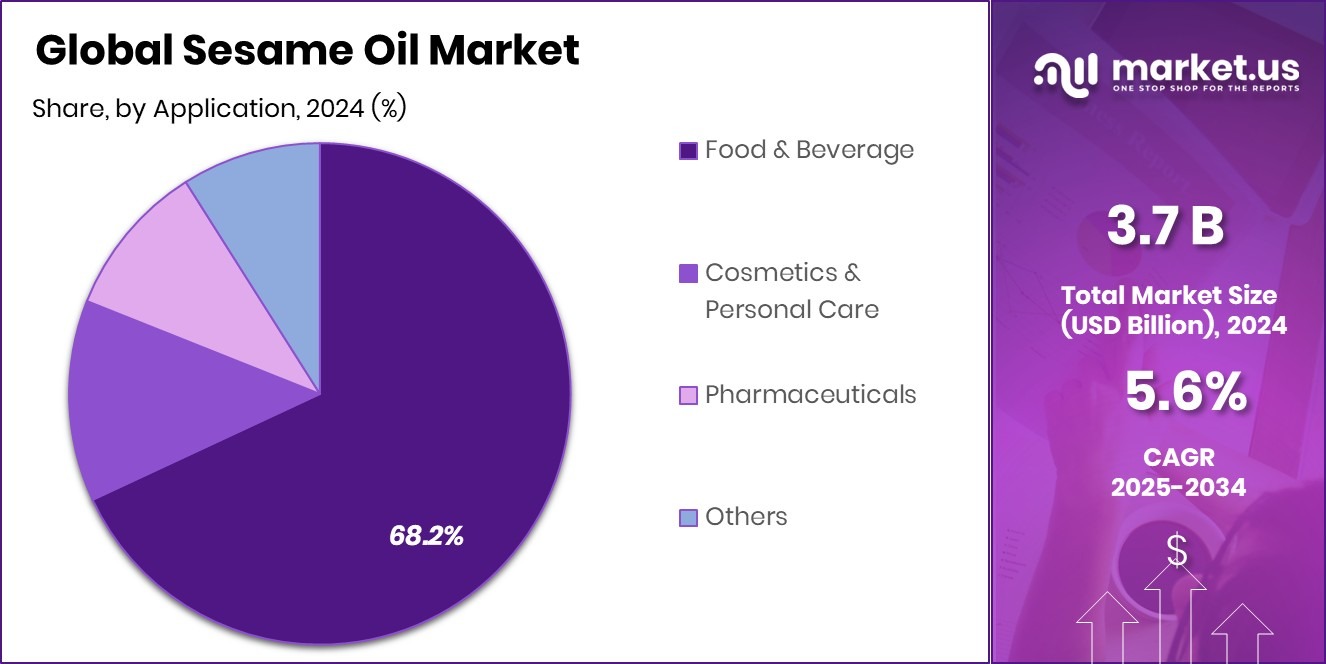

- The food and beverage segment drives 68.2% of demand in the Sesame Oil Market by application.

- Hypermarkets and supermarkets distribute 45.7% of the sesame oil sold in the global retail market.

- North America’s sesame oil market reached USD 1.2 billion with a 33.9% share.

By ProcessingType Analysis

Refined segment dominates Sesame Oil Market with 68.4% global share.

In 2024, Refined held a dominant market position in the By Processing Type segment of the Sesame Oil Market, with a 68.4% share. This strong performance can be attributed to the refined oil’s wider application across culinary, cosmetic, and industrial uses due to its neutral flavor, extended shelf life, and high smoke point.

Refined sesame oil is preferred in large-scale food production and foodservice operations, where consistency and stability are critical. Its clarity and minimal aroma make it suitable for formulations in skincare and pharmaceutical preparations, where strong scents or coloration may be undesirable.

The demand for refined sesame oil is also supported by its affordability and availability, making it more accessible to a broader consumer base, particularly in emerging and urban markets. Its widespread retail presence across both modern trade and traditional outlets has enabled refined variants to secure a consistent volume share.

Furthermore, the growing consumer shift toward health-conscious eating—favoring oils with better oxidative stability and lower saturated fat content—has worked in favor of refined sesame oil, which retains much of the original nutritional value after processing.

By Product Analysis

Processed product category leads with 73.9% share in Sesame Oil.

In 2024, Processed held a dominant market position in the By Product segment of the Sesame Oil Market, with a 73.9% share. This substantial lead highlights the widespread preference for processed sesame oil across both commercial and household applications.

Processed sesame oil undergoes various treatment methods such as filtration, bleaching, or deodorization to enhance its usability, stability, and shelf life. These characteristics make it particularly suitable for use in packaged foods, cooking oils, cosmetics, and pharmaceutical formulations where consistency and safety standards are prioritized.

The popularity of processed sesame oil is also driven by its enhanced flavor neutrality and adaptability across diverse culinary practices. Its refined appearance and extended storage properties cater well to the needs of large-scale food manufacturers and retailers aiming for quality and uniformity. Additionally, the increasing demand for oils with stable performance under high temperatures has supported the dominance of processed variants in this segment.

From a consumer perspective, processed sesame oil offers a balance of affordability, versatility, and accessibility, making it a staple in everyday use. Its availability across both traditional and modern retail channels further reinforces its leading position in the market.

By Type Analysis

Refined Sesame Oil accounts for 49.5% market share worldwide.

In 2024, Refined Sesame Oil held a dominant market position in the By Type segment of the Sesame Oil Market, with a 49.5% share. This leadership reflects the widespread consumer and industrial preference for oils that offer consistency, stability, and a longer shelf life.

Refined sesame oil undergoes processing to remove impurities, odor, and strong flavor, making it highly versatile for use in food preparation, packaged products, and non-food applications. Its light color, neutral taste, and high smoke point make it particularly appealing for everyday cooking, especially in households and commercial kitchens.

The dominance of refined sesame oil is further supported by its strong demand from food processors and cosmetic manufacturers, who require standardized ingredients for scalable production.

This type is also favored in urban and health-conscious markets where refined oils are perceived as safer and cleaner for frequent use. The growing emphasis on quality assurance and shelf-stable products in retail channels has also reinforced the position of refined sesame oil in the market.

By Application Analysis

Food and Beverage application contributes 68.2% to Sesame Oil Market.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Sesame Oil Market, with a 68.2% share. This significant share is largely attributed to the widespread use of sesame oil in culinary practices across households, restaurants, and food processing industries.

Its unique flavor profile, nutritional value, and functional properties have made it a preferred ingredient in various regional cuisines and packaged food products. The growing interest in traditional cooking oils and natural food ingredients has further reinforced its relevance in the food and beverage segment.

The dominance of this segment is also supported by increasing consumer awareness regarding healthier oil alternatives. Sesame oil, being rich in antioxidants and unsaturated fats, is gaining popularity among health-conscious consumers seeking clean-label and nutrient-dense food products

By Distribution Channel Analysis

hypermarket and supermarket channel holds 45.7 of % Sesame Oil Market share.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Sesame Oil Market, with a 45.7% share. This strong positioning is a result of the widespread consumer reliance on large-format retail stores for grocery and household needs.

Hypermarkets and supermarkets provide a convenient shopping experience, offering a wide variety of sesame oil brands, packaging sizes, and price points under one roof. Their ability to stock both domestic and imported products enhances product visibility and encourages impulse purchases.

The dominance of this channel is further supported by its expansive geographic reach and robust supply chains, ensuring consistent product availability across urban and semi-urban markets.

Consumers often prefer these retail formats for the assurance of quality, competitive pricing, and promotional offers that accompany bulk and family-sized packs. The organized retail structure also plays a key role in influencing brand perception and trust among buyers.

Key Market Segments

By Processing Type

- Refined

- Unrefined

By Product

- Processed

- Virgin

By Type

- Cold-Pressed Sesame Oil

- Refined Sesame Oil

- Blended Sesame Oil

By Application

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Rising Health Awareness Boosts Sesame Oil Demand

One of the major driving factors for the sesame oil market is the growing awareness about health and nutrition among consumers. People are now more focused on using natural, plant-based oils that offer health benefits beyond just cooking. Sesame oil is rich in antioxidants, healthy fats, and vitamins, which makes it appealing for those seeking heart-healthy and anti-inflammatory options.

As lifestyles become more health-conscious, especially in urban areas, consumers are shifting towards oils with added nutritional value. This shift is encouraging both households and food manufacturers to include sesame oil in daily use. The trend is further supported by the rising popularity of traditional medicine and clean-label food products, both of which favor natural oils like sesame oil.

Restraining Factors

High Price of Sesame Oil Limits Growth

One key factor holding back the growth of the sesame oil market is its relatively high price compared to other edible oils like soybean, sunflower, or palm oil. The cost of sesame seeds is influenced by seasonal supply, climate conditions, and limited growing regions, which can lead to price fluctuations. These high input costs make the final product expensive for many consumers, especially in price-sensitive markets.

As a result, households and businesses often prefer more affordable alternatives, even if they do not offer the same health benefits. This price barrier affects large-scale adoption and limits sesame oil’s competitiveness in the broader edible oil market, especially in regions where budget plays a major role in purchasing decisions.

Growth Opportunity

E‑Commerce Expansion Increases Sesame Oil Sales

The growing popularity of online shopping offers a significant growth opportunity for the sesame oil market. E-commerce platforms provide convenient access to a wide range of sesame oil products, including premium, cold‑pressed, and organic variants, which may not be easily found in physical stores. Consumers benefit from detailed product descriptions, customer reviews, and easy price comparisons, all of which support informed purchasing decisions.

Additionally, direct‑to‑consumer sales channels allow producers to reach niche markets, such as health‑focused shoppers and cooking enthusiasts, with minimal overhead costs. As internet penetration and smartphone usage continue to rise, especially in emerging markets, online grocery sales are expected to surge.

Latest Trends

Growing Use of Cold-Pressed Sesame Oil Globally

One of the latest trends in the sesame oil market is the rising preference for cold-pressed sesame oil. Unlike refined oils, cold-pressed sesame oil is extracted without heat or chemicals, which helps retain more nutrients, antioxidants, and natural flavor. Consumers are becoming more aware of the health benefits of minimally processed oils, and this has led to increased demand for cold-pressed options.

It is especially popular among health-conscious buyers and those seeking organic or clean-label products. The oil’s rich taste and purity also make it attractive for gourmet cooking and traditional remedies.

Regional Analysis

In 2024, North America held 33.9% market share, reaching USD 1.2 billion.

In 2024, North America emerged as the leading region in the global sesame oil market, commanding a significant 33.9% share, valued at USD 1.2 billion. This dominance is primarily driven by rising consumer awareness regarding plant-based nutrition, increasing demand for functional foods, and a strong preference for healthier cooking oils. The region benefits from a well-established food processing industry and growing interest in ethnic cuisines, particularly those incorporating sesame oil.

Europe also shows steady market development, supported by the region’s growing inclination toward clean-label products and natural health supplements. In Asia Pacific, sesame oil continues to hold cultural and culinary relevance, contributing to stable demand. Meanwhile, the Middle East & Africa and Latin America represent smaller shares, though both regions are experiencing gradual adoption of sesame oil due to rising urbanization and shifting dietary preferences.

However, these markets remain comparatively underdeveloped due to limited product penetration and economic constraints. Despite regional variations, North America’s 33.9% share reflects its mature retail infrastructure, diversified food applications, and increasing consumer focus on high-quality edible oils.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key industry leaders Archer Daniels Midland Company, Bunge Limited, and Cargill Inc. maintained prominent positions in the global sesame oil market. Each organization contributed distinct strengths and strategic value to the broader sesame oil ecosystem.

Archer Daniels Midland Company leveraged its extensive global supply chain and deep expertise in oilseed processing to secure a strong market presence. The company’s integrated operations—from sourcing high‑quality sesame seeds to large‑scale refining—have enabled consistent supply and quality assurance. Its broad distribution network, encompassing foodservice, retail, and industrial clients, ensured that its sesame oil products achieved strong market reach.

Bunge Limited focused on product and operational excellence, concentrating on maintaining high standards in processing and value‑added offerings. The company’s emphasis on vertical integration reduced supply chain vulnerabilities and improved cost efficiency. Bunge also leveraged advanced R&D and process capabilities, enabling it to optimize yield and refine product attributes such as clarity, stability, and neutrality.

Cargill Inc. emphasized sustainability and traceability across its sesame oil operations. Through partnerships with farming communities and implementation of traceable sourcing protocols, Cargill enhanced transparency and consumer trust. The company’s global footprint and tailored processing methods allowed for a diverse sesame oil portfolio, including refined and specialty variants.

Top Key Players in the Market

- Adams Group Inc.

- Archer Daniels Midland Company

- Bunge Limited

- Cargill Inc.

- Dipasa Group

- Fuji Oil Holdings Inc.

- Kadoya Sesame Mills Inc.

- Kevala International LLC

- La Tourangelle, Inc.

- Pansari Group

- TAKEMOTO OIL & FAT CO., LTD.

- The Adani Wilmar Ltd

- V.V. Vanniyom Oil Industries

- Wilmar International Limited

Recent Developments

- In July 2025, Bunge Limited announced the closure of its US$8 billion merger with grain trading firm Viterra. This significant consolidation enhances Bunge’s global scale and strengthens its processing and distribution capabilities, including for vegetable oils such as sesame oil.

- In September 2024, Kadoya announced plans to expand its production of organic, high-quality sesame oil by reconstructing an aging factory in Tonosho, Japan.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 6.4 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Processing Type (Refined, Unrefined), By Product (Processed, Virgin), By Type (Cold-Pressed Sesame Oil, Refined Sesame Oil, Blended Sesame Oil), By Application (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adams Group Inc., Archer Daniels Midland Company, Bunge Limited, Cargill Inc., Dipasa Group, Fuji Oil Holdings Inc., Kadoya Sesame Mills Inc., Kevala International LLC, La Tourangelle, Inc., Pansari Group, TAKEMOTO OIL & FAT CO., LTD., The Adani Wilmar Ltd, V.V. Vanniyom Oil Industries, Wilmar International Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adams Group Inc.

- Archer Daniels Midland Company

- Bunge Limited

- Cargill Inc.

- Dipasa Group

- Fuji Oil Holdings Inc.

- Kadoya Sesame Mills Inc.

- Kevala International LLC

- La Tourangelle, Inc.

- Pansari Group

- TAKEMOTO OIL & FAT CO., LTD.

- The Adani Wilmar Ltd

- V.V. Vanniyom Oil Industries

- Wilmar International Limited