Global Separation Membrane Market Size, Share, And Enhanced Productivity By Material (Polymeric (Natural, Synthetic), Inorganic (Metallic, Ceramic, Others)), By Process (Reverse Osmosis, Ultrafiltration, Nano-filtration, Micro-filtration), By Application (Gas Separation, Liquid Separation, Solid Separation), By End-user (Water and Wastewater Treatment, Industrial Processing, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168748

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

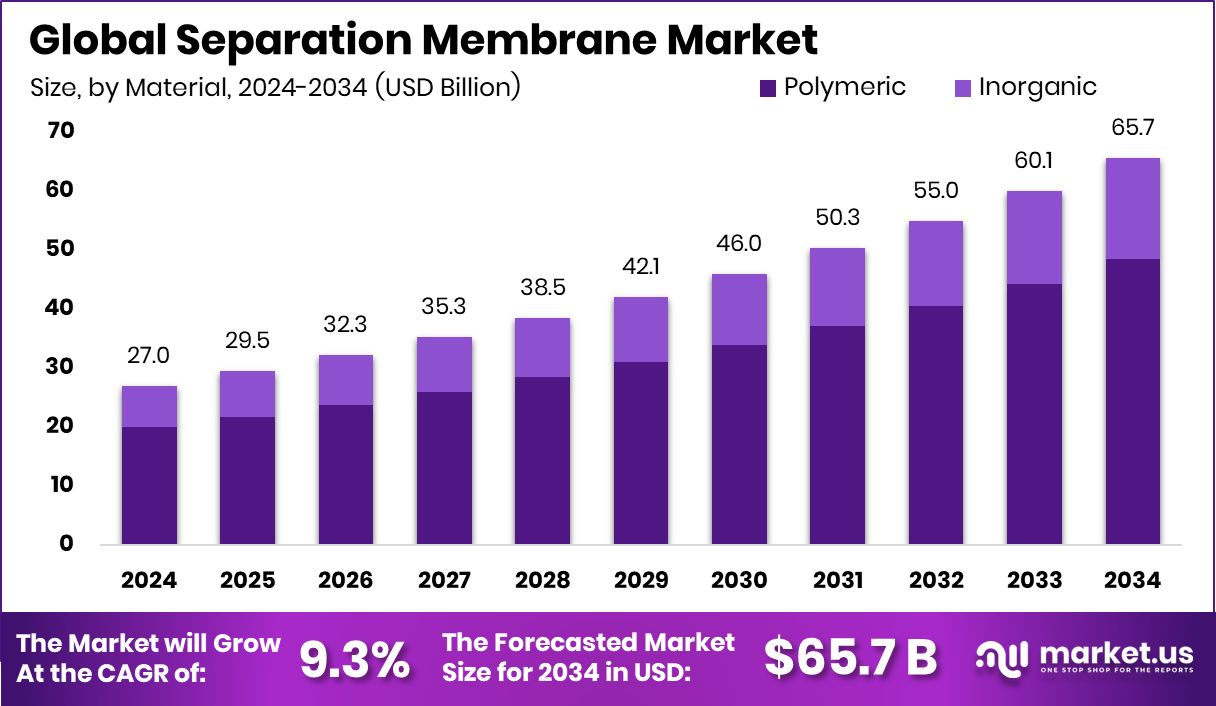

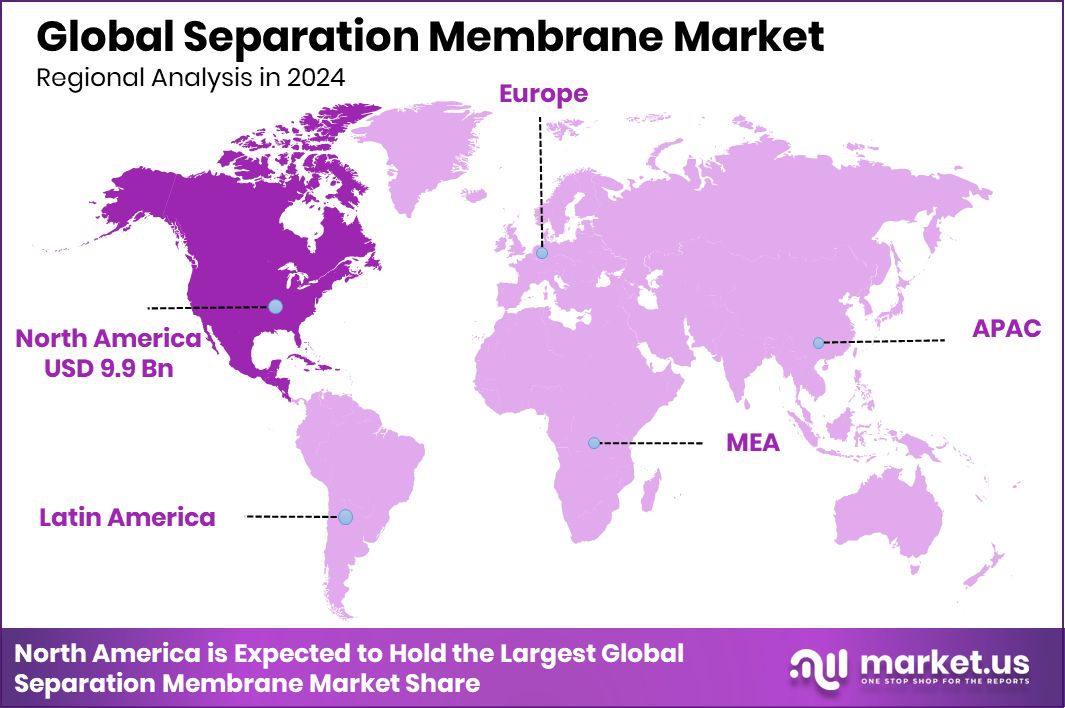

The Global Separation Membrane Market is expected to be worth around USD 65.7 billion by 2034, up from USD 27.0 billion in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034. Infrastructure investments keep North America dominant, holding 36.80% of the Separation Membrane Market worth USD 9.9 Bn.

A separation membrane is a thin material that allows selected molecules to pass through while blocking others. It works under pressure or concentration differences and is widely used to separate water, salts, gases, or organic compounds. These membranes are essential in water purification, wastewater treatment, food processing, pharmaceuticals, and chemical manufacturing because they offer efficient separation with low energy use.

The separation membrane market covers the production, supply, and application of membrane technologies used across clean water, industrial processing, and environmental management. This market supports activities such as desalination, wastewater recycling, potable water supply, and process filtration, helping industries and municipalities meet quality, safety, and sustainability goals.

Market growth comes from rising investment in water and wastewater infrastructure. Valley wastewater systems recently received a $35M boost from state funding, while Blue Earth received $19M from the PFA, showing strong public support for advanced treatment solutions that rely heavily on membrane systems.

Demand is increasing due to water scarcity and urban expansion. Startups are meeting household needs, with DrinkPrime raising ₹60 crore and an additional $3M to scale RO water supply. At the same time, Flocean secured US$9M to deliver subsea desalination projects.

Opportunities lie in smarter planning and the replacement of outdated systems. In Bengaluru, eleven RO plants costing ₹15–20 lakh each were demolished, highlighting the need for durable, well-integrated membrane-based infrastructure that avoids waste while supporting long-term water security.

Key Takeaways

- The Global Separation Membrane Market is expected to be worth around USD 65.7 billion by 2034, up from USD 27.0 billion in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034.

- Polymeric membranes dominate the separation membrane market with a 73.7% share due to flexibility and cost efficiency.

- Reverse osmosis leads processing technologies, holding 42.4%, driven by strong use in desalination systems globally.

- Liquid separation remains the key application, accounting for 67.9%, supported by industrial and municipal filtration needs.

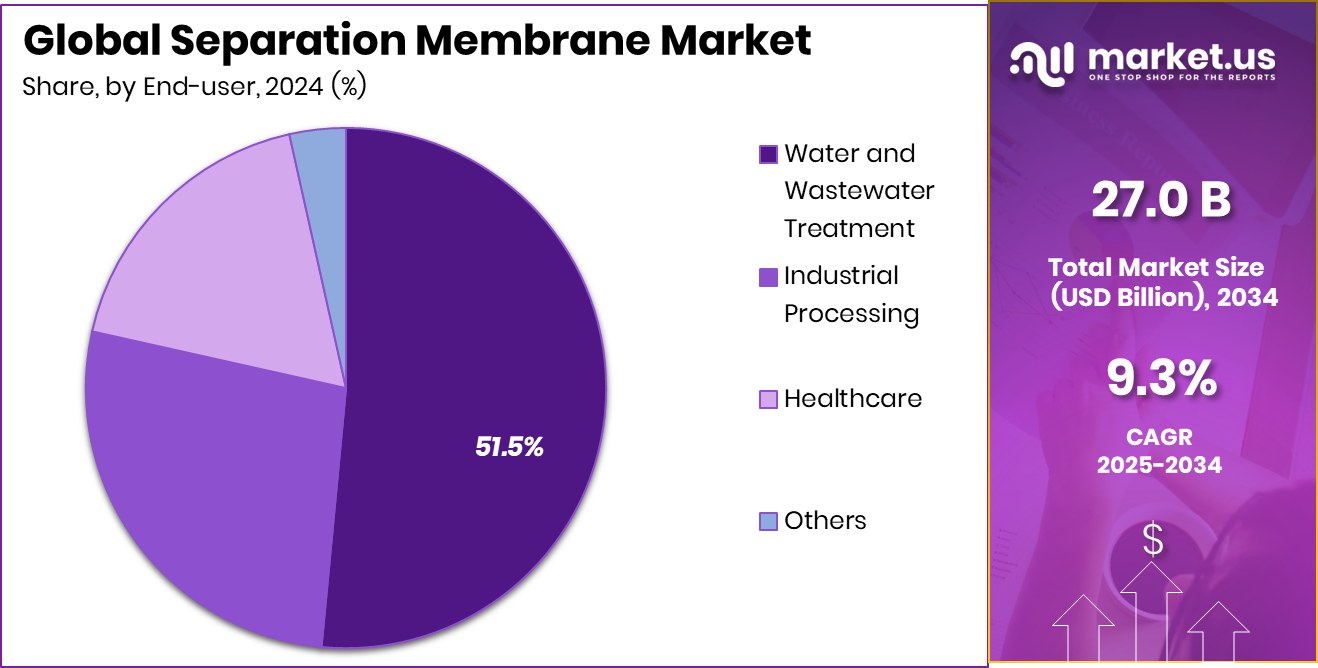

- Water and wastewater treatment leads end-user adoption with 51.5%, as cities expand clean water infrastructure.

- Demand across North America remains strong, supporting a market size of USD 9.9 Bn and a 36.80% share.

By Material Analysis

Polymeric membranes lead by material with 73.7%, driven by flexibility, durability, scalability, and cost efficiency.

In 2024, Polymeric held a dominant market position in the By Material segment of the Separation Membrane Market, with a 73.7% share, reflecting its widespread acceptance across core separation applications. Polymeric membranes are preferred because they offer a strong balance between performance, flexibility, and cost efficiency.

Their ability to operate across varied pressure ranges makes them suitable for water treatment, desalination, and industrial filtration uses. These membranes are also easier to process and modify, allowing manufacturers to tailor pore size and surface properties for specific separation needs.

The lighter weight and scalable production of polymeric materials further support their dominance, especially in large-volume installations. Consistent performance, reliable lifespan, and adaptability across operating environments continue to reinforce the leading role of polymeric membranes within the material-based segmentation.

By Process Analysis

Reverse osmosis dominates processes at 42.4%, supported by desalination, reuse systems, and urban drinking water needs.

In 2024, Reverse Osmosis held a dominant market position in the By Process segment of the Separation Membrane Market, with a 42.4% share, driven by its strong efficiency in removing dissolved salts, contaminants, and impurities.

Reverse osmosis membranes are widely trusted for delivering consistent water quality across municipal, industrial, and commercial treatment systems. Their ability to operate under high pressure allows effective separation at a molecular level, making them suitable for critical purification requirements. These systems also support water reuse and desalination needs in regions facing supply stress.

The proven reliability of reverse osmosis processes, along with steady improvements in membrane durability and performance stability, has continued to support its leading position within the process-based segmentation of the separation membrane landscape.

By Application Analysis

Liquid separation applications hold a 67.9% share, due to water purification, industrial filtration, and resource recovery needs.

In 2024, Liquid Separation held a dominant market position in the By Application segment of Separation Membrane Market, with a 67.9% share, supported by its critical role in water treatment, wastewater recycling, and industrial process filtration.

Liquid separation membranes are widely used to remove suspended solids, dissolved salts, and organic impurities from fluids, ensuring consistent output quality. Their strong adoption is linked to growing requirements for clean water, process efficiency, and regulatory compliance across multiple industries.

These membranes perform reliably under continuous operation and varying flow conditions, making them suitable for large-scale and decentralised systems alike. The ability of liquid separation applications to support reuse, purification, and resource recovery continues to reinforce their dominant position within the application-based segmentation.

By End-user Analysis

Water and wastewater treatment leads end-users at 51.5%, driven by regulation, scarcity, and infrastructure investment.

In 2024, Water and Wastewater Treatment held a dominant market position in the By Application segment of the Separation Membrane Market, with a 51.5% share, reflecting its essential role in managing clean water supply and wastewater discharge.

Separation membranes are widely applied to remove contaminants, salts, and organic matter from municipal and industrial water streams. Their consistent performance supports safe drinking water production, effluent treatment, and water reuse initiatives. Rising pressure on freshwater resources has further strengthened reliance on membrane-based systems within treatment facilities.

These applications benefit from stable operation, high separation efficiency, and the ability to handle varying water quality levels. The continued need for reliable treatment solutions has firmly positioned water and wastewater treatment as the leading application within this segment.

Key Market Segments

By Material

- Polymeric

- Natural

- Synthetic

- Inorganic

- Metallic

- Ceramic

- Others

By Process

- Reverse Osmosis

- Ultrafiltration

- Nano-filtration

- Micro-filtration

By Application

- Gas Separation

- Liquid Separation

- Solid Separation

By End-user

- Water and Wastewater Treatment

- Industrial Processing

- Healthcare

- Others

Driving Factors

Growing Demand for Clean Water Solutions

One of the strongest driving factors of the Separation Membrane Market is the rising need for clean and safe water across cities, industries, and communities. Rapid urban growth, population increase, and pressure on freshwater sources are forcing governments and businesses to invest in efficient water treatment technologies.

Separation membranes help remove salts, chemicals, and harmful particles with high accuracy, making them essential for drinking water and wastewater treatment. This demand is further supported by rising investments in membrane-based solutions.

For example, Water treatment firm Membrane Group secured $50 million in funding from GEF Capital Partners, highlighting strong confidence in advanced membrane technologies. Such funding helps scale production, improve technology performance, and expand treatment capacity, directly strengthening market growth through real-world deployment and infrastructure development.

Restraining Factors

High Installation And Maintenance Cost Challenges

A major restraining factor in the Separation Membrane Market is the high cost involved in installing and maintaining membrane systems. Advanced membranes require specialised equipment, skilled handling, and regular cleaning or replacement to maintain performance.

For many small municipalities and industries, these costs make adoption difficult, especially where budgets are limited. Even though funding support exists, it often covers only part of the expense. For instance, the Solvang Wastewater Treatment Plant received a $1M federal grant for an upgrade, showing that upgrades still depend on external financial support.

When funding is not available, projects are delayed or scaled down. These financial pressures slow wider adoption, particularly in developing regions and smaller facilities needing reliable but affordable treatment solutions.

Growth Opportunity

Expanding Public Investment In Water Infrastructure

A key growth opportunity for the Separation Membrane Market lies in rising public funding for water and environmental infrastructure projects. Governments and regulators are increasingly supporting advanced treatment systems to improve water quality and sustainability. This creates strong demand for membrane technologies used in purification and recycling.

Recently, water treatment projects were among the winners in a £42 million funding round from a regulator, showing growing institutional support for modern solutions. In addition, DANR announced nearly $140 million for statewide environmental projects, further highlighting its long-term commitment to upgrading treatment facilities.

Such funding enables new installations, technology upgrades, and wider adoption of membrane systems, opening significant growth opportunities across municipal and environmental applications.

Latest Trends

Surge In Government-Backed Water Protection Projects

One of the latest trends in the Separation Membrane Market is the growing focus on government-supported water protection and treatment programs. Public agencies are prioritising long-term water quality, coastal protection, and pollution control, which increases the use of advanced membrane systems. These projects focus on removing contaminants efficiently while supporting reuse and environmental safety.

A strong example of this trend is the Cape Cod and Islands Water Protection Fund Management Board awarding $105 million for water protection initiatives. Such large-scale funding encourages the adoption of modern separation membranes in municipal systems. This trend reflects a shift toward preventive and sustainable water management, where membranes play a vital role in protecting sensitive ecosystems and ensuring reliable, clean water supplies.

Regional Analysis

North America led the Separation Membrane Market with 36.80% share, valued at USD 9.9 Bn in 2024.

North America leads the Separation Membrane Market, holding a dominant 36.80% share valued at USD 9.9 Bn, driven by strong adoption of advanced water treatment and industrial filtration systems. The region benefits from well-established municipal infrastructure, strict water quality standards, and steady investments in wastewater treatment upgrades. High awareness of water reuse and sustainable resource management continues to support membrane usage across applications.

Europe represents a mature regional market where separation membranes are widely applied in environmental protection and industrial processing. The region shows steady adoption linked to compliance-driven water treatment practices and long-term sustainability goals. Membranes are increasingly integrated into treatment systems to improve efficiency and meet regulatory expectations.

Asia Pacific reflects growing regional momentum due to rapid urbanisation and industrial expansion. Rising pressure on freshwater resources is encouraging greater use of membrane-based separation solutions, particularly in densely populated and industrial zones seeking reliable purification methods.

The Middle East & Africa region relies on separation membranes to address water scarcity challenges. Desalination and water reuse projects are key areas where membrane systems support a dependable water supply under harsh operating conditions.

Latin America shows gradual adoption, supported by expanding municipal treatment needs and increasing focus on improving water quality and operational efficiency across public infrastructure projects.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Dow Chemical Corporation remains a significant force in the separation membrane space through its strong material science capabilities. The company focuses on polymer-based membrane solutions that support water purification, industrial processing, and sustainability goals. Dow’s strength lies in integrating membrane performance with durability and efficiency, backed by its deep expertise in chemistry and large-scale manufacturing. Its ability to serve both municipal and industrial customers positions it well in applications where reliability and long operating life are critical.

Toray Industries continues to demonstrate technical leadership in separation membranes by combining advanced materials engineering with precision manufacturing. The company emphasises high-performance membranes for water treatment and industrial separation, where consistency and quality are essential. Toray’s long-term focus on innovation allows it to improve membrane selectivity and resistance, helping users achieve better output with lower operational stress. This technology-driven approach supports Toray’s strong standing in global membrane adoption.

Pall Corporation plays an important role in specialised separation membrane applications, particularly where purity and process control are essential. The company is known for its focus on filtration precision and system-level solutions rather than standalone products. Pall’s membranes support critical processes that require stable performance and contamination control, making them valuable across high-standard environments. This application-focused strategy strengthens Pall’s relevance in the global separation membrane landscape.

Top Key Players in the Market

- Dow Chemical Corporation

- Toray Industries

- Pall Corporation

- Applied Membranes, Inc.

- Evoqua Water Technologies

- GEA Filtration

- Koch Membrane Systems

- 3M Company

- Veolia Environnement

- Pentair plc

Recent Developments

- In May 2024, Dow expanded its “Protect the Climate” targets to include a dedicated Water & Nature stewardship program. As part of this, Dow pledged that its top 20 water-dependent sites will adopt water-resilient management by 2030, and by 2050 aims to conserve 50,000 acres of habitat across its operations.

- In March 2024, Toray announced a breakthrough: a new, highly durable reverse osmosis (RO) membrane designed for long-term water treatment and wastewater reuse. This membrane doubles resistance to chemical cleaning compared to older designs, helping keep filtration performance stable over time and reducing replacement frequency. The company is prepared to mass-produce this membrane and launch it in the Chinese market during the first half of 2024.

Report Scope

Report Features Description Market Value (2024) USD 27.0 Billion Forecast Revenue (2034) USD 65.7 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polymeric (Natural, Synthetic), Inorganic (Metallic, Ceramic, Others)), By Process (Reverse Osmosis, Ultrafiltration, Nano-filtration, Micro-filtration), By Application (Gas Separation, Liquid Separation, Solid Separation), By End-user (Water and Wastewater Treatment, Industrial Processing, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow Chemical Corporation, Toray Industries, Pall Corporation, Applied Membranes, Inc., Evoqua Water Technologies, GEA Filtration, Koch Membrane Systems, 3M Company, Veolia Environnement, Pentair plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Separation Membrane MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Separation Membrane MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow Chemical Corporation

- Toray Industries

- Pall Corporation

- Applied Membranes, Inc.

- Evoqua Water Technologies

- GEA Filtration

- Koch Membrane Systems

- 3M Company

- Veolia Environnement

- Pentair plc