Global Sandwich Panel Market Size, Share, And Enhanced Productivity By Product (Polystyrene Panels, Polyurethane Panels, Glass Wool Panels, Others), By Application (Walls and Floors, Roofs, Cold Storage, Others), By End-use (Residential, Non-residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2023

- Report ID: 173148

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

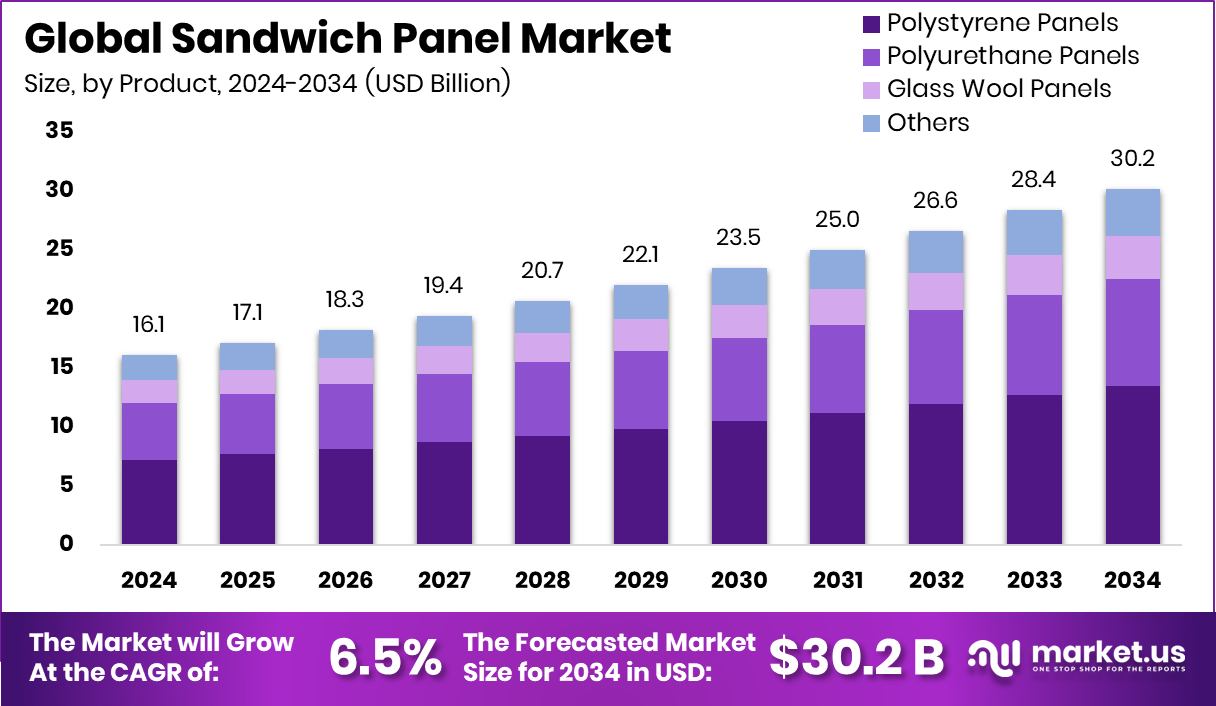

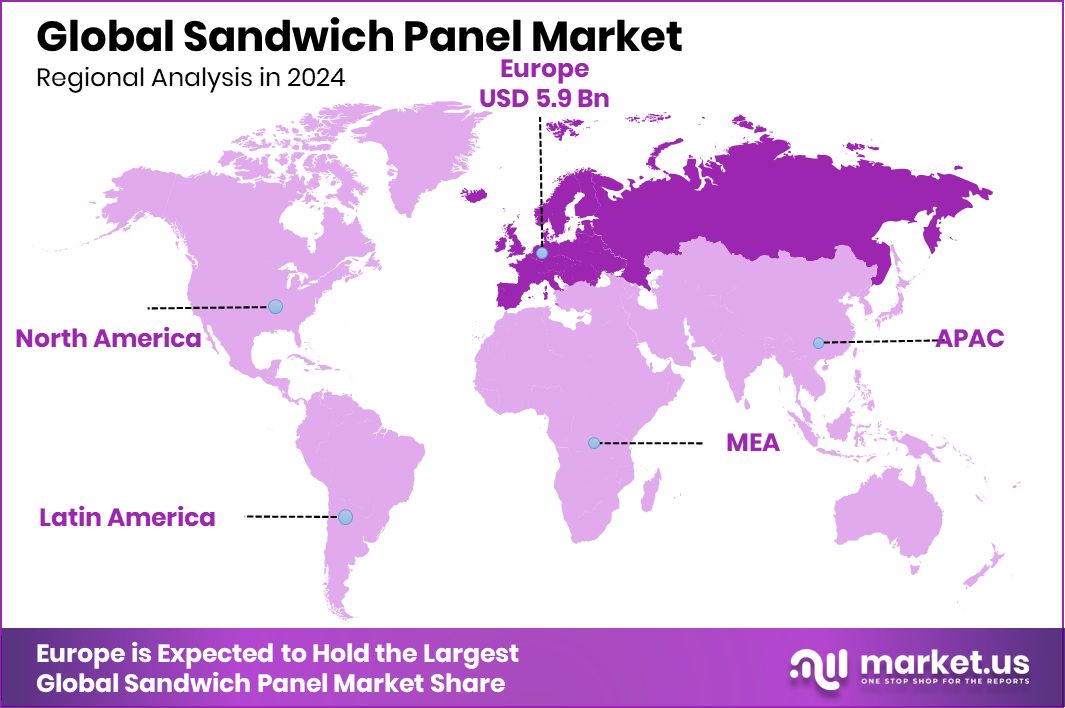

The Global Sandwich Panel Market is expected to be worth around USD 30.2 billion by 2034, up from USD 16.1 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034. Europe accounted for 36.80% of the Sandwich Panel Market, representing a USD 5.9 Bn value.

A sandwich panel is a modern construction material made by bonding an insulating core between two rigid outer layers, usually metal sheets. This structure provides strength, thermal insulation, and sound control in one integrated product. Sandwich panels are widely used in walls, roofs, floors, and cold storage buildings because they reduce construction time while improving energy efficiency and durability.

The sandwich panel market refers to the overall ecosystem involved in manufacturing, supplying, and using these panels across residential, non-residential, and industrial construction. Demand comes from builders looking for faster installation, lower operating costs, and better insulation performance. The market supports applications such as warehouses, commercial buildings, factories, healthcare facilities, and modular structures where consistent quality and speed matter.

Growth factors for the sandwich panel market are closely linked to innovation in insulation materials and sustainable construction. For example, RPI researchers were awarded $1.5 M to produce hemp-based insulated siding, highlighting growing interest in bio-based and low-carbon insulation solutions. Such research supports next-generation panels that improve thermal performance while reducing environmental impact, helping the market evolve beyond conventional materials.

Demand is rising as manufacturers expand production capacity to meet construction needs. An insulated panel manufacturer opening a $24 M Monroe County facility reflects strong confidence in long-term demand for insulated building systems. Additionally, Sips Eco Panels’ £1 M investment to double its workforce shows how operational scaling is responding to higher orders for energy-efficient panel solutions.

Opportunities are expanding as insulated panels support broader social and institutional priorities. $20 M in new giving to support diversity, equity, and inclusion initiatives at Brown strengthens educational and research environments where advanced, efficient buildings are increasingly required. Together, innovation funding, capacity expansion, and institutional investment create long-term opportunities for sandwich panels across sustainable and modern construction.

Key Takeaways

- The Global Sandwich Panel Market is expected to be worth around USD 30.2 billion by 2034, up from USD 16.1 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- In the Sandwich Panel Market, Polystyrene Panels led the By Product segment with 44.7%, driven by cost efficiency and thermal insulation performance.

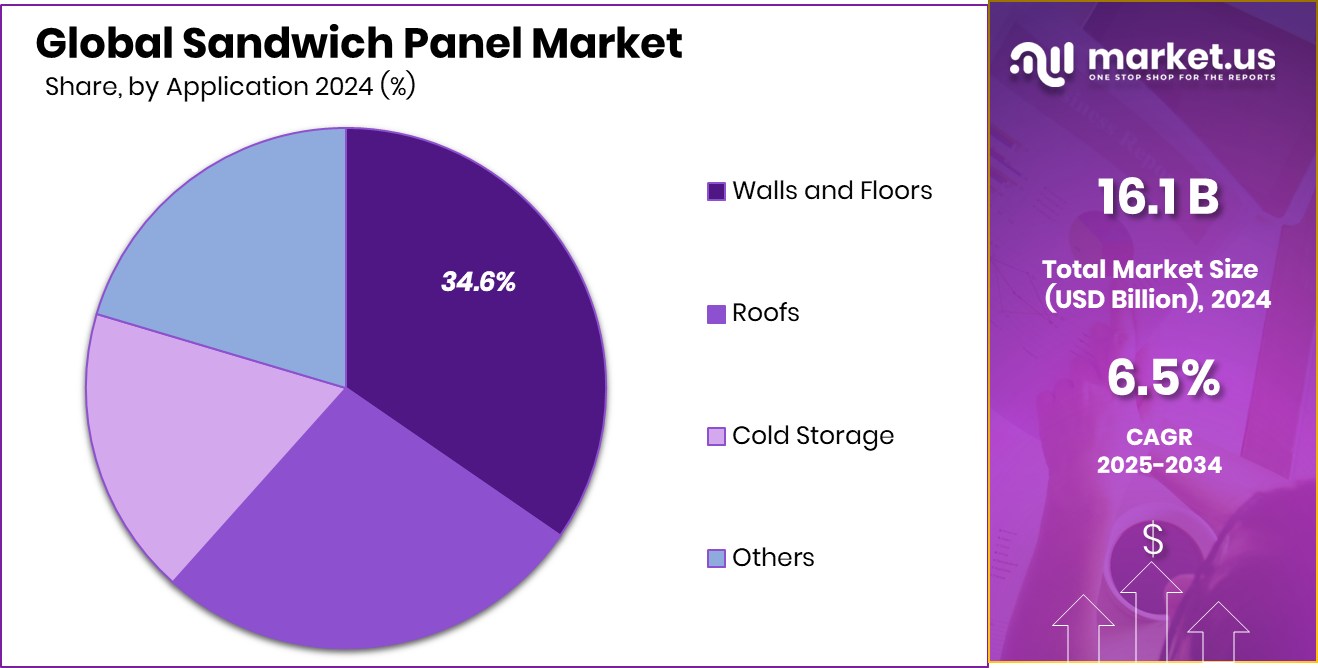

- Within the Sandwich Panel Market, Walls and Floors dominated the By Application segment at 34.6%, supported by rapid industrial and commercial construction demand.

- Across the Sandwich Panel Market, Non-residential end-use accounted for 67.8%, fueled by warehouses, factories, and large infrastructure projects.

- Europe’s Sandwich Panel Market reached 36.80% share, generating USD 5.9 Bn revenue region.

By Product Analysis

In Sandwich Panel Market, polystyrene panels dominate products with a 44.7% share.

In 2024, Polystyrene Panels held a dominant position in the Sandwich Panel Market, accounting for 44.7% of total product demand. This strong share is mainly driven by their cost-effectiveness, lightweight structure, and reliable thermal insulation performance. Polystyrene panels are widely preferred in commercial and industrial buildings where fast installation and budget control are critical. Their closed-cell structure supports energy efficiency goals by reducing heat loss, which aligns well with modern building codes.

In addition, ease of handling and compatibility with prefabricated construction methods make polystyrene panels attractive for large-scale projects. As construction timelines shorten globally, these panels continue to gain preference for roofing, wall cladding, and cold storage facilities.

By Application Analysis

Within the Sandwich Panel Market, walls and floors lead applications at 34.6%.

In 2024, Walls and Floors emerged as the leading application segment in the Sandwich Panel Market, capturing 34.6% of overall demand. The growing use of sandwich panels in internal and external wall systems is driven by rising demand for energy-efficient buildings and modular construction. For flooring applications, sandwich panels offer high load-bearing capacity along with sound and thermal insulation benefits.

Commercial complexes, warehouses, and industrial facilities increasingly adopt these panels to reduce construction time and improve structural consistency. Their ability to integrate insulation and structural support into a single system makes them highly suitable for fast-track projects. This application segment benefits strongly from urbanization and infrastructure upgrades worldwide.

By End-use Analysis

Across the Sandwich Panel Market, non-residential end-use dominates demand holding 67.8% share.

In 2024, the Non-residential sector dominated the sandwich panel market by end use, holding a significant 67.8% share. Demand is largely supported by the rapid expansion of industrial buildings, logistics centers, cold storage units, healthcare facilities, and commercial infrastructure. Non-residential projects prioritize durability, fire resistance, and thermal efficiency—key advantages offered by sandwich panels. These structures also benefit from reduced maintenance costs and improved indoor environmental control.

Government investments in public infrastructure and industrial parks further strengthen demand from this segment. As businesses focus on operational efficiency and energy savings, non-residential construction continues to remain the primary growth engine for sandwich panels globally.

Key Market Segments

By Product

- Polystyrene Panels

- Polyurethane Panels

- Glass Wool Panels

- Others

By Application

- Walls and Floors

- Roofs

- Cold Storage

- Others

By End-use

- Residential

- Non-residential

Driving Factors

Public Infrastructure Spending Drives Sandwich Panel Adoption

Rising public infrastructure investment is a key driving factor for the Sandwich Panel Market, as governments prioritize faster, cost-efficient building solutions. When budgets increase, authorities look for materials that shorten construction timelines while improving energy performance and durability. A clear example is the Bridgeport school board exploring restoration of program cuts after the city boosted its budget by $4 M.

Such funding increases often translate into school renovations, facility upgrades, and new construction projects where insulated sandwich panels are highly suitable. These panels combine structure and insulation in one system, helping public buildings reduce energy costs and meet modern building standards.

Schools, hospitals, and municipal facilities benefit from quicker installation, minimal disruption, and long service life. As cities redirect funds into upgrading aging infrastructure, sandwich panels gain traction as a practical, efficient solution for publicly funded construction projects.

Restraining Factors

High Material Innovation Costs Limit Panel Adoption

High costs linked to advanced material innovation act as a key restraining factor in the Sandwich Panel Market. Manufacturers are under pressure to improve fire resistance, strength, and sustainability, but developing new materials often requires significant upfront investment. This challenge is reflected in Fiber Elements, raising €2.6 million in seed funding to develop 3D basalt fiber technology. While such innovation can improve composite and panel performance, the added research, testing, and production costs may increase final product prices.

Higher prices can discourage adoption, especially in cost-sensitive construction projects such as small commercial buildings or public housing. Builders may delay switching to newer sandwich panel solutions until costs stabilize. As innovation accelerates, balancing performance improvements with affordability remains a critical restraint for wider market penetration.

Growth Opportunity

Market Volatility Accelerates Cost-Efficient Building Solutions

Economic uncertainty is creating a clear growth opportunity for the Sandwich Panel Market, as builders seek cost-efficient and low-risk construction methods. When Wall Street slides as trade war escalates and the S&P 500 confirms a correction, construction investors and developers often become cautious with capital spending. In such conditions, materials that reduce project timelines and limit cost overruns gain stronger attention. Sandwich panels help control budgets by combining structure and insulation in a single product, lowering labor needs and shortening installation schedules.

During volatile markets, developers prefer predictable construction costs and faster project completion to reduce financial exposure. As global trade tensions affect raw material pricing and financing confidence, demand shifts toward solutions that offer efficiency, speed, and operational savings. This environment positions sandwich panels as a practical option for maintaining construction activity despite broader economic pressure.

Latest Trends

Smart Roofing Integration Shapes Modern Panel Systems

A key latest trend in the Sandwich Panel Market is closer integration with smart and fortified roofing systems. Innovation is accelerating as Netic AI received $23M in Series B funding, highlighting growing interest in data-driven roofing performance and predictive maintenance. At the same time, Louisiana’s fortified roof program reaching 10,000 installations shows how resilience standards are influencing roof and wall system choices, favoring durable insulated panels.

Industry consolidation is also shaping this trend, with Holcim agreeing to buy Xella in a $2.2 billion walls and roofs deal, strengthening integrated building envelope solutions. Together, digital roofing, resilience programs, and large-scale acquisitions are pushing sandwich panels toward smarter, stronger, and more system-based construction applications.

Regional Analysis

Europe dominated the Sandwich Panel Market with 36.80% share, valued at USD 5.9 Bn.

Europe emerged as the dominating region in the Sandwich Panel Market, holding a market share of 36.80% and reaching a value of USD 5.9 Bn. This strong position is supported by steady renovation activity, strict energy-efficiency regulations, and widespread adoption of prefabricated construction systems. European construction practices increasingly favor sandwich panels for thermal insulation, fire safety, and faster project execution across commercial and industrial buildings. The region’s mature construction ecosystem and focus on sustainable building standards continue to reinforce its leadership position.

North America represents a well-established regional market for sandwich panels, driven by consistent demand from non-residential construction, logistics facilities, and industrial infrastructure. The region benefits from advanced building technologies, standardized construction codes, and strong acceptance of insulated panel systems for walls, roofs, and cold storage applications. Demand remains stable as builders prioritize durability, energy efficiency, and reduced construction timelines.

Asia Pacific shows strong growth potential due to rapid urbanization, expanding industrial zones, and rising adoption of modular construction methods. Increasing infrastructure development and manufacturing activity support wider use of sandwich panels in warehouses, factories, and commercial buildings. The region’s focus on cost-efficient and fast construction solutions continues to strengthen market penetration.

The Middle East & Africa and Latin America markets are developing steadily, supported by industrial expansion, commercial construction, and climate-driven demand for thermal insulation. Sandwich panels are increasingly used to improve building performance, reduce energy consumption, and support faster project completion in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Kingspan Group continued to play a defining role in the global Sandwich Panel Market through its strong focus on insulated building envelope solutions. The company’s expertise in high-performance insulation and integrated panel systems supports demand from industrial, commercial, and logistics construction. Kingspan’s emphasis on thermal efficiency, fire performance, and off-site construction aligns closely with modern building requirements. Its broad geographic presence and technical know-how allow it to serve large, complex projects while maintaining consistent product standards across regions.

Owens Corning maintained a solid position in the Sandwich Panel Market by leveraging its long-standing capabilities in insulation and composite building materials. The company benefits from strong brand recognition and deep technical experience in thermal and acoustic performance. Owens Corning’s material science approach supports sandwich panel applications where durability, insulation consistency, and lifecycle performance are critical. Its close engagement with contractors and building professionals helps translate performance requirements into practical construction solutions.

Isopan remained a specialized and influential player in 2024, known for its dedicated focus on insulated metal sandwich panels. The company serves industrial, commercial, and cold-chain infrastructure with solutions designed for energy efficiency and rapid installation. Isopan’s strength lies in combining insulation performance with architectural flexibility, making its panels suitable for both functional and aesthetic applications. Its manufacturing expertise and application-specific designs reinforce its relevance in technically demanding construction projects worldwide.

Top Key Players in the Market

- Kingspan Group

- Owens Corning

- Isopan

- PFB Corporation

- Metecno Group

- RAY-CORE SIPs

- American Insulated Panel

- Metl-Span

- KPS Global

- American Buildings Company

Recent Developments

- In June 2025, Kingspan Insulation published a white paper titled The Operating Energy, Cost, and Carbon Benefits of Insulation. Although broader than sandwich panels, it supports demand for high-performance panel solutions by highlighting measurable insulation benefits

- In June 2025, American Buildings Company announced the 2025 Excellence in Design Awards winners, featuring buildings that prominently used its Insulated Metal Panels and roof systems in major projects like the Baptist Health IcePlex. This recognition underscores ABC’s focus on high-performance insulated panel solutions in modern construction applications.

- In May 2025, KPS Global completed the acquisition of SRC Refrigeration, a Michigan-based manufacturer of walk-in coolers and freezers. This acquisition strengthens KPS Global’s product portfolio and manufacturing reach in the cold storage space, allowing it to serve more customers with integrated panel-based coolers and freezers.

Report Scope

Report Features Description Market Value (2024) USD 16.1 Billion Forecast Revenue (2034) USD 30.2 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Polystyrene Panels, Polyurethane Panels, Glass Wool Panels, Others), By Application (Walls and Floors, Roofs, Cold Storage, Others), By End-use (Residential, Non-residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kingspan Group, Owens Corning, Isopan, PFB Corporation, Metecno Group, RAY-CORE SIPs, American Insulated Panel, Metl-Span, KPS Global, American Buildings Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kingspan Group

- Owens Corning

- Isopan

- PFB Corporation

- Metecno Group

- RAY-CORE SIPs

- American Insulated Panel

- Metl-Span

- KPS Global

- American Buildings Company