Global Residential Energy Management Market Size, Share, And Enhanced Productivity By Platform (Energy Management Platform (EMP), Customer Engagement Platform (CEP), Energy Analytics), By Application (Smart Meters, In-House Displays, Smart Appliances, The Smart Thermostat), By Communication Technology (ZigBee, Wireless M-Bus, Threads, Wi-Fi, Z-Wave, Home Plugs), By Hardware (Gateways, Demand Response (DR) Devices, Ventilating, Load Control Switches (LCS), Heating and Air-Conditioning (HVAC) Control Devices), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171239

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

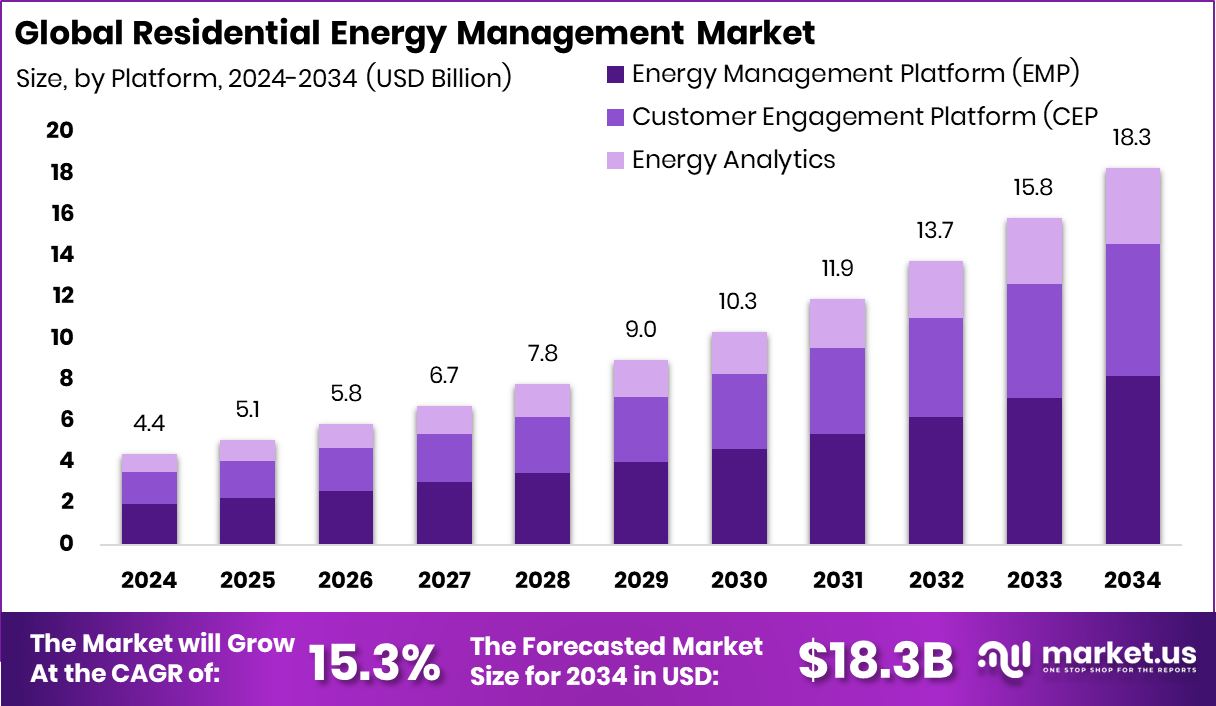

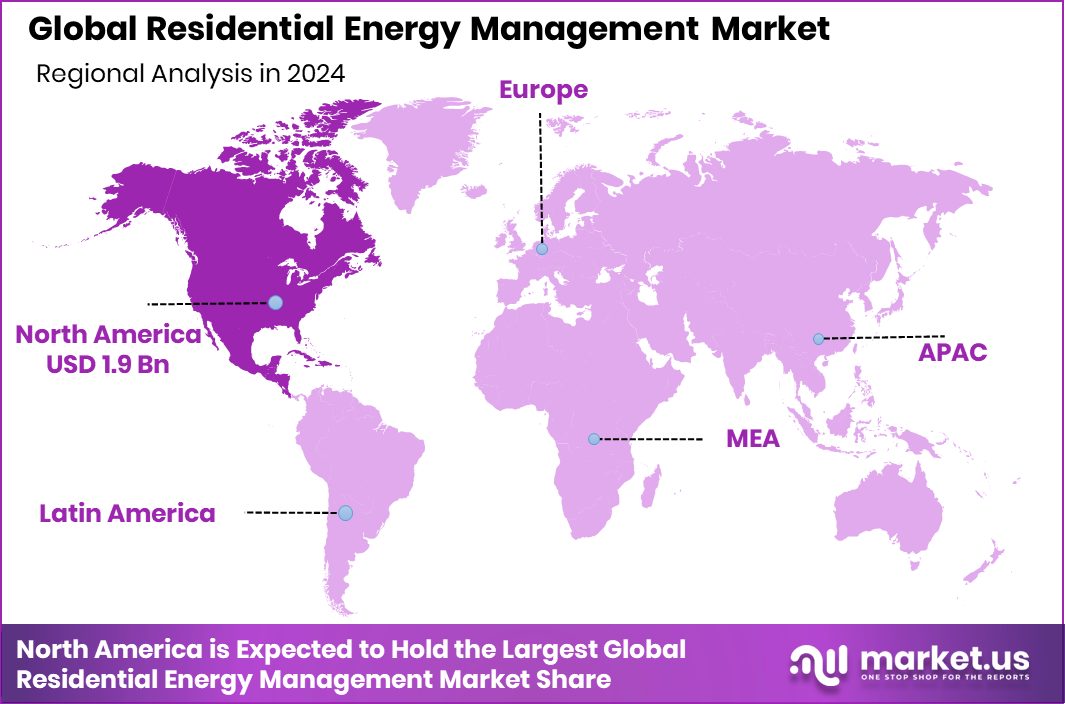

The Global Residential Energy Management Market is expected to be worth around USD 18.3 billion by 2034, up from USD 4.4 billion in 2024, and is projected to grow at a CAGR of 15.3% from 2025 to 2034. North America remains the region in the Energy Management Market with 43.20% USD 1.9 Bn.

Residential Energy Management refers to the use of digital tools, connected devices, and analytics to monitor, control, and optimize energy consumption within homes. It helps households track electricity usage, manage appliances efficiently, and reduce unnecessary energy waste while maintaining comfort. These systems bring visibility to daily energy behavior and support smarter decisions at the household level.

The Residential Energy Management Market covers platforms, hardware, and software that enable energy monitoring, automation, and analysis in residential settings. Market growth is supported by rising investments in energy analytics and digital infrastructure. Capital inflows such as KKR’s $2 bn investment in SK E&S’ new preferred shares and Apterra-led USD 600 m financing for Centrio Energy signal strong confidence in advanced energy systems and residential-scale optimization solutions.

Growth factors include the rapid adoption of data-driven energy tools and analytics. Funding rounds like Invictus Growth’s $35 m investment in AI-based energy analytics, Orennia’s $25 m raise, and Amperon’s $20 m funding show rising demand for intelligent forecasting and consumption insights that directly support residential energy management capabilities.

Demand is further strengthened by grid modernization and risk management needs. Initiatives such as the Energy Department’s $7.5 m investment in grid reliability analytics, along with Renew Risk’s €5.9 m and £5 m raises, highlight the importance of analytics in managing residential energy volatility and reliability.

Future opportunities lie in scalable, data-centric solutions. Early-stage support like QuanE Energy’s $500,000 funding and Smart Grid Analytics’ USD 3.3 m raise reflects growing space for innovation in residential-focused energy intelligence.

Key Takeaways

- The Global Residential Energy Management Market is expected to be worth around USD 18.3 billion by 2034, up from USD 4.4 billion in 2024, and is projected to grow at a CAGR of 15.3% from 2025 to 2034.

- In the Residential Energy Management Market, Energy Management Platforms led with 44.9% adoption among households.

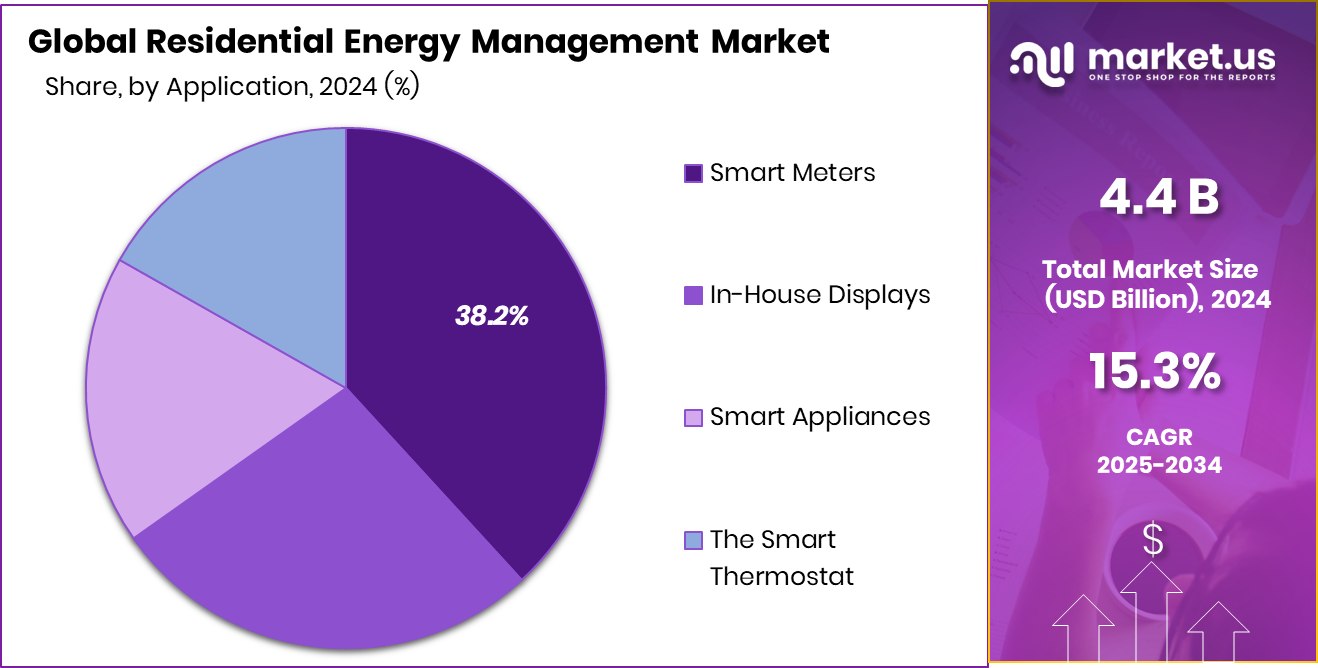

- In the Residential Energy Management Market, Smart Meters dominated applications, capturing 38.2% usage across homes.

- In the Residential Energy Management Market, Wi-Fi led communication technologies with 31.6% share for devices.

- In the Residential Energy Management Market, HVAC control devices led hardware, accounting for 32.3% share.

- North America leads the Energy Management Market, holding 43.20% share, generating USD 1.9 Bn.

By Platform Analysis

In the Residential Energy Management Market, Energy Management Platforms (EMP) lead with 44.9% share.

In 2024, Energy Management Platform (EMP) held a dominant market position in By Platform segment of the Residential Energy Management Market, with a 44.9% share, reflecting its central role in coordinating household energy visibility and control through a single interface.

EMP solutions consolidate consumption data, automate schedules, and translate insights into practical actions for homeowners, making daily energy decisions simpler and more reliable. Their dominance is reinforced by intuitive dashboards, real-time alerts, and rule-based controls that align comfort with efficiency.

As households seek a clearer understanding of usage patterns and costs, EMPs act as the operational brain of residential energy systems. This leadership position indicates strong user trust in platforms that reduce complexity, improve transparency, and deliver measurable efficiency outcomes without disrupting everyday living.

By Application Analysis

Smart Meters dominate applications in the Residential Energy Management Market, holding 38.2% adoption.

In 2024, Smart Meters held a dominant market position in the Application segment of the Residential Energy Management Market, with a 38.2% share, underscoring their importance as the primary data source for household energy intelligence.

Smart meters enable accurate, real-time measurement of electricity use, replacing estimates with precise readings that support informed decisions. Their dominance reflects growing preference for transparent billing, usage tracking, and faster issue detection within homes.

By continuously capturing consumption patterns, smart meters empower residents to understand peak usage behaviors and adjust habits accordingly. This leading position also highlights their role in enabling downstream management tools to function effectively, making smart meters a foundational component of modern residential energy management ecosystems.

By Communication Technology Analysis

Wi-Fi communication technology accounts for 31.6% share within the Residential Energy Management Market.

In 2024, Wi-Fi held a dominant market position in the By Communication Technology segment of the Residential Energy Management Market, with a 31.6% share, driven by its widespread availability and ease of integration within homes. Wi-Fi connectivity allows seamless communication between energy devices and user interfaces without specialized infrastructure, supporting quick deployment and user familiarity.

Its dominance reflects homeowner preference for reliable, high-bandwidth connections that enable real-time monitoring and control. Wi-Fi’s compatibility with existing home networks simplifies installation and maintenance, reducing barriers to adoption. This leadership position indicates that convenience and interoperability remain decisive factors, as households prioritize communication technologies that fit naturally into everyday digital environments.

By Hardware Analysis

HVAC control devices represent 32.3% of hardware demand in the Residential Energy Management Market.

In 2024, Heating and Air-Conditioning (HVAC) Control Devices held a dominant market position in the Hardware segment of the Residential Energy Management Market, with a 32.3%, highlighting their critical impact on household energy consumption.

HVAC systems account for a significant share of residential energy use, making their control devices central to efficiency improvements. The dominance of HVAC control devices reflects strong demand for precise temperature regulation, scheduling, and responsiveness to occupancy patterns.

By optimizing heating and cooling operations, these devices help balance comfort with energy savings throughout the year. Their leading position signals continued focus on managing high-consumption equipment as a practical pathway to meaningful residential energy optimization.

Key Market Segments

By Platform

- Energy Management Platform (EMP)

- Customer Engagement Platform (CEP)

- Energy Analytics

By Application

- Smart Meters

- In-House Displays

- Smart Appliances

- The Smart Thermostat

By Communication Technology

- ZigBee

- Wireless M-Bus

- Threads

- Wi-Fi

- Z-Wave

- Home Plugs

By Hardware

- Gateways

- Demand Response (DR) Devices

- Ventilating

- Load Control Switches (LCS)

- Heating and Air-Conditioning (HVAC) Control Devices

Driving Factors

Smart Meter Expansion Driving Residential Energy Intelligence

The growing rollout of smart meters is a key driving factor for the Residential Energy Management Market. Smart meters give households clear, real-time visibility into energy use, helping people understand where power is consumed and how to manage it better. This shift supports accurate billing, better load control, and smarter daily energy decisions. Large-scale deployments show how critical this technology has become. CyanConnode secured a £70 million ($92.8 million) contract to deploy around 750,000 smart meters in Goa, India, highlighting strong demand for digital energy infrastructure at the residential level.

Investment momentum further reinforces this driver. NRFC’s $100 million investment to support Intellihub’s smart meter rollout reflects confidence in metering-led energy management models. At the consumer-facing level, platforms that translate meter data into simple insights are expanding, supported by Berlin-based Ostrom, raising €20 million to accelerate Germany’s smart energy capability. Together, these developments underline how smart meters act as the foundation for modern residential energy management systems.

Restraining Factors

High Deployment Complexity Slows Residential Energy Adoption

A major restraining factor in the Residential Energy Management Market is the complexity involved in large-scale smart meter deployment. Installing, integrating, and maintaining smart meters across residential areas requires coordination, skilled labor, and system readiness, which can slow adoption timelines. Even when financial support is available, execution challenges remain.

For example, a new batch of smart meters is being installed for over 14,000 consumers with support from Italy and UNDP, showing that external backing is often needed to overcome implementation hurdles. Similarly, CyanConnode secured $7.5 m to boost India’s smart meter rollout, highlighting that additional capital is required just to manage rollout scale.

In India, a ₹3467 Cr project for installing 76 lakh smart meters further illustrates how size and complexity can strain logistics and operations. These factors collectively act as barriers, delaying full residential energy management adoption.

Growth Opportunity

Large-Scale Smart Meter Programs Unlock Market Growth

A strong growth opportunity in the Residential Energy Management Market lies in nationwide smart meter programs that create long-term demand for digital energy solutions. Government-led rollouts help expand residential access to accurate energy data, which supports better monitoring, control, and efficiency at the household level.

The National Treasury moving ahead with a R2 bn smart meter rollout signals a large installed base that can later connect with advanced residential energy management tools. Progress is already visible, with 67,000 smart meters deployed across 18 municipalities, showing steady execution and growing reach.

Market structure is also evolving, as Iberdrola’s £900 million sale of its UK smart metering business reflects strategic shifts that open space for new service models and technology upgrades. Together, these developments highlight clear opportunities to scale residential energy platforms alongside expanding smart meter infrastructure.

Latest Trends

Rising Smart Meter Investments Shape Residential Energy Trends

A key latest trend in the Residential Energy Management Market is the growing focus on smart metering as a foundation for digital energy control in homes. Investments continue to flow into technologies that improve accuracy, monitoring, and data-driven energy use.

SAT Private Limited securing a $2.5 million investment for smart meter technology highlights rising interest in innovative residential metering solutions. At the policy level, Japan’s approval of a $3.5 m grant for smart water meters reflects a broader move toward intelligent utility monitoring that complements home energy management systems.

However, implementation risks remain visible, as the decision to pull out of a smart meter project in Kerala could lead to a loss of grants worth Rs 9000 crores, showing how policy shifts can directly influence market momentum. These dynamics define the current evolution of residential energy management.

Regional Analysis

North America dominates the Energy Management Market with 43.20% share at USD 1.9 Bn.

North America dominated the Residential Energy Management Market, accounting for a 43.20% share valued at USD 1.9 Bn, reflecting strong adoption of connected home energy solutions across the region. High penetration of smart homes, advanced grid infrastructure, and consumer focus on energy efficiency support sustained demand for residential energy management systems. The region benefits from mature digital ecosystems and widespread use of intelligent devices that enable monitoring, automation, and optimization of household energy consumption, reinforcing its leading position.

Europe represents a well-established regional market, driven by strong awareness of energy conservation and structured residential efficiency practices. Households increasingly rely on digital tools to monitor usage and improve control over daily energy consumption, supporting steady market development.

Asia Pacific shows expanding momentum as urbanization and rising household electrification increase interest in managing residential energy use. Growing adoption of smart home technologies supports broader integration of energy management solutions across residential settings.

Middle East & Africa are emerging gradually, with residential energy management gaining attention as households seek better visibility into electricity usage and operational efficiency.

Latin America continues to develop steadily, supported by increasing digital connectivity and the gradual uptake of residential energy monitoring and control solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Elster Group continues to play a focused role in the Residential Energy Management Market through its long-standing expertise in metering and measurement technologies. In 2024, the company’s strengths lie in accurate data capture and reliable residential energy monitoring solutions that support utilities and households alike. Elster’s approach emphasizes precision, system reliability, and long operational lifecycles, which remain critical for residential environments. From an analyst perspective, its value is anchored in enabling consistent energy visibility at the household level, forming a dependable foundation for broader energy management and optimization strategies.

Itron Incorporated maintains a strong analytical position in the residential energy ecosystem by combining metering hardware with data-driven energy intelligence. In 2024, the company’s residential focus centers on helping households and utilities better understand consumption patterns and system performance. Itron’s solutions are designed to translate raw energy data into actionable insights, improving demand awareness and operational efficiency. Analysts view Itron as a key enabler of smarter residential energy decisions, particularly where accurate usage tracking and data reliability directly influence energy optimization and customer engagement.

Schneider Electric SE holds a strategic position in residential energy management through its integrated approach spanning hardware, software, and energy automation. In 2024, the company’s residential offerings emphasize connectivity, system interoperability, and user-centric energy control. Schneider Electric’s strength lies in linking household devices into cohesive energy management frameworks that improve efficiency and control. From an analyst’s viewpoint, the company benefits from its broad electrical and digital expertise, allowing it to address residential energy challenges holistically while supporting long-term energy efficiency objectives.

Top Key Players in the Market

- Elster Group

- Itron Incorporate

- Schneider Electric SE

- General Electric Company

- Landis+Gyr AG

- Opower Incorporate

- Aclara Technologies LLC

- Others

Recent Developments

- In March 2025, Itron teamed up with CHINT Global to introduce the first residential smart meter based on the DLMS Generic Companion Profile (GCP) standard. This new meter supports smoother integration across different manufacturers, helping utilities deploy interoperable smart metering solutions more easily, speeding up advanced residential energy management deployments worldwide.

- In February 2025, Schneider Electric completed the acquisition of Motivair Corporation, a company that builds advanced cooling technologies for data centers and electrical systems. This deal strengthens Schneider’s ability to deliver more efficient power and cooling solutions, which are important for integrated energy systems that include home and grid-level management.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 18.3 Billion CAGR (2025-2034) 15.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Platform (Energy Management Platform (EMP), Customer Engagement Platform (CEP), Energy Analytics), By Application (Smart Meters, In-House Displays, Smart Appliances, The Smart Thermostat), By Communication Technology (ZigBee, Wireless M-Bus, Threads, Wi-Fi, Z-Wave, Home Plugs), By Hardware (Gateways, Demand Response (DR) Devices, Ventilating, Load Control Switches (LCS), Heating and Air-Conditioning (HVAC) Control Devices) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Elster Group, Itron Incorporated, Schneider Electric SE, General Electric Company, Landis+Gyr AG, Opower Incorporated, Aclara Technologies LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Residential Energy Management MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Residential Energy Management MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Elster Group

- Itron Incorporate

- Schneider Electric SE

- General Electric Company

- Landis+Gyr AG

- Opower Incorporate

- Aclara Technologies LLC

- Others