Global Recycled Composites Market Size, Share, And Enhanced Productivity By Fiber Type (Recycled Carbon Fiber, Recycled Glass Fiber, Others), By End Use (Automotive and Transportation, Aerospace, Construction and Infrastructure, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172960

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

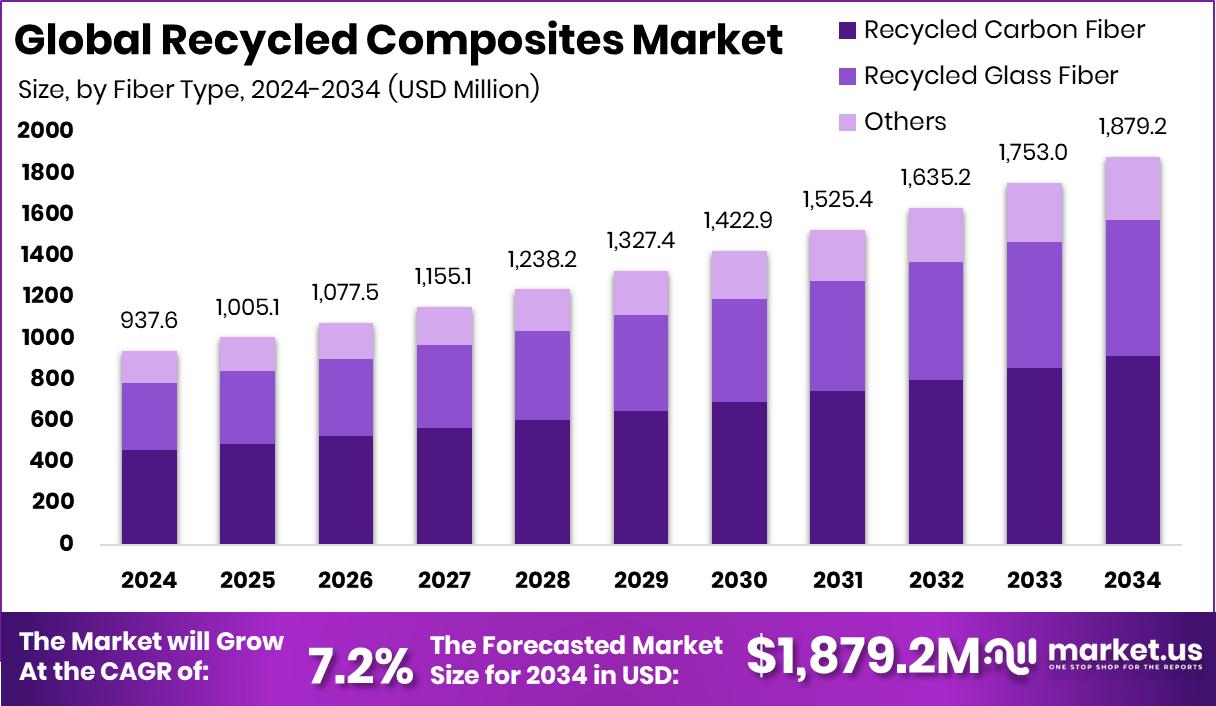

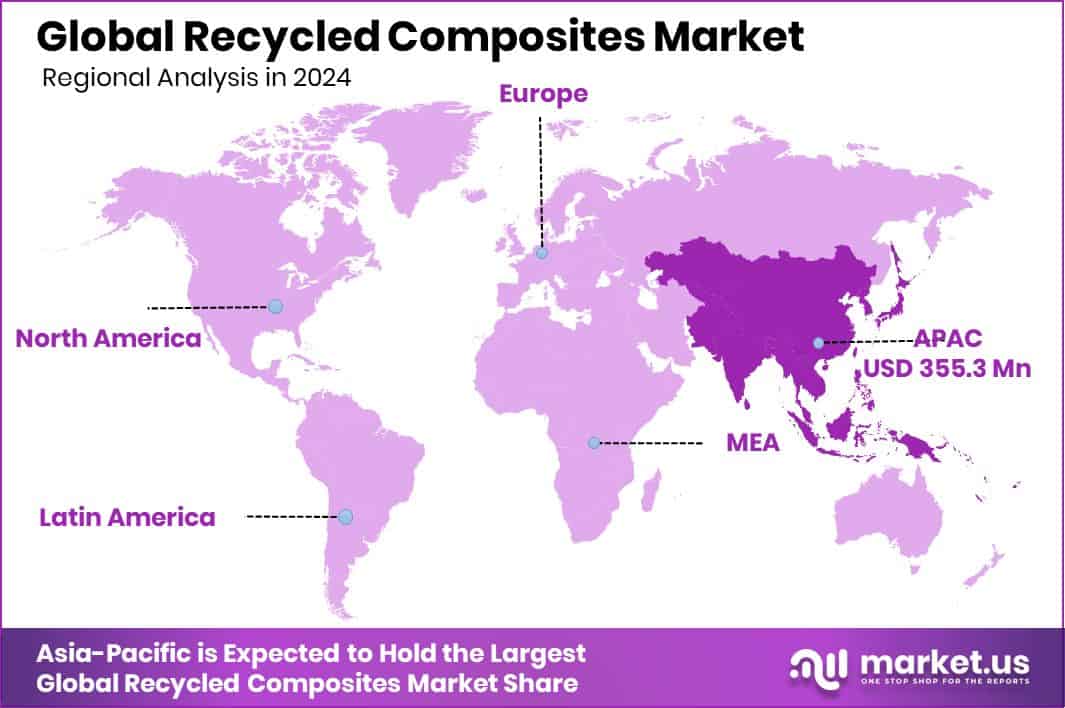

The Global Recycled Composites Market is expected to be worth around USD 1,879.2 million by 2034, up from USD 937.6 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. Asia Pacific accounted for 37.90% of the recycled composites market worth USD 355.3 Mn.

Recycled composites are materials made by recovering fibers and resins from used or discarded composite products and reprocessing them into new usable forms. These materials often come from carbon fiber, glass fiber, or resin-based waste generated by industries such as transportation, energy, construction, and manufacturing. Instead of sending composite waste to landfills, recycling methods allow valuable fibers to be reused, reducing material loss and environmental impact while extending the lifecycle of high-performance materials.

The Recycled Composites Market refers to the commercial ecosystem focused on producing, processing, and using these recovered composite materials across industries. This market supports circular manufacturing by turning end-of-life composite products into raw material alternatives. It plays an important role in reducing dependency on virgin fibers, lowering waste disposal pressure, and supporting sustainability goals across industrial value chains.

One key growth factor is increasing investment in advanced recycling technologies. Fairmat secured €51.5M to scale near-infinite carbon fiber reuse, while Vartega raised $10 million to promote recycled carbon fiber adoption. These funds support better fiber recovery, improved material quality, and wider industrial acceptance of recycled composites.

Demand is rising as governments actively support recycling infrastructure. The U.S. Department of Energy announced $20 million to improve recycling of wind energy technologies, while Michigan awarded $5.6M in recycling and waste reduction grants. These initiatives push industries to manage composite waste responsibly and create steady demand for recycled solutions.

A major opportunity lies in innovation and new applications. Fairmat’s $57m raise, Fiberdom’s $3.9m funding, and new technology development signal strong momentum for scaling recycled composites into mainstream manufacturing, opening long-term opportunities across multiple sectors.

Key Takeaways

- The Global Recycled Composites Market is expected to be worth around USD 1,879.2 million by 2034, up from USD 937.6 million in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- Recycled carbon fiber dominated the recycled composites market, accounting for 48.8% share due to sustainability demand.

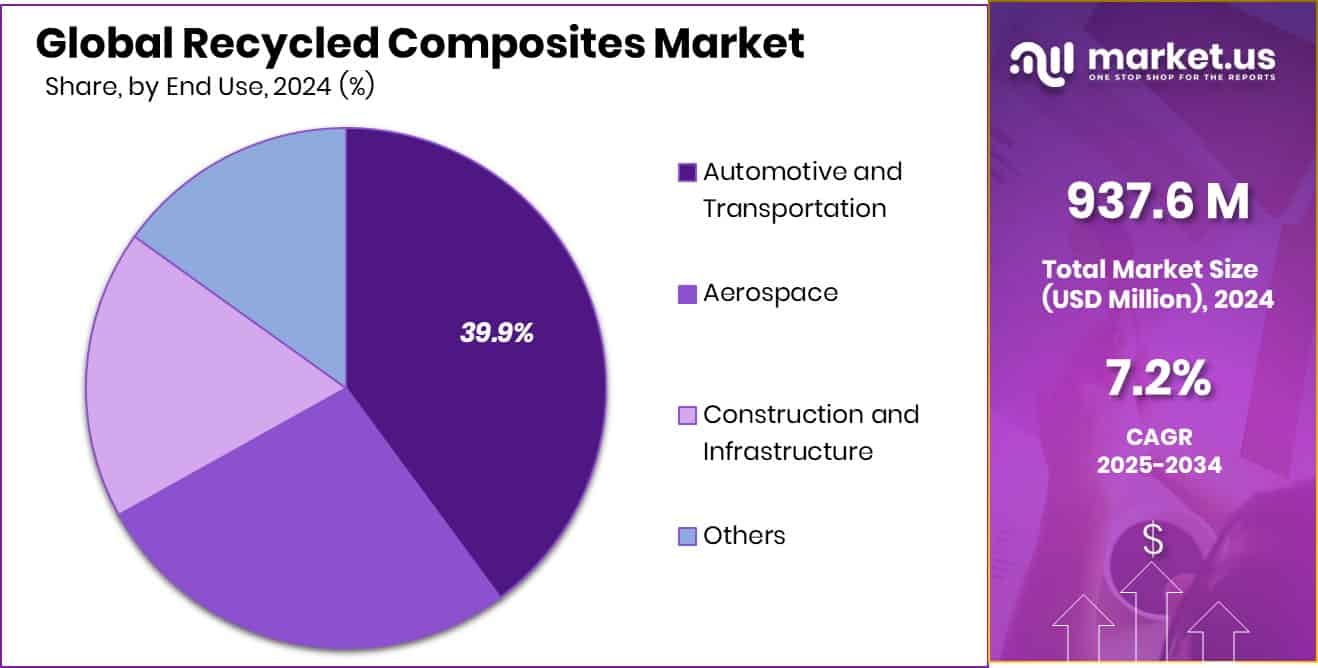

- Automotive and transportation led the recycled composites market end use, holding 39.9% amid lightweight adoption.

- Recycled Composites Market in Asia Pacific reached USD 355.3 Mn, representing 37.90% share.

By Fiber Type Analysis

Recycled carbon fiber dominates the recycled composites market, holding 48.8% share.

In 2024, the Recycled Composites Market saw recycled carbon fiber emerge as a leading fiber type, accounting for 48.8% of total demand. This strong share reflects growing efforts to reduce composite waste and lower raw material costs without compromising performance. Recycled carbon fiber offers high strength-to-weight benefits similar to virgin fiber, making it attractive for cost-sensitive and sustainability-driven applications.

Manufacturers increasingly adopt mechanical and thermal recycling technologies to recover usable fibers from aerospace, automotive, and industrial scrap. In addition, tighter environmental regulations and corporate net-zero targets have pushed OEMs to integrate recycled materials into product design. As processing quality improves and supply chains stabilize, recycled carbon fiber continues to gain trust across structural and semi-structural composite applications.

By End Use Analysis

Automotive and transportation lead the recycled composites market demand, accounting for 39.9%.

In 2024, the automotive and transportation sector dominated the Recycled Composites Market by end use, holding a 39.9% share. Automakers are actively using recycled composites to reduce vehicle weight, improve fuel efficiency, and meet emission norms. Recycled composite materials are increasingly used in interior panels, underbody shields, battery enclosures, and non-critical structural components.

Electric vehicle production has further accelerated this trend, as lightweight and sustainable materials help extend driving range. Transportation OEMs also value recycled composites for their cost stability compared to volatile virgin material prices. With circular manufacturing models gaining traction, automotive suppliers are forming closed-loop systems that reuse composite waste, reinforcing long-term demand from this end-use segment.

Key Market Segments

By Fiber Type

- Recycled Carbon Fiber

- Recycled Glass Fiber

- Others

By End Use

- Automotive and Transportation

- Aerospace

- Construction and Infrastructure

- Others

Driving Factors

Circular Economy Funding Accelerates Recycled Composites Adoption

In 2024, a major driving factor for the Recycled Composites Market is the growing push toward circular supply chains, strongly supported by targeted funding. Estonian deeptech company Jälle Technologies raised €2 million in pre-seed funding to advance sustainable recycling technologies, highlighting how early-stage innovation is being encouraged to recover and reuse complex materials more efficiently.

At the same time, EGLE awarded $5.6 million to build Michigan’s circular supply chains, strengthening regional systems that connect waste collection, processing, and reuse. These funding efforts reduce technical and cost barriers linked to recycling composites, making reused materials more reliable for industrial applications.

As recycling ecosystems improve, manufacturers gain easier access to recycled inputs, lower disposal costs, and better compliance with sustainability goals. Together, innovation-focused and infrastructure-focused funding directly accelerates recycled composite usage across multiple industries.

Restraining Factors

High Technology Costs Limit Recycling Scale Expansion

In 2024, one key restraining factor for the Recycled Composites Market is the high cost of advanced recycling technologies and infrastructure. Recycling composite materials is more complex than standard plastics because fibers and resins are tightly bonded, requiring specialized equipment and skilled processing. Although Akron received $51 million in federal funding to build a sustainable polymer technology hub, this also highlights the challenge: large financial support is often needed just to make recycling systems viable.

Many regions and small manufacturers cannot afford similar investments, slowing widespread adoption. Without access to advanced hubs, recycled composite quality can vary, making buyers hesitant to replace virgin materials. Until recycling technologies become more affordable and scalable, high capital and operating costs will continue to limit the faster growth of recycled composites across industries.

Growth Opportunity

Advanced Fiber Recycling Unlocks New Market Applications

In 2024, a major growth opportunity for the Recycled Composites Market comes from innovation in recycled fiber transformation. Verretex raised €159k to convert damaged glass fibres into high-performance textiles, showing how waste fibres can be upgraded into valuable inputs instead of being discarded. This approach expands the usable scope of recycled composites beyond low-value applications.

At the same time, Fiber Elements secured €2.6 million in seed funding to develop 3D basalt fiber, opening opportunities for stronger and more durable recycled composite structures. These developments support the creation of next-generation composite materials with better mechanical performance and design flexibility.

As recycled fibres move into higher-value uses such as technical textiles and advanced components, manufacturers gain new revenue streams. This shift improves acceptance of recycled composites and supports long-term market expansion.

Latest Trends

Fibre-Based Composite Packaging Gains Strong Industry Attention

In 2024, a clear latest trend in the Recycled Composites Market is the shift toward fibre-based composite packaging as industries look for sustainable material alternatives. Pulpex secured £62 million to launch a fibre-based packaging factory, highlighting growing confidence in recycled and renewable fibre composites for large-scale use. This trend shows how recycled composites are moving beyond traditional structural applications into packaging solutions that reduce plastic dependency.

Fibre-based composites offer strength, light weight, and recyclability, making them suitable for protective and rigid packaging needs. The funding supports advanced processing, scalability, and commercial production, which are critical for wider market adoption.

As packaging regulations tighten and brands demand eco-friendly materials, fibre-based recycled composites are becoming a preferred option. This trend is reshaping how recycled composites are designed, manufactured, and positioned for everyday industrial use.

Regional Analysis

Asia Pacific led the Recycled Composites Market with 37.90% share at USD 355.3 Mn.

The Recycled Composites Market shows clear regional differentiation across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped by industrial maturity, sustainability priorities, and manufacturing depth. Asia Pacific remains the dominating region, accounting for 37.90% of the global market and reaching a value of USD 355.3 Mn, supported by strong automotive production, expanding construction activity, and rising use of recycled materials across manufacturing hubs. North America follows with steady adoption driven by circular economy practices and recycled material integration in transportation and industrial applications.

Europe continues to benefit from structured recycling frameworks and material reuse standards across automotive and infrastructure segments. The Middle East & Africa region shows a gradual uptake, mainly linked to infrastructure development and emerging composite applications.

Latin America demonstrates moderate growth potential, supported by improving industrial capabilities and increasing awareness of sustainable material solutions. Overall, Asia Pacific’s scale, cost efficiency, and manufacturing concentration firmly position it as the leading regional contributor to the recycled composites industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Trex Company, Inc. continues to set a benchmark in the recycled composites landscape through its strong focus on high-performance recycled materials. The company’s long-standing expertise in converting recycled plastics into durable composite products positions it as a reference player for circular material adoption. Trex’s emphasis on product consistency, long lifecycle performance, and large-scale recycling integration strengthens confidence among builders and infrastructure users seeking reliable recycled composite solutions.

Fiberon is viewed as a strategically agile player, leveraging recycled composites to balance design flexibility with sustainability. The company’s product positioning reflects growing market demand for recycled materials that meet both aesthetic and structural expectations. Fiberon’s approach highlights how recycled composites are no longer limited to cost-driven use cases, but are increasingly valued for performance, durability, and surface quality across residential and commercial applications.

Meanwhile, UPM brings a differentiated materials perspective to the recycled composites market. Its strong background in bio-based and circular material solutions reinforces innovation around renewable and recycled inputs. UPM’s role reflects a broader industry shift where recycled composites intersect with advanced material science, supporting long-term sustainability goals while maintaining industrial-grade performance standards.

Top Key Players in the Market

- Trex Company, Inc.

- Fiberon

- UPM

- SGL Carbon

- Toray Industries, Inc.

- Vartega Inc.

- Carbon Conversions Inc.

- Solvay

- Mitsubishi Chemical Corporation

Recent Developments

- In November 2025, UPM launched WISA®-LNG Spruce plywood, a new material solution for liquefied natural gas (LNG) carrier insulation. This product broadens UPM’s advanced materials offerings; although not a direct recycled composite, it reflects innovation in engineered wood composites.

- In February 2025, Toray Group showcased new composite materials at JEC World 2025, including items made from recycled carbon fiber reinforced thermoset composites. This event highlighted Toray’s ongoing work to expand sustainable and recycled material solutions for mobility and energy sectors.

Report Scope

Report Features Description Market Value (2024) USD 937.6 Million Forecast Revenue (2034) USD 1,879.2 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fiber Type (Recycled Carbon Fiber, Recycled Glass Fiber, Others), By End Use (Automotive and Transportation, Aerospace, Construction and Infrastructure, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Trex Company, Inc., Fiberon, UPM, SGL Carbon, Toray Industries, Inc., Vartega Inc., Carbon Conversions Inc., Solvay, Mitsubishi Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Recycled Composites MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Recycled Composites MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Trex Company, Inc.

- Fiberon

- UPM

- SGL Carbon

- Toray Industries, Inc.

- Vartega Inc.

- Carbon Conversions Inc.

- Solvay

- Mitsubishi Chemical Corporation