Global PVC Processing Aids Market Size, Share, And Enhanced Productivity By Product Type (Acrylic Processing Aids, Methacrylate Processing Aids, Others), By Application (Pipes and Fittings, Rigid Sheets and Panels, Wires and Cables, Others), By End-User (Building and Construction, Automotive, Electrical and Electronics, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177635

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

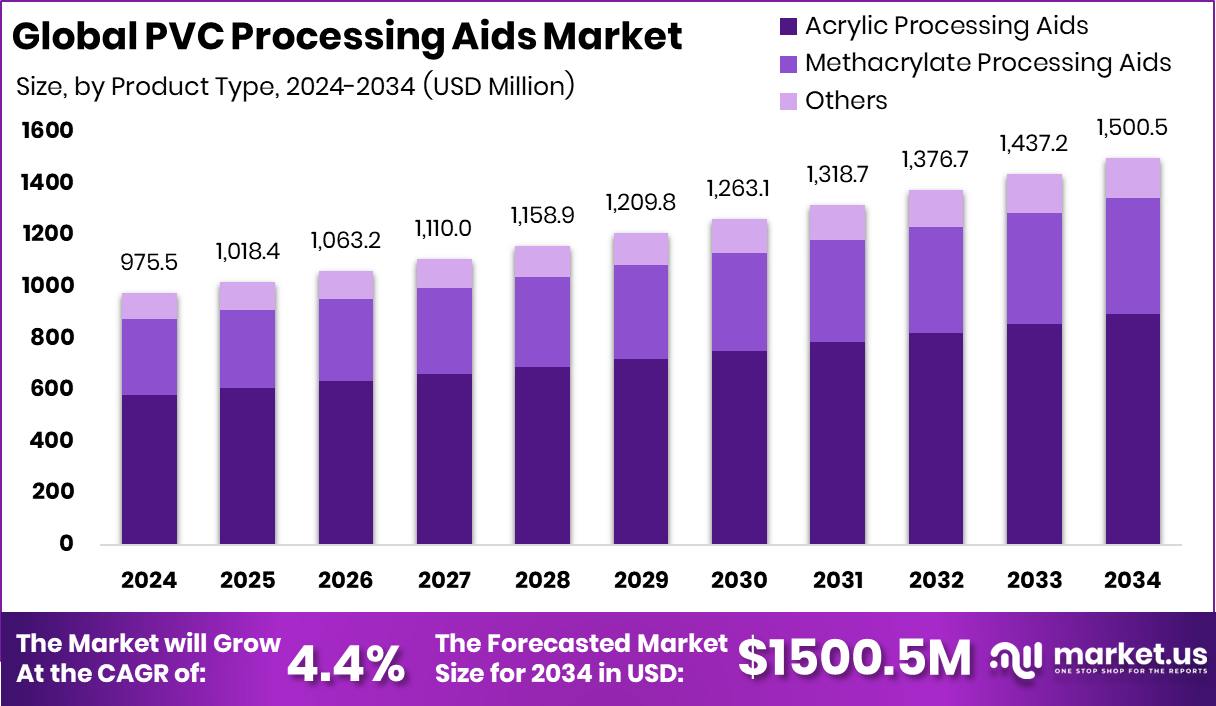

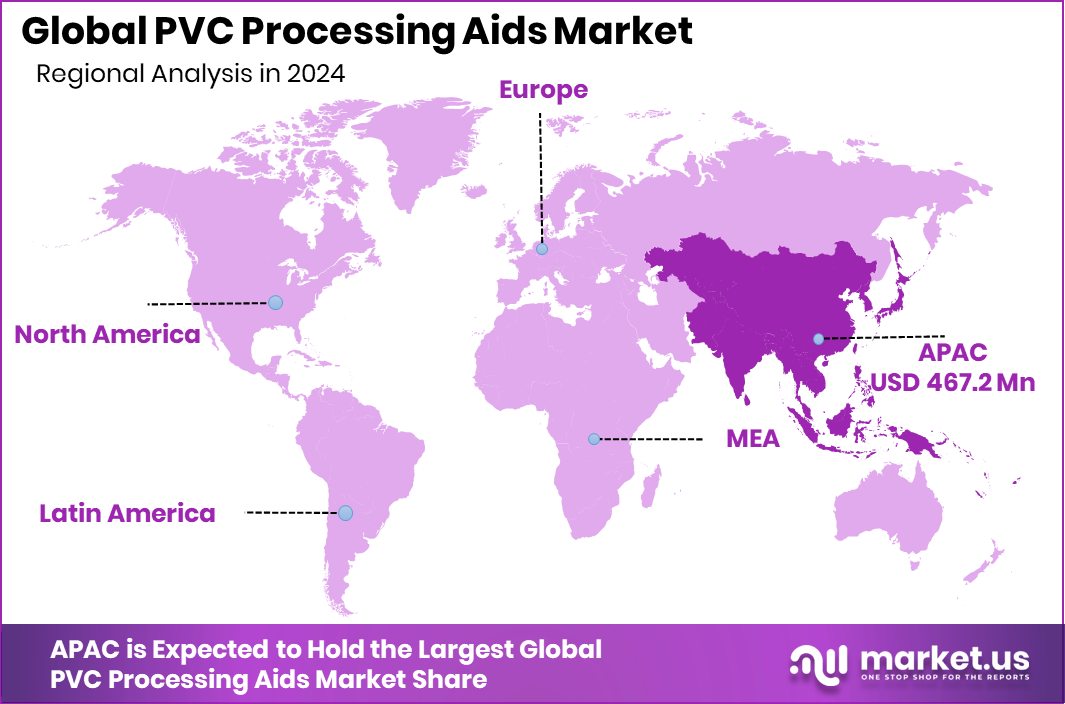

The Global PVC Processing Aids Market is expected to be worth around USD 1500.5 million by 2034, up from USD 975.5 million in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Asia Pacific accounted for 47.9%, valued at USD 467.2 Mn.

PVC Processing Aids are specialty additives used during the manufacturing of polyvinyl chloride (PVC) products. They help improve melt flow, fusion, surface finish, and mechanical strength during extrusion and molding. By enhancing process stability and reducing defects, these additives ensure consistent quality in finished PVC products such as pipes, sheets, cables, and profiles.

The PVC Processing Aids Market refers to the global trade and consumption of these additives across product types, including acrylic processing aids, methacrylate processing aids, and others. Demand is largely linked to PVC production volumes across applications like pipes and fittings, rigid sheets and panels, wires and cables, and various industrial uses. End-user industries such as building and construction, automotive, electrical and electronics, and packaging drive overall consumption.

Growth in this market is strongly supported by infrastructure development and pipe replacement programs. Erie’s $72M lead pipe replacement project and Massachusetts receiving nearly $93M in federal funding highlight ongoing investments in water systems. Additionally, the EBRD is providing €10 million to finance copper pipe production in Uzbekistan, which reflects a continued focus on pipeline infrastructure, indirectly supporting PVC pipe demand.

Demand remains steady due to expanding construction and renovation activities. Even institutional upgrades, such as the $900,000 required to fix Orleans Parish jail conditions, signal ongoing building maintenance needs. Opportunities lie in durable, cost-efficient PVC solutions that support modern infrastructure, energy systems, and long-term public utility upgrades.

Key Takeaways

- The Global PVC Processing Aids Market is expected to be worth around USD 1500.5 million by 2034, up from USD 975.5 million in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In the PVC Processing Aids Market, acrylic processing aids account for a 59.6% share.

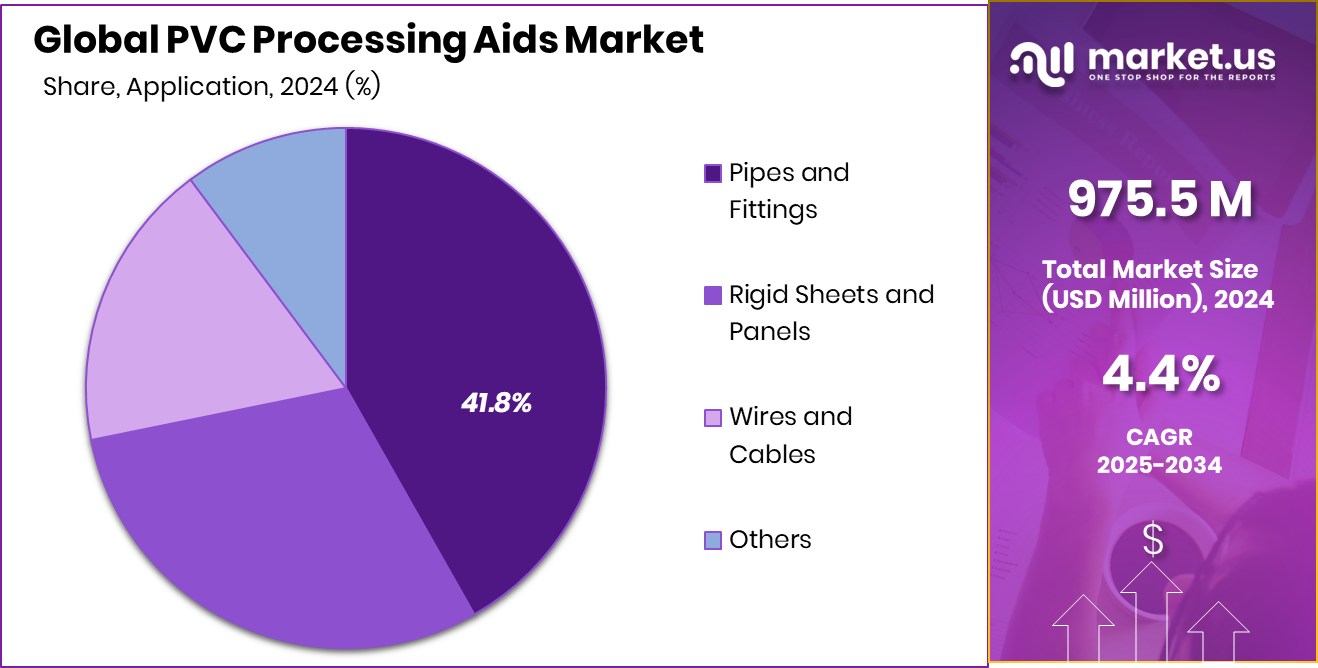

- Within the PVC Processing Aids Market, pipe and fitting applications hold a 41.8% share.

- Building and construction dominate the PVC Processing Aids Market with a 53.5% share.

- Asia Pacific PVC Processing Aids Market reached USD 467.2 Mn.

By Product Type Analysis

PVC Processing Aids Market sees Acrylic Processing Aids dominating with 59.6% share.

In 2024, Acrylic Processing Aids accounted for 59.6% of the PVC Processing Aids Market by product type, reflecting their strong preference among PVC manufacturers for enhancing melt strength, fusion rate, and surface finish. These additives play a critical role in improving processability during extrusion and molding, especially in rigid PVC applications. Acrylic-based solutions are widely adopted because they offer consistent thermal stability and better impact performance compared to alternative chemistries.

Manufacturers continue to favor acrylic processing aids due to their compatibility with high-output production lines and their ability to reduce cycle times. As construction-grade PVC demand remains steady across developing economies, the dominance of acrylic processing aids highlights the market’s focus on performance efficiency, cost optimization, and improved product durability in demanding applications.

By Application Analysis

PVC Processing Aids Market pipes and fittings application leads with 41.8% share.

In 2024, Pipes and Fittings represented 41.8% of the PVC Processing Aids Market by application, making it the leading segment. The strong share is driven by growing infrastructure development, urban housing projects, and water management initiatives worldwide. PVC pipes require enhanced flow properties and mechanical strength during production, which increases the need for high-quality processing aids. These additives help improve surface smoothness, dimensional stability, and impact resistance, which are essential for plumbing, irrigation, and drainage systems.

With governments investing in sanitation and water distribution networks, the demand for durable and corrosion-resistant PVC pipes remains high. As a result, processing aid consumption continues to rise in this segment, supported by steady construction activities and the replacement of aging metal piping systems.

By End-User Analysis

PVC Processing Aids Market: Building and construction end-users account for 53.5%.

In 2024, Building and Construction emerged as the dominant end-user segment, holding 53.5% of the PVC Processing Aids Market. The sector’s leadership is closely tied to the extensive use of PVC materials in windows, doors, siding, flooring, roofing membranes, and structural profiles. Processing aids are essential in ensuring smooth extrusion, high gloss finish, and long-term durability of these construction components.

Rapid urbanization, smart city developments, and renovation activities are supporting PVC demand across residential and commercial projects. Additionally, PVC’s cost-effectiveness, weather resistance, and low maintenance requirements make it a preferred material in modern construction. The significant share of the building and construction sector underscores its ongoing influence in shaping processing aid consumption trends across global PVC manufacturing industries.

Key Market Segments

By Product Type

- Acrylic Processing Aids

- Methacrylate Processing Aids

- Others

By Application

- Pipes and Fittings

- Rigid Sheets and Panels

- Wires and Cables

- Others

By End-User

- Building and Construction

- Automotive

- Electrical and Electronics

- Packaging

- Others

Driving Factors

Rising global infrastructure development projects

Rising global infrastructure development projects continue to support steady demand for PVC products, particularly in pipes, fittings, cables, and construction profiles. Large public investments signal long-term infrastructure commitments that indirectly benefit PVC processing materials. For example, Rwanda secured funding for a $100M cable car project, reflecting broader urban development and tourism infrastructure upgrades. Such projects require extensive electrical cabling, structural components, and supporting systems where PVC materials are widely used.

As governments prioritize modernization of transport networks, utilities, and smart city initiatives, PVC processors increase production capacity, leading to higher consumption of processing aids that enhance efficiency, surface quality, and durability. This ongoing infrastructure push across developing and developed economies remains a strong foundation for market expansion.

Restraining Factors

Volatile raw material price fluctuations

Volatile raw material price fluctuations remain a major challenge for manufacturers of PVC processing aids. Changes in feedstock and petrochemical costs directly impact production expenses and profit margins, creating uncertainty in pricing strategies. At the same time, broader financial movements across the cable and construction ecosystem influence investment patterns.

For instance, Cable One awarded over $125,000 in grants to support nonprofits, reflecting capital allocation priorities that may not directly focus on manufacturing expansion. When industry participants manage costs carefully amid economic fluctuations, procurement of additives and specialty materials can face cautious spending decisions. Such financial sensitivity and cost pressures may slow aggressive expansion plans and limit short-term purchasing volumes in the PVC processing value chain.

Growth Opportunity

Expansion in emerging construction economies

Expansion in emerging construction economies presents significant opportunities for PVC processing aids suppliers. Rapid urbanization, housing development, and infrastructure upgrades across Asia and other high-growth regions are increasing demand for PVC pipes, profiles, and cable insulation materials. Asia Pacific Wire & Cable launched a $33.9 million rights offering to fund expansion, signaling confidence in regional demand growth.

Capacity additions in wire and cable production translate into a greater need for stable, high-performance PVC compounds, thereby increasing processing aid consumption. As manufacturers invest in plant upgrades and new production lines, opportunities arise for advanced additive solutions that improve output rates, enhance fusion control, and reduce waste, strengthening long-term growth potential across emerging markets.

Latest Trends

Shift toward high-performance acrylic formulations

A noticeable shift toward high-performance acrylic formulations is shaping product development strategies in the PVC processing aids market. Manufacturers are increasingly focusing on improved melt strength, better surface finish, and enhanced weather resistance to meet evolving construction and cable industry standards. Investment activity across the broader cable sector highlights modernization trends.

Southern Cable launched a private placement to fund a RM129 million expansion plan, demonstrating ongoing production scaling and technology upgrades. As cable and construction material producers expand operations, demand grows for more efficient and consistent processing solutions. This trend encourages innovation in advanced acrylic processing aids designed to support higher throughput, improved product durability, and competitive manufacturing efficiency.

Regional Analysis

Asia Pacific dominated the PVC Processing Aids Market with 47.9% share.

The PVC Processing Aids Market demonstrates varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific emerged as the dominating region, accounting for 47.9% of the global market, valued at USD 467.2 Mn. The region’s leadership position reflects its strong manufacturing base and high PVC consumption across key industries.

North America and Europe continue to represent established markets, supported by stable demand from construction and infrastructure-related applications. Meanwhile, the Middle East & Africa and Latin America show steady participation in the global landscape, driven by ongoing urban and industrial development activities.

However, Asia Pacific clearly maintains a competitive advantage in terms of both volume and revenue contribution, supported by its 47.9% share and USD 467.2 Mn valuation. The regional distribution highlights the Asia Pacific’s dominant role in shaping overall market performance compared to other geographic segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arkema continues to position itself as a technology-driven supplier, focusing on specialty materials and high-performance polymer additives that enhance PVC processing efficiency and product durability. Its emphasis on innovation and application development allows it to maintain strong relationships with compounders and processors seeking consistent quality and improved output rates.

Dow remains a strategically important participant, leveraging its deep expertise in materials science and polymer chemistry. The company’s broad manufacturing footprint and integrated supply capabilities support stable product availability and technical service support for PVC manufacturers. Dow’s strength lies in balancing performance enhancement with process optimization, enabling customers to achieve better fusion control and surface finish.

ANEKA Belgium NV, while comparatively specialized, plays a focused role in delivering tailored processing aid solutions. Its agility and customer-centric approach allow it to serve niche and performance-sensitive applications. Collectively, these companies shape market competition through product innovation, technical collaboration, and consistent supply reliability in 2024.

Top Key Players in the Market

- Arkema

- Dow

- ANEKA Belgium NV

- Evonik Industries

- BASF

- Mitsubishi Chemical Group Corporation.

- Akdeniz Chemson.

- Shandong Hongfu Chemical Co. LTD

- Clariant

- Baerlocher GmbH

- SONGWON

Recent Developments

- In September 2025, Dow announced a new additive product called DOWSIL™ 5-1050 Polymer Processing Aid (PPA). This product is designed to help improve processing for film packaging by reducing melt defects and die build-up, offering manufacturers a non-fluoropolymer option that still delivers good extrusion quality.

- In May 2024, Arkema agreed to acquire Dow’s flexible packaging laminating adhesives business. This acquisition is expected to expand Arkema’s product portfolio into high-value adhesive applications, strengthen its commercial presence, and support growth in flexible packaging markets.

Report Scope

Report Features Description Market Value (2024) USD 975.5 Million Forecast Revenue (2034) USD 1500.5 Million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Acrylic Processing Aids, Methacrylate Processing Aids, Others), By Application (Pipes and Fittings, Rigid Sheets and Panels, Wires and Cables, Others), By End-User (Building and Construction, Automotive, Electrical and Electronics, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, Dow, ANEKA Belgium NV, Evonik Industries, BASF, Mitsubishi Chemical Group Corporation., Akdeniz Chemson., Shandong Hongfu Chemical Co. LTD, Clariant, Baerlocher GmbH, SONGWON Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  PVC Processing Aids MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

PVC Processing Aids MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema

- Dow

- ANEKA Belgium NV

- Evonik Industries

- BASF

- Mitsubishi Chemical Group Corporation.

- Akdeniz Chemson.

- Shandong Hongfu Chemical Co. LTD

- Clariant

- Baerlocher GmbH

- SONGWON