Global Power Over Ethernet Market Size, Share, Industry Analysis Report By Type (Power Sourcing Equipment Controllers and ICs, Powered Device Controllers and ICs), By Application (Connectivity, Security and Access Control, Infotainment, LED Lighting and Control, Others), By End Use (Commercial, Industrial, Residential), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162871

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- PoE Adoption and Use

- Investment and Business Benefits

- U.S. Market Size

- Type Analysis

- Application Analysis

- End Use Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

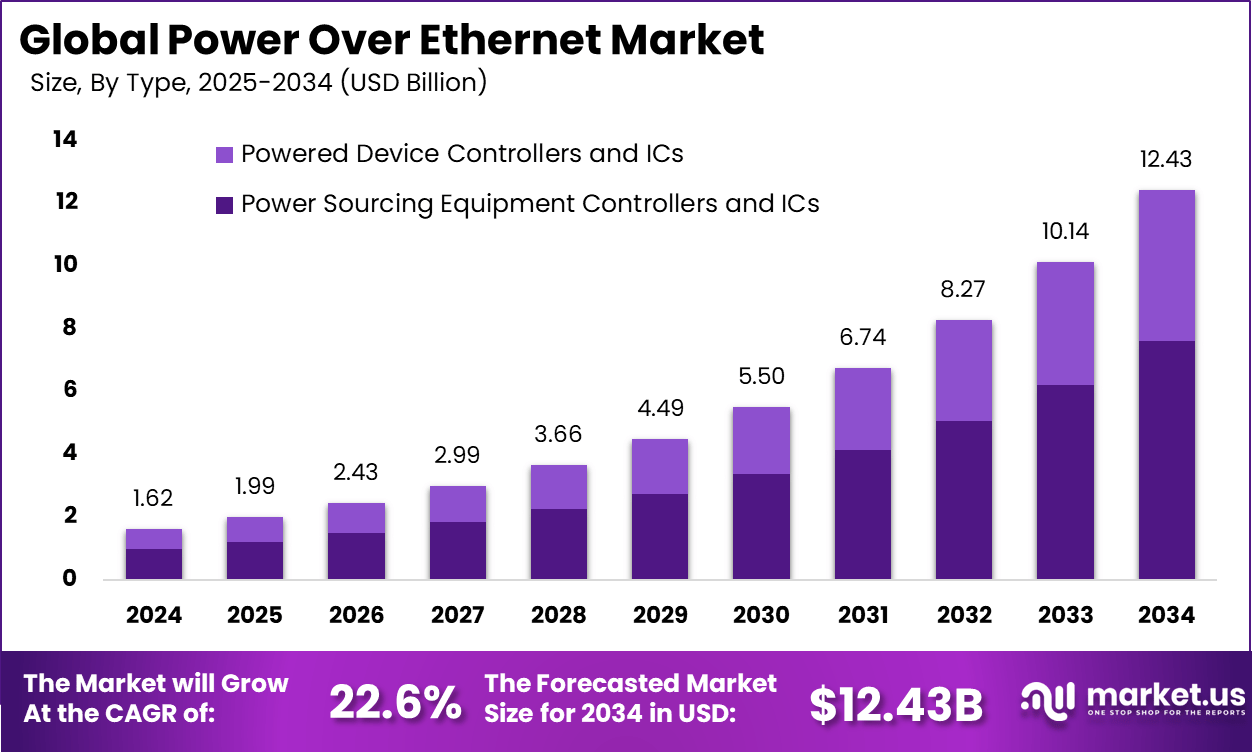

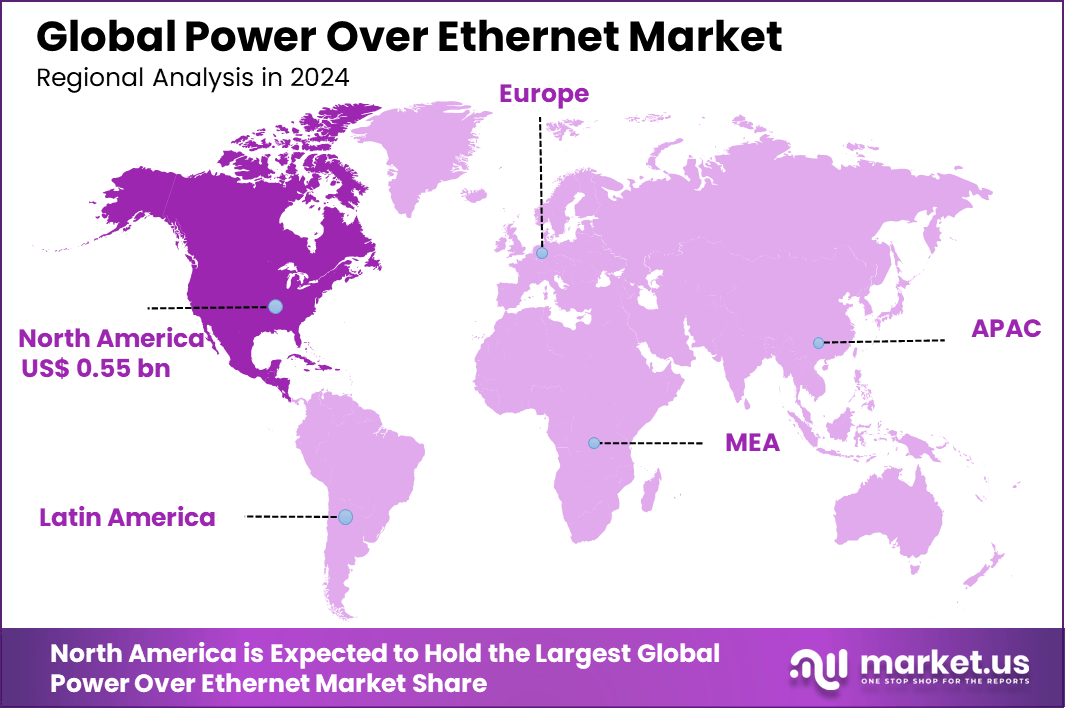

The Global Power Over Ethernet Market size is expected to be worth around USD 12.43 billion by 2034, from USD 1.62 billion in 2024, growing at a CAGR of 22.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 0.55 billion in revenue.

Power Over Ethernet (PoE) is a technology that allows electrical power and data to be transmitted over a single Ethernet cable. This innovation simplifies network installation by eliminating the need for separate power supplies for devices, making it a practical solution for powering devices like IP cameras, wireless access points, and VoIP phones. PoE is widely used in commercial buildings, smart homes, and industrial settings due to its efficiency and scalability.

The top driving factors for PoE adoption include the growing demand for unified connectivity in smart infrastructure, which allows buildings and enterprises to reduce installation costs and energy usage. The ability to deliver power and data through one cable enables faster deployments and easier maintenance. Additionally, the rise in connected devices and the expansion of smart city projects have spurred demand for PoE solutions by providing energy-efficient and scalable network infrastructure.

The market for Power Over Ethernet (PoE) is driven by the increasing adoption of IoT devices and smart building solutions. PoE simplifies the installation of connected devices like IP cameras, wireless access points, and smart lighting by supplying both power and data through a single Ethernet cable. This reduces infrastructure costs and enhances network flexibility, making it popular across commercial and industrial sectors.

For instance, In June 2025, Innoviz Technologies Ltd. launched the InnovizSMART Long-Range LiDAR sensor, aimed at smart applications such as security, mobility, robotics, aerial systems, and smart traffic management. The solution delivers automotive-grade performance with long-range capability and includes native Power over Ethernet (PoE) support to enable easy deployment and maintenance in urban environments.

Demand for PoE is heavily driven by its application in smart building automation, IP surveillance systems, and digital signage. The technology supports devices that need reliable energy without complex wiring. Moreover, PoE facilitates centralized power management, which improves uptime and reduces troubleshooting efforts in enterprise networks. Industries adopting IoT devices are increasingly reliant on PoE for seamless device integration and network flexibility.

For instance, in September 2025, Brilliant NextGen Inc., headquartered in San Mateo, California, announced the launch of its Power Over Ethernet (PoE) smart home controls professional line. This innovative system delivers both power and data through a single CAT5/6 cable, simplifying installations by eliminating the need for licensed electricians and allowing flexible mounting options beyond traditional switch locations.

Key Takeaway

- The Power Sourcing Equipment (PSE) Controllers and ICs segment dominated with 61.2%, driven by increasing integration of PoE controllers in network switches and routers for efficient power delivery.

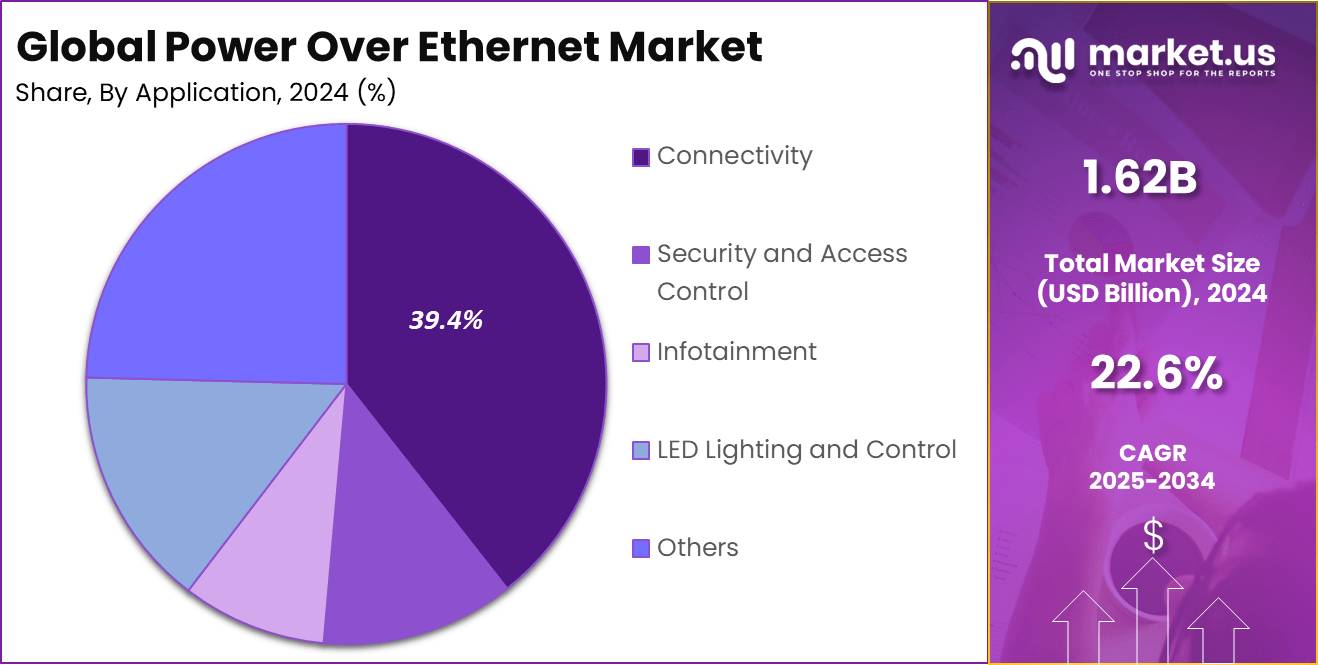

- The Connectivity segment accounted for 39.4%, reflecting growing demand for unified power and data transmission solutions across smart building and enterprise networks.

- The Commercial segment led with 68.5%, supported by the widespread use of PoE in office automation, IP telephony, and intelligent lighting systems.

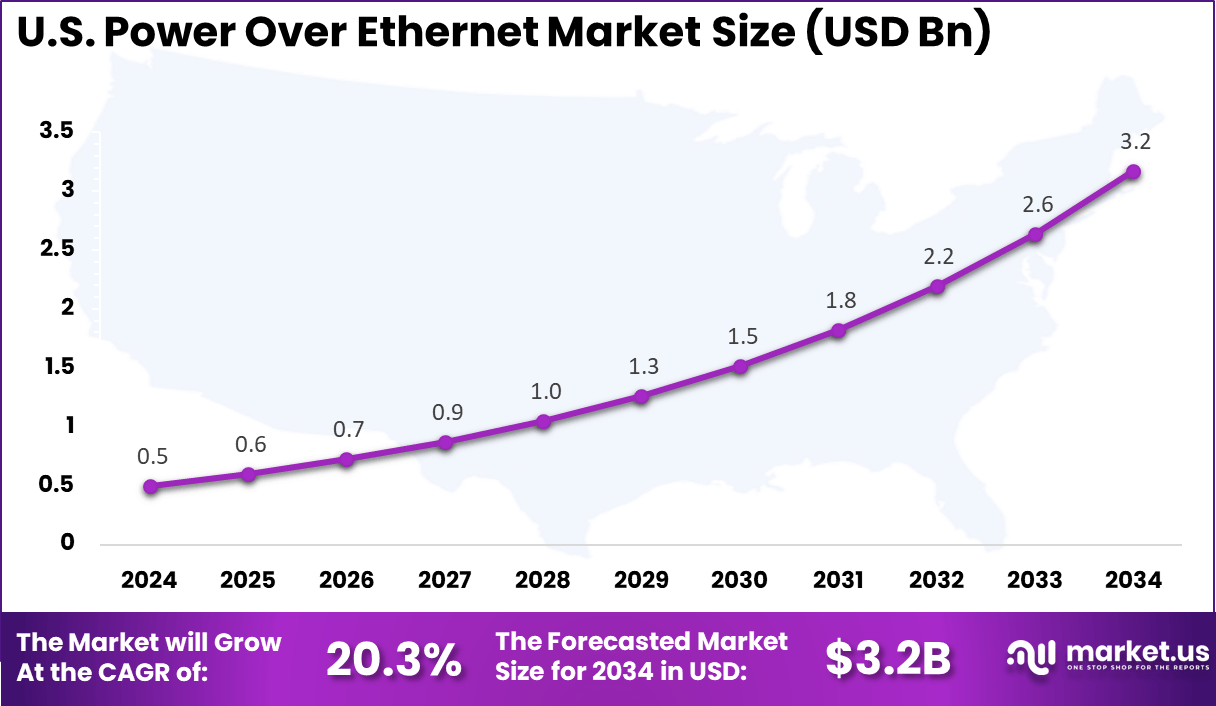

- The US market reached USD 0.5 Billion in 2024, registering a strong 20.3% CAGR, fueled by rapid digital infrastructure development and growing adoption of smart workplace technologies.

- North America held a dominant 34% share of the global market, supported by advanced IT infrastructure, early PoE standard implementation, and high enterprise network modernization investments.

Role of Generative AI

Generative AI is playing an increasing role in managing and optimizing PoE networks. Nearly 40% of enterprises now use AI to monitor power use and predict faults in PoE systems. This helps avoid unexpected failures by identifying potential issues before they cause problems, improving network reliability, and reducing downtime.

Furthermore, AI-driven power management allows PoE systems to allocate energy more efficiently, contributing to energy savings of up to 25%. By automatically adjusting power delivery based on device needs, generative AI ensures the network runs smoothly while cutting unnecessary power consumption, which also reduces operational expenses.

PoE Adoption and Use

- Common applications: Power over Ethernet (PoE) is widely adopted to supply both power and data to networked devices. Typical applications include IP phones, wireless access points, IP cameras, card readers, LED lighting systems, and IoT sensors, making it a cornerstone of modern connected infrastructure.

- Key benefits: The most significant advantages of PoE are simplified installation and lower deployment costs, as a single cable can deliver both power and data. This eliminates the need for additional electrical wiring and reduces installation complexity.

- Market penetration: Adoption is expanding as PoE-enabled end-point devices are frequently added during new network deployments or switch upgrades. This integration process makes it convenient and cost-effective for organizations to extend PoE capabilities.

- Interoperability: The IEEE PoE standards play a critical role by ensuring interoperability. Devices from different manufacturers can operate seamlessly within the same PoE ecosystem, fostering a more open and scalable market environment.

Investment and Business Benefits

Investment opportunities in PoE lie mainly in developing higher wattage standards, energy-efficient ICs, and PoE switches with built-in security features. The technology’s integration with AI-powered network management tools can optimize power consumption and predict maintenance needs.

Growing markets such as smart cities, healthcare IoT, and industrial IoT offer substantial growth avenues for manufacturers and service providers. Business benefits of PoE include lower installation and operational costs, increased energy efficiency, and enhanced network flexibility.

It also supports sustainability goals by reducing electrical wiring waste and enabling energy-saving features such as smart lighting control. Enterprises report up to a 25% reduction in their energy bills after adopting PoE lighting systems, alongside improved network resilience.

U.S. Market Size

The market for Power Over Ethernet within the U.S. is growing tremendously and is currently valued at USD 0.5 billion, the market has a projected CAGR of 20.3%. The growth is due to the increasing demand for efficient network infrastructure in smart buildings and enterprises.

The rising deployment of PoE-powered wireless access points, IP security cameras, and VoIP systems plays a pivotal role, as these solutions simplify installations and reduce power cabling costs. Additionally, smart city projects and IoT adoption accelerate market expansion. U.S. companies are investing in high-power PoE standards such as IEEE 802.3bt to support energy-hungry applications.

For instance, in October 2025, Broadcom Inc. showcased major advancements in AI networking solutions at the 2025 Open Compute Project Global Summit in San Jose. They introduced next-gen Ethernet switches, including Tomahawk 6 and Jericho4, designed to handle high-bandwidth AI workloads efficiently, highlighting Broadcom’s leadership in scalable, power-efficient AI infrastructure networking.

In 2024, North America held a dominant market position in the Global Power Over Ethernet Market, capturing more than a 34% share, holding USD 0.55 billion in revenue. This dominance is due to the region’s advanced technology infrastructure and high adoption rates of smart building and IoT solutions.

Ongoing investments in network modernization, widespread deployment of PoE-enabled devices like security cameras and wireless access points, and strong government support for energy-efficient technologies contribute to its market strength. These factors collectively drive North America’s leading position in the PoE sector.

For instance, in July 2025, Microchip Technology Inc. announced a strategic partnership with Delta Electronics to develop silicon carbide (SiC) power management solutions. This collaboration aims to accelerate sustainable PoE applications by leveraging Microchip’s mSiC technology, addressing growing power efficiency and reliability demands across AI, automation, and electrification markets.

Type Analysis

In 2024, The Power Sourcing Equipment Controllers and ICs segment held a dominant market position, capturing a 61.2% share of the Global Power Over Ethernet Market. This segment includes critical components responsible for supplying power through Ethernet cables to connected devices, such as PoE switches and injectors.

The importance of this segment lies in its role in enabling efficient and reliable power delivery, supporting the growing number of networked devices in both commercial and industrial environments. The demand for intelligent, scalable controllers is growing as organizations expand smart building infrastructure and data centers. These controllers help manage the balance of power and data flow, improving operational efficiency and reducing the need for additional cabling.

For Instance, in October 2025, STMicroelectronics advanced its power solutions with a new compact 12kW power delivery board showcased at the Open Compute Project (OCP) 2025 event. This development highlights STMicroelectronics’ focus on efficient power sourcing equipment controllers supporting high-performance PoE applications.

Application Analysis

In 2024, the Connectivity segment held a dominant market position, capturing a 39.4% share of the Global Power Over Ethernet Market. This refers to the use of PoE technology to power network devices such as IP cameras, wireless access points, and VoIP phones, which all rely on seamless connectivity without separate power sources.

The appeal of PoE in connectivity lies in its ability to consolidate power and data over a single cable, simplifying network setups. The segment benefits from the trend toward network modernization and enhanced communication capabilities across industries.

Businesses favor PoE connectivity because it minimizes installation costs and offers flexible deployment options for growing networks, especially in offices and public spaces that require robust, reliable communication systems.

For instance, in April 2025, Axis Communications expanded its IoT capabilities with powerful edge devices such as AI-enabled recording servers and multifunctional network speakers that leverage PoE for simplified network integration and enhanced connectivity.

End Use Analysis

In 2024, The Commercial segment held a dominant market position, capturing a 68.5% share of the Global Power Over Ethernet Market. Commercial buildings, including offices, retail outlets, and hospitality venues, widely use PoE for powering communication and security devices, lighting, and smart building systems.

The major drivers include cost savings from reduced cabling and simplified device installations. Commercial environments continue to adopt PoE solutions to support energy-efficient infrastructure and scalable network designs. The flexibility of PoE aligns with the dynamic needs of commercial enterprises, making this sector the largest and most influential user of Power over Ethernet technology.

For Instance, in March 2025, Monolithic Power Systems showcased an extensive PoE product portfolio capable of supporting power levels up to 71.3W, enabling high-performance and efficient network solutions tailored for commercial environments.

Emerging Trends

Advanced PoE standards are gaining traction as device density surges. In the U.S., 58% of recently installed smart office networks use IEEE 802.3bt PoE switches to power high-wattage edge devices like Wi-Fi 6E routers and LED lighting panels. This trend is enabling greater adoption of automation-enabled IoT infrastructure, with installers demanding improved efficiency and flexibility.

A notable 44% of North American data centers are investing in PoE-based liquid cooling and modular rack setups to cut energy use and maintain uptime. This shift reflects a growing preference for scalable, cost-effective network deployment models, accommodating decentralized cloud workloads and boosting energy savings.

Growth Factors

The growth of digital workplaces is driving PoE adoption for powering smart access controls and collaborative tools. Over 62% of newly constructed U.S. offices use integrated PoE networks for desk sensors and meeting room panels, reflecting a strong move toward unified, low-power connectivity. These flexible systems offer seamless upgrades without major rewiring.

Increasing IoT device density is a major catalyst. Roughly 35% more sensor devices were added to manufacturing facilities in North America in 2024 compared to the prior year, with most powered by PoE cabling for centralized management. This rising adoption provides facilities with real-time data visibility, which strengthens operational resilience.

Key Market Segments

By Type

- Power Sourcing Equipment Controllers and ICs

- Powered Device Controllers and ICs

By Application

- Connectivity

- Security and Access Control

- Infotainment

- LED Lighting and Control

- Others

By End Use

- Commercial

- Industrial

- Residential

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for IoT and Smart Building Devices

The increasing adoption of IoT devices and smart building technologies is driving the market for Power over Ethernet. These devices, including security cameras, wireless access points, and smart lighting, need both power and data connectivity, which PoE conveniently provides through a single cable. This integration simplifies setup and lowers infrastructure costs, making it a favored choice for enterprises and institutions looking for efficient network solutions.

Organizations are focused on digital transformation and operational efficiency, which further accelerates PoE adoption. The technology’s ability to reduce cabling complexity and maintenance efforts enhances network scalability and flexibility. Growing smart city projects and industrial automation also contribute to this rising demand.

For instance, in October 2025, STMicroelectronics advanced its power solutions with a compact power delivery board compliant with PoE standards, designed for efficient smart building applications. This development simplifies powering IoT devices over Ethernet cables, supporting the increasing need for integrated smart devices in modern infrastructure.

Restraint

Power Delivery Limitations for High-Energy Devices

One significant limitation holding back Power over Ethernet’s wider use is its restricted power delivery capability. Even advanced PoE standards have caps on how much power they can supply, which is insufficient for certain high-energy-consuming equipment commonly found in industrial or medical applications. This limits PoE’s applicability in sectors requiring robust power solutions.

Moreover, higher power transmission creates technical challenges such as heat buildup within network hardware, potentially affecting reliability and lifespan. These engineering hurdles add cost and complexity, making some organizations hesitant to fully depend on PoE for power-intensive use cases.

For instance, in March 2025, Monolithic Power Systems emphasized their PoE ICs optimized for power efficiency and integration but acknowledged the inherent power limits on devices supported by PoE standards. While offering solutions up to certain wattages, this reflects ongoing constraints for powering high-energy applications fully reliant on PoE.

Opportunities

Expansion into Smart Lighting and 5G Infrastructure

Smart lighting systems and 5G infrastructure deployment provide notable growth avenues for Power over Ethernet technology. PoE is increasingly chosen to power LED lighting because of energy efficiency and control benefits through centralized management. As commercial buildings adopt smart lighting, PoE offers a streamlined, cost-effective power solution.

The rollout of 5G networks is also driving demand for PoE to power wireless access points and small cell deployments. PoE simplifies network expansion by reducing the need for separate electrical wiring, which is especially beneficial in dense urban environments. These sectors represent a promising future for PoE adoption.

For instance, in September 2025, Axis Communications launched multisensory technologies compatible with PoE for smarter security systems, underscoring the growth potential for PoE in intelligent lighting and building management. Their products enable efficient, centralized power delivery, supporting expansion into smart lighting applications.

Challenges

Interoperability and Standardization Issues

Interoperability between different PoE standards and multi-vendor equipment remains a challenge for seamless deployment. The existence of various PoE protocols, each with distinct power levels and communication methods, can complicate integration and cause compatibility problems. This lack of uniformity leads to increased installation times and potential system inefficiencies.

In large network setups, especially those incorporating devices from multiple manufacturers, ensuring smooth operation demands stringent adherence to standards and extensive testing. This fragmentation delays broader acceptance and necessitates additional investment in network planning and support to avoid issues.

For instance, in April 2025, Axis Communications released updates improving PoE management and configuration software to address integration challenges amidst diverse device ecosystems. This demonstrates efforts to resolve interoperability issues critical to smooth PoE deployments.

Key Players Analysis

The Power Over Ethernet (PoE) Market is led by semiconductor and networking giants such as STMicroelectronics, Broadcom, Microchip Technology Inc., and Texas Instruments Incorporated. These companies supply advanced PoE controllers, ICs, and transceivers that deliver efficient power and data transmission over Ethernet cables.

Prominent connectivity and device manufacturers such as Axis Communications AB, Semiconductor Components Industries, LLC, Silicon Laboratories, and Monolithic Power Systems, Inc. focus on integrating PoE solutions into networked systems to simplify installation and reduce infrastructure costs. Their innovations enhance reliability and scalability in enterprise networks, industrial automation, and smart building applications.

Additional contributors including MSTronic Co., Ltd, Cisco Systems, Inc., and other key participants strengthen the market through comprehensive PoE-enabled networking equipment, switches, and infrastructure solutions. Their continued investment in high-power PoE (up to 100W), intelligent power management, and hybrid fiber-Ethernet systems supports the growing demand for connected devices and energy-efficient network architectures globally.

Top Key Players in the Market

- STMicroelectronics

- Broadcom

- Microchip Technology Inc.

- Axis Communications AB

- Texas Instruments Incorporated

- Semiconductor Components Industries, LLC

- Silicon Laboratories

- Monolithic Power Systems, Inc.

- MSTronic Co., Ltd

- Cisco Systems, Inc.

- Others

Recent Developments

- In October 2025, STMicroelectronics released new PoE integrated circuits (ICs) specifically designed for powered devices compliant with IEEE 802.3at and IEEE 802.3af standards. Their PM880x family simplifies power supply design with integrated PoE interfaces, targeting telecom and mid-power applications with capabilities up to 99.9W.

- In August 2025, Shade Innovations (SI), known for motorized window coverings and outdoor shading solutions, launched its new 1000-Watt Power over Ethernet (PoE) Switch, which delivers industry-leading power capacity at just 25% of the cost of comparable products.

Report Scope

Report Features Description Market Value (2024) USD 1.62 Bn Forecast Revenue (2034) USD 12.4 Bn CAGR(2025-2034) 22.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Power Sourcing Equipment Controllers and ICs, Powered Device Controllers and ICs), By Application (Connectivity, Security and Access Control, Infotainment, LED Lighting and Control, Others), By End Use (Commercial, Industrial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape STMicroelectronics, Broadcom, Microchip Technology Inc., Axis Communications AB, Texas Instruments Incorporated, Semiconductor Components Industries, LLC, Silicon Laboratories, Monolithic Power Systems, Inc., MSTronic Co., Ltd, Cisco Systems, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Power Over Ethernet MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Power Over Ethernet MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- STMicroelectronics

- Broadcom

- Microchip Technology Inc.

- Axis Communications AB

- Texas Instruments Incorporated

- Semiconductor Components Industries, LLC

- Silicon Laboratories

- Monolithic Power Systems, Inc.

- MSTronic Co., Ltd

- Cisco Systems, Inc.

- Others