Global Polyol Sweetener Market Size, Share Analysis Report By Product (Sorbitol, Xylitol, Mannitol, Maltitol, Isomalt, Others), By Form (Powder, Liquid), By Function (Flavoring and Sweetening Agents, Bulking Agents, Excipients, Humectants, Others), By Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152846

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

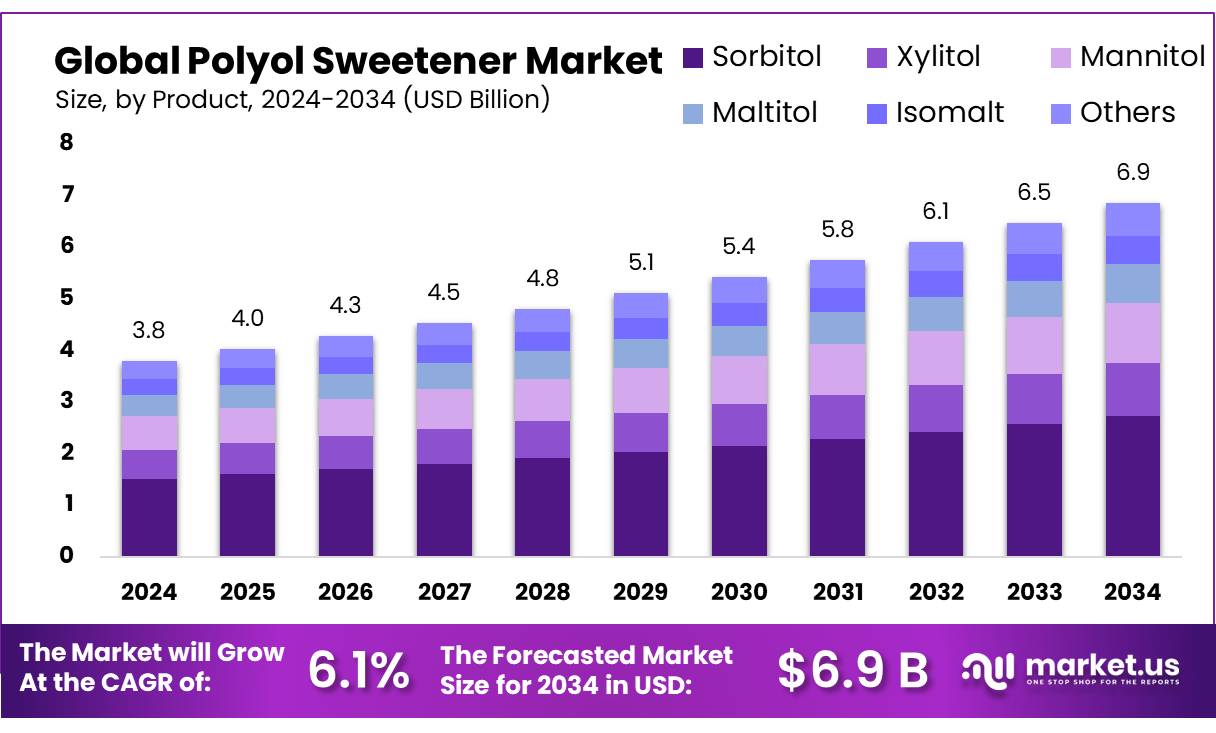

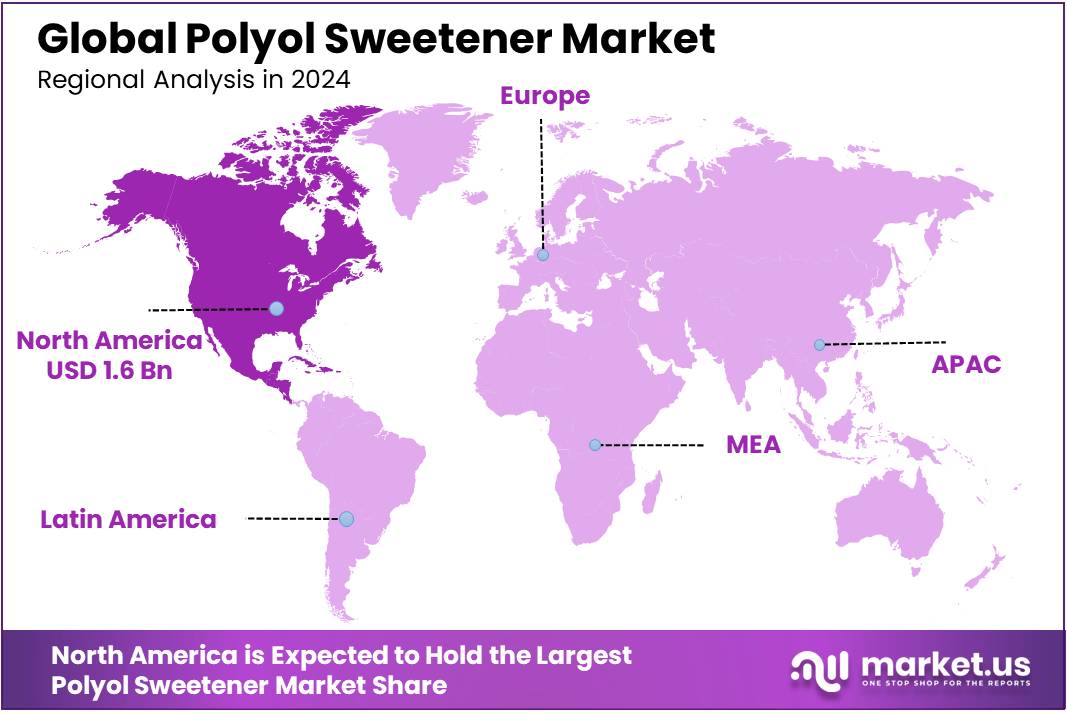

The Global Polyol Sweetener Market size is expected to be worth around USD 6.9 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 44.6% share, holding USD 1.6 Billion revenue.

Polyol sweeteners, also known as sugar alcohols, are carbohydrate-derived low-calorie sweetening agents widely used in food and beverage applications. They include erythritol, xylitol, sorbitol, maltitol, isomalt, and mannitol. These compounds deliver bulk and flavor comparable to sucrose while exerting a minimal impact on glycemic response. According to the UK Food & Drink Federation, polyols provide approximately 2.4 kcal/g (10 kJ/g), with erythritol offering virtually zero calories (0kJ/g). Their dual function as bulking agents and low-calorie sweeteners makes them ideal substitutes in sugar reduction formulations.

The U.S. Food and Drug Administration (FDA) has acknowledged polyols as safe for human consumption, with guidelines on their usage in various food categories. The increased regulatory support for polyol-based products is further bolstering their market growth. Additionally, the European Union (EU) has adopted regulatory frameworks ensuring the quality and safety of polyol sweeteners in food products, offering added confidence for food manufacturers.

Key industrial drivers include escalating consumer health consciousness, rising rates of diabetes and obesity, and proactive government regulations aimed at reducing added sugar parameters. In Europe, Regulation EC 1129/2011 and Regulation 1333/2008 authorize polyols under “quantum satis” conditions in food applications, with specific limits to address laxative concerns from excessive consumption. In the United States, sugar regulation initiatives, particularly the USDA’s Feedstock Flexibility Program, incentivize the diversion of surplus sugar to alternative sweetening agents and ethanol, indirectly stimulating demand for sugar substitutes.

Future growth opportunities for the polyol sweetener concentrates market are vast, with substantial potential in emerging markets where the prevalence of obesity and diabetes is rising. According to the International Diabetes Federation (IDF), the number of people with diabetes is expected to reach 700 million by 2045, particularly in low- and middle-income countries. This creates a substantial opportunity for polyol sweeteners in these regions, as consumers seek healthier alternatives to sugar.

Key Takeaways

- Polyol Sweetener Market size is expected to be worth around USD 6.9 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 6.1%.

- Sorbitol held a dominant market position, capturing more than a 39.7% share in the global polyol sweetener market.

- Powder held a dominant market position, capturing more than a 72.3% share in the global polyol sweetener market.

- Flavoring & Sweetening Agents held a dominant market position, capturing more than a 52.6% share in the global polyol sweetener market.

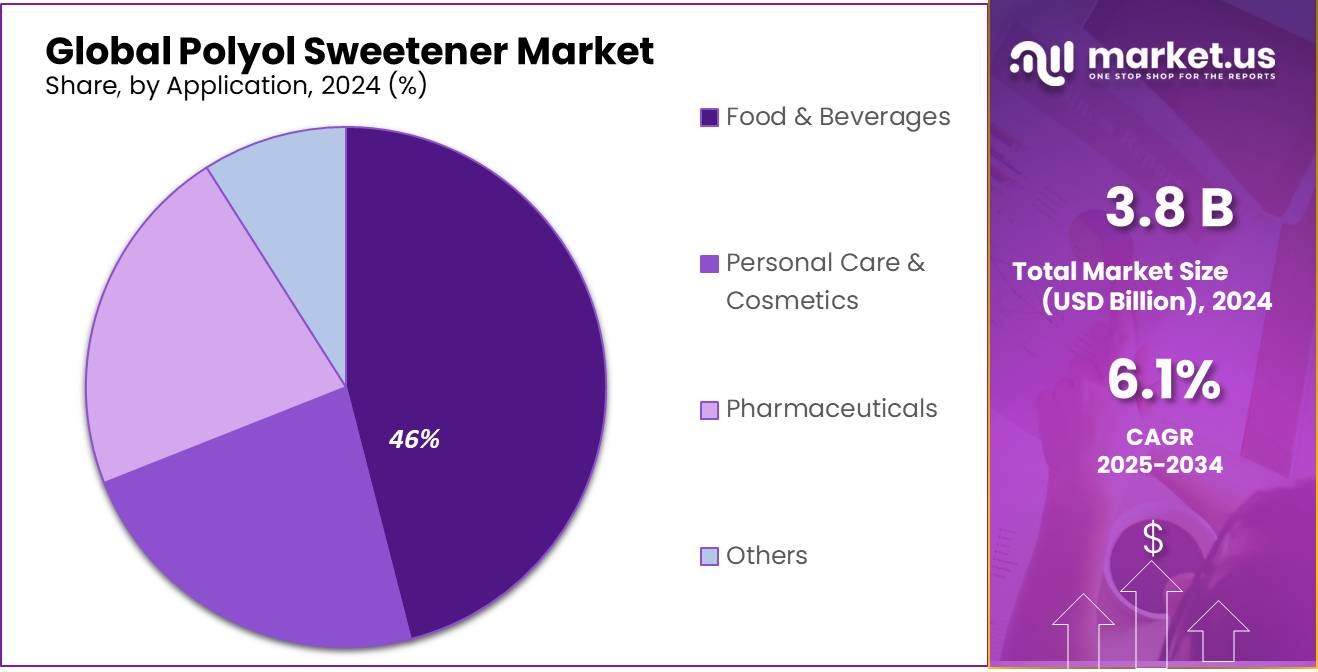

- Food & Beverages held a dominant market position, capturing more than a 46.5% share in the global polyol sweetener market.

- North America held a dominant position in the global polyol sweetener market, capturing approximately 44.6% of the total market share, which translates to a market value of USD 1.6 billion.

By Product Analysis

Sorbitol Leads with 39.7% Share Owing to Its Versatile Use in Food and Pharma

In 2024, Sorbitol held a dominant market position, capturing more than a 39.7% share in the global polyol sweetener market by product grade. This leading position is driven by its wide application in sugar-free and diabetic-friendly food products, beverages, chewing gums, and oral care products. As a low-calorie sweetener with moisture-retaining and texturizing properties, sorbitol has become a preferred ingredient in the formulation of candies, baked goods, and syrups. Additionally, its usage in pharmaceutical products as a stabilizer and humectant—especially in cough syrups and chewable tablets—has strengthened demand from the healthcare sector.

By Form Analysis

Powder Form Dominates with 72.3% Share Due to Its Stability and Versatility

In 2024, Powder held a dominant market position, capturing more than a 72.3% share in the global polyol sweetener market by form. This strong preference is mainly due to the powder form’s ease of handling, long shelf life, and better stability under various storage and transportation conditions. Powdered polyol sweeteners are widely used in the production of bakery goods, confectionery, dairy products, and powdered drink mixes, where they blend easily with dry ingredients and provide consistent texture and sweetness.

By Function Analysis

Flavoring & Sweetening Agents Lead with 52.6% Share Due to Growing Demand for Sugar-Free Products

In 2024, Flavoring & Sweetening Agents held a dominant market position, capturing more than a 52.6% share in the global polyol sweetener market by function. This strong presence is largely due to the increasing demand for sugar-free, low-calorie, and diabetic-friendly food and beverage products. Polyol sweeteners, such as sorbitol, xylitol, and maltitol, are widely used not just for their sweetness but also for their ability to enhance flavor, mask bitterness, and improve mouthfeel. These properties make them ideal substitutes for traditional sugars in a wide range of applications including confectionery, dairy, beverages, and pharmaceuticals.

By Application Analysis

Food & Beverages Dominate with 46.5% Share Due to Rising Demand for Sugar Alternatives

In 2024, Food & Beverages held a dominant market position, capturing more than a 46.5% share in the global polyol sweetener market by application. This leadership is mainly driven by the rising demand for healthier, low-sugar, and low-calorie food and drink products. Polyol sweeteners such as sorbitol, xylitol, and erythritol are extensively used in bakery items, confectionery, dairy products, and beverages to replicate the sweetness of sugar while offering added benefits like improved texture, moisture retention, and lower glycemic impact.

Key Market Segments

By Product

- Sorbitol

- Xylitol

- Mannitol

- Maltitol

- Isomalt

- Others

By Form

- Powder

- Liquid

By Function

- Flavoring & Sweetening Agents

- Bulking Agents

- Excipients

- Humectants

- Others

By Application

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Others

Emerging Trends

Surge in Clean Label and Natural Ingredient Preferences

A notable trend in the polyol sweetener market is the increasing consumer preference for clean label and natural ingredients. Consumers are becoming more health-conscious and are seeking products with minimal processing and transparent ingredient lists. This shift is driving food manufacturers to adopt polyol sweeteners derived from natural sources, such as corn and fruits, to meet consumer demand for products perceived as healthier and more natural.

The U.S. Department of Agriculture (USDA) has observed a growing trend towards natural and minimally processed foods, reflecting a broader consumer movement towards clean eating. This trend is influencing the sweetener industry, with an increasing number of food and beverage products incorporating polyol sweeteners as natural alternatives to traditional sugars. For instance, xylitol, a polyol sweetener, is derived from birch wood and corn cobs, aligning with the demand for plant-based and natural ingredients.

In response to this trend, food manufacturers are reformulating products to include polyol sweeteners, thereby reducing added sugars and appealing to health-conscious consumers. This shift not only caters to consumer preferences but also aligns with regulatory guidelines promoting reduced sugar intake. The USDA’s Dietary Guidelines for Americans emphasize the importance of reducing added sugars in the diet, further encouraging the use of alternative sweeteners like polyols.

As the demand for clean label products continues to rise, the polyol sweetener market is expected to expand, driven by consumer preferences for natural and minimally processed ingredients. This trend presents significant growth opportunities for polyol sweeteners, positioning them as key ingredients in the development of healthier food and beverage options.

Drivers

Increasing Health Consciousness and Rising Demand for Sugar Alternatives

One of the key driving factors for the growth of the polyol sweetener market is the rising health consciousness among consumers, combined with a growing demand for healthier, sugar-free alternatives in food and beverages. With the increasing prevalence of obesity, diabetes, and other diet-related health issues, consumers are becoming more aware of the health risks associated with high sugar consumption. According to the World Health Organization (WHO), nearly 2 billion adults worldwide are overweight, and 650 million are obese. This alarming rise in obesity rates has prompted a shift toward healthier dietary choices, including the adoption of sugar substitutes like polyol sweeteners.

Polyol sweeteners such as sorbitol, xylitol, and erythritol provide a lower-calorie alternative to sugar without compromising taste. They are also non-cariogenic, meaning they do not contribute to tooth decay, making them especially appealing to health-conscious individuals and those concerned about dental health. The growing demand for sugar-free products, particularly in the confectionery, dairy, and beverage sectors, is a direct response to these concerns. A report from the U.S. Centers for Disease Control and Prevention (CDC) states that sugar intake among Americans has significantly decreased over the last decade, with many consumers turning to alternatives like polyols for their sweetening needs.

Government initiatives are also playing a crucial role in promoting the adoption of polyol sweeteners. The U.S. Department of Agriculture (USDA) has been actively involved in campaigns to reduce sugar intake, encouraging food manufacturers to use sugar substitutes in their products. Additionally, the WHO’s global guidelines recommend reducing added sugar to less than 10% of total energy intake, which further boosts the demand for sugar alternatives like polyols.

Restraints

High Cost of Production and Limited Availability

A significant restraining factor for the growth of the polyol sweetener market is the high cost of production and the limited availability of raw materials required for their manufacturing. Polyol sweeteners are derived from sugars such as glucose, fructose, or corn syrup, which undergo complex chemical processes to transform into sugar alcohols.

These processes involve expensive production methods, which contribute to the higher price point of polyol-based products compared to traditional sugars. The raw materials used to produce polyols, such as corn and wheat, are also subject to fluctuations in price due to factors like weather conditions, agricultural yields, and transportation costs.

According to the U.S. Department of Agriculture (USDA), the cost of corn has seen significant fluctuations over the years, directly impacting the price of glucose, a key ingredient in polyol production. For example, in 2022, the average price of corn in the U.S. was reported at US$ 6.75 per bushel, which marked a rise from previous years. This increase in raw material costs translates to higher production costs for polyol manufacturers, which, in turn, raises the price of final products for consumers.

Furthermore, the manufacturing processes for polyols often require specialized equipment and adhere to stringent quality control standards, which also contribute to higher operational costs. These high costs can limit the widespread adoption of polyol sweeteners in cost-sensitive markets, especially in regions with lower purchasing power.

Government initiatives, such as the USDA’s support for the agricultural industry, aim to stabilize raw material prices, but challenges related to the cost of production remain a barrier to the broader application of polyol sweeteners in everyday consumer products.

Opportunity

Expansion of Sugar Reduction Initiatives and Policy Support

A significant growth opportunity for polyol sweeteners lies in the global push toward reducing sugar consumption, driven by increasing health concerns and supportive government policies. Organizations such as the World Health Organization (WHO) have been instrumental in promoting guidelines to limit sugar intake. The WHO recommends that added sugars constitute less than 10% of total daily energy intake, with further benefits observed when this is reduced to below 5%. This recommendation aligns with efforts to combat rising obesity rates and related health issues.

Governments worldwide are responding to these health concerns by implementing policies that encourage the use of sugar alternatives. For instance, the U.S. Department of Agriculture (USDA) has been actively involved in promoting alternatives to sugar through nutrition guidelines and public health campaigns aimed at reducing sugar consumption in processed foods. These initiatives have led to the growing availability and use of polyol sweeteners in the food and beverage sector, particularly in sugar-free products.

The increasing preference for natural and plant-based sweeteners is also expected to influence the demand for polyol concentrates. As consumer preferences continue to shift towards functional foods and beverages, there is considerable potential for the integration of polyols into a wider range of products, from baked goods to beverages. Additionally, growing investments in research and development by food manufacturers, aimed at improving the taste and texture of polyol-based products, will play a pivotal role in driving the market’s expansion.

Regional Insights

In 2024, North America held a dominant position in the global polyol sweetener market, capturing approximately 44.6% of the total market share, which translates to a market value of USD 1.6 billion. This regional leadership is largely attributed to the growing demand for low-calorie, sugar-free, and diabetic-friendly food and beverage products across the United States and Canada. The rising prevalence of lifestyle-related health conditions such as obesity and type-2 diabetes has driven both consumer and regulatory shifts toward healthier food choices.

Government-led initiatives like the U.S. Food and Drug Administration’s Nutrition Innovation Strategy and updated labeling requirements have also encouraged manufacturers to reformulate products with reduced sugar content. Additionally, North America boasts a well-developed food processing industry with widespread adoption of polyol sweeteners in bakery, confectionery, dairy, and functional beverages.

The demand for polyol sweeteners in pharmaceutical and personal care applications is also rising in North America, with these ingredients widely used in chewable tablets, syrups, toothpaste, and mouthwash. Furthermore, the region is home to key production and R&D hubs focused on developing innovative sugar-reduced solutions, supported by a consumer base increasingly prioritizing wellness and clean-label ingredients.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill, Inc. is a leading U.S.-based food ingredient company actively involved in producing and supplying polyol sweeteners such as erythritol and sorbitol. The company offers a wide range of reduced-calorie sweeteners for use in confectionery, beverages, dairy, and pharmaceuticals. With advanced manufacturing facilities and a strong R&D focus, Cargill emphasizes clean-label and sugar-reduction solutions. Its operations in North America and Europe are supported by robust logistics and partnerships across the global food and beverage industry.

Gulshan Polyols Ltd., based in India, is a prominent producer of sorbitol and other polyol derivatives catering to food, pharmaceutical, and personal care industries. The company operates modern manufacturing units with significant export capabilities to Asia-Pacific, the Middle East, and Africa. Gulshan focuses on cost-effective production and consistent quality standards. With certifications such as FSSC 22000 and a growing global presence, it plays a key role in meeting the increasing demand for low-calorie sweeteners across emerging markets.

Ingredion Inc., headquartered in the United States, supplies specialty ingredients including polyol sweeteners like erythritol and maltitol for the global food and beverage sector. Known for its innovation in clean-label and sugar-reduction technologies, the company serves clients in over 120 countries. Ingredion’s strong emphasis on health-oriented product development, combined with technical support and sustainable sourcing practices, positions it as a trusted partner for brands targeting low-calorie and diabetic-friendly food formulations.

Top Key Players Outlook

- Cargill, Inc.

- Gulshan Polyols Ltd.

- Ingredion Inc.

- Roquette Frères

- PT. Ecogreen Oleochemicals

- Mitsubishi Corporation Life Sciences Ltd.

- Tereos

- Jungbunzlauer Suisse AG

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Shandong Futaste Co.

- DuPont

- zuChem

- Beneo

- Foodchem International Corp.

Recent Industry Developments

In December 2024 Gulshan Polyols, reported a 64.32% rise in sales to ₹609.76 crore, with a net profit of ₹6.75 crore, up 45.79% from the previous quarter.

In 2024, Roquette reported a turnover of €4.495 billion, reflecting a 10% decrease compared to 2023. Despite this decline, the company maintained a strong operating margin of 11.8%, demonstrating resilience in a challenging market environment.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Bn Forecast Revenue (2034) USD 6.9 Bn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sorbitol, Xylitol, Mannitol, Maltitol, Isomalt, Others), By Form (Powder, Liquid), By Function (Flavoring and Sweetening Agents, Bulking Agents, Excipients, Humectants, Others), By Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Inc., Gulshan Polyols Ltd., Ingredion Inc., Roquette Frères, PT. Ecogreen Oleochemicals, Mitsubishi Corporation Life Sciences Ltd., Tereos, Jungbunzlauer Suisse AG, Zhejiang Huakang Pharmaceutical Co., Ltd., Shandong Futaste Co., DuPont, zuChem, Beneo, Foodchem International Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Inc.

- Gulshan Polyols Ltd.

- Ingredion Inc.

- Roquette Frères

- PT. Ecogreen Oleochemicals

- Mitsubishi Corporation Life Sciences Ltd.

- Tereos

- Jungbunzlauer Suisse AG

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Shandong Futaste Co.

- DuPont

- zuChem

- Beneo

- Foodchem International Corp.