Global Polymer Nanocomposites Market By Type (Ceramic Matrix, Metal Matrix, Polymer Matrix), By Polymer (Epoxy Resin, Polyamide, Polyethylene, Polypropylene, Others), By Nanomaterials (Nanoclays, Carbon Nanotubes, Nanofiber, Nano-Oxides, Others), By End User (Automotive And Aerospace, Electricals And Electronics, Packaging, Biomedical, Paints And Coatings, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175064

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

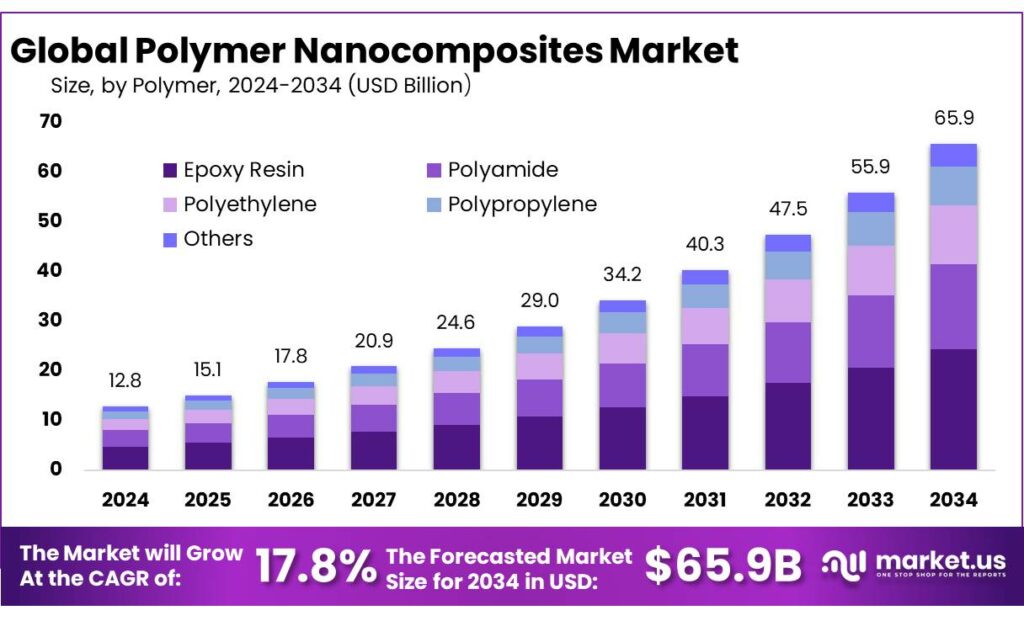

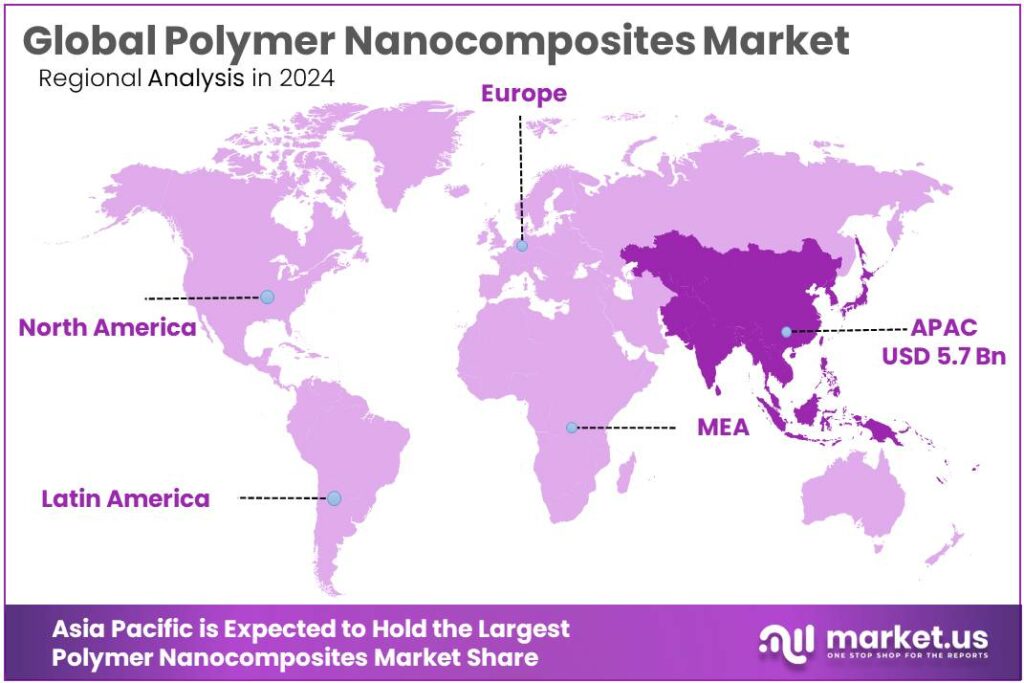

Global Polymer Nanocomposites Market size is expected to be worth around USD 65.9 Billion by 2034, from USD 12.8 Billion in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 45.20% share, holding USD 5.7 Billion in revenue.

Polymer nanocomposites are engineered plastics where a small amount of nano-scale fillers is dispersed inside a polymer to upgrade performance. In industrial terms, the value proposition is “more function per gram”: improved barrier resistance, stiffness-to-weight, heat stability, and sometimes antimicrobial or sensing functions—without a full material changeover. This matters because the plastics economy is large and still expanding: global plastics production reached 413.8 million tonnes in 2023.

The industrial scenario is shaped strongly by food and consumer packaging, where barrier and shelf-life performance directly influence waste and compliance. In the EU, 40% of plastics are used in packaging, and packaging waste reached 186.5 kg per person in 2022, keeping regulators and brand owners focused on redesign and materials innovation.

In parallel, food-system organizations quantify the scale of preventable loss: UNEP estimates 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers, with 631 million tonnes occurring at household level. FAO also highlights a broader framing that about one-third of food produced for human consumption is lost or wasted globally—around 1.3 billion tonnes per year.

Driving factors also come from plastics lifecycle scrutiny and regulatory tightening. The OECD reports global plastics production rising from 234 million tonnes (2000) to 460 million tonnes (2019), while plastic waste increased from 156 million tonnes (2000) to 353 million tonnes (2019); after accounting for recycling losses, only 9% of plastic waste was ultimately recycled (with 19% incinerated and close to 50% landfilled). These system-level numbers encourage materials that can down-gauge packaging, extend product life, and enable higher-performance mono-material designs.

Regulatory and sustainability forces are reinforcing this adoption curve. Plastic waste is projected to rise from 353 Mt (2019) to 1,014 Mt (2060) under current trajectories, while the share successfully recycled is projected to move from 9% (2019) to 17% (2060)—an improvement, but still leaving a large unmanaged burden. Governments are responding with packaging-focused rules: in the EU, policymakers have highlighted that each European generates about 190 kg of packaging waste per year, and policy packages include restrictions and bans on specific single-use packaging formats from 1 January 2030.

Government initiatives that strengthen the industrial pipeline—R&D funding, shared characterization facilities, and translation programs—also support future scale-up. For example, India’s Union Cabinet approved continuation of the Nano Science and Technology “Nano Mission” (Phase II) with a total cost of Rs. 650 crores (12th Plan period), reflecting the role of public investment in enabling nanomaterials research capacity and application-oriented development.

Key Takeaways

- Polymer Nanocomposites Market size is expected to be worth around USD 65.9 Billion by 2034, from USD 12.8 Billion in 2024, growing at a CAGR of 17.8%.

- Polymer Matrix held a dominant market position, capturing more than a 69.2% share.

- Epoxy Resin held a dominant market position, capturing more than a 37.1% share.

- Nanoclays held a dominant market position, capturing more than a 39.8% share.

- Automotive & Aerospace held a dominant market position, capturing more than a 34.5% share.

- Asia Pacific dominates Polymer Nanocomposites with 45.20% share, valued at USD 5.7 Bn.

By Type Analysis

Polymer Matrix leads the market with a strong 69.2% share in 2024.

In 2024, Polymer Matrix held a dominant market position, capturing more than a 69.2% share, reflecting its central role in shaping the overall direction of the polymer nanocomposites industry. This segment remains the backbone of material development because it serves as the structural foundation into which nanofillers are incorporated.

Its versatility across thermoplastics, thermosets, and elastomers allows manufacturers to engineer performance-specific materials suited for packaging, automotive, electronics, construction, and consumer goods. The large share also highlights the growing preference for polymer systems that balance lightweight properties with improved thermal, mechanical, and barrier features—benefits increasingly demanded in industrial applications.

By Polymer Analysis

Epoxy Resin leads the segment with a strong 37.1% share in 2024.

In 2024, Epoxy Resin held a dominant market position, capturing more than a 37.1% share, driven by its exceptional strength, thermal resistance, and strong bonding characteristics. Industries such as aerospace, electronics, coatings, and automotive continue to rely on epoxy-based nanocomposites because they offer high stiffness and durability even with low filler loading. The material’s ability to enhance electrical insulation and resist moisture also makes it a preferred choice for demanding structural and protective applications. This large share reflects the ongoing shift toward materials that can withstand harsh environments while maintaining long service life.

By Nanomaterials Analysis

Nanoclays lead the market with a strong 39.8% share in 2024.

In 2024, Nanoclays held a dominant market position, capturing more than a 39.8% share, reflecting their wide acceptance as one of the most practical and cost-effective nanomaterials used in polymer nanocomposites. Their ability to improve barrier properties, thermal stability, and mechanical strength with very low loading makes them highly attractive for packaging, automotive parts, construction materials, and consumer products. Nanoclays also disperse easily in many polymer matrices, helping manufacturers enhance performance without significantly increasing production costs. This strong share shows the growing preference for materials that offer both efficiency and sustainability benefits.

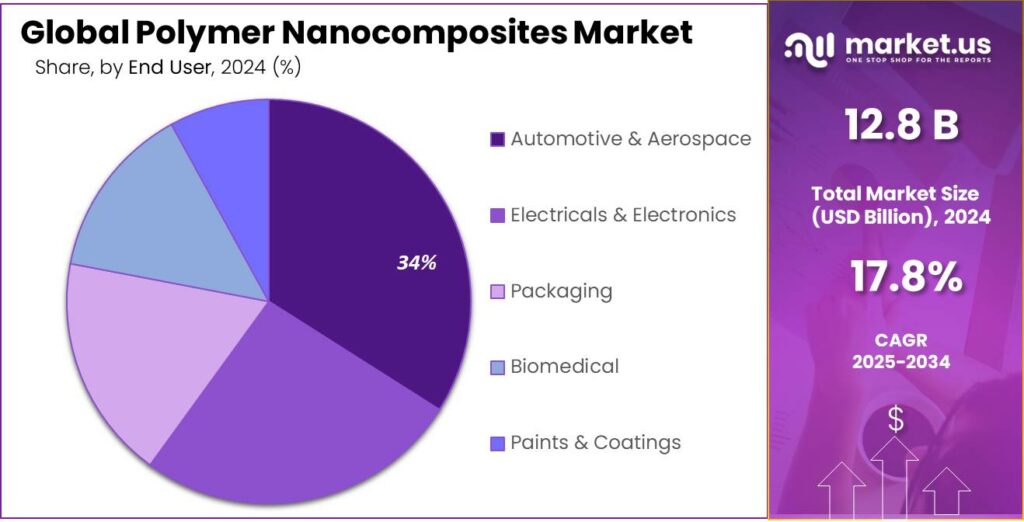

By End User Analysis

Automotive & Aerospace lead the segment with a strong 34.5% share in 2024.

In 2024, Automotive & Aerospace held a dominant market position, capturing more than a 34.5% share, driven by the industry’s growing shift toward lighter, stronger, and more durable materials. Polymer nanocomposites help reduce vehicle and aircraft weight while improving fuel efficiency, mechanical strength, and thermal resistance. These advantages make nanocomposite materials valuable for structural components, interior panels, under-the-hood parts, and protective coatings. Companies across both sectors are increasingly using these materials to meet strict performance, safety, and emissions targets, contributing to the segment’s strong lead in 2024.

Key Market Segments

By Type

- Ceramic Matrix

- Metal Matrix

- Polymer Matrix

By Polymer

- Epoxy Resin

- Polyamide

- Polyethylene

- Polypropylene

- Others

By Nanomaterials

- Nanoclays

- Carbon Nanotubes

- Nanofiber

- Nano-Oxides

- Others

By End User

- Automotive & Aerospace

- Electricals & Electronics

- Packaging

- Biomedical

- Paints & Coatings

- Others

Emerging Trends

Shift to recyclable, high-barrier packaging is shaping today’s nanocomposite trend

One major latest trend in polymer nanocomposites is the move toward recyclable high-barrier packaging, especially for food. Packaging teams are trying to solve two problems at the same time: keep food fresh for longer and make packs simpler to recycle. Nanocomposites fit neatly here because small additions of nanomaterials (like nanoclays or nano-silica) can lift barrier strength and toughness without making films thick. That matters for everyday items such as snacks, dairy, sauces, and ready meals, where oxygen and moisture control directly affect shelf life and returns.

Food waste data keeps this trend in focus. FAO estimates that roughly one-third of food produced for human consumption is lost or wasted globally, equal to about 1.3 billion tonnes per year. In parallel, UNEP reports that in 2022 the world wasted about 1.05 billion tonnes of food across households, food service, and retail, which equals 132 kg per person; households alone account for 631 million tonnes or about 79 kg per person.

Government policy is pushing the market in the same direction, and it is becoming more specific each year. The European Parliament notes that each European generated 188.7 kg of packaging waste in 2021, and without extra action this is expected to rise to 209 kg in 2030. On top of that, EU policy work is aiming for packaging placed on the market to be reusable or recyclable in an economically feasible way by 2030.

Recycling performance data also explains why the industry is careful about how it uses nanomaterials. Eurostat notes that in 2021 each person in the EU generated 35.9 kg of plastic packaging waste, and 14.2 kg of that was recycled. In another Eurostat update, the EU recycled 41% of generated plastic packaging waste in 2022.

Drivers

Food waste pressure is pushing smarter packaging demand

One major driving factor for polymer nanocomposites is the rising need to protect food better and waste less, without making packaging heavier. Food companies and retailers lose money when products spoil early, leak, or get damaged in transport. That is why packaging teams keep looking for materials that improve barrier performance while keeping films thin and easy to process. Polymer nanocomposites fit this need well because a small amount of nanomaterial can strengthen a polymer and improve shelf-life protection, especially in flexible packaging.

The size of the food-waste problem keeps this driver active. The Food and Agriculture Organization (FAO) estimates that about one-third of food produced for human consumption is lost or wasted, equal to roughly 1.3 billion tonnes per year. This is not just a consumer issue; it reflects weaknesses across storage, packaging, transport, and retail handling. When food waste is that large, even small improvements in packaging performance become valuable. Better barrier films and tougher packs can slow oxidation, reduce moisture loss, and cut punctures—practical reasons why polymer nanocomposites keep getting attention in food-linked supply chains.

Recent global tracking also shows how much food is being thrown away at the consumer end. UNEP’s Food Waste Index Report 2024 states that in 2022, around 1.05 billion tonnes of food were wasted across households, food service, and retail, with households alone at 631 million tonnes. The report also highlights an average of 79 kg per person per year wasted at household level. For packaged food brands, this data strengthens the case for packaging upgrades that keep products usable for longer and reduce damage in distribution.

Recent global tracking also shows how much food is being thrown away at the consumer end. UNEP’s Food Waste Index Report 2024 states that in 2022, around 1.05 billion tonnes of food were wasted across households, food service, and retail, with households alone at 631 million tonnes. The report also highlights an average of 79 kg per person per year wasted at household level. For packaged food brands, this data strengthens the case for packaging upgrades that keep products usable for longer and reduce damage in distribution.

Restraints

Limited recycling compatibility is slowing wider adoption

One major restraining factor for polymer nanocomposites is their complicated relationship with recycling systems. While these materials offer strong performance advantages, they also introduce challenges for recyclers who need clean, predictable material streams. When nanofillers such as nanoclays, graphene, metal oxides, or nanosilica are blended into polymers, they can modify melting behavior, viscosity, color, or residue levels.

A clear picture of the challenge comes from global data. The OECD reports that global plastic waste is projected to almost triple from 353 million tonnes in 2019 to 1,014 million tonnes in 2060, while the share of plastic waste that actually gets recycled will rise only modestly—from 9% in 2019 to 17% in 2060. Even with improvements, the majority of plastics will still end up in landfills or the environment, meaning recyclers remain highly cautious about new materials that add complexity. When plastic streams are already difficult to sort, the introduction of nanocomposite structures only increases the risk of contamination and downgraded material quality.

Government policy is adding pressure as well. The European Parliament notes that Europeans generate nearly 190 kg of packaging waste per person every year, and new regulations are pushing companies toward packaging that is fully recyclable or reusable. These rules include bans on certain single-use plastic packaging types starting 1 January 2030. The industry reads these requirements as a call for simpler, mono-material structures that recyclers can process easily—not for multi-component nanocomposite materials that may require special handling or advanced sorting technologies.

For polymer producers and converters, this creates a very human, day-to-day tension. Engineers want to use nanocomposites because they improve strength, barrier properties, and product protection. But sustainability teams, brand owners, and waste managers worry that those same benefits might compromise circularity goals. Many companies feel caught in the middle: they want better materials, but they also need to meet regulations and improve recycling outcomes.

Opportunity

Recyclable high-barrier food packaging is the biggest opportunity

A major growth opportunity for polymer nanocomposites is next-generation food packaging that is both high-barrier and easier to recycle. Food brands, retailers, and packaging converters are under steady pressure to protect products longer, cut damage in transit, and reduce waste—yet they also need packaging designs that fit tighter recycling rules. Polymer nanocomposites can help because a small amount of nano-reinforcement can improve barrier and strength, allowing thinner films and better protection without adding much weight.

The numbers behind food waste make this opportunity hard to ignore. FAO estimates that roughly one-third of food produced for human consumption is lost or wasted globally, equal to about 1.3 billion tonnes per year. That scale turns packaging improvements into a practical business lever. When oxygen, moisture, or small punctures shorten shelf life, value is lost at the factory gate, in warehouses, and on store shelves. Nanocomposite barrier films and coatings can reduce permeability and improve toughness, helping products stay acceptable for longer and survive handling without leaks or tears.

Recent food-sector reporting shows that waste is not only happening before food reaches consumers. UNEP’s Food Waste Index Report 2024 estimates that in 2022 the world generated 1.05 billion tonnes of food waste across households, food service, and retail—about 19% of food available to consumers—equal to 132 kg per person, with households at 79 kg per person. For packaging developers, this points to a clear opportunity: better portion control, stronger seals, improved barrier layers, and designs that keep food usable after opening.

At the same time, policy is pushing packaging toward recyclability and waste reduction, which creates a second layer of demand. The European Parliament reports that each European generated 188.7 kg of packaging waste in 2021, and without extra measures this is expected to rise to 209 kg in 2030. This direction supports materials that can “do more with less,” but only if they still fit recycling systems. The European Commission also sets an objective to make all packaging on the EU market recyclable in an economically viable way by 2030.

Regional Insights

Asia Pacific dominates Polymer Nanocomposites with 45.20% share, valued at USD 5.7 Bn.

In 2024, Asia Pacific led the Polymer Nanocomposites Market, supported by the region’s deep manufacturing base and fast-moving downstream industries. Asia and Oceania contributed 57.2% of global manufacturing value added in 2024, showing why materials innovation scales quickly here—from compounding and masterbatches to high-volume conversion into parts, films, and coatings. This industrial depth makes it easier for suppliers to qualify nanocomposite grades, run pilot lines, and shift into commercial production without long delays, especially in high-output hubs across China, Japan, South Korea, and ASEAN.

Asia Pacific’s demand is also lifted by transport electrification and modern packaging needs, both of which benefit from lighter, stronger, and more durable polymer systems. The IEA reports global electric car sales exceeded 17 million in 2024, with China alone selling over 11 million, which raises material demand for lightweight components, thermal management parts, and protective housings where nanocomposites can add strength and heat resistance. On the packaging side, scale matters: OECD analysis shows China represented 69% of plastics use within the Asia-Pacific trade region in 2022, highlighting the region’s massive polymer processing footprint and the practical pathway for nanocomposite adoption in barrier and durability-focused applications.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Asahi Kasei enhances polymer nanocomposites with engineered resins and functional additives. The group employs approximately 48,000 people worldwide and operates in 20+ countries. Its materials business contributes around 40% of corporate revenue, driven by high-performance polymers such as engineering plastics, synthetic fibers, and specialty compounds used in mobility, electronics, and industrial components requiring strength and heat resistance.

BYK-Chemie is a major supplier of additives used in polymer nanocomposites. The company offers 5,000+ additive formulations, operates 26 global locations, and serves customers in 100+ countries. With more than 2,500 employees, BYK provides dispersants, surface modifiers, and rheology-control additives that help improve nanoparticle distribution, processing stability, and mechanical performance in polymer systems.

Evonik supports nanocomposite development through specialty chemicals, nanosilica, and performance polymers. The company employs around 34,000 people and operates in 100+ countries. Its Smart Materials division accounts for nearly 30% of total business activity, producing additives, silicas, and high-performance polymer components used in automotive, electronics, packaging, and industrial applications requiring strength and enhanced durability.

Top Key Players Outlook

- 3M

- Arkema

- Asahi Kasei

- BYK-Chemie

- Evonik Industries

- Nanoshel

- RTP Company

- Thermo Fisher Scientific

- Unitika

Recent Industry Developments

Asahi Kasei’s Material segment, part of a larger group with ¥3,037.3 billion net sales, 50,352 employees, more than 309 subsidiaries in ~40 countries, and ¥110.6 billion R&D spend (FY2025), reinforces its ability to move nanocomposite developments from lab concept into commercial reality.

In 2025, Evonik reaffirmed its commitment to specialty chemicals, including solutions for polymer modification and nanoparticle integration, with robust first-quarter growth in volumes and a projected adjusted EBITDA between €2.0 billion and €2.3 billion—showing resilience amid market uncertainty.

Report Scope

Report Features Description Market Value (2024) USD 12.8 Bn Forecast Revenue (2034) USD 65.9 Bn CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ceramic Matrix, Metal Matrix, Polymer Matrix), By Polymer (Epoxy Resin, Polyamide, Polyethylene, Polypropylene, Others), By Nanomaterials (Nanoclays, Carbon Nanotubes, Nanofiber, Nano-Oxides, Others), By End User (Automotive And Aerospace, Electricals And Electronics, Packaging, Biomedical, Paints And Coatings, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, Arkema, Asahi Kasei, BYK-Chemie, Evonik Industries, Nanoshel, RTP Company, Thermo Fisher Scientific, Unitika Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polymer Nanocomposites MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Polymer Nanocomposites MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Arkema

- Asahi Kasei

- BYK-Chemie

- Evonik Industries

- Nanoshel

- RTP Company

- Thermo Fisher Scientific

- Unitika