Global Paper Chemicals Market Size, Share Analysis Report By Form (Speciality, Commodity), By Type of Product (Pulp Chemicals, Functional Chemicals, Process Chemicals), By Application (Coagulation Collector, pH Buffering Agent, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161022

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

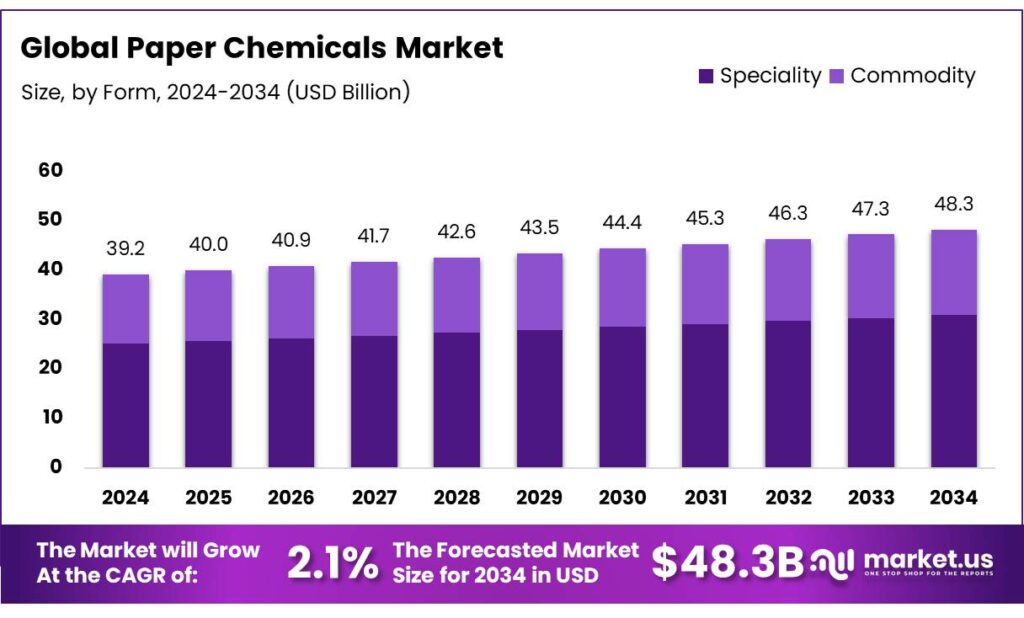

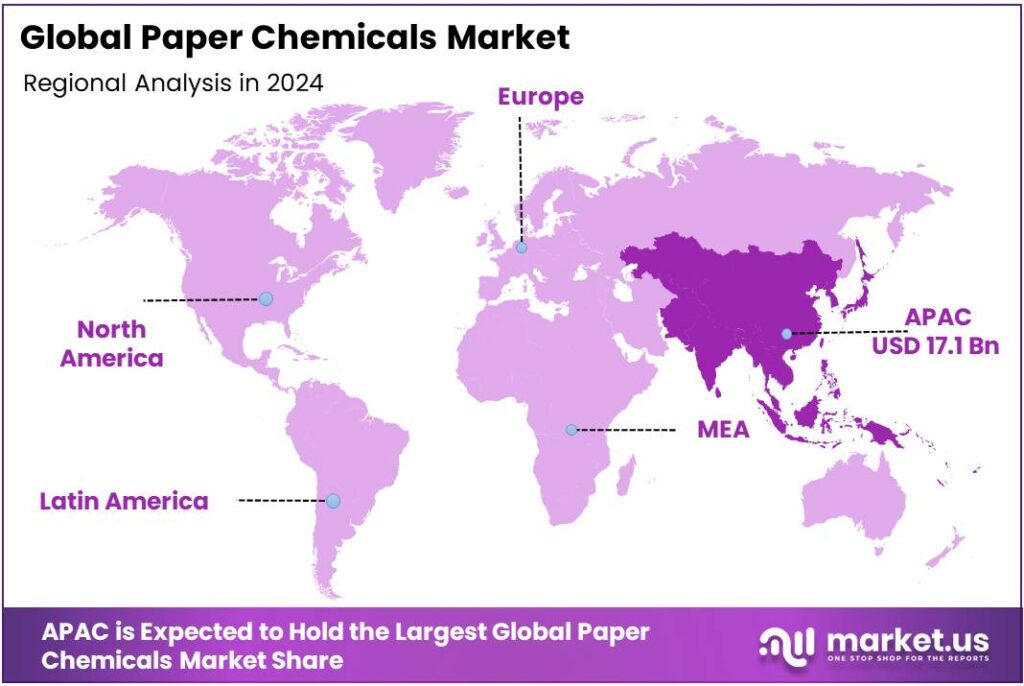

The Global Paper Chemicals Market size is expected to be worth around USD 48.3 Billion by 2034, from USD 39.2 Billion in 2024, growing at a CAGR of 2.1% during the forecast period from 2025 to 2034. Strong industrial growth and rising Chemical production supported Asia-Pacific’s 43.80% leading regional market position.

Paper chemicals (also referred to as pulp & paper or papermaking chemicals) encompass a variety of additives, bleaching agents, process aids, functional chemicals, sizing agents, retainers, and coating/functional additives used during paper and board manufacture to improve brightness, strength, printability, water resistance, and process efficiency. The industry is closely tied to the health of the pulp & paper sector and plays a critical role in enabling specialty papers, high-performance packaging, sustainable and recycled paper grades, and advanced coatings.

The industrial scenario is characterized by structural links to the global pulp & paper value chain, energy costs, and recycling/packaging demand. Global pulp and paper production statistics are maintained by FAO and indicate long-term growth in production capacity and recovered-paper utilization trends; production and capacity data are published annually in FAO forestry statistics. Energy intensity is notable: the paper sector was identified by the International Energy Agency as responsible for just under 2% of total industrial CO₂ emissions in 2022, and paper production is expected to rise into the 2030s, which will put upward pressure on absolute energy use unless intensity falls.

Government initiatives and policy support, several national policies in major markets indirectly affect the paper chemicals industry by promoting circularity, chemical safety, and incentive schemes in chemicals/manufacturing. For example, in India, the “ChemIndia / Chemicals & Petrochemicals” portal provides 100% FDI via the automatic route in chemicals (except for certain hazardous chemicals) allowing easier capital inflows. India’s broader chemical & petrochemical sector is expected to reach USD 304 billion by 2025 under favorable policy push and incentives. The Indian chemical industry as a whole is presently valued at ~USD 220 billion and is projected to reach ~USD 300 billion by 2030.

Key Takeaways

- Paper Chemicals Market size is expected to be worth around USD 48.3 Billion by 2034, from USD 39.2 Billion in 2024, growing at a CAGR of 2.1%.

- Upto 99% held a dominant market position, capturing more than a 64.2% share.

- Functional Chemicals held a dominant market position, capturing more than a 48.9% share.

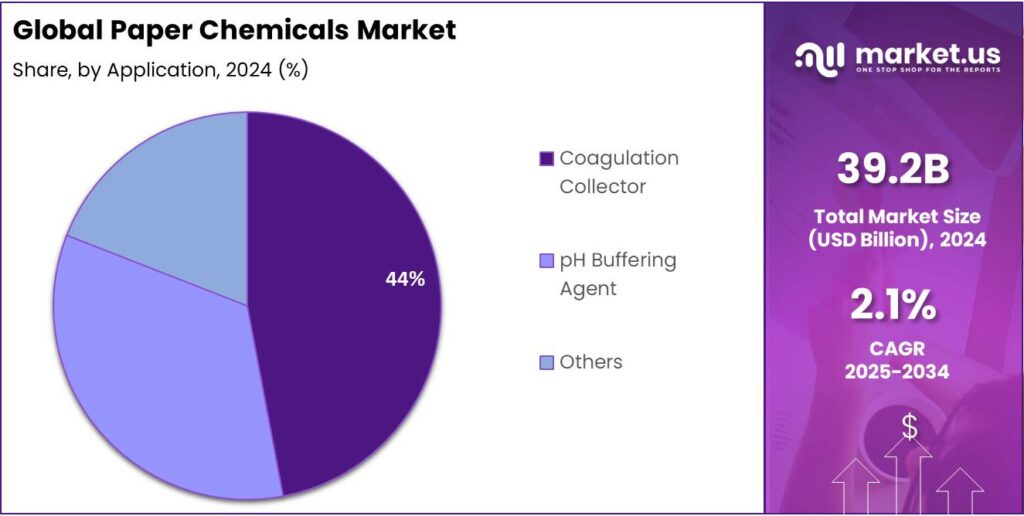

- Coagulation Collector held a dominant market position, capturing more than a 44.4% share.

- Asia-Pacific (APAC) region held a commanding role in the paper chemicals market, representing 43.80% of the global market and amounting to approximately USD 17.1 billion.

By Form Analysis

Speciality form dominates with up to 99% presence and a 64.2% share in 2024.

In 2024, Upto 99% held a dominant market position, capturing more than a 64.2% share. This segment was characterised by its broad applicability across coating, sizing and surface-modification processes, and was preferred where performance and product differentiation were required. Demand was driven by packaging substrates and high-value specialty papers, where the use of tailored chemistries was required to meet printability, strength and barrier specifications. Procurement strategies were observed to favour speciality formulations because processing consistency and end-product performance could be secured with smaller volume, higher-value inputs; as a result, margins were maintained and supplier relationships were consolidated.

By 2025, the speciality form was expected to remain the primary contributor to form-based revenues as mills focused on recyclability and downgauging initiatives that increased reliance on performance additives. Innovation in low-impact process chemistries and incremental improvements in runnability were reported to support continued uptake of speciality formats, while operational priorities—such as fibre-quality management and effluent control—were cited as reasons for sustained investment in this segment. Overall, the speciality-form position was sustained through a combination of technical fit for premium applications and preference by converters for chemistries that enable consistent manufacturing outcomes.

By Type of Product Analysis

Functional Chemicals lead the market with a strong 48.9% share in 2024.

In 2024, Functional Chemicals held a dominant market position, capturing more than a 48.9% share. This segment’s leadership was mainly driven by its essential role in enhancing paper properties such as strength, brightness, and printability, which are critical in high-quality printing and packaging applications. Functional chemicals—including sizing agents, retention aids, wet-strength resins, and coating binders—were widely adopted across both virgin and recycled paper manufacturing due to their ability to improve efficiency and reduce wastage.

The year 2024 witnessed growing demand for such chemicals, particularly in the packaging and specialty paper sectors, as industries moved toward lightweight yet durable paper products. By 2025, steady advancements in formulation technologies and the shift toward bio-based and low-VOC functional additives were expected to further strengthen this segment’s position. Rising sustainability standards and the focus on performance optimization at paper mills continued to support investment in functional chemicals, ensuring their central role in maintaining productivity, cost-efficiency, and environmental compliance in paper production.

By Application Analysis

Coagulation Collector dominates with 44.4% share in 2024 due to its critical role in wastewater treatment and pulp recovery.

In 2024, Coagulation Collector held a dominant market position, capturing more than a 44.4% share. This strong presence was attributed to its vital application in the clarification and purification stages of papermaking, where it plays a key role in removing suspended solids and improving water reuse efficiency. The increasing emphasis on sustainable production practices and water conservation within paper mills significantly boosted the use of coagulation collectors, as they help in reducing chemical load and meeting environmental discharge regulations.

Adoption rates were expected to rise further due to tightening wastewater norms and the expansion of recycled paper operations, which require efficient solid–liquid separation processes. The segment’s growth was also supported by ongoing innovations in eco-friendly coagulant formulations that deliver higher efficiency with lower environmental impact. Overall, the coagulation collector segment continued to be central to process optimization, environmental compliance, and cost-effective operation across the global paper industry.

Key Market Segments

By Form

- Speciality

- Commodity

By Type of Product

- Pulp Chemicals

- Functional Chemicals

- Process Chemicals

By Application

- Coagulation Collector

- pH Buffering Agent

- Others

Emerging Trends

Regulation-Driven Shift Toward Recyclability and Plastic Reduction in Food Packaging

A strong trend shaping the paper chemicals industry today is the regulatory push to reduce plastic use and enforce recyclability, particularly in food packaging, which forces innovation in paper-based and biodegradable chemical systems. This movement is not just technical or niche — it’s driven by public pressure, environmental urgency, and governments stepping in with rules that change what packaging is allowable. For the chemical suppliers serving paper, that shift is both a challenge and an opening.

- According to the Food and Agriculture Organization (FAO), globally the sector uses 37.3 million tonnes in food packaging alone. That scale makes the packaging sector a prime target for plastic reduction policies. Governments and regulatory bodies are responding: many countries now ban or limit single-use plastics, set stricter recycling targets, or demand that packaging be designed for circularity (reuse, recycling, composting).

For example, the Americas, Europe, and parts of Asia have pushed for tighter packaging laws. In the European Union, new rules now aim to make all packaging recyclable by 2030, and ban certain “forever chemicals” (PFAS) in food contact packaging. In the U.S., states are increasingly regulating PFAS and polystyrene in food packaging, reflecting a trend toward more chemical-level scrutiny. This regulatory tightening forces chemical formulators to rethink what materials and additives they use — legacy coatings or barrier agents that once passed muster may no longer be acceptable.

Consumers too expect greener packaging. Surveys and market signals show that compostable, recyclable, or plant-based packaging scores higher in many countries. “Paper” often fares well in those comparisons, especially in markets like India and the UK, which means chemical demand for paper-based food contact materials is under more favorable terms than for plastics.

Drivers

Rise of Sustainable Food Packaging Demand

One of the most powerful drivers for growth in the paper chemicals industry is the increasing global demand for sustainable food packaging. As consumers, governments, and food businesses push to reduce plastic waste, the food industry is turning toward paper-based and hybrid packaging solutions. That shift compels paper mills and converters to adopt new chemical additives and coatings to make paper materials meet food safety, barrier, and durability standards.

- According to the Food and Agriculture Organization (FAO), the world used 37.3 million tonnes of materials in food packaging in 2019. As the volume of packaged food grows, the demand for higher performing paper packaging rises in tandem. This trend offers a clear pull for advanced coating, barrier, and surface-modification chemicals.

This push toward sustainable packaging also aligns with environmental goals. Paper is perceived as more biodegradable and recyclable than many plastics. The life-cycle assessments comparing food packaging systems show that paper pathways can reduce waste and carbon footprint, especially when recycling loops are strong. As a result, food producers and packaging converters are willing to accept higher costs for chemical treatments that transform ordinary paper into safe, high-performance food packaging.

In sum, the shift by the food sector toward sustainable packaging, backed by environmental commitments, regulations, and public concern, is a major, human-sized force driving the paper chemicals industry forward. As food producers demand packaging that is both safe and green, chemical makers have an opportunity to supply coatings, barrier additives, and functional modifications that reconcile performance with compliance. This dynamic offers a stable and long-term growth path for chemical suppliers who can stay ahead in food-contact safety and sustainable design.

Restraints

Stringent Regulation and Compliance Burden

One of the most significant constraints on the growth of paper chemicals is the rigorous regulatory environment governing food-contact materials and chemical safety. Because many paper chemicals—especially coatings, barrier additives, wet-strength agents, and sizing chemicals—come into contact with food (e.g., in food packaging), they must comply with multiple safety, migration, and toxicity standards. These compliance demands raise costs, slow innovation, and deter entry, especially for smaller chemical firms.

The U.S. Food and Drug Administration (FDA) regulates “Food Contact Substances” (FCS) used in packaging. Before a new chemical or additive can be used, it must be authorized or notified through a formal procedure, with scientific safety assessment required. If the chemical is new or not already approved, manufacturers must submit data on migration, toxicology, stability, and intended use — a process that may take months or years. This delays time-to-market and imposes high regulatory risk.

Another pressure comes from state-level packaging laws targeting broader “toxics in packaging” statutes. For instance, Rhode Island amended its law in 2022 to prohibit the sale or distribution of any food packaging containing PFAS starting January 1, 2025. Connecticut’s similar bans took effect December 31, 2023. Such places enforce their own stricter rules beyond federal regulation, forcing chemical makers (and their paper-industry clients) to adapt region by region. This regulatory fragmentation increases cost and complexity for chemical producers serving multiple markets.

Beyond the rules specifically on food safety, there is also the broader chemical regulation environment, such as the U.S. Toxic Substances Control Act (TSCA). Under TSCA, manufacture or import of new chemicals requires premanufacturing notification and safety assessment by the Environmental Protection Agency (EPA). That adds another layer of compliance cost for novel chemical entries.

Opportunity

Expansion of Eco-Friendly Food Packaging

Now, from the policy side, governments are stepping in. In India, for example, the Food Safety and Standards Authority of India (FSSAI) released revised packaging regulations in March 2025. These allow the use of certain recycled plastics in food packaging if they meet strict safety standards. That signals a regulatory tolerance for circular materials, which indirectly benefits paper and hybrid packaging as well.

Also, India’s Plastic Waste Management Rules, 2021 and the related Extended Producer Responsibility (EPR) mandates force companies to take responsibility for the end-of-life of their packaging. Those rules push food and consumer goods companies to look for alternatives, which again is a tailwind for paper-based options and thus for chemical suppliers serving them.

India’s recycling rate is low — only about 9% of plastic packaging is recycled. That gap is one reason why governments are pushing packaging reform, and why companies want safer alternatives they can track, recycle, or compost. The push for circular economy packaging means that coatings, adhesives, barriers, and additives must be specifically engineered for recyclability, biodegradability, or compostability. That is exactly where the paper chemicals industry can innovate.

Food brands are under pressure — from consumers, NGOs, regulators — to deliver packaging that is both safe for food and kinder to the environment. Many are willing to pay a premium or invest more in R&D. For chemical companies, this means a chance to partner early: develop formulations with low migration, food safety compliance, and sustainable disposal profiles.

Regional Insights

In 2024, the Asia-Pacific (APAC) region held a commanding role in the paper chemicals market, representing 43.80% of the global market and amounting to approximately USD 17.1 billion. This dominance was grounded in several regional strengths: large and growing paper & pulp industries (notably in China, India, Japan), expanding packaging demand, and increasing regulatory pressure for sustainable and recycled paper products.

Industrialisation in APAC nations continued to accelerate through 2024. In countries such as China and India, urbanisation and rising per capita income escalated consumption of packaged goods, which directly increased demand for performance chemicals (functional, bleaching, process chemicals) used in coatings, sizing, retention, etc. Mills in APAC reportedly stepped up investments in chemicals that improve runnability, water-use efficiency, and fibre bond strength, in response to both cost pressures and environmental regulations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kemira, based in Helsinki, Finland, is a global leader in pulp & paper chemicals and water-intensive industries. It produces chemicals for fibre treatment, sizing, retention & drainage, wet strength, bleaching, and coating. In 2015, Kemira acquired AkzoNobel’s paper chemicals business for €153 million, adding six manufacturing sites and ~350 employees. The deal was expected to increase revenue by more than €200 million annually and yield net synergies of about €15 million/year.

BASF has long been active in paper chemicals, particularly wet-end additives, process & bleaching chemistries. In 2018-19, BASF merged its paper wet-end and water chemicals business with Solenis, resulting in pro forma sales of about €2.4 billion and ~5,200 employees in 2017. The combined entity, operating under Solenis, strengthened its service, production and geographic reach globally.

Solenis was formed through a merger with BASF’s wet-end & water chemicals business, creating a company focused on specialty chemicals for paper and water. In 2019, this combined business under Solenis reported pro forma sales around U.S. $3 billion, operating with about 5,200 employees worldwide. Solenis’ portfolio includes functional & process wet-end chemicals, water‐cycle solutions, and customer-centered services.

Top Key Players Outlook

- Kemira Oyj

- BASF

- Solenis

- Akzonobel N.V.

- Ecolab

- Ashland Inc.

- Harima Chemicals Group

- Buckman Laboratories International Inc.

- Archroma

Recent Industry Developments

In 2024, Ecolab Inc. delivered strong results in its paper-chemicals related work (under its Global Industrial segment, which includes Paper alongside Water, Food & Beverage). Total net sales for Ecolab in 2024 reached USD 15,741.4 million, up from 2023.

In 2024 AkzoNobel, the company achieved an adjusted EBITDA of €400 million with a margin of 14.4%, and operating income of €270 million.

Report Scope

Report Features Description Market Value (2024) USD 39.2 Bn Forecast Revenue (2034) USD 48.3 Bn CAGR (2025-2034) 2.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Speciality, Commodity), By Type of Product (Pulp Chemicals, Functional Chemicals, Process Chemicals), By Application (Coagulation Collector, pH Buffering Agent, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kemira Oyj, BASF, Solenis, Akzonobel N.V., Ecolab, Ashland Inc., Harima Chemicals Group, Buckman Laboratories International Inc., Archroma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kemira Oyj

- BASF

- Solenis

- Akzonobel N.V.

- Ecolab

- Ashland Inc.

- Harima Chemicals Group

- Buckman Laboratories International Inc.

- Archroma