Global P-Aminophenol Market Size, Share, And Business Benefit By Form (Powder, Crystals, Liquids), By Grade (Technical Grade, Pharmaceutical Grade), By Application (Pharmaceuticals, Hair Dye Intermediates, Rubber Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161223

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

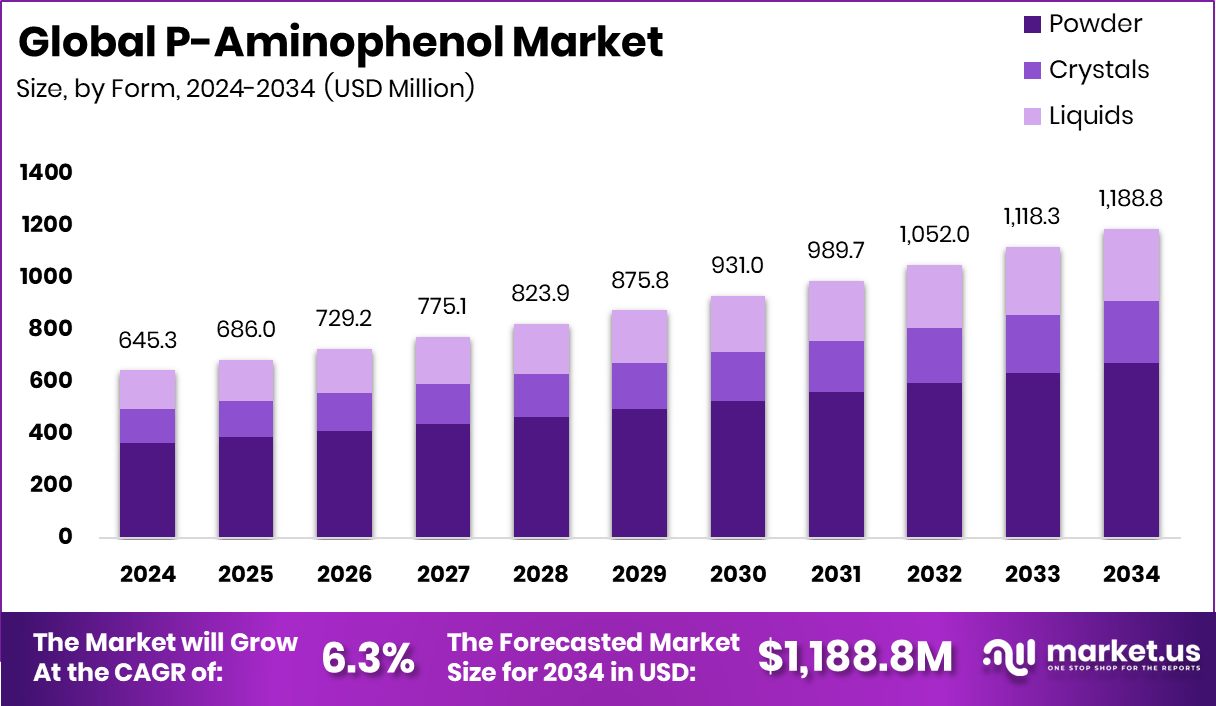

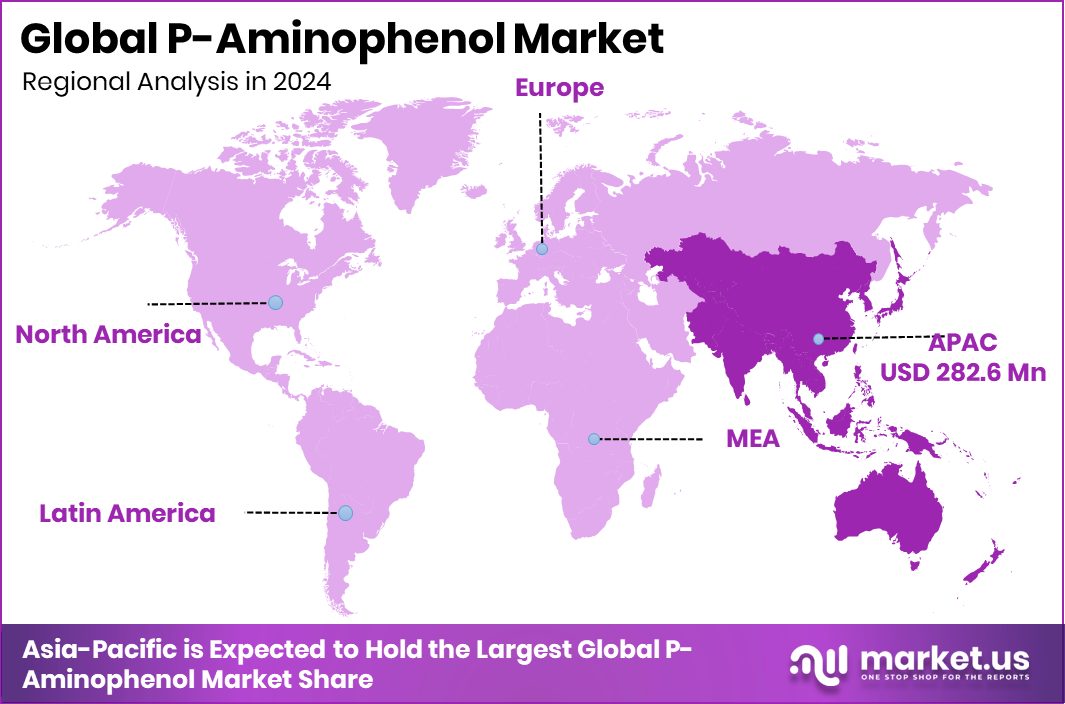

The Global P-Aminophenol Market is expected to be worth around USD 1,188.8 million by 2034, up from USD 645.3 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. The Asia-Pacific market value reached around USD 282.6 million during the year.

P-Aminophenol (para-aminophenol) is an organic compound with the chemical formula C₆H₇NO. It appears as a white to light pink crystalline solid and acts as both a reducing and coupling agent. It is primarily used as an intermediate in the manufacture of paracetamol (acetaminophen) and hair dyes. Due to its hydroxyl and amino functional groups positioned para to each other, it exhibits high reactivity in synthesis processes within the pharmaceutical and photographic industries.

The increasing production of pharmaceutical drugs, especially paracetamol, is a major growth factor. With the global rise in fever and pain relief medication demand, large-scale drug manufacturing has surged. Growing healthcare awareness and expanding pharmaceutical manufacturing hubs in Asia and Europe are also driving P-aminophenol demand, supporting consistent industry growth.

Demand is significantly increasing due to its essential role in analgesic and antipyretic drug formulation. The expanding population, higher disease incidence, and need for affordable pain medication have enhanced consumption worldwide. Additionally, industrial demand for P-Aminophenol in dyeing, photographic chemicals, and polymers further fuels its steady market expansion.

New opportunities lie in bio-based and sustainable synthesis methods that minimize waste and improve purity levels. As environmental concerns rise, green chemistry routes for P-aminophenol production are gaining traction. Governments promoting cleaner manufacturing and pharmaceutical R&D funding create potential avenues for innovation and expansion across global markets.

Key Takeaways

- The Global P-Aminophenol Market is expected to be worth around USD 1,188.8 million by 2034, up from USD 645.3 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In 2024, the P-Aminophenol Market saw powder form dominate with a 56.8% share.

- Technical grade P-Aminophenol led the market, accounting for 67.5% due to wide industrial usage.

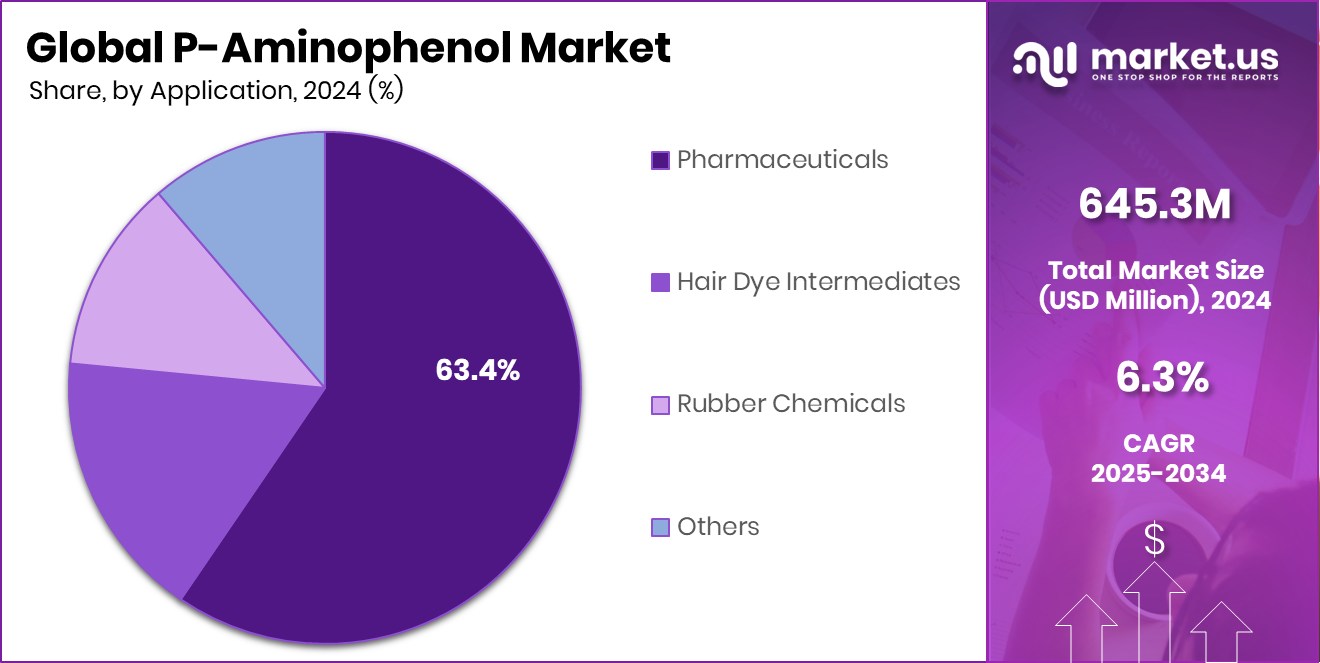

- Pharmaceuticals dominated the P-Aminophenol Market, capturing 63.4% of global consumption in 2024.

- Strong pharmaceutical production and expanding healthcare industries supported Asia-Pacific’s leading 43.80% share.

By Form Analysis

In 2024, powder form dominated the P-Aminophenol market with 56.8%.

In 2024, Powder held a dominant market position in the By Form segment of the P-Aminophenol Market, with a 56.8% share. The powder form remains widely preferred due to its high purity, ease of handling, and suitability for large-scale pharmaceutical synthesis, particularly in paracetamol production. Its stable composition and better solubility in industrial applications make it ideal for consistent formulation results.

Manufacturers favor the powdered form for controlled reactions, reduced impurities, and improved storage stability. The dominance of this segment reflects its cost-effectiveness and compatibility with automated processing systems used across the pharmaceutical and fine chemical industries, reinforcing its strong position within the overall P-Aminophenol market landscape in 2024.

By Grade Analysis

Technical grade held a 67.5% share in the global P-Aminophenol market.

In 2024, Technical Grade held a dominant market position in the By Grade segment of the P-Aminophenol Market, with a 67.5% share. This dominance is mainly due to its extensive use in industrial and pharmaceutical synthesis, where high efficiency and reliability are essential. Technical grade P-Aminophenol is widely utilized in large-scale production of paracetamol and hair dyes, offering the right balance between purity and cost-effectiveness.

Its consistent quality supports smooth chemical reactions in various formulations. The growing demand for bulk intermediates from pharmaceutical and cosmetic manufacturers continues to strengthen the preference for technical-grade material, ensuring its leadership within the P-Aminophenol market landscape during 2024.

By Application Analysis

The pharmaceuticals segment led the P-Aminophenol market, capturing a 63.4% share in 2024.

In 2024, Pharmaceuticals held a dominant market position in the By Application segment of the P-Aminophenol Market, with a 63.4% share. The segment’s strong position is largely driven by its critical role as an intermediate in the production of paracetamol, one of the world’s most widely used analgesics and antipyretic drugs. The high purity and stability of P-Aminophenol make it ideal for consistent pharmaceutical formulations.

Continuous growth in global healthcare demand and expanding medicine production capacities further support its leading application share. The pharmaceutical industry’s focus on reliable raw materials and stringent quality standards ensures the ongoing dominance of this segment in the overall P-Aminophenol market in 2024.

Key Market Segments

By Form

- Powder

- Crystals

- Liquids

By Grade

- Technical Grade

- Pharmaceutical Grade

By Application

- Pharmaceuticals

- Hair Dye Intermediates

- Rubber Chemicals

- Others

Driving Factors

Growing Pharmaceutical Production Boosts Market Expansion

The main driving factor for the P-Aminophenol market is the growing production of pharmaceutical drugs, especially paracetamol. P-Aminophenol is a key raw material used to manufacture paracetamol, which is in high demand worldwide due to rising cases of fever, pain, and cold-related illnesses. With expanding healthcare infrastructure and higher medicine consumption in developing countries, pharmaceutical manufacturing has increased rapidly. The compound’s high purity and consistent quality make it a preferred choice for large-scale drug synthesis.

Governments are also supporting medicine production through health initiatives and local manufacturing incentives, which further strengthen the market’s growth. This expanding pharmaceutical output continues to push steady demand for P-Aminophenol across global markets.

Restraining Factors

Health and Safety Concerns Limit Market Growth

One major restraining factor for the P-Aminophenol market is its health and safety risks during manufacturing and handling. The compound can cause skin and eye irritation, and long-term exposure may lead to respiratory issues for workers if proper safety measures are not followed. These health concerns make it necessary for companies to invest in advanced safety equipment, controlled environments, and training programs, increasing operational costs.

Strict government regulations on chemical handling and waste disposal also add compliance burdens for producers. As a result, smaller manufacturers often face challenges in maintaining production efficiency. These safety and regulatory constraints slightly slow down overall market expansion despite growing industrial demand.

Growth Opportunity

Rising Demand for Green and Clean Production

A key growth opportunity in the P-Aminophenol market lies in the development of eco-friendly and sustainable production processes. Traditional manufacturing methods often generate chemical waste, prompting industries to shift toward cleaner synthesis routes. The growing focus on green chemistry, supported by government initiatives and environmental policies, encourages producers to adopt low-emission and energy-efficient technologies.

Developing bio-based methods for P-Aminophenol production can reduce dependency on harmful reagents while improving overall process efficiency. Pharmaceutical companies are increasingly favoring raw materials sourced from sustainable processes to meet global environmental standards. This shift toward green manufacturing presents a major opportunity for innovation, cost optimization, and long-term growth within the P-Aminophenol market.

Latest Trends

Adoption of Automated and Advanced Production Systems

A leading trend in the P-Aminophenol market is the adoption of automated and advanced production systems. Manufacturers are increasingly using modern equipment and digital monitoring technologies to improve efficiency, product quality, and safety during synthesis. Automation helps control reaction parameters more precisely, reducing human error and ensuring consistent purity levels required for pharmaceutical use.

Many facilities are upgrading their plants with real-time data systems and process optimization tools to reduce waste and energy consumption. This shift toward smart manufacturing aligns with global efforts for cleaner and safer chemical production. As a result, automation is becoming a key trend driving efficiency, reliability, and sustainability in the P-Aminophenol industry.

Regional Analysis

In 2024, the Asia-Pacific dominated the P-aminophenol market with a 43.80% share.

In 2024, Asia-Pacific held a dominant position in the global P-Aminophenol market, accounting for 43.80% of total revenue, valued at around USD 282.6 million. The region’s dominance is attributed to its strong pharmaceutical manufacturing base, particularly in countries like India, China, and Japan, which are major producers of paracetamol and related drugs. Expanding healthcare infrastructure and supportive government initiatives for local drug production have further enhanced regional growth.

North America followed, supported by a well-established pharmaceutical industry and consistent R&D investments aimed at improving drug synthesis efficiency. Europe maintained steady demand driven by stringent quality regulations and rising healthcare expenditure.

Meanwhile, Latin America and the Middle East & Africa regions are emerging markets, experiencing gradual growth due to expanding healthcare access and increasing pharmaceutical imports.

Overall, Asia-Pacific remains the leading hub for P-Aminophenol production and consumption, supported by cost-efficient manufacturing, high demand for analgesic formulations, and favorable regulatory environments that continue to position the region as a global leader in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Anhui Bayi Chemical Industry Co. Ltd., CDH Fine Chemicals, and Haihang Industry played a central role in shaping the global P-Aminophenol market.

Anhui Bayi Chemical Industry Co., Ltd. continued to strengthen its presence through consistent product quality and large-scale production capabilities, supporting the pharmaceutical and dye manufacturing industries. Its focus on efficient synthesis routes and safe operations has enhanced supply reliability across Asian markets.

CDH Fine Chemicals, recognized for its laboratory-grade and specialty chemical production, maintained its reputation by supplying high-purity P-Aminophenol suitable for pharmaceutical and research applications. The company’s emphasis on precision manufacturing and chemical consistency has supported growing demands in formulation and analytical use.

Haihang Industry, known for its broad chemical portfolio and export strength, expanded its reach in international markets by ensuring flexible production and reliable global distribution. The company’s focus on supply chain efficiency and customer-specific formulations positioned it as a reliable supplier.

Collectively, these companies have contributed to stable global availability, ensuring consistent supply for pharmaceutical synthesis and industrial applications. Their commitment to manufacturing excellence, quality assurance, and sustainable production practices continues to support market growth and strengthen the competitive landscape of the P-Aminophenol industry in 2024.

Top Key Players in the Market

- Anhui Bayi Chemical Industry Co. Ltd.

- CDH Fine Chemicals

- Haihang Industry

- Jayvir Dye Chem

- Liaoning Shixing Pharmaceutical & Chemical Co., Ltd.

- Loba Chemie

- Parachem Fine & Specialty Chemicals

- Sadhana Nitro Chem Limited

- Taixing Yangzi Pharm Chemical Co., Ltd.

- Valiant Organics Ltd.

- Wego Chemical Group

Recent Developments

- In August 2025, Liaoning Shixing was awarded a patent for an adsorption tower designed to recycle P-Aminophenol waste brine. This development reflects their effort to improve environmental management in their operations by recovering and reusing by-products associated with P-Aminophenol processes.

- In June 2024, Haihang exhibited at CPHI China 2024 (June 19-21) at Booth W4C98, showcasing its fine chemicals, intermediates, and cosmetic raw materials, which include 4-Aminophenol (P-Aminophenol).

Report Scope

Report Features Description Market Value (2024) USD 645.3 Million Forecast Revenue (2034) USD 1,188.8 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Crystals, Liquids), By Grade (Technical Grade, Pharmaceutical Grade), By Application (Pharmaceuticals, Hair Dye Intermediates, Rubber Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anhui Bayi Chemical Industry Co. Ltd., CDH Fine Chemicals, Haihang Industry, Jayvir Dye Chem, Liaoning Shixing Pharmaceutical & Chemical Co., Ltd., Loba Chemie, Parachem Fine & Specialty Chemicals, Sadhana Nitro Chem Limited, Taixing Yangzi Pharm Chemical Co., Ltd., Valiant Organics Ltd., Wego Chemical Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anhui Bayi Chemical Industry Co. Ltd.

- CDH Fine Chemicals

- Haihang Industry

- Jayvir Dye Chem

- Liaoning Shixing Pharmaceutical & Chemical Co., Ltd.

- Loba Chemie

- Parachem Fine & Specialty Chemicals

- Sadhana Nitro Chem Limited

- Taixing Yangzi Pharm Chemical Co., Ltd.

- Valiant Organics Ltd.

- Wego Chemical Group