Global Oil-in-Water Anionic Emulsifier Market Size, Share, And Enhanced Productivity By Emulsifier Type (Sulfate Esters, Sulfonates, Lactates, Specialty Formulations), By End Use (Food Manufacturers, Cosmetic Companies, Pharmaceutical Facilities, Chemical Processors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172722

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

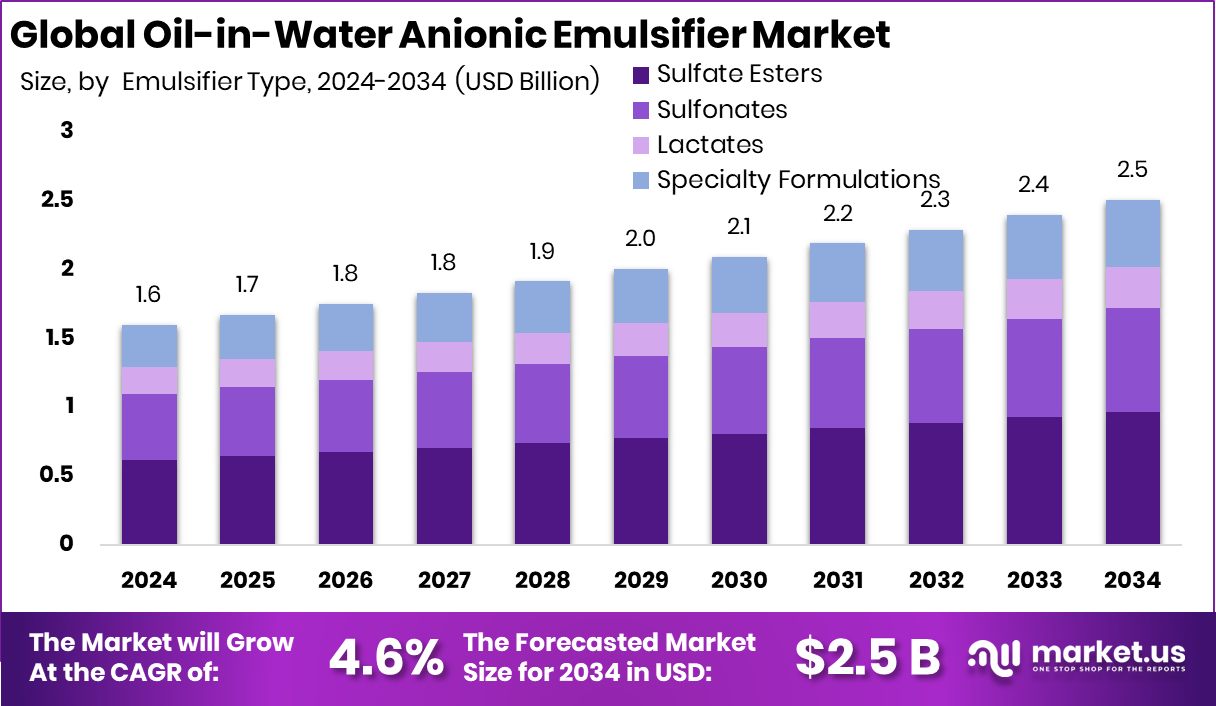

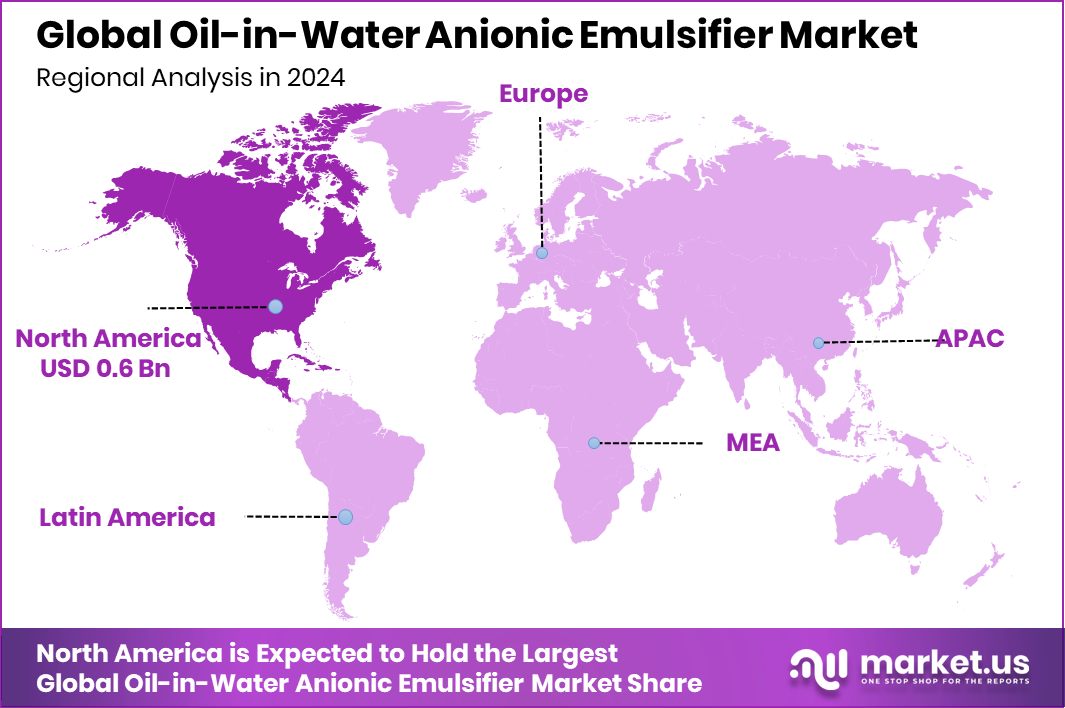

The Global Oil-in-Water Anionic Emulsifier Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034. North America dominates the Oil-in-Water Anionic Emulsifier Market at 37.90% share, with USD 0.6 Bn.

Oil-in-water anionic emulsifiers are substances that help oil droplets mix evenly into water and stay stable over time. They carry a negative electrical charge, which prevents oil droplets from joining back together. These emulsifiers are widely used in food, beverages, personal care products, pharmaceuticals, and nutrition-related formulations where smooth texture, uniform appearance, and stability are essential.

The Oil-in-Water Anionic Emulsifier Market represents the production and use of these emulsifiers across industries that depend on consistent water-based formulations. The market focuses on applications where oil must remain finely dispersed in water, such as liquid foods, dairy alternatives, topical products, and nutritional blends. Growth is closely tied to formulation reliability, safety expectations, and large-scale processing needs.

One key growth factor is the rising focus on nutrition, health, and food quality. Public and private investments support this trend, including the $2.5M Human Lactation Training Program grant and the $450,000 Lactation Certificate Program grant from Blue Cross Blue Shield NC. These initiatives encourage the development of stable, nutrient-rich liquid formulations that rely on effective emulsifiers.

Demand is increasing as institutions emphasize maternal and infant nutrition, supported by the $2.3M grant awarded to N.C. A&T and UNC-CH by the American Heart Association. This drives the need for safe, consistent oil-in-water systems in functional foods and health products.

Opportunities lie in developing emulsifiers that improve stability while supporting nutrition programs, clinical feeding solutions, and fortified beverages. As education, healthcare, and food systems align, demand for dependable oil-in-water anionic emulsifiers continues to expand steadily.

Key Takeaways

- The Global Oil-in-Water Anionic Emulsifier Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- Sulfate esters dominate the Oil-in-Water Anionic Emulsifier Market with 38.6% share due to stability benefits.

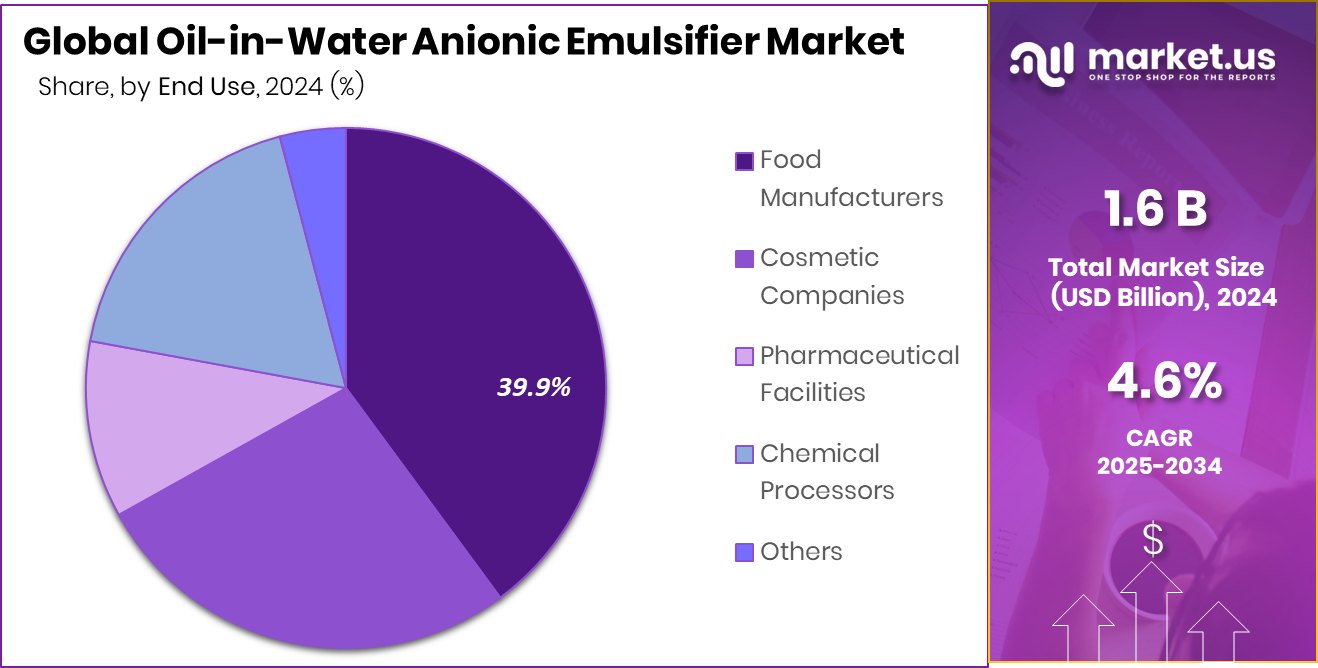

- Food manufacturers lead the Oil-in-Water Anionic Emulsifier Market with 39.9% share, driven by processed foods.

- In North America Oil-in-water anionic emulsifier market reached 37.90% share, or USD 0.6 Bn.

By Emulsifier Type Analysis

Sulfate esters dominate the oil-in-water anionic emulsifier market with 38.6% share globally.

In 2024, sulfate esters held a 38.6% share in the Oil-in-Water Anionic Emulsifier Market, reflecting their strong role in stable emulsion formation. Sulfate esters are widely preferred because they deliver high surface activity, consistent dispersion, and good compatibility with water-based systems. These properties make them suitable for processed foods, beverages, and industrial formulations that require long shelf life and uniform texture.

Food producers value sulfate esters for their predictable performance during heating, mixing, and storage. Their cost efficiency also supports large-scale manufacturing, especially in emerging economies where food processing volumes are rising steadily. As regulatory standards increasingly focus on formulation transparency and safety, sulfate esters with established compliance records continue to gain preference across water-based emulsifier applications.

By End Use Analysis

Food manufacturers lead the Oil-in-water anionic emulsifier market use, holding 39.9% share.

In 2024, food manufacturers accounted for 39.9% of end-use demand in the Oil-in-Water Anionic Emulsifier Market, driven by expanding processed and packaged food production. Emulsifiers are essential for maintaining texture, mouthfeel, and visual consistency in products such as sauces, dressings, bakery fillings, and dairy alternatives. Food manufacturers rely on anionic emulsifiers to ensure batch-to-batch uniformity while meeting efficiency and cost targets.

Rising urbanization and changing eating habits have increased demand for ready-to-eat and convenience foods, directly supporting emulsifier consumption. Additionally, manufacturers are reformulating products to improve stability while reducing waste and reprocessing losses. This practical need for performance reliability keeps food manufacturers at the center of market demand.

Key Market Segments

By Emulsifier Type

- Sulfate Esters

- Sulfonates

- Lactates

- Specialty Formulations

By End Use

- Food Manufacturers

- Cosmetic Companies

- Pharmaceutical Facilities

- Chemical Processors

- Others

Driving Factors

Digital Transformation Accelerates Demand for Stable Emulsifiers

The growing push toward digital food manufacturing is a key driving factor for the Oil-in-Water Anionic Emulsifier Market. As food producers adopt automated and data-driven production systems, consistency and formulation stability become more important than ever. Digitized processes rely on precise ingredient behavior, where emulsifiers must perform reliably across large batches and variable conditions. This shift is reinforced by innovation-led investments, such as BRAINR securing $13m in seed funding to digitize food manufacturing operations.

Such advancements encourage manufacturers to standardize formulations, reduce variability, and improve efficiency, all of which increase dependence on stable oil-in-water emulsifier systems. Anionic emulsifiers support smooth mixing, uniform texture, and predictable performance, which align well with automated controls and real-time monitoring. As digital tools reshape how food is produced, emulsifiers that support repeatable, efficient processing are becoming essential inputs rather than optional additives.

Restraining Factors

High Digital Compliance Costs Limit Small Manufacturers

One major restraining factor in the Oil-in-Water Anionic Emulsifier Market is the rising cost of digital transformation in food manufacturing. As production systems become more automated and data-driven, companies are required to upgrade equipment, software, and quality control processes. This creates pressure on smaller manufacturers that lack financial flexibility. The challenge is highlighted by BRAINR raising a record €11m to accelerate digital transformation in food manufacturing, showing that large investments are often needed to modernize operations.

While digital systems improve efficiency, they also demand precise ingredient performance, frequent testing, and skilled labor. Smaller producers may delay adopting advanced emulsifier solutions due to these costs. As a result, uneven digital readiness across manufacturers can slow broader adoption of advanced oil-in-water anionic emulsifiers, especially in price-sensitive and developing markets.

Growth Opportunity

Plant-Based Dairy Expansion Creates New Emulsifier Demand

A major growth opportunity for the Oil-in-Water Anionic Emulsifier Market comes from the rapid expansion of plant-based dairy manufacturing. Plant-based milk, yogurt, and cream alternatives require stable oil-in-water systems to deliver smooth texture, consistent taste, and long shelf life. This opportunity is reinforced by a Finnish food factory receiving $11.8M to expand plant-based dairy manufacturing capacity. Such investments increase large-scale production of liquid and semi-liquid products where emulsifiers play a critical role.

Anionic emulsifiers help evenly disperse plant oils in water, preventing separation during storage and transportation. As plant-based dairy products move from niche to mainstream consumption, manufacturers focus on formulation reliability and efficiency. This shift creates strong demand for dependable oil-in-water emulsifiers that support clean processing, scalable output, and consumer-acceptable quality across diverse plant-based dairy applications.

Latest Trends

Large-Scale Dairy Expansion Drives Emulsifier Innovation

A key latest trend in the Oil-in-Water Anionic Emulsifier Market is the expansion of large-scale dairy and food manufacturing facilities. Producers are increasing capacity to meet rising demand for yogurts, beverages, and value-added dairy products that rely on stable oil-in-water formulations. This trend is highlighted by Chobani raising $650M to fund major projects in Idaho and New York.

Such large investments push manufacturers to focus on consistency, shelf stability, and processing efficiency at higher volumes. Oil-in-water anionic emulsifiers support uniform texture and prevent separation during large-batch production and distribution. As facilities scale up, the need for emulsifiers that perform reliably under heat, mixing, and extended storage grows stronger. This trend shows how capacity expansion is directly shaping formulation choices and driving innovation in emulsifier performance.

Regional Analysis

North America leads Oil-in-water anionic emulsifier market with 37.90% share USD 0.6 Bn.

North America remained the dominating region in the Oil-in-Water Anionic Emulsifier Market, holding 37.90% of total demand and reaching a market value of USD 0.6 Bn. The region’s leadership is supported by a well-established food processing industry, strong consumption of packaged and convenience foods, and consistent use of water-based formulations across food, personal care, and industrial applications.

Europe represents a mature and regulation-driven market, where emulsifier usage is shaped by strict quality standards, clean formulation practices, and steady demand from bakery, dairy, and beverage producers. Asia Pacific shows strong underlying momentum due to expanding food manufacturing capacity, rising urban populations, and growing adoption of processed foods across developing economies, even though its structure remains highly price-sensitive.

The Middle East & Africa market is developing gradually, supported by increasing food imports, local processing initiatives, and rising awareness of formulation stability in packaged foods. Latin America contributes steadily through its expanding processed food sector and improving manufacturing infrastructure, particularly in bakery and dairy applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DSM continues to be viewed as a formulation-driven leader in the Oil-in-water anionic emulsifier market. The company’s strength lies in its in-depth knowledge of applications across food, nutrition, and specialty ingredients, enabling emulsifier solutions to be closely aligned with performance, stability, and regulatory expectations. DSM’s focus on consistent quality and technical support makes it a preferred partner for manufacturers seeking reliable, scalable emulsifier systems rather than commodity products.

Croda is recognized for its specialization in high-performance surfactants and emulsifiers, serving food and industrial customers that demand precision and customization. The company’s value proposition centers on tailored anionic emulsifier solutions designed for specific oil-in-water applications, including complex formulations requiring controlled dispersion and shelf stability. Croda’s application-led approach strengthens its position with customers seeking to optimize formulation efficiency and achieve consistent end-products.

Shah Patil & Company plays an important role by serving regional and export markets with cost-effective anionic emulsifier offerings. The company is viewed as a practical supplier supporting food processors and formulators that prioritize dependable supply and functional performance. Its market relevance is built on operational flexibility and responsiveness to customer formulation needs, particularly in price-sensitive segments of the global emulsifier landscape.

Top Key Players in the Market

- DSM

- Croda

- Shah Patil & Company

- Clariant

- Shree Vallabh Chemical

- CIDOLS

- Spectra Specialities

- Hielscher Ultrasonics

- Lansen

- Lubrizol

- BASF

Recent Developments

- In January 2025, Hielscher Ultrasonics introduced its Stepped Plate Sonicator, a new ultrasonic system designed to speed up and improve thawing processes in food production lines using high-intensity airborne ultrasound. This innovation helps maintain texture and reduce microbial risk during processing, demonstrating the company’s ongoing development of advanced ultrasonic solutions that can support emulsification and other liquid-processing applications beyond traditional sonicators.

- In October 2024, Clariant launched Pickmulse, a new emulsifier and encapsulation system developed under Lucas Meyer Cosmetics by Clariant. Pickmulse is designed to support oil-in-water and water-based formulations in skincare with easier formulation and improved skin tolerance compared to traditional surfactants.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Emulsifier Type (Sulfate Esters, Sulfonates, Lactates, Specialty Formulations), By End Use (Food Manufacturers, Cosmetic Companies, Pharmaceutical Facilities, Chemical Processors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DSM, Croda, Shah Patil & Company, Clariant, Shree Vallabh Chemical, CIDOLS, Spectra Specialities, Hielscher Ultrasonics, Lansen, Lubrizol, BASF Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oil-in-Water Anionic Emulsifier MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Oil-in-Water Anionic Emulsifier MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- DSM

- Croda

- Shah Patil & Company

- Clariant

- Shree Vallabh Chemical

- CIDOLS

- Spectra Specialities

- Hielscher Ultrasonics

- Lansen

- Lubrizol

- BASF