Global Natural Gas Liquids Market Size, Share, And Enhanced Productivity By Product (Ethane, Propane, Isobutene, Natural Gasoline), By Application (Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170021

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

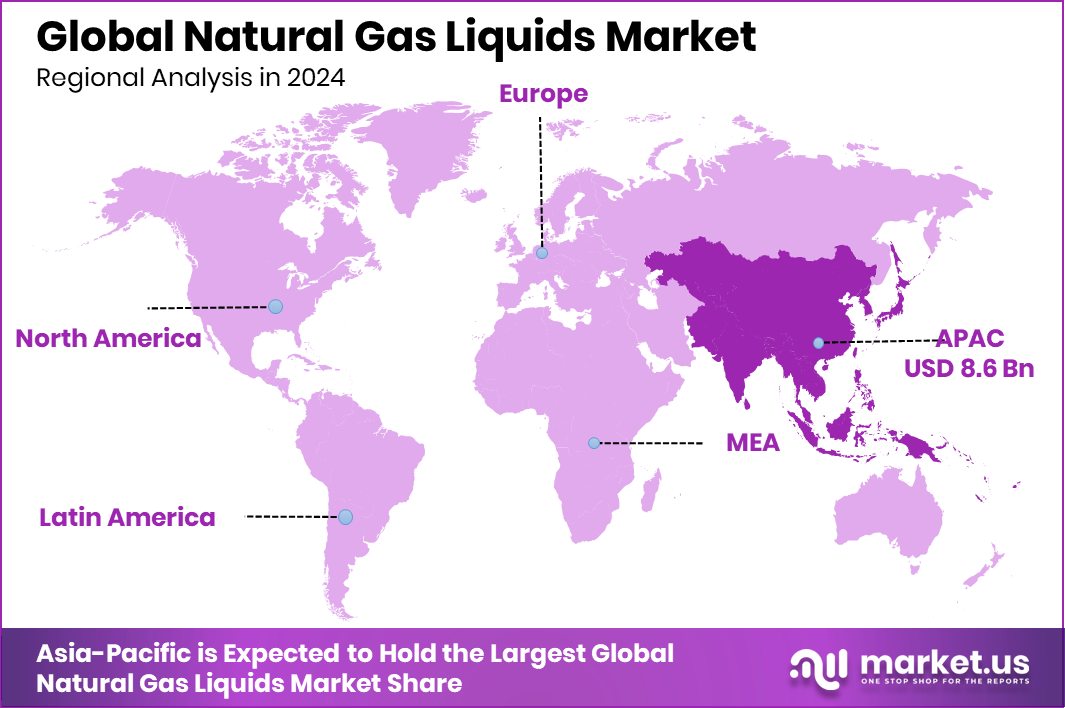

The Global Natural Gas Liquids Market is expected to be worth around USD 31.2 billion by 2034, up from USD 18.1 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. Expanding industries helped the Asia Pacific maintain a 47.80% market share and a USD 8.6 Bn value.

Natural gas liquids are hydrocarbons such as ethane, propane, butane, isobutane, and pentane that are separated from natural gas during processing. They serve as important feedstocks for fuels, petrochemicals, and heating applications. The Natural Gas Liquids Market refers to the global system of producing, transporting, and using these liquids across industrial, commercial, and residential sectors, with demand shaped by chemical manufacturing, energy use, and regional processing capacity.

Growth in this market is supported by rising petrochemical activity, where ethane and propane play a major role in producing plastics and industrial chemicals. Projects such as INEOS Olefins Belgium securing €3.5 billion for Project ONE show how large-scale infrastructure continues to drive NGL consumption through modern ethane-based production routes and expanded downstream applications.

Demand also benefits from regional support mechanisms and long-term energy planning. For example, Pennsylvania’s $1.65 billion tax break for advanced gas-based facilities encouraged major investments that rely on natural gas liquids as feedstock, improving industrial output and strengthening supply availability for domestic markets.

- Ares Management securing $300 million in U.S. gas project debt from Korea highlights how international financing continues backing gas-related assets, supporting processing, NGL handling, and new infrastructure with long-term commercial value and operational flexibility.

Opportunities are expanding as governments introduce environmental and industrial incentives. Pennsylvania receiving nearly $400 million from the EPA for emission-lowering technologies and Alberta advancing a $4.5-billion propane-to-plastics plant illustrate how NGL-linked projects still remain central to manufacturing growth, offering new capacity and improved economic prospects for the broader sector.

Key Takeaways

- The Global Natural Gas Liquids Market is expected to be worth around USD 31.2 billion by 2034, up from USD 18.1 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- Ethane holds a strong 41.4% share as petrochemical demand accelerates, Natural Gas Liquids Market expansion.

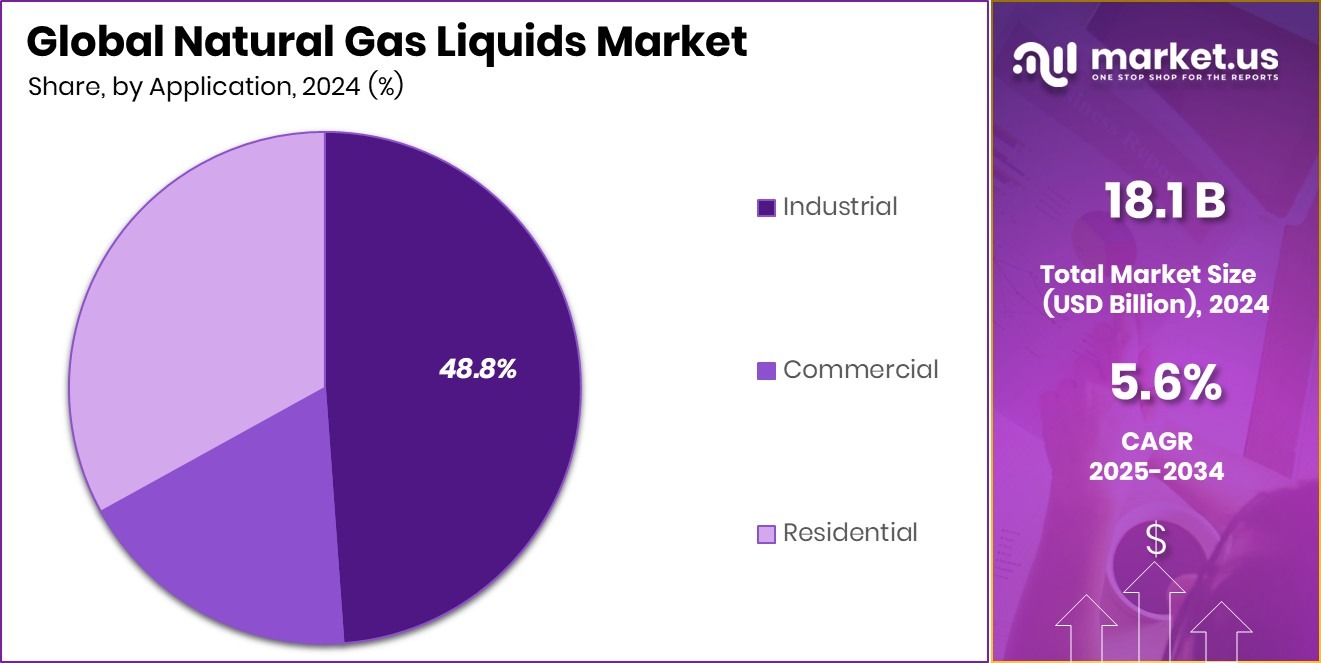

- Industrial use leads with 48.8% share, pushing steady growth across the global Natural Gas Liquids Market.

- Strong regional demand supported Asia Pacific’s 47.80% share, reaching USD 8.6 Bn overall.

By Product Analysis

Ethane dominates the Natural Gas Liquids Market with 41.4%, driving petrochemical growth.

In 2024, Ethane held a dominant market position in the By Product segment of the Natural Gas Liquids Market, with a 41.4% share. This strong position reflects its essential role as a key feedstock for the petrochemical industry, particularly in ethylene production, which supports plastics, packaging, and synthetic materials. Its consistent demand from large-scale crackers worldwide helps sustain its leading share.

Ethane’s availability from shale gas extraction further reinforces its dominance, as producers prioritize efficient recovery and separation due to its high economic value. Its lower cost compared to naphtha and its cleaner-burning profile strengthen its appeal across multiple industrial applications.

Moreover, steady expansion in downstream petrochemical capacities ensures that ethane continues to secure long-term relevance, maintaining its commanding presence in the market.

By Application Analysis

Industrial applications lead the Natural Gas Liquids Market with a strong 48.8% share.

In 2024, Industrial held a dominant market position in the By Application segment of the Natural Gas Liquids Market, with a 41.4% share. This leadership reflects the sector’s extensive reliance on natural gas liquids for manufacturing, processing, and energy requirements, particularly in petrochemicals, refining, and heavy industrial operations. Consistent demand for feedstocks such as ethane and propane strengthens the industrial segment’s overall contribution.

The segment’s dominance is also supported by expanding industrial output, where natural gas liquids offer a cost-efficient and reliable energy and raw material source. Their versatility in powering equipment, enabling chemical conversions, and supporting large-scale processing activities ensures the industrial segment maintains its strong market position.

Key Market Segments

By Product

- Ethane

- Propane

- Isobutene

- Natural Gasoline

By Application

- Industrial

- Commercial

- Residential

Driving Factors

Growing Energy Demand Strengthens NGL Consumption

Rising energy needs across residential and public sectors continue to support higher Natural Gas Liquids use, especially as many regions depend on reliable heating and transportation fuels. Governments releasing long-pending support programs also help stabilize demand. For example, approximately $3.6 billion in delayed LIHEAP funding was released to assist households with heating needs, indirectly supporting steady fuel consumption during seasonal peaks. This creates consistent flow in the NGL value chain, benefiting suppliers and processors.

- The $35.9 million awarded in Michigan for clean school buses, including propane units, increases long-term demand for NGL-derived fuels while modernizing school transportation systems with cleaner options and new infrastructure.

Additional momentum comes from federal initiatives such as the $1.5 billion FTA fund promoting cleaner mobility solutions and the $23 million DOE support for developing domestic fuels from biomass and waste. Together, these programs improve energy reliability, widen fuel applications, and create more opportunities for Natural Gas Liquids to support heating, mobility, and industrial development in a balanced, future-ready manner.

Restraining Factors

Operational Delays and Supply Challenges Limit Growth

One major restraint for the Natural Gas Liquids Market is the operational and delivery delays that disrupt fuel usage and planning cycles. When transportation fleets or public systems face setbacks, the demand for propane and related liquids becomes uneven, affecting supply stability. For instance, North Penn required a $611K transfer because of delays in propane bus deliveries, showing how schedule disruptions create financial pressure and unpredictable consumption patterns across sectors.

- Although South Carolina is investing in 235 new propane school buses, such large transitions also face logistical hurdles, including fleet readiness, fueling infrastructure setup, and rollout timelines, which can slow immediate NGL demand despite long-term benefits.

These issues highlight how project delays, supply chain constraints, and infrastructure dependencies can temporarily reduce NGL consumption and complicate planning for producers, transporters, and end-users.

Growth Opportunity

Expanding Infrastructure Unlocks New NGL Opportunities

A key growth opportunity for the Natural Gas Liquids Market comes from rising investments in propane and ethane infrastructure that broaden fuel usage across transportation and industrial sectors. For example, Missouri is offering almost $1 million in propane school bus funding, helping districts shift toward cleaner and more affordable fuel options, which increases long-term propane demand and strengthens NGL consumption patterns within local communities.

- The $130 million bid by APA Group for the Ethane Pipeline Income Fund highlights growing interest in expanding ethane transport systems, opening new routes for petrochemical supply, and supporting stable feedstock movement for downstream industries.

Additional momentum comes from initiatives such as 21 projects selected for Shell environmental mitigation funding, which encourage cleaner operational practices and more sustainable energy development. Meanwhile, Qenos’ $659 million loss and the up to $200 million commitment to keep its remaining plant running show how restructuring activities can create future opportunities for improved supply contracts, updated infrastructure, and fresh investment streams. Together, these developments create new growth windows for NGL producers, pipeline operators, and end-use sectors.

Latest Trends

Digital Tools and Clean Fuels Shape NGL Trends

A leading trend in the Natural Gas Liquids Market is the growing shift toward digital platforms and cleaner fuel innovation, which is reshaping how companies manage demand, customer behavior, and long-term fuel strategies. Businesses are increasingly adopting advanced analytics to understand usage patterns and optimize distribution, improving how propane and related liquids move through the market.

- The Danish startup Propane securing €1 million for an AI-powered customer intelligence platform shows how digital tools are becoming central to forecasting fuel needs, strengthening service efficiency, and creating smarter decision-making systems across the NGL value chain.

Another key trend comes from government-driven clean fuel programs. The U.S. Department of Energy announced up to $23 million to accelerate renewable chemicals and fuels, reflecting rising interest in blending traditional natural gas liquids with more sustainable energy pathways. This encourages innovation in processing methods, new hybrid fuel products, and cleaner industrial applications, helping the market evolve toward modern, technology-enabled, and environmentally conscious operations.

Regional Analysis

Asia Pacific dominated the Natural Gas Liquids Market with 47.80%, valued at USD 8.6 Bn.

Asia Pacific dominated the Natural Gas Liquids Market in 2024 with a 47.80% share, valued at USD 8.6 Bn, reflecting its strong industrial base, growing petrochemical demand, and continuous expansion in energy-intensive manufacturing. The region’s rising consumption of ethane, propane, and butane across processing industries reinforces its leadership, supported by steady refinery operations and large-scale utilization in chemical production. This dominance highlights Asia Pacific as the primary growth center within the global market.

North America followed with stable demand driven by natural gas processing and downstream applications, supported by mature extraction infrastructure and consistent consumption in industrial and residential sectors. Europe maintained balanced growth influenced by energy diversification efforts and established petrochemical clusters that rely on natural gas liquids for operational efficiency.

The Middle East & Africa continued leveraging strong hydrocarbon availability, with regional producers integrating natural gas liquids into refining and export activities. Latin America demonstrated steady adoption influenced by industrial development and improved utilization of natural gas-derived products across manufacturing segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ExxonMobil Corporation continued to strengthen its position in the global Natural Gas Liquids (NGL) market by leveraging its expansive upstream capabilities and integrated value chain. The company’s diversified natural gas portfolio allows it to maintain consistent NGL output, supporting petrochemical, industrial, and fuel markets. Its focus on operational efficiency and large-scale project execution ensures steady supply reliability, which remains a core competitive advantage. ExxonMobil’s long-standing expertise in processing technologies further supports strong participation in key NGL streams such as ethane, propane, and butane.

Chevron Corporation maintained a resilient market presence through its disciplined development of gas-rich basins and efficient midstream infrastructure. The company’s strategic investments in processing facilities enable improved recovery and separation of NGL components, reinforcing its contribution to downstream industries. Chevron’s emphasis on operational optimization and stable production volumes supports its role as a dependable supplier in global trade flows.

Royal Dutch Shell plc demonstrated steady performance driven by its integrated gas operations and global footprint. Its advanced liquefaction and processing capabilities enhance the value of extracted natural gas liquids, allowing Shell to serve multiple end-use sectors with reliability. The company’s balanced global operations provide flexibility in responding to changing demand patterns, ensuring continued relevance in the evolving NGL landscape.

Top Key Players in the Market

- ExxonMobil Corporation

- Chevron Corporation

- Royal Dutch Shell plc

- BP plc

- ConocoPhillips

- TotalEnergies SE

- Enterprise Products Partners LP

- Eni S.p.A.

- Occidental Petroleum Corporation

- Saudi Aramco

Recent Developments

- In November 2025, ExxonMobil agreed to acquire a 40% stake in the Bahia Natural Gas Liquids pipeline, which will help increase its access to NGL flows from the Permian Basin and expand the system’s capacity to handle growing volumes. The deal is expected to close in early 2026 pending approvals.

- In June 2025, Chevron expands its LNG supply deal, signing a long-term agreement with Energy Transfer to secure an additional 1 million tonnes per annum (mtpa) of liquefied natural gas (LNG) from the Lake Charles LNG export facility, raising its total contracted LNG volume to 3 mtpa. This expansion strengthens Chevron’s LNG supply position and long-term energy commitments.

- In June 2025, Shell revealed plans to add up to 12 million metric tons of additional LNG capacity by 2030. This expansion of LNG projects across several countries (including Canada, Qatar, Nigeria, and the UAE) will increase Shell’s ability to handle more gas liquids in global markets, strengthening its role in supplying cooled natural gas products.

Report Scope

Report Features Description Market Value (2024) USD 18.1 Billion Forecast Revenue (2034) USD 31.2 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Ethane, Propane, Isobutene, Natural Gasoline), By Application (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ExxonMobil Corporation, Chevron Corporation, Royal Dutch Shell plc, BP plc, ConocoPhillips, TotalEnergies SE, Enterprise Products Partners LP, Eni S.p.A., Occidental Petroleum Corporation, Saudi Aramco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Gas Liquids MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Gas Liquids MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ExxonMobil Corporation

- Chevron Corporation

- Royal Dutch Shell plc

- BP plc

- ConocoPhillips

- TotalEnergies SE

- Enterprise Products Partners LP

- Eni S.p.A.

- Occidental Petroleum Corporation

- Saudi Aramco