Global Municipal Water Market Size, Share, And Enhanced Productivity By Type (Municipal Drinking Water Treatment , Municipal Waste Water Treatment), By Application (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169791

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

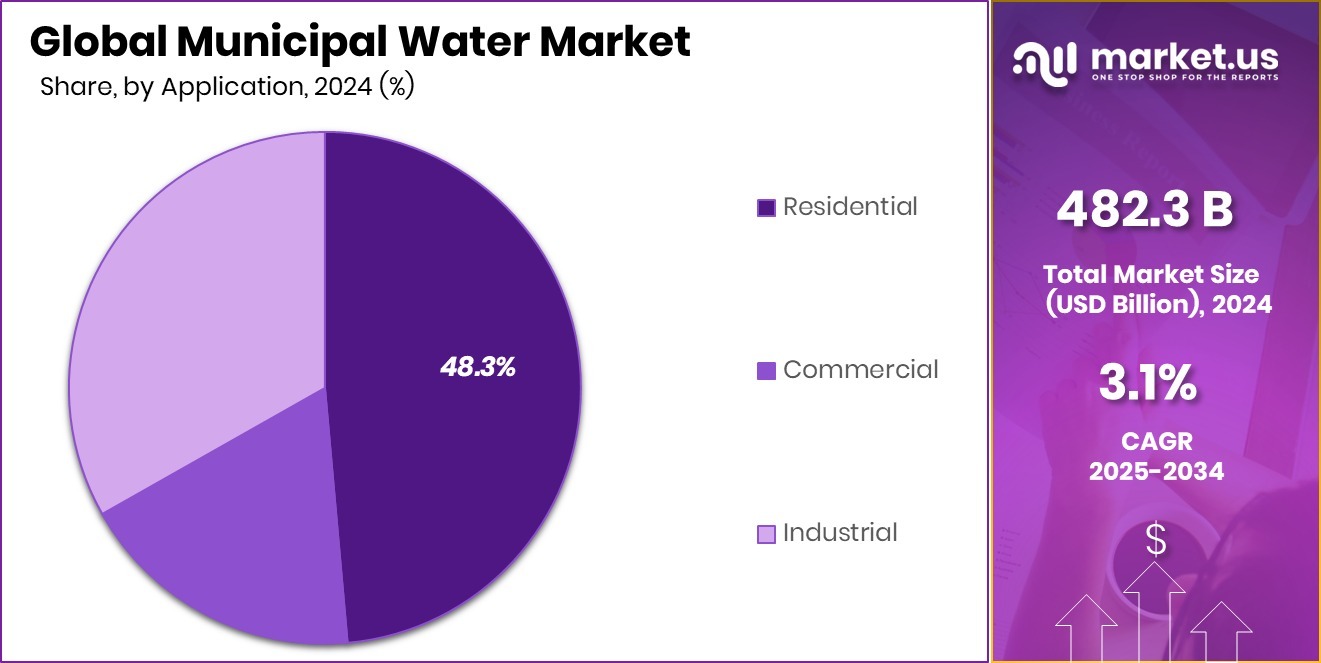

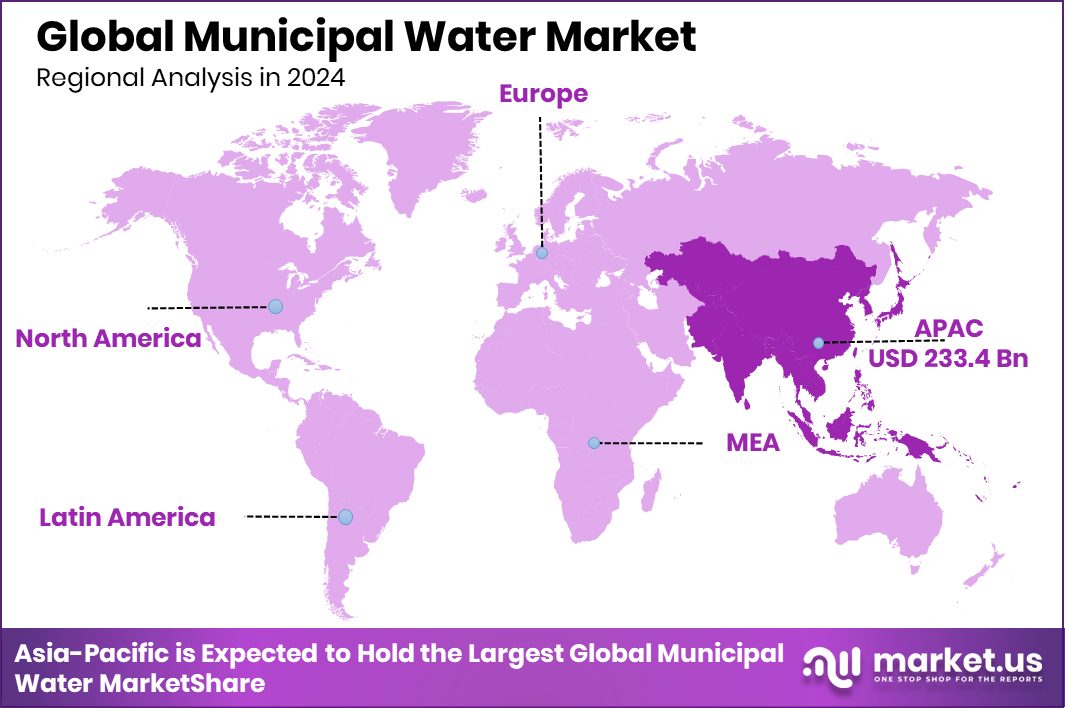

The Global Municipal Water Market is expected to be worth around USD 654.5 billion by 2034, up from USD 482.3 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034. Strong population growth positions Asia-Pacific as the dominant region, holding 48.40%, valued at USD 233.4 Bn.

Municipal water refers to treated water that is supplied by local governments or public utilities for everyday use in homes, businesses, schools, and public services. It includes sourcing raw water, treating it to meet safety standards, and distributing it through pipelines so communities have reliable access to clean drinking water and sanitation.

The municipal water market covers the planning, construction, operation, and upgrade of public water and wastewater systems. Its growth is closely linked to aging infrastructure, stricter water quality rules, and rising pressure on cities to ensure safe, uninterrupted supply. New York’s $78 million funding for water quality improvements highlights how governments are prioritizing system upgrades to protect public health.

Demand for municipal water services continues to rise as cities expand and systems require modernization. In Beloit, Kansas, upgrades are supported by an $11,404,000 low-interest loan under the KPWSLF, including $2,587,320 in principal forgiveness, easing the financial burden on local authorities. Since 1997, this program has delivered over $1.5 billion to municipalities, reflecting sustained demand for affordable water financing.

Opportunities in this market are growing through targeted grants and housing-linked investments. Lawton received $5.125 million in EPA grants, combined with a $2 million state ARPA grant, to modernize treatment processes. In Ontario, $3,832,500 is enabling water infrastructure expansion to support 3,688 new homes, showing how water systems unlock urban development.

- Phoenix, Arizona: Nearly $180 million in federal funding is supporting an advanced purification facility treating 8 million gallons per day, increasing total city treatment capacity to 12.5 million gallons daily.

- Michigan: Over $267 million in state grants are funding storm sewers, lead service line replacements, and water main repairs to strengthen public health protection statewide.

Key Takeaways

- The Global Municipal Water Market is expected to be worth around USD 654.5 billion by 2034, up from USD 482.3 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034.

- Municipal Drinking Water Treatment dominates the Municipal Water Market with a 62.8% share, driven by regulatory water quality standards and essential public health needs.

- Residential application holds a 48.3% share in the Municipal Water Market, supported by urban population growth and daily household water consumption patterns.

- The Asia-Pacific Municipal Water Market reached USD 233.4 Bn, supported by expanding public infrastructure needs.

By Type Analysis

In the Municipal Water Market, municipal drinking water treatment leads with 62.8% share, reflecting priority on safe, regulated water supply systems.

In 2024, Municipal Drinking Water Treatment held a dominant market position in the By Type segment of the Municipal Water Market, with a 62.8% share, reflecting its essential role in safeguarding public health and ensuring safe daily water consumption. This dominance is driven by the continuous need to treat raw water to meet regulated safety and quality standards before distribution across urban and semi-urban populations.

Municipal drinking water treatment remains a priority for local authorities due to rising concerns around waterborne contaminants, aging treatment facilities, and increasing demand for a consistent potable water supply. The segment benefits from steady operational demand, as drinking water services are non-discretionary and required across residential, commercial, and public infrastructure settings.

Additionally, growing urban population density and stricter compliance requirements strengthen the reliance on centralized drinking water treatment systems. This segment maintains long-term stability within the municipal water market, supported by routine maintenance needs, system optimization efforts, and the critical responsibility of delivering safe water to communities every day.

By Application Analysis

Within the Municipal Water Market, the residential segment holds a 48.3% share, driven by urban households’ consistent dependence on reliable municipal water access

In 2024, Residential held a dominant market position in the By Type segment of the Municipal Water Market, with a 48.3% share, mainly due to the essential nature of household water consumption for drinking, cooking, sanitation, and personal hygiene. Residential demand remains consistent and predictable, making it the largest and most stable consumption segment within municipal water systems.

The dominance of the residential segment is also supported by population growth in urban and suburban areas, where dependable municipal water supply is a basic public service. Daily household usage creates sustained demand, requiring continuous operation, monitoring, and maintenance of distribution networks to ensure uninterrupted service quality and safety.

Furthermore, rising living standards and increased awareness of water quality at the household level strengthen reliance on municipally supplied water. Residential users depend heavily on centralized systems for treated water access, reinforcing this segment’s strong presence and long-term importance within the municipal water market.

Key Market Segments

By Type

- Municipal Drinking Water Treatment

- Municipal Waste Water Treatment

By Application

- Residential

- Commercial

- Industrial

Driving Factors

Government Infrastructure Spending Strengthens Municipal Water Systems

A major driving factor of the municipal water market is strong government investment aimed at upgrading aging water and wastewater infrastructure. Many cities are facing old pipelines, treatment plants, and rising compliance requirements, which makes public funding essential. These investments help improve water safety, reduce system losses, and ensure a reliable supply for growing populations. As water is a basic public service, governments continue to prioritise long-term resilience and environmental protection through structured financing and grants.

Public funding support clearly shows this commitment. New York State approved $265 million in financial assistance through its Environmental Facilities Corporation to improve water infrastructure statewide. In North Carolina, $204 million in grants were awarded to enhance drinking water and wastewater projects, helping communities meet health and environmental standards.

- Canada and Ontario: Over $190.2 million from the federal government, $140.5 million from Ontario, and $108.5 million from local communities are jointly supporting large-scale water infrastructure improvements across regions.

Restraining Factors

High Infrastructure Costs Slow Municipal Water Projects

One of the key restraining factors in the municipal water market is the high cost of building and upgrading water infrastructure. Treatment plants, storage facilities, and transmission pipelines require large upfront investment and long construction periods. Smaller municipalities often struggle to move projects forward due to limited budgets, approval delays, and rising material and labor expenses. These cost pressures can slow modernization efforts and extend the life of outdated systems.

Government support helps reduce this burden, but it also highlights how capital-intensive the sector remains. In Oregon, the legislature provided $20 million for Salem-area water projects, including a water treatment and water storage facility that acts as a critical backup if the main supply is disrupted. Similarly, targeted grants are essential for projects that protect long-term water reliability.

- Sun Peaks, Canada: A $4,583,125 federal–provincial grant supports the Sun Peaks Water Supply Line Project, demonstrating the scale of financial support needed to overcome infrastructure cost barriers.

Growth Opportunity

Water Infrastructure Expansion Driven by Urban Housing Growth

A major growth opportunity in the municipal water market comes from large-scale housing development and community expansion. As cities plan for new residential areas, water supply and treatment systems must expand at the same pace. Reliable municipal water networks are a basic requirement for new homes, creating steady demand for upgraded pipelines, treatment capacity, and disinfection facilities. This link between housing and water infrastructure opens long-term opportunities for system expansion and capacity enhancement.

- In Ontario, water infrastructure investments are supporting the construction of more than 500,000 new homes, including $35 million allocated to enable nearly 47,000 new homes in the Peel Region, highlighting how urban growth directly drives municipal water development.

Public health protection also creates opportunities through targeted improvement programs. In the United States, the Environmental Protection Agency is awarding over $16 million to Alaska’s drinking water and clean water revolving loan programs, with an additional $2.6 million dedicated to strengthening safe drinking water systems. In Canada, improved treatment standards are enabling new project development at the municipal level.

- Phillips Reservoir, Canada: $9.5 million in joint federal and provincial funding supports a new UV disinfection facility, improving water treatment capacity and reliability while meeting stricter public health requirements.

Latest Trends

Modern Water Systems Focus on Safety

A key latest trend in the municipal water market is the strong focus on modernizing water systems to improve safety, reliability, and long-term sustainability. Governments are prioritizing upgrades that support housing growth, protect agricultural areas, and reduce health risks linked to aging infrastructure.

In Ontario, $135 million is being invested in water systems and irrigation infrastructure across the Niagara Region and Leamington, helping support home construction, protect farmland, and maintain local employment. This reflects a broader shift toward integrated water planning that balances urban needs with environmental protection.

Another clear trend is the replacement of outdated and hazardous water service components. In the United States, Salt Lake City received approval for a $39 million loan dedicated to lead service line inventory and replacement across the city’s drinking water system. In Canada, the Oneida Nation of the Thames secured $43 million in federal funding to improve access to clean drinking water, along with more than $110 million jointly invested by Canada and British Columbia across 14 drinking water, wastewater, and stormwater projects.

- Canada–British Columbia Projects: Over $110 million invested across 14 water infrastructure projects to strengthen drinking water, wastewater, and stormwater services, improving reliability, safety, and climate readiness for local communities.

Regional Analysis

Asia-Pacific leads the Municipal Water Market with a 48.40% share, driven by rapid urbanization.

Asia-Pacific remains the dominating region in the Municipal Water Market, holding a 48.40% share valued at USD 233.4 Bn, supported by rapid urban expansion, dense population centers, and rising demand for safe municipal water access. Large metropolitan developments and continuous pressure on public water utilities strengthen the region’s leading position, making municipal water supply a critical public service across both urban and semi-urban areas.

North America represents a mature municipal water market, characterized by established water distribution networks and consistent demand driven by residential, commercial, and industrial usage. The region focuses on system reliability, service continuity, and maintaining water quality standards, which sustains stable operational demand across cities and municipalities.

Europe’s municipal water market is shaped by structured public utilities and a strong emphasis on regulated water management practices. The region maintains steady demand due to the essential nature of municipal water services across residential communities, public institutions, and urban infrastructure.

The Middle East & Africa market is influenced by growing urban centers and increasing awareness of reliable municipal water access. Municipal water systems play a vital role in supporting population growth and improving living conditions in expanding cities.

Latin America shows steady development in municipal water services, driven by urban population growth and the need for improved public water distribution systems, supporting essential household and community water requirements across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Veolia Environnement S.A. holds a strong position through its long-standing role in managing water supply, wastewater treatment, and recycling services for cities. The company’s integrated approach supports municipalities in improving efficiency, reducing water losses, and managing complex water challenges. Its operational scale and technical depth allow it to support both large metro systems and smaller urban utilities, making it a reliable partner for long-term municipal water management.

Suez S.A. continues to play an important role in helping cities improve water quality and service reliability. The company focuses on optimizing water treatment processes, distribution efficiency, and wastewater reuse, which are increasingly critical for urban sustainability. In 2024, Suez’s experience in managing municipal systems supports cities in balancing regulatory compliance with cost control, while maintaining consistent water services for residential and commercial users.

Xylem Inc. is recognized for its strong expertise in water infrastructure equipment and smart water technologies. The company supports municipal utilities through advanced pumping systems, monitoring solutions, and data-driven tools that improve system visibility and performance. In 2024, Xylem’s focus on efficiency and asset management helps municipalities reduce operational stress, improve water delivery reliability, and plan future infrastructure upgrades with greater confidence.

Top Key Players in the Market

- Veolia Environnement S.A.

- Suez S.A.

- Xylem Inc.

- Pentair plc

- American Water Works Company, Inc.

- Evoqua Water Technologies LLC

- Kurita Water Industries Ltd.

- Aquatech International LLC

- Calgon Carbon Corporation

- Danaher Corporation

Recent Developments

- In October 2025, Veolia’s U.S. unit completed the acquisition of the Manalapan Township Water System in New Jersey. The deal, priced around USD 4 million, brings about 3,500 homes and businesses under Veolia’s service, expanding its municipal-water footprint and enabling planned infrastructure upgrades for long-term reliability.

- In October 2025, the Grand Paris Seine & Oise Urban Community renewed its contract with SUEZ to operate the Mureaux Wastewater Treatment Plant — covering 24 municipalities and servicing roughly 120,500 inhabitants — committing to transform the facility toward energy neutrality by 2033.

Report Scope

Report Features Description Market Value (2024) USD 482.3 Billion Forecast Revenue (2034) USD 654.5 Billion CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Municipal Drinking Water Treatment, Municipal Waste Water Treatment), By Application (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Veolia Environnement S.A., Suez S.A., Xylem Inc., Pentair plc, American Water Works Company, Inc., Evoqua Water Technologies LLC, Kurita Water Industries Ltd., Aquatech International LLC, Calgon Carbon Corporation, Danaher Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Municipal Water MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Municipal Water MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veolia Environnement S.A.

- Suez S.A.

- Xylem Inc.

- Pentair plc

- American Water Works Company, Inc.

- Evoqua Water Technologies LLC

- Kurita Water Industries Ltd.

- Aquatech International LLC

- Calgon Carbon Corporation

- Danaher Corporation