Global Mulch Film Market Size, Share Analysis Report By Type (Black, Clear/Transparent, Colored, Degradable, Others), By Raw Material (Conventional, Biodegradable), By Crop Type (Fruits and Vegetables, Grains and Oilseeds, Flowers and Plants, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155450

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

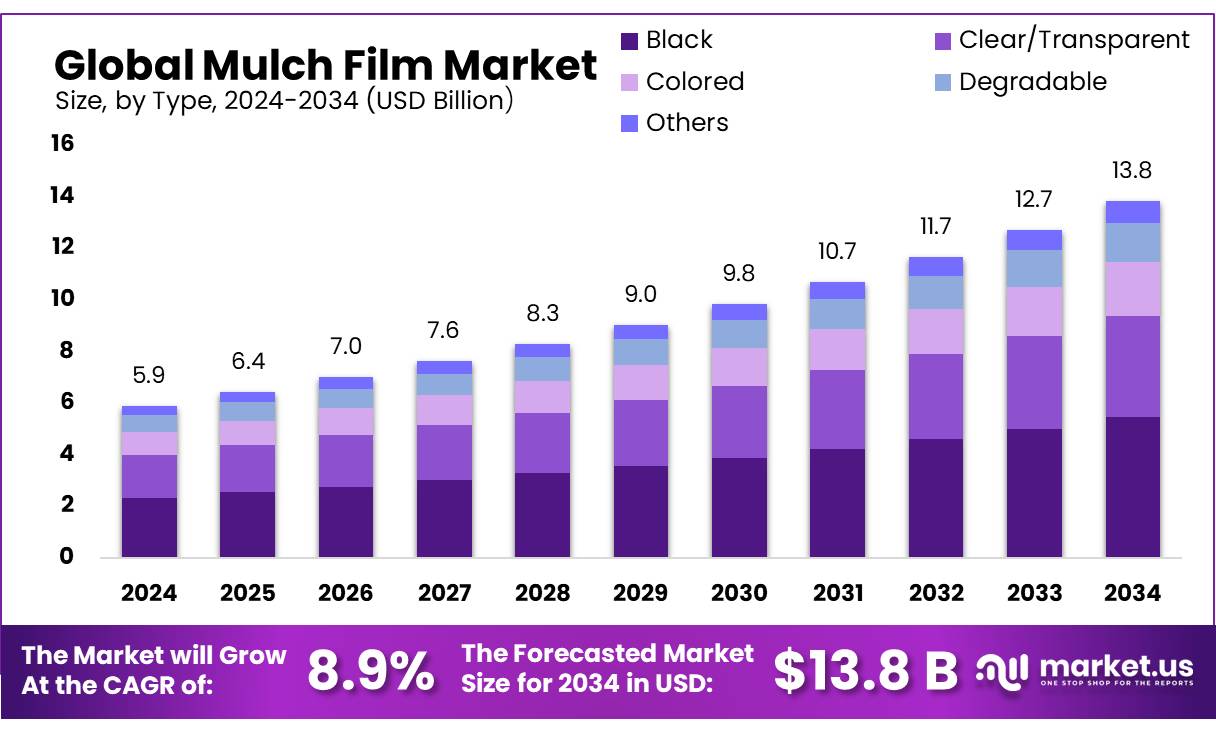

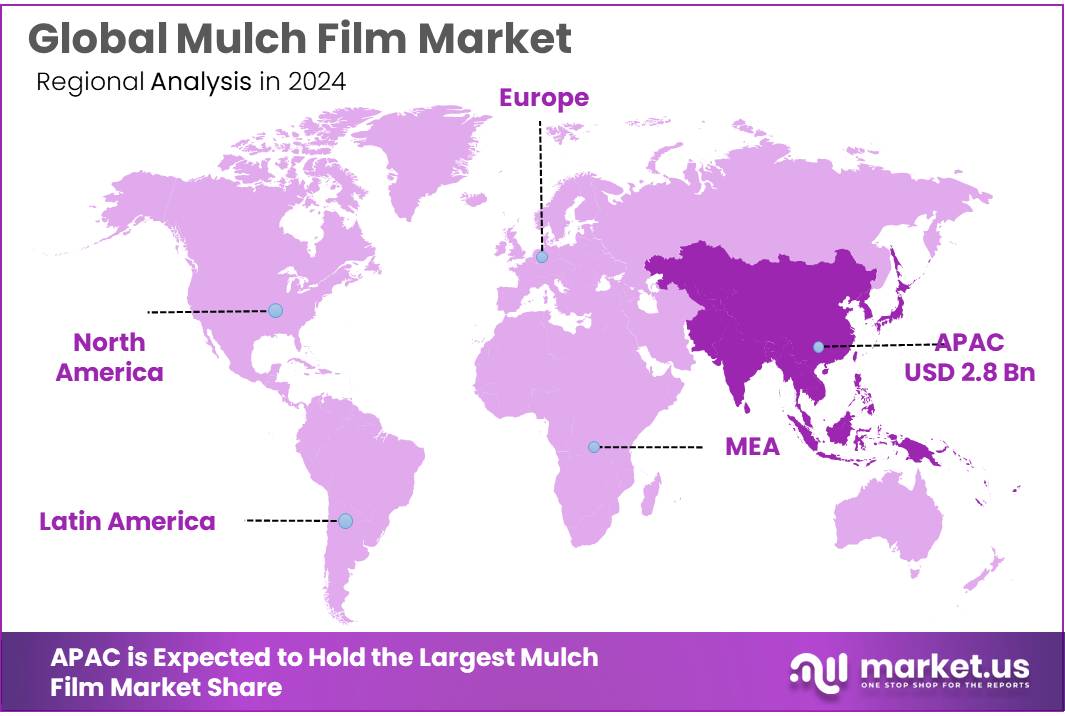

The Global Mulch Film Market size is expected to be worth around USD 13.8 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 47.8% share, holding USD 2.8 Billion revenue.

Mulch film concentrates are additive masterbatches—typically UV/HALS stabilizers, antioxidants, slip/antiblock and pigment (often carbon black)—formulated for thin agricultural films that suppress weeds, conserve soil moisture and accelerate harvests. Their relevance is growing as plastic mulch now covers tens of millions of hectares globally and is embedded in modern horticulture and row-crop systems.

The Food and Agriculture Organization (FAO) estimates agriculture uses about 12.5 million tonnes of plastic products each year in plant and animal production, underscoring the scale at which stabilizer- and pigment-rich concentrates are required to keep mulch films functional in sun, heat and agrochemical exposure.

Industrial dynamics are shaped by high, rising demand for films and by tightening performance and sustainability rules. Industry data indicate combined demand for greenhouse, mulching and silage films could rise by ~50% from 6.1 Mt (2018) to 9.5 Mt by 2030, a trajectory that directly lifts concentrate consumption for UV packages and processing aids.

In the United States, academic assessments suggest vegetable growers alone use roughly 0.13 Mt of polyethylene mulch annually, signaling a large installed base of film that depends on concentrates for durability and opacity. China—the world’s largest mulch user—has introduced a national threshold of 75 kg/ha for residual mulch in soils (GB/T 25413-2010), pushing the market toward thicker, longer-life films and better recovery practices; both trends favor higher-performance concentrate recipes.

Policy is a clear demand driver. In India, the Mission for Integrated Development of Horticulture (MIDH) provides capital support for plastic mulching: 50% subsidy up to ₹16,000/ha in FY 2024-25 and ₹20,000/ha with a ₹40,000/ha unit cost cap in FY 2025-26, with guidance on film thickness and recycling—measures that expand adoption while nudging quality and end-of-life management. In Europe, product conformity is steered by EN 17033 (2018), which specifies requirements and test methods for biodegradable mulch films in soil; this standard underpins certification schemes and informs procurement choices, creating a premium segment for compliant concentrates.

Key Takeaways

- Mulch Film Market size is expected to be worth around USD 13.8 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 8.9%.

- Black held a dominant market position, capturing more than a 39.4% share of the global mulch film market.

- Conventional held a dominant market position, capturing more than a 78.9% share in the mulch film market.

- Fruits & Vegetables held a dominant market position, capturing more than a 56.2% share in the mulch film market.

- Asia Pacific (APAC) region held a commanding position in the global mulch film market, accounting for 47.8% of total market share, valued at approximately USD 2.8 billion.

By Type Analysis

Black Mulch Film dominates with 39.4% due to its superior weed control and heat absorption benefits.

In 2024, Black held a dominant market position, capturing more than a 39.4% share of the global mulch film market by type. This strong preference is largely driven by black film’s ability to block sunlight from reaching the soil, effectively suppressing weed growth and maintaining soil moisture. Farmers also benefit from its heat-absorbing property, which warms the soil, encouraging faster seed germination and early plant growth—especially in cooler regions. Governments in major agricultural economies such as India and China continue to support the use of plasticulture techniques, including black mulch films, under schemes like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and the National Mission on Sustainable Agriculture (NMSA), further accelerating adoption.

By Raw Material Analysis

Conventional Raw Materials lead mulch film market with 78.9% due to affordability and wide availability.

In 2024, Conventional held a dominant market position, capturing more than a 78.9% share in the mulch film market by raw material type. This dominance is mainly because conventional materials like polyethylene (LDPE, LLDPE) are cost-effective, durable, and readily available in large quantities. These plastics offer strong resistance to tearing, UV rays, and agrochemicals, making them the preferred choice for farmers across large-scale agricultural regions. Most government-backed programs that support plasticulture—like India’s Mission for Integrated Development of Horticulture (MIDH)—still use conventional plastic mulch films due to their lower upfront costs and ease of application, especially among small and medium farmers.

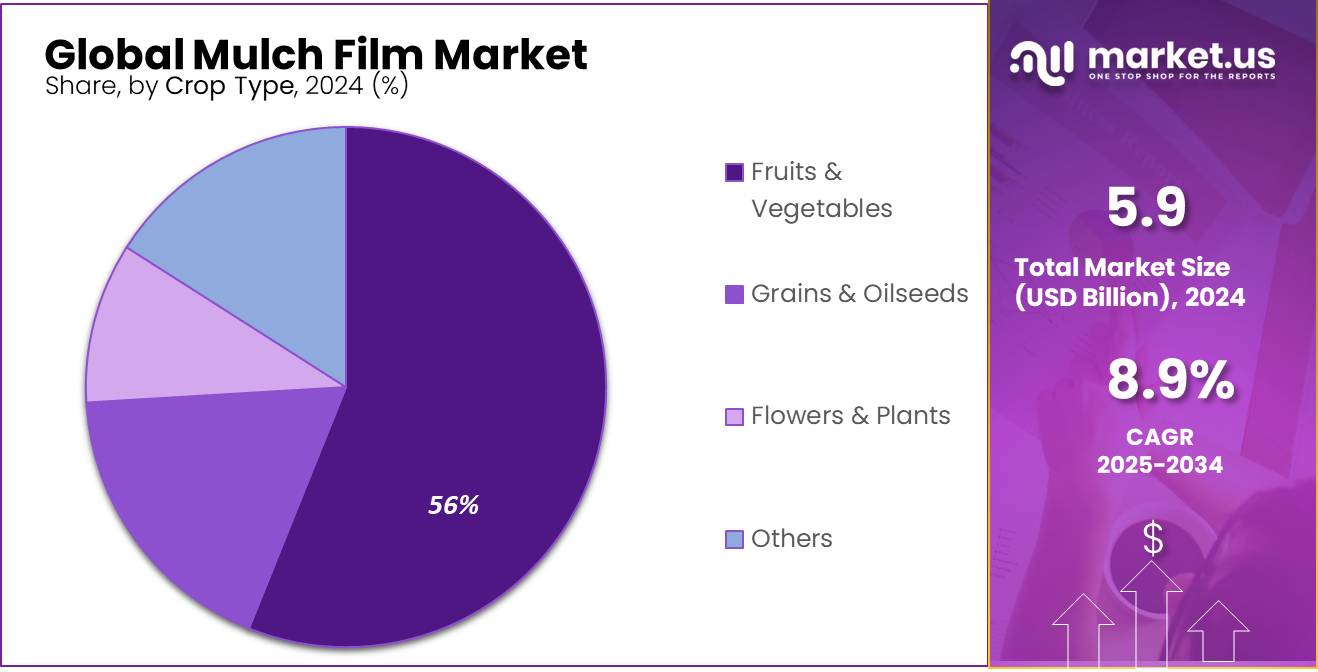

By Crop Type Analysis

Fruits & Vegetables lead mulch film usage with 56.2% share due to better yield and moisture retention.

In 2024, Fruits & Vegetables held a dominant market position, capturing more than a 56.2% share in the mulch film market by crop type. This segment leads the market because mulch films help maintain soil moisture, control weeds, and speed up harvest cycles—key benefits for fruit and vegetable growers. Crops like tomatoes, melons, cucumbers, strawberries, and peppers are highly sensitive to temperature and moisture fluctuations, and the use of mulch film creates a more stable growing environment. Governments around the world have also promoted plastic mulching in horticulture through subsidies and technical support. For example, India’s MIDH scheme and China’s plasticulture promotion policies have significantly encouraged mulch use in vegetable and fruit cultivation.

Key Market Segments

By Type

- Black

- Clear/Transparent

- Colored

- Degradable

- Others

By Raw Material

- Conventional

- LDPE

- LLDPE

- HPDE

- EVA

- Others

- Biodegradable

- Thermoplastic Starch (TPS)

- Starch Blended with Polylactic Acid (PLA)

- Starch Blended with Polyhydroxyalkanoate (PHA)

- Others

By Crop Type

- Fruits & Vegetables

- Grains & Oilseeds

- Flowers & Plants

- Others

Emerging Trends

Rise of Smart Biodegradable Mulch Films in Precision Agriculture

A significant trend in the mulch film industry is the development and adoption of smart biodegradable mulch films, driven by advancements in technology and a growing emphasis on sustainable farming practices. These innovative films integrate sensors and AI-driven technologies to monitor soil conditions in real-time, allowing for precise control over irrigation, nutrient delivery, and degradation rates. This approach not only enhances crop yield and quality but also reduces environmental impact by minimizing resource wastage.

Recent studies have highlighted the benefits of these smart films. For instance, researchers at Lehigh University are developing biodegradable mulch films that deliver nutrients directly to crops, offering an eco-friendly alternative to traditional plastics in agriculture. These films aim to reduce plastic pollution and boost soil health by providing essential nutrients to plants as they grow.

Furthermore, innovations in polymer science have led to the creation of biodegradable films with tailored properties. Materials such as thermoplastic starch (TPS), polylactic acid (PLA), and polyhydroxyalkanoates (PHA) are being used to produce films that are not only biodegradable but also offer enhanced mechanical strength, UV resistance, and controlled degradation rates. This customization ensures that the films meet the specific needs of different crops and environmental conditions.

The adoption of these smart biodegradable mulch films is further supported by government policies and initiatives aimed at promoting sustainable agricultural practices. For example, the European Union’s Green Deal and Farm to Fork strategy encourage the use of eco-friendly materials in agriculture, including biodegradable mulch films. These policies provide incentives for farmers to transition towards more sustainable practices, thereby reducing the environmental footprint of agriculture.

Drivers

Adoption of Biodegradable Mulch Films in Agriculture

A significant driving factor for the adoption of biodegradable mulch films is the increasing need for sustainable agricultural practices that minimize environmental impact. Traditional polyethylene (PE) mulch films, commonly used in agriculture, pose disposal challenges as they are not biodegradable and can lead to plastic accumulation in soils. This accumulation can impede water infiltration, reduce soil aeration, and negatively affect soil microbial communities.

In response to these concerns, biodegradable mulch films have been developed as an eco-friendly alternative. These films are designed to degrade naturally in the soil, reducing the need for removal and disposal. A study funded by the USDA’s National Institute of Food and Agriculture (NIFA) highlighted the potential of biodegradable plastics in agriculture, noting that such materials can help reduce plastic waste and improve soil health.

The U.S. Department of Agriculture (USDA) has also recognized the importance of biodegradable mulch films. In 2014, the USDA’s National Organic Program amended its regulations to allow the use of biodegradable biobased mulch films in organic crop production. These films must meet specific criteria, including biodegradability and biobased content, to ensure they align with organic farming standards.

Furthermore, research conducted by Michigan State University, funded by the USDA, evaluated biodegradable biobased mulch films in organic crop production. The study found that these films could provide similar benefits to traditional PE films, such as weed control and moisture retention, while being more environmentally friendly.

Restraints

High Cost and Economic Viability Challenges

A significant barrier to the widespread adoption of biodegradable mulch films in agriculture is their higher cost compared to conventional polyethylene (PE) mulch films. Studies have shown that biodegradable mulch films can be 1.5 to 2 times more expensive than traditional plastic mulch, even when accounting for the costs associated with removal and disposal of conventional films . For instance, in China, the procurement cost of biodegradable mulch film is approximately CNY 4,000 per hectare, whereas conventional film costs around CNY 1,000 per hectare.

This cost disparity poses a significant challenge for small-scale farmers who may not have the financial resources to invest in more expensive materials. Although government subsidies can offset some of these costs, they may not be sufficient to make biodegradable mulch films economically viable for all farmers. In China, for example, subsidies for biodegradable mulch film application are CNY 1,800 per hectare, which still leaves farmers with a substantial financial burden.

Moreover, the performance of biodegradable mulch films in the field can vary depending on environmental conditions. Factors such as temperature, humidity, and soil type can influence the degradation rate of these films, potentially affecting their effectiveness in weed control and moisture retention. Inconsistent performance may deter farmers from adopting these materials, as they seek reliable solutions to enhance crop yields and reduce labor costs.

To address these challenges, ongoing research and development are crucial to improve the affordability and performance of biodegradable mulch films. Advancements in material science and manufacturing processes can lead to cost reductions and enhanced functionality, making these films more accessible to a broader range of farmers. Additionally, policy measures that provide financial incentives and support for the adoption of sustainable agricultural practices can play a pivotal role in overcoming economic barriers and promoting the transition to biodegradable mulch films.

Opportunity

Government Support and Policy Initiatives

A significant growth opportunity for biodegradable mulch films lies in the increasing support from government policies and initiatives aimed at promoting sustainable agricultural practices. Governments worldwide are recognizing the environmental challenges posed by traditional polyethylene mulch films, such as plastic accumulation in soils and the release of microplastics. In response, they are implementing policies that encourage the adoption of biodegradable alternatives.

For instance, in Europe, the European Union has published standards for biodegradable mulch films, promoting their use to enhance sustainability in agriculture. These standards ensure that biodegradable films meet specific criteria, including biodegradability and ecotoxicity testing, to minimize environmental impact. Such regulatory frameworks provide farmers with clear guidelines and incentives to transition towards more sustainable practices.

Similarly, in the United States, the U.S. Department of Agriculture (USDA) has been actively involved in researching and promoting biodegradable mulch films. The USDA’s National Organic Program has approved the use of biodegradable biobased mulch films in organic crop production, provided they meet specific criteria, including biodegradability and biobased content. This approval opens avenues for organic farmers to adopt biodegradable mulch films without compromising their certification standards.

These government initiatives not only provide regulatory support but also offer financial incentives to farmers adopting sustainable practices. For example, subsidies and grants may be available to offset the higher initial costs of biodegradable mulch films, making them more accessible to farmers. Additionally, research funding supports the development of cost-effective biodegradable materials, further facilitating their adoption.

Regional Insights

Asia Pacific dominates mulch film market with 47.8% share, valued at USD 2.8 Billion in 2024.

In 2024, the Asia Pacific (APAC) region held a commanding position in the global mulch film market, accounting for 47.8% of total market share, valued at approximately USD 2.8 billion. This dominance is largely due to the extensive adoption of plasticulture practices in high-output agricultural economies such as China, India, Japan, and South Korea. China alone accounts for nearly 60% of the global plastic mulch film usage, covering millions of hectares of farmland, especially in arid and semi-arid zones like Xinjiang and Inner Mongolia.

- According to China’s Ministry of Agriculture, more than 20 million hectares of agricultural land were under mulch film cultivation in 2024, significantly driving regional demand for both conventional and advanced biodegradable mulch films.

India, another key player in the region, has seen a consistent rise in mulch film consumption supported by central government schemes such as the Mission for Integrated Development of Horticulture (MIDH) and Pradhan Mantri Krishi Sinchayee Yojana (PMKSY). These programs provide up to 50% subsidies on plastic mulching, promoting its widespread adoption in vegetable and fruit cultivation. Additionally, increasing awareness among farmers about moisture retention, weed control, and improved crop yield has strengthened mulch film usage across major agricultural states like Maharashtra, Karnataka, and Tamil Nadu.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a global leader in agricultural solutions and offers advanced mulch film solutions through its biodegradable polymer line, ecovio®. The company focuses on environmentally friendly alternatives and partners with film manufacturers to support sustainable agriculture. In 2024, BASF reported growing demand for certified soil-biodegradable mulch films, particularly in Europe and Asia. Its R&D investments have helped improve film durability and biodegradation performance, aligning with EU EN 17033 standards and driving adoption across organic and conventional farming systems.

BioBag International AS, headquartered in Norway, is a pioneer in compostable and biodegradable packaging, including agricultural mulch films. The company’s mulch products comply with EN 17033 standards and are widely used in European organic farming. In 2024, BioBag reported increased demand for its certified soil-degradable films in Italy, France, and Spain due to stricter regulations on plastic waste in soil. Its emphasis on sustainability and partnerships with local growers strengthen its position in the high-performance biodegradable film segment.

RKW SE is a German-based global manufacturer of film solutions, including premium-grade agricultural mulch films. The company serves both conventional and high-tech farming operations, offering films that enhance crop yield and water efficiency. In 2024, RKW introduced upgraded multilayer mulch films designed for longer durability and tailored light transmission. With strong operations across Europe, North America, and APAC, RKW leverages innovation and product customization to address region-specific crop and climate needs, maintaining its competitiveness in the global mulch film market.

Top Key Players Outlook

- BASF SE

- Kingfa Sci & Tech Co Ltd

- BioBag International AS

- Yibiyuan Water-Saving Equipment Technology Co., Ltd.

- RKW SE

- Polystar Plastics Ltd

- Armando Alvarez

- Novamont S.p.A.

- Berry Global Inc.

- Napco National

Recent Industry Developments

In 2024, BASF SE made meaningful inroads in the mulch film space through its ecovio® M 2351, a certified soil‑biodegradable biopolymer that farmers can plough back into the ground after harvest—no messy removal required. Importantly, this film breaks down naturally into CO₂, water, and biomass, eliminating persistent microplastics from fields.

In 2024, RKW SE took a clear and forward-looking step in the mulch film landscape by integrating its dedicated agri‑focused unit, RKW Agri GmbH & Co. KG, into the main group as part of a broader strategic restructuring—a move finalized in early 2025 that underscores the company’s commitment to agricultural applications.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Bn Forecast Revenue (2034) USD 13.8 Bn CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Black, Clear/Transparent, Colored, Degradable, Others), By Raw Material (Conventional, Biodegradable), By Crop Type (Fruits and Vegetables, Grains and Oilseeds, Flowers and Plants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Kingfa Sci & Tech Co Ltd, BioBag International AS, Yibiyuan Water-Saving Equipment Technology Co., Ltd., RKW SE, Polystar Plastics Ltd, Armando Alvarez, Novamont S.p.A., Berry Global Inc., Napco National Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Kingfa Sci & Tech Co Ltd

- BioBag International AS

- Yibiyuan Water-Saving Equipment Technology Co., Ltd.

- RKW SE

- Polystar Plastics Ltd

- Armando Alvarez

- Novamont S.p.A.

- Berry Global Inc.

- Napco National