Global Mirin Market Size, Share, And Business Benefits By Type (Aji-mirin, Hon-mirin, Shio mirin), By Application (Residential, Commercial), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159357

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

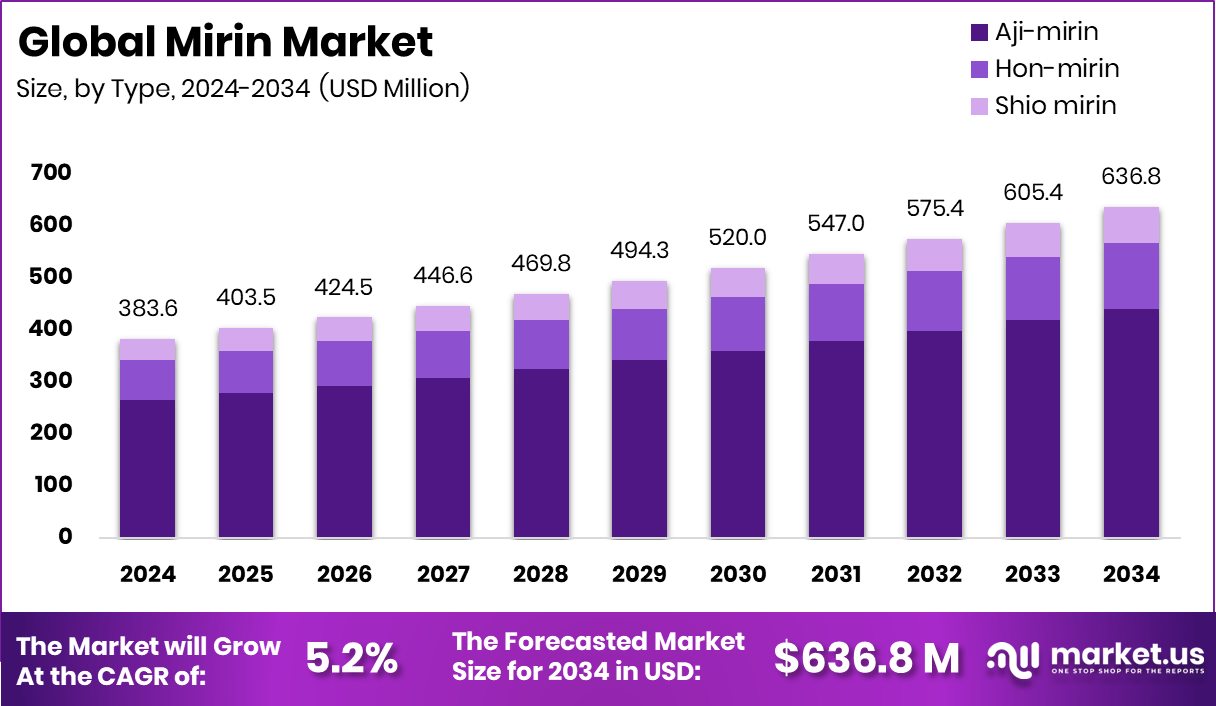

The Global Mirin Market is expected to be worth around USD 636.8 million by 2034, up from USD 383.6 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Asia Pacific’s 37.90% share reflects its strong consumer base and cultural demand.

Mirin is a type of sweet rice wine that is commonly used in Japanese cuisine. It has a lower alcohol content compared to other rice wines like sake, typically around 14-15%. The primary use of mirin is as a seasoning in various Japanese dishes, including teriyaki sauce, soups, marinades, and glazes, providing a sweet and savory flavor profile. It is also valued for its ability to enhance the depth of flavors in broths and sauces.

The growth of the mirin market can be attributed to the increasing global popularity of Japanese cuisine. As more consumers around the world embrace international flavors, the demand for ingredients like mirin has expanded. Additionally, the rise of health-conscious eating has spurred interest in traditional, naturally brewed products, which has given a boost to the market. Mirin is seen as a versatile and healthier alternative to sugar in many culinary applications, further driving demand.

As more consumers opt for organic and authentic food products, there is an opportunity for companies to introduce high-quality, organic mirin to cater to the growing preference for clean-label and natural ingredients. Moreover, with an increasing number of consumers shifting towards plant-based diets, mirin’s role in vegan and vegetarian dishes presents further growth opportunities. Expanding distribution channels to include online marketplaces can also provide significant growth potential, especially for niche and artisanal brands.

In the broader landscape, funding for emerging food startups continues to grow, as evidenced by investments such as a femtech startup raising $1.8 million. While funding in the food industry has been competitive, opportunities for innovation and market expansion remain abundant. For instance, GOOD Meat recently secured $170 million in funding, showcasing the appetite for investment in food production and culinary innovation.

Key Takeaways

- The Global Mirin Market is expected to be worth around USD 636.8 million by 2034, up from USD 383.6 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Aji-mirin dominates the market with a share of 69.2% due to its widespread use.

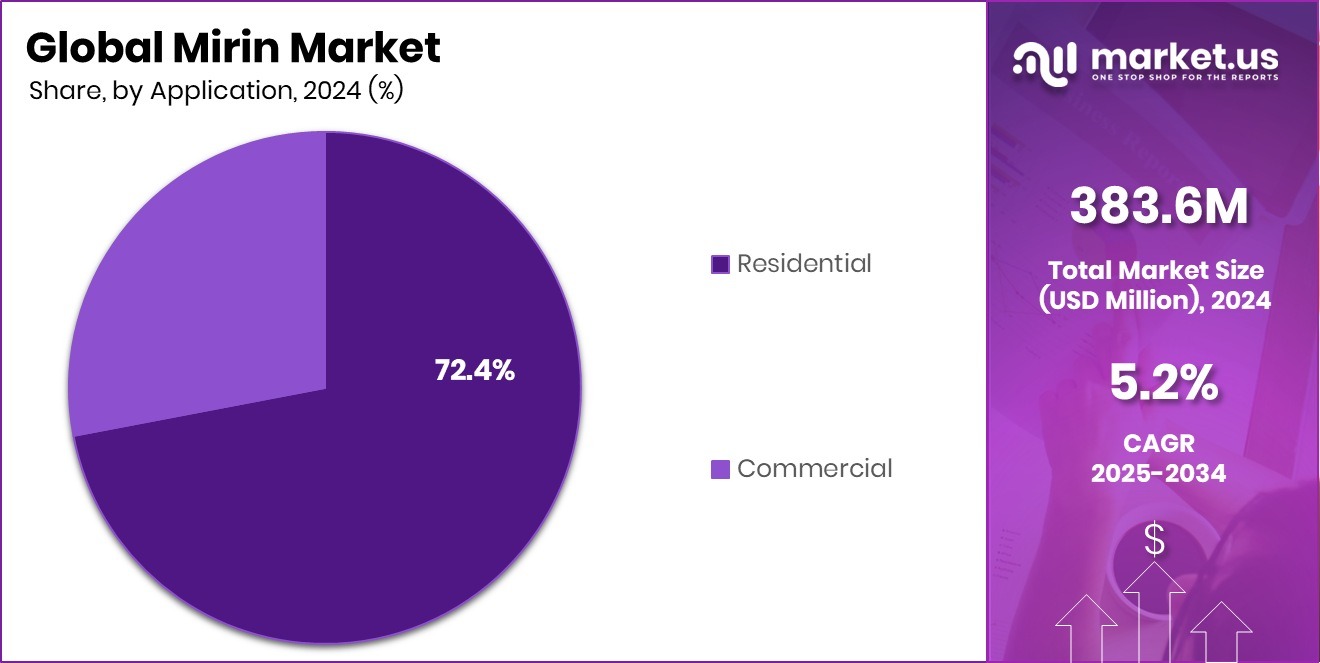

- The residential application of mirin holds 72.4% market share, driven by home cooking preferences.

- Hypermarkets and supermarkets lead distribution channels, accounting for 44.8% of the mirin market sales globally.

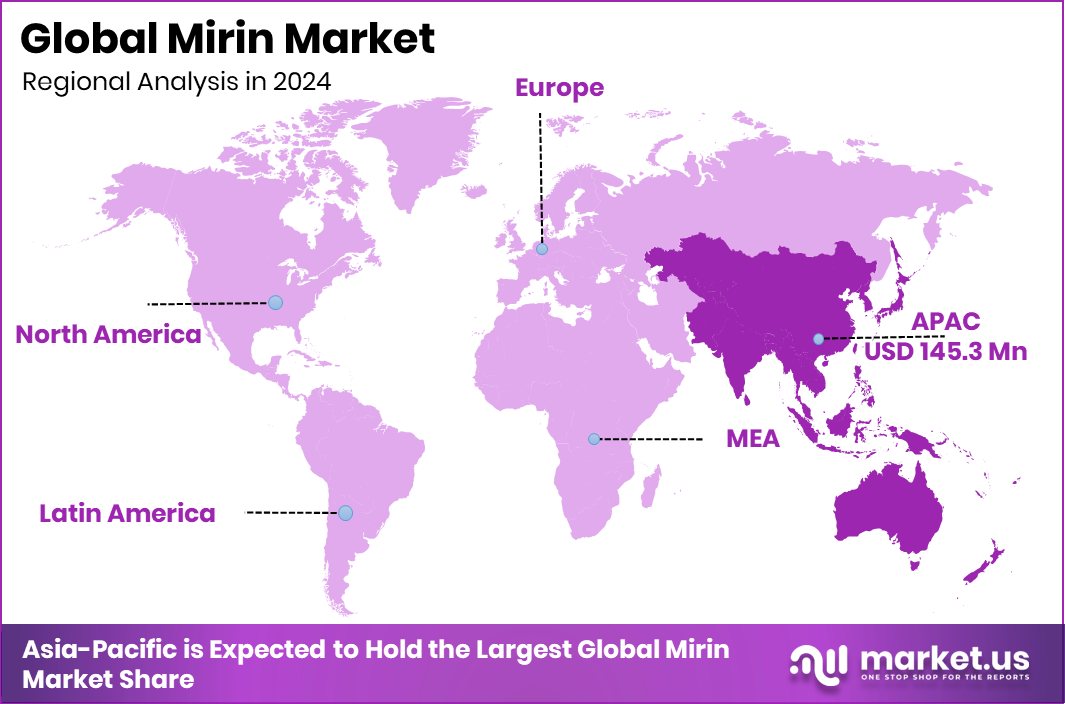

- The Mirin Market in the Asia Pacific was valued at USD 145.3 million.

By Type Analysis

Aji-mirin dominates the market, accounting for 69.2% of total consumption.

In 2024, Aji-mirin held a dominant market position in the By Type segment of the Mirin Market, with a 69.2% share. This strong position highlights the continued consumer preference for Aji-mirin, which has become a staple ingredient due to its versatility in Japanese cooking. Its wide usage in enhancing flavors, balancing saltiness, and adding mild sweetness has strengthened its demand in both household kitchens and the foodservice sector.

The significant 69.2% share also underlines its competitive edge over other mirin types, supported by its accessibility and established reputation in the market. This dominance reflects how Aji-mirin continues to define the growth trajectory of the Mirin Market, shaping consumption patterns and maintaining its leadership role in 2024.

By Application Analysis

The residential sector holds the largest share, contributing 72.4% to demand.

In 2024, Residential held a dominant market position in the By Application segment of the Mirin Market, with a 72.4% share. This notable share reflects the strong preference for mirin in household cooking, where it is widely used to add depth, sweetness, and balance to everyday meals. Its consistent adoption across residential kitchens shows how cultural traditions and evolving culinary practices continue to support its demand.

The 72.4% dominance also indicates that consumers increasingly recognize mirin as an essential ingredient, not just in traditional Japanese dishes but also in modern home cooking. This solid foothold in the residential segment underlines its role as a key driver for overall market stability and sustained growth in 2024.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead distribution, with 44.8% of mirin sales through them.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Mirin Market, with a 44.8% share. This leadership reflects the strong reliance of consumers on large retail outlets for purchasing daily cooking essentials such as mirin. The accessibility, wide product variety, and attractive pricing strategies offered by these retail formats have made them the preferred choice for households seeking convenience and quality.

The 44.8% share highlights how hypermarkets and supermarkets continue to shape consumer buying behavior, ensuring steady product availability and driving consistent sales. Their dominance in distribution channels underscores their critical role in strengthening the market presence of mirin during 2024.

Key Market Segments

By Type

- Aji-mirin

- Hon-mirin

- Shio mirin

By Application

- Residential

- Commercial

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience stores

- Online

- Others

Driving Factors

Government Grants Fuel Production Innovation

In recent years, increased government funding has acted as a key driver in the mirin market by supporting advanced processing, quality enhancement, and scale expansion initiatives. Public grants allocated to food-tech R&D help producers adopt modern fermentation, automation, and safety systems—thus lowering costs and improving consistency.

Such funding reduces barriers for small and medium enterprises to upgrade facilities, enabling them to compete in domestic and export markets. As a result, the overall capacity and technological maturity of the mirin industry improve, supporting broader market growth. Government backing of innovation thus underpins industry development and helps sustain long-term competitiveness.

Restraining Factors

Uneven Government Funding Hamstrings Small Producers

One key restraining factor in the mirin market is how government funding often favors large producers, leaving small or regional makers at a disadvantage. When public grants or subsidies are concentrated on bigger firms, they gain better access to capital, modern infrastructure, and expanded distribution, while smaller players struggle to compete with limited support. This imbalance can stifle innovation and local diversity in the market.

As a result, market consolidation is encouraged, reducing competition and slowing growth in niche or artisanal segments. Over time, this dynamic may limit product variety and inhibit entry for new players, restraining overall expansion in the mirin industry.

Growth Opportunity

Export Subsidies Create New Export Growth Avenues”

One major growth opportunity in the mirin market is the support from government export subsidies aimed at promoting processed food exports. For example, Japan announced a ¥907 million subsidy to assist the export of certain food products. This form of funding reduces the cost burden for producers who want to ship mirin overseas, improving their competitiveness in foreign markets.

With such backing, manufacturers can scale up, explore new geographies, and invest in packaging or compliance to meet international standards. As more governments replicate or expand export-oriented funding, mirin producers can tap fresh demand abroad. This subsidy push thus offers a clear growth path for the mirin industry.

Latest Trends

Government Grants Encourage Fermentation-Based Products”

One of the latest trends in the mirin market is the rising use of fermentation innovations backed by government grants. Public funding is increasingly directed toward developing advanced fermentation technologies, enzyme engineering, and microbial strain improvements. These subsidies help producers lower production costs, ensure safety standards, and accelerate scale-up of novel mirin variants.

With such support, companies are experimenting with new flavor profiles, cleaner labeling, and improved shelf life, fueling consumer interest. As a result, fermentation-driven product development is gaining momentum and opening doors for more differentiated mirin offerings.

Regional Analysis

In 2024, the Asia Pacific dominated the Mirin Market with a 37.90% share.

The Mirin Market shows varied performance across different regions, reflecting distinct consumer preferences and cultural ties to traditional cooking practices. In 2024, Asia Pacific emerged as the dominating region, holding a significant 37.90% share, valued at USD 145.3 million. This strong position is largely driven by the long-established culinary use of mirin in Japanese and neighboring Asian cuisines, reinforcing its leadership in both consumption and production.

Other regions, such as North America and Europe, represent stable but smaller shares, where mirin is primarily consumed by niche markets and restaurants catering to Japanese food culture. Meanwhile, the Middle East & Africa and Latin America account for limited demand, mainly centered in urban areas with exposure to international cuisines. These regions, though smaller in contribution, reflect gradual acceptance as global food habits diversify.

However, none of these markets comes close to matching Asia Pacific’s dominance, which clearly drives the overall growth trajectory of the industry. The figures underline how cultural integration and regional food habits anchor market performance, with the Asia Pacific setting the pace and holding the strongest position in the global mirin landscape in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Mirin Market continues to be shaped by the strategic efforts of leading players such as Kikkoman Corporation, Eden Foods, and Mizkan Holdings, each contributing to the expansion and recognition of mirin worldwide.

Kikkoman Corporation remains at the forefront with its strong global brand presence and extensive distribution networks. The company has leveraged its heritage in Japanese condiments to position mirin as both a traditional and modern cooking ingredient. Its emphasis on quality, product consistency, and innovation ensures that Kikkoman maintains dominance in both domestic and international markets.

Mizkan Holdings, another key player, capitalizes on its wide range of food and beverage offerings, with mirin being a cornerstone in its portfolio of Japanese condiments. Its reputation for authenticity and cultural alignment with Japanese cuisine strengthens its hold in the Asia Pacific region. Additionally, Mizkan’s ability to adapt packaging and product formats for global consumers ensures its competitiveness in emerging and established markets.

Eden Foods, while comparatively smaller in scale, plays a significant role in bringing organic and natural versions of mirin to consumers, particularly in North America. Its focus on clean-label products aligns with growing health-conscious consumer trends, giving Eden Foods a niche yet impactful position.

Top Key Players in the Market

- Kikkoman Corporation

- Eden Foods

- Mizkan Holdings

- Sakura Foods Corporation

- Takara Sake

- Yutaka

- Kankyo Shuzo

- Urban Platter

- Soeos

Recent Developments

- In August 2024, Mizkan America announced a US$156 million expansion at its Owensboro, Kentucky, facility. The expansion adds ~320,000 sq ft to the plant (total over 970,000 sq ft), introduces new machinery, equipment, IT upgrades, and a new manufacturing line.

Report Scope

Report Features Description Market Value (2024) USD 383.6 Million Forecast Revenue (2034) USD 636.8 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Aji-mirin, Hon-mirin, Shio mirin), By Application (Residential, Commercial), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kikkoman Corporation, Eden Foods, Mizkan Holdings, Sakura Foods Corporation, Takara Sake, Yutaka, Kankyo Shuzo, Urban Platter, Soeos Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kikkoman Corporation

- Eden Foods

- Mizkan Holdings

- Sakura Foods Corporation

- Takara Sake

- Yutaka

- Kankyo Shuzo

- Urban Platter

- Soeos