Global Mining Waste Management Market Size, Share, And Enhanced Productivity By Mining Method (Surface Mining, Underground Mining), By Metal/Mineral (Thermal Coal, Coking Coal, Iron Ore, Gold, Copper, Lead, Zinc, Other), By Waste Type (Solid Waste (Waste Rock, Tailings, Others), Liquid Waste), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176337

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

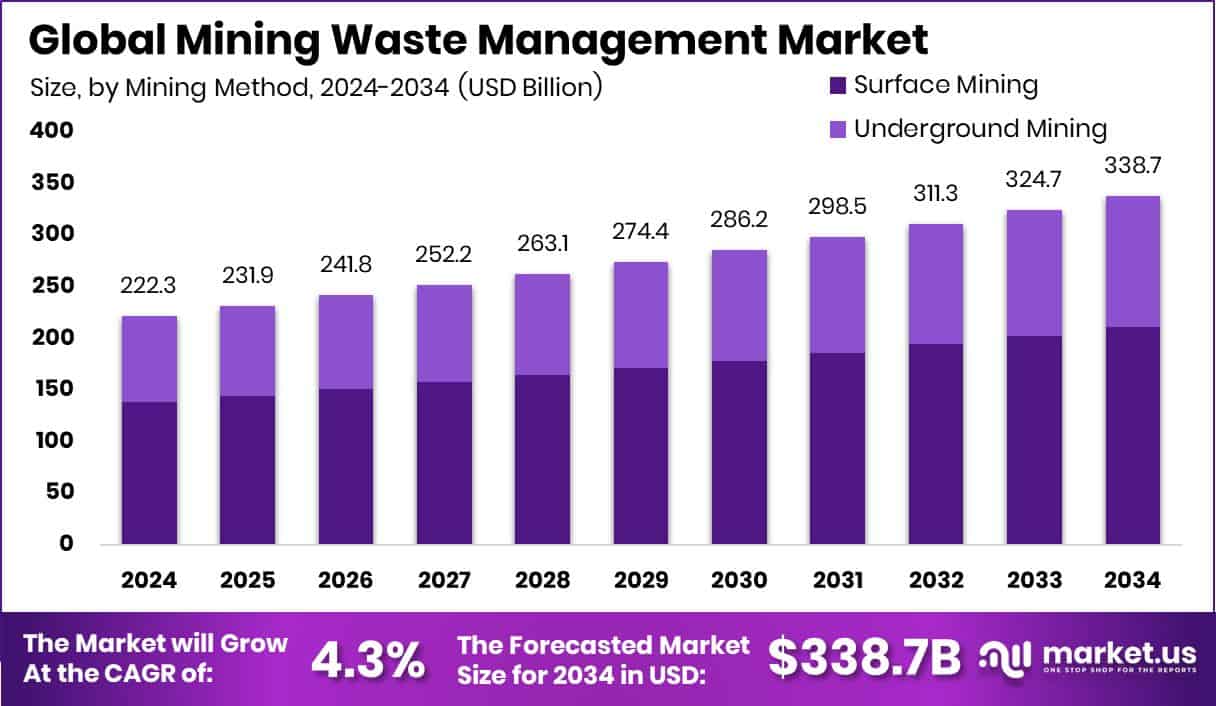

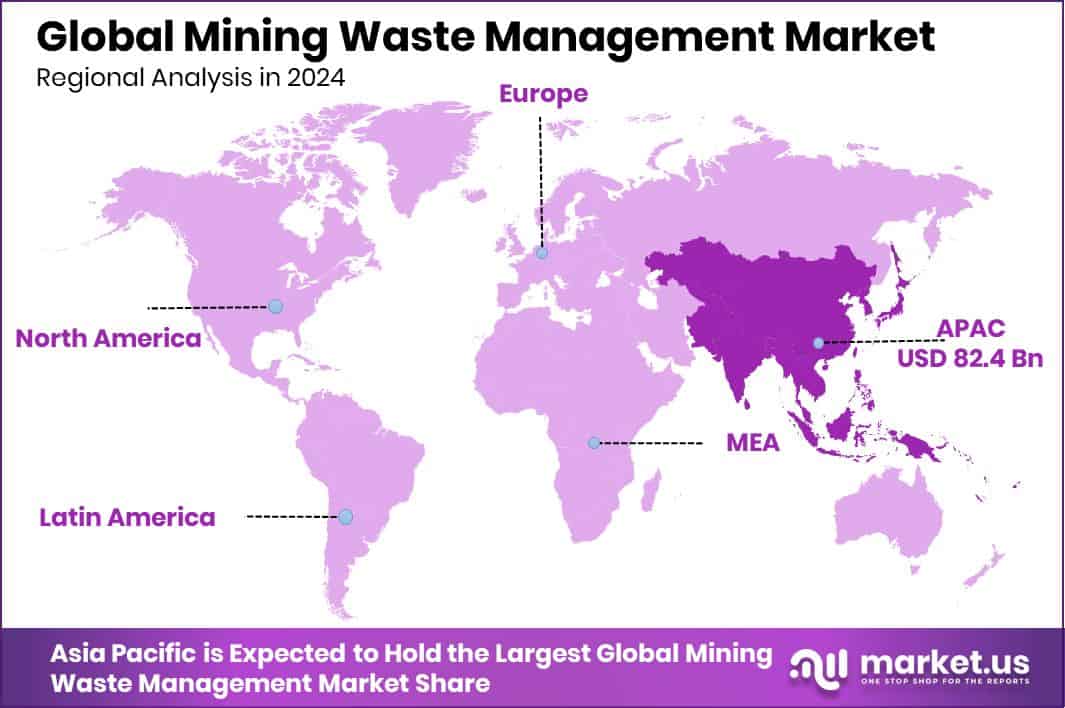

The Global Mining Waste Management Market is expected to be worth around USD 338.7 billion by 2034, up from USD 222.3 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Asia Pacific maintains dominance at 37.1%, contributing significantly to USD 82.4 Bn overall.

The Global Mining Waste Management Market revolves around the handling, processing, and safe disposal of materials left after extracting minerals. Mining waste includes rock, tailings, slurry, and contaminated water generated through surface mining and underground mining methods. Because minerals such as thermal coal, iron ore, copper, gold, and zinc require heavy excavation, waste volumes are high and demand proper monitoring to reduce environmental pressure.

Mining Waste Management refers to the systems and practices used to manage solid waste and liquid waste created during mineral extraction. The market for these services has grown as countries strengthen environmental rules and invest in the rehabilitation of old and new mine sites. Rising awareness about soil and water protection continues to push mining companies toward structured waste-handling solutions.

Growth is supported by increasing global interest in resource efficiency. Governments are also investing heavily—such as the $5 million funding for critical mineral discovery in mine waste and the £12M support for the Ionic Rare Earths Belfast recycling plant—highlighting the value held within tailings and leftover materials. These initiatives unlock opportunities for recovery-focused waste treatment.

Demand further rises as nations work to secure essential minerals. The Energy Department’s $1B funding for critical mineral supply and the ISGS’s $10 million grant for abandoned mine research create opportunities to modernize waste sites, produce cleaner materials, and repurpose historic waste streams for future use.

Key Takeaways

- The Global Mining Waste Management Market is expected to be worth around USD 338.7 billion by 2034, up from USD 222.3 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- Surface Mining dominates the Mining Waste Management Market with 62.4%, requiring advanced disposal and monitoring solutions.

- Thermal Coal leads the Mining Waste Management Market at 25.8%, increasing demand for efficient waste handling.

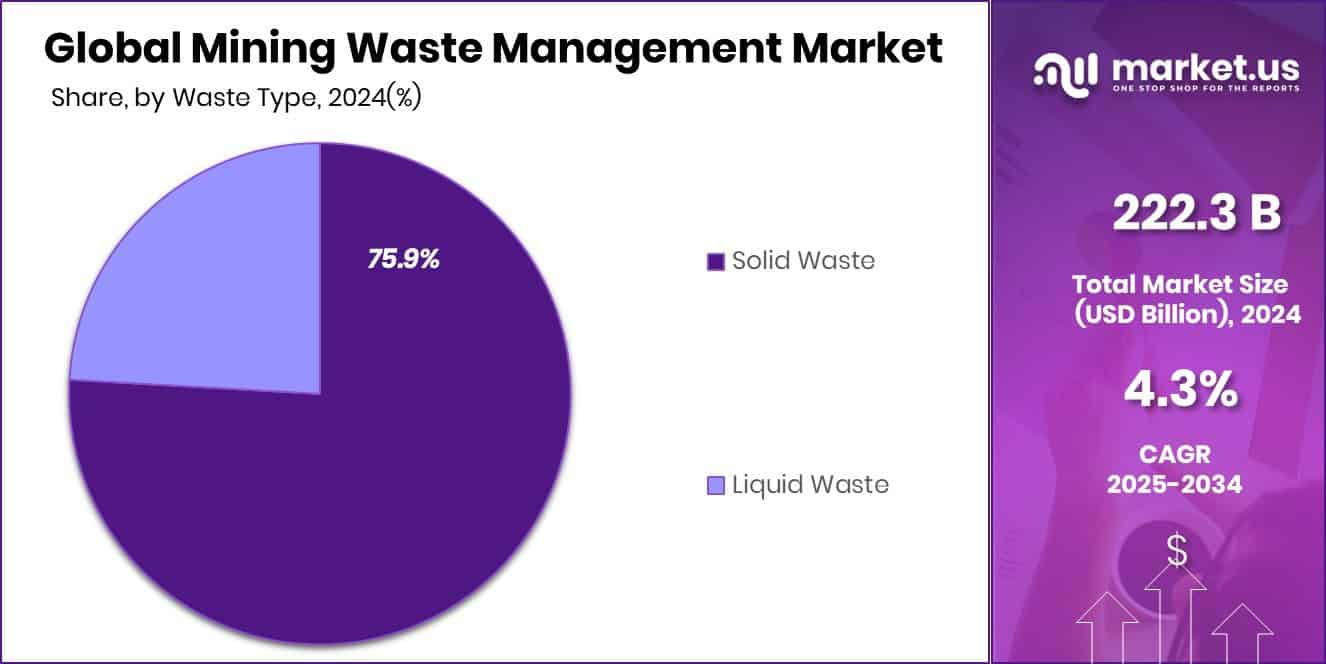

- Solid Waste accounts for 75.9% of the Mining Waste Management Market, driving innovations in sustainable management.

- The Asia Pacific’s strong mining activity drives its 37.1% share and USD 82.4 Bn valuation.

By Mining Method Analysis

Mining Waste Management Market is dominated by surface mining with a 62.4% share.

In 2024, Surface Mining held a dominant position in the Mining Waste Management Market, accounting for 62.4% of the total waste generated due to its large-scale extraction activities. This method disturbs vast land areas, leading to higher volumes of overburden, tailings, and spoil heaps compared to underground mining. The widespread use of open-pit and strip mining for minerals like coal, iron ore, and bauxite intensifies the demand for structured waste handling systems.

Companies are increasingly adopting engineered landfills, tailing dams, and soil-stabilization techniques to manage growing waste loads. Environmental rules continue to tighten, pushing miners to improve restoration plans and invest in monitoring technologies that reduce long-term ecological risks associated with surface-mining waste.

By Metal/Mineral Analysis

Mining Waste Management Market is dominated by Thermal Coal, holding a 25.8% share.

In 2024, Thermal Coal mining dominated the Metal/Mineral segment of the Mining Waste Management Market, holding 25.8% share, as coal extraction produces extensive overburden and combustion residues. Power utilities and mining operators face rising pressure to comply with stricter disposal and ash-handling standards.

Large coal basins across Asia-Pacific, Africa, and parts of North America continue to generate significant waste streams, increasing the need for lined ash ponds, dry-ash handling, and advanced slurry treatment. As several countries introduce emission-reduction roadmaps, mining firms are prioritizing safer waste-storage methods and rehabilitation programs for degraded sites. This shift supports long-term operational continuity while reducing environmental liabilities linked to thermal-coal mining activities.

By Waste Type Analysis

Mining Waste Management Market is dominated by Solid Waste, capturing a 75.9% share.

In 2024, Solid Waste emerged as the leading waste category in the Mining Waste Management Market, accounting for a substantial 75.9% share due to massive volumes of rock, soil, and tailings generated during mineral extraction. The handling of this waste requires extensive infrastructure, including waste dumps, containment embankments, and long-term monitoring systems.

Mines producing metals, coal, and industrial minerals rely heavily on engineered barriers and compaction techniques to minimize contamination risks. With regulators placing greater focus on land restoration and groundwater protection, operators are adopting more sustainable disposal strategies. The rising need to stabilize large waste piles and reclaim mined land continues to shape investment decisions across global mining operations.

Key Market Segments

By Mining Method

- Surface Mining

- Underground Mining

By Metal/Mineral

- Thermal Coal

- Coking Coal

- Iron Ore

- Gold

- Copper

- Lead

- Zinc

- Other

By Waste Type

- Solid Waste

- Waste Rock

- Tailings

- Others

- Liquid Waste

Driving Factors

Rising waste volumes demand structured management

Growing waste volumes continue to push the Mining Waste Management Market toward more structured and accountable handling methods. Many regions now prioritize the rehabilitation of old mine sites, which strengthens demand for organized waste programs. Recent public investments also support this shift.

The Alabama Department of Workforce awarded $11.75 million through the 2023 OSMRE AMLER Grants to help transform abandoned mine lands in Hoover, reinforcing the need for long-term waste oversight. Similarly, West Virginia officials recommended $27 million to clean up abandoned coal mines, adding urgency to proper waste-site management. Together, rising waste output and targeted funding create strong momentum for structured mining waste solutions.

Restraining Factors

High operational costs limit adoption

Despite increasing environmental attention, the Mining Waste Management Market faces financial barriers that slow wider adoption. Many small and mid-scale mining operations struggle with the high cost of engineered landfills, tailings upgrades, and long-term groundwater monitoring systems. Additional challenges arise from the expenses required to modernize older waste sites.

The U.S. Interior Department recently disbursed $13 million to revitalize coal communities, highlighting the scale of funding often needed to support cleanup activities. Likewise, the Indiana state government secured $24 million to address legacy pollution and revive coal-impacted regions. These examples show how cost pressures remain a major restraint, especially where private operators lack comparable financial backing.

Growth Opportunity

Critical minerals recovery boosts waste value

Opportunities in the Mining Waste Management Market continue to expand as countries search for critical minerals within old tailings and waste dumps. Recovery-focused projects are rising, making waste piles an important secondary source of valuable materials. This shift is supported by new restoration and reclamation initiatives.

Southwest Virginia recently received an $11 million boost to reclaim abandoned coal mines, opening pathways for safer reuse and mineral recovery. Meanwhile, the U.S. Interior Department announced nearly $725 million for abandoned coal-mine reclamation, creating a strong pipeline for remediation work. These initiatives encourage modernization of waste facilities and support emerging opportunities in resource recovery from legacy mining materials.

Latest Trends

Latest Increasing shift toward tailings reuse technologies

Recent trends in the Mining Waste Management Market show a clear movement toward tailings reuse, improved reclamation approaches, and innovative waste-processing technologies. Many regions are shifting from simple disposal to techniques that stabilize, repurpose, or recover value from mining by-products. The U.S. Interior Department announced over $119 million for abandoned coal-mine reclamation, signaling continued national interest in restoring degraded lands.

At the same time, Alaska may receive $1.3 million in federal funding to clean up derelict coal mines, reinforcing the trend toward rehabilitation-driven waste management. These developments reflect a broader industry focus on sustainability, better land stewardship, and maximizing long-term environmental safety around mine-affected regions.

Regional Analysis

Asia Pacific leads the market with 37.1%, valued at USD 82.4 Bn.

In 2024, the Asia Pacific region dominated the Mining Waste Management Market with a substantial 37.1% share, valued at USD 82.4 Bn, driven by extensive coal, iron ore, and metal mining activities across major economies. The region’s reliance on large open-cut operations results in high waste output, strengthening demand for structured waste handling and tailings infrastructure.

North America follows with steady growth, supported by strong regulatory oversight that encourages advanced waste containment systems in mining-intensive areas. Europe maintains a mature market, shaped by strict environmental directives and continuous rehabilitation requirements for mine sites.

In Latin America, expanding copper and lithium projects sustain the need for controlled waste disposal frameworks. Meanwhile, the Middle East & Africa records rising participation as mineral-rich nations increase extraction activities, leading to greater emphasis on stable solid-waste management practices across developing mining corridors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ausenco remained a strategic engineering partner for miners aiming to modernize tailings, optimize slurry transport, and improve long-term site rehabilitation. Its focus on designing resilient waste facilities positioned it as a trusted technical contributor in projects where stability, lifecycle efficiency, and risk reduction were central requirements.

EnviroServ strengthened its relevance by offering integrated on-site waste handling, hazardous-material management, and environmental compliance services across developing mining corridors. Its operational capability supported mining companies dealing with large volumes of solid and slurry waste, particularly where regulatory expectations demanded improved traceability and safer disposal frameworks.

Interwaste Holding Ltd. continued expanding its role by emphasizing customized waste-minimization strategies, including separation, secure containment, and environmentally responsible disposal pathways. The company’s service-driven model helped miners streamline operational waste flows and maintain compliance during both active production phases and closure planning.

Top Key Players in the Market

- Ausenco

- EnviroServ

- Interwaste Holding Ltd.

- Veolia Environment S.A.

- Tetronics International

- John Wood Group plc

- Ramboll Group

- Tetra Tech Inc.

- Cleanaway Environmental Services

- Seche Environment Company

- Aevitas

Recent Developments

- In November 2025, Ausenco introduced a new MTM-TSF (Multidisciplinary Technical Maturity for Tailings Storage Facilities) tool at the 10th Congreso Relaves Peru 2025. This methodology helps mining companies assess and manage tailings facility risks, support strategic decisions, and strengthen project planning across lifecycle stages, reflecting Ausenco’s commitment to safer waste handling and sustainability

- In June 2025, EnviroServ’s Meadowdale laboratory earned recertification from the South African National Accreditation System (SANAS). This achievement confirms the lab’s technical capability to analyse and classify waste accurately, including hazardous and contaminated mining wastes, helping clients meet regulatory standards. This supports improved environmental safety and quality control in waste handling.

Report Scope

Report Features Description Market Value (2024) USD 222.3 Billion Forecast Revenue (2034) USD 338.7 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mining Method (Surface Mining, Underground Mining), By Metal/Mineral (Thermal Coal, Coking Coal, Iron Ore, Gold, Copper, Lead, Zinc, Other), By Waste Type (Solid Waste (Waste Rock, Tailings, Others), Liquid Waste) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ausenco, EnviroServ, Interwaste Holding Ltd., Veolia Environment S.A., Tetronics International, John Wood Group plc, Ramboll Group, Tetra Tech Inc., Cleanaway Environmental Services, Seche Environment Company, Aevitas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mining Waste Management MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Mining Waste Management MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ausenco

- EnviroServ

- Interwaste Holding Ltd.

- Veolia Environment S.A.

- Tetronics International

- John Wood Group plc

- Ramboll Group

- Tetra Tech Inc.

- Cleanaway Environmental Services

- Seche Environment Company

- Aevitas