Global Methylene Diphenyl Diisocyanate Market Size, Share, And Business Benefit By Application (Rigid Foams, Flexible Foams, Coatings, Elastomers, Adhesives and Sealants, Others), By End-user (Construction, Furniture and Interiors, Electronics and Appliances, Automotive, Footwear, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 163875

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

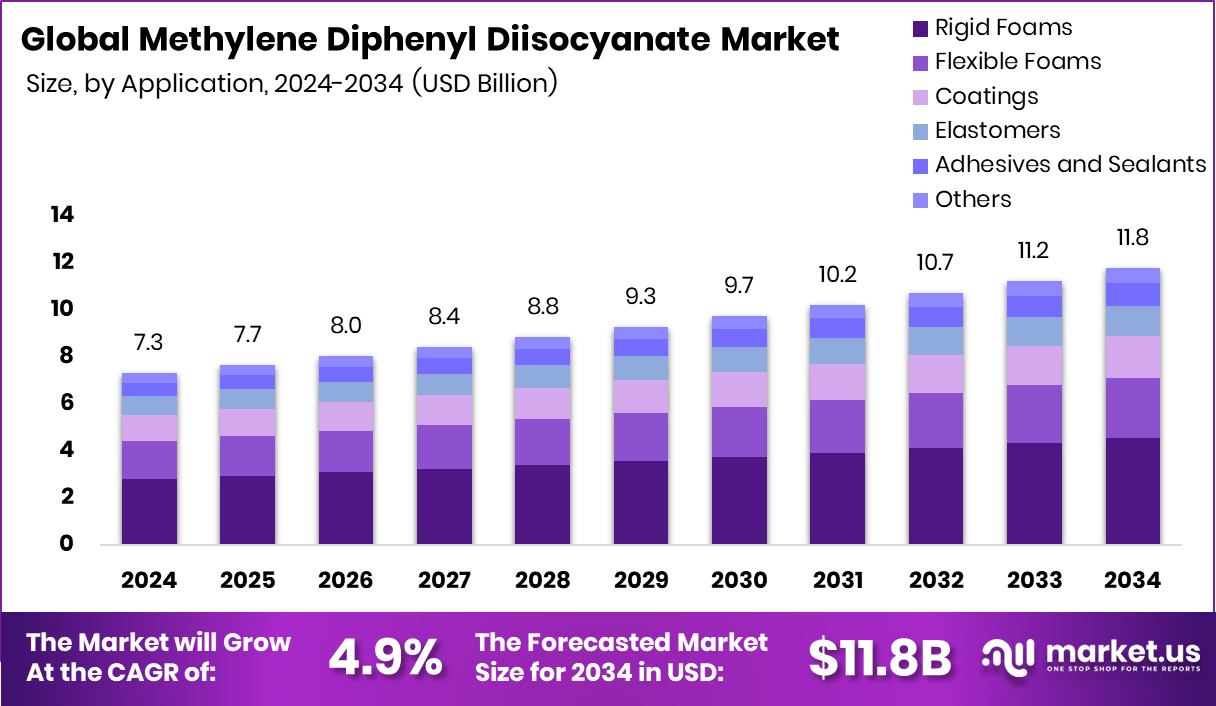

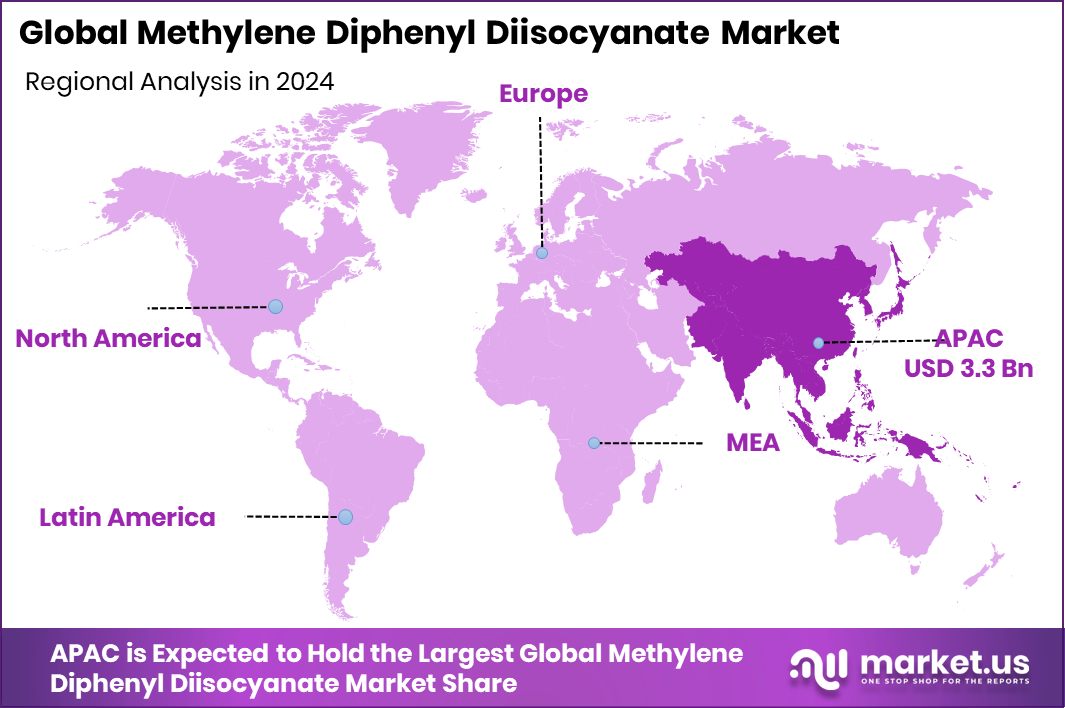

The Global Methylene Diphenyl Diisocyanate Market is expected to be worth around USD 11.8 billion by 2034, up from USD 7.3 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Expanding manufacturing and insulation applications strengthen Asia-Pacific’s USD 3.3 Bn MDI market presence.

Methylene Diphenyl Diisocyanate (MDI) is an aromatic diisocyanate largely used as a chemical intermediate in the manufacture of polyurethane. It exists in several isomeric forms (notably 2,2′-; 2,4′-; and 4,4′-MDI), with the 4,4′ isomer the most widely used. MDI reacts with polyols and other hydroxyl-containing materials to form urethane bonds, and it is employed in foams, coatings, adhesives, sealants, and elastomers. It must be handled under strict safety controls because of its reactivity (especially with water) and sensitization potential.

The MDI market is driven by the rising demand for energy-efficient construction and refrigeration insulation, as rigid polyurethane foams made from MDI provide strong thermal insulation performance. The trend toward lightweight structural materials in automotive and industrial applications boosts the use of MDI-based polyurethanes in adhesives and composites.

Additionally, the rapid expansion of industrial coatings in infrastructure and manufacturing supports growth, especially since MDI plays a key role in coatings, sealants, and elastomers that enhance durability and performance. Emerging investments are reflecting this trend: for instance, a coatings maker closed a $9.2 M funding round to meet growing demand, and Brightplus secured $2.3 M to scale recyclable bio-based textile coatings, signaling increasing emphasis on advanced materials and coatings technologies.

The demand for MDI is broadening thanks to the expanding construction sector (especially in insulation and building envelopes), refrigeration and cold-chain logistics, and rising industrial equipment manufacturing in emerging economies. Solid demand in adhesives and engineered wood panels further supports it, because MDI‐based binders are used in composite wood and flooring laminates.

As manufacturing shifts toward greater efficiency and sustainability, demand for high-performance polyurethane systems (often MDI-based) grows. Concurrently, large investments in coatings and surface solutions, such as Ecoat, securing €21 M for low-carbon paints and coatings, and the France-based Ecoat securing €21 M to drive the ecological transition of the paints and coatings industry, reflect how downstream coatings demand is reinforcing the substrate chemical demand of MDI.

Opportunity in the MDI space lies in developing lower-carbon, bio-based, or recycled raw material routes and adjacent high-value applications. For example, the coatings sector is pursuing novel chemistries and eco-friendly formulations, while advanced manufacturing, such as 3D-printed coatings (as evidenced by Flō Optics securing $35 M Series A for 3D printing of lens coatings), opens technology-rich niches.

In addition, nano-coatings and functional surfaces for emerging sectors such as hydrogen production (illustrated by Latvian Naco Technologies securing €2.5 M in pre-Series A funding to develop hydrogen production with nano-coatings) create upstream demand linkages where MDI or MDI-based systems may play a role. Thus, the interplay of sustainability, advanced coatings, novel applications, and raw-material innovation provides a rich opportunity landscape for MDI.

Key Takeaways

- The Global Methylene Diphenyl Diisocyanate Market is expected to be worth around USD 11.8 billion by 2034, up from USD 7.3 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In 2024, Rigid Foams dominated the methylene diphenyl diisocyanate market, capturing 38.4% share globally.

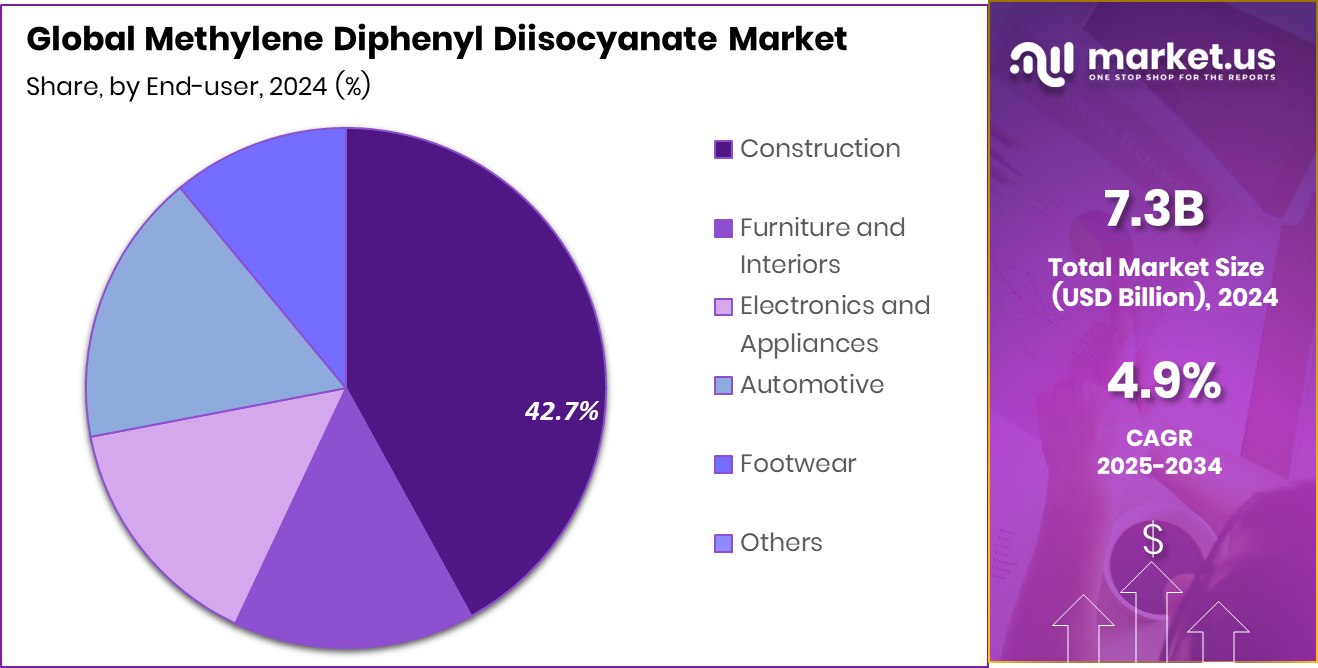

- The Construction sector led the methylene diphenyl diisocyanate market, securing a 42.7% share during 2024.

- The Asia-Pacific 46.20% share, region leads due to strong construction growth and industrial foam demand.

By Application Analysis

In 2024, Rigid Foams dominated the methylene diphenyl diisocyanate market with a 38.4% share.

In 2024, Rigid Foams held a dominant market position in the By Application segment of the Methylene Diphenyl Diisocyanate Market, with a 38.4% share. This segment’s growth is primarily driven by the rising demand for energy-efficient insulation materials in construction and refrigeration applications.

Rigid polyurethane foams made from MDI offer exceptional thermal performance, structural strength, and cost efficiency, making them ideal for building envelopes and cold-chain logistics. The global shift toward sustainable infrastructure and green building standards continues to reinforce MDI consumption in this category.

Moreover, advancements in low-carbon coatings and funding activities across coating technologies indirectly support the segment, as MDI-based foams are widely used in related insulation and protective applications.

By End-user Analysis

The Construction sector led the methylene diphenyl diisocyanate market with a 42.7% share.

In 2024, Construction held a dominant market position in the By End-User segment of the Methylene Diphenyl Diisocyanate Market, with a 42.7% share. The segment’s dominance stems from the extensive use of MDI-based rigid polyurethane foams in building insulation, roofing, and structural applications that enhance energy efficiency. The growing focus on sustainable infrastructure and eco-friendly materials further drives adoption, as MDI foams contribute to reduced carbon emissions through better thermal performance.

Moreover, government incentives promoting energy-efficient buildings have accelerated construction activities, reinforcing demand for MDI in insulation and coating products. Continuous innovations and funding in low-carbon coatings and building materials are further strengthening the segment’s role in the overall market expansion.

Key Market Segments

By Application

- Rigid Foams

- Flexible Foams

- Coatings

- Elastomers

- Adhesives and Sealants

- Others

By End-user

- Construction

- Furniture and Interiors

- Electronics and Appliances

- Automotive

- Footwear

- Others

Driving Factors

Rising Demand for Energy-Efficient Construction Materials

The major driving factor for the Methylene Diphenyl Diisocyanate (MDI) market is the growing demand for energy-efficient and sustainable construction materials. MDI is a key raw material for producing rigid polyurethane foams used in insulation, roofing, and wall systems that help reduce energy consumption in buildings. Governments and industries worldwide are focusing on green infrastructure to cut carbon emissions.

The trend toward sustainable coatings and materials is also reinforced by recent funding activities, such as Pepperfry raising INR 43 crore from existing investors, supporting eco-friendly product expansion and development. These combined initiatives highlight a strong movement toward sustainability and energy efficiency, directly increasing the need for MDI-based insulation and coating solutions.

Restraining Factors

Health and Environmental Risks in the Production Process

One major restraining factor for the Methylene Diphenyl Diisocyanate (MDI) market is the health and environmental risks linked to its production and handling. MDI is a reactive chemical that can cause respiratory irritation and other health concerns if not properly managed. Strict environmental and worker safety regulations in several regions make production and compliance costly for manufacturers.

The growing awareness of safer and more eco-friendly materials further challenges market growth. However, innovation continues across connected industries, such as DecorMatters securing $10 million in funding to innovate the interior design and furniture shopping experience, highlighting the global push toward safer, sustainable, and consumer-focused solutions that may eventually shape cleaner, more responsible uses of materials like MDI in modern design.

Growth Opportunity

Expanding Use in Sustainable Furniture and Interiors

A key growth opportunity for the Methylene Diphenyl Diisocyanate (MDI) market lies in its expanding use across sustainable furniture and interior applications. MDI-based polyurethane foams are widely used in furniture padding, mattresses, and cushioning materials due to their durability and comfort. As consumers and businesses move toward eco-friendly and flexible living solutions, demand for advanced polyurethane materials continues to rise.

The trend is further supported by new investments, such as Furniture Rental Service Feather securing $30 million to fund expansion, which highlights growing interest in sustainable and circular furniture models. This shift opens new opportunities for MDI manufacturers to develop greener, low-emission foam systems tailored for modern, environmentally conscious interior and furniture markets.

Latest Trends

Adoption of Circular Economy in Furniture Production

One of the latest trends shaping the Methylene Diphenyl Diisocyanate (MDI) market is the growing adoption of circular economy practices in the furniture industry. MDI-based foams are being optimized for recyclability and reuse, aligning with sustainable furniture manufacturing goals.

Companies are shifting toward modular and eco-friendly designs that reduce waste and extend product life cycles. This trend gained momentum with Nornorm securing a €50 million loan to scale its circular furniture model, emphasizing the market’s move toward sustainability-driven innovation.

As furniture and interior businesses embrace recycling and responsible production, the use of MDI in producing durable, long-lasting, and recyclable foam materials is becoming a key focus, reinforcing the market’s transition toward greener industrial practices.

Regional Analysis

In 2024, Asia-Pacific held a 46.20% share, valued at USD 3.3 Bn.

In 2024, Asia-Pacific dominated the Methylene Diphenyl Diisocyanate (MDI) Market, accounting for a 46.20% share valued at USD 3.3 billion. This dominance is driven by rapid industrialization, strong construction growth, and expanding polyurethane production across China, India, Japan, and South Korea. The region’s increasing demand for energy-efficient building insulation and durable coatings has significantly boosted MDI consumption.

North America follows, supported by the widespread use of MDI in insulation materials, automotive interiors, and cold-chain logistics infrastructure. Europe also shows stable growth, encouraged by sustainability policies promoting eco-friendly coatings and energy-efficient housing materials.

Meanwhile, the Middle East & Africa region is gradually adopting MDI-based foams for construction and industrial applications, particularly in Gulf countries. Latin America exhibits steady demand growth due to expanding construction projects and manufacturing activities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF focused on improving energy-efficient insulation and sustainable polyurethane production, aligning with global climate goals and green construction trends. The company’s strong presence in Asia and Europe strengthened MDI integration into eco-friendly foams, adhesives, and coatings.

Covestro AG emphasized circular economy initiatives, investing in low-emission MDI solutions and recyclable polyurethane systems to support the growing demand for sustainable materials in construction and automotive industries.

Meanwhile, Dow advanced its polyurethane technology by enhancing process efficiency and developing high-performance MDI-based materials suitable for industrial coatings and insulation applications. Together, these companies are redefining the MDI market by balancing industrial performance with environmental responsibility, promoting innovations that improve insulation efficiency, reduce waste, and optimize product lifecycles.

Their combined strategic investments, focus on R&D, and sustainability-driven approach are shaping the next phase of MDI evolution—meeting global demand for high-quality, durable, and eco-conscious polyurethane materials essential for construction, mobility, and industrial applications worldwide.

Top Key Players in the Market

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Tosoh Corporation

Recent Developments

- In October 2024, Covestro announced a takeover offer from ADNOC’s investment vehicle (XRG) whereby XRG would acquire up to 91.3% of Covestro’s shares. This move positions Covestro, a major producer of materials like MDI (methylene diphenyl diisocyanate) and derived polyurethane products, for broader global scale and integration.

- In March 2024, BASF’s Monomers division announced that its MDI production site in Geismar (USA) had become ISCC PLUS and REDcert²-certified, meaning MDI and other isocyanates from the company can now be offered as sustainably sourced, globally.

Report Scope

Report Features Description Market Value (2024) USD 7.3 Billion Forecast Revenue (2034) USD 11.8 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Rigid Foams, Flexible Foams, Coatings, Elastomers, Adhesives and Sealants, Others), By End-user (Construction, Furniture and Interiors, Electronics and Appliances, Automotive, Footwear, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Covestro AG, Dow, Hexion Inc., Huntsman International LLC, Karoon Petrochemical Company, Kumho Mitsui Chemicals Inc, KURMY CORPORATIONS, Sadara, Tosoh Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Methylene Diphenyl Diisocyanate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Methylene Diphenyl Diisocyanate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Tosoh Corporation