Global Management Decision Market By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Credit Risk Assessment, Fraud Detection, Customer Engagement & Personalization, Others), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), Retail & E-commerce,Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171819

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- End-User Industry Analysis

- Investment and Business Benefits

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

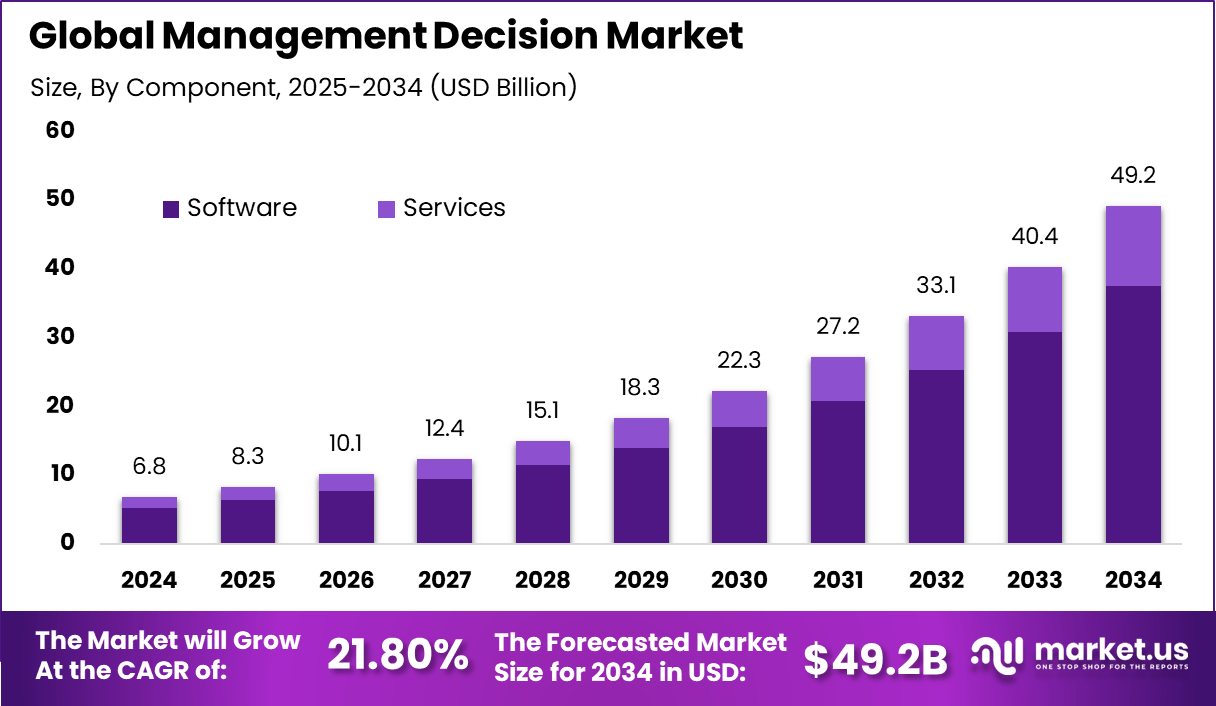

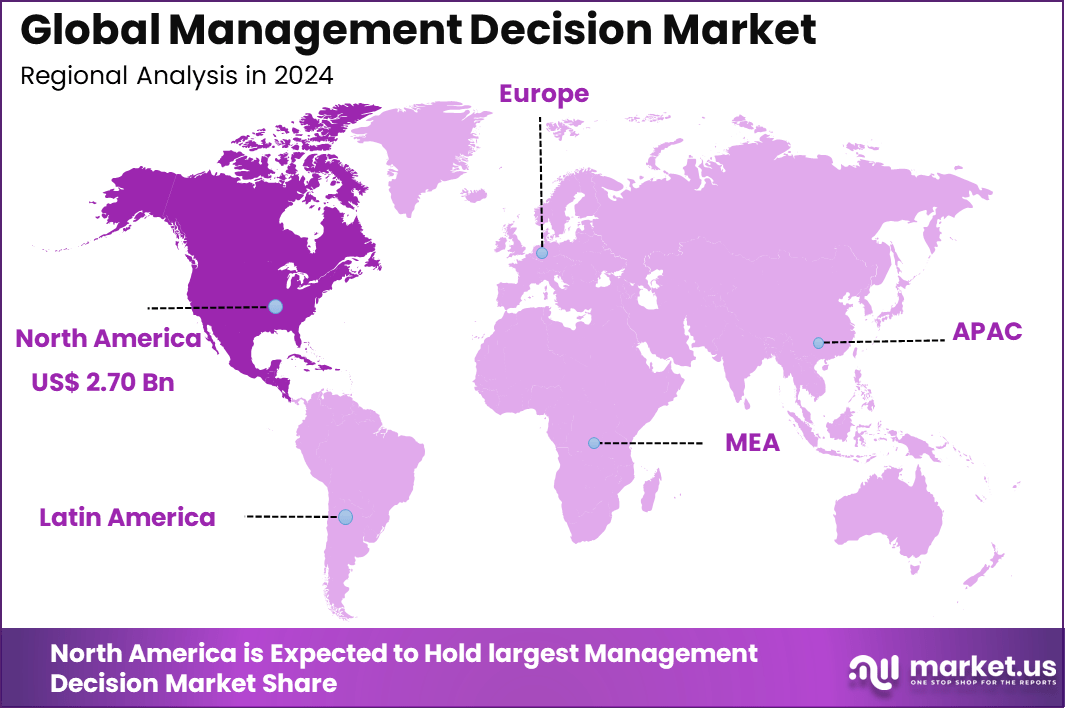

The Global Management Decision Market generated USD 6.8 billion in 2024 and is predicted to register growth from USD 8.3 billion in 2025 to about USD 49.2 billion by 2034, recording a CAGR of 21.80% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.5% share, holding USD 2.70 Billion revenue.

The Management Decision Market refers to software platforms and analytical tools that support organizations in making informed business decisions. These solutions use data analysis, rules engines, predictive models, and decision logic to guide operational and strategic choices. They are widely used in areas such as risk management, customer engagement, pricing, and compliance. The market includes decision management software, decision support systems, and embedded decision tools.

Management decision solutions help organizations convert data into actionable insights. They support both automated and human-led decision processes. These tools are designed to improve consistency, speed, and accuracy in decision making. The market plays a critical role in data-driven and digitally mature organizations. Demand for management decision solutions is driven by the growing volume and complexity of business data. Organizations face pressure to make faster decisions while reducing errors and bias. Traditional manual decision processes are often slow and inconsistent.

Management decision platforms rely on technologies such as advanced analytics, machine learning, and business rules management systems. These technologies allow systems to evaluate multiple data points and outcomes simultaneously. Predictive models help estimate risks and opportunities before decisions are executed. Automation ensures decisions are applied consistently across processes.

Cloud computing supports adoption by improving scalability and accessibility. Integration with enterprise systems such as CRM, ERP, and data platforms enhances functionality. Low-code and no-code tools also support adoption by enabling business users to design decision workflows. These technologies make decision management more flexible and user-friendly.

Top Market Takeaways

- By component, software took 76.5% of the management decision market, as it provides tools for data analysis and smart choices.

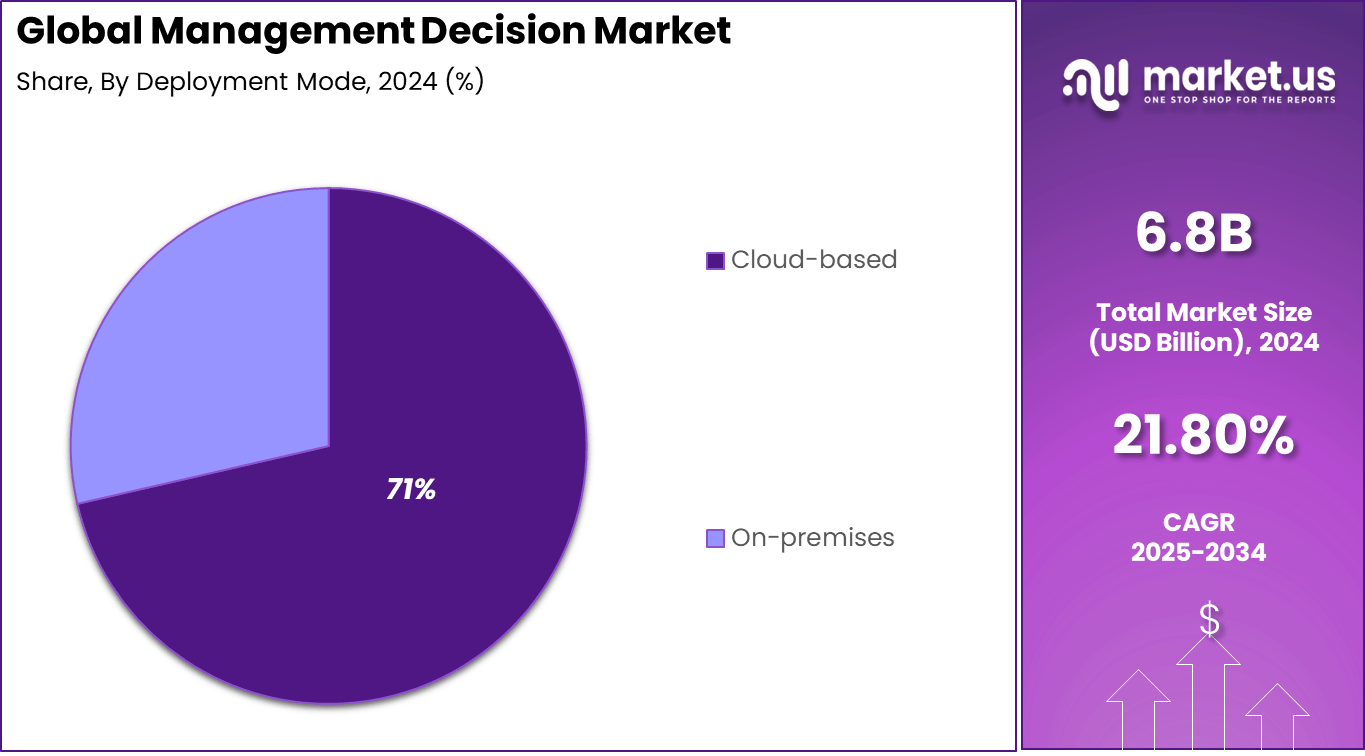

- By deployment mode, cloud-based solutions held 71.4% share, offering easy access and real-time updates.

- By organization size, large enterprises captured 82.3%, using advanced software for complex business decisions.

- By application, credit risk assessment led with 38.7%, helping firms check loan risks and customer credit.

- By end-user industry, BFSI accounted for 65.8%, relying on tools for financial planning and compliance.

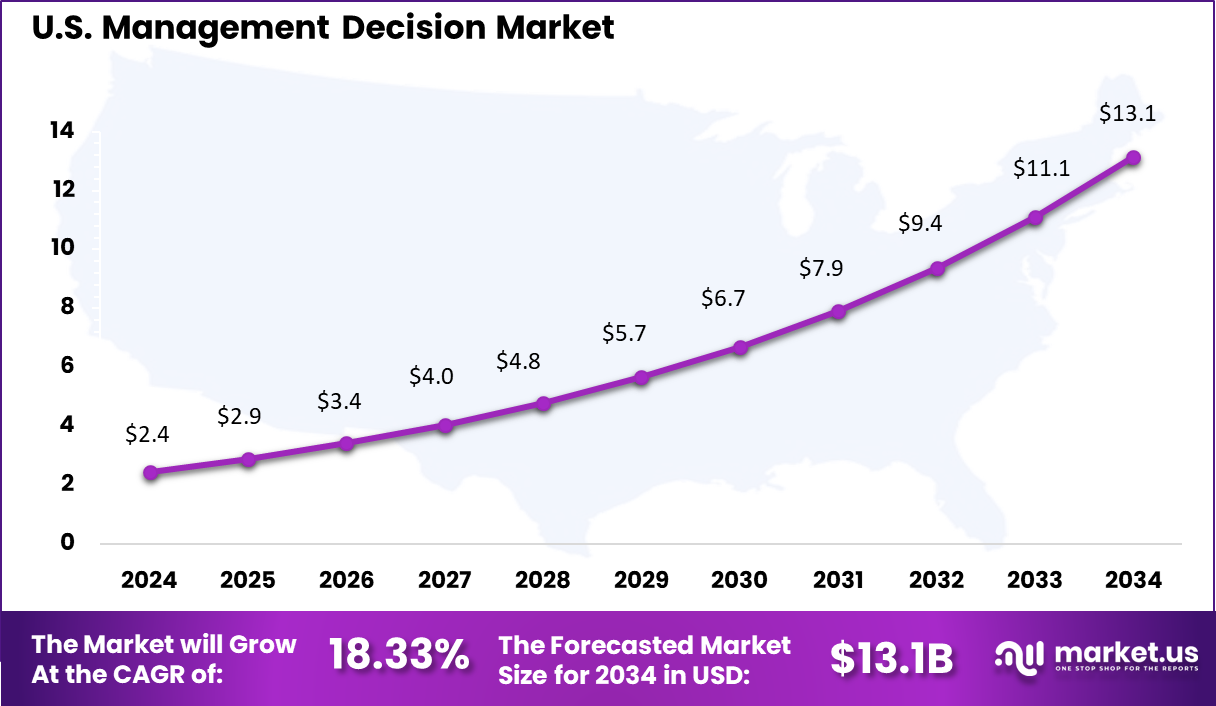

- North America had 39.5% of the global market, with the U.S. at USD 2.44 billion in 2025 and growing at a CAGR of 18.33%.

Quick Market Facts

Global Adoption Rates 2025

- 88% of enterprises regularly use AI powered solutions in at least one business function.

- Only 38% of organizations have established a fully data driven culture.

- Just 26% of companies are considered mature in advanced analytics and AI usage.

- SME adoption in manufacturing stands at 36%.

- SMEs that adopt analytics report an 80% improvement in decision quality.

Usage Statistics by Industry

- Finance and banking report 91% analytics adoption.

- Healthcare organizations show 89% usage.

- Technology sector adoption reaches 72%.

- Retail and e commerce adoption stands at 70%.

Key Usage Trends in 2025

- 75% of organizations rely on cloud delivered BI and analytics tools.

- Cloud analytics adoption was 45% in 2021.

- 84% of companies are using low code or no code analytics platforms.

- 75% of insights are consumed as data stories.

- 23% of organizations have scaled agentic AI beyond pilot stages.

Barriers and Challenges

- Data quality issues affect 68% of organizations.

- Organizational resistance is reported by 52% of managers.

- Only 24% of global executives are certified as data literate.

- Just 32% of executives feel confident creating measurable value from data.

- Regulatory compliance is ranked as the top challenge for analytics adoption in 2025.

Component Analysis

Software accounts for 76.5%, indicating that decision-making processes rely heavily on digital platforms. These software solutions support data analysis, rule management, and automated decision workflows. Organizations use software to improve accuracy and speed in operational decisions. Centralized decision engines help reduce human error. Software-based systems also enable consistent policy enforcement.

The dominance of software is driven by increasing data volume and complexity. Enterprises require tools that can process information in real time. Software platforms integrate with existing business systems easily. They also support updates as decision rules evolve. This ensures long-term usability and adoption.

Deployment Mode Analysis

Cloud-based deployment holds 71.4%, reflecting strong preference for flexible and scalable environments. Cloud platforms allow organizations to access decision tools from multiple locations. They support faster deployment and easier maintenance. This reduces the burden on internal IT teams. Cloud access improves collaboration across departments.

Adoption of cloud-based deployment is driven by cost efficiency and scalability. Organizations can adjust resources based on demand. Cloud platforms also support regular updates without system downtime. Security controls have improved significantly in cloud environments. These factors support continued growth.

Organization Size Analysis

Large enterprises represent 82.3%, highlighting their dominant role in the market. These organizations manage complex operations that require structured decision-making. Management decision software helps coordinate actions across departments. Centralized tools support enterprise-wide governance. Scale increases the need for automated decisions.

Adoption among large enterprises is driven by efficiency and risk management needs. Decision platforms help standardize processes across regions. They also provide visibility into outcomes and performance. Large enterprises invest in these tools to support strategic planning. This sustains high adoption levels.

Application Analysis

Credit risk assessment accounts for 38.7%, making it the leading application area. Organizations use decision tools to evaluate borrower risk and creditworthiness. Automated assessment improves consistency in lending decisions. Real-time data analysis supports faster approvals. This reduces operational delays.

Growth in this application is driven by demand for accurate risk evaluation. Financial institutions rely on data-driven insights to manage credit exposure. Decision platforms support scenario analysis and rule-based assessments. This helps reduce default risk. Credit risk assessment remains a critical use case.

End-User Industry Analysis

The BFSI sector holds 65.8%, making it the largest end-user industry. Financial institutions depend on structured decision systems for lending, fraud detection, and compliance. High transaction volumes require fast and accurate decisions. Management decision tools support operational stability. Regulatory requirements also increase demand.

Adoption in BFSI is driven by the need for transparency and control. Decision platforms help align business rules with regulatory standards. They also support audit trails and reporting. Improved decision accuracy reduces financial risk. This keeps BFSI at the center of market demand.

Investment and Business Benefits

Investment opportunities in this market include platforms that combine decision management with artificial intelligence. Solutions that support explainable and transparent decision logic are gaining attention. Tools that integrate decision making into digital workflows offer long-term value. These capabilities align with enterprise digital transformation goals.

There are also opportunities in industry-specific decision solutions. Tailored platforms for banking, insurance, healthcare, and supply chain management are in demand. Investors may focus on vendors offering modular and scalable decision frameworks. These investments support sustainable adoption across sectors.

Management decision solutions improve business outcomes by enabling faster and more accurate decisions. Organizations benefit from reduced operational risk and improved performance. Automated decisions support consistent customer experiences. This leads to higher satisfaction and trust.

Another benefit is enhanced agility. Decision platforms allow organizations to adapt rules and models quickly as conditions change. This supports rapid response to market shifts and regulatory updates. Improved decision transparency also strengthens internal accountability.

Benefits

- Better decision quality through structured analysis and clear evaluation criteria

- Faster response to market changes and internal performance signals

- Reduced risk from bias by relying on data driven insights and rules

- Improved alignment between strategy, execution, and measurable outcomes

- Stronger governance with documented decisions and clear responsibility tracking

Usage

- Supporting strategic planning by comparing scenarios and expected outcomes

- Guiding operational decisions such as pricing, sourcing, and resource allocation

- Evaluating risk and compliance impacts before approving major initiatives

- Monitoring performance indicators to trigger timely management actions

- Enabling collaboration by sharing decision models and insights across teams

Emerging Trends

Key Trend Description AI Threat Detection AI spots cyber attacks in real time across containers and virtual machines. Zero Trust Runtime Zero trust rules are enforced continuously on all cloud workloads. CNAPP Convergence Cloud workload protection merges with cloud security posture tools into one stack. eBPF Deep Visibility Kernel level technology provides deep visibility into cloud processes. Serverless Protection Functions and containers are secured without installing agents. Growth Factors

Key Factors Description Multi Cloud Spread Organizations use AWS, Azure, and GCP and require a unified security platform. Container Boom Growth of Docker and Kubernetes increases the need for runtime protection. Ransomware Rise Cloud data attacks push adoption of strong workload protection solutions. Compliance Push Regulations such as GDPR and PCI require proof of workload security. DevSecOps Shift Security is built into development pipelines from the start. Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Credit Risk Assessment

- Fraud Detection

- Customer Engagement & Personalization

- Supply Chain Optimization

- Others

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- Retail & E-commerce

- Healthcare

- Telecommunications

- Manufacturing

- Others

Regional Analysis

North America accounted for 39.5% share, supported by strong adoption of data driven decision making across enterprises and public sector organizations. Management decision platforms have been widely used to improve strategic planning, risk assessment, and operational efficiency.

Demand has been driven by the growing volume of enterprise data and the need to convert complex information into actionable insights. Organizations in the region have increasingly relied on these platforms to support faster and more consistent decision processes across departments.

The U.S. market reached USD 2.44 Bn and is projected to grow at an 18.33% CAGR, reflecting strong demand from large enterprises and regulated industries. Adoption has been particularly high in banking, insurance, healthcare, and government sectors, where complex regulatory and operational decisions are common. Management decision platforms have helped organizations standardize decision logic, improve transparency, and reduce reliance on manual judgment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver of market growth is the rising complexity of business environments that require rapid, informed decisions. Globalization, digital transformation, and evolving customer expectations have increased uncertainty for decision makers. Organizations are responding by adopting solutions that provide structured insights and reduce risk in strategic planning. Demand for technologies that support data consolidation and analysis is therefore growing across industries.

Another driver is the expansion of digital infrastructure that generates actionable data at every operational level. With connected systems, enterprises now have access to detailed performance indicators and customer behavior metrics. This data abundance supports deeper analysis and more nuanced decision outcomes. As a result, management teams are prioritizing systems that can convert raw data into meaningful recommendations.

Restraint Analysis

One restraint on market expansion is the shortage of skilled personnel who can interpret complex analytical outputs. Effective use of decision support tools requires expertise in data interpretation, modelling, and business strategy. Many organizations face talent gaps that limit their ability to fully benefit from advanced decision technologies. This constraint can slow adoption and reduce the effectiveness of deployed systems.

Another restraint is the high initial investment required for sophisticated decision support platforms. Small and mid-sized enterprises may find the cost of implementation, integration, and training prohibitive. These financial barriers can delay modernization of decision-making processes. As a result, organizations with limited budgets may continue to rely on traditional methods.

Opportunity Analysis

Significant opportunity exists in the development of user-centric decision support solutions that simplify complex analysis for non-technical users. Tools that provide intuitive dashboards, natural language summaries, and guided recommendations can broaden adoption. By lowering the technical barrier, these solutions can empower more stakeholders to contribute to decision processes. This democratization of insights is expected to drive market uptake.

Another opportunity is the integration of management decision systems with collaborative platforms that support cross-functional alignment. Decision outcomes are often more effective when teams can share context, discuss scenarios, and coordinate actions seamlessly. Embedding analytics within collaboration tools enhances transparency and accelerates execution. This convergence is likely to attract organizations seeking unified solutions.

Challenge Analysis

A major challenge for the market is ensuring data quality and consistency across disparate sources. Decision support systems rely on accurate, reliable data to generate valid recommendations. Inconsistent or incomplete data can lead to flawed insights and poor outcomes. Addressing data governance and standardization is therefore critical to achieving trusted decision support.

Another challenge is balancing automation with human oversight. While AI-driven recommendations can enhance efficiency, decision makers may be reluctant to rely fully on automated outputs. Ensuring that tools augment rather than replace human judgement requires careful design and governance. This balance is essential to foster confidence in technology-enabled decision frameworks.

Competitive Analysis

FICO, SAS Institute, Inc., IBM Corporation, and Oracle Corporation lead the management decision market with advanced decision management, analytics, and rule based platforms. Their solutions support credit decisioning, risk assessment, pricing, and fraud prevention across BFSI and enterprise sectors. These companies focus on scalability, explainable decision logic, and regulatory compliance.

Pegasystems, Inc., TIBCO Software, Inc., Sapiens International Corporation, and Experian plc strengthen the market with real time decision engines, customer analytics, and policy driven automation. Their platforms help organizations improve response speed and consistency across complex workflows. These providers emphasize integration with business processes and adaptive decision models.

Actico GmbH, Equifax, Inc., TransUnion, InRule Technology, Inc., Sparkling Logic, Inc., OpenRules, Inc., and Scorto, Inc. expand the landscape with specialized decision rules, scoring engines, and governance focused tools. Their offerings support niche use cases and mid market enterprises. These companies focus on flexibility, transparency, and faster deployment.

Top Key Players in the Market

- FICO (Fair Isaac Corporation)

- SAS Institute, Inc.

- IBM Corporation

- Oracle Corporation

- Pegasystems, Inc.

- TIBCO Software, Inc.

- Sapiens International Corporation

- Experian plc

- Actico GmbH

- Equifax, Inc.

- TransUnion

- InRule Technology, Inc.

- Sparkling Logic, Inc.

- OpenRules, Inc.

- Scorto, Inc.

- Others

Future Outlook

The future outlook for the Management Decision market is expected to remain positive as organizations rely more on data to guide strategic and operational choices. Decision management solutions are being used to automate routine decisions, improve consistency, and reduce human error across business processes.

Growing data availability from digital systems is supporting wider adoption across banking, insurance, retail, and public services. In the coming years, deeper use of analytics, AI, and real time data is likely to improve decision accuracy and help organizations respond faster to changing conditions.

Recent Developments

- In March 2025, the U.S. Department of Health and Human Services released a strategic plan identifying seven key domains where AI is expected to improve healthcare delivery, public health outcomes, and workforce development.

- Earlier, in January 2025, FICO launched Decision Optimizer X, integrating simulation, machine learning, and prescriptive analytics to help organizations manage risk, improve profitability, and enhance customer experience within a single platform.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Bn Forecast Revenue (2034) USD 49.2 Bn CAGR(2025-2034) 21.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Credit Risk Assessment, Fraud Detection, Customer Engagement & Personalization, Others), By End-User Industry (Banking, Financial Services, and Insurance (BFSI) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FICO (Fair Isaac Corporation), SAS Institute, Inc., IBM Corporation, Oracle Corporation, Pegasystems, Inc., TIBCO Software, Inc., Sapiens International Corporation, Experian plc, Actico GmbH, Equifax, Inc., TransUnion, InRule Technology, Inc., Sparkling Logic, Inc., OpenRules, Inc., Scorto, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Management Decision MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Management Decision MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FICO (Fair Isaac Corporation)

- SAS Institute, Inc.

- IBM Corporation

- Oracle Corporation

- Pegasystems, Inc.

- TIBCO Software, Inc.

- Sapiens International Corporation

- Experian plc

- Actico GmbH

- Equifax, Inc.

- TransUnion

- InRule Technology, Inc.

- Sparkling Logic, Inc.

- OpenRules, Inc.

- Scorto, Inc.

- Others