Global M-Aminophenol Market Size, Share, And Business Benefit By Types (Purity 99.5%, Purity 99%), By Application (Dyes, Pesticide, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161277

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

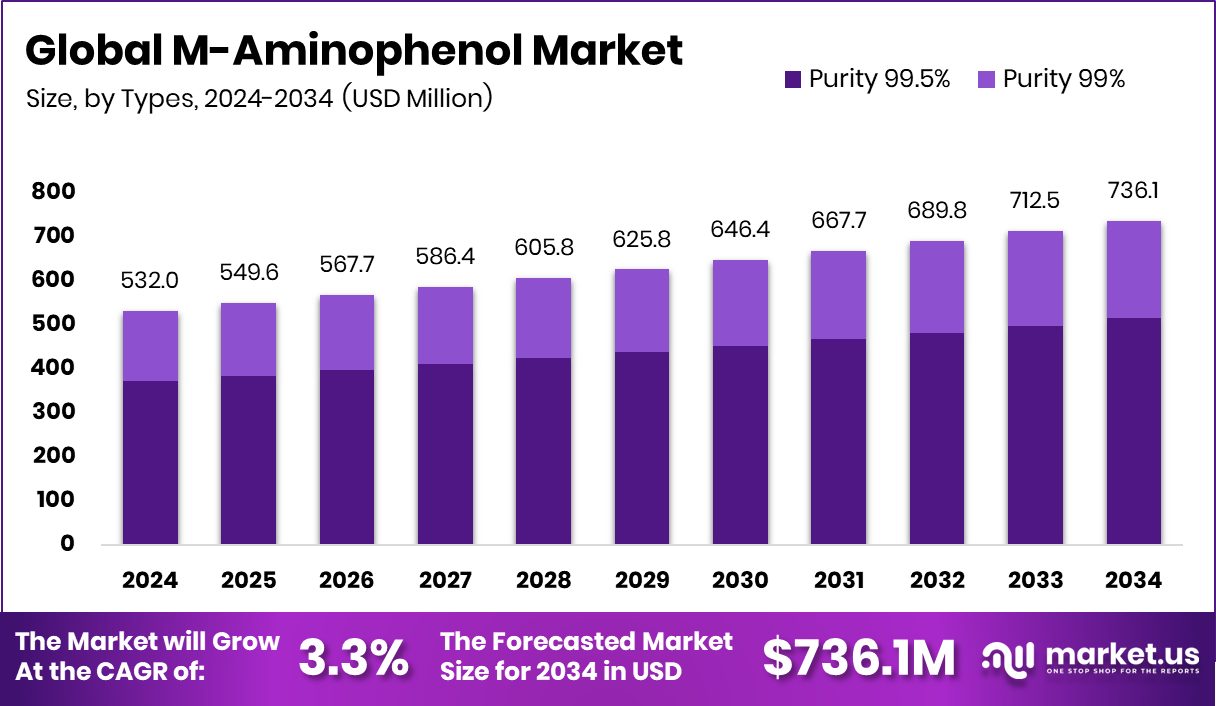

The Global M-Aminophenol Market is expected to be worth around USD 736.1 million by 2034, up from USD 532.0 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034. Rising chemical manufacturing and cosmetic demand in the Asia-Pacific 46.80% boosted overall M-Aminophenol consumption.

m-Aminophenol (also called 3-aminophenol) is an aromatic compound containing both an amino (-NH₂) and a hydroxyl (-OH) group attached to a benzene ring in the meta position. It is used as a versatile intermediate in chemical synthesis—for example, in the manufacture of dyes, colorants, and certain specialty chemicals.

The m-aminophenol market is the global trade of this intermediate chemical used in industries such as cosmetics (hair dyes), specialty pigments, photography, and other fine chemical applications. The demand is linked tightly to downstream sectors that consume dyes or formulations requiring m-aminophenol as a building block.

One growth driver is the increasing demand for novel and vibrant hair dyes and other colorants, where m-aminophenol is used in oxidative dye formulations. As cosmetic and personal care consumption rises globally, this supports m-aminophenol growth. Meanwhile, advances in green synthesis and more cost-effective production methods push supply-side growth. Also, growth in regional chemical manufacturing hubs increases local demand for intermediates.

Demand is driven by the push for more varied and safer colorants in cosmetics, and expansion in specialty chemicals requiring fine intermediates. There is an opportunity in tailoring m-aminophenol derivatives or formulations for niche high-end applications (e.g., in imaging, specialty dyes). Also, since funding is flowing into sustainable agriculture and pest control, there may be linkage: Eeki raising $7 million for pesticide-free staple vegetables, TRIC Robotics securing $5.5 M to scale chemical-free pest control, BiocSol’s €5.2 M seed funding in microbial pesticides, and Pest Share’s $28 million for pest control platforms — as the broader chemical and agrochemical ecosystem shifts, intermediates like m-aminophenol may find adjacent use or be influenced by that capital movement.

Key Takeaways

- The Global M-Aminophenol Market is expected to be worth around USD 736.1 million by 2034, up from USD 532.0 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034.

- In 2024, Purity 99.5% dominated the M-Aminophenol market, holding a significant 69.9% share globally.

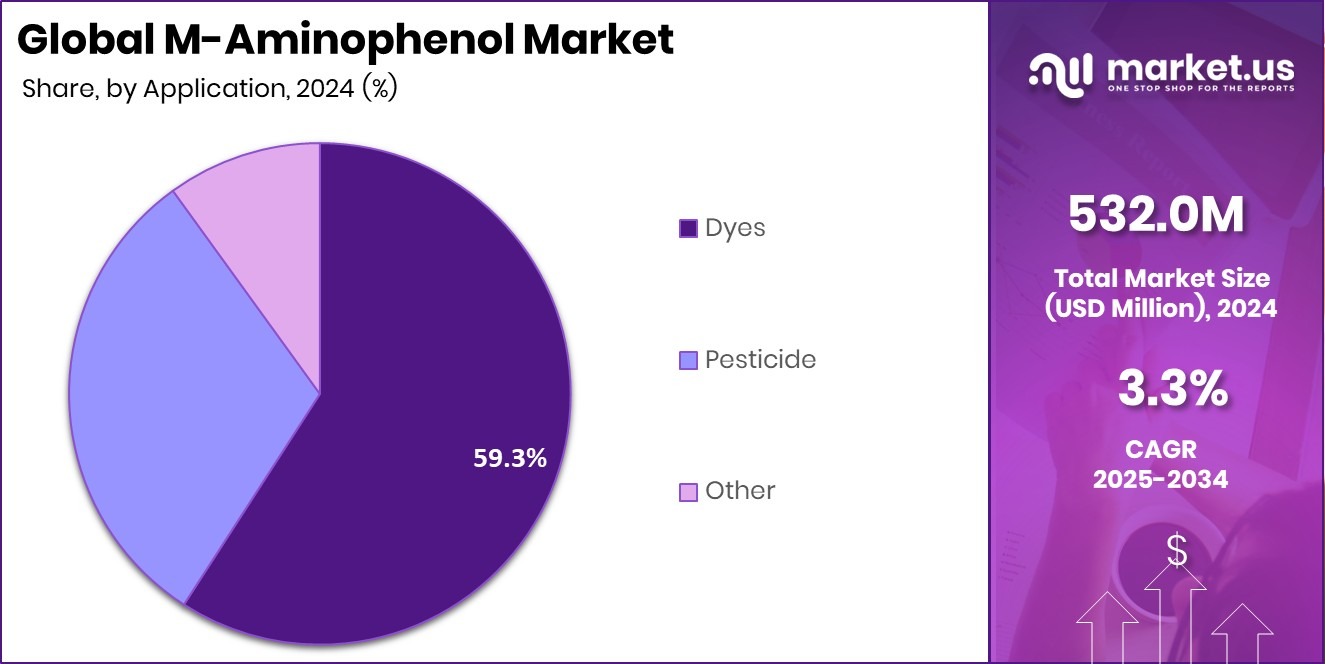

In 2024, Dyes accounted for 59.3% of the M-aminophenol market, driven by cosmetic applications. - The Asia-Pacific region recorded strong growth, reaching a market value of USD 248.9 million.

By Types Analysis

In 2024, the M-Aminophenol Market saw Purity 99.5% dominate strongly.

In 2024, Purity 99.5% held a dominant market position in the By Types segment of the M-Aminophenol Market, with a 69.9% share. This high-purity grade was widely preferred across industrial and cosmetic formulations due to its consistent chemical composition and reliability in colorant and dye synthesis. Manufacturers prioritized 99.5% purity for its stability and low impurity levels, ensuring better performance in hair dye and fine chemical production.

The growing focus on high-quality intermediates in pharmaceutical and specialty applications further strengthened the dominance of this purity level. As end-use industries continued to demand precise formulations, the 99.5% purity segment maintained its leadership, reflecting its strong suitability for regulated and high-performance chemical uses.

By Application Analysis

In 2024, Dyes held a 59.3% share in the M-Aminophenol Market.

In 2024, Dyes held a dominant market position in the By Application segment of the M-Aminophenol Market, with a 59.3% share. The compound’s strong oxidative dyeing ability and stability made it an essential intermediate in the production of hair dyes, textile colorants, and specialty pigments. Its precise color control and compatibility with other dye components supported its wide use across cosmetic and industrial formulations.

The demand for long-lasting and safe color solutions in personal care products continued to strengthen this segment’s leadership. With steady advancements in formulation chemistry and cleaner synthesis methods, the dyes segment sustained its dominance, reflecting its critical role in enhancing performance and color quality across end-use industries.

Key Market Segments

By Types

- Purity 99.5%

- Purity 99%

By Application

- Dyes

- Pesticide

- Other

Driving Factors

Rising Use of M-Aminophenol in Eco-Friendly Chemical Production

One major driving factor for the M-Aminophenol market is its growing use in sustainable and eco-friendly chemical formulations. Industries are steadily shifting toward safer raw materials and intermediates for dyes, cosmetics, and pharmaceuticals. M-Aminophenol offers good reactivity and stable performance, making it a preferred choice in cleaner production lines.

The global focus on green chemistry is also helping this shift, encouraging the adoption of low-toxicity intermediates in colorant and fine chemical manufacturing. A notable development reflecting this movement is Scotland’s SOLASTA Bio securing £4 million in pre-seed funding to create nature-inspired pesticides. Such investments in bio-based chemical innovation indirectly support wider use of safe intermediates like M-Aminophenol in sustainable production chains.

Restraining Factors

Health and Safety Concerns in Chemical Handling

A key restraining factor for the M-Aminophenol market is the health and safety risk associated with its handling and exposure. M-Aminophenol is a toxic and irritating compound that requires strict safety measures during production, storage, and transportation. Prolonged exposure can cause skin irritation, respiratory issues, and other health concerns for workers, which limits its widespread use in certain facilities without advanced protective systems.

Additionally, environmental regulations on hazardous waste management and chemical disposal increase compliance costs for manufacturers. These factors often discourage smaller producers from expanding capacity. As a result, the need for specialized safety equipment, trained staff, and controlled environments continues to pose challenges to market growth and operational efficiency.

Growth Opportunity

Expansion into High-Purity Pharmaceutical Grade Applications

A major growth opportunity for the M-Aminophenol market lies in its potential use within high-purity pharmaceutical formulations. With increasing demand for reliable intermediates in drug synthesis, the compound’s chemical stability and high reactivity make it suitable for developing advanced pharmaceutical ingredients. Manufacturers focusing on purity levels above 99% can meet the stringent quality requirements of the healthcare sector, opening new revenue channels.

Additionally, the ongoing shift toward regulated and high-quality chemical production enhances the appeal of M-Aminophenol in medical-grade uses. As more companies invest in purification technologies and clean manufacturing practices, the expansion into pharmaceutical-grade applications is expected to create steady and long-term growth prospects for the global M-Aminophenol market.

Latest Trends

Growing Focus on Sustainable and Low-Impact Chemical Processes

A key latest trend in the M-Aminophenol market is the shift toward sustainable and low-impact chemical production. Manufacturers are focusing on greener synthesis methods that reduce toxic byproducts and energy use. This change is driven by stricter environmental rules and growing awareness about pollution control. The compound’s versatility allows it to fit well into eco-friendly formulations used in dyes and specialty chemicals.

In line with this sustainability wave, Florida State University (FSU) researchers received nearly $1.5 million in EPA grants to study precipitation, pesticides, and pollution in South Florida waterways. Such environmental initiatives highlight a broader movement toward cleaner chemical ecosystems, encouraging industries to adopt safer processes where compounds like M-Aminophenol can be produced responsibly.

Regional Analysis

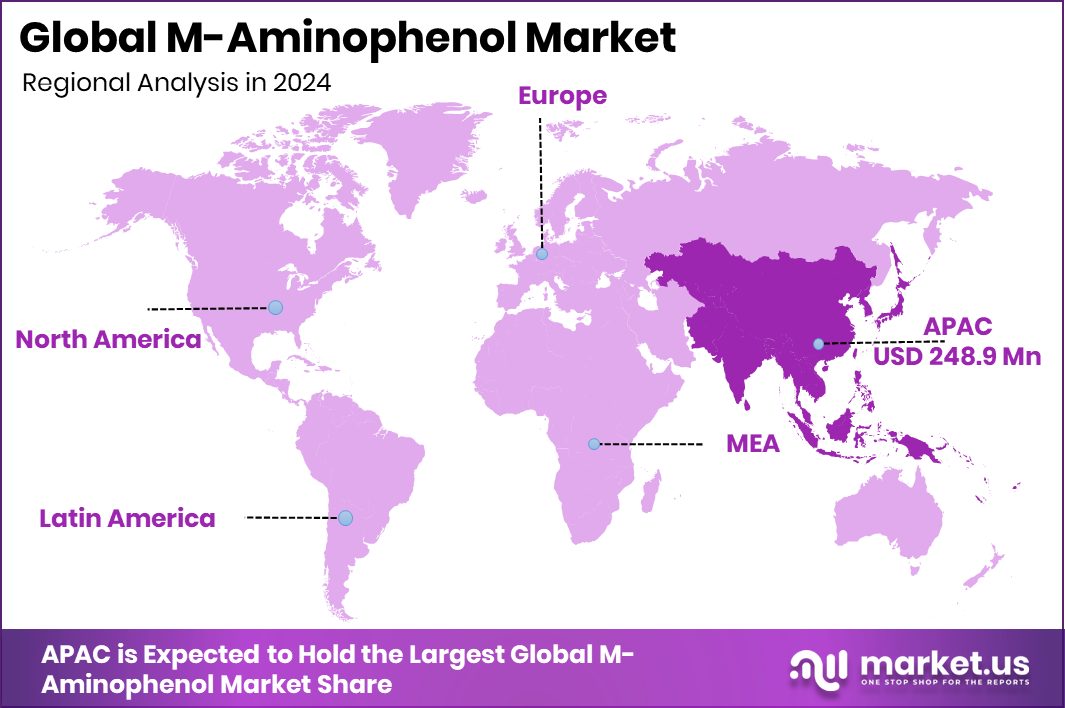

In 2024, the Asia-Pacific dominated the M-Aminophenol market with a 46.80% share.

In 2024, the Asia-Pacific region dominated the global M-Aminophenol market, capturing a significant 46.80% share valued at USD 248.9 million. The region’s leadership was supported by rapid expansion in chemical manufacturing hubs across China, India, and Japan, coupled with growing demand for dyes and personal care formulations. Rising industrialization and supportive government policies encouraging domestic chemical production further enhanced market growth in the Asia-Pacific.

North America followed with steady demand driven by advanced cosmetic and specialty chemical applications, supported by strong regulatory standards and innovation in formulation technologies.

Europe maintained a notable position, benefiting from stringent environmental norms and ongoing shifts toward sustainable chemical intermediates. Meanwhile, the Middle East & Africa and Latin America represented emerging regions, showing gradual adoption of M-Aminophenol in industrial and consumer product manufacturing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Hebei Jianxin Chemical, Zhejiang Longsheng, and Amino-chem remained key contributors to the global M-Aminophenol market, supporting supply stability and innovation in specialty chemical production.

Hebei Jianxin Chemical focused on maintaining high product purity standards and expanding its production efficiency to meet the growing demands of both the domestic and export markets. The company’s strong expertise in fine chemical synthesis allowed it to meet the rising need for high-quality intermediates used in dyes and cosmetic formulations. Its adherence to environmental safety norms and technological improvements in production helped strengthen its market presence.

Zhejiang Longsheng leveraged its advanced chemical processing infrastructure and long-standing experience in aromatic intermediates to sustain its competitive position. The company’s focus on continuous process optimization and sustainability is aligned with global trends toward cleaner and safer chemical manufacturing. By expanding its portfolio of specialty chemicals, Zhejiang Longsheng enhanced its capability to cater to downstream industries relying on M-Aminophenol-based products.

Amino-chem concentrated on developing efficient synthesis pathways to ensure cost-effectiveness and product consistency. The firm’s emphasis on research-driven operations and product customization allowed it to meet diverse application needs in dyes, pharmaceuticals, and fine chemicals. Collectively, these companies reinforced the M-Aminophenol market’s supply reliability, improved global distribution networks, and encouraged sustainable production practices that supported long-term industrial growth and innovation across various end-use sectors.

Top Key Players in the Market

- Hebei Jianxin Chemical

- Zhejiang Longsheng

- Amino-chem

- Aarti Industries

- Others

Recent Developments

- In April 2025, Zhejiang Longsheng released its 2024 results, showing that its dyes and intermediates business (which includes meta-aminophenol in its portfolio of intermediates) delivered sales growth of ~7.17% and improved margins.

- In April 2025, In Aarti’s 2025 product catalogue, 4-Aminophenol is listed among its chemical offerings, suggesting they continue to market that intermediate.

Report Scope

Report Features Description Market Value (2024) USD 532.0 Million Forecast Revenue (2034) USD 736.1 Million CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Purity 99.5%, Purity 99%), By Application (Dyes, Pesticides, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hebei Jianxin Chemical, Zhejiang Longsheng, Amino-chem, Aarti Industries, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hebei Jianxin Chemical

- Zhejiang Longsheng

- Amino-chem

- Aarti Industries

- Others