Global Luxury Mattress Market Size, Share, Growth Analysis By Type (Memory Foam, Latex, Hybrid, Others), By Size (Twin, Twin XL, Full, Full XL, Queen, King, California King, Others), By Thickness (Below 5 Inches, 6-10 Inches, 10-20 Inches, Above 20 Inches), By End-Use (Residential, Commercial, Hotels, Resorts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158260

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

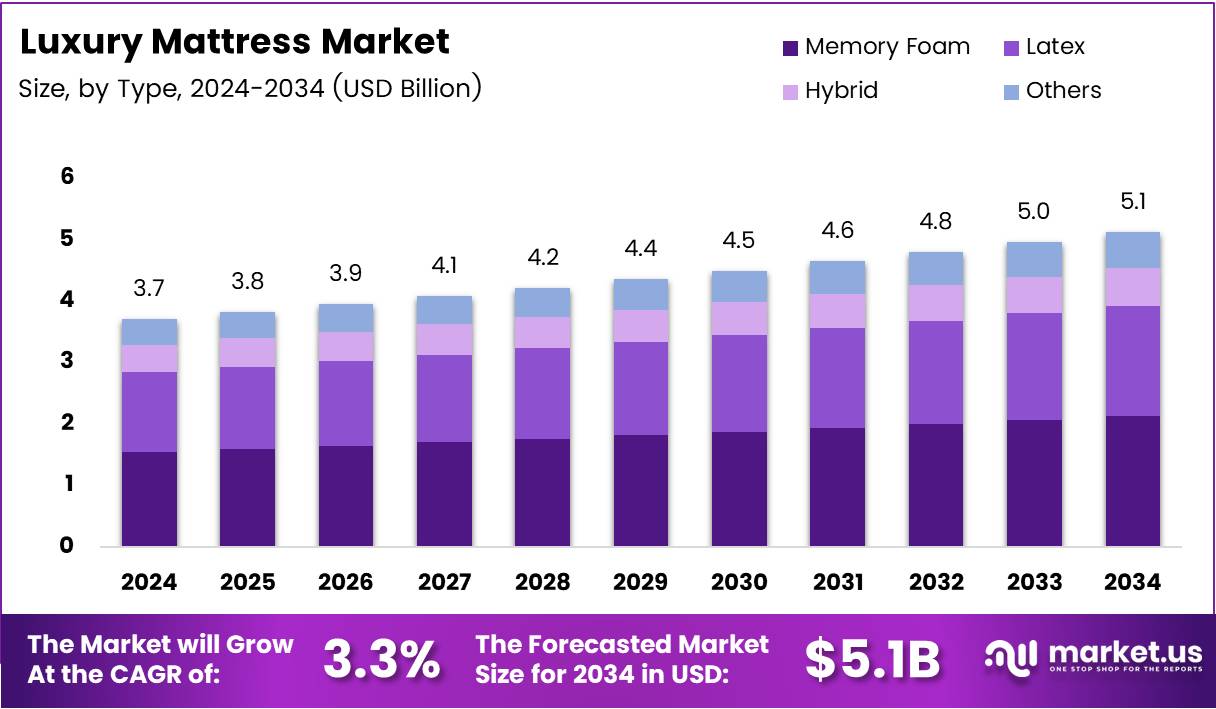

The Global Luxury Mattress Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 3.3% during the forecast period from 2025 to 2034.

The luxury mattress market is growing rapidly, driven by an increasing demand for comfort, high-quality materials, and personalized sleep solutions. Consumers are shifting their focus towards high-end, durable mattresses designed for improved sleep quality. As health awareness rises, premium mattresses are seen as investments in better well-being, fostering market growth.

Notably, the market is also expanding due to innovations in materials such as memory foam, latex, and hybrid mattresses. These materials contribute to the increased appeal of luxury products by offering better support, temperature regulation, and longer-lasting comfort. Furthermore, sustainable and eco-friendly options are gaining traction as consumers prioritize environmental concerns.

Government initiatives and regulations play a crucial role in shaping the market. Increasing awareness around sleep health, alongside sustainability efforts, has prompted regulatory bodies to introduce standards to ensure better quality. In countries like the UK, government policies encouraging sustainable products are helping to boost demand for greener mattresses, aligning with consumer preferences.

As the demand for luxury mattresses continues to rise, the market sees significant opportunities. The trend toward better sleep is not only driven by personal comfort but also by the growing awareness of sleep’s impact on health. This opens doors for luxury mattress brands to innovate further, offering specialized products for various sleep disorders and preferences.

Consumer behavior further influences market growth, with surveys showing that 75% of consumers cited dissatisfaction with their current beds as a driving factor for mattress shopping. Additionally, 33% of consumers are motivated by health and medical concerns when purchasing mattresses. According to the survey, 73% of UK consumers are willing to pay a premium for environmentally friendly products, with 36–37% of individuals aged 16–44 open to paying 10–20% more for greener mattresses.

Moreover, consumers are increasingly willing to invest heavily in quality. Many are prepared to spend over $2,500 for a mattress that promises optimal comfort and durability, reflecting their evolving preferences. This trend highlights the shift toward prioritizing long-term investment in sleep quality, which is expected to continue influencing purchasing decisions in the luxury mattress market.

Key Takeaways

- The Global Luxury Mattress Market is expected to reach USD 5.1 Billion by 2034, growing at a CAGR of 3.3% from 2025 to 2034.

- Memory Foam dominates the By Type Analysis segment with a 38.9% market share in 2024, driven by its body contouring and therapeutic benefits.

- Queen Size holds a 34.2% share in the By Size Analysis segment in 2024, being the preferred choice for luxury mattresses.

- 10-20 Inches thickness holds a 67.5% share in the By Thickness Analysis segment, offering the ideal balance of comfort and durability.

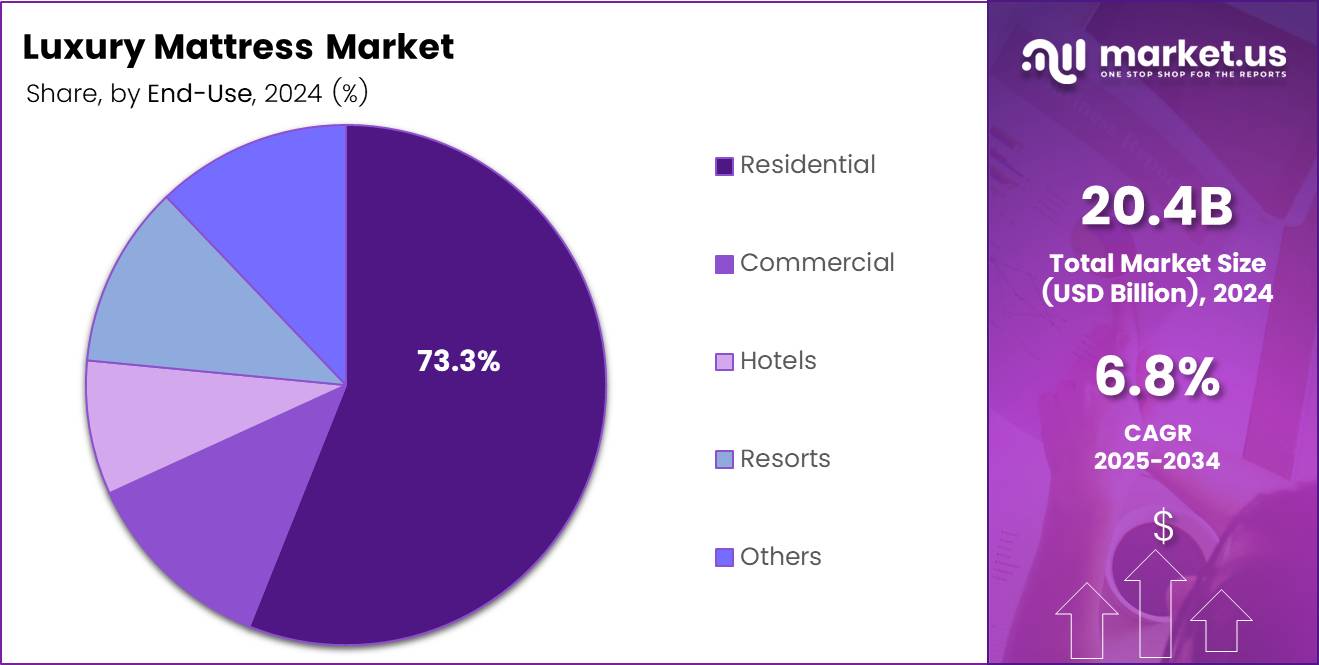

- The Residential sector dominates the By End-Use Analysis segment with a 73.3% share, reflecting consumers’ growing investment in home comfort.

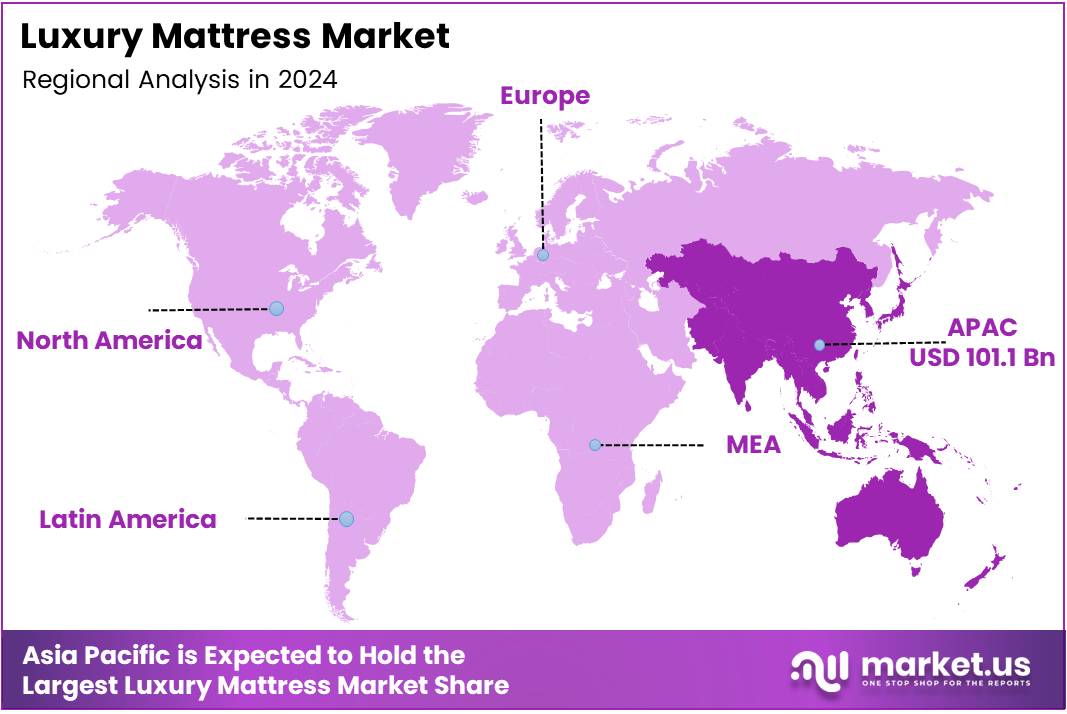

- Asia Pacific leads the global luxury mattress market with 39.7% share, valued at USD 1.4 billion in 2024, driven by rising incomes and wellness trends.

Type Analysis

Memory Foam dominates with 38.9% due to its superior pressure relief and motion isolation properties.

In 2024, Memory Foam held a dominant market position in By Type Analysis segment of Luxury Mattress Market, with a 38.9% share. This dominance stems from its exceptional ability to contour to body shapes and provide personalized comfort. Memory foam’s temperature-sensitive properties and pressure point relief capabilities have made it the preferred choice among luxury mattress buyers seeking therapeutic benefits.

Latex emerged as a strong competitor, appealing to environmentally conscious consumers who value natural materials and responsive support. The Hybrid segment gained traction by combining the benefits of multiple materials, offering customers the best of both worlds with innerspring support and foam comfort layers.

The Others category encompasses innovative materials and specialized constructions that cater to niche preferences. As consumer awareness about sleep health increases, the demand for premium memory foam mattresses continues to drive market growth, with manufacturers investing heavily in advanced foam technologies and cooling features to enhance the luxury sleeping experience.

Size Analysis

Queen dominates with 34.2% due to its perfect balance of space and bedroom compatibility.

In 2024, Queen held a dominant market position in By Size Analysis segment of Luxury Mattress Market, with a 34.2% share. The Queen size has become the gold standard for luxury mattresses, offering optimal sleeping space for couples while fitting comfortably in most master bedrooms. Its versatility makes it suitable for both shared and individual use.

King size mattresses represent the premium segment, appealing to customers with larger bedrooms and those prioritizing maximum sleeping space. California King caters to taller individuals seeking extra length without compromising luxury comfort features.

Twin and Twin XL sizes serve specific market niches, including luxury guest rooms, high-end dormitories, and premium single sleeper applications. Full and Full XL sizes bridge the gap between individual and couple sleeping arrangements.

The Others category includes specialty sizes and custom dimensions that luxury mattress manufacturers offer to meet unique customer requirements. The Queen segment’s dominance reflects consumer preference for balanced proportions that deliver luxury comfort without overwhelming bedroom spaces.

Thickness Analysis

10-20 Inches dominates with 67.5% due to its optimal comfort layering and premium positioning.

In 2024, 10-20 Inches held a dominant market position in By Thickness Analysis segment of Luxury Mattress Market, with a 67.5% share. This thickness range represents the sweet spot for luxury mattresses, providing sufficient depth for multiple comfort layers while maintaining structural integrity and durability.

The 10-20 inch range allows manufacturers to incorporate advanced comfort technologies including multiple foam layers, cooling gels, and transition zones that justify premium pricing. This thickness delivers the substantial feel that luxury mattress buyers associate with high-quality construction and superior comfort.

6-10 Inches appeals to customers seeking luxury features in a more moderate profile, suitable for adjustable bases and lower bed frames. Below 5 Inches serves specialized applications where space constraints require thinner luxury options.

Above 20 Inches represents the ultra-luxury segment, targeting customers who desire maximum plushness and are willing to invest in the thickest available comfort layers. The dominant 10-20 inch segment reflects market demand for mattresses that deliver comprehensive luxury features while remaining practical for everyday use and bedroom furniture compatibility.

End-Use Analysis

Residential dominates with 73.3% due to increasing consumer focus on premium home comfort investments.

In 2024, Residential held a dominant market position in By End-Use Analysis segment of Luxury Mattress Market, with a 73.3% share. The residential sector’s overwhelming dominance reflects consumers’ growing willingness to invest significantly in home comfort and sleep quality improvement. Post-pandemic lifestyle changes have intensified focus on creating luxury sleeping environments at home.

Rising disposable incomes and increased awareness of sleep’s impact on health and productivity drive residential luxury mattress purchases. Consumers view premium mattresses as long-term investments in personal well-being, justifying higher price points for advanced comfort technologies and superior materials.

The Commercial segment, while smaller, encompasses high-end hotels, luxury resorts, and premium healthcare facilities that prioritize guest comfort and brand reputation. These establishments recognize that luxury mattresses enhance customer satisfaction and differentiate their service offerings.

Commercial applications require mattresses that combine luxury comfort with durability to withstand frequent use. The residential segment’s dominance indicates that luxury mattresses have transitioned from being primarily commercial amenities to essential home comfort investments, reflecting evolving consumer priorities and lifestyle preferences.

Key Market Segments

By Type

- Memory Foam

- Latex

- Hybrid

- Others

By Size

- Twin

- Twin XL

- Full

- Full XL

- Queen

- King

- California King

- Others

By Thickness

- Below 5 Inches

- 6-10 Inches

- 10-20 Inches

- Above 20 Inches

By End-Use

- Residential

- Commercial

- Hotels

- Resorts

- Others

Drivers

Rising Disposable Income and Spending Power Drives Luxury Mattress Market Growth

Rising disposable income is a key driver for the growth of the luxury mattress market. As consumers’ purchasing power increases, many are opting for premium products that offer greater comfort and long-term health benefits. A higher income allows consumers to invest in higher-quality products, including luxury mattresses, that enhance sleep quality and overall well-being.

The increased awareness about the health benefits of quality sleep has further fueled the demand for luxury mattresses. More consumers are realizing that good sleep is essential for physical and mental health, leading them to prioritize spending on products that support restful sleep, such as luxury mattresses.

There is also a growing preference for premium, customized products. Consumers are looking for mattresses that offer personalized features, such as firmness adjustments and temperature control, to cater to individual comfort needs. This trend towards customization is particularly strong in the luxury mattress segment, where consumers expect tailored options.

Technological advancements in mattress materials and comfort features have also contributed to the market’s growth. Innovations such as memory foam, cooling gels, and adjustable bases are attracting consumers seeking the latest in sleep technology, making luxury mattresses an increasingly appealing investment for those focused on quality sleep.

Restraints

Competition from Budget and Mid-range Mattresses Limits Luxury Mattress Market Growth

The luxury mattress market faces strong competition from budget and mid-range mattress segments. Many consumers still prioritize affordability over luxury, particularly in emerging markets where disposable income remains lower. The presence of low-cost alternatives can hinder the expansion of the luxury segment, as price-sensitive consumers opt for more budget-friendly options.

Another challenge is the lack of awareness regarding the long-term value of luxury mattresses. Some consumers may not fully appreciate the durability and health benefits that premium mattresses offer, leading them to perceive them as an unnecessary expense. This gap in consumer education limits the market potential.

Concerns about sustainability in mattress manufacturing processes are also a growing issue. As environmental awareness increases, consumers are increasingly scrutinizing the materials and production methods used by mattress manufacturers. Luxury mattress brands that do not adopt sustainable practices may face backlash from eco-conscious consumers, which could affect their market share.

Growth Factors

Expansion of Online Platforms and Eco-friendly Choices Presents Growth Opportunities in the Luxury Mattress Market

The luxury mattress market has significant growth opportunities, particularly through the expansion of online retail platforms. Direct-to-consumer sales via online channels offer luxury mattress brands an opportunity to reach a broader audience, especially as more consumers prefer to shop online. These platforms also enable companies to offer competitive pricing, eliminating the need for intermediaries.

There is rising demand for eco-friendly and sustainable luxury mattresses. Consumers are increasingly interested in products made with natural, non-toxic materials and environmentally friendly manufacturing processes. As sustainability becomes a priority, luxury mattress brands that focus on eco-conscious products are likely to capture a growing segment of health and environmentally-conscious buyers.

Another opportunity is the increasing preference for mattress-in-a-box convenience models. These models offer customers the convenience of having a luxury mattress delivered directly to their door in a compact, easy-to-handle package. This trend is reshaping how consumers purchase mattresses, opening new avenues for growth in the market.

The growing focus on sleep quality and wellness among affluent consumers presents another opportunity. As more people prioritize sleep as an integral part of their overall health and wellness, the demand for high-end mattresses designed to improve sleep quality is expected to rise. This segment is particularly driven by the affluent population, which is willing to invest in luxury sleep solutions.

Emerging Trends

Technological Integration and Social Media Influence Shape Luxury Mattress Trends

One of the key trends in the luxury mattress market is the integration of smart technology for sleep tracking. Smart mattresses equipped with sensors that monitor sleep patterns and adjust the bed’s firmness or temperature are becoming increasingly popular. Consumers are seeking more personalized and data-driven solutions for optimizing their sleep experience.

Rising popularity of hybrid mattresses combining memory foam and spring systems is another notable trend. Hybrid mattresses offer the benefits of both foam and traditional spring systems, providing superior comfort and support. This combination is appealing to consumers seeking the best of both worlds.

There is also a surge in demand for organic and natural mattress materials. As consumers become more health-conscious and environmentally aware, many are seeking mattresses made from organic cotton, natural latex, and other non-toxic materials. This trend is reshaping consumer preferences towards more sustainable options.

The influence of celebrity endorsements and social media marketing has also become a significant factor in the luxury mattress market. As celebrities promote specific brands on social media, they help drive consumer awareness and increase demand for premium products. This trend is shaping consumer behavior, particularly among younger, socially engaged consumers.

Regional Analysis

Asia Pacific Dominates the Luxury Mattress Market with a Market Share of 39.7%, Valued at USD 1.4 Billion

In 2024, the Asia Pacific region led the global luxury mattress market, accounting for 39.7% of the market share, valued at USD 1.4 billion. This dominance is driven by increasing disposable incomes and the growing preference for premium mattresses among consumers. Countries such as China and Japan are seeing higher demand due to the rising focus on health and wellness.

North America Luxury Mattress Market Trends

North America holds a significant position in the luxury mattress market, with strong consumer demand for premium sleep products. The market is supported by the increasing awareness of sleep health, with consumers willing to invest in high-quality mattresses. As the largest consumer market in terms of revenue, North America continues to witness steady growth in the luxury mattress segment.

Europe Luxury Mattress Market Trends

Europe is a key player in the global luxury mattress market, driven by a growing preference for sustainable and eco-friendly products. The region’s market growth is supported by a high rate of consumer spending on health and comfort. The demand for organic and green mattresses is expected to increase, boosting market growth over the forecast period.

Middle East & Africa Luxury Mattress Market Trends

The Middle East and Africa market is experiencing steady growth in the luxury mattress segment, fueled by rising disposable income and changing lifestyles. The region is witnessing increasing demand for high-end mattresses, particularly in countries like the UAE and Saudi Arabia, as consumers seek comfort and quality sleep solutions.

Latin America Luxury Mattress Market Trends

In Latin America, the luxury mattress market is gradually expanding, driven by an improving economic environment and growing awareness about sleep quality. Brazil and Mexico are key markets where consumers are becoming more inclined toward investing in durable and comfortable mattresses. As purchasing power increases, the demand for luxury sleep products is expected to rise.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Luxury Mattress Company Insights

The global luxury mattress market in 2024 is characterized by innovation, sustainability, and a focus on consumer experience. Key players such as Amore Mattress, Casper, Duroflex Pvt. Ltd., and Harrison Spinks are leading this transformation.

Amore Mattress has established itself as a prominent player in the luxury mattress segment. With over 40 years of experience, the company offers a diverse range of high-quality mattresses designed to cater to various sleep preferences. Their commitment to craftsmanship and customer satisfaction has earned them a loyal customer base.

Casper continues to be a significant force in the global mattress market. Known for its innovative approach, the company has expanded its product line to include advanced sleep technologies. Their focus on research and development ensures that they remain at the forefront of the industry.

Duroflex Pvt. Ltd. stands out in the Indian market with its emphasis on research-backed and technology-led mattresses. The company has integrated its manufacturing processes, allowing for greater control over product quality and innovation. Their commitment to excellence has made them a trusted name in the industry.

Harrison Spinks is renowned for its sustainable practices and luxury craftsmanship. As a fifth-generation family business, they produce mattresses using natural materials sourced from their own farm. This vertical integration ensures high-quality products and supports their commitment to environmental responsibility.

These companies exemplify the dynamic nature of the luxury mattress market, where innovation, sustainability, and customer-centric approaches drive success.

Top Key Players in the Market

- Amore Mattress

- Casper

- Duroflex Pvt. Ltd.

- HARRISON SPINKS

- Hilding Anders International AB

- King Koil Licensing Co. Inc.

- Kingsdown Mattress

- Livpure Pvt. Ltd.

- Magniflex India

- NOCTALIA SLU

Recent Developments

- May 2025: Mattress Warehouse surpasses 500 stores with the acquisition of multiple regional retail chains, marking a significant milestone in its expansion strategy. This move enhances its market share and strengthens its retail presence across the U.S.

- Feb 2025: Tempur Sealy completes the $5B acquisition of Mattress Firm, positioning itself as the leading player in the U.S. mattress retail market. The acquisition is part of its strategy to expand its footprint and improve brand consolidation.

- Feb 2025: Tempur Sealy’s $5 billion acquisition of Mattress Firm is expected to boost its distribution capabilities while providing customers with a broader range of mattress options. The deal is seen as a major step in consolidating its position in the U.S. mattress sector.

- Apr 2024: AI Dream acquires U.S. Mattress Company King Koil, strengthening its portfolio of premium mattress brands. This acquisition aims to leverage advanced AI technology in mattress development and manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 5.1 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Memory Foam, Latex, Hybrid, Others), By Size (Twin, Twin XL, Full, Full XL, Queen, King, California King, Others), By Thickness (Below 5 Inches, 6-10 Inches, 10-20 Inches, Above 20 Inches), By End-Use (Residential, Commercial, Hotels, Resorts, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amore Mattress, Casper, Duroflex Pvt. Ltd., HARRISON SPINKS, Hilding Anders International AB, King Koil Licensing Co. Inc., Kingsdown Mattress, Livpure Pvt. Ltd., Magniflex India, NOCTALIA SLU Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amore Mattress

- Casper

- Duroflex Pvt. Ltd.

- HARRISON SPINKS

- Hilding Anders International AB

- King Koil Licensing Co. Inc.

- Kingsdown Mattress

- Livpure Pvt. Ltd.

- Magniflex India

- NOCTALIA SLU