Global Low Voltage Protection and Control Devices Market Size, Share, And Enhanced Productivity By Product Type (Protection Equipment, Switching Equipmen, Monitoring Devices), By End-use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170975

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

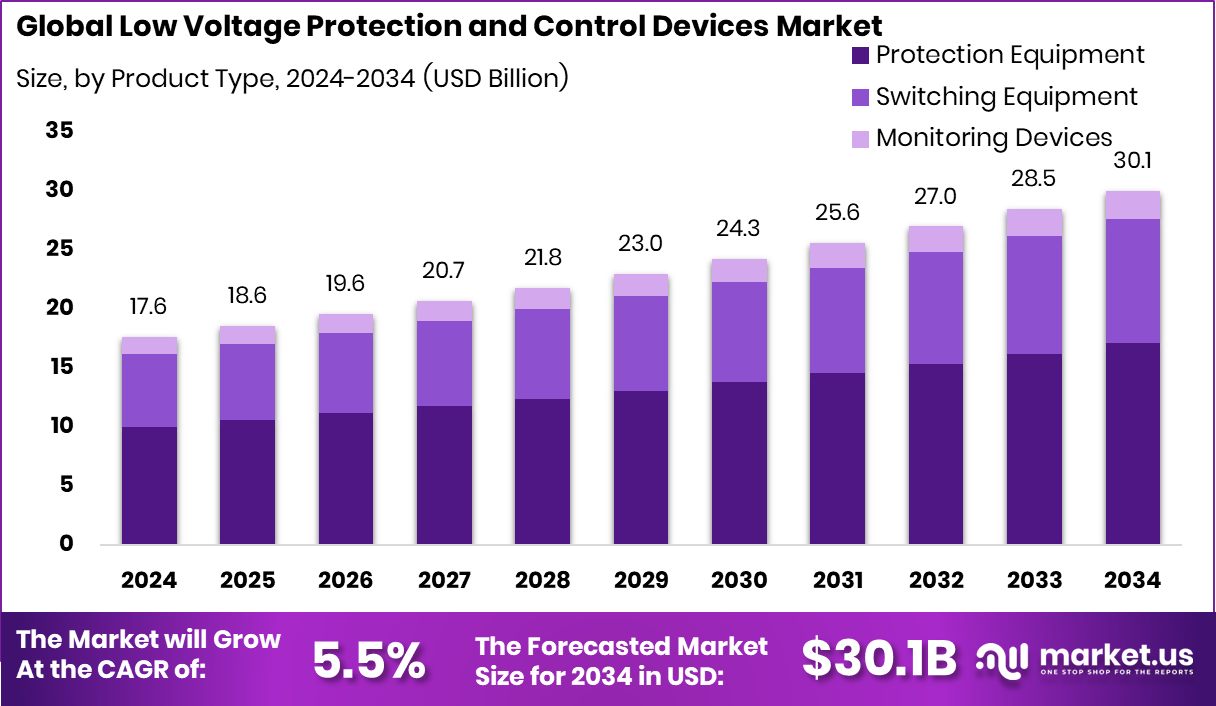

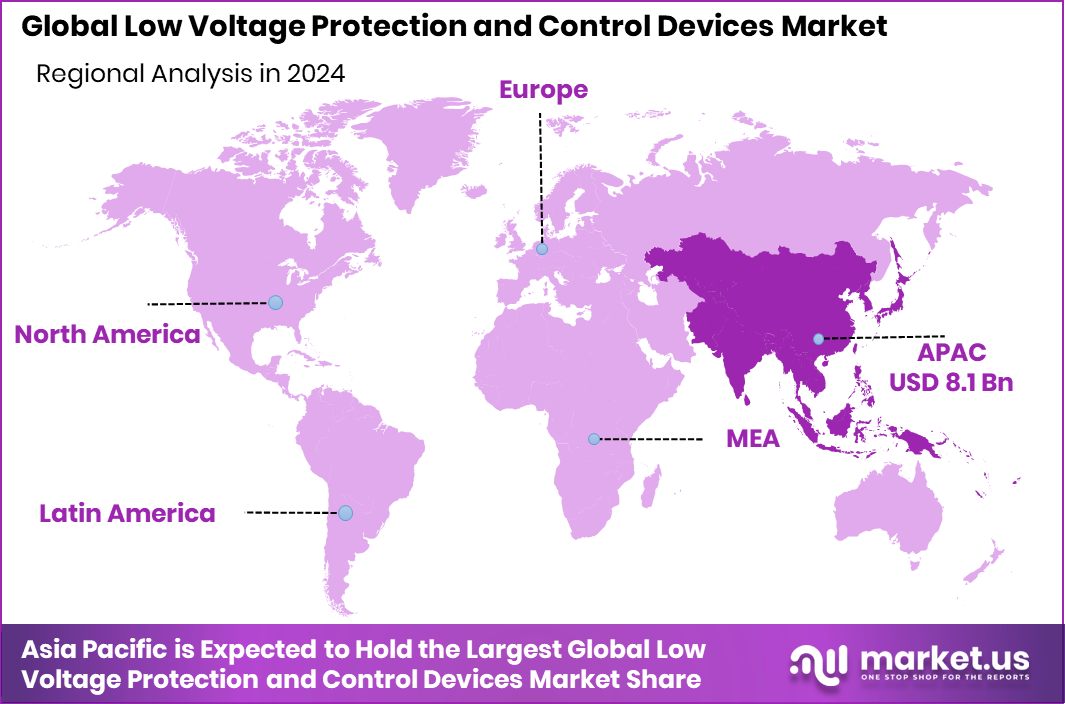

The Global Low Voltage Protection and Control Devices Market is expected to be worth around USD 30.1 billion by 2034, up from USD 17.6 billion in 2024, and is projected to grow at a CAGR 5.5% from 2025 to 2034. Asia Pacific dominates demand, holding 46.20% and generating USD 8.1 Bn market value.

Low Voltage Protection and Control Devices are electrical components designed to safeguard circuits and manage power flow at lower voltage levels. These devices help prevent damage caused by overloads, short circuits, voltage fluctuations, and electrical faults. They also ensure safe switching, monitoring, and control of electrical systems in residential, commercial, and industrial environments, supporting reliable and stable power usage.

The Low Voltage Protection and Control Devices Market represents the organized demand and supply of these safety and control solutions across power distribution networks. The market exists to address growing electrical safety needs, system efficiency requirements, and regulatory expectations that emphasize protection, reliability, and continuity in everyday power operations without interruptions.

Growth in this market is mainly driven by rising electrification and the need for safer power systems. Innovation in compact safety designs has gained attention, highlighted by Salzer Electronics securing a patent for a compact high-voltage safety device, which led to a 14.76% stock surge. This reflects how innovation-focused developments continue to strengthen confidence in electrical protection technologies.

Demand for low voltage protection and control devices is supported by grid modernization efforts and improved reliability standards. Public initiatives such as the USD 18M funding opportunity announced by the U.S. Department of Energy for Flexible Innovative Transformer Technologies underline the broader push toward resilient and efficient power infrastructure.

- EU funding accelerated the development of the world’s first SF6-free 420 kV circuit breaker, signaling strong momentum toward cleaner and safer electrical protection technologies.

Key Takeaways

- The Global Low Voltage Protection and Control Devices Market is expected to be worth around USD 30.1 billion by 2034, up from USD 17.6 billion in 2024, and is projected to grow at a CAGR 5.5% from 2025 to 2034.

- In the Low Voltage Protection and Control Devices Market, protection equipment leads with 56.9% share.

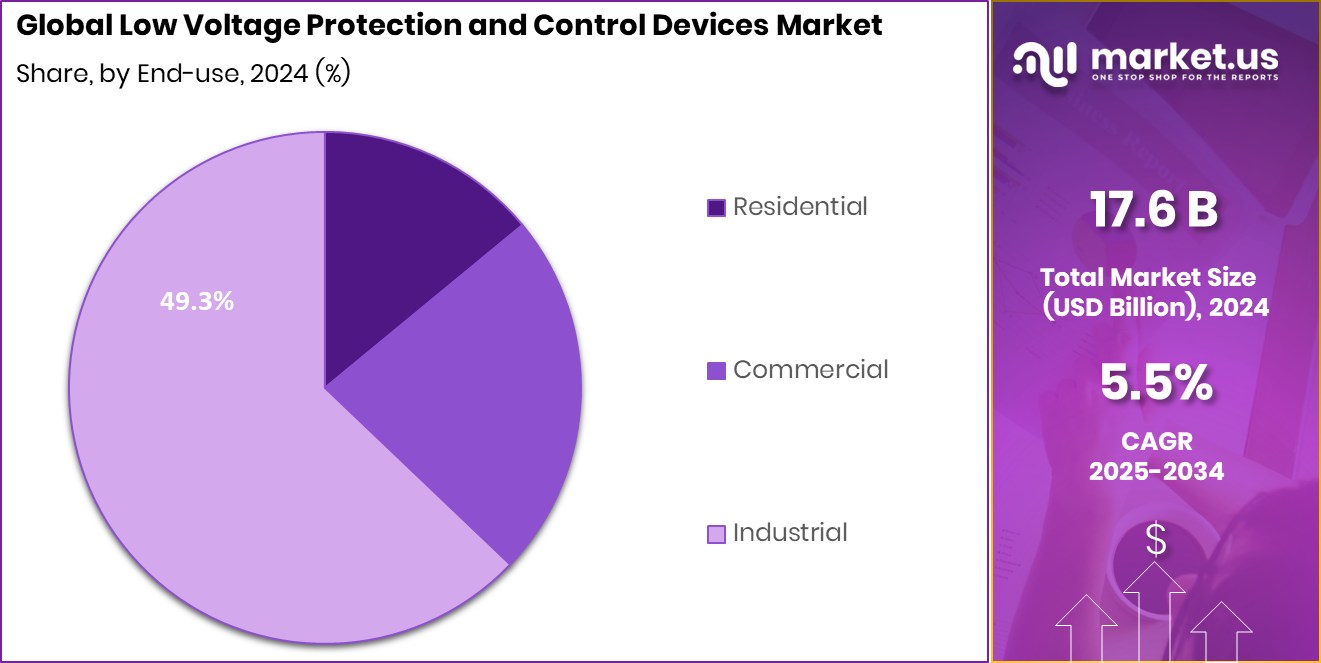

- Industrial end-use dominates the Low Voltage Protection and Control Devices Market, accounting for 49.3% demand.

- In the Asia Pacific, low-voltage devices reached 46.20% share, totaling USD 8.1 Bn.

By Product Type Analysis

Protection equipment dominates the voltage protection and control devices market with 56.9% share.

In 2024, Protection Equipment held a dominant market position in the By Product Type segment of the Low Voltage Protection and Control Devices Market, with a 56.9% share. This strong position reflects the essential role of protection-focused devices in maintaining electrical safety, system reliability, and operational continuity across low-voltage networks. Their adoption remains closely tied to compliance needs and the growing focus on safeguarding electrical infrastructure.

The 56.9% share also indicates consistent demand from users prioritizing fault prevention, equipment protection, and controlled power distribution. Market performance at this level shows how protection equipment continues to be viewed as a core requirement rather than an optional upgrade, reinforcing its leadership within the product type landscape of low-voltage protection and control devices.

By End-use Analysis

Industrial end-use leads the low voltage protection and control devices market, holding 49.3%.

In 2024, Industrial held a dominant market position in the By End-use segment of the Low Voltage Protection and Control Devices Market, with a 49.3% share. This dominance highlights the industrial sector’s continuous dependence on reliable low-voltage systems to support uninterrupted operations, equipment safety, and process efficiency in demanding environments.

Holding a 49.3% share, the industrial end-use segment reflects steady usage driven by routine power control needs, machinery protection, and system monitoring. Industrial facilities consistently invest in dependable low-voltage protection and control solutions to reduce downtime and ensure stable performance, reinforcing the sector’s leading contribution to overall market demand.

Key Market Segments

By Product Type

- Protection Equipment

- Switching Equipment

- Monitoring Devices

By End-use

- Residential

- Commercial

- Industrial

Driving Factors

Grid Reliability Pressure Drives Protection Device Adoption

One major driving factor for the Low Voltage Protection and Control Devices Market is the growing pressure to maintain grid reliability and operational safety amid policy and funding uncertainties. When large-scale funding disruptions occur, power operators and facility managers focus more on protecting existing electrical infrastructure rather than expanding new systems. This makes low voltage protection and control devices essential for preventing faults, minimizing downtime, and extending equipment life using already-installed networks.

The recent decision by Harvard University to reject federal funding conditions, followed by the Trump administration freezing USD 2.2 billion in grants, highlights how sudden funding shifts can disrupt infrastructure planning. In such environments, organizations prioritize electrical safety, system control, and risk reduction through dependable low voltage protection solutions. These devices help ensure continuity of operations even when broader investment pipelines slow down.

Restraining Factors

Policy Uncertainty Slows Electrical Infrastructure Investment Decisions

One key restraining factor for the Low Voltage Protection and Control Devices Market is policy uncertainty around public funding and regulatory decisions. When government support programs face legal challenges or sudden changes, project timelines often slow down. This directly affects spending on electrical upgrades, including low-voltage protection and control devices, as buyers delay decisions until funding clarity improves.

A clear example is Oregon challenging the EPA’s decision to end a USD 87 million solar grant. Such disputes create hesitation across related electrical projects, even beyond renewable installations. Utilities, commercial builders, and public institutions may postpone investments in protection and control systems while waiting for outcomes. This cautious approach reduces short-term demand, especially for large-scale deployments, and limits market momentum despite ongoing safety and reliability needs.

Growth Opportunity

SF₆-Free Switchgear Push Creates Strong Market Opportunity

A major growth opportunity for the Low Voltage Protection and Control Devices Market is the shift toward environmentally safer electrical technologies. Power operators and infrastructure planners are actively moving away from traditional insulating gases and materials that raise environmental concerns. This transition creates strong demand for modern protection and control devices that can work alongside cleaner, next-generation electrical systems while maintaining safety and reliability.

The European Union’s decision to co-fund the development of a 245 kV SF₆-free g³ gas-insulated substation confirms growing confidence in sustainable grid technologies. Although focused on higher voltage systems, this initiative sets a clear direction for the entire electrical value chain, including low voltage equipment. As utilities adopt greener designs, compatible low voltage protection and control solutions gain wider acceptance and long-term demand.

Latest Trends

Energy Storage Expansion Reshapes Protection Device Requirements

A key latest trend in the Low Voltage Protection and Control Devices Market is the rapid expansion of grid-connected energy storage systems. As more batteries are added to power networks, the need for precise protection, switching, and control at low voltage levels is increasing. Energy storage sites require reliable devices to manage power flow, prevent overloads, and ensure safe connections between storage units and distribution systems.

This trend is reinforced by large public subsidy programs supporting storage deployment. Poland’s plan to distribute PLN 4 billion (USD 1 billion) by the end of 2025 aims to bring more than 5 GWh of energy storage projects online by 2028. Such large-scale installations increase demand for advanced low voltage protection and control solutions that can handle frequent charging cycles, bidirectional power flows, and grid stability requirements.

Regional Analysis

Asia Pacific leads the market with 46.20% share valued at USD 8.1 Bn.

Asia Pacific dominated the Low Voltage Protection and Control Devices Market, holding a 46.20% share and reaching a market value of USD 8.1 Bn, making it the leading regional contributor. This dominance reflects the region’s broad deployment of low-voltage electrical systems across manufacturing, infrastructure, and utility networks, where protection and control devices are critical for operational safety and power stability. Strong industrial activity and expanding power distribution frameworks have positioned the Asia Pacific ahead of other regions in overall market value and adoption scale.

In comparison, North America and Europe represent mature markets where replacement demand and system upgrades support steady consumption of low-voltage protection and control devices. These regions maintain consistent usage due to established electrical standards and long-standing industrial bases.

The Middle East & Africa shows gradual uptake, largely linked to expanding power infrastructure and controlled electrification projects, while Latin America contributes through selective industrial and commercial applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB continued to show strong positioning in the Low Voltage Protection and Control Devices Market in 2024 through its broad product portfolio and engineering-driven approach. The company’s focus on reliability, safety, and system integration supports its relevance across industrial, commercial, and utility environments. ABB’s ability to align protection and control solutions with digital monitoring and automation needs strengthens its long-term competitiveness and customer retention.

Eaton maintained a stable and influential presence in 2024 by emphasizing practical, application-focused low-voltage protection and control solutions. The company’s strength lies in addressing operational efficiency, electrical safety, and lifecycle performance. Eaton’s solutions are widely recognized for ease of integration within existing electrical systems, making them attractive for users seeking dependable performance without operational complexity.

Fuji Electric Co. Ltd demonstrated consistent momentum in the market by leveraging its deep expertise in power electronics and industrial systems. In 2024, the company’s low-voltage protection and control devices reflected a strong balance between durability and performance. Fuji Electric’s focus on industrial-grade applications supports steady demand, particularly where operational precision and electrical stability remain critical decision factors.

Top Key Players in the Market

- ABB

- Eaton

- Fuji Electric co. Itd

- Hitachi

- Rockwell Automation

- Schneider Electric

- Siemens

- Yaskawa

- CHINT Group

- WEG SA

Recent Developments

- In March 2025, Yaskawa made its iC9226M-EC and iC9226M-FSoE controllers available in Europe. These are part of the iCube Control automation platform, offering advanced control for motion systems, safety functions, and synchronized performance for up to 64 axes of devices. The launch strengthens Yaskawa’s automation controller range for factory systems.

- In February 2025, WEG launched the RUW200 modular remote unit designed for industrial automation. This product enhances device integration and communication in control systems, supporting IoT-ready protocols like EtherNet/IP and Modbus-TCP, which improves automation and operational efficiency.

- In February 2025, CHINT launched a range of new low-voltage products designed to improve power management, safety, and efficiency across telecom, industrial, and building sectors. These included advanced RCBOs, VFDs, switchgear, and supporting software aimed at smart, reliable electrical distribution.

Report Scope

Report Features Description Market Value (2024) USD 17.6 Billion Forecast Revenue (2034) USD 30.1 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Protection Equipment, Switching Equipmen, Monitoring Devices), By End-use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Eaton, Fuji Electric co. Itd, Hitachi, Rockwell Automation, Schneider Electric, Siemens, Yaskawa, CHINT Group, WEG SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low Voltage Protection and Control Devices MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Low Voltage Protection and Control Devices MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Eaton

- Fuji Electric co. Itd

- Hitachi

- Rockwell Automation

- Schneider Electric

- Siemens

- Yaskawa

- CHINT Group

- WEG SA