Global Low Voc Paint Market Size, Share, And Business Benefits By Туре (Low-VOC, No or Zero VOC, Natural), By Formulation Type (Water-borne, Solvent-borne, Powder), By Application (Architecture and Decorative, Automotive OEM, Automotive Refinish, Marine, Consumer Durables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160705

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

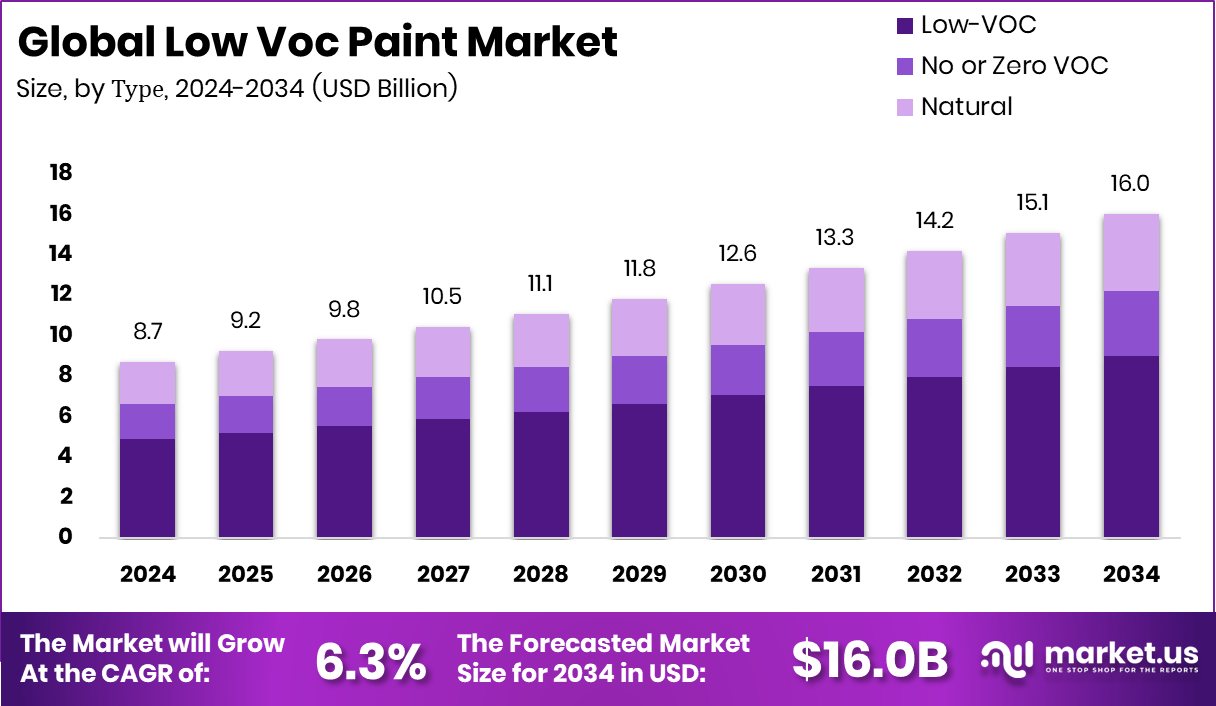

The Global Low Voc Paint Market is expected to be worth around USD 16.0 billion by 2034, up from USD 8.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. Rising adoption of sustainable paints in residential projects strengthens North America’s 47.80% market leadership.

Low-VOC paint refers to formulations that emit a reduced amount of volatile organic compounds (VOCs) compared to conventional paints—typically under about 50 grams per liter for flat finishes, while non-flat finishes may allow slightly more. These paints are usually water-based or use milder solvents, and they aim to minimize harmful off-gassing, odors, and indoor air pollution while still delivering acceptable coverage and durability.

The low-VOC paint market is a subset of the broader coatings and paint industry focused on environmentally friendlier products. It includes architectural coatings (for homes, offices, and commercial buildings), industrial coatings, wood finishes, and specialty applications where low emissions are essential (e.g., hospitals, schools, and green buildings). As regulations, consumer awareness, and sustainability goals strengthen, this niche is becoming a mainstream growth segment within the paints sector.

One strong growth driver is tightening environmental and health regulations around indoor air quality and VOC limits. Governments and standards bodies are pushing stricter emission limits and certification requirements, forcing traditional paint manufacturers to reformulate. In parallel, growing public awareness of health risks from VOCs—such as respiratory irritation or long-term exposure effects—encourages consumers and businesses to prefer safer alternatives. Technological advancements also make it easier to produce competitively priced low-VOC formulations with performance close to conventional paints.

Demand is rising, especially in residential and commercial construction projects that target green building certifications or wellness branding, as well as in renovation markets in developed cities. There is also an opportunity in the retrofit and public infrastructure sectors, where authorities increasingly require healthier materials.

On the financing front, major funding flows into environmental and water-health domains indirectly bolster the sustainability ecosystem: the McMaster-based UN institute for water and health research has secured a $10 million funding extension, a British recycling firm (Impact Recycling) raised €3.8 million for its water-based density separation technology, and BioAlert obtained $2.5 million to develop pathogen detection in water. These investments illustrate growing financial momentum in adjacent environmental technology fields, which can drive collaboration, R&D spillovers, and credibility for eco-friendly products like low-VOC paints.

Key Takeaways

- The Global Low Voc Paint Market is expected to be worth around USD 16.0 billion by 2034, up from USD 8.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In 2024, the Low-VOC type held a 56.3% share, driven by rising indoor air-quality awareness.

- Water-borne formulation dominated with a 59.7% share, supported by non-toxic solvents and improved application performance.

- The architecture and decorative segment led with a 42.8% share, benefiting from robust urbanization and housing expansion.

- The North American 47.80% share growth is driven by eco-friendly construction and stricter environmental regulations.

By Туре Analysis

In 2024, Low-VOC paints held a 56.3% market share.

In 2024, Low-VOC held a dominant market position in the By Type segment of the Low-VOC Paint Market, with a 56.3% share. This dominance reflects the growing preference for environmentally safe coatings that meet global emission standards while maintaining strong performance and finish quality. Increasing awareness of indoor air quality, stricter regulations on volatile organic compounds, and the rising adoption of sustainable construction materials have strengthened its market presence.

Consumers and institutional buyers are shifting toward low-odor, non-toxic paints suitable for homes, hospitals, and educational facilities. The continued funding momentum across environmental research and clean technologies further supports the eco-friendly shift, positioning low-VOC paints as a standard choice for modern architectural and industrial applications.

By Formulation Type Analysis

Water-borne paints captured a 59.7% share due to minimal odor and toxicity.

In 2024, Water-borne held a dominant market position in the By Formulation Type segment of the Low-VOC Paint Market, with a 59.7% share. This leadership is driven by its eco-friendly composition, reduced solvent emissions, and improved safety for both users and the environment. Water-borne paints are preferred for their low odor, easy application, and compliance with stringent environmental standards, making them ideal for residential, commercial, and institutional projects.

The shift toward sustainable and water-based technologies aligns with global initiatives promoting green materials. Additionally, advancements in formulation stability and durability have enhanced their performance, solidifying their dominance as the preferred choice for achieving both environmental responsibility and high-quality finishing in the Low-VOC paint sector.

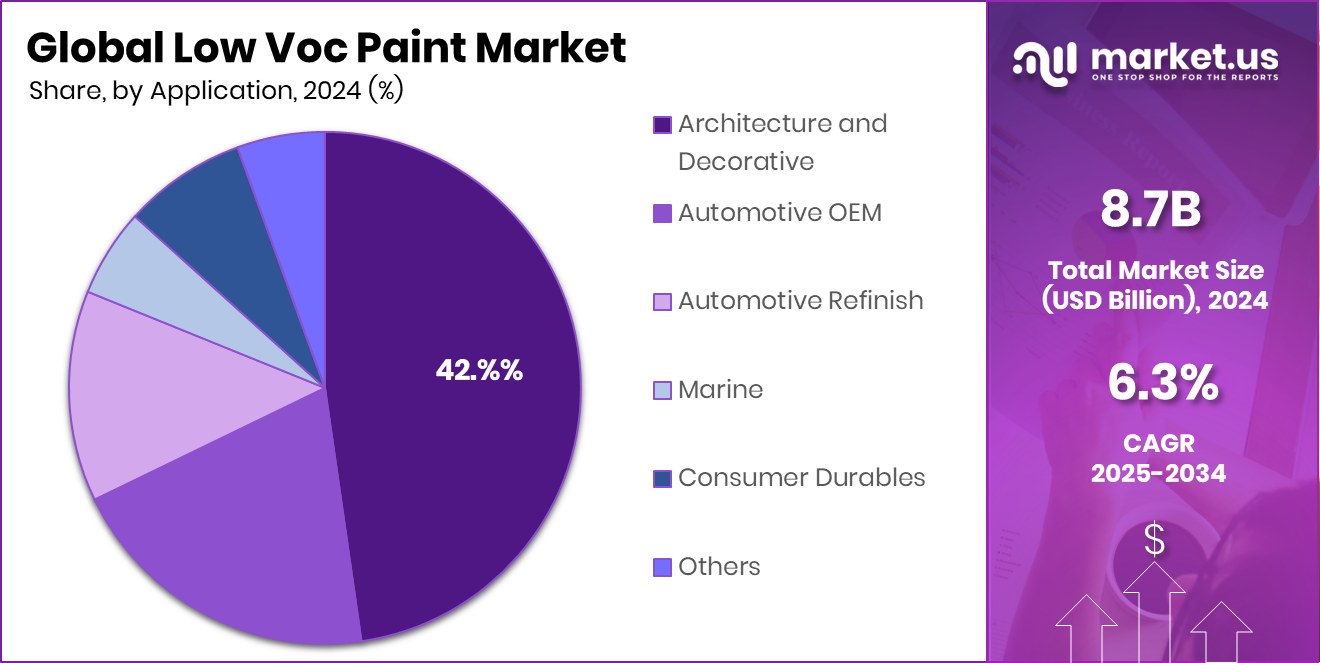

By Application Analysis

Architecture and decorative uses accounted for 42.8% of total sales.

In 2024, Architecture and Decorative held a dominant market position in the By Application segment of the Low-VOC Paint Market, with a 42.8% share. This dominance is attributed to the rising use of low-emission paints in residential, commercial, and institutional buildings to enhance indoor air quality and meet green building standards. Consumers increasingly prefer eco-friendly paints that provide aesthetic appeal while minimizing health risks.

Governments and construction bodies promoting sustainable materials further accelerate adoption in architectural applications. The segment benefits from technological improvements that enhance color retention, durability, and surface finish, making low-VOC paints a preferred option for interior and exterior decorative uses across modern urban and environmentally conscious infrastructure projects.

Key Market Segments

By Туре

- Low-VOC

- No or Zero VOC

- Natural

By Formulation Type

- Water-borne

- Solvent-borne

- Powder

By Application

- Architecture and Decorative

- Automotive OEM

- Automotive Refinish

- Marine

- Consumer Durables

- Others

Driving Factors

Growing Focus on Eco-Friendly Construction and Coatings

One of the key driving factors for the Low-VOC Paint Market is the increasing global focus on eco-friendly construction and sustainable building materials. Governments and organizations are setting strict limits on volatile organic compound emissions, encouraging builders and consumers to adopt safer and greener alternatives. Low-VOC paints align perfectly with these goals by improving indoor air quality, reducing harmful odors, and supporting energy-efficient, healthy environments.

Public investments in sustainability research and innovation also strengthen this trend. For instance, Cooke’s waterborne feed trial was among 67 projects awarded USD 18 million by the Marine Fund Scotland, highlighting how environmental initiatives and funding are accelerating green technology adoption, indirectly supporting demand for eco-safe paints in architectural and industrial applications.

Restraining Factors

Higher Production Cost and Limited Performance Awareness

A major restraining factor for the Low-VOC Paint Market is the relatively higher production cost compared to conventional paints. Manufacturing low-VOC formulations requires advanced raw materials and specialized processing to ensure low emissions without compromising durability or finish quality. These added costs often translate into higher retail prices, limiting adoption among cost-sensitive consumers and small contractors.

Additionally, there remains limited awareness about the long-term health and environmental benefits of low-VOC paints, particularly in developing regions. Many users still perceive them as less durable or less vibrant than traditional options, slowing their overall market penetration. Overcoming these barriers requires stronger consumer education and continued technological improvements to make eco-friendly paints more accessible and affordable.

Growth Opportunity

Rising Green Building Projects Boost Market Opportunity

A key growth opportunity for the Low-VOC Paint Market lies in the rapid rise of green building projects worldwide. Increasing emphasis on sustainability and eco-certifications like LEED is driving builders and architects to prefer low-emission materials. Low-VOC paints fit these requirements perfectly, offering healthier indoor environments and compliance with global green standards.

As construction sectors in urban areas focus more on energy-efficient and environmentally safe practices, the adoption of these paints continues to expand. Supporting this transition, the Biden-Harris Administration and NOAA have funded over $22.78 million to advance research on water-related climate impacts, reinforcing the government’s commitment to sustainability. Such initiatives indirectly encourage the wider acceptance of low-VOC technologies across architectural and decorative applications.

Latest Trends

Integration of Carbon-Neutral and Sustainable Paint Innovations

One of the latest trends in the Low-VOC Paint Market is the integration of carbon-neutral and sustainable paint technologies. Manufacturers are increasingly exploring bio-based raw materials, natural pigments, and advanced water-based binders to further reduce environmental footprints. This shift aligns with the global movement toward carbon reduction and circular economy goals.

Low-VOC paints are now being designed not only to minimize emissions but also to contribute to carbon capture and long-term sustainability. Supporting this green innovation wave, CarbonBlue secured $10 million in Seed funding for its CO₂ removal technology, reflecting a strong push for climate-positive solutions. Such advancements inspire cross-industry collaboration, accelerating the development of eco-conscious coatings that meet both environmental and performance expectations.

Regional Analysis

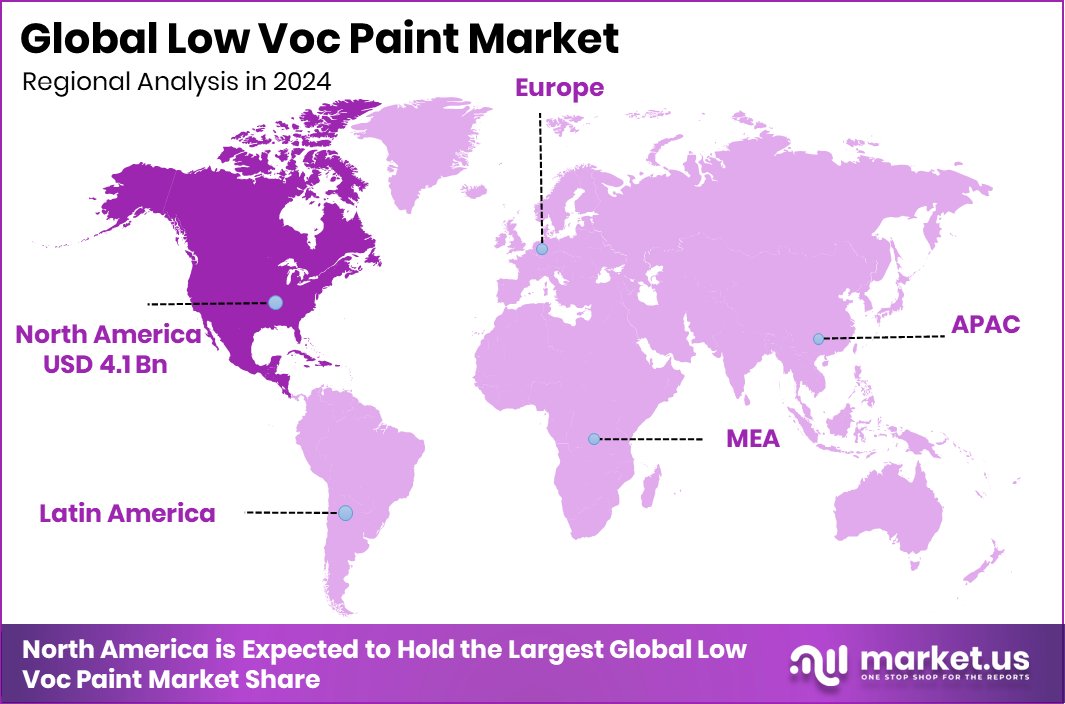

In 2024, North America held a 47.80% share, valued at USD 4.1 billion.

In 2024, North America dominated the Low-VOC Paint Market, accounting for 47.80% of the total share, valued at USD 4.1 billion. This strong position is driven by the region’s well-established construction sector, high awareness of indoor air quality, and stringent environmental regulations promoting the use of eco-friendly coatings. The United States and Canada lead adoption through green building certifications and sustainable housing initiatives.

Europe follows closely, supported by strict VOC emission directives from the European Union and increasing renovation activities in energy-efficient buildings. Asia Pacific is emerging as a rapidly growing region, driven by urbanization and infrastructure expansion in countries such as China, Japan, and India.

Meanwhile, the Middle East & Africa region witnesses steady demand due to large-scale commercial construction and tourism-driven infrastructure projects.

Latin America shows moderate growth, supported by rising awareness and gradual regulatory shifts toward low-emission products. Overall, the market’s regional landscape highlights North America’s dominance, followed by Europe and the Asia Pacific as key contributors to global revenue.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Akzo Nobel N.V. continued to leverage its deep coatings expertise to advance low-VOC and zero-VOC product lines. Among its offerings is Intercrete 4890, an advanced low-VOC, water-based anti-carbonation coating that addresses both performance and environmental demands. Akzo’s aerospace division also markets low-VOC topcoats (for example, the Eclipse series) that combine gloss, durability and regulatory compliance. Its Interpon powder coatings are inherently VOC-free, giving it a distinct edge in metal and architectural applications.

American Formulating & Manufacturing (AFM Safecoat) places its emphasis on health, indoor air quality, and minimal toxicity. For over 25 years, the company has focused on environmentally responsible, sustainable paints, stains, wood finishes, and sealers formulated for low emissions. Its niche strength lies in building awareness among health-conscious consumers, institutions, and green building proponents. While its scale is more limited than global multinationals, its brand identity as a specialist in “clean” coatings helps it maintain relevance in regulated or sensitive environments.

Arkema positions itself as a materials innovator contributing to low-VOC technologies through its resin, binder, additive, and coating systems. Its portfolio includes waterborne systems, high-solid resins, and additives tailored for low-emission formulations. Notably, Arkema’s Kynar Aquatec PVDF latex coatings offer low-VOC protective performance and favorable thermal benefits (lower roof temperatures, prolonged reflectivity). Meanwhile, its SYNAQUA® 9511 and non-isocyanate systems underline the firm’s commitment to safer chemistries.

Top Key Players in the Market

- Akzo Nobel N.V.

- American Formulating & Manufacturing

- Arkema

- Asian Paints

- AURO

- Axalta Coating Systems, LLC

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Limited

- BioShield Paint Company

Recent Developments

- In April 2025, Akzo Nobel extended its relationship with Signify and launched a new wood coating with 20% bio-based content, reinforcing its push toward greener formulations.

- In February 2024, Arkema showcased new technologies for more sustainable paints and coatings at Paint India, pushing its low-VOC, high-solid, waterborne, and UV/LED/EB coating solutions.

Report Scope

Report Features Description Market Value (2024) USD 8.7 Billion Forecast Revenue (2034) USD 16.0 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Туре (Low-VOC, No or Zero VOC, Natural), By Formulation Type (Water-borne, Solvent-borne, Powder), By Application (Architecture and Decorative, Automotive OEM, Automotive Refinish, Marine, Consumer Durables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel N.V., American Formulating & Manufacturing, Arkema, Asian Paints, AURO, Axalta Coating Systems, LLC, BASF SE, Benjamin Moore & Co., Berger Paints India Limited, BioShield Paint Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Akzo Nobel N.V.

- American Formulating & Manufacturing

- Arkema

- Asian Paints

- AURO

- Axalta Coating Systems, LLC

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Limited

- BioShield Paint Company