Global Low Density Polyethylene Market By Manufacturing Process (Autoclave Method, Tubular Method), By Feedstock (Natural Gas, Naphtha, Others), By Application (Film And Sheets, Extrusion Coating, Injection Molding, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151682

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

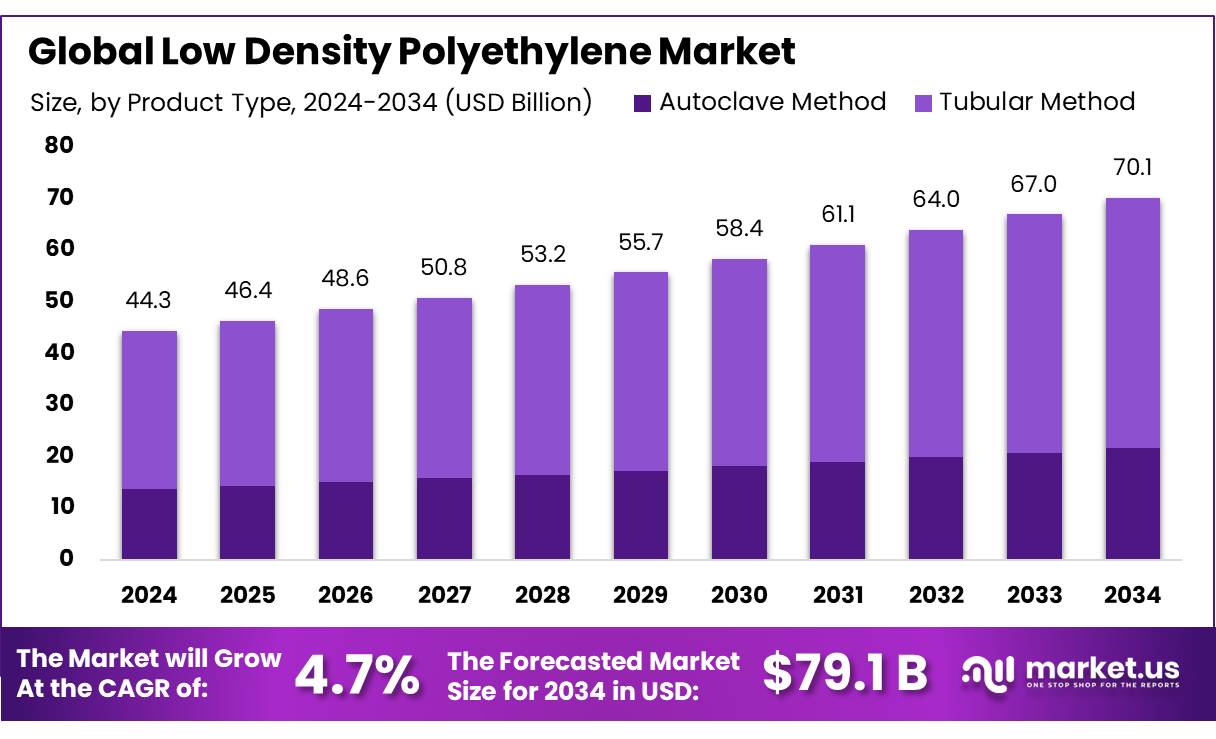

The Global Low Density Polyethylene Market size is expected to be worth around USD 70.1 Billion by 2034, from USD 44.3 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

Low-Density Polyethylene (LDPE) concentrates are a pivotal segment within the polymer industry, renowned for their flexibility, chemical resistance, and versatility. Predominantly utilized in packaging, agriculture, and construction, LDPE’s unique molecular structure imparts superior toughness and processability compared to other polyethylene variants. In India, LDPE production reached approximately 650,000 tonnes in FY2023 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.52% through FY2035.

Government initiatives have played a pivotal role in fostering the growth of the LDPE sector. Programs such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), with an allocation of ₹50,000 crore over five years, aim to promote micro-irrigation and watershed development, thereby enhancing the demand for LDPE-based agricultural films . Additionally, the implementation of anti-dumping duties on LDPE imports, as directed by the Supreme Court of India in April 2023, seeks to protect domestic manufacturers from unfair competition and promote self-reliance in the polymer sector .

The growing demand for sustainable packaging solutions, coupled with advancements in recycling technologies, presents significant opportunities for the LDPE market. For instance, in Mangaluru, over 170,000 kg of LDPE plastic waste from Material Recovery Facilities has been repurposed for road construction, enhancing road durability and contributing to effective waste management.

Key Takeaways

- Low Density Polyethylene Market size is expected to be worth around USD 70.1 Billion by 2034, from USD 44.3 Billion in 2024, growing at a CAGR of 4.7%.

- Tubular Method held a dominant market position, capturing more than a 69.2% share in the global low density polyethylene (LDPE) market by manufacturing process.

- Naphtha held a dominant market position, capturing more than a 53.1% share in the global low density polyethylene (LDPE) market.

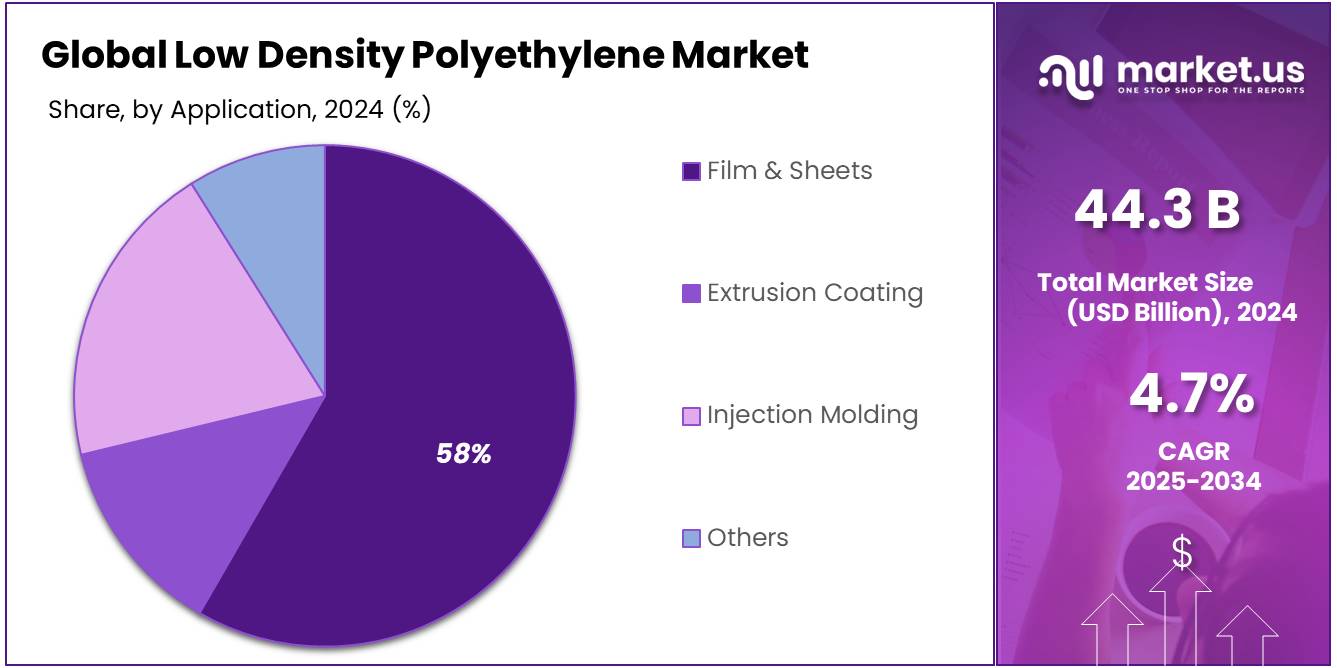

- Film & Sheets held a dominant market position, capturing more than a 58.8% share in the global low density polyethylene (LDPE) market.

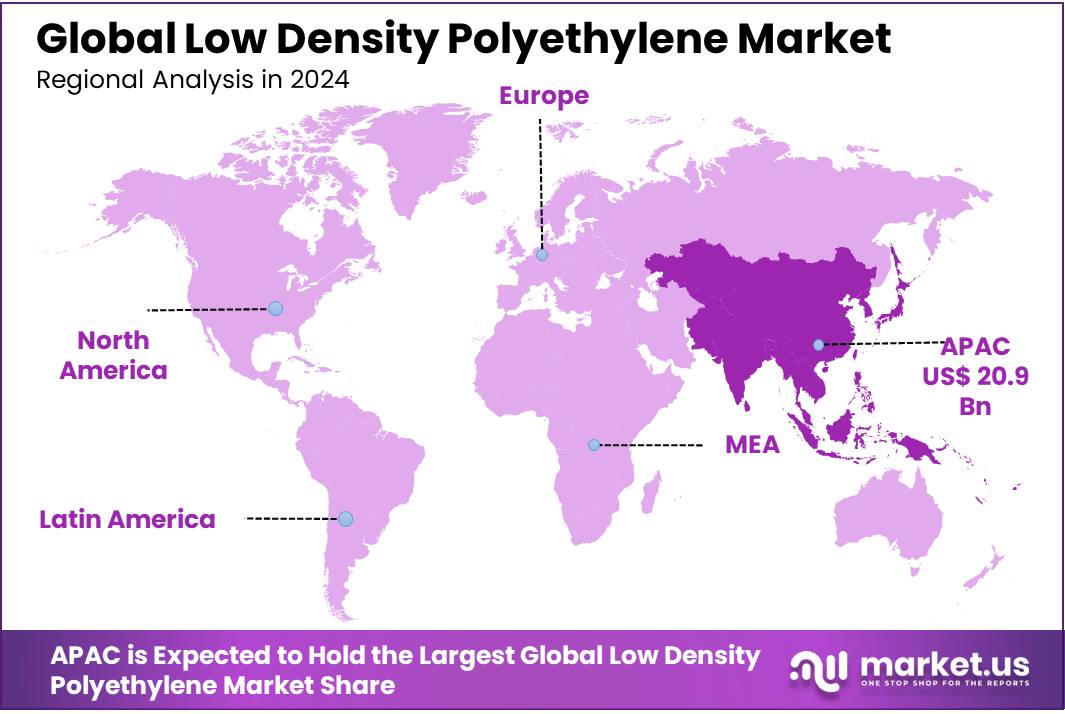

- Asia-Pacific (APAC) region is expected to dominate the Low-Density Polyethylene (LDPE) market, holding a substantial market share of 47.2%, valued at USD 20.9 billion.

By Manufacturing Process

Tubular Method leads with 69.2% share due to high efficiency and widespread industrial preference.

In 2024, Tubular Method held a dominant market position, capturing more than a 69.2% share in the global low density polyethylene (LDPE) market by manufacturing process. This method remains the most preferred production technology due to its operational simplicity, cost-efficiency, and ability to produce high-quality LDPE with uniform properties. The tubular process allows better control over molecular weight distribution, making the resulting polymer ideal for film applications, which continue to dominate LDPE consumption worldwide.

Industries favor this method for its scalability and consistent output, especially in packaging, agricultural films, and industrial liners. As of 2025, the continued expansion of flexible packaging and infrastructure-related applications is expected to sustain the dominance of the tubular method, particularly in emerging markets across Asia and Latin America where new LDPE plants often adopt this technique for its long-term production benefits and energy optimization.

By Feedstock

Naphtha dominates with 53.1% share due to its wide availability and suitability for LDPE production.

In 2024, Naphtha held a dominant market position, capturing more than a 53.1% share in the global low density polyethylene (LDPE) market by feedstock. Its widespread use is largely attributed to the strong presence of naphtha crackers in key LDPE-producing regions such as Asia-Pacific and Europe, where crude oil-based refining remains a primary route for olefin production. Naphtha’s versatility and ability to yield multiple co-products, including ethylene—the main building block for LDPE—make it a favored feedstock among manufacturers.

By Application

Film & Sheets dominate with 58.8% share due to strong demand in packaging and agriculture.

In 2024, Film & Sheets held a dominant market position, capturing more than a 58.8% share in the global low density polyethylene (LDPE) market by application. This segment continues to lead due to the high demand for flexible packaging in food, retail, and consumer goods industries. LDPE’s excellent clarity, flexibility, and moisture resistance make it the preferred material for producing stretch films, shrink wraps, and protective sheets.

In agriculture, LDPE films are widely used for mulching and greenhouse covers, contributing significantly to the segment’s growth. As of 2025, the rising consumption of packaged food products and the expansion of e-commerce are expected to further boost the use of LDPE films and sheets across both developed and emerging markets. The segment’s dominance is reinforced by its versatility and critical role in applications that require lightweight, durable, and cost-effective plastic solutions.

Key Market Segments

By Manufacturing Process

- Autoclave Method

- Tubular Method

By Feedstock

- Natural Gas

- Naphtha

- Others

By Application

- Film & Sheets

- Extrusion Coating

- Injection Molding

- Others

Drivers

Sustainability Trends in Packaging

One of the major driving factors for the Low Density Polyethylene (LDPE) market is the growing demand for sustainable packaging solutions. The packaging industry has been under pressure to adopt environmentally friendly materials as consumers and businesses increasingly prioritize sustainability. LDPE, known for its flexibility and low-density characteristics, is widely used in packaging applications, especially for food products, where it is valued for its ability to provide a barrier against moisture and contaminants.

In 2024, global food packaging accounted for a significant share of LDPE usage. The global food packaging market is projected to grow at a compound annual growth rate (CAGR) of 4.5%, with a noticeable shift towards eco-friendly materials. According to the Food Packaging Forum, sustainable packaging solutions are expected to represent a growing portion of the market, with demand for biodegradable and recyclable materials like LDPE increasing as regulations become stricter. For instance, the European Union’s directive to reduce single-use plastics has pushed food and beverage manufacturers to shift towards using more recyclable packaging materials, including LDPE, which is valued for its recyclability.

Additionally, LDPE’s role in providing cost-effective packaging while adhering to sustainability guidelines aligns with government initiatives. In the United States, the Food and Drug Administration (FDA) has endorsed the use of LDPE for food-safe packaging, which further fuels demand. As a result, the material is not only becoming more popular among food companies looking to meet regulatory standards but also with consumers demanding environmentally responsible products.

Restraints

Regulatory Challenges in LDPE Food Packaging

A significant challenge facing the Low-Density Polyethylene (LDPE) market is the increasing regulatory scrutiny over plastic waste management and food safety standards. Governments worldwide are intensifying efforts to curb plastic pollution, leading to stricter regulations that impact the use of LDPE in food packaging.

In India, the Plastic Waste Management (Amendment) Rules, 2021, prohibit the manufacture, import, stocking, distribution, sale, and use of identified single-use plastic items with low utility and high littering potential, effective from July 1, 2022. These items include plastic carry bags with a thickness of less than 120 microns, which are commonly made from LDPE. The government has also notified that non-woven plastic carry bags of less than 60 grams per square meter (GSM) are prohibited from September 30, 2021.

Furthermore, the Food Safety and Standards Authority of India (FSSAI) has introduced amendments to the Food Safety and Standards (Packaging) Regulations, 2025, restricting the use of recycled plastics in food packaging. The amendments permit only recycled polyethylene terephthalate (rPET) for food-grade applications, excluding LDPE and other plastics, due to concerns over contamination and migration of harmful substances into food.

These regulatory measures pose challenges for manufacturers relying on LDPE for food packaging. Companies must invest in alternative materials and technologies to comply with the new standards. For instance, the Andhra Pradesh government has revived its anti-plastic initiative, promoting the use of eco-friendly alternatives like banana-leaf plates and wooden spoons, and offering incentives for businesses adopting sustainable practices.

Opportunity

Growth Opportunities in India’s Food Packaging Sector

India’s food packaging market has shown robust growth, with a projected Compound Annual Growth Rate (CAGR) of 6.22% from 2024 to 2030, increasing from USD 14.91 billion in 2023 to an estimated USD 22.76 billion by 2030. Flexible packaging, which includes LDPE-based materials, is the largest and fastest-growing segment within this market.

This growth is further supported by government initiatives aimed at promoting sustainable packaging practices. The Food Safety and Standards Authority of India (FSSAI) has been actively encouraging the use of safe and sustainable packaging materials. FSSAI’s guidelines emphasize the reduction of plastic usage and the adoption of alternative materials, aligning with the broader goals of reducing plastic waste and promoting environmental sustainability.

Moreover, the Indian government’s endorsement of recycled plastics for food packaging marks a significant policy shift towards a circular economy. On Environment Day 2025, India officially approved the use of recycled plastics in food-grade applications, promoting eco-friendly practices and encouraging businesses to support a sustainable future.

Trends

Increasing Demand for Sustainable Packaging Solutions

In recent years, the demand for sustainable packaging has significantly impacted the Low Density Polyethylene (LDPE) market. This shift is primarily driven by growing consumer awareness regarding environmental sustainability and an increasing emphasis on reducing plastic waste. According to the U.S. Food and Drug Administration (FDA), the food packaging sector alone represents a significant portion of plastic consumption, with approximately 20% of all plastic products being used in food packaging applications.

Governments worldwide are encouraging the adoption of eco-friendly materials to mitigate the environmental impact of plastic. For instance, in 2024, the European Union’s Green Deal highlighted initiatives to reduce single-use plastics, which are expected to accelerate the demand for biodegradable and recyclable alternatives. As LDPE is a commonly used material in packaging due to its flexibility, durability, and relatively low cost, companies are turning to LDPE as a more sustainable alternative compared to other plastic types.

The Food and Agriculture Organization (FAO) reports that food packaging alone in the U.S. generates over 7 million metric tons of plastic waste each year, urging manufacturers to adopt more sustainable practices. Additionally, the development of post-consumer recycled LDPE products has gained traction, with companies increasingly focusing on creating packaging that is not only recyclable but also made from recycled materials.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region is expected to dominate the Low-Density Polyethylene (LDPE) market, holding a substantial market share of 47.2%, valued at USD 20.9 billion. This dominance is driven by the region’s growing industrialization, robust manufacturing sector, and high demand for LDPE in packaging applications. Countries such as China, India, and Japan are leading contributors to this growth. China’s expanding e-commerce sector and rising demand for consumer goods are fueling the need for flexible packaging materials, including LDPE, which is widely used for food packaging, bags, and wraps.

India, with its large food packaging market, is experiencing significant growth in LDPE usage, spurred by increasing consumer spending and the government’s push for sustainable packaging. According to a report by the Indian Ministry of Commerce & Industry, India’s packaging industry is expected to grow at a CAGR of 6.1% between 2023 and 2030, further boosting demand for LDPE materials. In Japan, the rise of eco-friendly packaging solutions is encouraging manufacturers to adopt LDPE, especially as government regulations push for recycling and reducing plastic waste.

Additionally, the region benefits from favorable economic conditions, including low production costs and the presence of key manufacturers, which makes it an attractive hub for LDPE production and consumption. The APAC region is expected to maintain its dominance in the LDPE market due to these factors, with continued investments in infrastructure and manufacturing facilities across key countries. The combination of growing demand for packaging solutions, increasing population, and regulatory support positions APAC as the key region driving growth in the global LDPE market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a global leader in the chemical industry, known for its innovative solutions in the Low-Density Polyethylene (LDPE) market. The company offers a wide range of LDPE products used in applications like packaging, agriculture, and automotive. BASF’s commitment to sustainability and efficient production methods strengthens its position in the global market. The company’s advanced research and development capabilities enable the creation of environmentally friendly and cost-effective LDPE solutions.

Braskem is a prominent producer of LDPE and other polymers, focusing on sustainable and high-performance materials. Headquartered in Brazil, Braskem has a strong presence in the Americas and Europe. The company is committed to innovation and the development of green polyethylene, aligning with the global demand for more sustainable plastic solutions. Braskem’s LDPE products serve diverse industries such as packaging, agriculture, and consumer goods, maintaining a competitive edge through efficient manufacturing processes.

Chevron Phillips Chemical Company is a leading player in the global LDPE market. The company operates state-of-the-art facilities in North America and globally, producing high-quality LDPE products used primarily in packaging, agriculture, and coatings. Chevron Phillips focuses on innovation and customer satisfaction, leveraging its strong research and development capabilities to meet the evolving demands of various industries. Its focus on sustainability ensures its products are aligned with the increasing demand for eco-friendly alternatives.

Top Key Players in the Market

- BASF SE

- Braskem

- Chevron Phillips Chemical Company

- China Petrochemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- Petkim Petrokimya Holding A.Ş

- Qatar Petrochemical Company (QAPCO) Q.P.J.S.C.

- Reliance Industries Limited

- SABIC

- Sasol

- Shell

Recent Developments

In 2024, BASF’s LDPE operations contributed to the company’s overall chemical sales, which amounted to approximately €92.98 billion in 2021.

In 2025, ExxonMobil commenced operations at its Huizhou Chemical Complex in Guangdong Province, China, which includes a 500,000 metric tons per year LDPE unit.

Report Scope

Report Features Description Market Value (2024) USD 44.3 Bn Forecast Revenue (2034) USD 70.1 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Manufacturing Process (Autoclave Method, Tubular Method), By Feedstock (Natural Gas, Naphtha, Others), By Application (Film And Sheets, Extrusion Coating, Injection Molding, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Braskem, Chevron Phillips Chemical Company, China Petrochemical Corporation, Exxon Mobil Corporation, Formosa Plastics Corporation, INEOS, LyondellBasell Industries Holdings B.V., Mitsui Chemicals, Inc., Petkim Petrokimya Holding A.Ş, Qatar Petrochemical Company (QAPCO) Q.P.J.S.C., Reliance Industries Limited, SABIC, Sasol, Shell Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low Density Polyethylene MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Low Density Polyethylene MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Braskem

- Chevron Phillips Chemical Company

- China Petrochemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- Petkim Petrokimya Holding A.Ş

- Qatar Petrochemical Company (QAPCO) Q.P.J.S.C.

- Reliance Industries Limited

- SABIC

- Sasol

- Shell