Global Lithium Niobate Market Size, Share, And Enhanced Productivity By Form (Powder, Ingot, Wafer), By Grade (Electron Grade, Agriculture Grade, Industrial Grade), By Application (Electron-optical Modulators, Acousto-Optical Filters, Quasi-phase Matched Frequency Generation, Integrated Optical Devices, Wavefront Distortion, Acoustic Transducers), By End-use (Aerospace, Defense, Telecommunication, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176730

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

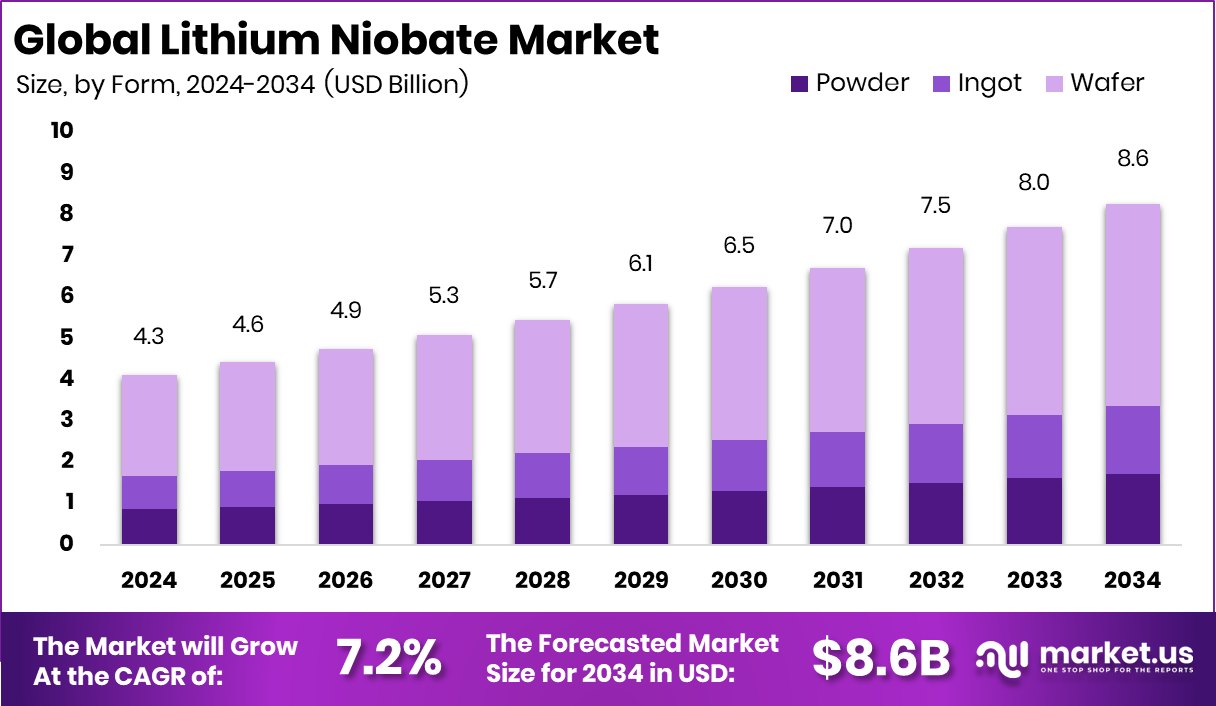

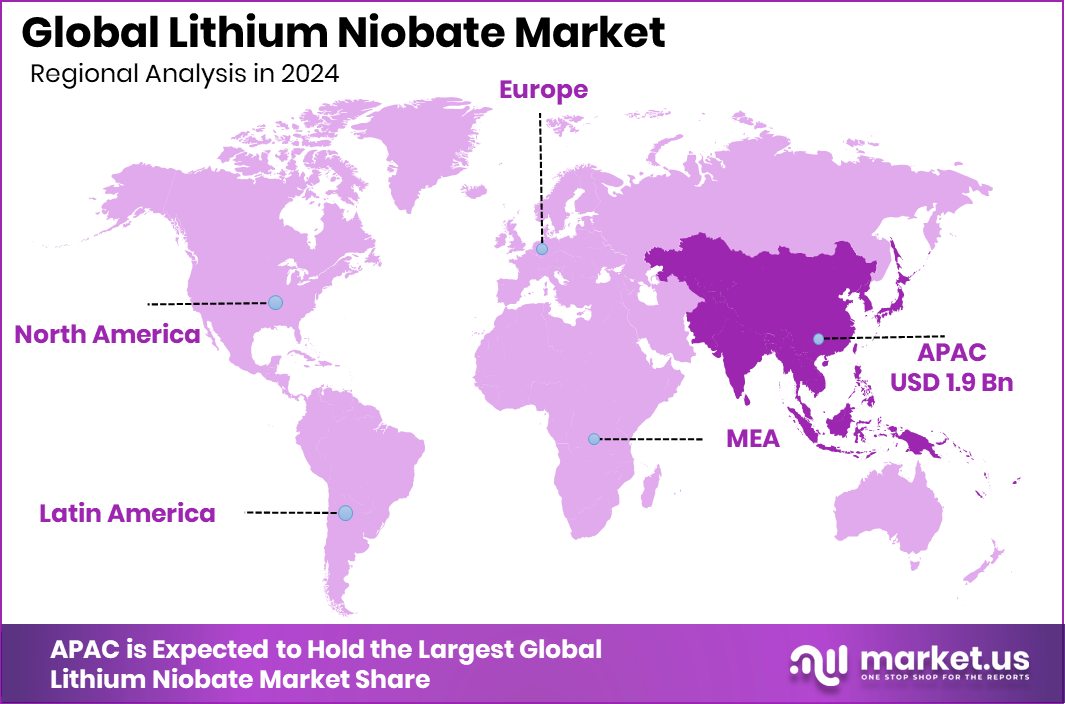

The Global Lithium Niobate Market is expected to be worth around USD 8.6 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. Demand for optical components kept Asia Pacific dominant at 45.6% and USD 1.9 Bn.

Lithium niobate is a widely used crystalline material known for its strong electro-optical, acousto-optical, and nonlinear optical properties. It enables functions such as modulation, frequency conversion, and precision wave control, making it essential in communication systems, sensing devices, and advanced photonics. The global Lithium Niobate Market covers forms such as powder, ingot, and wafer, along with grades used for electronic, industrial, and specialized applications.

The Lithium Niobate Market represents the commercial ecosystem supporting modulators, filters, frequency-generation devices, acoustic transducers, and integrated optical components. Growth is shaped by rising use in aerospace, defense, and telecommunication systems, where stable high-speed optical performance is required. As data traffic expands, demand for components made from lithium niobate continues to rise.

Strong funding activity is pushing new opportunities. Q.ANT closed an $80 million Series A tranche to advance photonic AI infrastructure, encouraging broader adoption of high-performance materials. Photonics startup Lightium raised $7 million to mass-produce thin-film lithium niobate interconnects and also secured $2.9 million for data-center commercialization. These investments push new design possibilities in high-speed communication.

Research support also contributes to market expansion. Twelve HKU projects received HK$72 million under RGC schemes, reinforcing innovation in optical sciences. Meanwhile, HyperLight secured $37 million to advance lithium niobate technologies, reflecting strong commercial confidence.

Key Takeaways

- The Global Lithium Niobate Market is expected to be worth around USD 8.6 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- The Lithium Niobate Market sees strong demand as wafer form dominates with 56.9% global share.

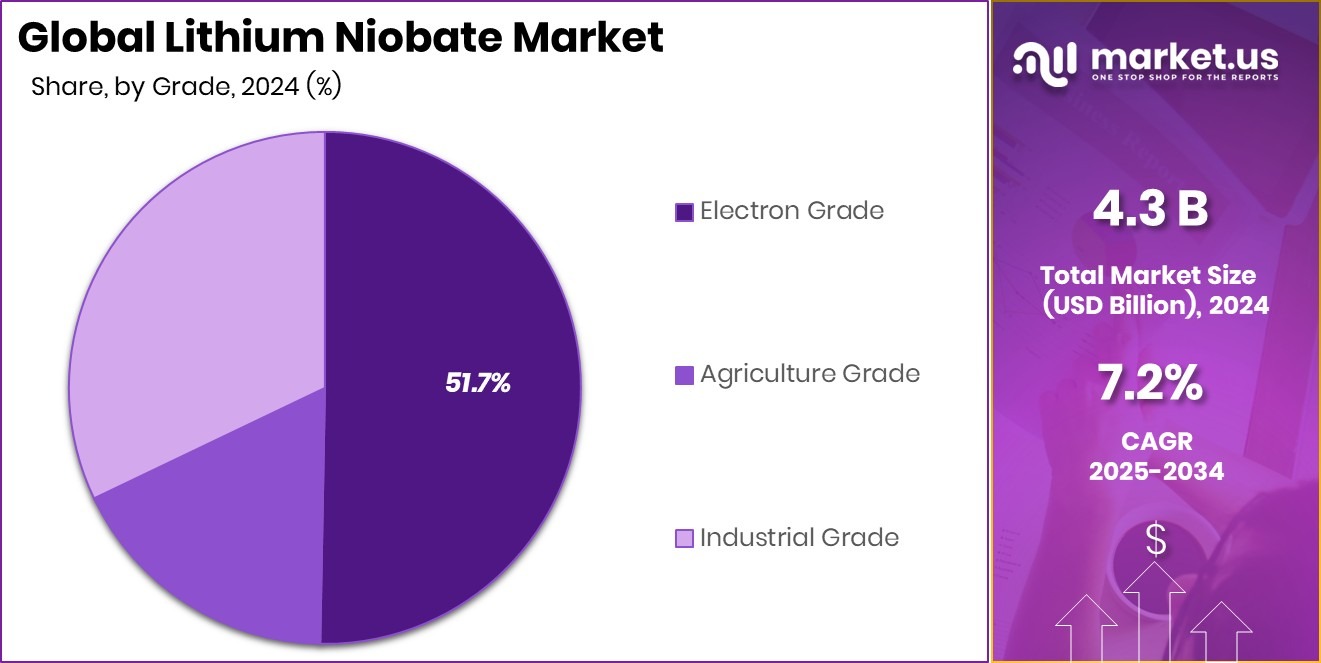

- In the Lithium Niobate Market, electron-grade materials lead growth by securing 51.7% of total usage.

- The Lithium Niobate Market expands steadily as electron-optical modulators account for 39.8% of applications.

- The Lithium Niobate Market benefits from rising telecommunication adoption, contributing 49.1% to end-use demand.

- Strong telecom expansion helped Asia Pacific secure 45.6%, valued at USD 1.9 Bn.

By Form Analysis

The Lithium Niobate Market sees wafer form dominating with 56.9% share globally today.

In 2024, the lithium niobate market saw wafer form dominating with a strong 56.9% share, driven by its widespread use in optical communication and integrated photonics. Wafer-based lithium niobate continues to gain momentum because it supports high-precision fabrication of modulators, frequency converters, and resonators essential for next-generation telecom systems. Its excellent electro-optical properties make it preferred in 5G infrastructure and high-speed data centers.

Moreover, the shift toward compact photonic chips increased demand for wafer-level processing, strengthening this segment’s position. Manufacturers are also investing in thin-film technologies to improve performance while lowering production costs, further supporting wafer growth. As telecom operators upgrade networks, wafer-grade lithium niobate remains the backbone of high-speed optical devices.

By Grade Analysis

In this market, electron-grade materials hold a strong 51.7% overall share.

In 2024, electron-grade lithium niobate accounted for 51.7%, emerging as the leading grade due to its exceptional purity and superior electro-optic efficiency. This grade is crucial for applications requiring precision performance, including quantum communication, nonlinear optics, and advanced signal processing. The global push for faster data transfer and high-bandwidth communication significantly boosted demand for electron-grade crystals.

Its ability to deliver low optical loss and enhanced stability makes it the preferred material for high-end photonic components. As industries focus on next-generation modulators and frequency doublers, electron-grade lithium niobate continues to play a pivotal role. Increasing R&D funding in photonic integrated circuits further solidifies the dominance of this high-purity grade across global markets.

By Application Analysis

Electron-optical modulators lead applications within the lithium niobate market with 39.8% demand.

In 2024, electron-optical modulators held a 39.8% share, making them a central application for the lithium niobate market. This dominance is driven by the material’s unmatched electro-optic coefficients, enabling ultra-fast modulation speeds required in modern communication networks. Lithium niobate modulators are widely used in fiber-optic communication, satellite transmission, and high-frequency RF systems.

As data consumption continues to soar, industries rely heavily on modulators built on lithium niobate to achieve low-loss, high-bandwidth signal operations. The surge in cloud computing and internet-based services also boosted demand for high-speed modulators. With ongoing advancements in thin-film technologies, lithium-niobate-based modulators are becoming more compact and energy-efficient, strengthening the segment’s long-term growth.

By End-use Analysis

Telecommunication remains the top end-use segment, capturing 49.1% market share worldwide.

In 2024, the telecommunication sector dominated the lithium niobate market with a substantial 49.1% share, driven by rapid expansion in optical fiber networks and increasing global data traffic. Lithium niobate is essential in telecom infrastructure because it supports high-speed modulation, wavelength conversion, and signal routing.

As countries invest in 5G rollouts and high-capacity communication systems, demand for lithium-niobate-based components continues to surge. This material’s stability and optical efficiency make it indispensable for long-distance signal transmission with minimal loss. Telecommunication operators are adopting more advanced modulators and photonic integrated circuits, further strengthening the market’s reliance on lithium niobate. The industry’s continued digitalization ensures sustained demand for this highly functional material.

Key Market Segments

By Form

- Powder

- Ingot

- Wafer

By Grade

- Electron Grade

- Agriculture Grade

- Industrial Grade

By Application

- Electron-optical Modulators

- Acousto-Optical Filters

- Quasi-phase Matched Frequency Generation

- Integrated Optical Devices

- Wavefront Distortion

- Acoustic Transducers

By End-use

- Aerospace

- Defense

- Telecommunication

- Others

Driving Factors

Rising demand for high-speed optical communication

The Lithium Niobate Market is expanding steadily, driven primarily by the rising demand for high-speed optical communication. As data transmission needs grow, lithium niobate’s superior electro-optical performance makes it a key material for next-generation photonics. Major funding activities strengthen this momentum, such as Google backing Lightmatter again in a $400 million fundraising round that accelerates photonic processing technologies dependent on high-precision optical materials.

Additionally, Ligentec joined a €48 million EU-funded industrial silicon photonics project, reinforcing ecosystem growth. These investments support faster, more efficient communication systems where lithium niobate modulators, filters, and integrated devices are increasingly required, helping drive overall market adoption.

Restraining Factors

High production costs limit scalability

Despite strong demand, the Lithium Niobate Market faces noticeable challenges, with high production costs remaining one of the main restraints. Manufacturing lithium niobate devices requires specialized fabrication processes, precise crystal handling, and tight quality control, all of which raise expenses and limit mass-scale deployment. These cost pressures are highlighted even as major photonics players secure funding, such as Q.ANT, which raised $72 million to advance photonic processors designed for AI computing.

While this investment strengthens the broader photonics landscape, it also underscores the cost-intensive nature of advanced optical materials. The expense of production continues to slow adoption in price-sensitive sectors despite growing technological benefits.

Growth Opportunity

Expansion of thin-film lithium niobate applications

The market is seeing a strong opportunity in the expansion of thin-film lithium niobate applications, especially as industries require smaller, faster, and more energy-efficient optical components. Thin-film platforms open pathways for compact modulators, frequency converters, and integrated photonic chips. This opportunity is strengthened by active funding in the photonics sector, such as Lightium, a Zurich-based company that secured €6.2 million to support data-center growth with advanced photonic chip designs. These chips rely heavily on thin-film lithium niobate for performance and scalability. As digital infrastructure expands globally, thin-film technologies create promising commercial potential across telecommunications, cloud systems, and next-generation optical devices.

Latest Trends

Increasing use of integrated photonic circuits

A key trend shaping the Lithium Niobate Market is the accelerating use of integrated photonic circuits. These compact systems merge multiple optical functions into a single platform, improving speed, efficiency, and power use for communication and sensing applications. Investment activity further validates this shift.

Photonics chip manufacturer Infinera secured USD 93 million in new funding, reinforcing market interest in advanced integrated photonics. Such financial support helps accelerate research, manufacturing capability, and the commercialization of lithium-niobate-based circuits. As integrated photonics gains adoption in telecom and computing, lithium niobate continues to play a crucial role in enabling high-performance optical functions.

Regional Analysis

Asia Pacific led the Lithium Niobate Market with 45.6%, reaching USD 1.9 Bn.

In the Lithium Niobate Market, Asia Pacific stood out as the dominant region, securing a strong 45.6% share valued at USD 1.9 Bn, supported by rising optical communication deployments and expanding photonics manufacturing.

North America continued to show steady demand driven by telecom upgrades, growing adoption of high-speed modulators, and increased integration of advanced electro-optic components in communication networks. Europe maintained consistent growth as industries strengthened investments in optical systems and signal-processing technologies, sustaining regional momentum.

Meanwhile, the Middle East & Africa observed a gradual uptake as data infrastructure evolved in emerging economies, supporting the need for optical materials. Latin America demonstrated moderate progress, supported by telecom modernization and the gradual adoption of photonic technologies across developing markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Sumitomo Metal Mining continued strengthening its position in the global Lithium Niobate Market by leveraging its long-standing expertise in advanced materials and precision crystal growth. The company’s capability to manufacture high-purity lithium niobate crystals supported the growing demand for optical modulators, frequency converters, and integrated photonic components. Its disciplined production approach, combined with a strong materials science foundation, helped ensure a stable supply for telecom and industrial photonics clients seeking consistent electro-optical performance.

At the same time, Coherent Corp. played a crucial role in shaping technological adoption across high-performance optical systems. Known for its innovation in electro-optical devices and photonic integration, the company expanded its use of lithium niobate across communication equipment requiring fast modulation speeds and reduced signal loss. Coherent’s engineering depth enabled it to meet rising expectations for next-generation telecom networks and precision sensing platforms.

Meanwhile, CASTECH remained a key supplier of lithium niobate crystals through its specialization in crystal growth and optical component fabrication. Its ability to deliver tailored crystal specifications supported applications in lasers, nonlinear optics, and high-frequency communication systems. CASTECH’s strong manufacturing discipline and customization capability allowed it to serve a broad end-user base seeking reliable, application-ready lithium niobate components.

Top Key Players in the Market

- Sumitomo Metal Mining

- Coherent Corp.

- CASTECH

- Exail

- Thorlabs Inc.

- Gooch & Housego

- Raicol Crystals

- Deltronic Crystal Industries

- HC Photonics

- EKSMA Optics

- CASTECH Inc.

Recent Developments

- In March 2025, Coherent announced it would showcase new optical communication products and technologies at the OFC 2025 conference in San Francisco (April 1–3). This included advanced optical transceivers and photonics solutions aimed at next-generation optical networks. The demonstrations highlighted Coherent’s focus on evolving optical components that support faster and more efficient communication systems.

- In April 2024, Sumitomo Metal Mining began plans to build new recycling plants to recover valuable metals like copper, nickel, cobalt, and lithium from used lithium-ion batteries. This move supports expanding material supply chains and efficient reuse of lithium, which is linked to their materials business, such as lithium niobate raw materials. The plants are expected to be completed by June 2026, strengthening resource sustainability.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 8.6 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Ingot, Wafer), By Grade (Electron Grade, Agriculture Grade, Industrial Grade), By Application (Electron-optical Modulators, Acousto-Optical Filters, Quasi-phase Matched Frequency Generation, Integrated Optical Devices, Wavefront Distortion, Acoustic Transducers), By End-use (Aerospace, Defense, Telecommunication, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sumitomo Metal Mining, Coherent Corp., CASTECH, Exail, Thorlabs Inc., Gooch & Housego, Raicol Crystals, Deltronic Crystal Industries, HC Photonics, EKSMA Optics, CASTECH Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lithium Niobate MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Lithium Niobate MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sumitomo Metal Mining

- Coherent Corp.

- CASTECH

- Exail

- Thorlabs Inc.

- Gooch & Housego

- Raicol Crystals

- Deltronic Crystal Industries

- HC Photonics

- EKSMA Optics

- CASTECH Inc.