Global Libya Dairy Products Market Size, Share, And Enhanced Productivity By Product Type (Milk, Cheese, Butter and Cream, Milk Powders, Yogurt, Others), By Source (Flavored, Unflavored), By Sales Channel (Modern Trade, Online Retailers, Convenience Stores, Mom and Pop Shops, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175840

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

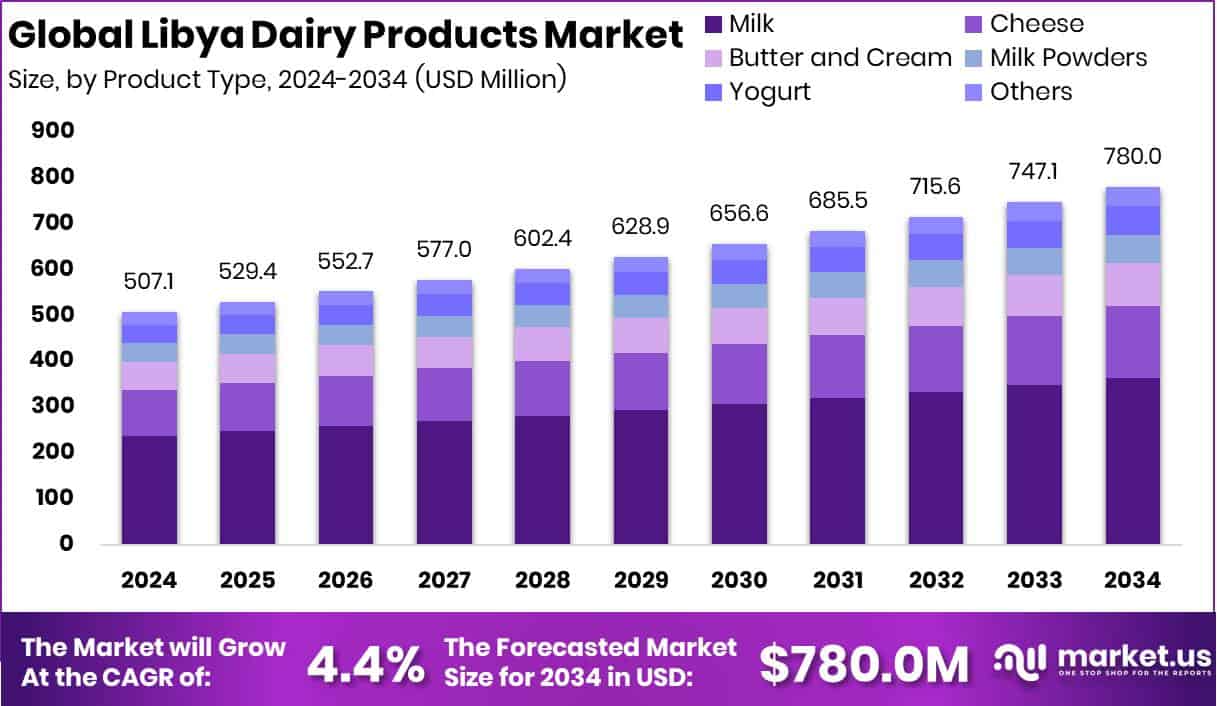

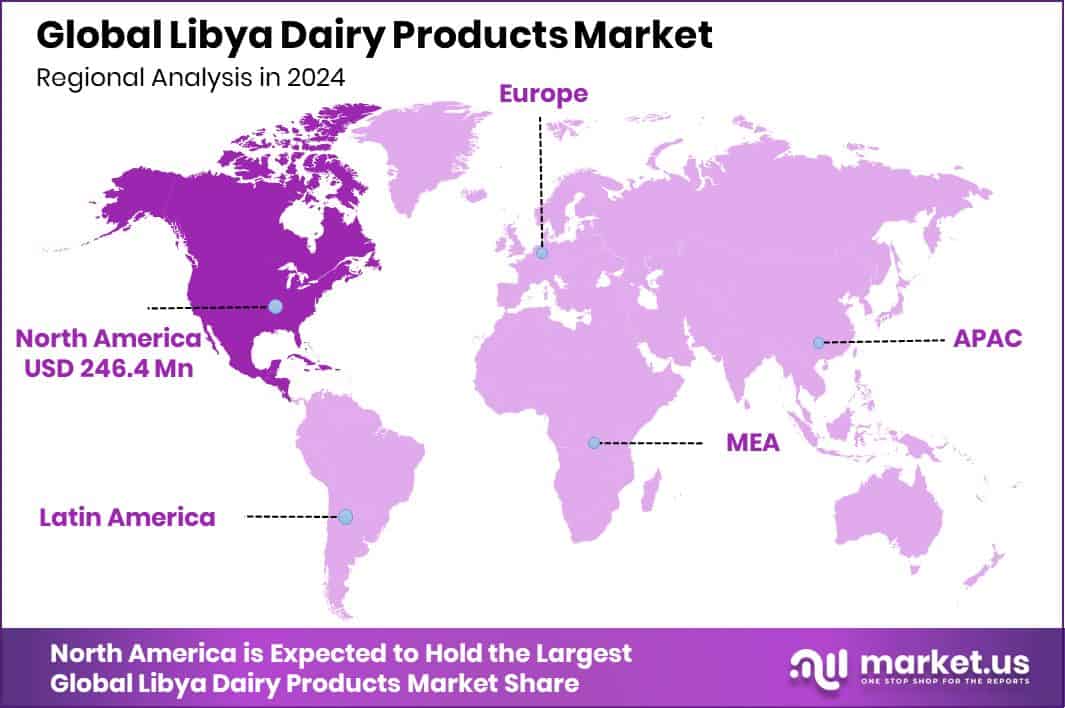

The Global Libya Dairy Products Market is expected to be worth around USD 780.0 million by 2034, up from USD 507.1 million in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. North America’s robust dairy consumption helped maintain 48.6% market dominance worth USD 246.4 Mn.

The Libya Dairy Products category includes everyday items such as milk, cheese, butter, cream, yogurt, milk powders, and flavored or unflavored dairy options made for household use, foodservice, and retail shelves. These products support daily nutrition and play an important role in Libyan diets, where consumers rely on accessible and versatile dairy for cooking and family consumption. The Libya Dairy Products Market represents the overall supply, demand, distribution, and sales of these products through modern trade, convenience stores, mom-and-pop shops, and online channels across the country.

Growth in Libya’s dairy sector is supported by rising consumer interest in quality food products and improved retail participation. Events like the Libya Food Expo, which hosted 200 local and foreign participants, highlight growing engagement in food and dairy activities, helping strengthen domestic and imported product visibility. This expanding platform is improving product awareness and supporting long-term market expansion.

Demand remains steady as consumers continue to prioritize essential dairy items. However, external disruptions occasionally influence market availability. For example, a Libyan order for 2,500 Irish cattle was cancelled due to visa delays, showing how logistical challenges can indirectly affect livestock-linked dairy supply planning.

Opportunities are emerging through international support programs. Initiatives like the USDA awarding $11 million in grants to strengthen the dairy industry, along with the IDFA applauding the DBII grant program, signal wider global improvements that can indirectly benefit markets connected to international dairy flows. Additionally, funding such as $750,000 for dairy farms and France’s Nutropy raising €7 million for animal-free dairy proteins reflects innovation and future diversification potential for markets like Libya seeking stable and modern dairy solutions.

Key Takeaways

- The Global Libya Dairy Products Market is expected to be worth around USD 780.0 million by 2034, up from USD 507.1 million in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- Libya Dairy Products Market sees milk holding a 46.7% share due to strong everyday consumption.

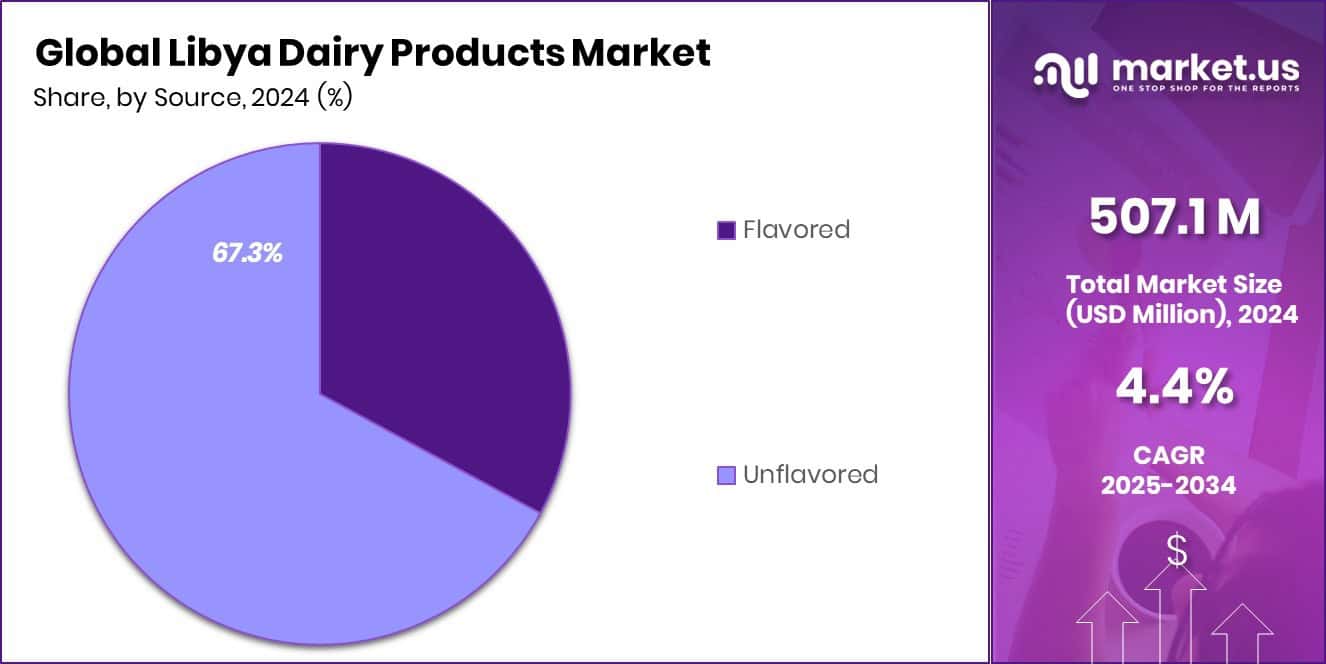

- Unflavored variants dominate the Libyan Dairy Products Market with 67.3% preference for natural taste.

- Mom and Pop Shops drive 46.2% share in the Libya Dairy Products Market distribution.

- In North America, strong retail expansion supported the 48.6% share and USD 246.4 Mn demand.

By Product Type Analysis

Milk leads the Libya Dairy Products Market with 46.7%, driving strong nationwide consumption growth.

In 2024, the Libyan Dairy Products Market saw Milk hold a dominant share of 46.7%, reflecting its essential role in everyday nutrition and household consumption patterns. Libyan consumers continued to prefer fresh and affordable dairy options, especially in urban and semi-urban areas where milk remains a dietary staple for children and adults. The rising interest in locally sourced dairy, along with gradual improvements in cold-chain networks, helped maintain steady demand.

Despite economic pressures, households prioritized milk due to its nutritional value and versatility across beverages, cooking, and traditional recipes. This strong reliance on milk products strengthened the segment’s leadership position and contributed significantly to the overall market stability in 2024.

By Source Analysis

Unflavored variants dominate Libya Dairy Products Market preferences, securing 67.3% consistent consumer demand.

In 2024, the Libyan Dairy Products Market also experienced strong momentum in the Unflavored segment, which captured a substantial 67.3% share under the “By Source” category. Libyan consumers showed a clear preference for natural-tasting dairy products, driven by cultural habits and trust in minimally processed options. Traditional eating patterns emphasize purity and simplicity, encouraging higher acceptance of unflavored milk, yogurt, and cheese.

Moreover, affordability and wider availability made this category even more attractive for families seeking value and consistency. As flavored dairy products remain relatively niche due to higher pricing and limited regional penetration, unflavored variants continued to dominate retail shelves, reinforcing their position as the preferred choice throughout 2024.

By Sales Channel Analysis

Mom & Pop Shops shape Libya Dairy Products Market distribution, holding 46.2% retail share.

In 2024, the Libyan Dairy Products Market recorded notable strength in the Mom & Pop Shops channel, which accounted for 46.2% of total sales. These neighborhood stores remained central to daily shopping routines, especially in rural and densely populated urban areas where modern retail infrastructure is still developing. Their proximity, trust-based customer relationships, and flexible purchasing options played a major role in boosting dairy sales.

Consumers frequently relied on such outlets for fresh milk, yogurt, and other short-shelf-life products due to convenience and quick access. Despite emerging supermarkets, mom & pop shops retained their stronghold thanks to familiarity and accessibility, ensuring they remained a critical distribution channel across Libya in 2024.

Key Market Segments

By Product Type

- Milk

- Cheese

- Butter and Cream

- Milk Powders

- Yogurt

- Others

By Source

- Flavored

- Unflavored

By Sales Channel

- Modern Trade

- Online Retailers

- Convenience Stores

- Mom and Pop Shops

- Others

Driving Factors

Rising demand for essential dairy nutrition

The Libya Dairy Products Market continues to grow as consumers prioritize nutritious and essential dairy items for everyday meals. The rising demand for milk, yogurt, and cheese reflects a shift toward more reliable and consistent food choices across households. This upward trend is further supported by global innovation in dairy science. For example, PFx Biotech secured €2.5 million to develop allergy-free human milk proteins, showing how international advancements can inspire improvements in dairy quality and safety worldwide.

Such breakthroughs indirectly motivate Libyan producers and suppliers to strengthen their offerings and match evolving consumer expectations. As nutritional awareness increases, the demand for dairy staples will continue to push the market toward better standards and wider product availability.

Restraining Factors

Cold-chain limitations restrict product distribution

The Libya Dairy Products Market still faces challenges due to limited cold-chain infrastructure, which affects product freshness and distribution reliability. Many regions depend on shorter supply chains, and temperature-sensitive dairy products often experience transport delays, reducing shelf stability. These constraints make it difficult for retailers to maintain consistent stock levels.

Additionally, international innovation highlights a growing performance gap. For instance, PFx Biotech’s €2.5 million seed funding for allergy-free milk proteins shows how rapidly global dairy technology is advancing, while Libyan distribution systems remain under pressure. Until cold-chain networks are modernized and storage reliability improves, the market will continue to face distribution inefficiencies that limit growth potential.

Growth Opportunity

Growing interest in value-added dairy

The Libya Dairy Products Market has strong opportunities as consumers show increasing interest in value-added products such as fortified milk, flavored yogurt, and specialty cheese. Rising health awareness is opening space for innovative dairy formats. International progress also signals promising pathways.

The British startup BoobyBiome raised €2.8 million to advance infant-health solutions using breast-milk microbiome research, while Imagindairy secured $28 million to scale animal-free milk technologies. These developments demonstrate growing global investment in dairy alternatives and enhanced nutrition. Libya can benefit by exploring partnerships, modern processing technologies, and premium dairy lines. As local preferences evolve, the market is well-positioned to expand into enriched and specialized dairy segments.

Latest Trends

Higher preference for unflavored dairy choices

A noticeable trend in the Libya Dairy Products Market is the strong consumer preference for unflavored dairy items, especially plain milk, laban, and yogurt. Libyan households value natural taste and simple ingredients, making unflavored options more appealing than sweeter or flavored varieties. This trend aligns with global innovation in modern dairy production.

Startups developing next-generation products—such as the $13 million funding raised by a cow-free milk company and ORIGHT securing $1 million for dairy-tech advancements—are reshaping consumer expectations worldwide. While Libya’s market remains rooted in traditional dairy choices, these international breakthroughs highlight future possibilities for clean-label, sustainable, and minimally processed dairy solutions.

Regional Analysis

North America led the Libya Dairy Products Market with 48.6%, reaching USD 246.4 Mn.

In the Libya Dairy Products Market, North America emerged as the dominating region, accounting for a substantial 48.6% share, valued at USD 246.4 million in 2024. This leadership reflects strong consumption patterns, efficient supply chains, and stable retail penetration that continue to support dairy flows connected to Libyan trade needs.

Europe followed with steady demand for processed dairy goods, backed by established regulatory standards and consistent import activity that aligns with Libyan distribution requirements. In the Asia Pacific region, growing population centers and expanding dairy processing capabilities contributed to rising trade interactions, although still below North America’s dominant scale.

The Middle East & Africa remained closely linked to Libya’s dairy demand, supported by geographic proximity and shared consumption trends. Latin America showed moderate participation, driven by selective exports and evolving dairy product preferences that complement Libya’s market structure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the Libyan Dairy Products Market saw meaningful activity from Al Naseem, which continued to strengthen its presence through a wide portfolio of milk, yogurt, and flavored dairy products tailored to local taste preferences. The company’s consistent focus on freshness, quality, and reliable distribution allowed it to sustain strong consumer trust, especially in urban centers where demand for packaged dairy remains high. Al Naseem’s ability to scale production and maintain steady market visibility positioned it as one of the key contributors to Libya’s evolving dairy landscape.

Aljaied also played a significant role across the market, supported by its established processing capabilities and long-standing reputation for delivering dependable dairy essentials. With a focus on affordability and accessibility, the company maintained strong engagement with household consumers across various regions. Its commitment to supplying staple dairy categories such as milk, cheese, and yogurt helped stabilize product availability during fluctuating supply cycles, making it an important participant in Libya’s dairy value chain.

Similarly, Al-Mazraa maintained its footing by emphasizing product quality and localized market understanding. The company’s operational flexibility allowed it to meet diverse consumer needs, especially in areas where traditional dairy consumption remains strong. Al-Mazraa’s continued focus on everyday dairy staples supported consistent demand, reinforcing its relevance within the competitive environment of the Libya Dairy Products Market in 2024.

Top Key Players in the Market

- Al Naseem

- Aljaied

- Al-Mazraa

- Alnour Company

- Arab Dairy

- B&C Food

- Buhajar Group

- Ghalia

- Guney Sut

- HB Group

Recent Developments

- In March 2025, Al Naseem Food Industries in Libya’s dairy sector won the Best Libyan Product Award for its quality dairy offerings, highlighting its strong local manufacturing reputation. The company, known for producing milk, laban, rayeb, yogurt, cheese, juices, and ice cream, continued to build brand value through this recognition, boosting consumer trust in its products. This award shows Al Naseem’s commitment to quality and excellence in dairy production.

Report Scope

Report Features Description Market Value (2024) USD 507.1 Million Forecast Revenue (2034) USD 780.0 Million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Milk, Cheese, Butter and Cream, Milk Powders, Yogurt, Others), By Source (Flavored, Unflavored), By Sales Channel (Modern Trade, Online Retailers, Convenience Stores, Mom and Pop Shops, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Al Naseem, Aljaied, Al-Mazraa, Alnour Company, Arab Dairy, B&C Food, Buhajar Group, Ghalia, Guney Sut, HB Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Libya Dairy Products MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Libya Dairy Products MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Al Naseem

- Aljaied

- Al-Mazraa

- Alnour Company

- Arab Dairy

- B&C Food

- Buhajar Group

- Ghalia

- Guney Sut

- HB Group