Global Kvass Market Size, Share, And Enhanced Productivity By Nature (Organic, Conventional), By Flavour (Apple, Beets, Bird cherry, Lemon, Cherry, Cranberry, Mint, Strawberry), By Sales Channel (Supermarket, Convenience Store, E-Commerce, Food service, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172360

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

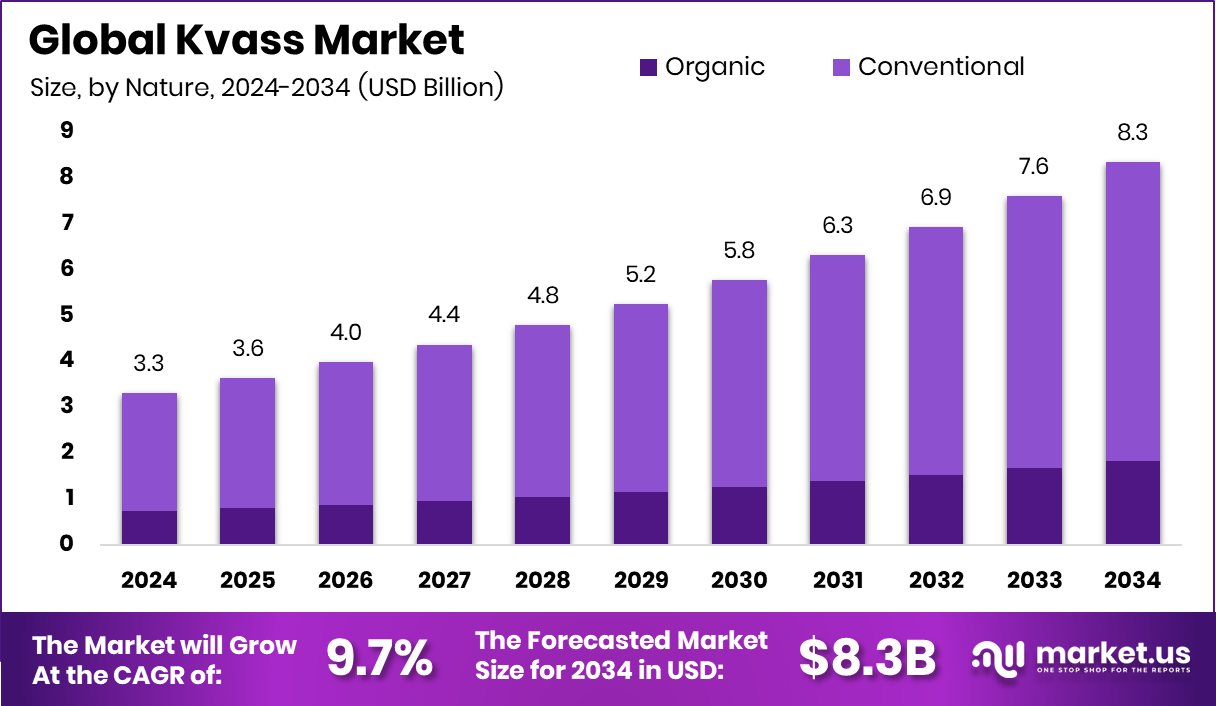

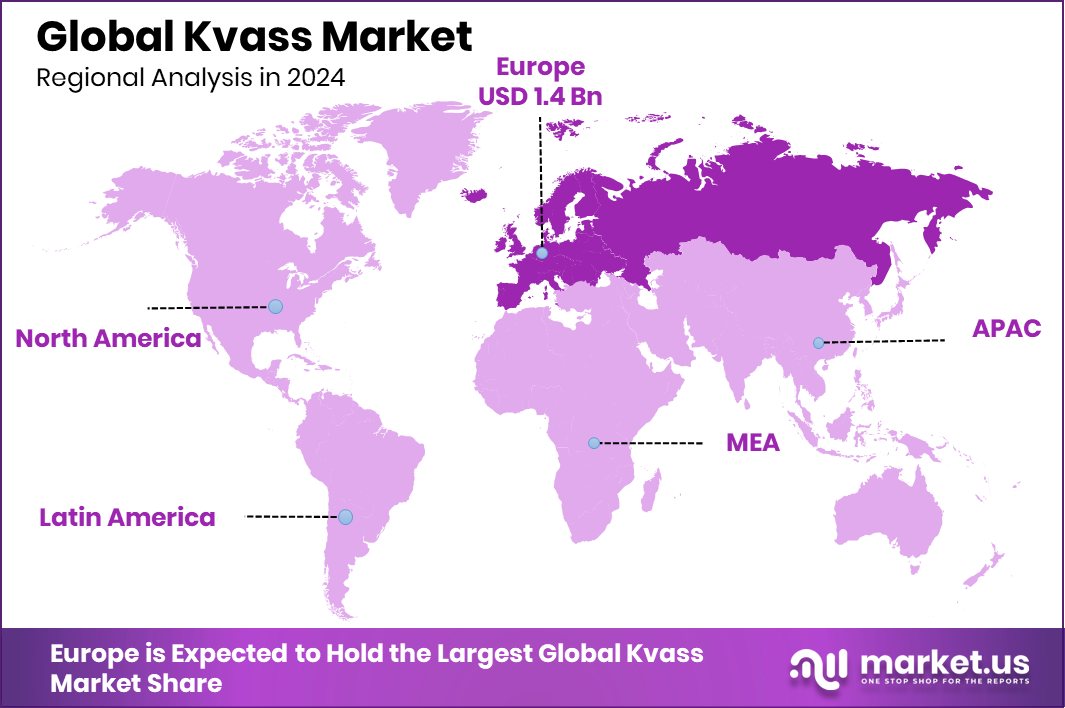

The Global Kvass Market is expected to be worth around USD 8.3 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 9.7% from 2025 to 2034. Kvass Market in Europe reached USD 1.4 Bn, representing 43.90% regional market share.

Kvass is a traditional fermented beverage made mainly from rye bread, water, and natural fermentation. It has a mildly sweet and tangy taste, low alcohol content, and is widely consumed as a refreshing drink. Kvass is valued for its natural fermentation, simple ingredients, and cultural importance, especially as an everyday beverage rather than an occasional drink.

The Kvass Market refers to the production, distribution, and consumption of this fermented drink across retail and foodservice channels. The market includes plain and flavored variants and serves consumers looking for natural, fermented, and traditional beverage options. Kvass is increasingly viewed as an alternative to sugary soft drinks because of its fermentation-based profile and familiar taste.

Growth factors for the kvass market are closely linked to rising interest in natural and fermented foods. This trend aligns with broader food-system investments, such as Fragaria Fruits raising $2 million to scale premium berry production in India and Oishii securing $16 million to expand luxury strawberries globally. These investments highlight how consumers and investors are supporting natural, quality-focused food products.

Demand for kvass is supported by changing preferences toward taste, authenticity, and sustainability. Developments such as TRIC Robotics raising $5.5 million to scale UV automation for sustainable strawberry farming show how efficiency and quality are becoming priorities across food production. At the same time, proposed $600 million budget cuts affecting major water projects highlight growing pressure on resource-efficient food and beverage systems.

Opportunities in the kvass market come from innovation and scaling. Examples include Strawberry raising $6 million to launch an AI-powered browser and Oishii raising $134 million in Series B funding while prioritizing taste over speed. These signals reflect a broader shift toward premium, well-crafted products, creating room for kvass to grow through quality, consistency, and thoughtful expansion.

Key Takeaways

- The Global Kvass Market is expected to be worth around USD 8.3 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 9.7% from 2025 to 2034.

- Conventional kvass dominates the Kvass Market by nature, holding 78.3% share due to affordability globally.

- Apple flavor leads the Kvass Market by flavour with 21.7% share, driven by taste preference.

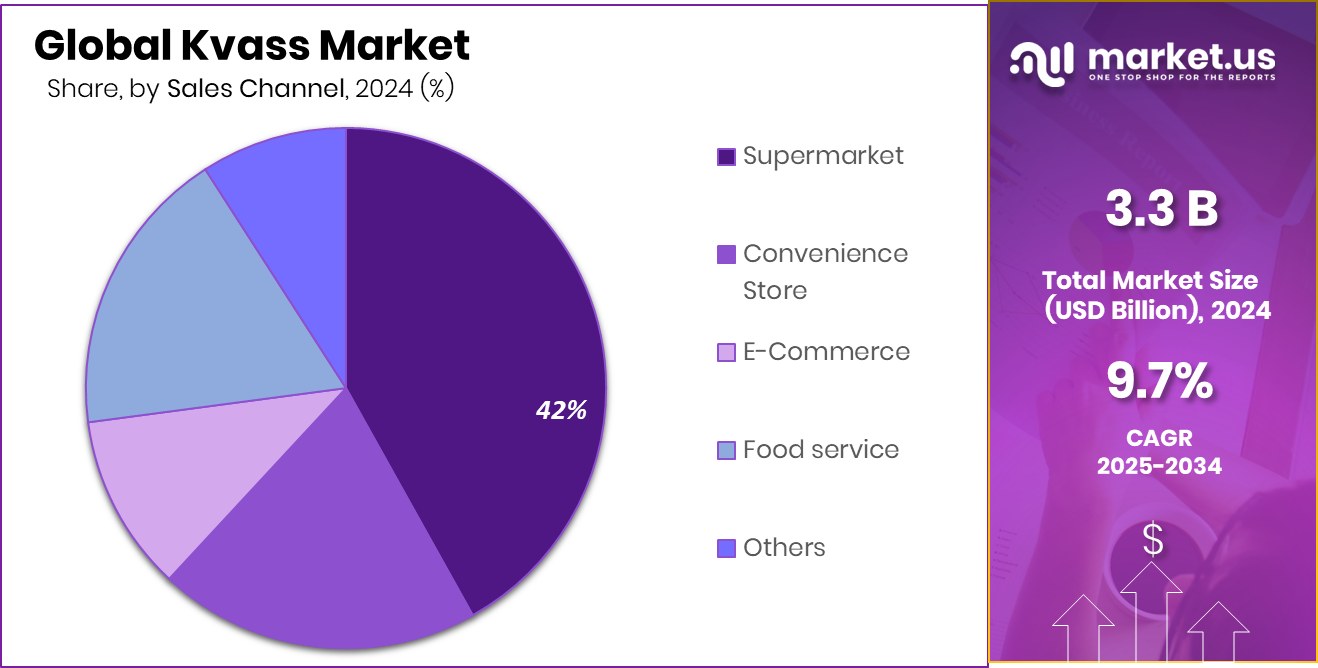

- Supermarkets dominate Kvass Market sales channels, capturing 41.9% share through wide availability and consumer trust.

- In 2024, Europe accounts for USD 1.4 Bn, holding 43.90% of the Kvass Market.

By Nature Analysis

In the Kvass Market, conventional products dominate demand, holding 78.3% share globally.

In 2024, the Kvass Market was largely shaped by the dominance of conventional kvass, which held a strong 78.3% share by nature. This leadership reflects the deep cultural roots of kvass in Eastern Europe, where consumers strongly associate the drink with traditional fermentation methods, classic bread-based recipes, and familiar taste profiles.

Conventional kvass benefits from established supply chains, lower production costs, and wide availability across local and export markets. Many small and mid-sized producers continue to rely on time-tested brewing techniques rather than organic certifications, which can increase costs and limit scalability.

For price-sensitive consumers, conventional kvass offers affordability without compromising authenticity. In addition, foodservice operators and bulk buyers prefer conventional variants due to consistent quality and longer shelf stability. While interest in organic beverages is growing, conventional kvass remains the backbone of the market, supported by strong consumer trust, cultural loyalty, and widespread retail presence.

By Flavour Analysis

Within the Kvass Market, apple flavor leads preferences, capturing 21.7% of consumption share.

In 2024, flavor innovation played an important role in the Kvass Market, with apple-flavored kvass accounting for 21.7% of total flavor demand. Apple has emerged as the most preferred flavor because it balances the traditional fermented taste of kvass with mild sweetness and natural fruit notes. This makes it attractive not only to long-time kvass drinkers but also to younger consumers and first-time buyers seeking a refreshing, easy-to-drink beverage.

Apple-flavored kvass is often positioned as a bridge between classic kvass and modern functional drinks, as apples are widely associated with natural energy and digestive benefits. Producers favor apples due to its stable supply, predictable pricing, and compatibility with fermentation processes.

The flavor also performs well in export markets, where consumers may be unfamiliar with traditional rye-based kvass. As a result, Apple remains a key driver for flavor-led product differentiation and volume growth.

By Sales Channel Analysis

Supermarkets lead the Kvass Market sales channels, accounting for 41.9% of total sales.

In 2024, supermarkets emerged as the leading sales channel in the Kvass Market, capturing a significant 41.9% share. Supermarkets play a critical role by offering high product visibility, wide brand selection, and competitive pricing, which encourages impulse purchases and repeat buying.

Consumers prefer supermarkets because they can compare traditional and flavored kvass options in one place, often supported by promotional discounts and in-store tastings. Large retail chains also provide producers with scale, enabling nationwide distribution and steady sales volumes. For new brands, supermarket shelves offer credibility and faster consumer adoption compared to smaller specialty stores.

In urban areas, supermarkets are particularly influential due to high foot traffic and changing shopping habits. Even as online grocery sales grow, supermarkets continue to dominate kvass distribution because fermented beverages benefit from controlled storage and immediate availability. This channel remains central to market expansion and brand visibility.

Key Market Segments

By Nature

- Organic

- Conventional

By Flavour

- Apple

- Beets

- Bird cherry

- Lemon

- Cherry

- Cranberry

- Mint

- Strawberry

By Sales Channel

- Supermarket

- Convenience Store

- E-Commerce

- Food service

- Others

Driving Factors

Rising Preference for Natural and Tech-Enabled Foods

A major driving factor for the Kvass Market is the growing preference for natural products combined with modern technology in food systems. Consumers are paying more attention to how drinks are made, favoring traditional fermentation, simple ingredients, and clean production methods. This shift is also visible across agriculture and food technology. For example, Singrow raised $4.5 million in Series A funding to expand its seed breeding and vertical farming business beyond Asia, showing how innovation is improving food quality and supply stability.

At the same time, Stockholm-based Strawberry secured €5.1 million to develop an AI-powered browser that reduces repetitive tasks, reflecting how digital tools are supporting efficiency across industries, including food and beverages. Together, these developments show a broader move toward smarter, more transparent systems. Kvass benefits from this trend because it naturally fits consumer demand for authentic, traditionally made drinks while still offering room for modern production improvements.

Restraining Factors

High Costs and Competitive Beverage Investment Pressure

A key restraining factor for the Kvass Market is the growing cost pressure created by heavy investment flows into other premium food and beverage segments. For instance, Fragaria Fruits secured $2 million in funding led by WEH Ventures to transform India’s premium fruit market, highlighting how capital is being directed toward fresh, high-margin produce rather than traditional fermented drinks.

At the same time, Apple’s plan to spend more than $500 billion in the U.S. over the next four years shows how large-scale corporate investments are reshaping supply chains, labor markets, and operational costs across industries. These shifts indirectly raise costs for smaller beverage producers through higher logistics, technology, and compliance expenses.

Kvass producers, especially traditional ones, often operate on tight margins and may struggle to compete for resources, shelf space, and consumer attention in such a capital-intensive environment. This imbalance can slow expansion and limit innovation in the kvass market.

Growth Opportunity

Digital Engagement Expands Beverage Discovery Channels

A strong growth opportunity for the Kvass Market lies in using digital engagement to reach new consumers and improve brand discovery. The launch of Lemon Slice, with $10.5 million in funding to introduce real-time interactive avatars, shows how technology is changing the way people interact with products and services. Such digital tools can help beverages like kvass tell their story, explain fermentation benefits, and connect with younger audiences in simple, engaging ways.

At the same time, Lemon Tree Hotels reported a 93% surge in Q1 net profit with rising revenue reflecting stronger travel and hospitality activity. This creates more on-premise consumption opportunities in hotels, cafes, and restaurants, where traditional and regional drinks gain visibility. Together, digital innovation and hospitality growth open new paths for kvass to expand beyond retail, improve consumer awareness, and drive steady market growth through experience-led consumption.

Latest Trends

Platform Expansion Signals Data-Driven Beverage Market Shift

A key latest trend in the Kvass Market is the growing influence of platform expansion and data-driven ecosystems across industries. This shift is reflected in lemon. markets expanding its €2.2 trillion custodian arsenal, showing how platforms are scaling rapidly by improving infrastructure, transparency, and real-time access. Similar thinking is shaping beverage markets, where producers and distributors increasingly rely on digital platforms to manage inventory, pricing, and consumer insights more efficiently.

For kvass, this trend supports better demand tracking, smoother distribution, and faster response to changing consumer preferences. As platforms become more powerful, traditional beverages gain new tools to modernize without losing authenticity. Improved data access also helps reduce waste and improve supply planning, which is important for fermented drinks with shelf-life sensitivity. Overall, platform-led expansion is quietly reshaping how kvass reaches consumers, making the market more responsive, organized, and scalable.

Regional Analysis

Europe dominates the Kvass Market with a 43.90% share, valued at USD 1.4 Bn.

In 2024, Europe clearly dominated the Kvass Market, holding a 43.90% share and reaching a value of USD 1.4 Bn, supported by strong cultural acceptance, long-standing consumption habits, and wide retail availability across Eastern and Central European countries. Kvass remains a traditional beverage in this region, consumed regularly across households, foodservice outlets, and modern retail formats, reinforcing Europe’s leadership position.

North America represents a developing market, where kvass demand is driven by growing interest in fermented drinks, gut-health awareness, and ethnic beverage exposure, particularly in urban centers. Asia Pacific shows gradual adoption, supported by rising experimentation with fermented and probiotic-style beverages, although kvass remains a niche offering compared to local traditional drinks.

In Middle East & Africa, kvass consumption is limited but emerging, mainly through specialty retailers and expatriate communities familiar with Eastern European food culture. Latin America also reflects early-stage market development, where interest in natural and fermented beverages is growing, yet kvass awareness remains relatively low.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Baltika Breweries continued to play a defining role in the global kvass market through its strong brewing heritage and wide consumer reach. The company benefits from deep expertise in fermentation, large-scale production capabilities, and an established distribution network. Baltika’s approach to kvass focuses on consistency, familiar taste profiles, and mainstream accessibility, helping the drink remain relevant among traditional consumers while maintaining steady volumes across core markets. Its ability to balance heritage beverages alongside modern portfolio management strengthens its long-term positioning in kvass.

Krasny Vostok holds a distinctive position in the kvass segment by emphasizing regional authenticity and traditional brewing identity. The company is closely associated with classic kvass consumption patterns, appealing to consumers seeking familiar flavors and cultural continuity. Krasny Vostok’s strength lies in preserving the traditional image of kvass while ensuring reliable quality and availability. This focus supports stable demand, particularly among loyal consumers who prioritize taste authenticity over experimentation or premium positioning.

Biokvass represents a more specialized presence within the global Kvass Market, concentrating on natural fermentation and product purity. Biokvass appeals to consumers who value clean-label beverages and traditional preparation methods. Its positioning aligns with growing interest in fermented drinks as part of everyday diets. By staying focused on core kvass values rather than broad diversification, Biokvass strengthens its niche relevance and contributes to category credibility through product integrity and craftsmanship.

Top Key Players in the Market

- Baltika Breweries

- Krasny Vostok

- Biokvass

- Gubernija

- Coca-Cola Company

- Bryanskpivo

- Carlsberg Group

- All Stars Beverages

- Piebalgas Alus

- Kvass Beverages Llc

Recent Developments

- In April 2025, Bryanskpivo raised kvass prices after new excise taxes classified kvass as a sugar-containing product from January 2025. The company kept its original recipe and natural fermentation, adjusting prices to manage higher costs while maintaining product authenticity.

- In July 2024, Carlsberg Group acquired Britvic plc for £3.3 billion, forming Carlsberg Britvic in January 2025. The deal expanded non-alcoholic and soft-drink capabilities, strengthened distribution, and supported diversification into fermented beverages while maintaining core beer brands.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 8.3 Billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Flavour (Apple, Beets, Bird cherry, Lemon, Cherry, Cranberry, Mint, Strawberry), By Sales Channel (Supermarket, Convenience Store, E-Commerce, Food service, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Baltika Breweries, Krasny Vostok, Biokvass, Gubernija, Coca-Cola Company, Bryanskpivo, Carlsberg Group, All Stars Beverages, Piebalgas Alus, Kvass Beverages Llc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Baltika Breweries

- Krasny Vostok

- Biokvass

- Gubernija

- Coca-Cola Company

- Bryanskpivo

- Carlsberg Group

- All Stars Beverages

- Piebalgas Alus

- Kvass Beverages Llc