Global Keratin Market Size, Share, And Enhanced Productivity By Product (Alpha-Keratin, Beta-Keratin, Hydrolyzed Keratin, Keratin Amino Acid, Bio Peptide Keratin), By Type (Natural Keratin, Synthetic Keratin), By Source (Animal-based Keratin, Plant-based Keratin, Lab-grown Keratin), By Application (Personal Care and Cosmetics, Healthcare and Pharmaceuticals, Food and Beverage, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173618

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

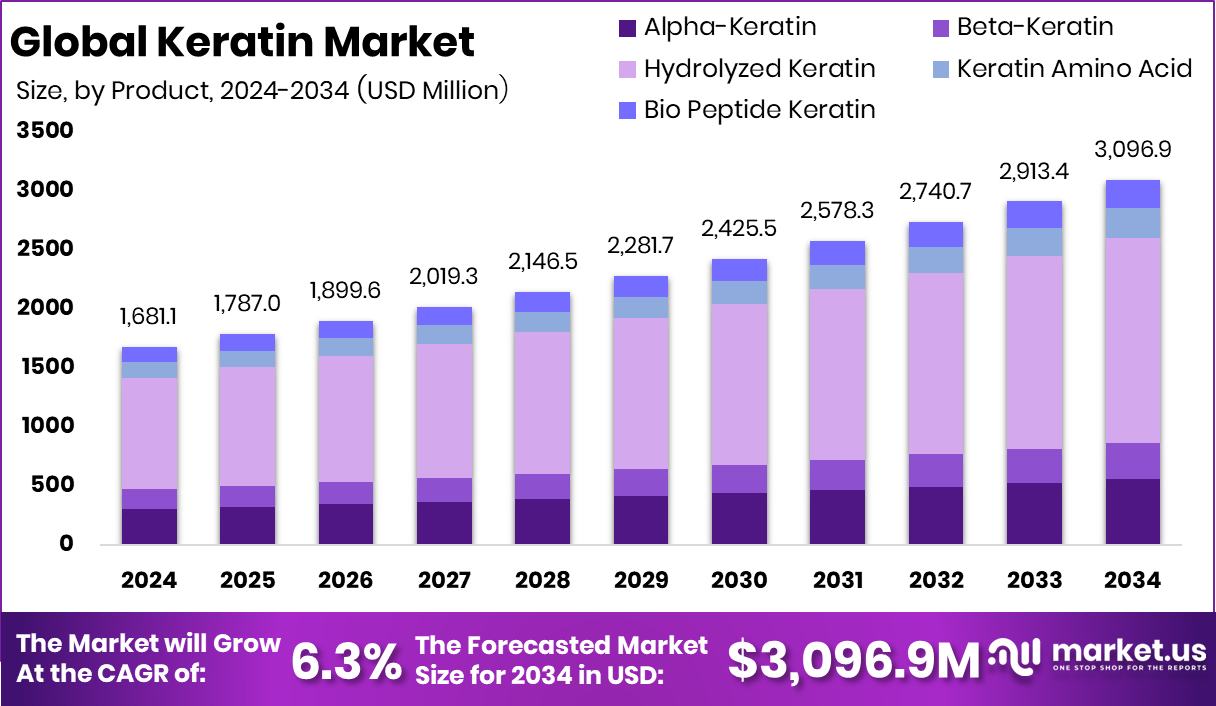

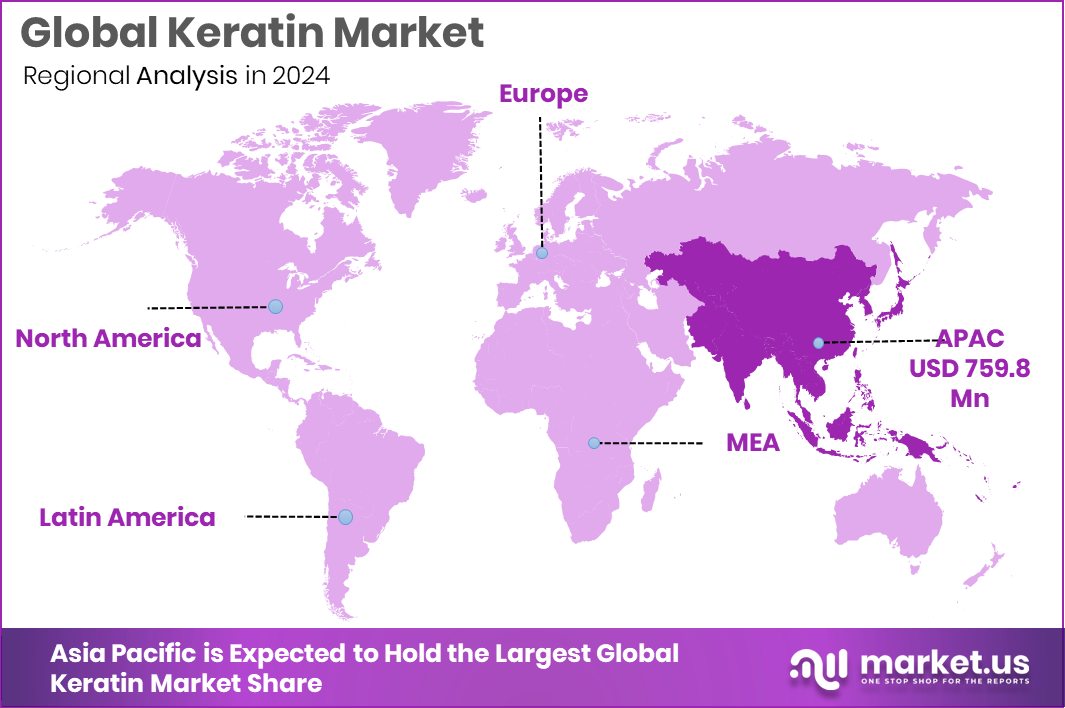

The Global Keratin Market is expected to be worth around USD 3,096.9 million by 2034, up from USD 1681.1 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. With 45.20% market share, Asia Pacific remains the largest Keratin Market region by value.

Keratin is a natural structural protein found in hair, skin, nails, feathers, and horns. It provides strength, protection, and elasticity, helping tissues resist damage from physical stress, chemicals, and environmental exposure. Because keratin bonds tightly and forms protective layers, it is widely valued for repair, conditioning, and reinforcement purposes. When processed into usable forms, keratin becomes an important functional ingredient for products that focus on strengthening, smoothing, and restoring damaged biological structures.

The Keratin Market refers to the production, processing, and commercial use of keratin across applications such as personal care, cosmetics, biomedical research, and protein-based innovations. It covers different forms, including hydrolyzed and natural keratin, sourced mainly from animal by-products or alternative bio-derived processes. The market exists at the intersection of beauty, health, and advanced material science, where protein functionality plays a central role.

One key growth factor is rising innovation in life sciences and protein technologies. For example, Raleigh’s Virtue Labs raised $3.6M in equity funding, with potential to raise $8.3M more, highlighting investor interest in protein-focused development. Similarly, Japanese biotech Dioseve secured $7 million to advance cell-derived biological technologies, reinforcing long-term confidence in protein-based research platforms.

Demand for keratin is expanding as consumers seek solutions for hair damage, skin repair, and protein reinforcement. Broader awareness of protein functionality is also supported by cross-sector investments, such as a $2.6 million grant funding a new wildlife forensic center, emphasizing biological material analysis and protein identification capabilities.

The opportunity landscape is widening as protein recovery and reuse gain importance. A Swiss startup raised $10M to repurpose dairy factory waste into usable protein, reflecting circular protein innovation trends. At the same time, Qnovia’s $16 million Series B funding underscores growing acceptance of advanced biological delivery systems, indirectly supporting future keratin-based therapeutic and functional applications.

Key Takeaways

- The Global Keratin Market is expected to be worth around USD 3,096.9 million by 2034, up from USD 1681.1 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- The keratin market shows that hydrolyzed keratin leads products, holding a 56.2% share due to superior solubility performance.

- The keratin market indicates that natural keratin dominates types with a 73.5% share, driven by consumer preference globally.

- The keratin market highlights animal-based keratin as the leading source, capturing a 67.9% share across industries and worldwide applications.

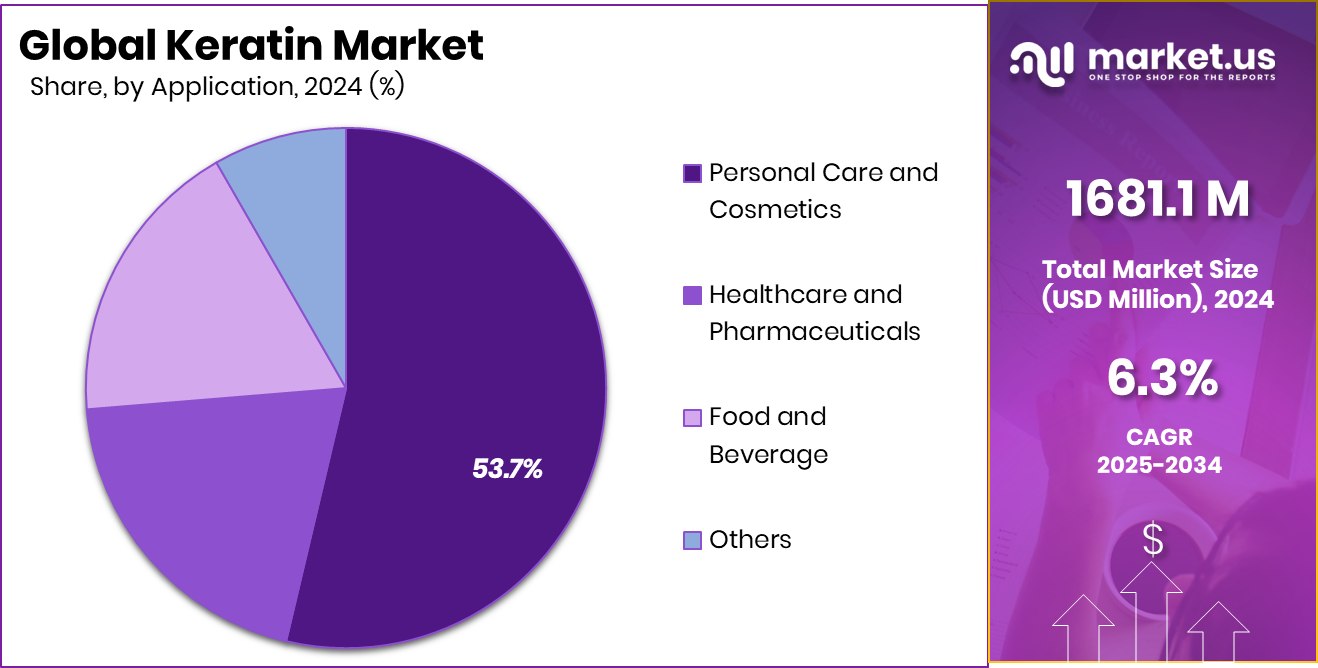

- The keratin market sees personal care and cosmetics applications dominate with a 53.7% share of global, market-wide demand.

- Strong consumer demand positions Asia Pacific as the leading Keratin Market region at USD 759.8 Mn.

By Product Analysis

In the Keratin Market, hydrolyzed keratin leads products with a 56.2% share globally today.

In 2024, the Keratin Market witnessed strong product-level dominance from Hydrolyzed Keratin, which accounted for 56.2% of total demand due to its superior functionality in formulation-based industries. Hydrolyzed keratin is widely used because its smaller molecular structure allows better penetration into hair and skin fibers, improving strength, elasticity, and moisture retention. This characteristic makes it highly suitable for shampoos, conditioners, serums, and professional hair treatments.

In addition, hydrolyzed keratin offers better solubility and compatibility with water-based formulations, supporting its adoption in mass-market and premium products. Rising consumer focus on hair repair, damage control, and protein-enriched cosmetics further strengthened its position. The Keratin Market continues to favor hydrolyzed formats as manufacturers prioritize performance-driven and easily absorbable ingredients.

By Type Analysis

In the keratin market, natural keratin dominates the type segment, capturing 73.5% of the market share.

In 2024, the Keratin Market was largely shaped by Natural Keratin, which held a dominant share of 73.5% by type, reflecting a strong industry shift toward clean-label and minimally processed ingredients. Natural keratin is preferred for its close similarity to human hair and skin proteins, making it effective and well-tolerated across cosmetic and personal care applications. Brands increasingly emphasize ingredient transparency, pushing demand for naturally derived keratin over synthetic alternatives.

Moreover, natural keratin aligns with sustainability narratives, especially when sourced responsibly from existing animal by-products. This preference is reinforced by consumer skepticism toward chemically modified proteins and growing regulatory scrutiny around synthetic additives. As a result, the Keratin Market continues to rely heavily on natural keratin to meet performance, safety, and perception-driven expectations.

By Source Analysis

In the keratin market, animal-based keratin remains the primary source, with a 67.9% contribution overall.

In 2024, the Keratin Market remained strongly dependent on Animal-based Keratin, which represented 67.9% of the total supply by source. Animal-based keratin, primarily extracted from wool, feathers, horns, and hooves, offers high protein purity and established extraction processes. These sources benefit from consistent availability due to their integration with livestock and poultry industries, supporting large-scale production at stable costs.

Manufacturers prefer animal-based keratin for its proven effectiveness in strengthening hair fibers and enhancing texture in cosmetic formulations. Additionally, the utilization of animal by-products supports waste valorization, improving overall resource efficiency. While plant-based alternatives are emerging, animal-based keratin continues to dominate the Keratin Market due to its reliability, scalability, and long-standing industrial acceptance.

By Application Analysis

In the Keratin Market, personal care cosmetics applications account for 53.7% of demand globally.

In 2024, the Keratin Market saw its strongest application demand from Personal Care and Cosmetics, accounting for 53.7% of total usage. Keratin is a critical ingredient in hair care products aimed at repair, smoothing, and protection from environmental damage. The expansion of salon services, premium hair treatments, and at-home care routines significantly boosted consumption.

Consumers increasingly seek products that address hair thinning, breakage, and chemical damage, directly supporting keratin-infused formulations. Beyond hair care, keratin is also used in nail strengtheners and skin-conditioning products, broadening its application base. The Keratin Market continues to grow alongside evolving beauty standards, rising grooming awareness, and the sustained demand for functional, protein-based cosmetic ingredients.

Key Market Segments

By Product

- Alpha-Keratin

- Beta-Keratin

- Hydrolyzed Keratin

- Keratin Amino Acid

- Bio Peptide Keratin

By Type

- Natural Keratin

- Synthetic Keratin

By Source

- Animal-based Keratin

- Plant-based Keratin

- Lab-grown Keratin

By Application

- Personal Care and Cosmetics

- Healthcare and Pharmaceuticals

- Food and Beverage

- Others

Driving Factors

Biotechnology Driving Innovation in Beauty Proteins

One major driving factor of the Keratin Market is the rapid rise of bioengineered beauty solutions. Startups are increasingly using biotechnology to develop high-performance protein ingredients that improve product consistency and sustainability. This shift is supported by strong investor confidence, highlighted by a spinout that launched with $78M to bioengineer next-generation beauty products.

Such funding reflects growing belief in lab-designed proteins as reliable alternatives to traditional extraction methods. In parallel, consumer-facing brands are scaling faster, as seen when YSE Beauty closed a $15 million Series A round to expand clean and effective beauty formulations. Together, these developments show how science-led product development and capital inflow are accelerating keratin innovation, improving formulation quality, and expanding adoption across modern personal care routines.

Restraining Factors

High Development Costs Limit Market Accessibility

A key restraining factor for the Keratin Market is the high cost associated with developing advanced protein solutions. Early-stage companies often struggle with long research timelines, regulatory requirements, and scale-up expenses. For instance, POSITIVE received only $200,000 in seed funding, showing how limited capital can slow product validation and commercialization.

At the same time, Melt&Marble secured €7M to scale lab-grown skincare ingredients, underscoring that meaningful progress requires substantial investment. Smaller players without access to such funding face barriers to entering the market. These cost pressures can delay innovation, restrict production capacity, and limit price competitiveness, making it harder for keratin-based solutions to reach wider consumer segments despite growing interest.

Growth Opportunity

Vegan and AI-Led Protein Beauty Trends

A major latest trend shaping the Keratin Market is the move toward vegan and digitally designed protein alternatives. Brands and technology platforms are combining AI with biotechnology to design peptides that mimic traditional proteins without animal sources. This direction is reinforced by a U2-backed startup raising $42M in Series C funding for an AI-led vegan peptide platform.

At the consumer end, beauty brand Pilgrim raised Rs 200 crore to expand its personal care portfolio, reflecting strong demand for modern, ethically positioned products. Together, these developments highlight a shift toward cruelty-free, scalable protein innovation, positioning keratin alternatives as a fast-evolving segment aligned with changing consumer values.

Latest Trends

Circular Protein Use Strengthens Beauty Ingredient Supply

Another important driving factor for the Keratin Market is the growing focus on circular protein utilization. Companies are finding ways to convert industrial by-products into high-value beauty proteins, reducing waste and improving sustainability. A Swiss startup raised $10M to repurpose dairy factory waste into usable protein, demonstrating how alternative protein recovery can support ingredient supply chains.

Additionally, D2C beauty brand Pilgrim raised Rs 200 Cr through mixed funding rounds, enabling faster product expansion and ingredient sourcing flexibility. These developments show how sustainability-focused protein reuse and brand scaling are working together to support long-term keratin availability and market resilience.

Regional Analysis

Asia Pacific dominates the Keratin Market with 45.20% share, generating USD 759.8 Mn revenue.

In 2024, the Asia Pacific region emerged as the dominating market for keratin, accounting for 45.20% share and generating approximately USD 759.8 Mn in revenue. This substantial share reflects robust demand across personal care, cosmetics, and professional hair treatment segments, supported by a large consumer base in countries such as China, India, Japan, and South Korea. Rapid urbanization, rising beauty and grooming awareness, and expanding retail penetration have strengthened regional uptake.

North America continues to hold a significant position, driven by high per-capita consumption of premium keratin-infused products and established personal care brands. Europe maintains steady growth with demand from both mainstream and niche cosmetic lines incorporating keratin for hair and skin benefits.

In Latin America, increasing beauty expenditure and shifting consumer preferences toward protein-based formulations are contributing to market expansion. The Middle East & Africa region, while smaller in absolute value, exhibits emerging opportunities as beauty routines modernize and distribution networks widen. Collectively, these regional dynamics underscore the Asia Pacific’s leadership in the global keratin market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hefei TNJ Chemical Industry Co., Ltd. plays an important role in the keratin market through its focus on standardized production and consistent quality delivery. The company’s keratin offerings are aligned with industrial and cosmetic formulation requirements, making them suitable for downstream users seeking reliability rather than experimentation. Its operational strength lies in chemical processing expertise, scalable manufacturing, and the ability to supply keratin in forms compatible with personal care and industrial applications. From an analyst perspective, Hefei TNJ benefits from disciplined production practices and export-oriented operations, which support stable participation in global supply chains where specification adherence is critical.

Rejuvenol is primarily associated with premium keratin solutions tailored for hair care and cosmetic performance. The company emphasizes functional benefits such as hair repair, strengthening, and surface smoothness, which align well with professional salon and high-end consumer product expectations. Analysts view Rejuvenol as a brand-driven player, where formulation performance and end-use results matter more than volume leadership. Its positioning supports long-term relevance in markets that value ingredient effectiveness, consistency, and brand trust within keratin-based personal care solutions.

Keraplast brings a differentiated perspective to the keratin market by focusing on advanced keratin-based materials. The company’s activities extend beyond conventional cosmetics, reflecting innovation-oriented use of keratin in functional and specialty applications. From an analyst standpoint, Keraplast strengthens the market’s technological depth, supporting diversification and value-added use cases that expand keratin’s commercial relevance beyond traditional personal care segments.

Top Key Players in the Market

- Hefei TNJ Chemical Industry Co., Ltd.

- Rejuvenol

- Keraplast

- NutriScience Innovations LLC

- Wellgreen Technology Co., Ltd.

- Greentech Biochemicals Co., Limited.

- MakingCosmetics Inc.

- Kerline Srl

- Active Concepts LLC

- BASF SE

Recent Developments

- In July 2024, Active Concepts LLC introduced AC Skinmuni-Tea, a natural active ingredient derived from fermented matcha leaves designed to provide both mood-enhancing and skin-nourishing benefits for personal care formulations. This launch reflects the company’s focus on multifunctional, nature-inspired cosmetic ingredients that support skin health and wellbeing. This product expansion aligns with their broader expertise in specialized ingredients for hair and skin care.

- In April 2024, Hefei TNJ Chemical participated in the Middle East Coatings Show 2024 held in Dubai, UAE. The company showcased a range of its chemical products and reinforced its presence in international markets, facilitating engagement with customers from the Middle East and expanding visibility for its cosmetics-related materials, including keratin-relevant ingredients.

Report Scope

Report Features Description Market Value (2024) USD 1681.1 Million Forecast Revenue (2034) USD 3,096.9 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Alpha-Keratin, Beta-Keratin, Hydrolyzed Keratin, Keratin Amino Acid, Bio Peptide Keratin), By Type (Natural Keratin, Synthetic Keratin), By Source (Animal-based Keratin, Plant-based Keratin, Lab-grown Keratin), By Application (Personal Care and Cosmetics, Healthcare and Pharmaceuticals, Food and Beverage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hefei TNJ Chemical Industry Co., Ltd., Rejuvenol, Keraplast, NutriScience Innovations LLC, Wellgreen Technology Co., Ltd., Greentech Biochemicals Co., Limited., MakingCosmetics Inc., Kerline Srl, Active Concepts LLC, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hefei TNJ Chemical Industry Co., Ltd.

- Rejuvenol

- Keraplast

- NutriScience Innovations LLC

- Wellgreen Technology Co., Ltd.

- Greentech Biochemicals Co., Limited.

- MakingCosmetics Inc.

- Kerline Srl

- Active Concepts LLC

- BASF SE