Global Isophorone Market Size, Share Analysis Report By Product Type (Liquid, Solid), By Purity (Upto 99%, Above 99%), By Application (Automotive, Construction, Electronics, Packaging, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160840

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

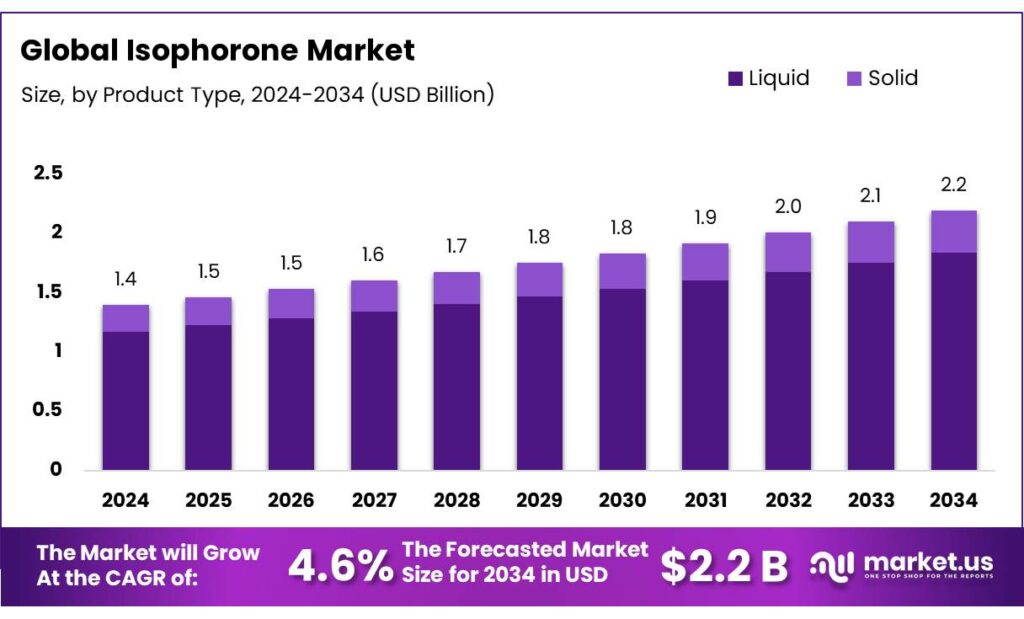

The Global Isophorone Market size is expected to be worth around USD 2.2 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Isophorone (systematically α,β-unsaturated cyclic ketone) is a key chemical intermediate and solvent used across coatings, adhesives, plastics, and specialty chemical sectors. It exhibits good solvency toward polymers, resins and organic compounds, and also serves as a precursor to compounds such as isophorone diisocyanate (IPDI) and isophorone diamine (via hydrogenation / amination routes). In terms of physical properties, commercial isophorone is a colorless (or slightly yellowish) liquid, with a vapor pressure of ~0.3 mmHg at 20°C and viscosity around 2.62 cP.

On the decarbonization front, the base chemicals sector is under increasing pressure: the chemical industry accounts for roughly 5% of global greenhouse gas emissions, and decarbonization investments in this sector must ramp substantially. In favorable future investment environments, cumulative spending on abatement in chemicals may exceed USD 1 trillion across major producing regions. Thus, firms that adopt low-carbon processes, energy efficiency, electrification, carbon capture, or renewable feedstocks may secure competitive edge. Moreover, regionally, supportive government policies in jurisdictions pushing for green chemicals may foster faster adoption of greener isophorone production.

Regulatory and environmental considerations exert notable influence on the sector. Isophorone has been monitored in industrial effluents and ambient waters (reported ranges in monitoring studies include <5 to ≈1,380 ppb in effluents and up to ~100 ppb in ambient water samples in historic surveillance), and U.S. federal assessments and toxicological reviews have documented inhalation and aquatic exposure pathways that inform discharge controls and worker-safety programs. These findings are shaping permitting, occupational exposure limits, and wastewater treatment requirements in producing jurisdictions.

Future growth opportunities are expected in higher-value, performance-led segments, process intensification to raise selectivity and reduce waste, and diversification into formulations compatible with stricter environmental controls. Incremental gains are likely where formulation performance cannot be replicated by lower-toxicity substitutes; however, regulatory tightening and investment in greener solvent alternatives represent material upside risk to baseline forecasts. Strategic investment in catalytic process upgrades, captive downstream integration, and compliance-led technology will determine competitive positioning through the remainder of the decade.

Key Takeaways

- Isophorone Market size is expected to be worth around USD 2.2 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 4.6%.

- Liquid held a dominant market position, capturing more than a 83.6% share.

- Upto 99% purity held a dominant market position, capturing more than a 67.9% share.

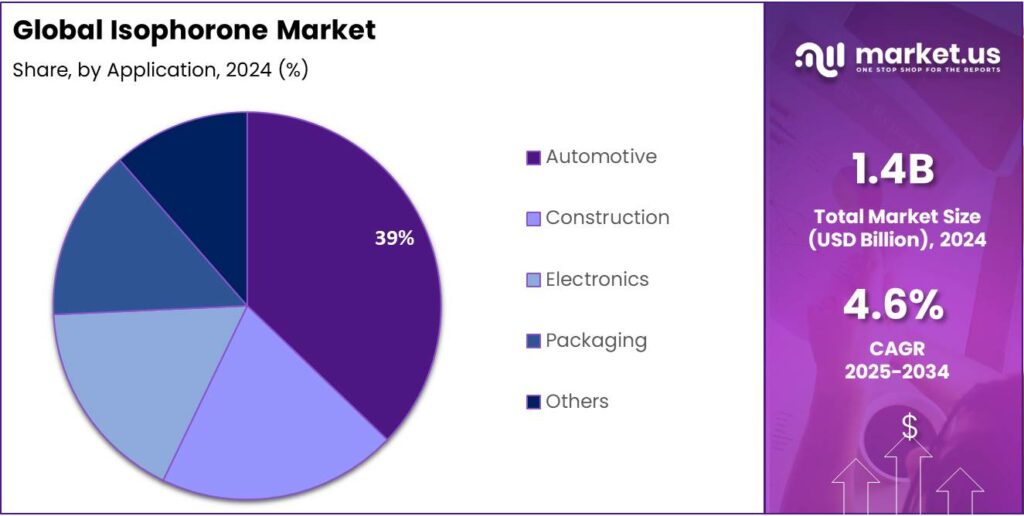

- Automotive held a dominant market position, capturing more than a 39.2% share.

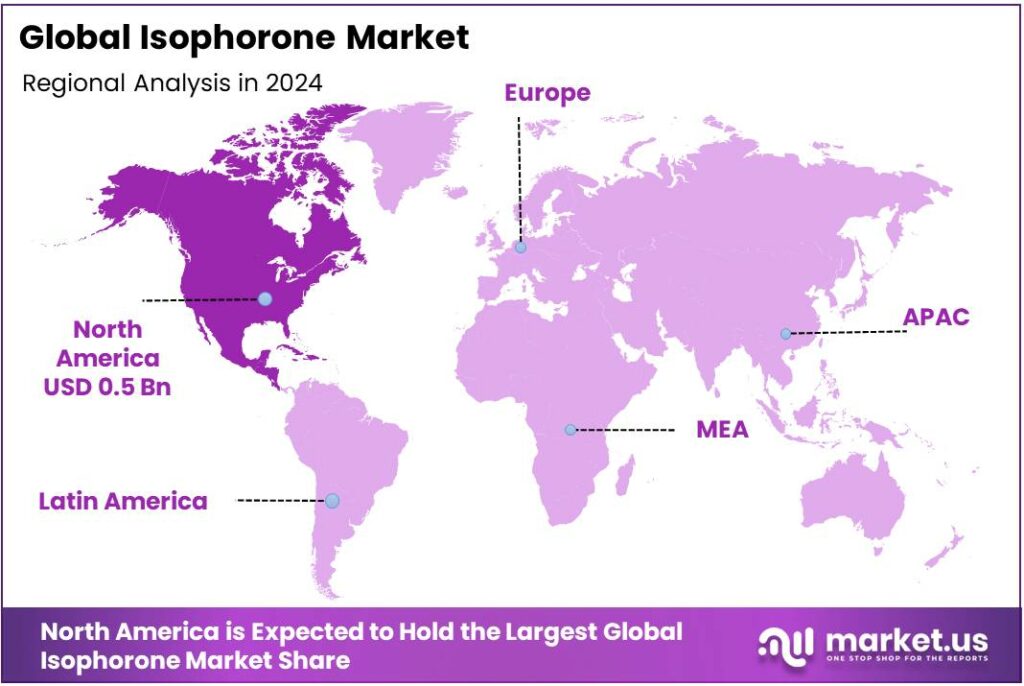

- North America maintained its leadership in the global isophorone market, capturing a dominant share of 42.70%, equating to an estimated market value of USD 0.5 billion.

By Product Type Analysis

Liquid dominates with 83.6% share in 2024 owing to its broad industrial utility.

In 2024, Liquid held a dominant market position, capturing more than a 83.6% share. This preference was driven by the solvent’s ready compatibility with common production processes and downstream chemistries, which allowed formulations to be manufactured and applied with fewer process adaptations. Handling and metering were reported to be more efficient for the liquid form, and logistics were simplified because no additional steps for phase conversion were required; as a result, production throughput was able to be maintained at lower operational cost.

The liquid product was favoured in high-value applications such as polyurethane intermediates and specialty coatings because solvent performance characteristics—solubility, evaporation profile, and formulation stability—were better preserved in liquid feedstocks. Regulatory compliance and occupational-safety controls were implemented around existing liquid-handling infrastructure rather than prompting capital-intensive conversion to alternate product forms, which further reinforced adoption.

In 2025, demand for the liquid form was expected to remain strong where performance requirements and supply-chain efficiency continued to take priority, while opportunities for incremental share growth were identified in segments requiring enhanced low-VOC formulations and process-integration with downstream isocyanate production. Strategic initiatives recommended for suppliers included improving supply reliability, investing in waste-reduction process improvements, and developing technical support for formulators to secure continued preference for the liquid product form.

By Purity Analysis

Upto 99% purity dominates with 67.9% share in 2024 driven by its wide industrial applications and cost efficiency.

In 2024, Upto 99% purity held a dominant market position, capturing more than a 67.9% share. This segment’s strength was largely attributed to its suitability across a broad range of industrial applications, including coatings, adhesives, and polymer intermediates, where ultra-high purity levels were not mandatory for achieving optimal performance. Manufacturers preferred this grade due to its balance between performance consistency and production economics, enabling cost-effective large-scale use without compromising product quality.

The up to 99% purity isophorone was widely adopted in routine formulations and solvent systems because it ensured stable solvency, chemical compatibility, and ease of processing across diverse manufacturing lines. The segment also benefited from well-established production routes and availability through global chemical supply networks, supporting steady procurement and minimal volatility in pricing.

As of 2025, the demand for up to 99% purity is expected to maintain its leading position, supported by the expansion of industrial coatings and resins sectors in emerging economies, along with the rising requirement for cost-optimized chemical intermediates. Future opportunities for this segment lie in the continued adoption of sustainable manufacturing practices and incremental process innovations aimed at improving yield and reducing impurities, reinforcing its competitive edge in the global isophorone market.

By Application Analysis

Automotive dominates with 39.2% share in 2024 due to growing demand for high-performance coatings and adhesives.

In 2024, Automotive held a dominant market position, capturing more than a 39.2% share. The strong presence of this segment was driven by the extensive use of isophorone-based derivatives in vehicle coatings, sealants, and adhesives, which require exceptional resistance to heat, abrasion, and environmental stress. Isophorone serves as a key intermediate in the production of isophorone diisocyanate (IPDI), a critical component for polyurethane coatings widely applied in automotive refinishing and OEM coatings.

The demand growth in this segment was further supported by rising global vehicle production and the increasing adoption of advanced, durable coatings to meet environmental and performance standards. Manufacturers in the automotive industry have been focusing on lightweight, corrosion-resistant materials, where isophorone-based resins and adhesives contribute to improved surface protection and extended vehicle lifespan.

In 2025, the automotive application segment is expected to continue expanding steadily, driven by technological advancements in coating formulations, stricter VOC emission regulations, and the growing production of electric vehicles, which require high-performance coatings and adhesive systems. Continuous innovation in eco-friendly formulations and solvent recovery systems is anticipated to further strengthen the segment’s role in the overall isophorone market landscape.

Key Market Segments

By Product Type

- Liquid

- Solid

By Purity

- Upto 99%

- Above 99%

By Application

- Automotive

- Construction

- Electronics

- Packaging

- Others

Emerging Trends

Shift to low-VOC, regulatory-aligned coating systems driven by food-sector modernization

A clear recent trend affecting isophorone use is the accelerated shift toward low-VOC, high-performance coating systems—largely prompted by expansion and modernization within the food and foodservice sectors and by tightening air-quality regulation. The scale of food-sector investment is material: total food sales at U.S. foodservice and retailing outlets reached USD 2.58 trillion in 2024, indicating sustained capital deployment into equipment, facilities and maintenance where durable, hygienic coatings are required.

This commercial expansion has been accompanied by sustained food-commodity activity globally, which supports ongoing investment in processing infrastructure; for example, the FAO Food Price Index averaged 128.8 points in September 2025, a level that reflects substantial movement and investment across food value chains. As processing lines, conveyors and storage systems are updated, demand for coatings that combine chemical resistance, cleanability and low discoloration has increased.

Regulatory drivers have reinforced this market direction. National and regional rules aimed at reducing volatile organic compound (VOC) emissions are resulting in concrete emissions reductions and in formulators’ preference for lower-solvent technologies. The U.S. national architectural coatings standard alone is estimated to reduce VOC emissions by approximately 103,000 megagrams per year (≈113,500 tpy), a regulatory outcome that incentivises the adoption of coatings with lower solvent loads and higher crosslinking efficiency—areas where isophorone-derived chemistries may be re-engineered to offer performance while meeting VOC ceilings.

Parallel policy work in the European Union, notably the Chemicals Strategy for Sustainability under the Green Deal, signals continued emphasis on safer and more sustainable chemical solutions and on innovation that lowers environmental and health risks. Such policy direction is prompting formulators and chemical producers to prioritise lower-impurity feedstocks, improved solvent recovery, and production methods that minimise emissions—practices that directly affect the supply-chain economics and acceptance of isophorone grades.

Drivers

Rising Demand from Coatings And Automotive Sectors

Governmental policies and industrial programs also support this driver. For instance, in the United States, the Department of Energy has backed research into lower-energy curing coatings for automotive paint shops, aiming to reduce overall energy consumption in vehicle finishing operations. Such initiatives encourage development of new coating chemistries and formulations, which in turn stimulate demand for advanced intermediates like isophorone.

Furthermore, regulatory pressure on volatile organic compounds (VOCs) and strict environmental norms in many regions push coatings manufacturers toward using more efficient, high-performance systems with cleaner profiles. To meet these regulations, formulators select intermediates offering better control over impurities and consistency—attributes that emphasize the value of cleaner, well-controlled isophorone grades.

As industries such as automotive, aerospace, general machinery, and infrastructure push for higher durability, chemical resistance, and aesthetic quality, more sophisticated coating systems are in demand. In particular, automotive refinishing, body panels, and protective undercoats increasingly require formulations with strong adhesion, UV stability, and low yellowing—traits that IPDI-based coatings (derived from isophorone chemistry) help deliver.

Automotive manufacturers are under pressure to reduce emissions and weight, which leads to increased use of coatings that can withstand harsher environments, thermal cycling, and mechanical stress. The coatings segment is thus a vital bridge between isophorone supply and end-use uptake in high performance applications.

Restraints

Strict Occupational Exposure Limits on Isophorone Hampers Market Growth

One major restraining factor for the isophorone market is the stringent regulation around human exposure and workplace safety. Because of its solvent nature and volatility, isophorone has been assigned specific permissible exposure limits (PELs) by government bodies such as OSHA, NIOSH, and state regulatory authorities. These safety limits increase operational cost, require additional process controls, and sometimes force reformulation or substitution, all of which suppress demand or slow adoption in sensitive applications.

In the United States, OSHA has set an 8-hour time-weighted average PEL for isophorone at 25 ppm (140 mg/m³). However, NIOSH and some state regulations are stricter: NIOSH recommends a much lower exposure limit of 4 ppm (23 mg/m³) over an 8-hour TWA. Because of these diverging standards, manufacturers producing for multiple markets must invest in advanced ventilation, exposure monitoring, and worker protection systems to comply with the most stringent requirement. These extra measures raise production cost and sometimes limit production scale or flexibility.

Short-term exposure limits or ceiling values also introduce constraints. For example, the U.S. state of Washington regulation for isophorone sets a ceiling limit of 5 ppm for short-term exposure in certain scenarios. When production, handling, or storage leads to emission spikes—such as during cleaning, maintenance or spills—companies must buffer or redesign process stages to avoid exceeding short-term limits. These design adaptations may involve additional equipment (scrubbers, closed transfer systems) or reduced batch sizes, which in aggregate limit throughput or increase unit cost.

Health risks associated with isophorone exposure strengthen regulatory oversight. In studies, exposure at or above 5-8 ppm has been associated with fatigue, nausea, irritation of eyes, nose, throat, and impaired judgement. Because of these adverse effects, regulatory agencies enforce or propose limits to ensure worker safety. This enforcement can take the form of inspections, penalties, or mandatory environmental impact control measures that drive capital investment and ongoing compliance costs.

Opportunity

Expansion of Low-VOC, High-Performance Coatings for the Food & Beverage Sector

A clear growth opportunity for isophorone lies in supplying intermediates for high-performance, low-VOC polyurethane coatings used across food processing, packaging equipment, and foodservice facilities. The food and beverage sector is large and expanding; for example, total food sales at U.S. foodservice and retailing outlets reached USD 2.58 trillion in 2024, which signals substantial ongoing investment in equipment, infrastructure and maintenance where durable coatings are required.

As food processing and foodservice operations expand, demand for surfaces that resist wear, chemicals, and frequent cleaning cycles intensifies. Isophorone-derived chemistries — notably isophorone diisocyanate (IPDI) used in polyurethane systems — offer strong weathering, chemical resistance, and low yellowing, properties that are valuable for stainless-steel coatings, conveyor systems, storage tanks and packaging lines. Investments in food industry capital equipment therefore translate into sustained demand for coating systems that rely on high-quality intermediates.

This linkage is strengthened when the scale of the food sector is considered alongside commodity and price trends the FAO Food Price Index, an indicator of global food market conditions, has shown month-to-month movements that reflect sizable underlying activity in food production and trade. Such macro dynamics support ongoing modernization and expansion of food value-chain infrastructure.

Regulatory and public-policy drivers create complementary opportunity. Regulatory efforts to reduce volatile organic compound (VOC) emissions from coatings encourage formulators to adopt higher-efficiency, lower-VOC chemistries that deliver performance with smaller solvent loads. U.S. federal standards for architectural and industrial coatings are estimated to reduce VOC emissions by about 103,000 megagrams per year (≈113,500 tons/year) under key EPA rules, highlighting the regulatory momentum toward cleaner coating systems.

Regional Insights

North America Leads the Isophorone Market with 42.70% Share, Valued at USD 0.5 Billion in 2024

In 2024, North America maintained its leadership in the global isophorone market, capturing a dominant share of 42.70%, equating to an estimated market value of USD 0.5 billion. This robust market presence is primarily attributed to the region’s advanced industrial infrastructure, stringent regulatory standards, and high demand across various end-use sectors, including automotive, construction, and specialty chemicals.

The United States, as the largest contributor within North America, benefits from a well-established chemical manufacturing base and a growing emphasis on high-performance materials. The adoption of isophorone in applications such as adhesives, coatings, and industrial solvents is driven by the need for durable and efficient chemical intermediates. Additionally, the region’s commitment to environmental sustainability and regulatory compliance has spurred the development and utilization of low-VOC formulations, further enhancing the demand for isophorone-based products.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arkema is a leading global chemical producer headquartered in France, specializing in advanced materials and specialty chemicals. The company has a strong presence in the isophorone market, focusing on high-performance coatings and adhesives. Arkema’s commitment to sustainability is evident through its investments in low-VOC technologies and the expansion of its production facilities, such as the doubling of its powder coating resins capacity in Navi Mumbai, India.

Evonik Industries, based in Germany, is a prominent player in the isophorone market, with a significant investment in its Shanghai facility. The company has invested over €100 million to establish an integrated production complex for isophorone and isophorone diamine in Shanghai, China. This facility boasts an annual output capacity of 50,000 metric tons, primarily serving customers in the coatings, adhesives, and composite industries across Asia.

Prasol Chemicals Pvt Ltd, located in India, is a significant producer of isophorone and other specialty chemicals. The company’s manufacturing facility in Khopoli spans approximately 68,644 square meters and produces a range of products, including isophorone, diacetone alcohol, and mesityl oxide. Prasol Chemicals serves various industries, such as paints, coatings, and thinners, and is known for its commitment to quality and sustainability.

Top Key Players Outlook

- Arkema Group

- Evonik Industries

- Jiangsu Huanxin High Tech Materials Co. Ltd

- Prasol Chemicals Pvt Ltd

- BASF SE

- Covestro AG

- Krasiklal

- DHALOP CHEMICALS

- Indian Organic Corporation

Recent Industry Developments

In 2024, Covestro’s global sales reached €14 billion, with a notable focus on high-performance materials like isophorone derivatives. The company operates 46 production sites worldwide and employs approximately 17,500 full-time equivalents, underscoring its extensive manufacturing capabilities.

In 2024, BASF’s Chemical Intermediates division, which includes isophorone production, achieved sales of €9.5 billion, a 2.5% increase from the previous year. This growth was driven by strong demand in applications such as coatings, adhesives, and automotive materials

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.2 Bn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid, Solid), By Purity (Upto 99%, Above 99%), By Application (Automotive, Construction, Electronics, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema Group, Evonik Industries, Jiangsu Huanxin High Tech Materials Co. Ltd, Prasol Chemicals Pvt Ltd, BASF SE, Covestro AG, Krasiklal, DHALOP CHEMICALS, Indian Organic Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arkema Group

- Evonik Industries

- Jiangsu Huanxin High Tech Materials Co. Ltd

- Prasol Chemicals Pvt Ltd

- BASF SE

- Covestro AG

- Krasiklal

- DHALOP CHEMICALS

- Indian Organic Corporation