Global Ipm Pheromone Market Size, Share, And Enhanced Productivity By Product (Sex Pheromones, Aggregation Pheromones, Alarm Pheromones, Others), By Function (Mating Disruption, Detection and Monitoring, Mass Trapping), By Mode of Application (Monitoring and Detection, Mating Disruption, Mass Trapping, Others), By Crop (Field Crops, Vegetable Crops, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178573

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

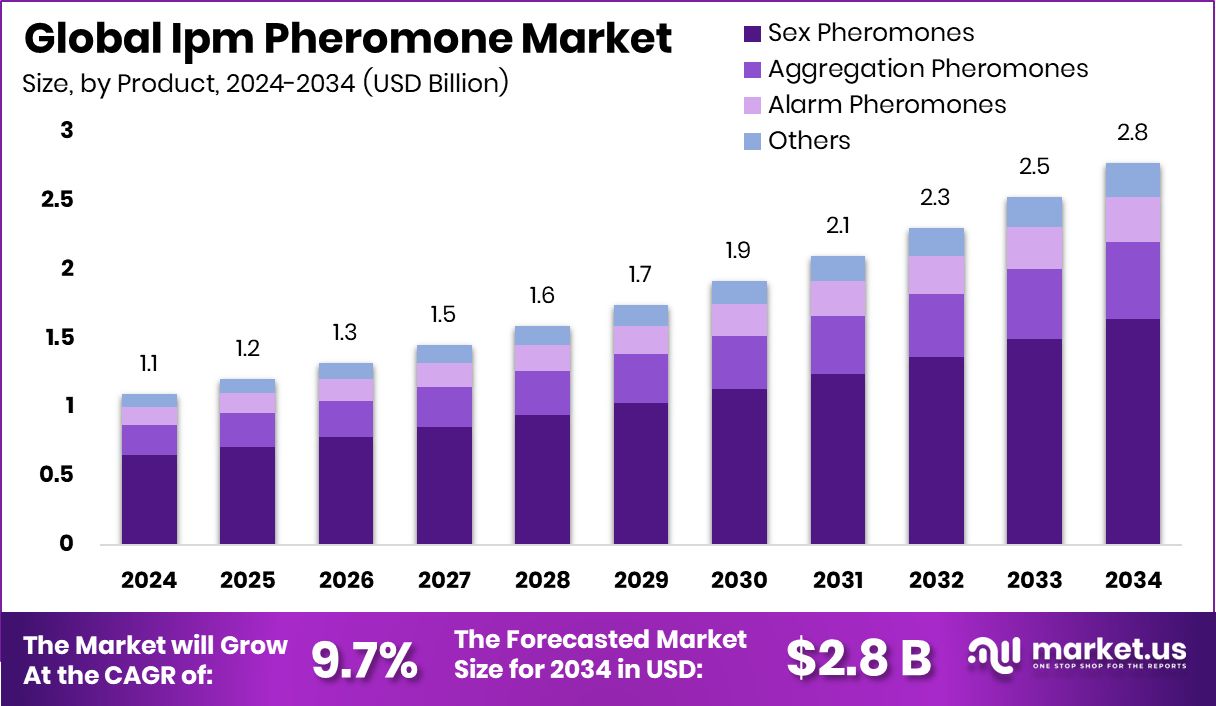

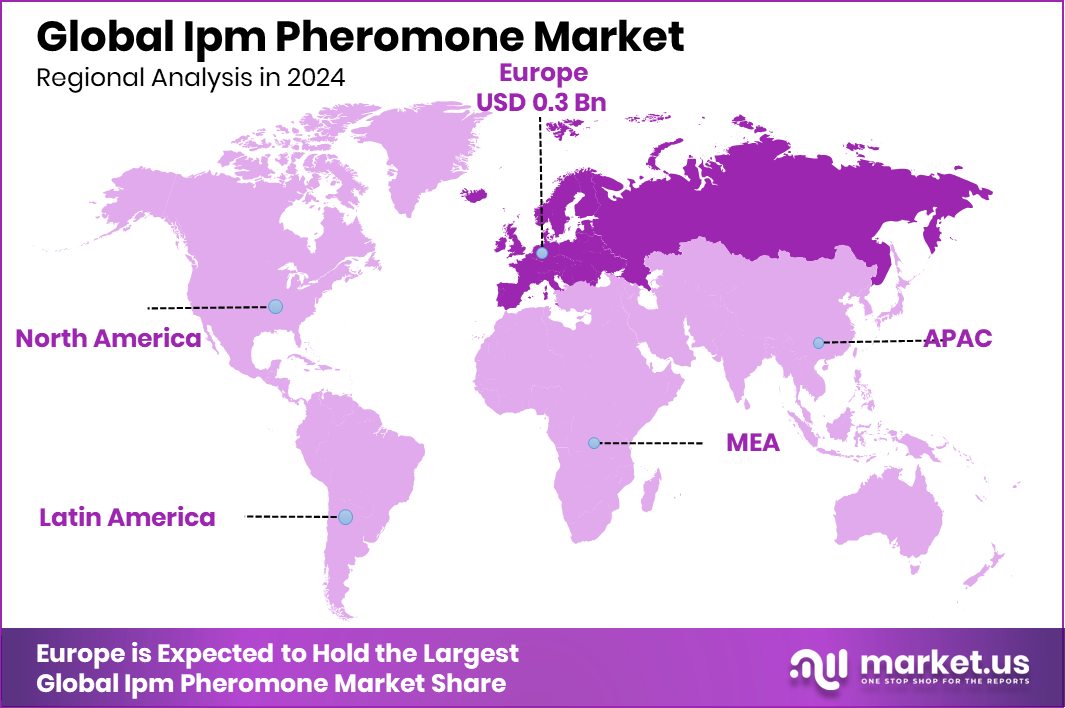

The Global Ipm Pheromone Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 9.7% from 2025 to 2034. With USD 0.3 Bn revenue, Europe captured 34.5% market share

IPM pheromone refers to the use of natural insect chemical signals within Integrated Pest Management systems to control pest populations in a targeted and environmentally responsible way. These pheromones mimic the scents insects release to communicate, helping farmers disrupt mating cycles, monitor pest movement, or trap harmful species without harming beneficial insects. Unlike broad chemical spraying, pheromone use focuses on specific pests, making crop protection more precise and sustainable.

The IPM Pheromone Market includes the development and supply of products such as sex pheromones, aggregation pheromones, and alarm pheromones. These are applied through functions like mating disruption, detection and monitoring, and mass trapping. They are widely used across field crops, vegetable crops, and other cultivated areas. The market reflects growing preference for eco-friendly crop protection tools that fit structured pest management programs.

Growth in this market is strongly linked to innovation and funding support. Pest pheromone startup BioPhero secured $17 million in a DCVC-led Series A round, highlighting investor confidence in biological pest control. Public funding also supports related sectors, including $1.2 million awarded to boost Massachusetts commercial fisheries and additional commercial fishing grants, showing wider support for sustainable resource management.

Demand is rising as farmers seek reliable alternatives to conventional pesticides. Increased awareness, regulatory pressure, and project funding initiatives create a strong opportunity for expanded pheromone adoption across crops and regions.

Key Takeaways

- The Global Ipm Pheromone Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 9.7% from 2025 to 2034.

- IPM Pheromone Market sees Sex Pheromones leading with a strong 59.2% share.

- IPM Pheromone Market shows Mating Disruption dominating the function segment at 49.6% share.

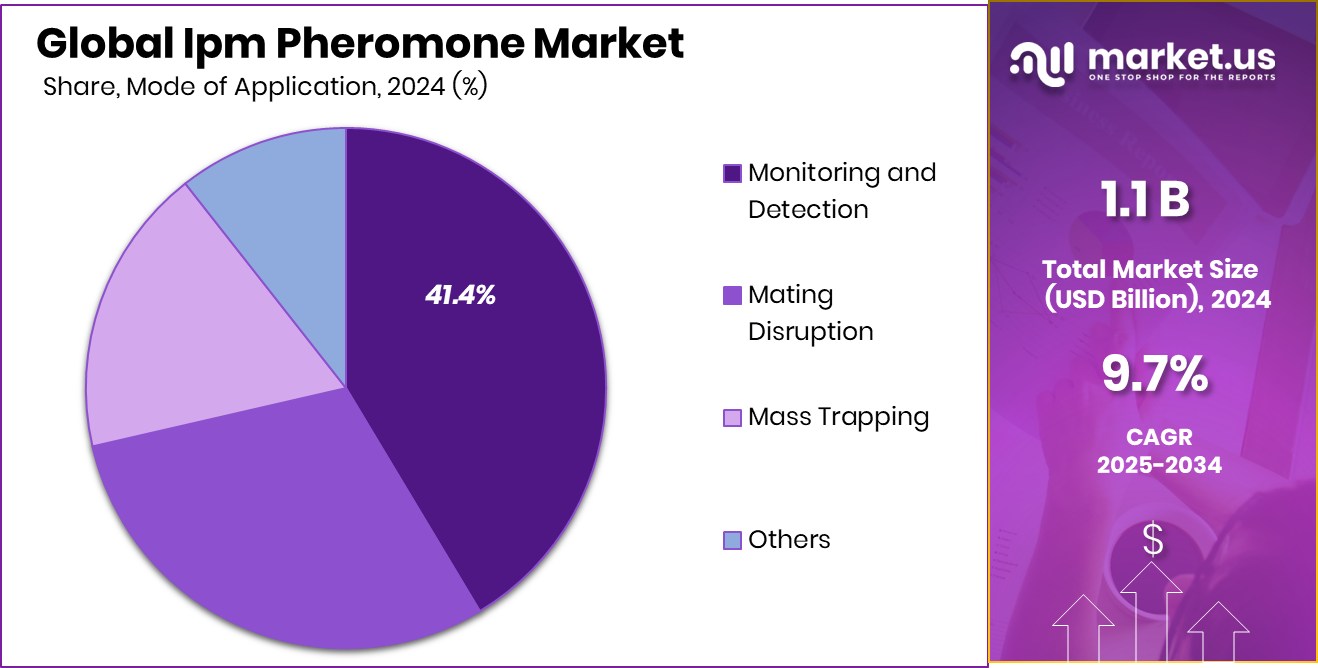

- IPM Pheromone Market highlights Monitoring and Detection as the leading application mode with 41.4% share.

- IPM Pheromone Market records field crops commanding a major 67.9% crop segment share.

- Europe accounted for 34.5% share, reaching USD 0.3 Bn value.

By Product Analysis

IPM Pheromone Market sees Sex Pheromones leading with 59.2% share.

In 2024, the IPM Pheromone Market saw Sex Pheromones holding a dominant share of 59.2%, making them the most widely used product type across integrated pest management programs. Farmers are increasingly shifting toward species-specific solutions that reduce chemical load while maintaining crop protection efficiency.

Sex pheromones are preferred because they precisely target insect populations without harming beneficial organisms. Their growing use in fruit orchards, vegetable farms, and large-scale plantations reflects a broader move toward sustainable agriculture.

Governments in several countries are also encouraging pheromone-based pest control through subsidy programs and residue-free farming initiatives. The steady demand is supported by export-oriented growers who must meet strict pesticide residue standards, further strengthening the commercial importance of sex pheromones in modern agriculture.

By Function Analysis

IPM Pheromone Market shows Mating Disruption holding 49.6% segment share.

In 2024, Mating Disruption accounted for 49.6% of the IPM Pheromone Market by function, showing its strong acceptance as a long-term pest control strategy. Instead of killing insects directly, this method confuses male pests and prevents them from locating females, which gradually reduces pest populations over time. Farmers prefer mating disruption in crops where repeated pesticide spraying used to be common, as it lowers application frequency and labor costs.

The technique has proven effective against moth species and other major agricultural pests, particularly in orchards and vineyards. With rising resistance to conventional insecticides, mating disruption provides a reliable alternative. Its growing adoption highlights a shift toward preventive and environmentally responsible pest management practices.

By Mode of Application Analysis

IPM Pheromone Market records Monitoring and Detection at 41.4% application.

In 2024, Monitoring & Detection led the IPM Pheromone Market by mode of application with a 41.4% share, reflecting the importance of early pest surveillance. Pheromone traps are widely used to monitor insect population levels before outbreaks become severe. This approach helps farmers make timely decisions on whether intervention is needed, reducing unnecessary pesticide applications.

Monitoring tools are cost-effective and easy to install, making them popular among both small and large farm operators. Accurate detection also supports data-driven farming, where crop protection strategies are based on real field conditions rather than routine spraying. As digital agriculture tools expand, pheromone-based monitoring systems are increasingly integrated with smart farm technologies for better precision.

By Crop Analysis

IPM Pheromone Market highlights Field Crops dominating with 67.9% share.

In 2024, Field Crops dominated the IPM Pheromone Market by crop type, capturing 67.9% of the overall share. Large-scale cultivation of crops such as cotton, maize, rice, and pulses creates significant demand for efficient pest control solutions. Field crops are often vulnerable to seasonal pest attacks that can impact yield and farmer income.

Pheromone-based solutions offer an eco-friendly way to manage these risks across vast agricultural areas. Growing awareness among farmers about residue-free produce and soil health has further supported adoption. Many government-backed agricultural programs promoting sustainable crop protection have also encouraged the use of pheromones in field crops, strengthening this segment’s leadership in the overall market.

Key Market Segments

By Product

- Sex Pheromones

- Aggregation Pheromones

- Alarm Pheromones

- Others

By Function

- Mating Disruption

- Detection and Monitoring

- Mass Trapping

By Mode of Application

- Monitoring and Detection

- Mating Disruption

- Mass Trapping

- Others

By Crop

- Field Crops

- Vegetable Crops

- Others

Driving Factors

Rising adoption of sustainable agriculture

Rising adoption of sustainable agriculture continues to strengthen the IPM Pheromone Market as growers look for safer and more targeted pest control methods. Farmers cultivating fruits, vegetables, and high-value crops are gradually reducing dependence on chemical sprays and shifting toward integrated pest management practices that protect soil health and beneficial insects. Government support is also reinforcing this shift.

The Specialty Crop Block Grant Program has made $72.9M in funding available to improve the competitiveness of specialty crops, indirectly encouraging the use of innovative crop protection tools such as pheromones. Such financial backing helps producers experiment with biological solutions, invest in monitoring systems, and scale sustainable farming models, creating a supportive environment for long-term market expansion.

Restraining Factors

High cost of pheromone products

High cost of pheromone products remains a practical challenge for many growers, particularly small and medium-scale farmers who operate with tight margins. Compared to conventional pesticides, pheromone dispensers, traps, and monitoring systems may require higher upfront investment, along with training and field knowledge for effective deployment. Although sustainable farming receives financial attention, allocation often targets broader crop development projects.

For example, Michigan awarded $2.08M for 22 specialty crop projects statewide, which supports innovation but does not always directly offset the higher costs of pheromone-based tools. This gap between funding distribution and on-ground affordability can slow adoption in certain regions, especially where farmers prioritize short-term cost savings over long-term environmental benefits.

Growth Opportunity

Expansion in emerging agricultural markets

Expansion in emerging agricultural markets presents a clear opportunity for the IPM Pheromone Market, particularly in regions where specialty crops are gaining importance. Public funding is strengthening this direction. The ADA received more than $500k in federal funds to support the specialty crop industry, encouraging improved pest management and market access. Additionally, the USDA awarded specialty crop producers $82M to expand markets, improve infrastructure, and enhance competitiveness.

As producers increase acreage and export-oriented production, demand grows for residue-free pest control methods that meet strict quality standards. Pheromone-based solutions fit well within this requirement, offering targeted control without compromising product safety, thereby opening new pathways for broader commercial adoption.

Latest Trends

Development of species-specific pheromone blends

Development of species-specific pheromone blends is emerging as a key trend in the IPM Pheromone Market, allowing farmers to target particular pest species with greater precision. This approach improves effectiveness while minimizing impact on non-target insects and surrounding ecosystems. Support from agricultural departments further strengthens this movement.

The Department of Agriculture awarded over $300,000 in Specialty Crop Block Grants to enhance the competitiveness of specialty crops, encouraging adoption of advanced pest management practices. These grants often promote innovation, field trials, and technology transfer, which accelerate acceptance of pheromone-based monitoring and disruption systems. As research refines formulation techniques and delivery systems, growers are increasingly viewing tailored pheromone blends as practical and reliable tools in integrated programs.

Regional Analysis

In 2024, Europe held 34.5% IPM Pheromone Market share, USD 0.3 Bn.

In 2024, Europe emerged as the dominating region in the IPM Pheromone Market, accounting for 34.5% of the global share and reaching a market value of USD 0.3 Bn. The region’s leadership reflects strong adoption of sustainable pest control practices and structured integrated pest management programs across agricultural economies. Regulatory emphasis on reducing chemical pesticide usage has further strengthened demand for pheromone-based solutions.

North America follows as a significant regional market, supported by advanced farming practices and increasing preference for residue-free crop protection methods. Asia Pacific is witnessing steady expansion, driven by large-scale agricultural production and growing awareness of environmentally responsible pest management.

Meanwhile, the Middle East & Africa region is gradually adopting IPM pheromone solutions to enhance crop productivity under challenging climatic conditions. Latin America also presents growing opportunities, supported by expanding cultivation areas and rising focus on export-quality agricultural produce. Europe’s 34.5% share clearly positions it as the leading regional contributor in value and adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global IPM Pheromone Market continues to be shaped by the strategic positioning of Harmony Ecotech Pvt. Ltd., Rovensa Next, and Syngenta.

Harmony Ecotech Pvt. Ltd. has built a focused presence in pheromone-based crop protection, particularly through field-level engagement and practical pest management solutions tailored for farmers. Its strength lies in localized production capabilities and consistent product development aligned with integrated pest management practices.

Rovensa Next has positioned itself as a sustainability-driven agricultural solutions provider, integrating biologicals and pheromone technologies within broader crop protection programs. The company’s approach combines innovation with environmental responsibility, helping growers transition from conventional chemical dependence to more balanced pest control systems. Its global footprint supports expansion across key agricultural regions.

Syngenta remains a major force due to its extensive research infrastructure and diversified crop protection portfolio. By integrating pheromone-based solutions into its existing agricultural ecosystem, the company strengthens its IPM offerings. Its scale, distribution reach, and long-standing relationships with growers provide a competitive advantage, reinforcing its influence in advancing pheromone adoption globally.

Top Key Players in the Market

- Harmony Ecotech Pvt. Ltd.

- Rovensa Next.

- Syngenta

- AgriSense-BCS Ltd.

- Laboratorio Agrochem S.L.

- Russell IPM Ltd

- Hercon Environmental.

- Semios.

- Bioline Agrosciences Ltd.

- Trécé, Inc.

Recent Developments

- In November 2025, Harmony Ecotech announced the launch of a new pheromone-based product named Arrest, designed specifically for horticulture crop protection. This product aims to support pest management in fruit and vegetable cultivation by enhancing monitoring and trapping effectiveness.

- In October 2025, Rovensa Next participated as a Platinum Sponsor at the Annual Biocontrol Industry Meeting (ABIM 2025) in Basel, Switzerland, where it showcased upcoming biocontrol products formulated to strengthen Integrated Pest Management (IPM) programs. This included multifunction bioinsecticides and biofungicides developed using its patented OROWET® technology, demonstrating the company’s innovation in biocontrol solutions.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sex Pheromones, Aggregation Pheromones, Alarm Pheromones, Others), By Function (Mating Disruption, Detection and Monitoring, Mass Trapping), By Mode of Application (Monitoring and Detection, Mating Disruption, Mass Trapping, Others), By Crop (Field Crops, Vegetable Crops, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Harmony Ecotech Pvt. Ltd., Rovensa Next., Syngenta, AgriSense-BCS Ltd., Laboratorio Agrochem S.L., Russell IPM Ltd, Hercon Environmental., Semios., Bioline Agrosciences Ltd., Trécé, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Harmony Ecotech Pvt. Ltd.

- Rovensa Next.

- Syngenta

- AgriSense-BCS Ltd.

- Laboratorio Agrochem S.L.

- Russell IPM Ltd

- Hercon Environmental.

- Semios.

- Bioline Agrosciences Ltd.

- Trécé, Inc.