Global Injection Molding Machine Market By Material (Plastics and Metal), By Technology (Hydraulic, Electric, and Hybrid), By End-Use (Automotive, Consumer Goods, Packaging, Electronics, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177380

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

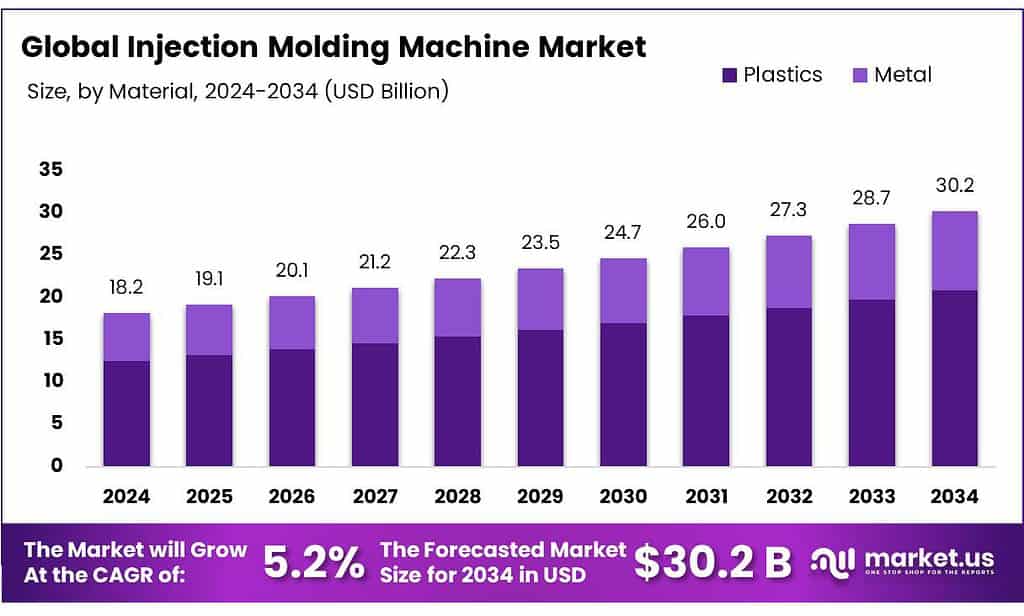

The Global Injection Molding Machine Market is expected to be worth around USD 30.2 Billion by 2034, up from USD 18.2 Billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. The North America segment maintained 35.8%, supporting a Shore Power value of USD 3.0 Bn.

An injection molding machine, known as an injection press, is an industrial device used to manufacture plastic products by injecting molten material into a mold. It is the primary equipment for high-volume production of identical plastic parts, ranging from simple bottle caps to complex automotive components. It is a premier, high-speed manufacturing process capable of producing thousands of identical, high-quality thermoplastic parts daily, with typical cycle times ranging from 10 to 60 seconds.

The injection molding machine market is shaped by a combination of technological, industrial, and regional dynamics. Automotive applications represent the highest revenue segment due to the demand for large, high-precision, and durable plastic components that require advanced, high-tonnage machines. Additionally, hydraulic machines remain widely used for their robustness, high clamping force capacity, and adaptability to demanding production conditions, though electric and hybrid machines are gaining attention for efficiency and Industry 4.0 integration.

- Smart systems contribute to a 25% reduction in scrap and a 20% to 40% drop in unplanned downtime through early anomaly detection.

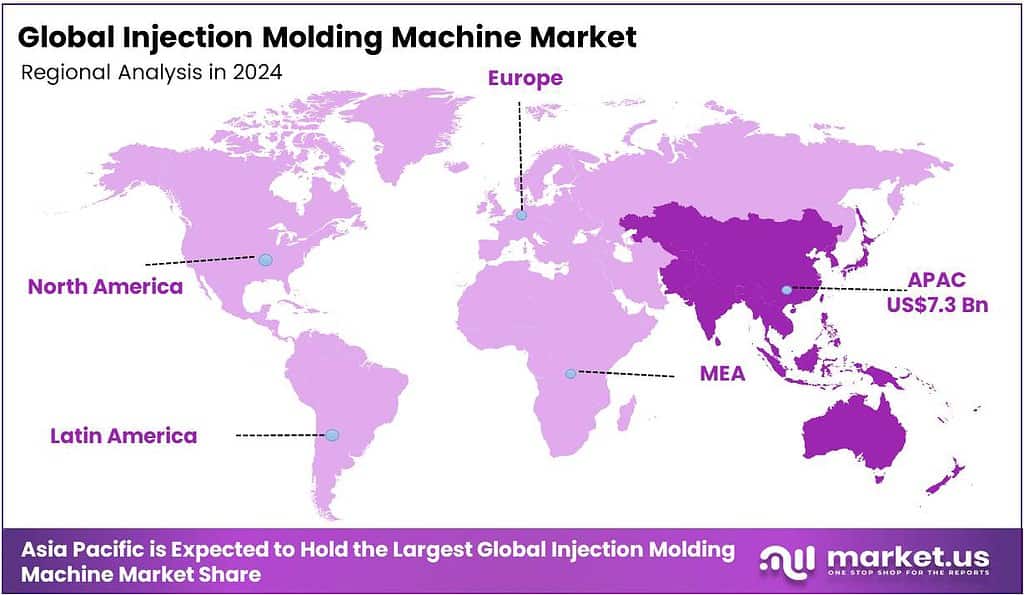

Market trends highlight a shift toward automation, digital controls, and smart manufacturing systems, enabling real-time monitoring, process optimization, and predictive maintenance. However, the challenges include high tooling costs, regulatory pressures on plastics, and supply chain disruptions arising from geopolitical tensions. Furthermore, the Asia Pacific region dominates, driven by large-scale manufacturing in automotive, electronics, and consumer goods sectors, with China, India, and Southeast Asia leading in machine production and consumption.

Key Takeaways:

- The global injection molding machine market was valued at USD 18.2 billion in 2024.

- The global injection molding machine market is projected to grow at a CAGR of 5.2% and is estimated to reach USD 30.2 billion by 2034.

- On the basis of material, plastics dominated the injection molding machine market, constituting 68.9% of the total market share.

- Based on the technology, hydraulic injection molding machines dominated the market, with a substantial market share of around 51.3%.

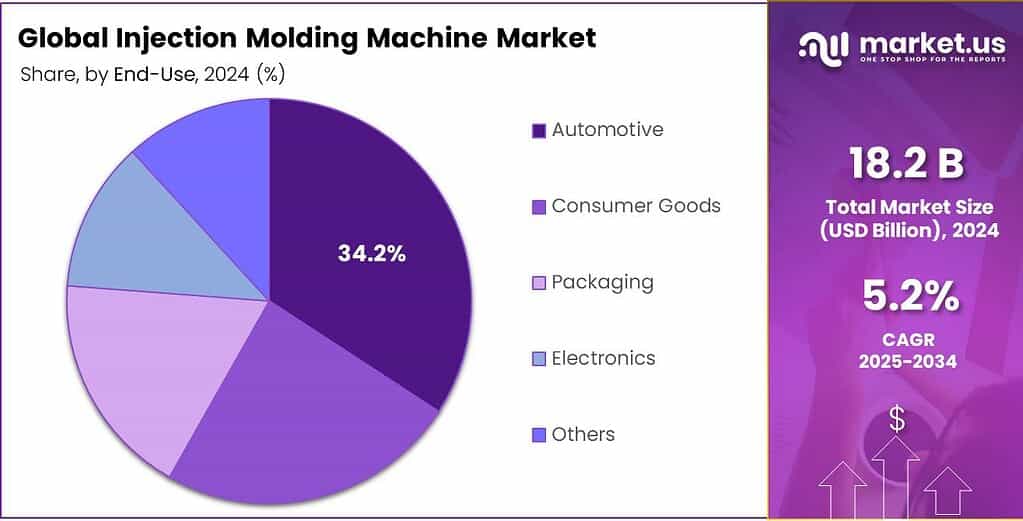

- Among the end-uses of injection molding machines, the automotive sector held a major share in the market, 34.2% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the injection molding machine market, accounting for 40.2% of the total global consumption.

Material Analysis

Plastics Dominated the Market Primarily Due to Process Compatibility, Material Efficiency, and Functional Versatility.

On the basis of material, the injection molding machine market is segmented into plastics and metals. Plastics dominated the injection molding machine market, comprising 68.9% of the market share. Injection molding is inherently suited to thermoplastics, which can be repeatedly melted, shaped, and solidified with high dimensional accuracy and minimal material waste. Plastics enable the production of complex geometries, thin walls, and integrated features in a single molding cycle, which is difficult and costly with metals.

Additionally, they offer lower processing temperatures and pressures than metal-forming processes, reducing energy consumption and tooling wear. Similarly, from a functional perspective, plastics provide advantageous properties such as low weight, corrosion resistance, electrical insulation, and design flexibility, making them suitable for a wide range of applications. These factors collectively drive the broader adoption of plastics over metals in injection molding operations.

Technology Analysis

Hydraulic Injection Molding Machines Held the Largest Share in the Market.

Based on the technology, the injection molding machine market is divided into hydraulic, electric, and hybrid. The hydraulic injection molding machines dominated the market, with a notable market share of 51.3%, mainly due to their robust performance, versatility, and cost-effectiveness across a broad range of applications. They are well-suited for high-clamping-force and large-part production, such as automotive components, industrial containers, and structural parts, where consistent pressure and durability are critical.

Additionally, hydraulic systems can tolerate material variability and demanding operating conditions better than electric systems, making them reliable for long production runs. Similarly, their lower upfront acquisition cost and widespread availability of maintenance expertise support continued adoption, especially in emerging manufacturing regions. Moreover, hydraulic machines are compatible with a wide range of mold sizes and materials, offering operational flexibility that remains essential for manufacturers producing diverse product portfolios.

End Use Analysis

The Automotive Sector Accounted for a Significant Portion of the Injection Molding Machine Market.

The injection molding machine market is categorized by end uses into automotive, consumer goods, packaging, electronics, and others. The automotive sector accounts for 34.2% of the total global usage of the injection molding machine market, due to the scale, complexity, and material requirements of automotive components. Vehicles incorporate a wide range of large and structurally demanding parts, including bumpers, dashboards, interior panels, and under-the-hood components, which require high-tonnage machines and precise molding capabilities.

Additionally, the automotive sector emphasizes durability, safety, and regulatory compliance, which necessitates rigorous quality standards and specialized equipment. The combination of large part sizes, high-performance materials, and stringent quality requirements leads to higher per-unit machine value and longer-term contracts, making automotive applications the largest contributor to the injection molding industry.

Key Market Segments:

By Material

- Plastics

- Metal

By Technology

- Hydraulic

- Electric

- Hybrid

By End-Use

- Automotive

- Consumer Goods

- Packaging

- Electronics

- Others

Drivers

Automotive Industry Demand Drives the Injection Molding Machine Market.

The automotive industry’s focus on lightweighting and electrification, driven by needs for fuel efficiency and extended EV battery range, makes it a primary driver for the injection molding machine market. According to the United States Department of Energy (DoE), a 10% reduction in vehicle weight can improve fuel economy by 6%-8% as less energy is required to accelerate a lighter object, underpinning lightweight-material adoption across passenger and commercial vehicles to meet fuel-efficiency and emissions norms.

The plastics, including advanced engineering polymers and composites, are replacing heavier metals in interior and exterior parts such as dashboards, bumpers, and housings owing to superior strength-to-weight ratios and corrosion resistance. Production demands for these larger, structurally significant parts require injection molding machines with higher clamping forces.

In addition, the large-tonnage machines, above 500 tons or more of clamping force, are increasingly utilized for large automotive components, as they enable single-cycle molding of complex, high-strength parts while reducing process steps. As vehicles integrate more polymer-based structural elements, especially in electric vehicles to offset battery mass, the material mandates and manufacturing scale directly elevate requirements for large-tonnage injection molding equipment.

Restraints

Tooling Costs and Environmental Concerns Might Pose a Challenge to the Injection Molding Machine Market.

The high tooling costs of injection moldings remain a structural challenge for manufacturers and end-users. Mold design and fabrication represent a significant upfront investment independent of production volume. The tooling expenses often start at several thousand dollars and rise markedly with complexity and precision requirements, often exceeding tens of thousands for intricate parts with undercuts or multiple cavities. These fixed tooling costs can comprise 50%-70% of total costs in low-volume scenarios, underscoring their impact on production planning and capital allocation.

- For instance, a US$10,000 mold equates to US$10.00 per part at 1,000 units, further dropping to US$0.10 at 100,000 units. Moreover, tooling factors such as material hardness, machine compatibility, and geometric complexity each drive cost escalations as they require specialized machining and high-skill labor.

Similarly, environmental concerns and regulatory frameworks impose compliance burdens on injection molding operations. Government strategies such as the European Union Plastics Strategy aim to reduce plastic waste and promote circular economy principles, including enhanced recyclability targets, influencing material selection and production practices. The EPA’s Plastics Molding and Forming Effluent Guidelines (40 CFR Part 463) regulate waste discharge, further emphasizing lifecycle approaches to reduce plastic pollution.

Furthermore, occupational health concerns are rising, with injection molding workshops recording airborne microplastics concentrations of 19.37 ± 7.38 μg/m³. These regulatory imperatives necessitate investment in sustainable materials and waste management systems, which can raise operational complexity and cost.

Opportunity

Applications of Injection Molding Machine in Consumer Goods and Electronics Industries Create Opportunities in the Market.

The consumer goods and electronics sectors serve as high-growth opportunities for the injection molding machine market, driven by trends in miniaturization, customization, and multi-material integration. Injection molding machines enable high-precision, high-throughput production of plastic components that are foundational to contemporary consumer goods and consumer electronics manufacturing. Within electronics, the process supports the manufacture of critical structural and protective components, including device housings, screen and lens covers, connectors, and heat-shielding parts, where dimensional accuracy and material stability are essential for assembly and performance.

Advanced injection molding techniques, such as molded interconnect devices (MIDs) that integrate circuitry into thermoplastic substrates, exemplify technology convergence in electronics production. Similarly, in consumer goods, injection molding produces a broad array of durable, dimensionally consistent parts such as household appliance housings, toys, personal care product packaging, and storage containers, leveraging versatile thermoplastics such as ABS, polypropylene (PP), and polyethylene (PE) that meet functional and aesthetic requirements.

Furthermore, plastics play a central role in household appliances and electronic device manufacturing, reflecting wide cross-sector utilization of injection-molded parts. These established applications, underpinned by robust material performance and repeatable precision, present structural opportunities for injection molding machine deployment across consumer and electronics value chains.

Trends

Shift Towards Automation and Smart Systems (Industry 4.0).

The transition toward automation and Industry 4.0 is reshaping injection molding operations by embedding smart systems that enable real-time monitoring, data exchange, and automated process control. Industry-wide standards such as Euromap’s OPC UA interfaces facilitate data communication between injection molding machines, auxiliary devices, and manufacturing execution systems, forming the technical basis for machine-to-machine interoperability in smart factories.

The OPC UA Protocol framework has become the global standard for industrial interoperability, enabling an injection molding machine (IMM) to provide a manufacturing execution system (MES) with approximately 200 types of data, such as molding conditions and status.

Additionally, the implementation of sensors and IoT technologies allows continuous collection of key parameters such as injection pressure, mold temperature, and cycle times, enhancing visibility across processes. These connected systems can optimize production, reduce waste, and support preventive maintenance by indicating variations before failures occur. Robotic automation in molding lines has demonstrated up to a 30% reduction in cycle times.

The digital manufacturing suites are integrating machine data and auxiliary equipment control to reduce downtime and improve operational efficiency in work cells. The shift to automation is reinforced by the broader manufacturing context of Industrial Internet of Things (IIoT) and cyber-physical systems, core pillars of smart manufacturing that improve productivity and adaptive control.

Geopolitical Impact Analysis

The Geopolitical Reality of Injection Molding Machine, Including Tariffs, Tensions, and Transformation.

The geopolitical tensions have introduced significant operational volatility into the injection molding machine market, primarily through protectionist trade policies and supply chain fragmentation. The U.S.-China trade conflict dynamics under 2025 policies include sequential tariff increases on Chinese goods, with additional U.S. tariffs up to 20% on imports from China and reciprocal Chinese levies of 10%-15% on U.S. exports, directly impacting cross-border trade flows and industrial inputs for global manufacturers.

For instance, as of late 2025, U.S. Section 232 tariffs on steel and aluminum, averaging 18% to 20%, have extended to injection molds and machinery, increasing capital expenditure for domestic processors. These measures introduce trade-policy-driven cost burdens on imported machinery components and molds, increasing procurement complexity for equipment reliant on transpacific supply lines.

Moreover, geopolitical fragmentation manifests in supply chain realignments, as manufacturers diversify sourcing away from single-country dependencies to mitigate exposure to tariffs and export control risks. Reported industrial shifts, such as U.S. firms relocating production and supplier networks from China to domestic bases with expanded contract commitments for plastics and machinery components, illustrate operational responses to these pressures.

These geopolitical forces influence delivery timelines, capital expenditure planning, and regional manufacturing strategies within the injection molding ecosystem, emphasizing strategic supply chain resilience over unfettered globalization.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Injection Molding Machine Market.

In 2024, the Asia Pacific dominated the global injection molding machine market, holding about 40.2% of the total global consumption, driven by substantial manufacturing investments and diversified end-use demand. The region accounts for the largest share of global installations and consumption. China remains the preeminent producer and consumer within the region, often exceeding a majority share of machine output and molded volume, with substantial production of hydraulic and hybrid units across multiple tonnage classes.

Similarly, the Chinese government initiatives, such as Made in China 2025, aim for 70% self-sufficiency in core technologies by 2025, which includes increasing domestic production of advanced machinery. Additionally, India, Japan, and Southeast Asian economies contribute significant unit consumption. The region’s dominance reflects large-scale automotive, electronics, and consumer goods manufacturing bases, where injection molding remains a core process for plastics and precision components.

- According to a report by the Indian Ministry of Commerce and Industry, India’s plastics exports recorded a healthy growth of 8% in April 2025, reflecting a strong production base.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of injection molding machines focus on a set of operational and technology-driven strategic activities to strengthen competitive positioning and expand market presence. Product differentiation through advanced automation, digital controls, and energy-efficient machine designs is a central priority, enabling higher precision, lower scrap rates, and reduced operating costs for customers.

Several manufacturers invest in R&D to develop hybrid and all-electric machines, as well as platforms compatible with Industry 4.0 standards for real-time monitoring and data integration. Additionally, localization of manufacturing and service networks is another key strategy, allowing for faster delivery, regulatory compliance, and responsive after-sales support in major end-use regions.

The Major Players in The Industry

- Arburg GmbH + Co KG

- Haitian International Holdings Limited

- Milacron

- Nissei Plastic Industrial Co., Limited

- Engel Austria GmbH

- Sumitomo (SHI) Demag Plastics Machinery GmbH

- Chen Hsong Holdings Limited

- Toyo Machinery & Metal Co., Ltd.

- Husky Injection Molding Systems Ltd

- Japan Steel Works Limited

- KraussMaffei Group

- UBE Machinery

- Shibaura Machine Co. Ltd.

- Wittmann Battenfeld

- Other Key Players

Key Development

- In January 2023, Sumitomo Heavy Industries launched a high-speed hybrid machine, iM18E, specifically for connectors and gears, raising the maximum injection speed up to 600 mm/sec and reducing power consumption by 50%.

- In November 2025, it was announced that Nissei Plastic Industrial Co., Ltd. and Toyo Innovex Co., Ltd. will be reorganized as wholly owned subsidiaries of a newly formed joint holding company, GMS Group Co., Ltd., through a share transfer with the effective date of the business integration to be April 1, 2026.

Report Scope:

Report Features Description Market Value (2024) USD 18.2 Bn Forecast Revenue (2034) USD 30.2 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastics and Metal), By Technology (Hydraulic, Electric, and Hybrid), By End-Use (Automotive, Consumer Goods, Packaging, Electronics, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Arburg GmbH + Co KG, Haitian International Holdings Limited, Milacron, Nissei Plastic Industrial Co., Limited, Engel Austria GmbH, Sumitomo (SHI) Demag Plastics Machinery GmbH, Chen Hsong Holdings Limited, Toyo Machinery & Metal Co., Ltd., Husky Injection Molding Systems Ltd., Japan Steel Works Limited, KraussMaffei Group, UBE Machinery, Shibaura Machine Co. Ltd., Wittmann Battenfeld, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Injection Molding Machine MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Injection Molding Machine MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Arburg GmbH + Co KG

- Haitian International Holdings Limited

- Milacron

- Nissei Plastic Industrial Co., Limited

- Engel Austria GmbH

- Sumitomo (SHI) Demag Plastics Machinery GmbH

- Chen Hsong Holdings Limited

- Toyo Machinery & Metal Co., Ltd.

- Husky Injection Molding Systems Ltd

- Japan Steel Works Limited

- KraussMaffei Group

- UBE Machinery

- Shibaura Machine Co. Ltd.

- Wittmann Battenfeld

- Other Key Players