Global Industrial UPS Market Size, Share, And Industry Analysis Report By Type (Online and Double Conversion, Line-interactive, Standby and Offline), By Power Rating (Above 500 KVA, 60 KVA to 500 KVA, Below 60 KVA), By Application (Data Center and Telecom, Manufacturing, Healthcare, Transportation, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168966

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

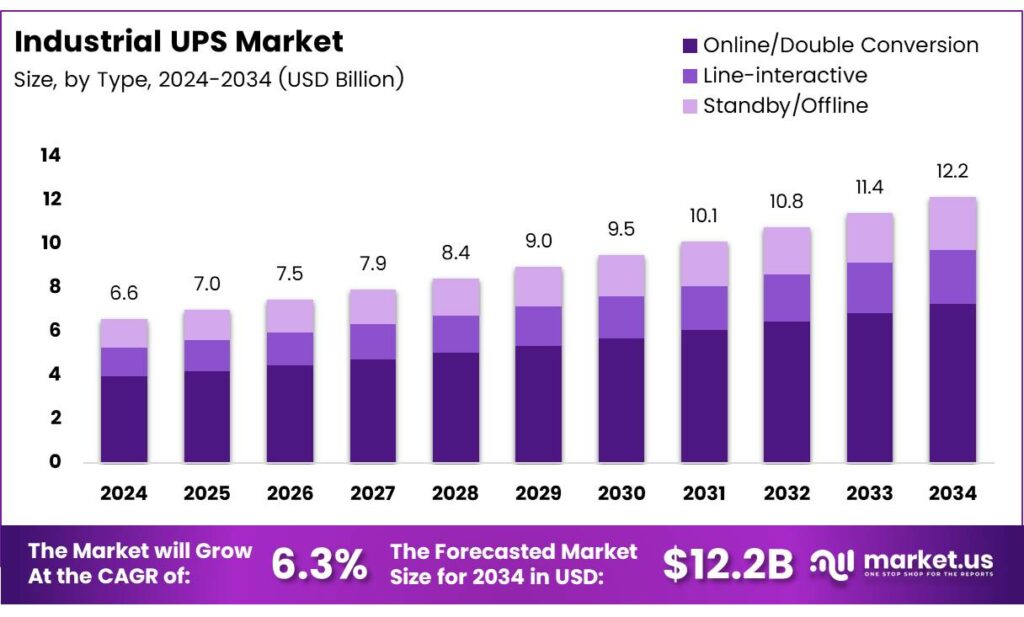

The Global Industrial UPS Market size is expected to be worth around USD 12.2 billion by 2034, from USD 6.6 billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Industrial UPS market refers to uninterrupted power systems engineered for mission-critical industrial operations requiring continuous, clean, and regulated electricity. It supports manufacturing lines, data-driven facilities, utilities, and institutional infrastructure where downtime causes financial and safety risks. Consequently, demand aligns closely with industrial automation, power quality standards, and resilient electrical infrastructure.

Industrial UPS adoption continues to expand steadily as industries digitize operations and depend on sensitive electronics. Growth is supported by rising usage of programmable logic controllers, industrial servers, automated printing machines, and computer centers. Buyers increasingly seek scalable, three-phase online UPS solutions for long operating lifecycles.

In India, government procurement through platforms like GeM encourages trusted industrial equipment sourcing. Enventa online industrial UPS offerings range from 3 kVA to 250 kVA, including 60 kVA and 100 kVA three-phase online UPS benefit institutions, computer centers, printing applications, and technical institutes seeking compliant power protection solutions within regulated procurement frameworks.

- Online UPS systems regulate output voltage within 2–3%, offering far tighter control than line-interactive systems operating within ±8–15% tolerance. This precision significantly reduces equipment stress, improves efficiency, and extends asset life in industrial environments. Based on IEEE power quality standards, offline and standby UPS systems experience unavoidable interruptions of 2–10 milliseconds.

Increasing awareness of power-quality losses supports Industrial UPS investment. The U.S. Department of Energy, poor power quality costs industries billions annually through downtime and equipment damage. Online Industrial UPS systems use double-conversion architecture, ensuring superior power conditioning. Incoming AC power converts to DC, passes through rechargeable batteries, and inverts back to stable AC output. This process delivers consistent 120 V and 230 V power, essential for voltage-sensitive industrial equipment.

Key Takeaways

- The Global Industrial UPS Market is projected to reach USD 12.2 billion by 2034, growing from USD 6.6 billion in 2024 at a 6.3% CAGR.

- Online and Double Conversion UPS dominate the market by type with a share of 58.1%, reflecting high demand for clean and uninterrupted power.

- Systems rated above 500 KVA lead the market, accounting for 44.9% of total revenue.

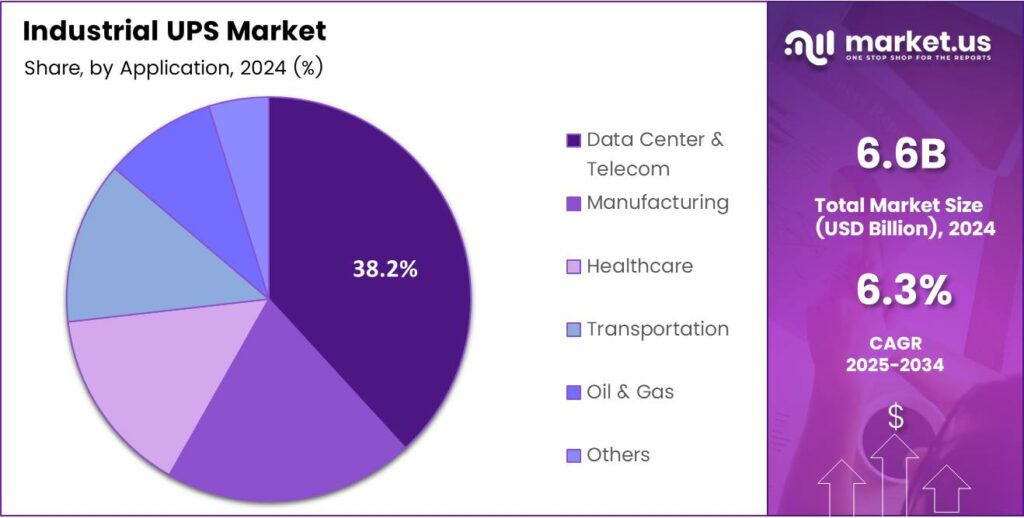

- Data Center and Telecom is the largest application segment, holding a market share of 38.2%.

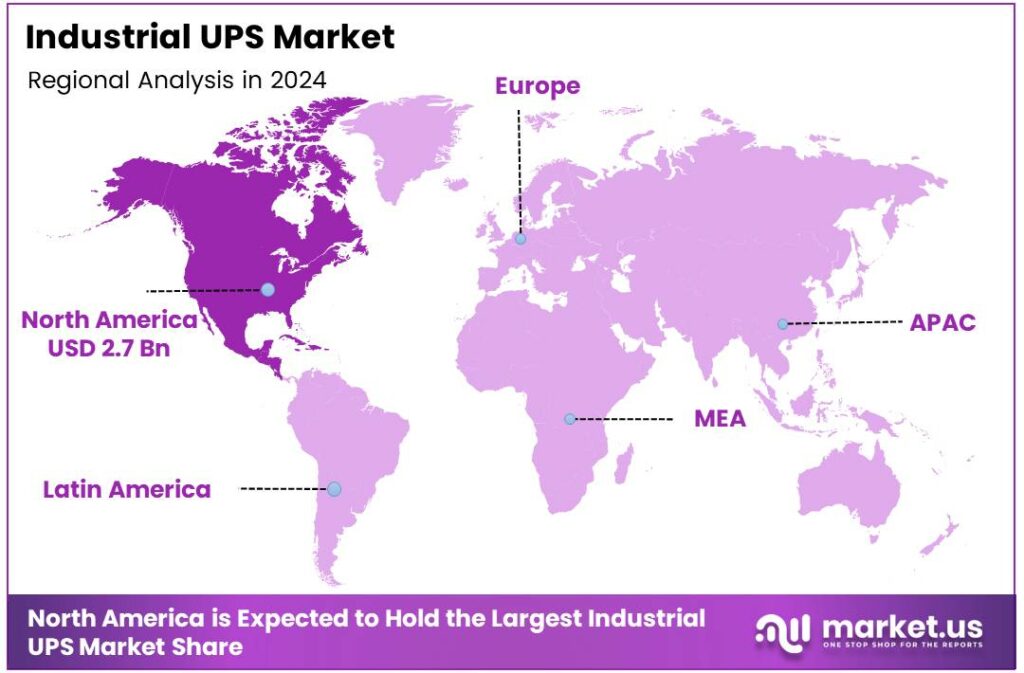

- North America dominates the global market with a share of 42.3%, valued at USD 2.7 billion.

By Type Analysis

Online and Double Conversion dominate with 58.1% due to their ability to deliver continuous and clean power for critical industrial operations.

In 2024, Online and Double Conversion held a dominant market position in the By Type Analysis segment of the Industrial UPS Market, with a 58.1% share. It leads because it provides constant power through double conversion, ensuring zero transfer time and protecting sensitive equipment.

Line-interactive UPS systems follow as a balanced option for industries needing voltage regulation with moderate backup protection. They are commonly deployed where grid power is fairly stable. Their efficiency and lower operating cost make them suitable for light industrial and distributed infrastructure applications.

Standby and Offline UPS solutions serve cost-sensitive environments where power disturbances are less frequent. These systems remain idle during normal operation and activate only during outages. As a result, adoption remains lower in heavy industrial settings but steady in auxiliary and support areas.

By Power Rating Analysis

Above 500 KVA dominates with 44.9%, driven by rising demand from large-scale industrial and infrastructure projects.

In 2024, Above 500 KVA held a dominant market position in the By Power Rating Analysis segment of the Industrial UPS Market, with a 44.9% share. Growth is supported by capacity expansion in data centers, utilities, and heavy manufacturing requiring high-load power protection.

60 KVA to 500 KVA systems act as a bridge between medium and large installations. These UPS units are widely used in factories, commercial complexes, and telecom hubs. Their flexibility supports growing industrial digitalization while maintaining a manageable footprint and investment requirements.

Below 60 KVA UPS systems cater to small industrial units and control rooms. They protect automation systems, monitoring devices, and localized equipment. Although limited in load capacity, their compact design and easier installation sustain stable uptake in decentralized industrial operations.

By Application Analysis

Data Center and Telecom leads with 38.2%, reflecting the critical need for uninterrupted power in digital infrastructure.

In 2024, Data Center and Telecom held a dominant market position in the By Application Analysis segment of the Industrial UPS Market, with a 38.2% share. Rapid data traffic growth and network expansion continue to drive strong reliance on high-reliability UPS systems.

Manufacturing applications depend on Industrial UPS to avoid production downtime and equipment damage. Power continuity supports automated lines and precision machinery. As factories adopt smart manufacturing practices, UPS adoption remains steady across discrete and process manufacturing facilities.

Healthcare relies on Industrial UPS systems to ensure patient safety and operational continuity. Backup power protects imaging systems, laboratories, and life-support equipment. Reliability and compliance requirements sustain consistent demand across hospitals and large diagnostic centers.

Transportation applications use Industrial UPS for signaling, control systems, and communication networks. Power reliability is essential for operational safety. Infrastructure upgrades and urban transit expansion support moderate but consistent adoption.

Key Market Segments

By Type

- Online and Double Conversion (58.1)

- Line-interactive

- Standby and Offline

By Power Rating

- Above 500 KVA (44.9)

- 60 KVA to 500 KVA

- Below 60 KVA

By Application

- Data Center and Telecom (38.2)

- Manufacturing

- Healthcare

- Transportation

- Oil and Gas

- Others

Emerging Trends

Shift Toward Energy-Efficient and Digitally Monitored UPS Systems Shapes Market Trends

A key trend in the Industrial UPS market is the shift toward energy-efficient designs. Companies want UPS systems that reduce power losses and lower electricity bills. High-efficiency double-conversion UPS systems are gaining attention due to their ability to deliver stable output with less energy waste.

- Digital monitoring and remote management are also becoming standard features. Modern UPS systems now offer real-time performance tracking, predictive maintenance alerts, and remote control capabilities. Large power-equipment manufacturers are increasingly promoting lithium-ion UPS because they occupy up to 40% less floor space and last 2–3 times longer than lead-acid systems.

Another important trend is the use of advanced battery technologies, such as lithium-ion batteries. These batteries offer longer life, faster charging, and less maintenance compared to traditional lead-acid batteries. Together, efficiency improvements and smart monitoring are reshaping how industries view and use UPS systems.

Drivers

Growing Need for Uninterrupted Power Supply in Critical Industrial Operations Drives Market Growth

Industries today rely heavily on continuous power to keep operations stable and safe. Sectors such as manufacturing, oil & gas, chemicals, data centers, and transportation cannot afford sudden power failures. Even a short outage can damage equipment, halt production, or cause data loss. This growing dependence on reliable electricity is a key driver for the Industrial UPS market.

- Industrial facilities are also using more automated systems, robotics, and digital control panels. These systems are highly sensitive to voltage fluctuations and power interruptions. Industrial robots installed 553,000 new units in a single year, increasing dependence on uninterrupted power for safety and precision operations.

Industrial UPS systems help maintain stable power quality, protecting machines and reducing downtime. As automation spreads across factories, the demand for robust UPS solutions continues to rise. In addition, aging power infrastructure in many regions leads to frequent voltage drops and power disturbances.

Restraints

High Initial Investment and Maintenance Costs Act as a Market Restraint

One major restraint in the Industrial UPS market is the high upfront cost. Industrial-grade UPS systems require advanced power electronics, large battery banks, and strong thermal management systems. For small and medium-sized industries, these initial costs can be difficult to justify, especially in price-sensitive markets.

- Beyond installation, regular maintenance also adds to the overall expense. Batteries need periodic replacement, and systems require skilled technicians for inspections and servicing. The U.S. DOE, batteries alone can contribute to the U.S. 30–40% of total UPS system cost, especially in high-availability industrial environments.

Another challenge is the space requirement for large UPS systems, especially in older industrial facilities with limited layout flexibility. Some companies choose backup generators instead, as they appear cheaper in the short term. These cost and infrastructure challenges slow down adoption, particularly among smaller industrial users.

Growth Factors

Expansion of Data Centers and Smart Manufacturing Creates New Growth Opportunities

The rapid expansion of data centers worldwide presents a strong growth opportunity for the Industrial UPS market. Data centers require constant, high-quality power to protect servers, storage systems, and network equipment. Industrial UPS systems are essential for preventing data loss and service disruption during power failures.

Smart manufacturing and Industry 4.0 initiatives are also opening new doors. Factories are increasingly using sensors, AI-driven systems, and real-time monitoring tools. These technologies need clean and uninterrupted power to work efficiently. Industrial UPS solutions play a critical role in ensuring operational continuity in such advanced setups.

Additionally, growing investments in renewable energy and microgrids create demand for UPS systems to balance power variations. As industries modernize and digitize operations, the scope for Industrial UPS adoption continues to expand strongly.

Regional Analysis

North America Dominates the Industrial UPS Market with a Market Share of 42.3%, Valued at USD 2.7 Billion

North America remains the leading region in the industrial UPS market due to the strong presence of large-scale manufacturing units, data centers, and energy-intensive industries. The region accounted for a dominant 42.3% share, valued at USD 2.7 billion, supported by high investments in grid reliability and backup power systems. Strict power quality standards and frequent modernization of electrical infrastructure continue to support steady demand.

Europe shows consistent adoption of industrial UPS systems driven by industrial automation, renewable energy integration, and stringent safety regulations. Countries across the region emphasize uninterrupted power for critical infrastructure such as railways, healthcare facilities, and industrial plants. The push toward energy efficiency and carbon reduction also encourages the deployment of advanced UPS technologies across industrial environments.

Asia Pacific is witnessing fast-paced growth due to rapid industrialization, expanding manufacturing bases, and rising digital infrastructure. Growing investments in factories, smart industrial zones, and large-scale data processing facilities are increasing the need for power continuity solutions. Power grid instability in developing economies further strengthens the demand for industrial UPS installations.

The U.S. market plays a crucial role within North America, supported by advanced manufacturing, cloud infrastructure, and critical industrial operations. High reliance on automated systems and digital production processes increases the need for reliable backup power. Continued investments in smart factories and grid resilience sustain long-term UPS demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Delta Electronics, Inc. continues to strengthen its position in the Industrial UPS Market through high-efficiency power electronics and scalable UPS architectures. In 2024, its focus on energy-efficient designs, modular systems, and integration with smart factories supports industries seeking reduced operating costs. Delta’s strong presence in Asia and expanding industrial footprint globally reinforce its long-term reliability advantage.

Eaton remains a key contributor to industrial power continuity by combining UPS systems with broader electrical distribution and power management solutions. During 2024, Eaton emphasises ruggedised UPS models designed for harsh industrial environments such as manufacturing, oil and gas, and utilities. Its ability to offer end-to-end power infrastructure strengthens customer loyalty and repeat deployments.

Huawei Digital Power Technologies Co., Ltd leverages advanced digital power platforms, combining UPS hardware with intelligent monitoring and AI-driven energy management. In 2024, Huawei’s industrial UPS strategy centres on high-density, high-reliability systems for data-intensive and automation-driven industries. Strong R&D investments support rapid innovation, especially in digitally enabled power protection solutions.

Kehua Tech plays an important role in industrial UPS by focusing on high-capacity systems and customised solutions for mission-critical applications. In 2024, the company emphasises technological reliability, grid adaptability, and localised manufacturing advantages. Kehua’s growing exposure in emerging industrial markets supports steady demand from power, transport, and heavy manufacturing sectors.

Top Key Players in the Market

- Delta Electronics, Inc.

- Eaton

- Huawei Digital Power Technologies Co., Ltd

- Kehua Tech

- Riello Elettronica

- Schneider Electric

- Shenzhen Kstar Science and Technology Co., Ltd.

- Vertiv Group Corp

Recent Developments

- In 2025, Delta Electronics continues to emphasize innovation in uninterruptible power supply (UPS) solutions tailored for industrial and data center applications, with a focus on high-reliability modular systems and energy-efficient infrastructure. The company unveiled a new 500m² Customer Experience Center in Soest, Germany, dedicated to data center and UPS solutions.

- In 2025, Eaton will have advanced its industrial UPS portfolio with a strong emphasis on high-density, energy-efficient architectures for AI-driven data centers and harsh industrial environments. Eaton unveiled a next-generation reference architecture for 800 VDC power infrastructure, developed in collaboration with NVIDIA, to support AI factories.

Report Scope

Report Features Description Market Value (2024) USD 6.6 billion Forecast Revenue (2034) USD 12.2 billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Online and Double Conversion, Line-interactive, Standby and Offline), By Power Rating (Above 500 KVA, 60 KVA to 500 KVA, Below 60 KVA), By Application (Data Center and Telecom, Manufacturing, Healthcare, Transportation, Oil and Gas, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Delta Electronics, Inc., Eaton, Huawei Digital Power Technologies Co., Ltd, Kehua Tech, Riello Elettronica, Schneider Electric, Shenzhen Kstar Science and Technology Co., Ltd., Vertiv Group Corp Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Delta Electronics, Inc.

- Eaton

- Huawei Digital Power Technologies Co., Ltd

- Kehua Tech

- Riello Elettronica

- Schneider Electric

- Shenzhen Kstar Science and Technology Co., Ltd.

- Vertiv Group Corp