Global Industrial Starches Market Size, Share Analysis Report By Source (Corn, Wheat, Cassava, Potato, Others), By Type (Native, Modified), By Product (Native Starch and Starch Derivatives And Sweeteners, Cationic Starch, Ethylated Starch, Oxidized Starch, Acid Modified Starch, Unmodified Starch), By Application (Food And Beverage, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174175

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

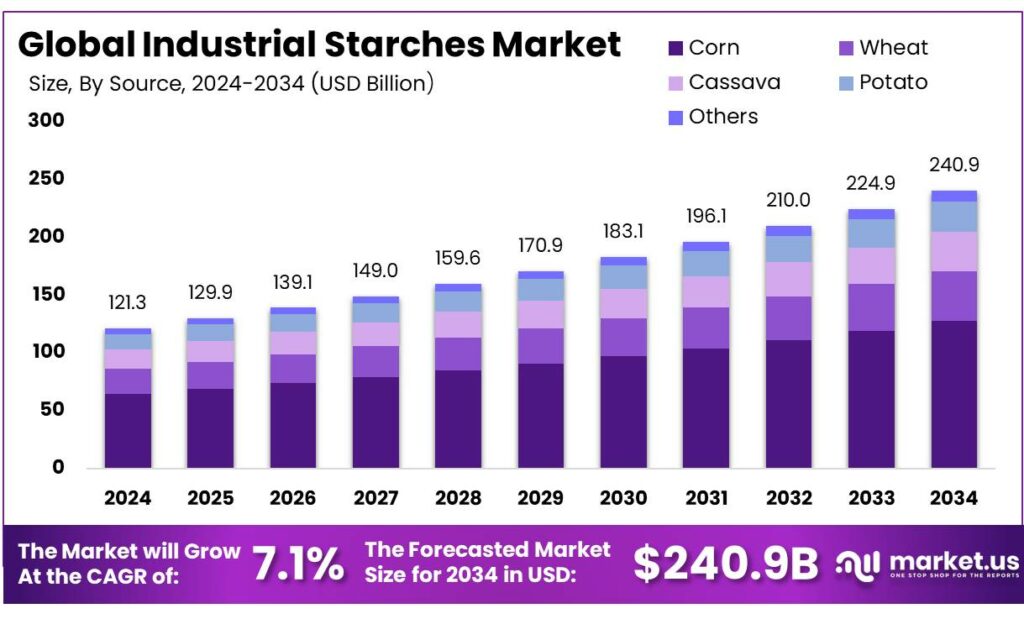

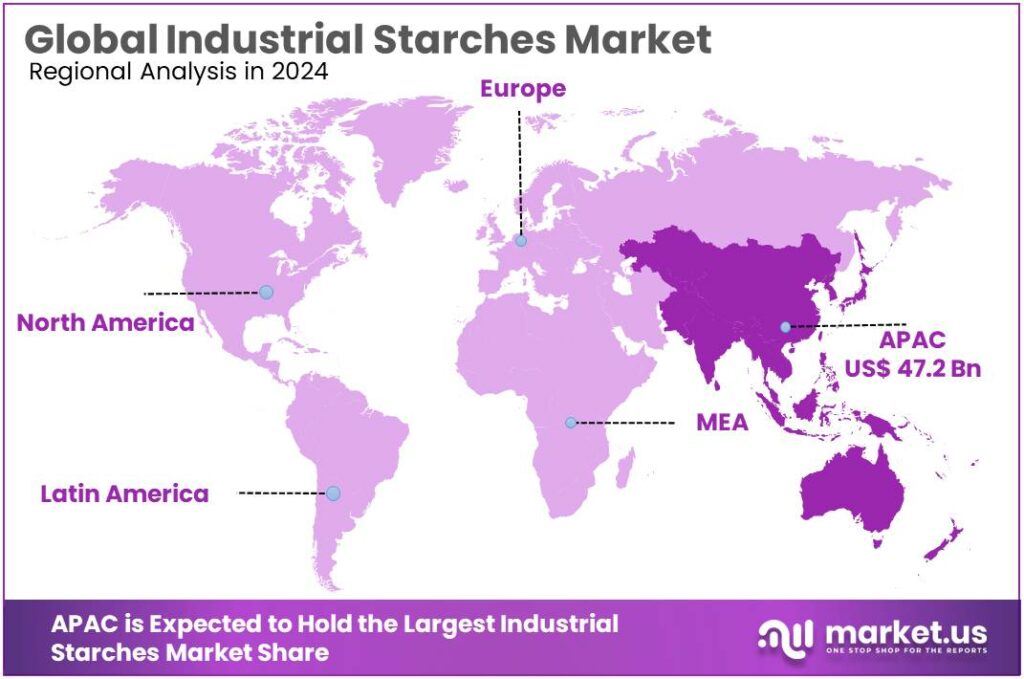

Global Industrial Starches Market size is expected to be worth around USD 240.9 Billion by 2034, from USD 121.3 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 39.9% share, holding USD 47.2 Billion in revenue.

Industrial starches are plant-based carbohydrates processed from crops such as maize, wheat, potato, and cassava, then engineered into native and modified forms to deliver binding, thickening, film-forming, and adhesive performance across food and non-food industries. Global feedstock availability underpins this scale—maize output alone reached about 1.2 billion tonnes in 2023, illustrating the depth of the crop base that industrial starch supply chains can draw from.

From an industrial scenario standpoint, starch demand sits downstream of large, steadily expanding food and feed flows, and upstream of multiple manufacturing chains. FAO projects world cereal utilization in 2025/26 to rise by 59.2 million tonnes, reflecting higher use across major cereals. The same FAO brief forecasts world cereal trade at 500.6 million tonnes in 2025/26, reinforcing how globally traded grain markets shape starch feedstock availability and pricing. On the roots-and-tubers side, cassava remains a critical starch source in parts of Asia, Africa, and Latin America; a 2024 peer-reviewed synthesis reports global cassava production reaching about 315 million tonnes in 2021.

Key driving factors combine food processing needs with industrial energy and materials transitions. In the United States, USDA ERS estimates total food, seed, and industrial corn use at 6.89 billion bushels in 2024/25, including corn used for ethanol at 5.5 billion bushels—a pull that influences starch-bearing crop economics and co-product streams. In India, policy-led biofuel scaling is also material: the Government of India reports ethanol blending rising to 17.98% in ESY 2024–25 and confirms the 20% blending target for ESY 2025–26 under the amended National Policy on Biofuels.

Policy is reinforcing this trajectory in multiple regions. India’s government has explicitly linked feedstock availability measures to achieving a 20% ethanol blending target by Ethanol Supply Year 2025–26, and official communication on the ethanol program reports macro benefits such as ₹1,06,072 crore foreign-exchange savings, 544 lakh metric tons of CO₂ reduction, and 181 lakh metric tons crude-oil substitution over the past decade. Such targets and outcomes encourage longer-term procurement contracts and new milling/fermentation assets, indirectly supporting industrial starch demand and derivative product diversification.

Key Takeaways

- Industrial Starches Market size is expected to be worth around USD 240.9 Billion by 2034, from USD 121.3 Billion in 2024, growing at a CAGR of 7.1%.

- Corn held a dominant market position, capturing more than a 53.2% share in the industrial starches market.

- Modified held a dominant market position, capturing more than a 69.1% share in the industrial starches market.

- Starch Derivatives & Sweeteners held a dominant market position, capturing more than a 36.3% share in the industrial starches market.

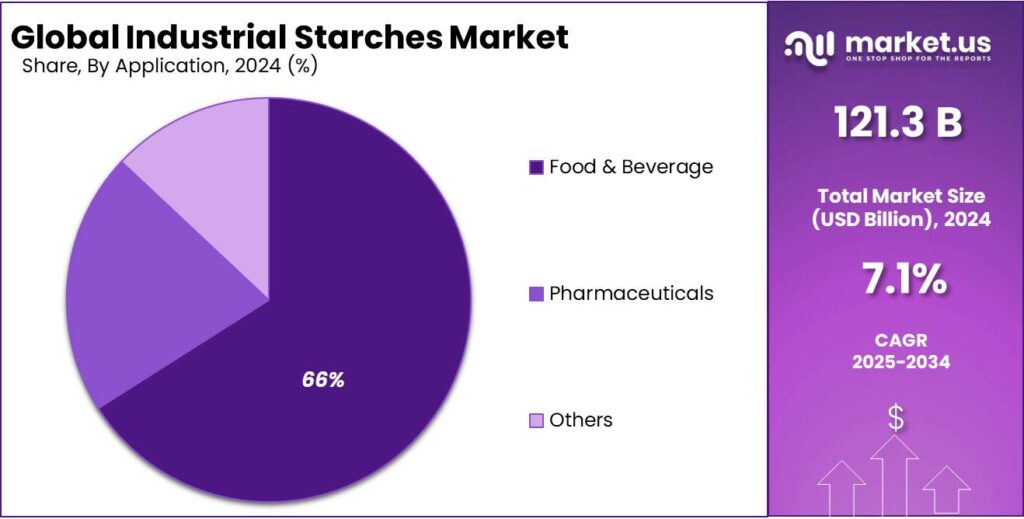

- Food & Beverage held a dominant market position, capturing more than a 66.8% share in the industrial starches market.

- Asia Pacific emerged as the dominating region in the industrial starches market, holding a 39.9% share valued at USD 47.2 Bn.

By Source Analysis

Corn-based starch leads with a 53.2% share due to wide industrial use

In 2024, Corn held a dominant market position, capturing more than a 53.2% share in the industrial starches market by source. This strong position is mainly due to the wide availability of corn and its ability to produce multiple starch grades for food, paper, textiles, and adhesives. Corn starch is easy to process, offers stable performance, and fits well into large-scale industrial operations. Manufacturers prefer corn because it delivers consistent quality while supporting high-volume production, making it the most commonly used starch source across industries during 2024.

By Type Analysis

Modified starch dominates with a 69.1% share due to better performance

In 2024, Modified held a dominant market position, capturing more than a 69.1% share in the industrial starches market by type. This leadership comes from its improved functional properties compared to native starch, such as better stability, higher viscosity control, and resistance to heat, shear, and processing stress. Industries such as food processing, paper, textiles, and adhesives rely on modified starch to deliver consistent results in demanding production environments. Its ability to perform reliably across different temperatures and formulations makes it the preferred choice for manufacturers focused on quality and efficiency throughout 2024.

By Product Analysis

Starch derivatives & sweeteners lead with a 36.3% share driven by versatility

In 2024, Starch Derivatives & Sweeteners held a dominant market position, capturing more than a 36.3% share in the industrial starches market by product. This segment leads because it offers a wide range of functional ingredients used across food, beverages, pharmaceuticals, and industrial applications. Products such as syrups, maltodextrins, and specialty derivatives provide sweetness, texture, and stability, making them essential for processed foods and drinks. Their ability to improve taste, mouthfeel, and shelf life keeps demand strong across multiple industries during 2024.

By Application Analysis

Food & beverage applications dominate with a 66.8% share due to daily consumption

In 2024, Food & Beverage held a dominant market position, capturing more than a 66.8% share in the industrial starches market by application. This strong share reflects the heavy use of starches in everyday food products such as bakery items, dairy foods, sauces, soups, snacks, and beverages. Industrial starches are widely used as thickeners, stabilizers, binders, and sweetening agents, helping manufacturers achieve consistent texture and taste at large production volumes. Because food and beverage products are produced continuously and consumed daily, demand for starch-based ingredients remained high throughout 2024.

Key Market Segments

By Source

- Corn

- Wheat

- Cassava

- Potato

- Others

By Type

- Native

- Modified

By Product

- Native Starch and Starch Derivatives & Sweeteners

- Cationic Starch

- Ethylated Starch

- Oxidized Starch

- Acid Modified Starch

- Unmodified Starch

By Application

- Food & Beverage

- Feed

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Convenience Foods

- Others

- Pharmaceuticals

- Others

Emerging Trends

Starch Plants Are Turning into Full Biorefineries

A clear latest trend in industrial starches is the shift from “starch-only” output to biorefinery-style production, where one factory is designed to extract multiple high-value streams from the same crop. Instead of focusing mainly on starch, modern processors increasingly sell starch + plant proteins + fibres into food, feed, and industrial customers. This trend matters because it changes the economics: when a processor can earn revenue from several co-products, it can invest more confidently in specialty starch grades, quality systems, and application support—rather than competing only on bulk pricing.

Europe is a strong example of how this model is taking shape. Starch Europe notes that the European starch industry produces 9.8 million tonnes of starch and starch-derivatives and more than 5 million tonnes of proteins and fibres each year, primarily extracted from about 22 million tonnes of EU-grown wheat, maize, and starch potatoes. This shows the “co-product mindset” is already industrial-scale, not experimental. Starch Europe also frames the sector as a rural manufacturing engine: it cites 75 plants in 19 EU Member States, processing 24 million tonnes of agricultural raw materials, generating revenues of €7.4 billion, and producing 10.7 million tonnes of starches and starch-derivatives plus over 5 million tonnes of plant-based proteins and fibres.

This same trend is closely tied to how food and packaging supply chains are changing. Large-volume sectors like paper and board still provide a stable outlet for starch-based functional chemistry. FAO reported that world paper production dropped by 3% in 2023 but still reached 401 million tonnes, which keeps demand strong for starch used in paper strength, surface treatment, and corrugating adhesives. When paper volumes are this large, starch processors benefit from predictable baseline industrial demand, while co-products give them additional revenue streams that help balance cyclical swings.

Government strategy is also pushing this “whole-crop utilization” approach. The European Commission stated that the EU bioeconomy had a value of up to €2.7 trillion in 2023 and employed 17.1 million people, highlighting how biomass-based industries are being positioned as a core part of industrial competitiveness. For starch producers, this is an enabling signal: policies that back bioeconomy growth make it easier to justify investments in upgraded fractionation, protein recovery, fibre applications, and lower-waste processing.

Drivers

Recyclable Packaging Rules Are Lifting Starch Use

One major driving factor for industrial starches is the packaging-and-paper industry’s steady move toward recyclable, fiber-based formats, where starch is a proven, cost-effective helper. In corrugated boxes, starch-based adhesives are widely used to bond paper layers, and starch derivatives are also used for surface sizing and strength improvement in paper and paperboard. This demand is not “fashion driven”; it follows the reality that global paper and packaging volumes remain huge, so even small recipe shifts create large starch pull-through. The FAO reported that world paper production fell by 3% in 2023, yet it still stood at 401 million tonnes, showing how large the base remains for starch-linked applications in packaging and papermaking.

Policy is turning that base demand into a stronger structural tailwind. The European Commission’s packaging direction is clear: all packaging must be recyclable by 2030, meaning materials and designs must work in real recycling systems rather than ending as waste. When brand owners and converters respond to this kind of rule, they often simplify structures, lean harder on paper-based packs, and reduce reliance on hard-to-recycle multi-material combinations. In practical terms, that pushes more volume into paper and board, and it increases the need for paper strength, runnability, and bonding performance—areas where starch solutions already have deep industrial acceptance. Because starches can deliver tack, viscosity control, and film formation without changing the “paper-first” recycling story, they fit the direction of travel in packaging compliance.

Industry data from Europe shows how meaningful non-food demand already is. Starch Europe states that European consumption is 7.2 million tonnes of starch and starch-derivatives, with 44% going into non-food uses such as paper and corrugating. That split matters because it signals industrial starch is not dependent only on food cycles; packaging and paper provide a second engine that can keep running even when food categories rotate. On the supply side, the same source notes Europe produces 9.8 million tonnes of starch and starch-derivatives from about 22 million tonnes of EU-grown wheat, maize, and starch potatoes—evidence of large, integrated capacity built specifically to serve both food and industrial buyers.

Restraints

Feedstock Price Swings Squeeze Starch Maker Margins

A major restraint for industrial starches is simple but stubborn: the business depends on large volumes of farm crops, and crop economics can swing fast. Starch producers buy corn/maize, wheat, potatoes, or cassava in bulk, then sell starches and derivatives into contracts that may not reprice as quickly as grain. When raw material costs jump, margins tighten first, and volume decisions get conservative. This is not a niche issue—industrial starch is tied to major food and industrial supply chains, so volatility travels straight from fields to factories.

The pressure is amplified because the same crops are increasingly pulled into competing uses, especially ethanol. In India, the government confirmed that oil marketing companies achieved an average ethanol blending of 19.05% under the Ethanol Blended Petrol program, and 19.93% blending was achieved during July 2025. When blending targets rise, more feedstock is routed into fuel supply, which can tighten availability for industrial users in certain regions and seasons. Reuters also reported that, in 2024/25, India allocated 5.2 million metric tons of rice for ethanol—up from 3,000 tons the prior year—showing how quickly policy can redirect starch-rich grains into non-food channels when stocks are high or goals shift.

Global price signals underline the same constraint. The FAO Cereal Price Index for the whole of 2025 averaged 107.9 points, down 4.9% versus 2024, but FAO’s December commentary also flagged that cereal quotations can firm on export concerns and biofuel-linked demand in large producers. For starch manufacturers, the direction is less important than the unpredictability: when prices fall, customer negotiations often demand immediate savings; when prices rise, passing costs through can lag. This “asymmetry” is a real operational brake because it makes earnings less stable and discourages aggressive capacity utilization during uncertain months.

Europe’s own industry numbers show how exposed the sector is to agricultural throughput. Starch Europe reports that its members process about 22 million tonnes of agricultural raw materials into 9.8 million tonnes of starch derivatives, and EU consumption totals 7.2 million tonnes of starch and starch-derivatives. Those volumes are large enough that even small disruptions—weather-driven yield losses, logistics bottlenecks, or policy-driven demand shifts—can move procurement costs materially.

Opportunity

Bio-Based Materials Push Opens New Starch Demand

A major growth opportunity for industrial starches is the fast-expanding push to replace fossil-based plastics and additives with bio-based, renewable materials. Starch fits this shift because it can act as a direct polymer, a blend component, or a low-impact functional additive in coatings, binders, and barrier layers. This is becoming less of a “green niche” and more of a procurement rulebook, especially in regions tightening packaging requirements and setting circular-economy goals. When brand owners try to simplify materials and improve end-of-life outcomes, starch-based solutions often become the practical option that engineers can scale without waiting for breakthrough chemistry.

The capacity numbers from the bioplastics industry show how big this runway is getting. European Bioplastics projects global bioplastics production capacity rising from about 2.47 million tonnes (2024) to around 5.73 million tonnes (2029)—more than doubling within five years. Importantly, the same group reported that actual bioplastics production in 2024 was about 1.44 million tonnes, with an average utilisation rate of 58%. For starch-linked materials, this gap is a real commercial signal: there is room to increase output using existing assets and supply chains, which can lower the barrier for new starch-based grades to win volume in packaging, shopping bags, food service items, and agricultural films.

Government policy is also strengthening the case for starch-led materials. The European Commission’s packaging direction states that all packaging must be recyclable by 2030, pushing companies to redesign packs, reduce problematic structures, and move toward solutions that work in real collection and recycling systems. In parallel, the EU is openly positioning the bioeconomy as a pillar of industrial competitiveness. In the Commission’s own 2025 communication, the EU bioeconomy is valued at up to €2.7 trillion (2023) and employs about 17.1 million people.

From an end-use angle, packaging remains the biggest practical bridge between policy and starch demand. FAO reported world paper production at 401 million tonnes in 2023, and packaging grades are a major share of that system. As more brands lean into fiber-based packaging to meet recyclability goals, starch demand can grow through paper strengthening, surface treatment, and corrugated board adhesives. At the same time, starch-based and starch-blend bioplastics can fill gaps where paper alone struggles—like moisture resistance, grease handling, or controlled compostability—without forcing a return to fully fossil-based materials.

Regional Insights

Asia Pacific dominates industrial starch demand with a 39.9% share, valued at 47.2 Bn

In 2024, Asia Pacific emerged as the dominating region in the industrial starches market, holding a 39.9% share valued at USD 47.2 Bn, supported by its large population base, expanding food processing sector, and strong agricultural raw material availability. Countries across the region are major producers and consumers of starch-based products, especially for food, beverages, paper, textiles, and industrial applications. The widespread use of starch in daily diets, combined with rising consumption of processed and packaged foods, keeps industrial starch demand structurally high across the region.

A key strength of Asia Pacific is its strong supply-side ecosystem. The region benefits from abundant corn, rice, cassava, and wheat production, which supports large-scale starch processing at competitive costs. This availability allows manufacturers to maintain steady production while meeting demand from both domestic consumption and export-oriented industries. Rapid urbanization and changing lifestyles in major economies are also increasing reliance on convenience foods, where starch plays a central role in texture, stability, and shelf-life performance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM is a major global processor of agricultural commodities and industrial starches. In 2024, ADM generated approximately USD 93 billion in revenue and employed around 41,000 people worldwide. Its starch portfolio supports food, beverage, and industrial customers through integrated sourcing, processing, and logistics across 160+ countries.

Tate & Lyle focuses on specialty starches and sweeteners for food and industrial use. In 2024, it recorded revenues of roughly GBP 1.75 billion and employed about 3,500 people worldwide. The company’s starch solutions support texture, stability, and performance across food, beverage, and selected industrial applications.

AGRANA is a European supplier of starch and sugar-based products. In 2024, the company reported revenues of around EUR 3.8 billion and employed approximately 9,000 people. Its starch operations support food processing and industrial uses, with production sites spread across Europe and selected global markets.

Top Key Players Outlook

- Cargill, Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- AGRANA Beteiligungs-AG

- Grain Processing Corporation

- Roquette Frères

- Tereos Group

- Royal Cosun

- Altia Industrial

Recent Industry Developments

In 2024, Cargill recorded approximately USD 160 billion in revenue and operated with about 160,000 employees worldwide, reflecting its large scale in agricultural commodities and ingredient supply.

In 2024, ADM reported USD 85.5 billion in revenue and USD 1.8 billion in net earnings, supported by more than 44,000 employees and operations across 270+ plants worldwide, reflecting its deep role in carbohydrate solutions such as starch and sweetener production.

Report Scope

Report Features Description Market Value (2024) USD 121.3 Bn Forecast Revenue (2034) USD 240.9 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Corn, Wheat, Cassava, Potato, Others), By Type (Native, Modified), By Product (Native Starch and Starch Derivatives And Sweeteners, Cationic Starch, Ethylated Starch, Oxidized Starch, Acid Modified Starch, Unmodified Starch), By Application (Food And Beverage, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Tate & Lyle PLC, AGRANA Beteiligungs-AG, Grain Processing Corporation, Roquette Frères, Tereos Group, Royal Cosun, Altia Industrial Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- AGRANA Beteiligungs-AG

- Grain Processing Corporation

- Roquette Frères

- Tereos Group

- Royal Cosun

- Altia Industrial