Global Hydroseeding Market Size, Share, And Enhanced Productivity By Type (Bonded Fiber Matrix (BFM) Mulch, Wood Fiber Mulch, Blended Mulch, Paper Mulch), By Application (Beautifying Yards, Stopping Erosion, Reducing Dust Pollution, Preventing Weed Growth, Creating Athletic Fields or Parks, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172107

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

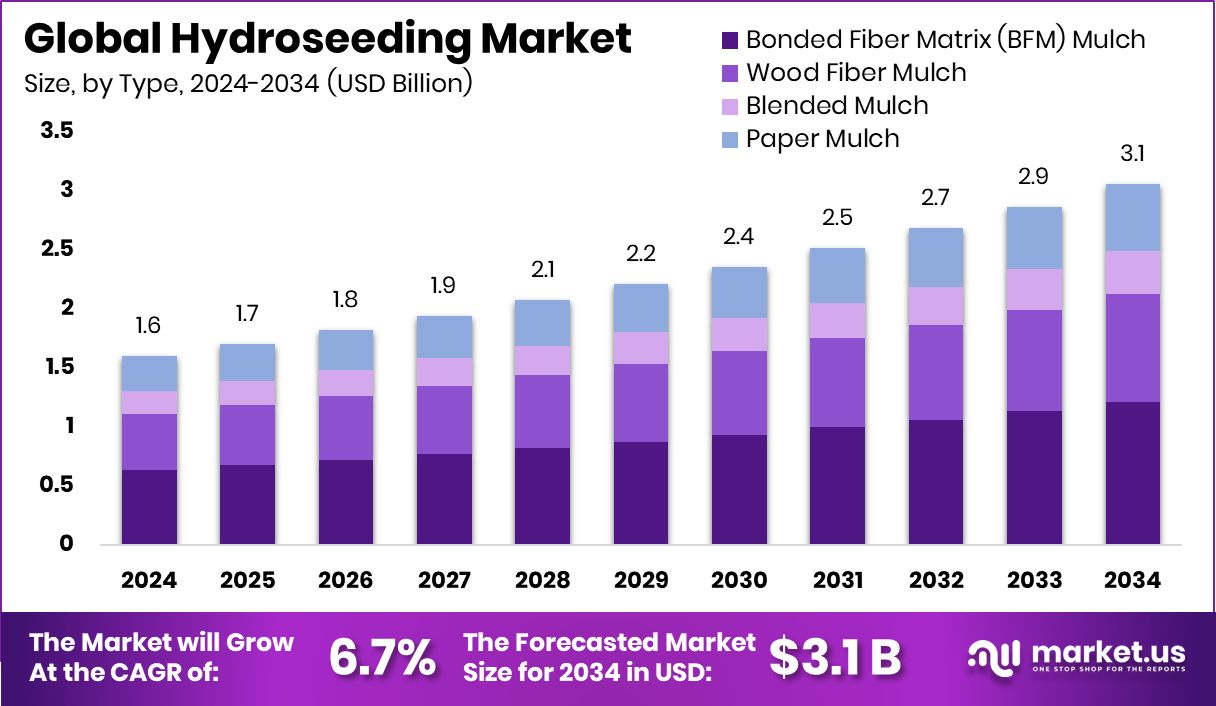

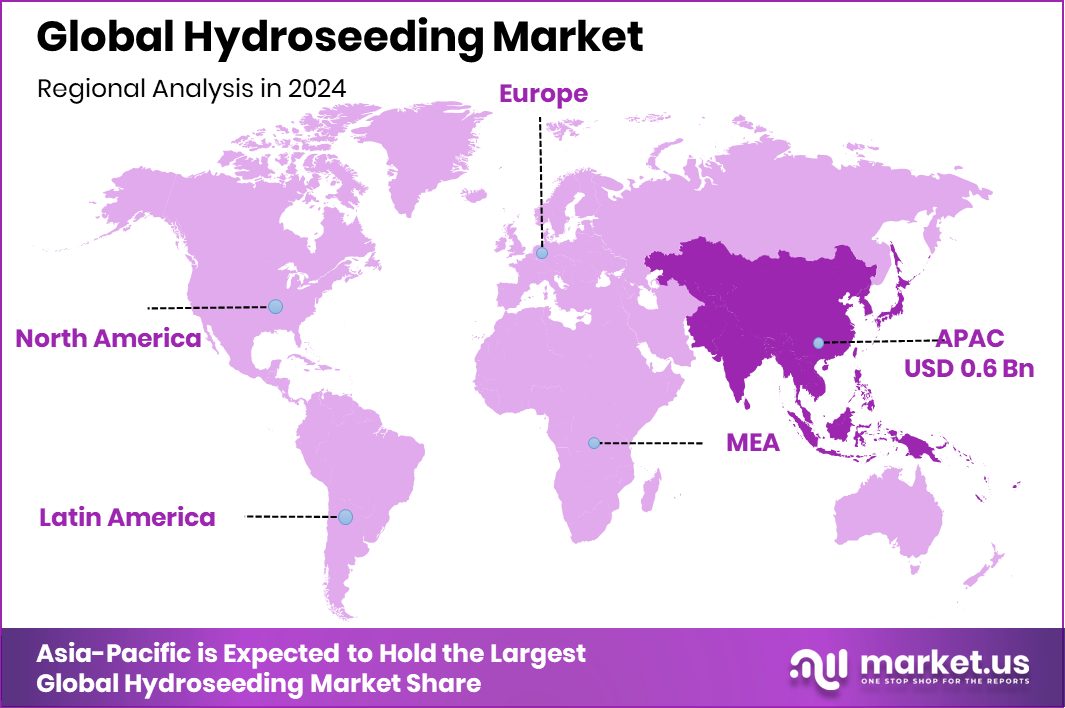

The Global Hydroseeding Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. The hydroseeding market in the Asia Pacific contributes 43.60% of global revenue, USD 0.6 billion.

Hydroseeding is a groundcover planting method that sprays a blended slurry of seed, mulch, water, and tackifiers over soil, helping vegetation sprout quickly and uniformly. It’s widely used for erosion control, landscaping, restoration, and slope stabilization because it covers large areas faster and more gently than traditional seeding. The slurry protects the seed from wind and water loss, improving germination and reducing the need for re‑work.

The hydroseeding market refers to the overall demand and supply of hydroseeding services, equipment, and materials used in landscaping, construction, and environmental projects. It includes the sale of hydroseeding machines, fiber mulches, seed blends, and additives that improve soil health and plant growth. This market grows as more landowners, developers, and governments adopt efficient revegetation methods for open spaces, infrastructure corridors, and reclaimed land.

One strong growth factor is increased funding for climate‑resilience projects. For example, State Launches $100 Million Grant Program ‘Prepare California’ Designed to Build More Resilient Communities, which encourages green infrastructure and erosion control efforts, driving hydroseeding demand where land needs restoration after wildfires and floods.

Demand is rising as sustainable solutions gain priority, and opportunity exists in developing plastic‑free and circular materials like Fiberdom, securing €3.5M in funding to drive plastic‑free, circular material innovations, which can feed into eco‑friendly hydroseeding inputs.

Additional opportunities include SaXcell securing €4 mn funding to launch a full‑scale production plant for regenerated fibers and Aisti securing €29M to build a new factory for sustainable wood fibre‑based acoustic tiles production, which signals wider support for sustainable biomaterials that can intersect with hydroseeding mulch development.

Key Takeaways

- The Global Hydroseeding Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- Bonded Fiber Matrix (BFM) mulch dominates the hydroseeding market with 39.5%.

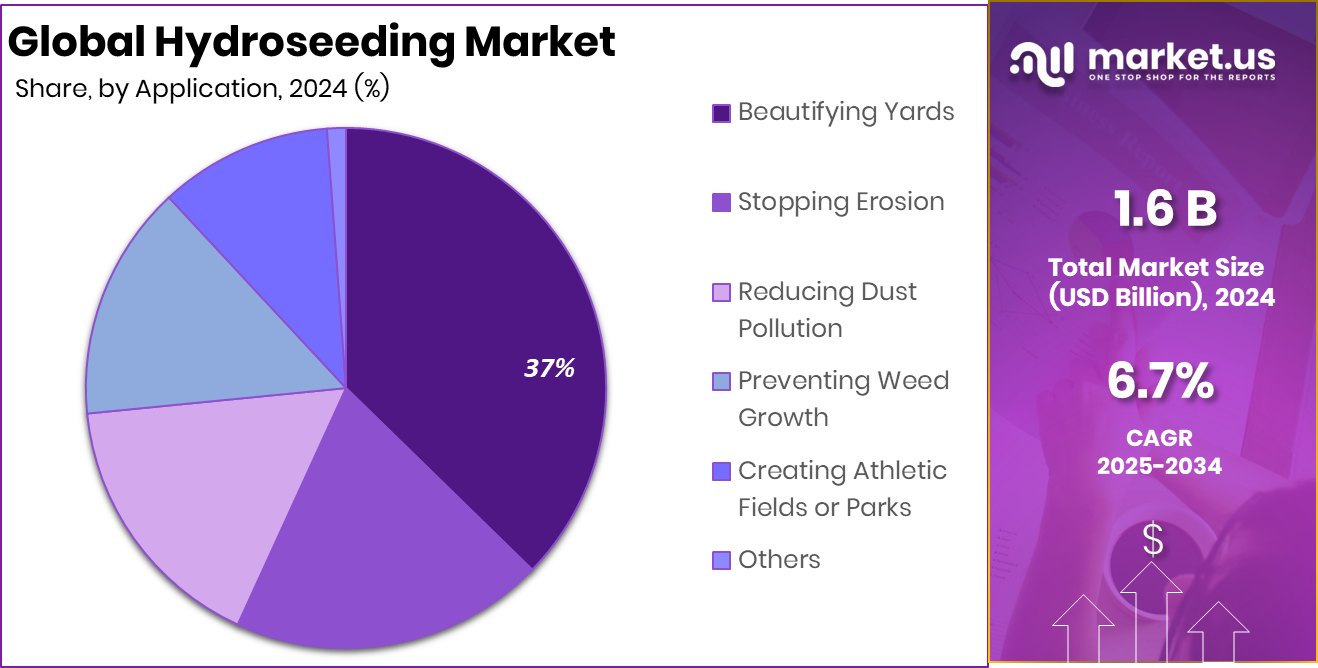

- Beautifying yards leads to hydroseeding market usage, accounting for a 38.2% share.

- In the Asia Pacific, hydroseeding demand grows significantly, reaching a USD 0.6 billion value.

By Type Analysis

Bonded Fiber Matrix (BFM) mulch dominates the hydroseeding market with a 39.5% share.

The Bonded Fiber Matrix (BFM) mulch segment dominates the hydroseeding market, accounting for a significant 39.5% share, driven by its superior soil erosion control, rapid seed germination, and ability to retain moisture effectively. As landscaping and agricultural projects increasingly demand environmentally friendly and efficient solutions, BFM mulch has become the preferred choice for contractors and municipal authorities, offering consistent coverage, minimal washout, and enhanced seed protection, which collectively improve overall project success rates while reducing maintenance costs, thus reinforcing its strong position within the hydroseeding industry.

By Application Analysis

Beautifying yards is the leading application in hydroseeding, accounting for 38.2% market usage.

Beautifying yards represents a major application within the hydroseeding market, capturing a notable 38.2% of overall usage, as homeowners and landscaping professionals seek faster, greener, and visually appealing lawn solutions. The hydroseeding process ensures even seed distribution, reduces weed growth, and enhances soil health, making it ideal for residential landscaping projects, parks, and recreational spaces, while supporting sustainable landscaping practices, lowering water consumption, and minimizing manual labor, all of which contribute to its growing popularity and the consistent expansion of the hydroseeding market.

Key Market Segments

By Type

- Bonded Fiber Matrix (BFM) Mulch

- Wood Fiber Mulch

- Blended Mulch

- Paper Mulch

By Application

- Beautifying Yards

- Stopping Erosion

- Reducing Dust Pollution

- Preventing Weed Growth

- Creating Athletic Fields or Parks

- Others

Driving Factors

Growing Focus on Eco‑Friendly Materials Boosts Hydroseeding Market

One major driving factor for the hydroseeding market is the increasing focus on eco‑friendly and sustainable materials in construction, landscaping, and land restoration. As more projects aim to reduce environmental impact, demand grows for products that support soil health, reduce pollution, and replace fossil‑based inputs. This shift encourages innovation in biodegradable mulches, organic seed blends, and environmentally safe additives used in hydroseeding.

A clear example of this trend is the Finnish startup Fiberwood, landing €3M in funding to make insulation and packaging fossil‑free, showing strong investor interest in sustainable material solutions. Although Fiberwood focuses on insulation and packaging, its success highlights the broader market move toward green, low‑impact materials that hydroseeding suppliers can adopt or be inspired by. As developers and communities seek greener alternatives, hydroseeding with sustainable inputs becomes more attractive, pushing market growth.

Restraining Factors

High Initial Costs and Material Availability Slow Adoption

One key restraining factor for the hydroseeding market is the high initial cost and limited availability of some required materials and technologies, which can make adoption slower for certain users. Hydroseeding equipment, specialized mulch blends, and biodegradable additives often require more upfront investment than traditional seeding, especially in regions where suppliers and trained operators are few.

Additionally, funding and investments may go to related material innovation areas, such as when Maine gets $22M to boost development of new wood products, focusing financial support on wood product R&D rather than directly on hydroseeding inputs. While this investment strengthens sustainable material sectors, it also highlights how capital may not always flow directly into hydroseeding supplies, which can limit the quick scale‑up of equipment fleets or advanced biodegradable mulch production. As a result, some smaller contractors or landowners may delay choosing hydroseeding, restraining broader market growth.

Growth Opportunity

Expanding Sustainable Soil Solutions Drives Hydroseeding Growth

A top growth opportunity for the hydroseeding market lies in the expanding development of sustainable soil and growing media solutions that improve plant establishment and reduce environmental impact. As more landscapers, developers, and restoration teams seek products that enhance seed germination while protecting soil health, demand rises for innovative growing mediums tailored for hydroseeding use.

A recent example of investment in this area is when a Norwegian company received €1.2M in funding for growing medium development, showing clear interest in advancing soil‑related technologies that can benefit vegetation projects. While this specific funding supports broader growing medium innovation, it signals a trend that aligns with hydroseeding needs for moisture‑retentive, nutrient‑rich blends.

By integrating these advanced media into hydroseeding applications, contractors can achieve stronger, faster plant growth on slopes, embankments, and restoration sites. This creates a meaningful opportunity for the hydroseeding market to adopt and offer improved, sustainable solutions.

Latest Trends

Carbon‑Smart Materials Use Increasing in Hydroseeding

A strong recent trend in the hydroseeding market is the use of carbon‑smart and low‑impact materials that help reduce overall environmental footprint while improving soil and plant health. Projects are increasingly looking for solutions that capture carbon, reduce waste, and support long‑term land productivity.

A key example of this shift is when Rubi nabs a government grant worth nearly $1M to scale its carbon‑to‑cellulose platform, a technology that turns carbon into usable plant‑friendly material. Although this funding supports Rubi’s carbon‑to‑cellulose work, it points to a broader move toward sustainable products that could be adapted for hydroseeding mulch, binders, and soil enhancers.

Contractors and land managers are beginning to look for inputs that not only help seed growth but also contribute to climate goals. This trend toward carbon‑focused materials is reshaping how hydroseeding solutions are selected and applied.

Regional Analysis

The Asia Pacific hydroseeding market holds a 43.60% share, valued at USD 0.6 billion.

The hydroseeding market exhibits varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, with Asia Pacific emerging as the dominating region. Asia Pacific accounts for a notable 43.60% share of the market, with a valuation of USD 0.6 billion, reflecting robust demand for soil stabilization, erosion control, and landscaping applications. This dominant performance underscores strong infrastructure development, increasing urban beautification projects, and heightened adoption of hydroseeding techniques in countries across the region.

In contrast, North America maintains a steady presence driven by established landscaping industries and ongoing investments in sustainable groundcover solutions. Europe continues to leverage stringent environmental regulations that favor hydroseeding, particularly for roadside revegetation and public green space development, fostering consistent market engagement.

The Middle East & Africa region demonstrates emerging opportunities as governments and private entities explore cost‑effective erosion control methods amid large construction and reclamation projects, while Latin America reflects gradual uptake influenced by agricultural expansion and urban planning initiatives.

Although specific regional values for North America, Europe, the Middle East & Africa, and Latin America are not provided, the overarching trend positions Asia Pacific at the forefront, capturing the largest market share and driving substantial revenue within the global hydroseeding landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Stover Seed Company is recognized for its high-quality seed blends and erosion control solutions, which have positioned it as a reliable partner for landscaping and revegetation projects. Their consistent focus on product quality and tailored solutions helps address both commercial and residential hydroseeding needs, supporting strong client loyalty.

Mid America Seeding and Grading LLC specializes in large-scale seeding and grading operations, providing comprehensive hydroseeding services across diverse terrains. Their expertise in handling complex projects efficiently has made them a preferred choice for contractors and developers seeking sustainable and timely groundcover solutions.

Ramy International brings an international perspective, leveraging global sourcing and technology to deliver innovative hydroseeding solutions that combine efficiency with environmental sustainability. Collectively, these companies drive competitiveness in the market, focusing on product reliability, service excellence, and customer-centric approaches. Their combined efforts not only enhance regional penetration but also contribute to the overall growth and adoption of hydroseeding practices worldwide. Looking ahead, these players are expected to continue shaping market dynamics through innovation and strategic project execution.

Top Key Players in the Market

- Stover Seed Company

- Mid America Seeding and Grading LLC

- Ramy International

- Global Environmental Solutions LLC

- Aathaworld Sdn Bhd

- Asia Landscaping Limited.

- Finn Corporation

- Terra Tech LLC

- Superior Groundcover, LLC.

Recent Developments

- In August 2025, Finn Corporation launched the MBM3 material blower, a redesigned and more powerful machine. While not a hydroseeder, this material blower supports hydroseeding and erosion control crews by moving mulch, compost, and seed material faster and more reliably in landscaping and ground stabilization projects.

- In June 2025, Asia Landscaping Limited was awarded a Lands Department term contract in Hong Kong for vegetation maintenance, tree maintenance, site inspection, and related landscaping works in the Sai Kung and Sha Tin districts for 2025–2027. The contract value is approximately HK$20.3 million. This win reflects the company’s ongoing involvement in large vegetation, planting, and green‑space projects, which typically include hydroseeding or related soft landscaping activities.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.1 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bonded Fiber Matrix (BFM) Mulch, Wood Fiber Mulch, Blended Mulch, Paper Mulch), By Application (Beautifying Yards, Stopping Erosion, Reducing Dust Pollution, Preventing Weed Growth, Creating Athletic Fields or Parks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Stover Seed Company, Mid America Seeding and Grading LLC, Ramy International, Global Environmental Solutions LLC, Aathaworld Sdn Bhd, Asia Landscaping Limited, Finn Corporation, Terra Tech LLC, Superior Groundcover, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stover Seed Company

- Mid America Seeding and Grading LLC

- Ramy International

- Global Environmental Solutions LLC

- Aathaworld Sdn Bhd

- Asia Landscaping Limited.

- Finn Corporation

- Terra Tech LLC

- Superior Groundcover, LLC.