Global Hydrolyzed Whey Protein Market Size, Share, And Business Benefits By Source (Milk, Soy, Pea, Others), By Hydrolysis Degree (Low DH, Medium DH, High DH), By Form (Capsulated, Powdered), By Application (Dietary Supplements, Food Beverages, Pharmaceuticals, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150906

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

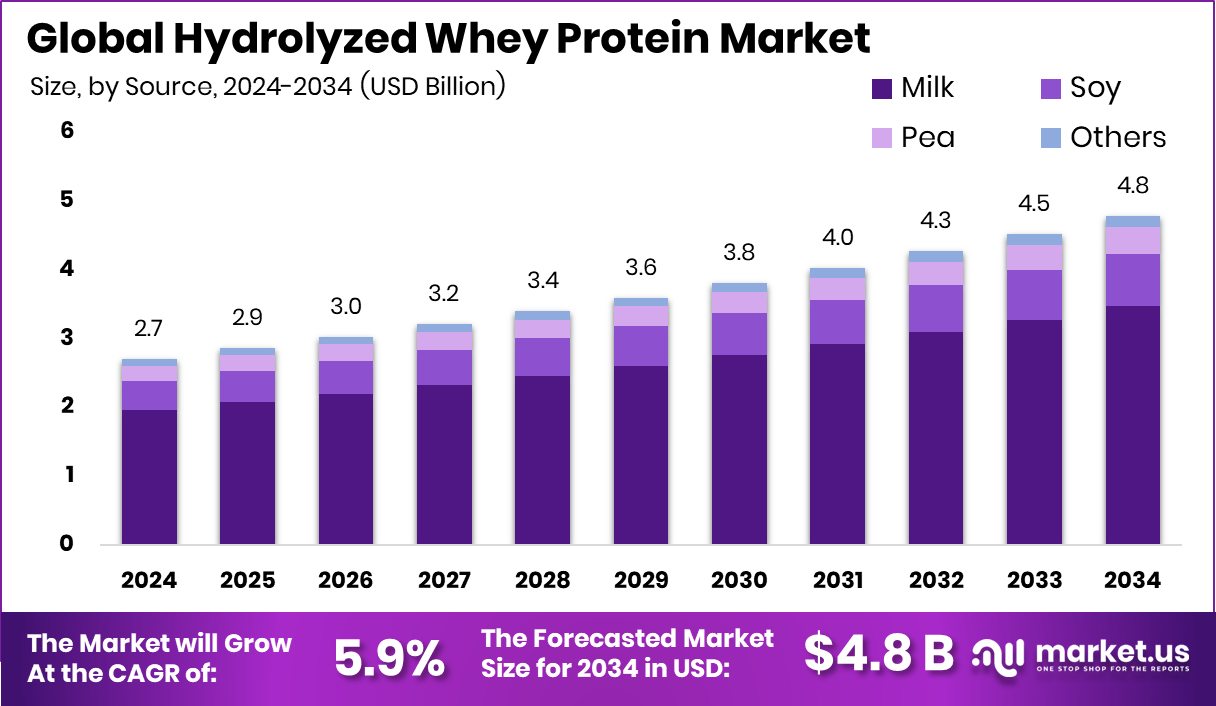

Global Hydrolyzed Whey Protein Market is expected to be worth around USD 4.8 billion by 2034, up from USD 2.7 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034. North America’s strong demand supports its USD 1.1 Bn and 42.1% dominance.

Hydrolyzed Whey Protein is a form of whey protein that has undergone a process called hydrolysis, where enzymes break down the protein chains into smaller segments known as peptides. This process mimics digestion, making the protein easier and faster to absorb by the body. It’s particularly popular among athletes, bodybuilders, and fitness enthusiasts due to its rapid absorption and reduced risk of allergies or digestive discomfort compared to standard whey protein. According to an industry report, Vivici secures €32.5M ($33.7M) in Series A funding to scale animal-free dairy protein production

Hydrolyzed Whey Protein Market refers to the commercial industry surrounding the production, distribution, and sale of hydrolyzed whey protein products. These include powders, bars, ready-to-drink beverages, and nutritional supplements tailored for various consumers, ranging from sports nutrition to clinical nutrition and even infant formula. The market has seen steady expansion, driven by lifestyle changes and increasing health awareness. According to an industry report, Formo raises $61M in Series B funding for plant-based cheese development

One key growth factor for the market is the rising demand for high-performance nutritional products. With more individuals engaging in fitness activities and sports, there’s a growing need for supplements that support muscle recovery and performance, where hydrolyzed whey protein fits well due to its fast-absorbing nature. According to an industry report, the German Ministry grants €2.6M to support a project converting dairy waste into mycelium protein

Consumer demand is also being fueled by the trend toward clean and functional foods. People are increasingly reading labels and opting for products with clear benefits and minimal additives. Hydrolyzed whey protein, often marketed as pure and scientifically processed, appeals to these informed choices. According to an industry report, Zero Cow Factory receives ₹32.82 crore in venture funding for alt-dairy innovations

Key Takeaways

- Global Hydrolyzed Whey Protein Market is expected to be worth around USD 4.8 billion by 2034, up from USD 2.7 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034.

- The hydrolyzed whey protein market is majorly driven by milk-based sources, contributing around 72.4% of the overall share.

- Medium-degree hydrolysis holds a 46.3% share, highlighting a preference for balanced digestion and nutrient absorption.

- Powdered form dominates the Hydrolyzed Whey Protein Market with 85.7%, favored for convenience and longer shelf stability.

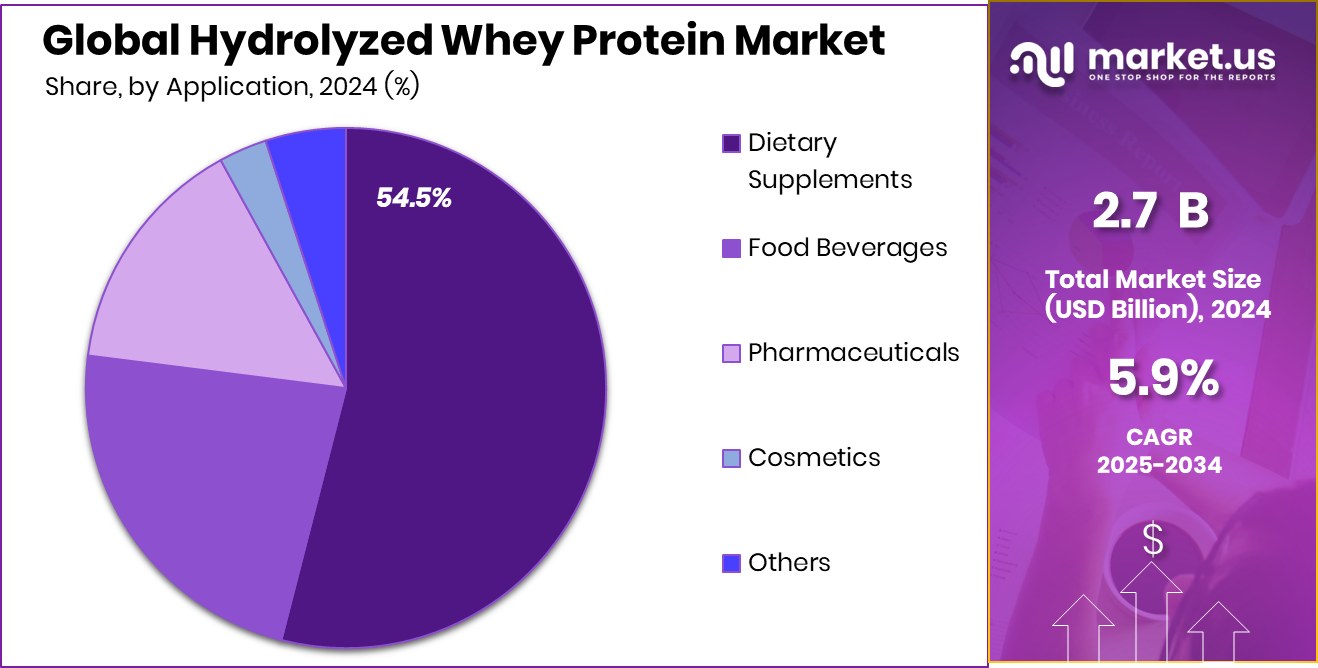

- Dietary supplements lead application usage at 54.5%, fueled by growing demand in fitness and wellness communities.

- The market value in North America reached USD 1.1 billion in 2024.

By Source Analysis

Hydrolyzed Whey Protein Market sees 72.4% contribution from milk-based sources globally.

In 2024, Milk held a dominant market position in the By Source segment of the Hydrolyzed Whey Protein Market, with a 72.4% share. This substantial lead can be attributed to the widespread availability of milk as a raw material, along with its well-established role in whey protein production.

Milk-derived hydrolyzed whey protein is favored for its high-quality amino acid profile and compatibility with various nutritional applications, making it a preferred choice among manufacturers and consumers alike. The processing of milk into hydrolyzed whey protein is also cost-effective and scalable, further solidifying its market dominance.

The strong consumer trust in milk-based ingredients, combined with proven clinical and performance benefits, continues to drive demand in this segment. Milk’s natural protein content and bioavailability make it highly suitable for hydrolysis, yielding peptides that are easily absorbed and digested.

This has led to its consistent preference in sports nutrition, infant formula, and medical dietary products. As health and wellness trends persist and the need for fast-absorbing protein solutions grows, milk’s established infrastructure and scientific backing ensure it maintains a leading position.

By Hydrolysis Degree Analysis

Medium DH category dominates the Hydrolyzed Whey Protein Market with a 46.3% market share.

In 2024, Medium DH held a dominant market position in the By Hydrolysis Degree segment of the Hydrolyzed Whey Protein Market, with a 46.3% share. This leadership is largely due to the balance of Medium Degree of Hydrolysis (DH) offers between functionality, taste, and digestibility. It provides sufficient protein breakdown to enhance absorption and reduce allergenic potential while maintaining a palatable taste profile—an important factor in consumer acceptance and product development.

Manufacturers often prefer Medium DH hydrolyzed whey protein because it ensures optimal performance in formulations without the bitterness sometimes associated with higher degrees of hydrolysis. This makes it suitable for a wide range of applications, including nutritional supplements, sports drinks, and clinical nutrition, where both efficacy and taste are critical. Its versatility supports its widespread adoption across multiple product categories.

Additionally, Medium DH is often seen as a cost-effective solution that meets both functional and commercial requirements, which helps to strengthen its market position. The 46.3% share in 2024 reflects strong industry and consumer preference for this middle-ground solution, offering the benefits of hydrolyzed protein without the compromise on flavor or application flexibility, ensuring it remains the go-to choice in hydrolyzed whey protein formulations.

By Form Analysis

Powdered form leads the Hydrolyzed Whey Protein Market, accounting for 85.7% overall demand.

In 2024, Powdered held a dominant market position in the By Form segment of the Hydrolyzed Whey Protein Market, with an 85.7% share. This significant lead is primarily driven by the widespread acceptance and convenience of powdered formulations across various consumer groups. Powdered hydrolyzed whey protein is favored for its longer shelf life, easy transportation, and flexibility in usage, allowing consumers to mix it into beverages, smoothies, or recipes based on personal preferences.

From a manufacturing standpoint, powdered form offers better storage stability and ease of handling during production and distribution, making it a practical choice for large-scale operations. It also allows for precise dosage control, which is essential in both sports nutrition and clinical settings. The dominant market share reflects how deeply integrated powdered hydrolyzed whey protein has become in daily nutritional routines, especially among fitness enthusiasts and health-conscious consumers.

The format’s compatibility with various flavors and additives also enhances its appeal, supporting product innovation while retaining its core functionality. The 85.7% share in 2024 underlines powdered hydrolyzed whey protein’s strong foothold in the market, backed by consumer familiarity, ease of use, and efficient supply chain handling, ensuring its continued preference in this segment.

By Application Analysis

Dietary supplements drive 54.5% of the Hydrolyzed Whey Protein Market applications worldwide.

In 2024, Dietary Supplements held a dominant market position in the By Application segment of the Hydrolyzed Whey Protein Market, with a 54.5% share. This leadership reflects the growing consumer inclination toward preventive health and wellness, where dietary supplements play a crucial role. Hydrolyzed whey protein is widely used in this segment due to its fast absorption, high bioavailability, and effectiveness in supporting muscle recovery, strength maintenance, and overall nutritional balance.

The convenience and targeted functionality of dietary supplements make them a preferred choice among a broad range of consumers—from active individuals and fitness enthusiasts to those seeking general health maintenance. Tablets, capsules, and especially protein powders fall under this category, allowing flexible consumption and precise dosage. The 54.5% share signals strong demand and continued reliance on hydrolyzed whey protein as a trusted ingredient in supplement formulations.

Manufacturers also benefit from the adaptability of hydrolyzed whey protein in supplement formats, enabling easy incorporation with other nutrients, flavors, or functional additives. This combination of consumer demand, product performance, and manufacturing efficiency has helped dietary supplements maintain a leading position in the hydrolyzed whey protein market in 2024, highlighting the segment’s strength and ongoing relevance.

Key Market Segments

By Source

- Milk

- Soy

- Pea

- Others

By Hydrolysis Degree

- Low DH

- Medium DH

- High DH

By Form

- Capsulated

- Powdered

By Application

- Dietary Supplements

- Food Beverages

- Pharmaceuticals

- Cosmetics

- Others

Driving Factors

Rising Health Awareness Boosts Protein Demand

One of the main driving factors for the hydrolyzed whey protein market is the growing awareness of health and wellness among people of all age groups. Consumers today are more focused on leading healthy lifestyles, eating balanced diets, and staying active. As a result, they are looking for products that support muscle health, energy, and recovery.

Hydrolyzed whey protein fits perfectly into this trend because it is easy to digest and quickly absorbed by the body. This makes it especially popular among gym-goers, athletes, and even older adults who need extra protein support. The clean label and high-quality image of hydrolyzed whey protein also appeal to health-conscious buyers, pushing demand across both developed and developing regions.

Restraining Factors

High Production Cost Limits Market Growth

A major restraining factor for the hydrolyzed whey protein market is its high production cost. The process of hydrolysis involves advanced technology and additional steps to break down protein into smaller peptides, making it easier to absorb. However, this also increases manufacturing expenses compared to regular whey protein. These added costs are often passed on to the consumers, making hydrolyzed whey protein products more expensive.

For price-sensitive customers, especially in developing markets, this can be a major drawback. The higher cost can also limit its use in budget-friendly food or supplement products. As a result, despite its benefits, the overall growth of the market can slow down due to affordability issues faced by both manufacturers and consumers.

Growth Opportunity

Expanding Medical Nutrition Needs Open New Avenues

One of the key growth opportunities for the hydrolyzed whey protein market lies in its potential expansion into medical nutrition. As more people require specialized diets—such as those recovering from surgery, managing chronic illnesses, or facing age-related muscle loss—there is a growing demand for easy-to-digest, high-quality protein sources. Hydrolyzed whey protein fits perfectly in this space, offering benefits like quick absorption, reduced allergenic potential, and enhanced nutrient delivery.

Healthcare providers and nutritionists increasingly recommend it for patients who struggle with standard proteins. By focusing on developing ready-to-drink formulas, powders, and fortifying existing medical foods, manufacturers can tap into a new and expanding consumer base. This shift can significantly boost market reach and drive long-term growth.

Latest Trends

Clean Label Products Drive Consumer Purchase Decisions

One of the latest trends in the hydrolyzed whey protein market is the growing preference for clean-label products. Consumers are becoming more aware of what goes into their food and supplements. They want products with simple, natural ingredients and minimal processing. This trend is especially strong among fitness-focused individuals and health-conscious buyers who carefully read labels before purchasing.

Hydrolyzed whey protein, when marketed as free from artificial flavors, sweeteners, and unnecessary additives, fits well with this clean label demand. Brands are responding by offering formulations with fewer ingredients and more transparent labeling.

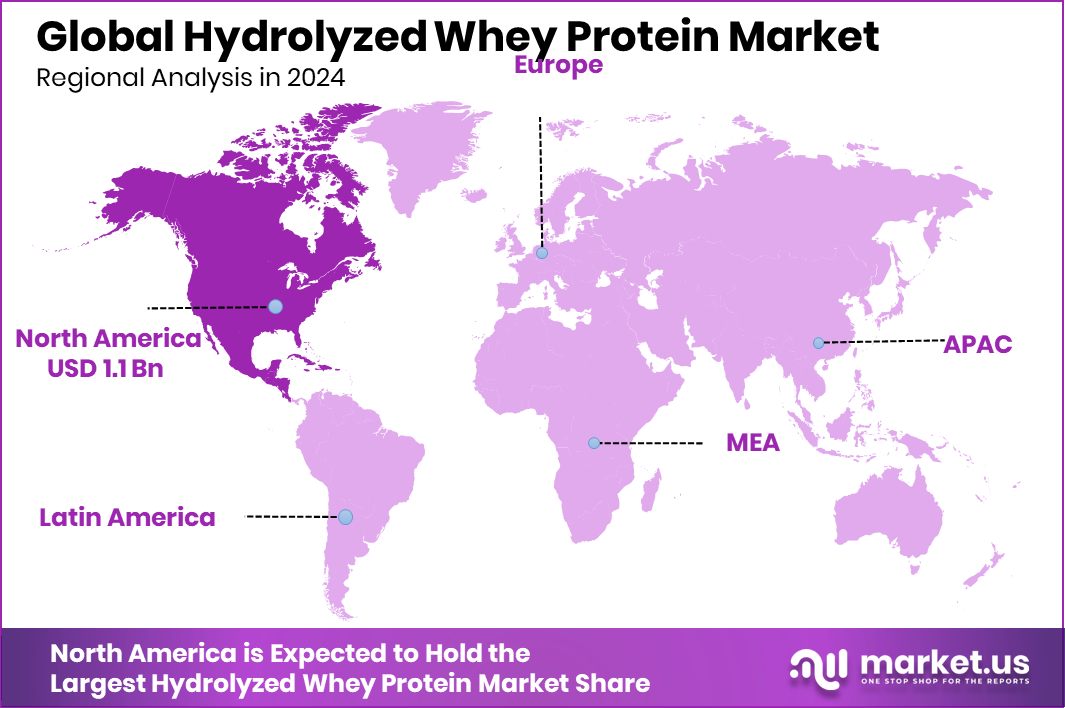

Regional Analysis

In 2024, North America held a 42.1% share of the hydrolyzed whey protein market.

In 2024, North America emerged as the dominating region in the Hydrolyzed Whey Protein Market, accounting for a substantial 42.1% market share, valued at approximately USD 1.1 billion. The region’s leadership is driven by high consumer awareness of protein-based nutrition, widespread adoption of fitness trends, and the presence of advanced health and wellness infrastructure.

North America’s mature supplement industry and increasing focus on clinical nutrition continue to support the market’s expansion. In Europe, the demand remains steady due to a strong sports culture and growing interest in clean-label protein products. Asia Pacific is witnessing rising adoption, particularly in urban centers, where fitness and wellness trends are gaining popularity.

The region holds significant potential due to its large population base and increasing disposable income. Middle East & Africa is gradually growing as health awareness improves and the market opens to premium nutritional products.

Latin America is also showing moderate growth, led by Brazil and Mexico, where sports and lifestyle nutrition markets are expanding. While all regions are contributing to the global market, North America remains the dominant player in 2024, both in terms of value and market share, reflecting its well-established consumer base and robust demand for hydrolyzed whey protein products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Agropur Inc., Arla Foods Ingredients, and Carbery Group played pivotal roles in shaping the global Hydrolyzed Whey Protein Market through innovation, production scale, and strategic focus on quality.

Agropur Inc. demonstrated strong capabilities in large-scale manufacturing and product development, leveraging its deep expertise in dairy processing. Its commitment to delivering high-purity hydrolyzed whey protein catered effectively to demand across sports nutrition and clinical nutrition segments. Agropur’s emphasis on technical refinement and clean-label solutions kept it competitive in both North American and global markets.

Arla Foods Ingredients, known for its science-led approach, maintained its reputation for premium quality and reliability. The company’s focus on high digestibility and performance-based benefits allowed it to align well with evolving consumer needs, particularly in Europe and Asia.

Carbery Group continued to be a key player with its commitment to innovation and performance nutrition. With a solid foundation in dairy protein expertise, the group prioritized consistency and functional benefits in its hydrolyzed whey protein offerings. Carbery also made strides in flavor optimization—an important factor for product adoption in the competitive supplement space.

Top Key Players in the Market

- Agropur Inc.

- Arla Foods Ingredients

- Carbery Group

- Fonterra Co-operative Group

- FrieslandCampina Ingredients

- Glanbia Nutritionals

- Groupe Lactalis

- Hilmar Cheese Company

- Ingredia Dairy Ingredients

- Kerry Group

- Lactalis Ingredients

- Actus Nutrition

Recent Developments

- In December 2024, Fonterra’s ingredient brand NZMP presented its range of hydrolyzed whey protein ingredients—including neutral pH protein water and drinking yogurt concepts—at Food Ingredients Europe 2024.

- In November 2024, Arla introduced Lacprodan® DI‑3092, a highly hydrolyzed whey protein ingredient with minimal bitterness, designed for peptide‑based medical nutrition. It delivers 10 g of protein per 100 ml—higher than standard options—and supports both ready‑to‑drink and powder formats.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Billion Forecast Revenue (2034) USD 4.8 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Milk, Soy, Pea, Others), By Hydrolysis Degree (Low DH, Medium DH, High DH), By Form (Capsulated, Powdered), By Application (Dietary Supplements, Food Beverages, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agropur Inc., Arla Foods Ingredients, Carbery Group, Fonterra Co-operative Group, FrieslandCampina Ingredients, Glanbia Nutritionals, Groupe Lactalis, Hilmar Cheese Company, Ingredia Dairy Ingredients, Kerry Group, Lactalis Ingredients, Actus Nutrition Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrolyzed Whey Protein MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrolyzed Whey Protein MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agropur Inc.

- Arla Foods Ingredients

- Carbery Group

- Fonterra Co-operative Group

- FrieslandCampina Ingredients

- Glanbia Nutritionals

- Groupe Lactalis

- Hilmar Cheese Company

- Ingredia Dairy Ingredients

- Kerry Group

- Lactalis Ingredients

- Actus Nutrition