Global Hydrolyzed Vegetable Protein Market Size, Share, And Business Benefit By Source (Soy, Wheat, Corn, Pea, Others), By Function (Flavoring Agent, Emulsifying Agent, Others), By Application (Bakery and Confectionary, Processed Food Products, Meat Substitutes, Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165231

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

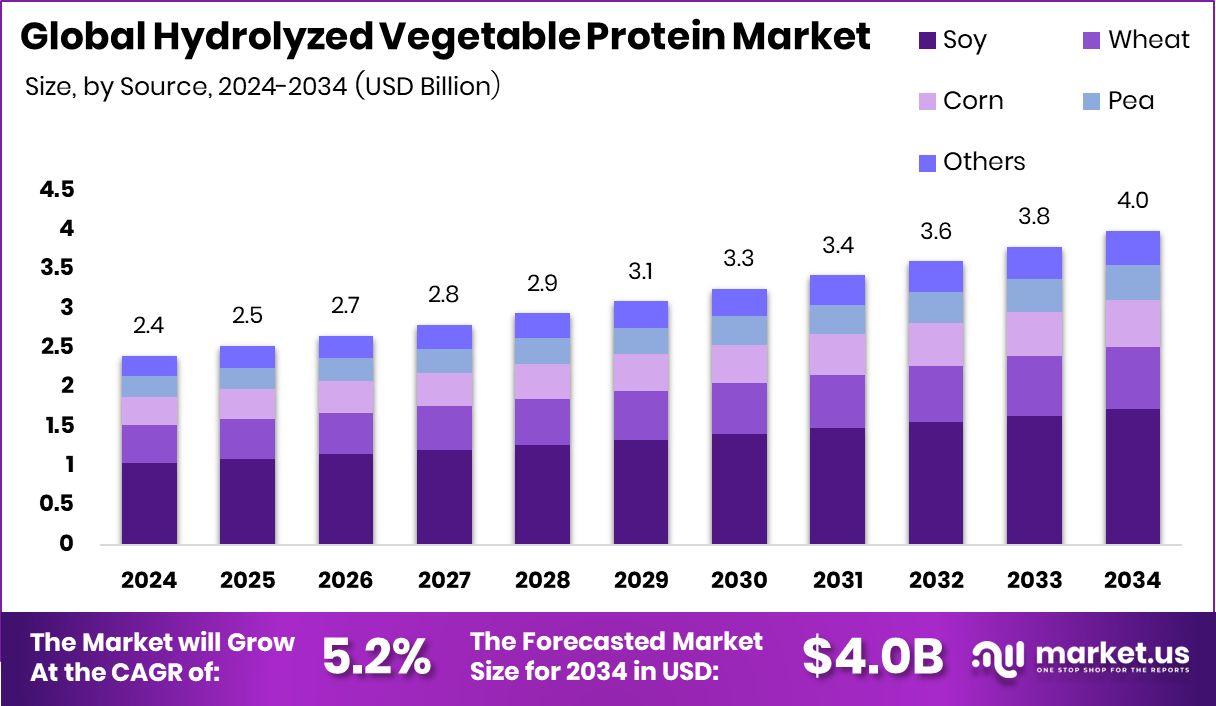

The Global Hydrolyzed Vegetable Protein Market is expected to be worth around USD 4.0 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Rising demand for plant-based flavor enhancers continues to support North America’s 44.70% market leadership.

Hydrolyzed Vegetable Protein (HVP) is a flavor enhancer made by breaking down vegetable proteins like soy, corn, or wheat into amino acids through hydrolysis. This process releases natural glutamates that enhance the savory or umami taste in soups, sauces, snacks, and processed foods. As consumer preference for plant-based, clean-label, and natural flavoring ingredients grows, HVP has become a key ingredient in modern food formulations.

The market growth is driven by the rising demand for plant-based ingredients in everyday food. Increasing awareness about health, reduced meat intake, and the popularity of vegan diets have boosted HVP usage. The growth of bakery startups such as Bakingo, which recently secured $16 million to expand across India, reflects the broader push for innovative, plant-forward ingredients in baked goods and snacks.

Demand for umami-rich, natural flavor enhancers continues to rise as consumers shift toward minimally processed foods. French fermentation firms securing $6 million to scale up upcycled cocoa alternatives show how sustainable flavor innovation aligns with HVP’s natural and eco-friendly image. The food industry increasingly uses HVP in soups, sauces, and seasonings to meet this evolving taste preference.

Future opportunities lie in diversification across new geographies and product lines. Japan’s Umami United, raising $2 million to expand plant-based egg alternatives into the US and Europe, illustrates the global appetite for natural flavor enhancers. Similarly, The Baker’s Dozen securing $5 million reflects investor confidence in clean-label bakery trends. Even unexpected funding events like the $3.6 million political allocation debates highlight how public spending priorities can influence agricultural and food innovation indirectly.

Key Takeaways

- The Global Hydrolyzed Vegetable Protein Market is expected to be worth around USD 4.0 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Soy-based Hydrolyzed Vegetable Protein dominates with 43.2%, offering rich umami flavor and strong plant-protein stability.

- Flavoring agents hold a 69.9% share, as HVP enhances savory depth in packaged and convenience foods.

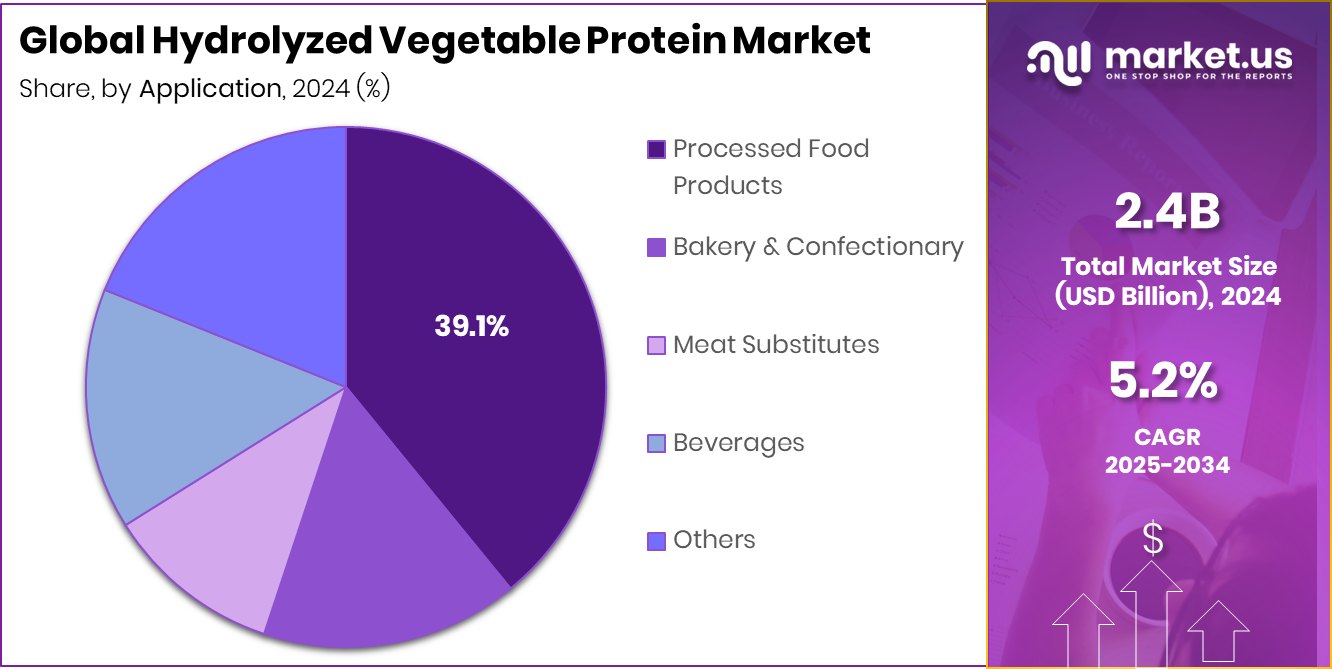

- Processed food applications account for 39.1% due to extensive HVP use in instant meals and snacks.

- The North American market value reached approximately USD 1.0 billion, driven by strong food innovation.

By Source Analysis

The hydrolyzed vegetable protein market from soy sources holds 43.2% of the global share.

In 2024, Soy held a dominant market position in the By Source segment of the Hydrolyzed Vegetable Protein Market, with a 43.2% share. The strong presence of soy-based HVP is linked to its superior amino acid profile, cost-effectiveness, and compatibility with various food applications such as soups, sauces, seasonings, and ready-to-eat meals.

Its widespread availability and nutritional benefits have further strengthened its demand among food manufacturers seeking plant-based flavor enhancers. The growing shift toward sustainable and natural protein ingredients has also reinforced soy’s leadership within the segment.

Its versatility and balanced umami characteristics make it the preferred choice for food formulators across global markets, ensuring continued dominance in the hydrolyzed vegetable protein industry.

By Function Analysis

Flavoring agent function dominates the Hydrolyzed Vegetable Protein Market with a 69.9% share.

In 2024, Flavoring Agent held a dominant market position in the By Function segment of the Hydrolyzed Vegetable Protein Market, with a 69.9% share. This strong presence was attributed to its extensive use in enhancing the umami and savory taste in soups, sauces, ready-to-eat meals, and snacks.

Food manufacturers increasingly preferred hydrolyzed vegetable protein as a natural alternative to synthetic flavor enhancers due to its clean-label and plant-based appeal. The demand was further supported by the shift toward healthier eating habits and the growing focus on authentic taste experiences.

The versatility and natural taste-improving characteristics of flavoring agents have made this segment the primary contributor to the market’s overall growth trajectory.

By Application Analysis

Processed food products lead the Hydrolyzed Vegetable Protein Market applications with a 39.1% share.

In 2024, Processed Food Products held a dominant market position in the By Application segment of the Hydrolyzed Vegetable Protein Market, with a 39.1% share. This dominance was driven by the increasing consumption of ready-to-eat and convenience foods across urban areas.

Hydrolyzed vegetable protein is widely used in processed foods to enhance flavor, improve texture, and provide a rich umami taste without synthetic additives. The rise in demand for quick meal solutions, coupled with consumers’ preference for natural and plant-based ingredients, has strengthened its use in sauces, soups, snacks, and instant noodles.

The segment continues to benefit from expanding packaged food industries and the shift toward healthier, flavor-rich, and clean-label processed food formulations.

Key Market Segments

By Source

- Soy

- Wheat

- Corn

- Pea

- Others

By Function

- Flavoring Agent

- Emulsifying Agent

- Others

By Application

- Bakery and Confectionery

- Processed Food Products

- Meat Substitutes

- Beverages

- Others

Driving Factors

Rising Focus on Plant-Based Protein Innovation

One major driving factor for the Hydrolyzed Vegetable Protein Market is the growing focus on plant-based protein innovation. Consumers today are more aware of the benefits of plant-derived ingredients, which are healthier and more sustainable compared to animal-based sources.

Hydrolyzed vegetable protein, made from soy, wheat, or corn, offers rich flavor and high nutritional value, making it ideal for soups, sauces, snacks, and instant foods. Governments and organizations are supporting such developments to address food security and nutritional needs.

For instance, the University of Illinois’ Soybean Innovation Lab received a $1.5 million grant to help tackle food insecurity across Africa, emphasizing the global importance of soy-based proteins in promoting sustainable and accessible nutrition solutions.

Restraining Factors

Limited Raw Material Availability and Price Fluctuations

One key restraining factor for the Hydrolyzed Vegetable Protein Market is the limited availability of raw materials and their unstable prices. Since hydrolyzed vegetable protein is derived mainly from soy, wheat, or corn, any disruption in the agricultural supply chain—such as poor harvests or export restrictions—directly impacts production costs.

The market often faces challenges from fluctuating crop prices and unpredictable weather conditions that affect global yields. These price shifts make it difficult for manufacturers to maintain consistent quality and supply levels.

Additionally, alternative protein ventures like MUCHgroup, which raised €375,000 to scale shiitake-based meat alternatives in the foodservice sector, increase competition for plant-based ingredients, adding further pressure to the overall raw material ecosystem.

Growth Opportunity

Expanding Government Support for Alternative Protein Development

A major growth opportunity for the Hydrolyzed Vegetable Protein Market lies in the expanding government support for alternative protein innovation. As global demand for sustainable and plant-based foods rises, authorities are investing heavily in research and production infrastructure.

Governments have already put $1 billion toward making better meat alternatives, reflecting a strong commitment to advancing eco-friendly food systems. Such initiatives encourage manufacturers to explore hydrolyzed vegetable protein as a clean-label, flavor-rich component in plant-based meats, soups, and snacks.

This financial push not only supports innovation but also helps reduce reliance on traditional animal protein sources. With increasing consumer acceptance and regulatory backing, hydrolyzed vegetable protein stands to benefit significantly from the evolving sustainable food landscape.

Latest Trends

Rising Popularity of Fermentation and Mycelium Blends

A key trend shaping the Hydrolyzed Vegetable Protein Market is the growing adoption of fermentation and mycelium-based innovations in food formulation. Food manufacturers are combining hydrolyzed vegetable protein with fermented or mycelium-derived ingredients to achieve better texture, nutrition, and taste in plant-based foods. This approach supports the demand for natural, clean-label alternatives that closely mimic the sensory qualities of meat.

The trend is reinforced by rising investment in next-generation protein technology — for example, Ecovative raised $11 million after outselling traditional meat alternatives with its mycelium-based MyBacon product. Such developments highlight a clear shift toward bio-based and sustainable flavor systems, where hydrolyzed vegetable protein plays a vital role in enhancing savory depth and overall product appeal.

Regional Analysis

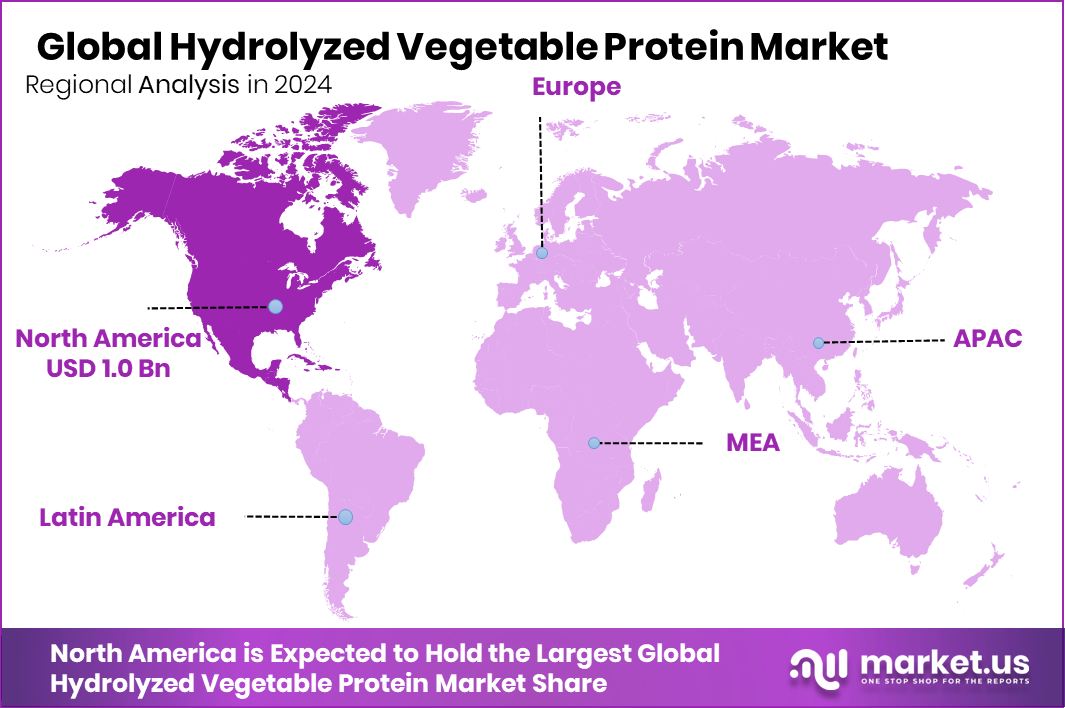

In 2024, North America dominated the Hydrolyzed Vegetable Protein Market with a 44.70% share.

In 2024, North America emerged as the dominant region in the Hydrolyzed Vegetable Protein Market, accounting for 44.70% share, valued at USD 1.0 billion. The region’s growth is primarily driven by the increasing adoption of plant-based ingredients and natural flavor enhancers in packaged foods and beverages. Consumers in the United States and Canada are showing a strong preference for clean-label and protein-rich diets, supporting the wider use of hydrolyzed vegetable protein in soups, sauces, and convenience meals.

In Europe, demand continues to grow due to rising awareness of sustainable food sources and the popularity of vegan and vegetarian lifestyles. The Asia Pacific region shows promising potential, supported by its large population base and growing food processing industry. Meanwhile, the Middle East & Africa and Latin America are experiencing gradual adoption, influenced by urbanization and changing food habits.

With major investments in food innovation and rising consumer interest in healthy ingredients, North America is expected to maintain its leadership in global market share, while Asia Pacific remains a fast-growing region due to increasing product availability and local manufacturing expansion in plant-derived food components.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ajinomoto has long leveraged its deep expertise in amino acid and flavor chemistry to offer high-quality HVP derived from soy and corn. Its focus on “umami-rich” formulations supports applications in processed meats, sauces, and seasoning blends, which keeps it well-positioned in the savory foods segment. The company’s global footprint and recognized brand in flavor-enhancement technologies give it a clear strategic advantage in HVP, even as cost pressures and raw-material volatility remain.

Kerry Group brings a strong combined portfolio of flavor ingredients and functional proteins, enabling it to integrate HVP solutions into snacks, savory meals, and clean-label formulations. With its emphasis on multifunctional HVPs that exhibit stability, solubility, and process tolerance, Kerry is well-suited for ingredient-intensive food manufacturing environments. In 2024, its ability to serve global food-industry customers and respond quickly to changing taste and labeling trends strengthens its role as a major HVP supplier.

Aipu Food Industry has carved out a niche in the HVP space by offering compound powder and liquid HVP products derived from soy, maize, and wheat, featuring a broad variety of flavors (neutral, poultry, meat, roasted) and color intensities. This flexibility makes Aipu suited for regional markets and varied food-application needs. In 2024, its strength lies in customizing HVP formulations for regional tastes and cost-sensitive requirements.

Top Key Players in the Market

- Ajinomoto Co., Inc.

- Kerry Group Plc.

- Aipu Food Industry

- Titan Biotech

- Cargill Inc.

- Roquette Frères

- DSM

- Tate & Lyle

- Griffith Foods

- MGP

Recent Developments

- In June 2025, through its subsidiary Ajinomoto Health & Nutrition North America, Inc. (AHN), Ajinomoto launched two new solution platforms: Salt Answer and Palate Perfect. These platforms address sodium reduction and taste enhancement, linking to hydrolyzed vegetable protein (HVP) use via umami/flavor enhancement technologies.

- In May 2024, Kerry reported that in Q1 2024, their Taste & Nutrition segment achieved volume growth of 3.1 %, driven by strong foodservice performance and innovation in savoury taste systems. They also launched a €300 million share buy-back programme to support capital allocation and strengthen shareholder value.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 4.0 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Soy, Wheat, Corn, Pea, Others), By Function (Flavoring Agent, Emulsifying Agent, Others), By Application (Bakery and Confectionery, Processed Food Products, Meat Substitutes, Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Co., Inc., Kerry Group Plc., Aipu Food Industry, Titan Biotech, Cargill Inc., Roquette Frères, DSM, Tate & Lyle, Griffith Foods, MGP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrolyzed Vegetable Protein MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrolyzed Vegetable Protein MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ajinomoto Co., Inc.

- Kerry Group Plc.

- Aipu Food Industry

- Titan Biotech

- Cargill Inc.

- Roquette Frères

- DSM

- Tate & Lyle

- Griffith Foods

- MGP