Global Household Insecticides Market Size, Share, Report Analysis By Product Type (Gel/Cream, Mat, Roll On, Patches, Powdered Granules, Liquid, Aerosol, Vaporizer), By Nature (Natural, Synthetic), By Insect Type (Mosquitoes, Cockroaches, Ants, Flies and Moths, Rats and Rodents, Bedbugs and Beetles, Others), By Sales Channel (Store-Based Retailing, Supermarket, Drug Stores and Pharmacy, Departmental Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156249

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

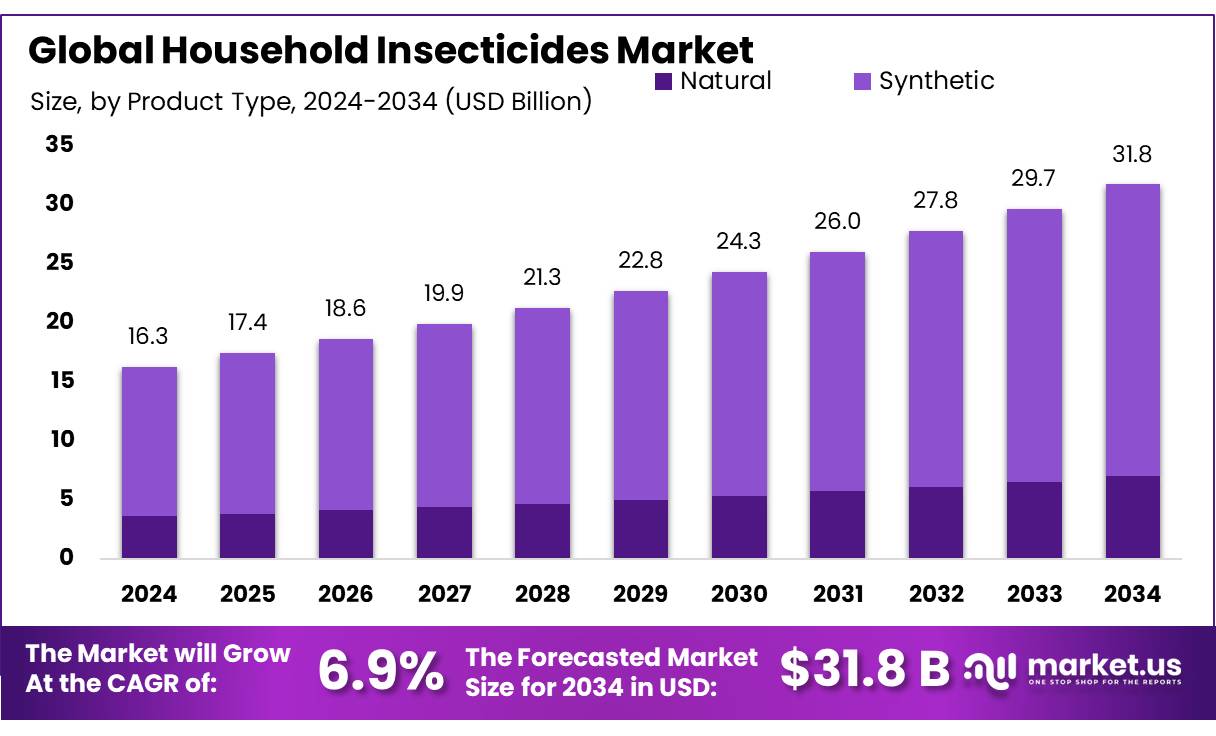

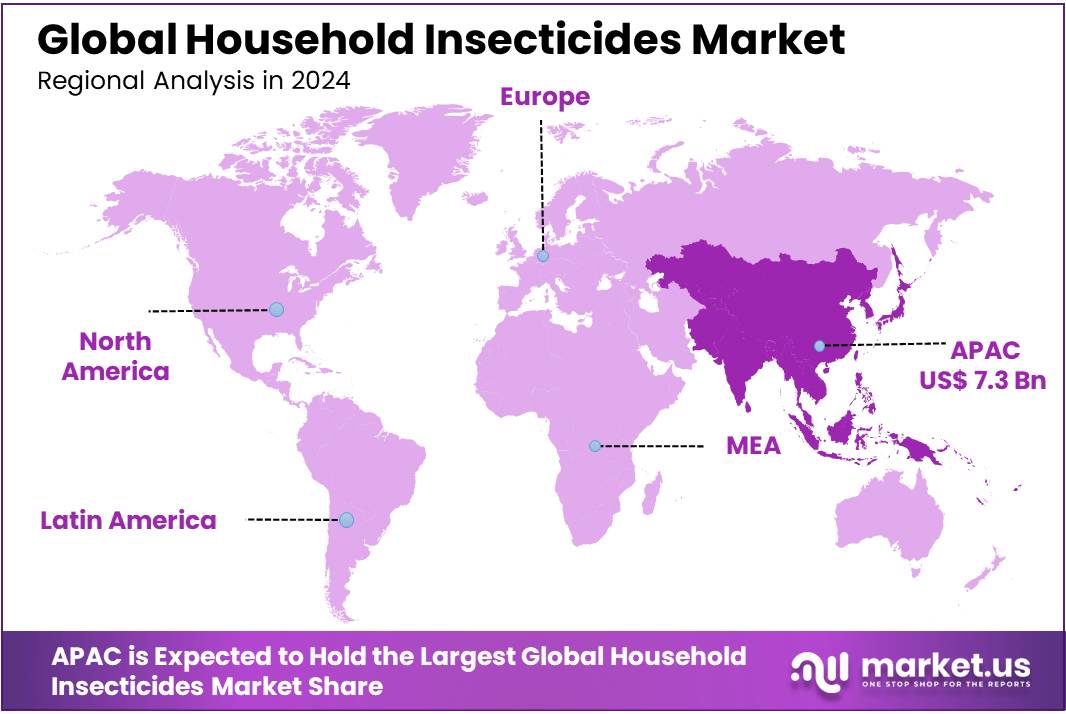

The Global Household Insecticides Market size is expected to be worth around USD 31.8 Billion by 2034, from USD 16.3 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 45.8% share, holding USD 7.3 Billion revenue.

Household insecticides are chemical products formulated for safe in‑home use to control common pests such as mosquitoes, flies, cockroaches, rats, bedbugs, and termites. These products—including sprays, vaporisers, coils, gels, patches, mats and roll‑ons—are tailored to work effectively in enclosed residential environments, often using either natural ingredients or synthetic compounds with lower toxicity relative to agricultural formulations.

The global chemical sector underpins the household insecticides industry. In India, the chemical industry contributes around 7 % of the nation’s GDP, and in 2019 was valued at approximately USD 100 billion, producing over 80,000 different chemical products, which include household insecticide intermediates and formulations.

On the public‑sector front, Hindustan Insecticides Limited (HIL) is a Central Public Sector Undertaking under India’s Ministry of Chemicals and Fertilizers, established in 1954 to produce DDT for malaria control efforts. HIL remains one of the country’s largest producers of insecticides and employs around 1,300 people, with manufacturing units across Kochi, Rasayani, and Bathinda. These government‑owned operations support national disease control programmes and contribute to industrial output in the insecticide segment.

India’s regulatory framework for household insecticides is shaped by the Insecticides Act of 1968 and Insecticides Rules of 1971, which mandate a color-coded toxicity‑label system on pesticide containers—ranging from red (extremely toxic) to green. This regulatory system ensures chemical safety and consumer protection for domestic use.

Key Takeaways

- Household Insecticides Market size is expected to be worth around USD 31.8 Billion by 2034, from USD 16.3 Billion in 2024, growing at a CAGR of 6.9%.

- Liquid held a dominant market position, capturing more than a 52.8% share of the household insecticides market.

- Synthetic held a dominant market position, capturing more than a 78.9% share of the household insecticides market.

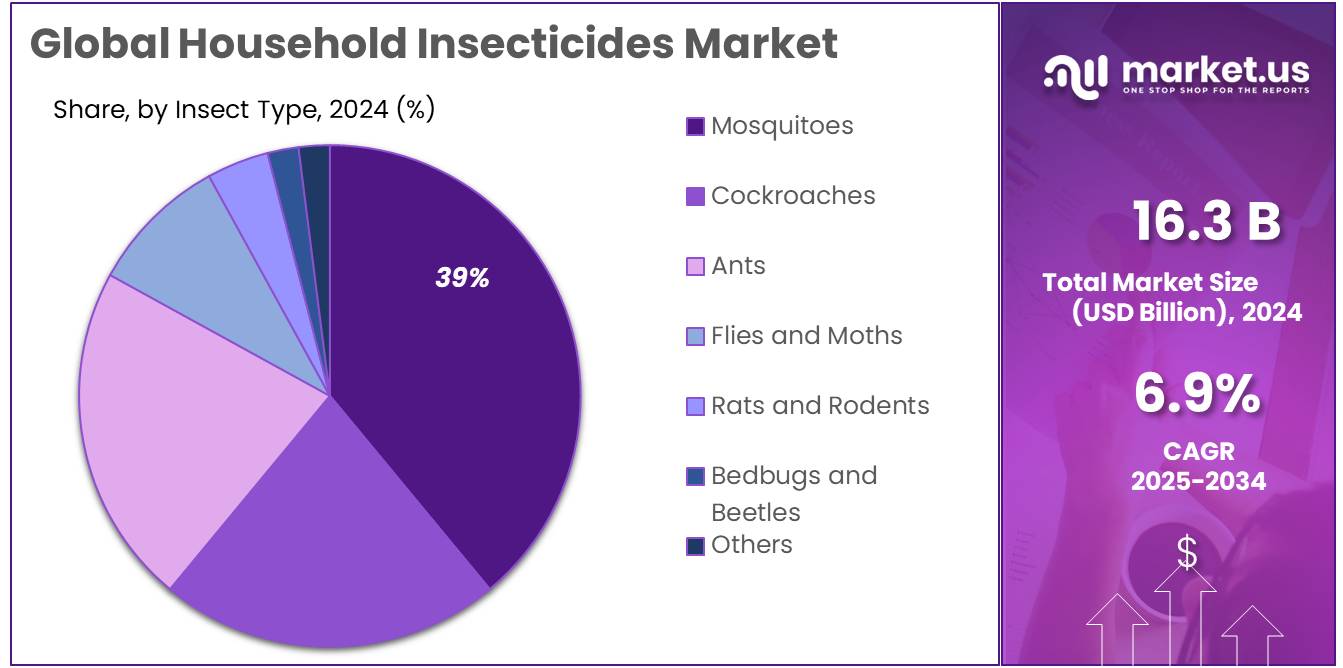

- Mosquitoes held a dominant market position, capturing more than a 39.6% share of the household insecticides market.

- Supermarket held a dominant market position, capturing more than a 28.1% share of the household insecticides market.

- Asia Pacific region held a dominant position in the global household insecticides market, capturing a 45.8% share, with the market valued at approximately USD 7.3 billion.

By Product Type Analysis

Liquid dominates with 52.8% due to strong consumer preference

In 2024, Liquid held a dominant market position, capturing more than a 52.8% share of the household insecticides market. Consumers leaned heavily toward liquid-based formats such as vaporizers and sprays because of their convenience, longer-lasting protection, and suitability for indoor use. The format has become particularly popular in regions with high mosquito-borne disease prevalence, where steady demand for preventive measures is vital.

By 2025, the preference for liquid insecticides continues to grow as awareness of vector-borne diseases rises in urban and semi-urban households. The adaptability of liquids—whether in electric vaporizers for continuous protection or in quick-action sprays—has strengthened their market share further. This segment’s dominance is reinforced by ongoing product innovations, improved safety formulations, and widespread availability across retail and e-commerce channels.

By Nature Analysis

Synthetic dominates with 78.9% due to its proven effectiveness

In 2024, Synthetic held a dominant market position, capturing more than a 78.9% share of the household insecticides market. The segment’s strength comes from the wide availability of synthetic chemical formulations such as pyrethroids and organophosphates, which are known for their quick action and reliable performance. Consumers in both urban and rural areas continue to trust synthetic options because they provide immediate results against mosquitoes, flies, and cockroaches, which are persistent household pests.

Moving into 2025, synthetic insecticides remain the preferred choice as they are more affordable and accessible compared to natural or organic alternatives. Their longer shelf life, ease of large-scale manufacturing, and integration into multiple product forms—including sprays, vaporizers, coils, and baits—have further supported their dominant market presence. Additionally, the ongoing risk of mosquito-borne diseases like dengue and malaria keeps demand strong, as households prioritize fast-acting and dependable pest control.

By Insect Type Analysis

Mosquitoes dominate with 39.6% due to rising disease concerns

In 2024, Mosquitoes held a dominant market position, capturing more than a 39.6% share of the household insecticides market. This dominance is driven by the continued global threat of mosquito-borne diseases such as dengue, malaria, chikungunya, and Zika, which remain pressing public health challenges. Consumers across Asia, Africa, and parts of Latin America have relied heavily on mosquito-targeted products like coils, vaporizers, sprays, and repellent creams to protect their households.

By 2025, the segment continues to expand as rising urbanization and climate changes extend mosquito breeding seasons in many regions. The introduction of enhanced formulations with longer-lasting protection, along with government health campaigns focused on mosquito control, further strengthens this category’s role. In countries with recurring dengue outbreaks, demand for household mosquito insecticides surges seasonally, reinforcing their market leadership.

By Sales Channel Analysis

Supermarket leads with 28.1% due to easy accessibility

In 2024, Supermarket held a dominant market position, capturing more than a 28.1% share of the household insecticides market. The segment benefits from consumer preference for one-stop shopping, where insecticides are easily accessible alongside other household essentials. Supermarkets also provide strong visibility for branded products through in-store displays, promotions, and seasonal campaigns, particularly during peak mosquito and pest seasons.

By 2025, supermarkets continue to maintain their influence as the trusted offline channel for household insecticides. The assurance of product authenticity, combined with bulk packaging options and frequent discount offers, makes them a preferred choice for families. Urban households, in particular, lean toward supermarkets for convenience and variety, ensuring consistent demand through this channel.

Key Market Segments

By Product Type

- Gel/Cream

- Mat

- Roll On

- Patches

- Powdered Granules

- Liquid

- Aerosol

- Vaporizer

By Nature

- Natural

- Synthetic

By Insect Type

- Mosquitoes

- Cockroaches

- Ants

- Flies and Moths

- Rats and Rodents

- Bedbugs and Beetles

- Others

By Sales Channel

- Store-Based Retailing

- Supermarket

- Drug Stores & Pharmacy

- Departmental Stores

- Online Retailers

- Others

Emerging Trends

Increasing Adoption of Smart and Automated Insect Control Solutions

A notable trend in the household insecticides market is the growing adoption of smart and automated pest control technologies. With advancements in home automation and the Internet of Things (IoT), households are now using devices that monitor, detect, and even eliminate pests without constant human intervention. According to the United Nations Food and Agriculture Organization (FAO), the integration of technology in pest management has led to a 15–20% improvement in efficiency and safety compared to traditional methods. This trend reflects a shift in consumer behavior towards convenience, safety, and efficiency in household pest management.

Smart insect control devices, such as electronic traps, ultrasonic repellents, and sensor-driven sprays, are becoming increasingly popular. These solutions minimize the need for chemical sprays, reducing health risks and environmental impact. The World Health Organization (WHO) emphasizes that reducing direct human exposure to chemical insecticides is crucial, especially in homes with children or elderly individuals, as prolonged exposure can lead to respiratory issues and other health complications. Automated solutions provide a safer alternative while maintaining effectiveness in controlling pests like mosquitoes, flies, and ants.

Additionally, technological improvements have enhanced the effectiveness of these devices. Sensors can now detect pest movement, and connected apps provide real-time notifications and control options. This enables households to respond quickly to infestations, reducing the spread of disease-carrying insects like mosquitoes. According to the Centers for Disease Control and Prevention (CDC), mosquitoes alone are responsible for over 700,000 deaths globally each year, highlighting the importance of effective household insect control.

Drivers

Limited Supply and Seasonal Availability of Apricot Oil

Apricot oil production is highly dependent on the availability of apricot kernels, which are a byproduct of apricot fruit processing. The global apricot production is concentrated in specific regions, with Turkey, Iran, and Uzbekistan leading in output.

- According to the Food and Agriculture Organization (FAO), Turkey produced approximately 460,000 metric tons of apricots in 2022, representing nearly 15% of the world’s total production.

This seasonal dependency introduces a significant challenge for consistent supply. Apricot trees flower in early spring and are harvested in late summer, making the oil available only at specific times of the year. Any adverse weather conditions, such as frost, drought, or unseasonal rains, can drastically reduce the yield. For instance, a report from the U.S. Department of Agriculture noted that unseasonal frost in California’s Central Valley caused a 30–40% decline in apricot yield in 2021. Such fluctuations directly affect the quantity of apricot oil available for both culinary and cosmetic uses.

Government initiatives are helping to mitigate some of these challenges. For example, agricultural extension programs in Turkey provide technical support to farmers to optimize yield and protect trees from adverse weather. Similarly, the U.S. Department of Agriculture promotes crop insurance schemes to reduce the financial impact of seasonal variability (USDA Crop Insurance). Despite these measures, the reliance on seasonal production and specific geographic regions remains a key restraining factor for the apricot oil market.

Restraints

Health and Environmental Concerns Limiting Household Insecticide Use

Household insecticides, while effective in controlling pests, face growing concerns over health and environmental safety. According to the World Health Organization (WHO), exposure to common chemical insecticides can lead to respiratory issues, skin irritation, and long-term neurological effects, particularly in children and the elderly. These health risks have created caution among consumers, with many households seeking natural or non-chemical alternatives.

In the United States, the Environmental Protection Agency (EPA) regulates household insecticides under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). The agency notes that more than 85% of accidental pesticide poisonings in children occur from exposure to household insecticides. This statistic underscores the potential dangers associated with improper usage, contributing to restrained adoption among families who prioritize safety.

Beyond direct health concerns, environmental implications are also significant. Insecticides containing organophosphates, pyrethroids, and other chemical compounds can contaminate water sources when washed down drains, affecting aquatic life and broader ecosystems.

The Food and Agriculture Organization (FAO) highlights that pesticide runoff contributes to soil degradation and biodiversity loss, with an estimated 25–30% of applied pesticides entering waterways rather than targeting intended pests). These environmental repercussions have prompted several governments to impose stricter regulations and encourage the development of eco-friendly formulations.

Opportunity

Rising Demand for Eco-Friendly and Natural Household Insecticides

The increasing awareness of health and environmental safety is driving a major growth opportunity for household insecticides in the form of eco-friendly and natural products. Consumers are gradually shifting from chemical-based solutions to products made from botanical extracts and naturally derived ingredients.

- According to the Food and Agriculture Organization (FAO), global demand for biopesticides, which include plant-based insect repellents and natural oils, has risen by nearly 20% over the last five years. This trend reflects the growing consumer preference for safer and sustainable household pest control options.

Households are increasingly concerned about the potential health risks posed by synthetic chemicals. The World Health Organization (WHO) notes that exposure to chemical insecticides, even in small amounts, can lead to respiratory problems, skin irritation, and in severe cases, neurological issues, particularly among children and the elderly. This concern is encouraging manufacturers to innovate with natural ingredients such as neem oil, citronella, peppermint, and pyrethrin, which provide effective pest control while minimizing health risks.

Urbanization and changing lifestyles also contribute to the growth opportunity. With over 56% of the world’s population living in urban areas as of 2023, according to the United Nations Department of Economic and Social Affairs, the demand for effective and convenient household insect control solutions is rising. Natural and eco-friendly products are particularly attractive in high-density urban homes where families are more conscious about indoor air quality and chemical exposure.

Regional Insights

Asia Pacific leads with 45.80% share and USD 7.3 Bn value (2024)

In 2024, the Asia Pacific region held a dominant position in the global household insecticides market, capturing a 45.8% share, with the market valued at approximately USD 7.3 billion. This dominance is driven by rapid urbanization, rising disposable incomes, and increased consumer awareness regarding hygiene and vector-borne diseases.

Countries such as China, India, and Japan represent key markets due to dense urban populations and frequent incidences of insect-borne illnesses, including dengue, malaria, and chikungunya. According to the World Health Organization (WHO), Asia accounts for over 70% of global dengue cases annually, which directly fuels demand for household insecticides as preventive measures.

Consumer preference for eco-friendly and natural insecticides is also gaining traction, particularly in developed markets like Japan and Australia, where sustainability and health concerns influence purchasing decisions. Technological innovations such as aerosol sprays, electric traps, and automated pest control devices further enhance product appeal.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tiger Bands Ltd. is a notable player in the household insecticides market, specializing in innovative mosquito repellent solutions and insect control devices. The company focuses on combining efficacy with safety, offering products that cater to urban households concerned about chemical exposure. With a strong distribution network in Asia and Africa, Tiger Bands has expanded its market presence, emphasizing eco-friendly and easy-to-use insecticide products. Their commitment to research and development ensures consistent product performance and consumer trust.

Kombat S. is recognized for its comprehensive range of household insecticides, including aerosols, coils, and liquid repellents. The company emphasizes high-quality formulations designed to target common household pests such as mosquitoes, flies, and cockroaches. Kombat S. has strengthened its market presence through effective branding and widespread retail availability. The company’s focus on product safety and user convenience has helped build strong customer loyalty, while ongoing innovation ensures that it meets evolving consumer preferences in pest control.

S. C. Johnson & Son Inc. is a leading multinational in the household insecticides sector, known for iconic brands such as Raid and Off!. The company combines extensive research with sustainable practices, offering products that effectively manage household pests while minimizing environmental impact. Strong global distribution channels and strategic marketing campaigns have made S. C. Johnson a trusted name in pest control. Its focus on innovation and safety ensures high consumer confidence and continued growth in both developed and emerging markets.

Top Key Players Outlook

- Tiger Bands Ltd.

- Kombat

- S. C. Johnson and Son Inc

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Ltd

- Pelgar International Limited

- AVIMA

- Protek

- Delta Company

- ASTRACHEM

- Sumitomo Chemical India Ltd.

Recent Industry Developments

In 2024, Protek—a subsidiary of South Africa’s Senwes group—continued serving homeowners with a thoughtful lineup of household insecticides that blend convenience and effectiveness; its 2024 product catalogue features user‑friendly formulations such as AK47, AnTrap Indoor ant bait station, Fiprogel Ant Gel and Fiprogel Roach Gel, and Guardian Indoor Insect Spray.

Report Scope

Report Features Description Market Value (2024) USD 16.3 Bn Forecast Revenue (2034) USD 31.8 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gel/Cream, Mat, Roll On, Patches, Powdered Granules, Liquid, Aerosol, Vaporizer), By Nature (Natural, Synthetic), By Insect Type (Mosquitoes, Cockroaches, Ants, Flies and Moths, Rats and Rodents, Bedbugs and Beetles, Others), By Sales Channel (Store-Based Retailing, Supermarket, Drug Stores and Pharmacy, Departmental Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tiger Bands Ltd., Kombat, S. C. Johnson and Son Inc, Reckitt Benckiser Group PLC, Godrej Consumer Products Ltd, Pelgar International Limited, AVIMA, Protek, Delta Company, ASTRACHEM, Sumitomo Chemical India Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Household Insecticides MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Household Insecticides MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tiger Bands Ltd.

- Kombat

- S. C. Johnson and Son Inc

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Ltd

- Pelgar International Limited

- AVIMA

- Protek

- Delta Company

- ASTRACHEM

- Sumitomo Chemical India Ltd.